The Changing Face of Corporate Boards

Boards in the United States are undergoing reforms in leadership, membership and performance evaluation. But are all the changes for the better?

Over the past four years, corporate boards in the United States have been under increasing pressure. Stimulated by high-profile scandals, investor dissatisfaction with board performance and questions about the level of executive compensation, regulators have introduced significant reforms in the rules governing boards. First, the U.S. Congress passed the Sarbanes-Oxley Act of 2002, which mandates that only independent directors can serve on the audit committee and also increases the requirements for the financial knowledge of directors, among other changes. Then the New York Stock Exchange and NASDAQ adopted new listing requirements, including implementing stricter rules for board independence and mandating regular executive sessions in which only outside directors meet. More recently, the U.S. Securities and Exchange Commission has proposed new reforms that would make it easier for outside shareholders who are disgruntled with a board’s performance to nominate their own slate of directors.

Of course, adopting new rules and regulations is one thing; whether the reforms actually change the way boards operate is another. Furthermore, during a period of great demand for change, it is important to focus on what actually contributes to the effectiveness of boards. A real danger exists that the mandated changes not only will fail to enhance how companies are governed but also will lead to a number of negative unintended consequences, including very high costs of implementation.

To investigate the impact of recent changes in boards, we conducted a study that compared the board practices and effectiveness of Fortune 1000 companies in 1998 versus 2003. (See “About the Research.”) We specifically looked at three areas: board leadership, the conditions governing board membership, and the performance evaluations of boards, individual board members and CEOs. We were particularly interested in determining whether any practices in those three areas were actually related to overall board performance.

Board Leadership

Experts have frequently commented on the type of leadership that a board should have. They generally agree that boards should have clearly developed governance standards specifying how they operate, what their roles are, and how the board will be led. But there is little consensus regarding whether the chair of the board should be an executive. In the United Kingdom and other countries, the common practice is to have a nonexecutive chair, whereas in the United States, the chair is typically also the company’s CEO. (See “Should the CEO Be the Chairman?” by Jay W. Lorsch and Andy Zelleke, p 71.)

The basic argument in favor of a nonexecutive chair is that such a person can provide the board with independent leadership and prevent any one individual from having too much power. In theory, this approach should enhance the board’s ability to evaluate managerial performance, to choose a new CEO when necessary and to lead in the event of a crisis. An alternative practice is to have an independent board member (often called alead orpresiding director) provide leadership by coordinating the agenda and chairing board meetings. Creating this type of position has very similar advantages to having a nonexecutive chair, although it may not move the board nearly as much toward independent operation.

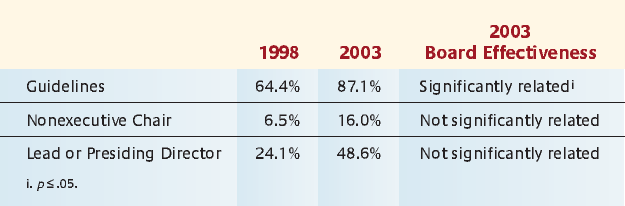

In our study, 64% of the companies had formal governance guidelines in 1998. (See “Leadership Practices Implemented by Boards.”) That number increased significantly by 2003, when 87% had formal written guidelines. An even greater proportional increase occurred with respect to the creation of nonexecutive chairs, albeit from a much lower base. In 1998, only 6% of companies had nonexecutive chairs; by 2003, this percentage had more than doubled to 16%. Thus, although a clear trend exists toward a greater use of nonexecutive chairs, the practice is still relatively rare among U.S. firms.

The practice of having a lead director has gained considerably in popularity. Only about a quarter of the boards studied had lead or presiding directors in 1998, but that number rose to almost 50% by 2003. When that percentage is combined with the fraction of companies having nonexecutive chairs, a clear majority of large U.S. corporations now have boards led by someone other than the company’s CEO. This is a major change from 1998, when only a little over 30% of companies were led by non-CEOs.

Interestingly, of the different aspects of board leadership studied, only the adoption of formal corporate governance guidelines was significantly related to board effectiveness. We found no significant relationship between board effectiveness and the practice of having a nonexecutive chair or that of having an independent person serve as a lead or presiding director.

