Overcoming Consumer Resistance to Innovation

Under the right circumstances, industry initiatives involving “coopetition” among competitors can reduce customers’ reluctance to adopt an innovation.

It took more than a half a century for the dishwasher, which was first introduced in 1893, to succeed as a mainstream product. No one sets out to develop an innovation that consumers are slow to adopt, and yet many ultimately successful innovations like the dishwasher or the microwave oven languish for years in the gap between early adopters and the mainstream market.1 Other examples of slow-diffusing innovations include automatic teller machines (which were first introduced in the United States and the United Kingdom in the late 1960s), online banking and alternative fuel vehicles.

Slow takeoff times mean delayed returns on investment or, in the worst case, negative payback if the product is pulled from the market before sales have a chance to take off. Slow takeoff times have been attributed to high introductory prices,2 uncompetitive products that are low quality or insufficiently innovative3 or failure to develop niche markets.4 Another reason is consumer resistance to an innovation,5 which may arise because the innovation conflicts with consumers” ingrained belief structures, requires acceptance of unfamiliar routines or necessitates abandoning deep-rooted traditions. Slow-diffusing innovations that require consumers to change established behaviors are called resistant innovations.6

How can managers create marketing programs that reduce takeoff time for resistant innovations? This article suggests marketing strategies appropriate for such innovations. Our conclusions stem from a multiphase research project conducted to examine why a particular innovation – screw cap wine closures – has achieved greater market acceptance in Australia and New Zealand than in the United States. (See “About the Research.”) Based on findings from this international case study, we elaborate on the role of vertical and horizontal cooperation as marketing strategies for resistant innovations and identify the reasons and conditions under which each strategy can successfully operate.

Why Consumers Resist Some Innovations

In developing launch strategies for new products, companies often overlook consumer behavioral responses to innovations. From the perspective of consumer attitudes, innovations may be categorized as either receptive or resistant. Receptive innovations tend to be welcomed by the market. They do not require consumers to alter existing belief structures, attitudes, traditions or entrenched routines significantly. Consumers are not required to move far from established comfort zones when adopting receptive innovations.

Resistant innovations, however, may have clear competitive advantages over existing products, but they either conflict with consumer belief structures or require potentially large behavioral changes from a status quo that the consumer finds satisfactory.7 To adopt resistant innovations, consumers must learn new routines and habits or embrace new traditions and values. Resistant innovations thus require consumers to incur psychological switching costs as well as economic switching costs.8 As a result, consumers have negative attitudes toward these innovations and resist adopting them.9

Marketing programs for launching new products frequently focus on the advantages of the products’ attributes over those of competing products. However, marketing a resistant innovation requires a company to address not only the product’s attributes but also the consumer’s mind-set regarding the innovation. Failure to address both of these issues can result in slow diffusion times.

In a 1989 article, Sundaresan Ram of Thunderbird School of Global Management and Jagdish N. Sheth of Emory University identified five barriers that consumers can erect when resisting innovations. First, the innovation may not be compatible with existing work flows and practices; consumers may prefer the status quo if the innovation requires learning new skills or altering long-ingrained routines. A second barrier occurs when consumers do not understand the value of the innovation. A third psychological barrier exists if consumers view the innovation as being too risky and postpone adoption until the risk is mitigated — either by new knowledge or through the experiences of others who have shown that the innovation is safe. A fourth reason is that the innovation requires a customer to deviate from established social norms and traditions. The fifth barrier is tied to a product’s image; a negative image, whether deserved or undeserved, can produce a barrier to adoption.

Screw Cap Wine Closures: A Case Study of a Resistant Innovation

Screw cap closures in the wine industry are a classic example of a resistant innovation. Screw caps are an innovative closure introduced in the wine industry as a solution to a major quality problem known as “cork taint,” which occurs when poor quality corks cause a bottle of wine to take on a musty flavor. An estimated 2% to 15% of all wine bottles that use natural cork closures are damaged by cork taint.10 For wineries, cork taint results in millions of dollars in lost revenue and brand-name erosion when consumers attribute the poor wine quality to the winery rather than to the closure. Screw caps, often called by their brand name, Stelvin, have been found to eliminate cork taint as well as other problems with cork closures, such as crumbling and leakage.

