Ally or Acquire? How Technology Leaders Decide

There are four phases in the life cycle of a technology, and for each there are appropriate ways of partnering with outsiders. Increasingly, the challenge for managers is to recognize which phase each of their products is in and decide what kinds of external partnerships are most likely to facilitate speedy development. Each product a company is juggling may be in a different phase, and because the partnerships developed for one phase of a given technology could serve a different purpose in another phase of another technology, partnerships must be handled with care. Despite the complexity that comes with the need to manage a variety of alliances, Microsoft Corp. and others are demonstrating that it can be done successfully.

The most dramatic change in global technological innovation — the movement toward externally oriented collaborative strategies that complement internal research-and-development investments — began more than a decade ago.1 Today companies use alliances, joint ventures, licensing, equity investments, mergers and acquisitions to accomplish their technological and market goals over a technology’s life cycle. How can companies decide when to use which form of partnership? In part, by understanding the externally focused technology-life-cycle model.2

The Technology-Life-Cycle Model of Alliances and Acquisitions

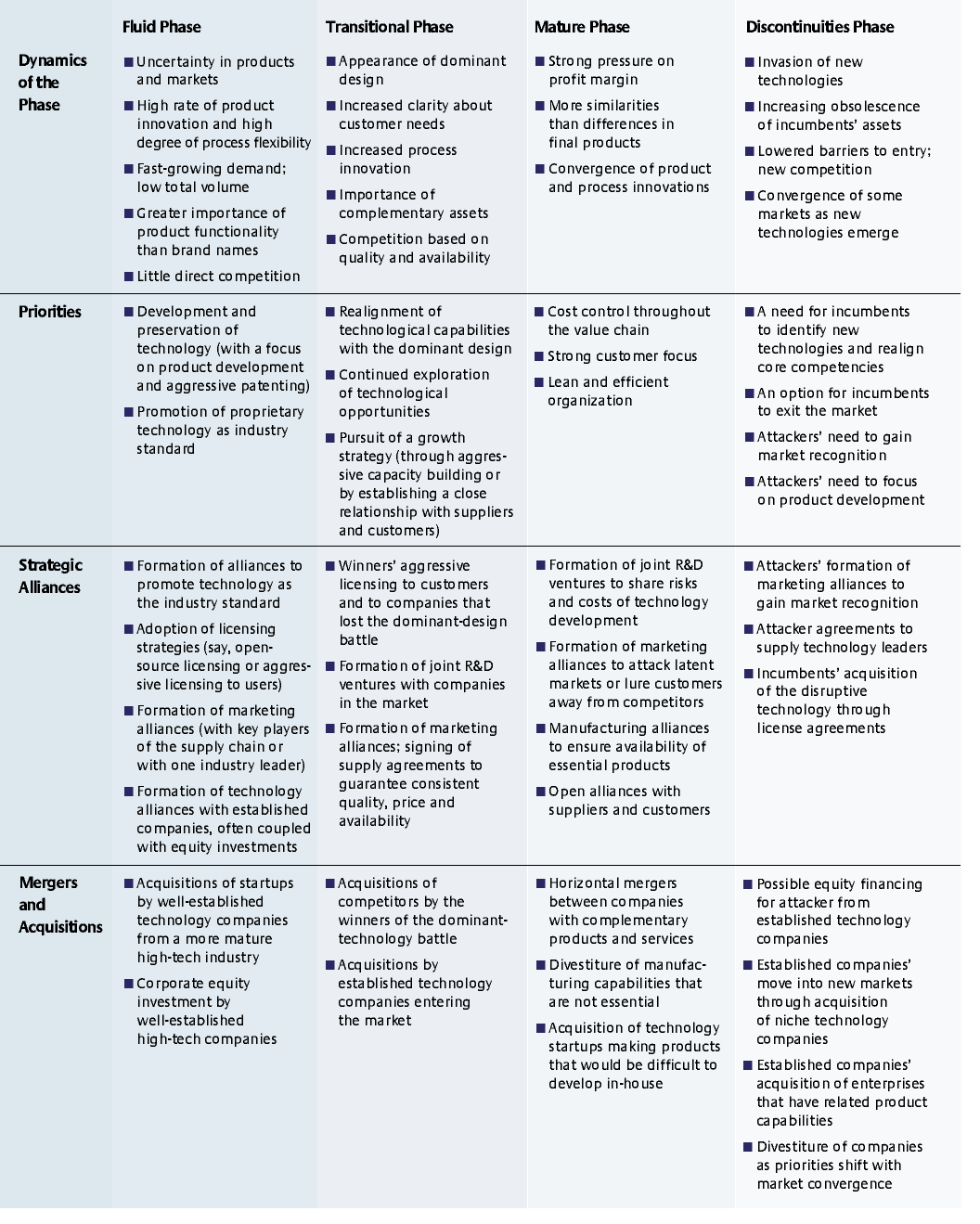

Understanding the role of alliances and acquisitions in the technology life cycle starts with understanding the cycle’s four stages: the fluid phase, the transitional phase, the mature phase and the discontinuities phase.3 The first three were identified in the 1970s by James M. Utterback. (See “The Utterback Model of the Technology Life Cycle.”) He later added a fourth, discontinuities, stage. Each stage is shaped by changes in the character and frequency of innovations in technology-based products and processes and by market dynamics. (See “Characteristics of the Four Technology Phases.”)

The Fluid Phase

In the fluid phase, the earliest pioneering products enter the market for that technology amid a high level of product and market uncertainty.

References

1. E.B. Roberts, “Benchmarking Global Strategic Management of Technology,” Research-Technology Management 44 (March–April 2001): 25–36.

2. The authors appreciate the financial support of the global industrial sponsors of the MIT International Center for Research on the Management of Technology, as well as funding from the National Science Foundation to the MIT Center for Innovation in Product Development.