The link between formal guidelines and board effectiveness is hardly surprising, because guidelines can provide structure for boards and help them be more effective in their deliberations and decision-making processes. Somewhat surprising is the lack of a connection between non-CEO leadership and board effectiveness, because it runs counter to a number of arguments favoring independent leadership. One explanation could be that because the accepted norm in the United States is to have the CEO serve as chair, appointing a different person might be perceived as the last resort of companies in crisis, such as General Motors Corp. in the 1980s. Another possibility is that having two leaders blurs accountability and results in internal board conflicts, particularly when the chair is the former CEO of the company.

There was, however, one area in which having a nonexecutive chair was related to board effectiveness: When boards had independent leadership, they tended to perform better in terms of corporate strategy. This result provides some support for the idea of having a nonexecutive who leads or presides over the board’s operations.

Limits on Board Membership

Establishing limits on the number of boards an individual can be on is justifiable for several reasons. First, the workload is increasing for board members, making it more likely that individuals who serve on many boards simply won’t have enough time to perform effectively. A less obvious issue concerns overlap. Many critics have pointed out that a relatively small number of people holding multiple board seats essentially forms a closed society of individuals that governs large U.S. corporations. When the same people sit on each others’ boards, they may lose objectivity and independence.

Long tenures are also a potential problem. When people remain on a board for a long time, they can become too close to senior management and lose their objectivity. In essence, they may become too comfortable with the status quo. On a related note, failure to have a mandatory retirement age has traditionally been thought to be detrimental to board performance if members are allowed to serve even after advanced age has substantially diminished their ability to perform effectively.

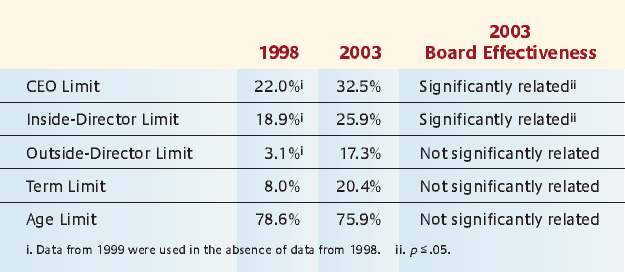

In our study, we found that a growing number of companies have been placing limits on board memberships. (See “Membership Practices Implemented by Boards.”) Specifically, companies are increasingly limiting the number of boards their directors, including their CEOs, can serve on. (That said, it should be noted that most companies still have no such limitations.) Particularly interesting is the greater prevalence of limitations for outside directors. In 1998, only 3% of companies limited the board memberships of their outside directors, whereas in 2003, this number had grown to 17%. Also, an increasing number of companies have been limiting the terms of their directors. Just 8% of firms had such a policy in 1998, whereas this number had more than doubled to 20% in 2003. Lastly, age limits are in place at more than 75% of companies, a practice that declined slightly from 1998 to 2003.

One effect of these limitations on board membership is that turnover among directors will inevitably increase. As a result, companies will have to expend more resources recruiting, training and developing new board members at a time when liability and workload concerns are making it more difficult to find qualified candidates. It also means that the total number of individuals on U.S. corporate boards will likely rise, because fewer people will be able to hold multiple board seats. This could result in the appointment of more “professional directors.” (See “Are Professional Board Directors the Answer?” by Eugene H. Fram, p. 75.) It may also lead to board members having more time to spend working with each company board they serve on, which should increase the effectiveness of those individuals.

Two of the practices pertaining to membership show a significant relationship to overall board effectiveness: limiting the number of boards a CEO can serve on and doing likewise for inside directors. A number of explanations are possible, but perhaps the most obvious is this: If CEOs and inside directors are serving on numerous other boards and the demands of those commitments are substantial, they will simply not have as much time to devote to their own companies. A counterargument is that, by allowing CEOs and inside directors to be on other companies’ boards, these individuals will gain valuable experience that will benefit them at their own organizations. Although that point is undoubtedly valid, a law of diminishing returns might apply, such that being on a number of outside boards could easily have an overall negative impact as the time demands outweigh the learning opportunities.