Although screw caps perform well in preserving wine quality, the wine industry has faced consistent resistance to them from consumers and distributors. In consumers’ minds, screw cap closures have often been associated with cheap, high-alcohol wines and thus have had a negative image. As a result, consumers have not historically accepted screw caps on high-end, high-quality wines.

Between 1976 and the early 1980s, approximately 20 million wine bottles were sealed with the screw cap closure in Australia and New Zealand.11 However, by 1984, these wineries had stopped using screw caps because of consumer resistance. Wineries found two types of consumer resistance toward screw caps: The first is the image barrier, since brand image suffers when consumers perceive wines bottled with screw caps as cheap and inferior, and the second is a tradition barrier. “Traditional consumers,” a segment identified by wineries we interviewed,prefer the romanticism and tradition associated with opening a cork-bottled wine and have refused to adopt screw caps. Resistance also existed from the distribution side, from distributors that doubted consumer acceptance of screw caps and shunned the extra marketing costs of pushing the new product into the market.

Despite the dismal market launch failure in the late 1970s, the wine industry continued to push for the diffusion of screw caps. Stelvin screw caps were reintroduced into the marketplace in Australia, New Zealand and the United States in the early 2000s — using two quite different marketing strategies, with varying results.

To date, U.S. wineries have experienced individual success in selling their screw cap lines to their target markets. However, screw caps are far from being accepted by the mainstream American consumer. A survey conducted in 200512 revealed that fewer than 10% of American wine consumers prefer screw cap closures to other closures. These findings were supported by 2005 U.S. wine industry statistics that indicate that less than 5% of U.S. wineries use these types of closures on their fine wines, defined as those priced at more than $7 a bottle. As a result, the mainstream U.S. market has not yet adopted the screw cap as the standard wine closure.

In Australia and New Zealand, however, screw caps have recently surpassed cork as the closure of choice for wineries, and screw caps are widely accepted by domestic consumers in those countries. Since the screw cap’s reintroduction in 2001, its usage has grown: In 2005, approximately 40% of domestically sold bottles of wine in Australia and more than 80% of domestically sold bottles of wine in New Zealand had screw cap closures.13 Wines with screw cap closures are now the first and fastest to sell in both markets. (Economic factors are not the reason behind the switch by the wineries, because, even though the screw cap closure itself is less expensive than the cork closure, screw caps require wine bottles to have threaded necks; as a result, there is no significant difference in manufacturing costs between the two closure methods. Moreover, wineries incur costs to install new screw cap bottling facilities.) The quite different marketing strategies used by U.S. wineries and Australasian (Australian and New Zealand) wineries have apparently led to these vastly different diffusion results. In particular, the New Zealand wine industry’s dramatic success in increasing screw cap usage yields key lessons about using horizontal cooperation, also known as “coopetition,” to market resistant innovations successfully.

Marketing Strategies For Resistant Innovations

The screw cap case study illustrates two marketing strategies for overcoming the barriers resistant innovations face: vertical cooperation and horizontal cooperation. Vertical cooperation refers to the need to involve the supply or distribution chain in developing a marketing strategy that will address consumers’ belief structure about the innovation. This strategy is important because distributors themselves may be resistant to stocking the product. Resistance can also occur if distributors fear slow sales due to consumers’ resistance to the innovation. Distributors don’t recognize that they may be propagating the slow takeoff of products through their own resistance. Thus, understanding all partners’ motives in the distribution chain, as well as the consumers’ mind-set, is necessary to put together an effective vertical marketing campaign. Vertical cooperation does not require contractual agreements, nor does it require long-term cooperation between supply and distribution chain members. Once consumers accept the innovation, cooperation in the channel can diminish without a negative effect on the marketing campaign.

Horizontal cooperation, or coopetition, refers to the need to involve competitors in developing a marketing strategy for the innovation. In some cases, horizontal competitive cooperation can be a marketing option for diffusing resistant innovations; our research suggests it can be used effectively by competing companies when they benefit collectively from the diffusion of a resistant innovation. In these circumstances, two or more businesses share a mutual goal that cannot easily be attained without the cooperation of partners.