3. For a comprehensive literature review on different models of the technology life cycle, see P. Anderson and M.L. Tushman, “Technological Discontinuities and Dominant Designs: A Cyclical Model of Technological Change,” Administrative Science Quarterly 35 (1990): 604–633. Further discussion of the model’s evolution is provided by J.M. Utterback, “Mastering the Dynamics of Innovation” (Boston: Harvard Business School Press, 1994). Utterback’s pioneering life-cycle work, begun in the 1970s, is best summarized by his book. Following Utterback, Tushman and Rosenkopf propose a similar technology-life-cycle model with four stages: eras of ferment, dominant designs, eras of incremental change, and technological discontinuities. See M.L. Tushman and L. Rosenkopf, “Organizational Determinants of Technological Change: Towards a Sociology of Technological Evolution,” Research in Organizational Behavior 14 (1992): 311–347. See also R.R. Nelson and S.G. Winter, “Simulation of Schumpeterian Competition,” American Economic Review 67 (1977): 271–276; R.R. Nelson and S.G. Winter, “The Schumpeterian Tradeoff Revisited,” American Economic Review 72 (1982): 114–132; G. Dosi, “Technological Paradigms and Technological Trajectories: A Suggested Interpretation of the Determinants and Directions of Technical Change,” Research Policy 11 (1982): 147–162; N. Rosenberg, “Inside the Black Box: Technology and Economics” (Cambridge: Cambridge University Press, 1982); D.J. Teece, “Profiting From Technological Innovation: Implications for Integration, Collaboration, Licensing and Public Policy,” Research Policy 15 (1986): 285–305; D.J. Teece, “Capturing Value From Technological Innovation: Integration, Strategic Partnering and Licensing Decisions,” Interfaces 18 (1988): 46–61; and R.R. Nelson, “Recent Evolutionary Theorizing About Economic Change,” Journal of Economic Literature 33 (1995): 48–90.

4. W.J. Abernathy and J.M. Utterback, “Patterns of Industrial Innovation,” Technology Review 80 (1978): 40–47.

5. R.M. Henderson, “Underinvestment and Incompetence as Responses to Radical Innovation: Evidence From the Photolithographic Alignment Equipment,” Rand Journal of Economics 24 (1993): 248–269.

6. http://www.cisco.com/warp/public/750/acquisition.

7. M.L. Tushman and P. Anderson, “Technological Discontinuities and Organizational Environments,” Administrative Science Quarterly 31 (1986): 439–465.

8. We define “propensity to ally” as the likelihood that a company will participate in joint ventures and alliances. Several ways for post hoc measurement of a company’s propensity to ally seem plausible — for example, by examining its total number of alliances normalized by sales. We define “propensity to acquire” as the likelihood that a company will make an acquisition, perhaps measured similarly by the total number of acquisitions normalized by sales.

9. http://www.microsoft.com.

10. Ibid.

11. Data from the Securities Data Company’s (SDC) joint-venture database. Many joint ventures involve multiple agreements.

12. W. Liu, “Essays in Management of Technology: Collaborative Strategies for American Technology Industries” (Ph.D. diss., MIT Department of Political Science, 2000).