Interestingly, the most popular practice having to do with membership — enforcing an age limit for board members — is not significantly related to board effectiveness. This observation raises the question of whether this practice should be in place at all, particularly given concerns about age discrimination. The same may be true of term limits, which have become increasingly popular even though they are not related to board effectiveness.

Performance Evaluations

The failure of many boards to operate effectively, particularly with respect to the firing of underperforming CEOs, has led to a growing emphasis on how boards evaluate top management as well as themselves. In the case of ineffective CEOs, boards need a process for identifying and addressing the performance shortfalls of those individuals. With respect to their own performance, boards need a mechanism for understanding their weaknesses and for making the necessary adjustments. Lastly, the performance of individual board members is another issue. Without a creditable process for evaluating directors, it may be difficult to obtain the best work from board members and to remove those who perform poorly.

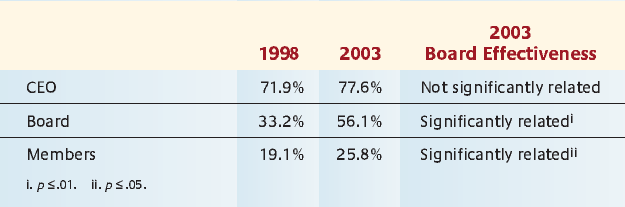

In our study, the most common evaluation process is for CEOs. (See “Performance Evaluations Used by Boards.”) In 1998, 71% of the boards evaluated the CEO; by 2003, that number had increased slightly to 78%. Perhaps the most surprising factor here is not that most boards formally evaluate their CEOs but that as recently as 2003, more than 20% of corporations still did not. Thus, despite the fact that boards have come under attack for the enormous escalation in CEO compensation during the last decade, and despite the lack of a relationship between CEO pay and performance, a significant number of the nation’s largest corporations do not evaluate CEO performance.

With respect to board evaluation, 56% of those boards surveyed had a process in place in 2003, substantially up from just 33% five years earlier. Interestingly, that big jump occurred before board evaluation became a requirement of the Sarbanes-Oxley Act.

The evaluation of individual board members has increased only slightly, from 19% in 1998 to nearly 26% in 2003. Companies doing these evaluations relied on three different mechanisms: self-evaluations, written feedback and feedback to the entire board. Of these, self-evaluations occurred in about 50% of the cases in which companies had an evaluation process. Providing written feedback to individual directors about their performance, often done by an outside consultant who might interview other board members and stakeholders, is a common practice among nearly half of the boards that conduct member evaluations. Similarly, giving feedback on the results of the evaluation process to the entire board occurs among more than half of the boards that conduct evaluations. The use of all three of these practices greatly increased from 1998 to 2003.

Boards that assess their members and themselves tend to be more effective than those that don’t. This finding strongly supports the Sarbanes-Oxley requirement that boards regularly evaluate themselves. It also suggests that, in the future, boards should be required to assess the performance of individual board members in addition to evaluating their own overall performance.

Interestingly, the routine conduct of CEO evaluations was not related to overall board performance — a surprising result, given the fact that one of the roles of most boards is to assess the CEO’s performance, and a formal process is usually the best way to accomplish this. However, since this is only one function of the board, it’s low impact onoverall board performance is plausible. But boards that did conduct CEO evaluations were rated more highly on theirstrategic performance. One possible explanation is that these boards used performance reviews to hold CEOs accountable for particular strategic goals and outcomes. Thus such evaluations helped to ensure that strategic decisions were translated into action.

Future Directions

Indeed, corporations in the United States have been changing, but the big question is whether they’ve been changing in the right ways. The evidence suggests that, as a general rule, they are. It should be noted that boards are likely to be just at the beginning of a major transformation. In the not-too-distant future, many of the practices studied here may be adopted more widely. Some changes will come about because of legal and regulatory requirements, others simply because boards will be under continuing pressure to improve their performance. A number of important questions about what makes for an effective board remain unanswered. Further research in this area should help to answer those questions, pointing toward increasingly better ways for boards to operate.