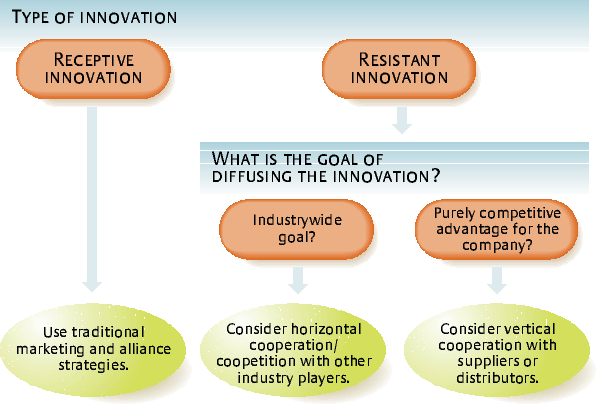

The best marketing strategy for a resistant innovation depends on the company’s overall goal relative to the industry environment. Often, the primary goal of innovation is for the company to differentiate itself to maximize its profits and market share. The driving motivation of the organization is “survival of the fittest.” In such situations, vertical cooperation marketing strategies are most effective.

However, sometimes a cooperative approach using horizontal cooperation is more effective. Businesses within the same industry are frequently faced with similar problems, and in such cases, a common goal exists for the industry as a whole. If companies work together cooperatively, they can grow the overall customer base so that greater profits ensue for the industry as a whole.14 The existence of this shared goal does not prevent companies from maintaining company-specific competitive goals; companies within the same industry can continue to pursue individual interests while also focusing on the industry-level goal.

The Process of Introducing Screw Cap Closures

Wineries in the U.S. and Australasian markets had a vested interest in using screw caps as wine closures, because screw caps solved a quality problem that wineries faced for years. However, U.S. wineries focused on vertical cooperation marketing strategies while the Australians and New Zealanders took a marketing approach emphasizing horizontal cooperation.15 U.S. wineries focused primarily on establishing niche markets. Their initial target market was the high-involvement wine connoisseur knowledgeable about the benefits of screw caps. After winning over early adopters, U.S. winemakers targeted consumer segments where they did not expect resistance to the innovation, such as young wine drinkers, women consumers, consumers who follow scientific developments in the market closely,16 or business markets such as the airline market, where the experiential aspects of wine consumption are not as important. For example, in 2005, Two Tone Farm, a venture by Beringer Blass Wine Estates, which is now part of Foster’s Group Ltd., a beverage company based in Melbourne, Australia, targeted young urban professionals interested in music, food and fun. Two Tone Farm’s wines were priced at approximately $10, and each new release included a music CD of up-and-coming small bands. This approach required the winery’s distribution channels to cooperate in bundling the two products together.

Another marketing strategy U.S. wineries used was to educate both final consumers and distribution channel members on the benefits of screw caps. By educating channel partners, wineries hoped resellers would be more likely to recommend screw-capped products. The Hogue Cellars,17 a winery located in Prosser, Washington, and owned by Constellation Brands Inc., which is headquartered in Fairport, New York, is an example of a winery that has taken this approach. A third marketing strategy focused on improving product. positioning. For example, Plump-Jack Winery,18 which is based in Napa Valley, California, and is part of the San Francisco-based PlumpJack Group, put screw caps on high-end wines, in effect utilizing the extrinsic cue of price to signal high quality. PlumpJack introduced the screw cap version of its 1997 Reserve Cabernet for $135 a bottle while bottles sealed with cork were offered at $125. With this price differential, PlumpJack sought to change the negative public perception of the screw cap by signaling higher quality with its use. Three Loose Screws, a division of another Napa Valley winery, Don Sebastiani & Sons, which is based in Sonoma, California, created a separate product line, Screw Kappa Napa,19 to tackle the screw cap’s negative image, adopting a humorous brand name and designing a playful Web site and bottle labels. This move required support from channel partners, which needed to stock an entirely new product line.

