Games Managers Play at Budget Time

One of the most thoroughly studied questions in business is how, at budgeting time, large corporations should choose among investment opportunities. In-house economists, management advisors and even Nobel laureates have worked on this problem and come up with an impressive array of quantitative and process-oriented resource allocation systems. Why, then, are so many senior executives frustrated with the process and convinced that their companies’ capital is not being invested as well as it could be?

One reason is that even the best-designed systems can be trumped by the power of personality. A forceful appeal sometimes carries more weight than even the most objectively accurate financial analysis built on highly reliable facts. It is now commonplace, in fact, for talented and charismatic managers to spin, manipulate and otherwise cajole senior management into funding their business ideas — often in the face of numbers that would, on their own, dictate a negative decision. Put another way, when people are economical with the truth during capital budgeting, the underlying economics get lost.

Having guided dozens of major corporations through the budgeting process and watched hundreds of presentations by line managers asking for capital, we have profiled five archetypes of bad behavior commonly used by managers to subvert decision-making standards and win resources. It is not uncommon for a manager to adopt more than one type, depending on how his or her plan is faring relative to others in the planning and budgeting process. Fortunately, there are ways for senior management teams to counteract such behavior directly during budgeting discussions and, over time, to instill values that lead to better use of investment capital.

The Sandbagger

“There is no way that we, or anyone else, can grow by 10%.”

Managers are sandbagging when they routinely come to the table with a business plan that is less ambitious than one they know they could probably fulfill. Sandbaggers argue that the market is so tough, the best the company could hope for is slight incremental improvement even with additional resources or the most heroic leadership. Of course, when such managers exceed their targets, as they usually do, they appear to be heroes themselves.

The president of a successful $700 million North American brokerage business, for example, was reluctant to commit to an earnings-growth target that the company’s CEO had proposed. While the president thought the business had the potential to achieve the CEO’s target, he did not want to risk missing the target and lose his group’s bonuses. Instead of turning to his team for ideas on how to reach the goals, however, he dug his heels in and insisted that the business really could not meet them; he eventually negotiated a lower target. At the end of the year, the brokerage division announced earnings growth that was just above the reduced target.

Later, during the president’s performance review, the CEO pointed to the repeated sandbagging and the time spent debating performance targets in the planning process as a serious problem. It was preventing the CEO and his team from spending time where they needed to most — with their employees and customers.

Sandbagging costs more than time, however: It also creates energy-sapping internal debate and, worse still, leads to people being overpaid for their performance as bonuses kick in even when low budget targets are met.

The Magician

“There really are no weak spots in our business right now.”

Sometimes division managers know things about their business that do not show up in the budget figures. They may have heard that a large customer was intending to defect, that a key manager was on her way out, or that market share numbers were starting to slip. But at budget time, magicians cover up faults in the business by conveniently leaving out uncomfortable facts and diverting attention to more positive aspects of the operation.

For instance, the manager of a European beverage company was taken aback when her colleagues noted several weaknesses in her plan for the core business. In response, she diverted their attention to a speculative new idea to launch store-branded products for discount retailers. A true magician, she alternately pointed to growth rates and customer surveys in that channel to support her claims that the new plan would significantly boost the company’s top line. After several months of debate, the top management team remained hopelessly deadlocked and frustrated at their inability to come to an agreement on the proposed new line of business. Meanwhile, the core business’s performance was declining.

There should be no magic to the budget process, but some managers try to cast a spell rather than answer legitimate challenges to their proposals. If they are not brought back to reality, the inconvenient details they’ve forgotten to mention will reappear and expose what may turn out to have been disastrous decisions.

The Lone Agent

“Yes, but that principle does not apply to our business.”

Some managers contend that their business cannot conform to corporate-budgeting conventions because of its supposedly unique character. In comparison with competitors, they say, it may be much bigger or much smaller, more international or more domestic, more high-tech or more low-tech. Driven by their fear of being managed to the norm, lone agents stonewall during meetings (“Yes, but …”) and expect special treatment. They demand different standards for goals and performance that undermine trust and teamwork and make performance management across a company’s businesses difficult.