While the marketing strategies used by the American wineries may have been successful for the individual wineries involved, the strategies had only limited success in altering U.S. consumers’ overall perception of screw caps. As of 2005, screw caps had not penetrated more than 5% of the U.S. market. The horizontal cooperation strategy used by the Australian and New Zealand wineries proved to be much more successful in altering consumers’ preferences toward screw caps.

Coopetition As a Marketing Strategy

While individual winemakers in the United States marketed screw cap innovation separately, Australian winemakers were the first to enter into a collaborative alliance voluntarily to promote screw caps. Driven by the superiority of screw caps over cork closures, a group of 15 winemakers from the Clare Valley of Australia in 2000 selected the Stelvin for closing their premium Riesling wines. Gaining insights from the failure to persuade consumers to accept screw caps on fine wine 20 years earlier, this coalition jointly launched a marketing campaign called “Riesling With a Twist” that communicated the quality aspects of the seal to the media, consumers and retailers. In this campaign, wine media critics were used as change agents to influence opinion leaders, since wine critics understood the benefits of screw caps over other closures. Wine media writers, wine connoisseurs and distributors were also targeted through trade shows. In addition, the winemakers used a variety of means to educate the consumer, including consumer-oriented direct marketing promotions such as informative flyers, e-mails, Web sites and wine tasting events. By 2001, most wineries in Australia had begun to use screw caps on one or more of their product lines, with an overwhelmingly positive response from domestic consumers.

The success of the Australian launch motivated 27 New Zealand wineries to form the New Zealand Wine Seal Initiative,20 launched in August 2001. A key role of the NZ Initiative was to promote the use of screw caps, to provide technical support to members regarding the use of screw cap wine seals, and to educate the wine trade, wine press and consumers about the benefits of using screw caps. In 2005, the NZ Initiative had more than 50 member wineries and represented premium producers throughout New Zealand. Both large and small companies were involved. The NZ Initiative also provided its members with additional benefits: They could share research news, exchange successful practices and share costs for the collective public relations efforts associated with educating consumers about screw caps.

The New Zealand wine industry is comparatively new in the global wine market compared to European wine industries or even the American wine industry. The New Zealand wine industry is also comprised of many small players, with newcomers frequently entering the industry. Accordingly, New Zealand wine-makers felt a need to establish a global brand by jointly promoting “New Zealand Wine” as a brand. Overall, the NZ Initiative involved collaborative efforts among winemakers who had two shared goals: to establish screw cap closures as a standard closure for their products and to enhance the reputation of New Zealand wines in the global marketplace. A committee of four representatives, elected by the winemakers, led the NZ Initiative. They specified common goals and established formal leadership for the initiative. The collaborative efforts among winemakers revolved around their two collective goals; the wineries remained competitors in all other respects.

Why was coopetition beneficial to the New Zealand wine-makers? They wanted to establish a new closure standard for the market, but it was a closure that had been resisted by the final consumer and that was not mandated by any outside agency, such as government enforcement. (Poor wine quality caused by cork taint does not constitute a threat to the welfare of New Zealand consumers.) In contrast to the individual efforts of U.S. winemakers, the NZ Initiative sought to send a unified signal to the market about the permanent commitment of wineries to the screw cap innovation and to send the message that screw caps provide better quality New Zealand wines. Without this collaboration among independent market competitors, the innovation might be perceived as just another short-lived marketing or branding strategy. In interviews, New Zealand winemakers emphasized that while each engaged in individual marketing campaigns similar to the marketing campaigns of their U.S. counterparts, they simultaneously promoted screw caps as part of the collective goals of the NZ Initiative. The NZ Initiative also allowed the participating wineries to reduce the risk of negative responses to the innovation from consumers and distributors and to share the costs associated with switching to screw caps. Winemakers did not fully invest in changing their wine production and bottling systems from cork to screw caps immediately, but they often borrowed or shared bottling equipment.

However, the question remains: Why did American wineries not engage in similar cooperation efforts? Coopetition took place in New Zealand in part because industry characteristics provided the right structural conditions for forging cooperation among competing parties, such as industry age, industry climate and industry governing institutions.21 For example, as noted previously, the U.S. wine industry is in a more mature phase than the wine industry in New Zealand. As a result, many American winemakers resisted the screw cap innovation or moved more slowly to implement it because of prior sunk costs in the form of established production lines and well-established brand names.

Furthermore, our interviews revealed that the overall climate in the U.S. wine industry is not generally characterized as cooperative. Interviews confirmed that information and knowledge are slow to diffuse among U.S. winemakers, even among those in geographical proximity. Although quality was the primary motivation for moving to the screw cap innovation, U.S. winemakers also focused on creative market positioning efforts in order to stand apart. Consequently, U.S. competitors had few incentives to collaborate.

In contrast, the New Zealand winemakers appear to be loosely connected to one making it more likely for collaboration to occur.22 The industry climate in the New Zealand wine industry can be characterized as more cooperative, open and friendly because of the need to promote “New Zealand Wine” as a brand. Compared to their American counterparts, New Zealand wine-makers are more willing to exchange research outcomes concerning new innovations. New Zealand winemakers also characterize collaboration as part of the New Zealand culture and identity, in contrast to the individualist and competitive spirit of the American wineries.

Implementing Coopetition For Diffusion-Resistant Innovations

Although horizontal cooperation was a successful strategy for the New Zealand wineries, it is not appropriate for every resistant innovation. If the goal of the introduction of the innovation is purely competitive, vertical cooperation with suppliers or distributors is generally most appropriate. But there are situations in which a common problem, shared collectively by industry players, cannot be overcome through the industry’s standard distribution channels. In such situations, many companies in the industry suffer from the same problem. Where such an industrywide goal exists yet there is uncertainty about the success of the innovation in the marketplace, horizontal cooperation between competitors in the industry may be an appropriate strategy. (See “Developing a Marketing Strategy For Diffusing Innovations.”)

However, before deciding to move forward with a horizontal cooperation strategy, managers need to examine the following issues:

Investigate the scope of the marketing problem that the new innovation faces. What are the consumers’ barriers to adopting the innovation? Are there high or low psychological barriers to adoption? Also, is the problem the company faces an industrywide problem?

Consider the resources available to address the issue. If company resources are lacking, coopetition provides the benefits of sharing costs with other companies that share the problem.

Analyze the specificity of the resources and knowledge that might be exchanged during coopetition. Managers need to determine the level of risk the company may face if knowledge is intentionally or unintentionally transferred during collaboration with competitors. For example, if knowledge regarding a competitive advantage of Company A (a specific production process) is easily transferred to a competing Company B during cooperative efforts, then coopetition is not advisable.

Evaluate the climate within the industry. As the screw cap case study suggests, coopetition is more likely to operate successfully when a collaborative climate exists in the industry. Trust is often seen as a prerequisite for the evolution of cooperation between competitors.23 Such trust can stem from friendships or business relationships between CEOs or board members. Have there been prior cases of collaboration between competitors in the industry, such as joint research? If prior instances of collaboration exist, it may be easier to move forward with coopetition.

To work together successfully, industry actors also need to be compatible. Compatibility can encompass similar historical, philosophical and strategic backgrounds or common values, experiences and principles.24 Compatibility may also take the form of common goals. Compatibility enhances cohesiveness — and thus the evolution of coopetitive structures.

Examine the role of industry-governing institutions or key industry experts. Our research suggests that when an industry-governing body such as a trade association is in place, it may play the role of organizer for the coopetition. However, where a governing body is nonexistent or ineffective, the influence of industry opinion leaders may be needed to provide the necessary momentum for initiating an alliance and keeping it on track.

The Potential of Coopetition

As innovations become more radical through technological advancements such as nanotechnology, genetic modifications and robotics, companies will increasingly encounter marketplace resistance by the average consumer due to perceived risks and uncertainties about the new products. Relying on traditional marketing strategies to overcome the psychological costs of adopting resistant innovations may not prove successful. When consumer barriers to an innovation are universal within an industry, a coopetition marketing strategy may be suitable to overcome this resistance.

The screw cap case study argues for several advantages of a coopetition strategy when introducing potentially resistant innovations into the marketplace. A coopetitive marketing strategy sends consumers a signal of serious, permanent changes in products or services, thus reducing consumers’ psychological switching costs associated with adopting the innovation. As a result, coopetition makes it easier to overcome consumers’ barriers to resistance. Furthermore, the New Zealand case suggests that coopetition brings additional benefits to participating companies, such as shared marketing costs, faster diffusion of market knowledge and increased bargaining power in the global market.