The group executive of a Latin American wholesale bank, a unit of a financial services company, lost his temper when he was asked by the executive committee to cut operating costs by 5% as part of a groupwide exercise to identify funds that could be reinvested in new businesses. Believing the target to be at odds with the right strategy for the bank — its location in a developing market made it different from other units, he contended — the executive would not agree to the request. Rather than open his thinking to alternatives, he lashed out at those who had proposed the cost targets and any other executive who appeared to support them. Other top executives, in turn, saw the executive’s behavior as divisive and an attempt to gain unfair privilege.

By claiming to merit special consideration, lone agents sow mistrust among their peers and superiors and, in the process, damage the top team’s ability to debate the key strategic issues it faces in a mature and disciplined way.

The Visionary

“I can’t say exactly when, but this is going to be big — really big.”

Managers who don’t have the numbers on their side often appeal to emotions. Visionaries harp repeatedly on the “breakthrough” technology or service that will “revolutionize” the industry and remain on the “cutting edge” for years to come. The core of the argument often goes like this: “Given the enormous upside, which at this point cannot be quantified because it is 5 to 10 years out, it will be worth putting up with poor short-term performance.”

For example, an ambitious director of business development for an insurance company proposed a plan that would allow consumers to buy term life insurance directly from the company, rather than through agents. His boss told the director that while the vision was compelling, he was troubled by the deep investment required throughout the planning horizon in order to set up the technology, change processes, educate consumers and so on. The fact was, the director had very little to say about near- or medium-term performance and tried to meet objections by going back to the long-term opportunity his vision represented. The end result in this case was a stalemate among the top executives, although visionaries often do win the resources they need — at least for a year or two, until top management and stockholders, frustrated by the lack of results, raise questions that lead to the plan’s termination.

Companies need visionaries, to be sure. But visionaries should be standing on solid factual ground when they look to the future, not floating in the clouds. The challenge, then, is to find a way to marry the vision with a genuine commitment to delivering short-term performance.

The Hostage Taker

“If we don’t invest big right now, we’ll be left on the sidelines.”

Sometimes managers claim that they can deliver significant and immediate performance improvements if they are given a huge proportion of the available corporate capital. Hostage takers act as if the decision-making obstacle is not the management team but the chief executive, who in their view should be prepared to bet the company on their brilliant plan.

The managing director for a U.K. Internet company wanted to turn his business into a full-service Web-hosting service provider — a radical proposal that would require a huge investment in a risky market and direct resources away from other profitable lines of business. Although the chief executive respected the managing director’s strategic and financial acumen, she was not convinced that the plan reflected the best use of the company’s capital. Rather than force a broader discussion of options and alternatives, however, she allowed her attention to be captured by the hostage taker’s ultimatum.

Consequently, the company invested hundreds of millions of pounds behind his growth plan and continued to do so for each of the next three years, even as the markets proved much more difficult than initially forecast. Other growth options were starved of investment during this time, leaving the company overexposed to a single high-risk opportunity.

Like lone agents, hostage takers want special treatment and, like visionaries, they appeal to emotions. But because of the percentage of corporate investment that they seek, they have the potential to do the most damage to the company’s future if their plans do not turn out as projected.

Why Do Managers Play Games?

It is one thing to be able to identify the games managers play and quite another to be able to do something about them. Each of the six archetypes reflects organizational or individual shortcomings — be it a lack of critical thinking, a misalignment in ambition and purpose, a breakdown in corporate culture or poor incentives.

First, managerial game playing sometimes reflects a lack of skills and know-how rather than Machiavellian intentions. For example, managers may be weak strategic thinkers, have poor planning skills, or be inexperienced in valuing investment opportunities correctly. In such situations, the remedy would include training, coaching and other forms of management education.

Second, bad behavior can be a matter of deeper flaws. Some managers know full well what they are doing and are simply not team players; others lack a proper focus on short-term performance. These deficiencies require a firmer hand.

Third, managerial stratagems at budget time can also reflect a lack of clarity about performance goals and expectations. It is not always easy to get the executive team and business-unit management to agree on specific performance targets. More often than not, misunderstandings arise over the pace at which goals are to be met: Executive teams usually have a much shorter time frame in mind when it comes to most performance targets. The end result is that business-unit managers feel they have to tap dance their way through uncomfortable meetings. While this gap may never be fully closed, its existence should be acknowledged by top management in order to minimize inefficient behavior.