References

1. As described by G.A. Moore in “Crossing the Chasm” (New York: HarperBusiness, 1991), the gap between the early adopters and the mainstream market is caused by the different preferences and expectations of these two segments with regard to the innovation.

2. P.N. Golder and G J. Tellis, “Will It Ever Fly? Modeling theTakeoff of Really New Consumer Durables,” Marketing Science 16, no. 3 (1997): 256-270.

3. R. Agarwal and B. Bayus, “The Market Evolution and Sales Takeoff of Product Innovations,” Management Science 48, no. 8 (August 2002): 1024-1041.

4. Moore, “Crossing the Chasm.”

5. E.M. Rogers, “Diffusion of Innovations,” 5th ed. (New York: Free Press, 2003).

6. S. Ram and J.N. Sheth, “Consumer Resistance to Innovations: The Marketing Problem and Its Solutions,” Journal of Consumer Marketing 6, no. 2 (1989): 5-14; and D. Krackhardt, “Organizational Viscosity and the Diffusion of Controversial Innovations,” Journal of Mathematical Sociology 22 (1997): 177-199.

7. Ram, “Consumer Resistance to Innovations.”

8. J.T. Gourville, “Why Consumers Don’t Buy: The Psychology of New Product Adoption,” Harvard Business School case no. 20039-504-056 (Boston: Harvard Business School Publishing, 2003).

9. Ibid.

10. D. Sogg, “The Science of Closures: Evaluating Corks, Twist-offs and Other Ways of Preserving the Quality of Bottled Wine,” Wine Spectator (March 31, 2005): 55-58.

11. S. Courtney, “The History and Revival of Screwcaps,” Wine of the Week (August 13, 2001), www.wineoftheweek.com/screwcaps/history.html.

12. O. Toubia, J.R. Hauser and R. Garcia, “Probabilistic Polyhedral Methods for Adaptive Choice-Based Conjoint Analysis: Theory and Application,” Marketing Science, in press.

13. Sogg, “The Science of Closures.”

14. The problem of “free riders” does exist, but it is not the focus of this paper.

15. R. Garcia and T. Atkin, “Co-opetition For the Diffusion of Resistant Innovations: A Case Study in the Global Wine Industry,” working paper 05-002, Institute for Global Innovation Management, Northeastern University, Boston, 2005.

16. This “scientific” wine consumer segment consists of wine drinkers who make wine choices based on quality and follow scientific developments in the market closely. All winemakers interviewed identified this consumer segment.

17. See www.hoguecellars.com/feature/homework.html (last viewed June 24, 2006).

18. See www.plumpjack.com.

19. See www.3loosescrews.com.

20. See www.screwcap.co.nz.

21. B. Kogut, W. Shan and G. Walker, “The Make-Or-Cooperate Decision in the Context of an Industry Network,” in “Networks and Organizations: Structure, Form, and Action,” eds. N. Nohria and E. Eccles (Boston: Harvard Business School Press, 1992): 348-365; R. Gulati and M. Gargiulo, “Where Do Interorganizational Networks Come From?” American Journal of Sociology 104 (March 1999): 1439-1493; and G. Walker, B. Kogut and W. Shan, “Social Capital, Structural Holes and the Formation of an Industry Network,” Organization Science 8, no. 2 (1997): 109-125.

22. X. Luo, R.J. Slotegraaf and X. Pan, “Cross-Functional ‘Coopetition’: The Simultaneous Role of Cooperation and Coopetition Within Firms,” Journal of Marketing 70, no. 2 (2006): 67-81.

23. R.M. Morgan and S.D. Hunt, “The Commitment-Trust Theory of Relationship Marketing,” Journal of Marketing 58, no. 3 (July 1994): 20-38.

24. L.P. Bucklin and S. Sengupta, “The Co-Diffusion of Complementary Innovations: Supermarket Scanners and UPC Symbols,” Journal of Product Innovation Management 10, no. 2 (1993): 148-160.