Finally, managerial antics may be a response to the environment — the corporate culture, incentives and values that shape the workplace. For example, if the company tends to promote hard-charging, sales-oriented types into senior management positions, the company may produce a surplus of lone agents and hostage takers. If the company’s general managers came up through the finance function, there may be a tendency to produce sandbaggers and magicians — people who know how to manipulate financial data to their own advantage. In either case, senior management will have to use all the tools at its disposal —mission statements, compensation, promotions and training —to develop a more cooperative, forward-looking and results-oriented system within the company.

Changing the Rules

Even in the most perfectly designed organization, managers are going to play the system, and executives need to be ready to deal with disruptive behavior when it arises. While this is clearly a long-term, complex issue, there are actions that senior management can take in the short term to reduce the tax that bad behaviors can levy on a company’s capital. It’s important to take action quickly, however, because managers who are successful game players will continue their behavior until it is checked — a sandbagger who gets his bonus one year will come up with new reasons for being unable to meet corporate targets the next time around.

Get It on the Table.

Openly acknowledge at the beginning of each budgeting meeting — in a lighthearted way — the human tendency to twist the facts to one’s favor. That will help diffuse tension and make it clear that the criteria for investment approval will be not only the hard numbers that make up the proposal but also the overall integrity with which the numbers are presented. Even if a business plan comes in with the highest internal rate of return of all the proposals, for example, it may not receive funding if the investment committee sees games being played that undermine the credibility of the analysis.

Paint a Picture of the Ideal.

Create a profile of the behaviors and values that managers ought to reflect when presenting budgets for approval. Examples might include the ability to meet short- and long-term expectations, the ability to be candid about the condition of the business, the ability to make and reach stretch targets and so on. The development of such skills can be made a part of corporate training programs. At Cadbury Schweppes Plc, 150 top managers learned about the behaviors and capabilities necessary for success at the company by participating in simulated dialogues focused on resource allocation. To put some bite into the program, even the CEO took part, role playing both good and bad behaviors and making it clear that failure to meet the required standards could cost a manager his or her seat at the top table.

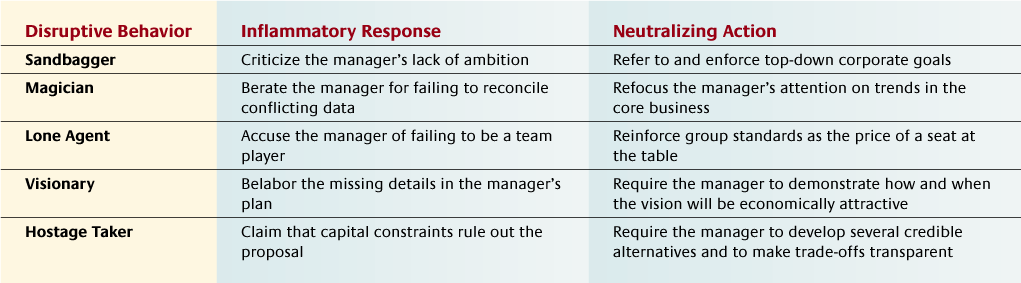

Deal Positively With Disruptive Behavior.

Be willing and ready to respond to disruptive game playing during budget meetings. For each type of manipulation, there is both an inflammatory and a productive way to respond. (See “Neutralizing Disruptive Behaviors.”) For example, when lone agents are demanding that a different set of rules be applied to their budgets, reemphasize the company’s well-publicized decision-making standards. And when managers are sandbagging, point to the existence of top-down goals, known to the sandbaggers well ahead of time.

Put Peer Pressure to Work.

Require that all business-unit and general managers be present for key business reviews — and that they participate in the question-and-answer phase. General managers from other businesses may have firsthand knowledge that will lead them to raise questions that executives may not have thought of. For example, a general manager who has seen business-unit magicians perform before may be able to redirect the meeting’s attention away from the dazzle of a new market and ask whether the company really has the organization in place to compete within it.

Executives with their hands on the till need to keep one eye on the numbers and the other on the psychology of their managers — and be ready to respond in real time to disruptive behavior. Taking the veil off of bad behaviors, however, does more than just make budgeting discussions more productive. It also lays the foundation for addressing two larger and longer-term challenges. By taking the time to define which competencies and behaviors are required to make the capital-budgeting process more effective and efficient, senior executives create organizational discipline and a concrete way of establishing the highly sought-after performance-oriented culture. And by linking behaviors and values to strategy and capital-allocation decisions, senior executives tap into a proven way of delivering better performance. In the end, everyone wins when the means and the ends of delivering performance are aligned.

References

abc