The Digital Transformation of Traditional Business

Topics

During the 1990s, companies had vast amounts of funding for new information technologies, or NIT.1 They invested millions of dollars on Web sites, sophisticated software packages, teleconferencing equipment, broadband networks, mobile communications and other digital technologies. Such investments helped them to keep abreast of competitors that were making similar expenditures. Today, many companies are strapped for resources, and they need to be extremely selective about the technologies they fund, deploying NIT in ways that are the most relevant to their businesses and strategic objectives, including their sales and marketing efforts.

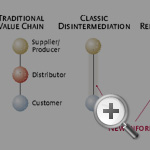

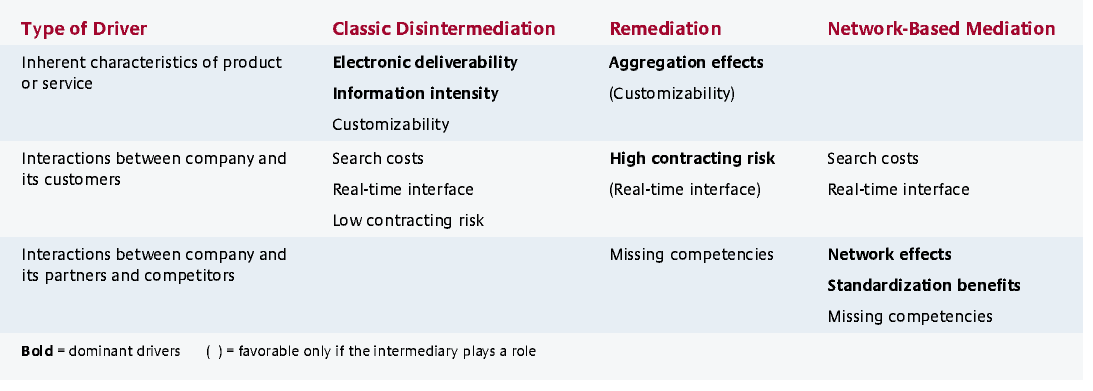

What kinds of companies and products can benefit most from the use of NIT? Books and airline tickets sell readily over the Internet whereas automobiles and high fashion clothing do not. Furthermore, what types of business transformations do such investments enable? A company might, for example, use NIT to cut away layers of middlemen, such as distributors, that separate it from its customers (called classic disintermediation). Or, instead of getting rid of middlemen, it might choose to embrace them (remediation). Or it might build strategic alliances and partnerships with new and existing players in a tangle of complex relationships (network-based mediation). (See “Three Mediation Strategies.”)

All three mediation strategies depend on various factors, such as a product’s customizability and information content. By fully understanding those drivers of NIT, companies can begin to predict the potential transformations of their industries, especially in terms of how products are marketed and sold. To that end, we have developed a systematic framework that identifies which drivers are important for the different approaches of classic disintermediation, remediation and network-based mediation. Using this tool, companies can determine both the optimum ways to transform their businesses and the NIT investments required to accomplish such changes.

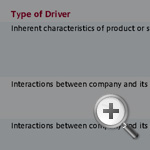

The Drivers of NIT

From a study of large corporations in North America and Europe, we have identified the different drivers that determine the competitive advantages of deploying NIT. (See “About the Research.”) Each of the drivers is very specific to how NIT can be applied in a particular industry. That is, they are not general factors, such as the overall cost of a technology. And they are different from the critical success factors that affect the implementation of information technology and that are mostly specific to a company, as opposed to being characteristic of an industry.2 Several of the drivers are obvious, and some have been identified previously. There are a total of 10, and they fall into three categories. (See “The 10 Drivers of New Information Technologies.”)

Electronic deliverability.

Some products have a large component that can be delivered electronically. Airline companies, for instance, enable customers to book reservations online, after which the confirmations and tickets can be delivered efficiently through e-mail. On the other hand, NIT has not been as effective with car shopping. Consumers can get information on different models and compare prices over the Web, but they still need to test drive the vehicles and physically inspect them before taking delivery.

Information intensity. 3

Nearly all products and services have some information content, but the amount varies dramatically. Cars come with volumes of operating instructions; ice cream bought from a street vendor comes with no information except the name of its flavor. With books and magazines, the information they deliver is the product. In the past, information was limited and difficult to collect, and customers often had to shoulder the burden of extracting the data they needed by sorting through manuals and other documentation or by calling toll-free numbers for help. The advent of new technologies such as the Web has enabled companies to leverage the information content that is inherent in their products and services. Of course, products and services with greater information intensity have more potential to benefit.

Customizability. 4

NIT allows many companies to tailor an overall offering to the specific needs and preferences of individual customers. In the past, newspapers were a one-size-fits-all product. Today, online editions can be customized to include just the news and information that a particular subscriber is likely to want. Similarly, customers of Dell Computer can purchase a PC with just the right disk space, m icroprocessor power and other features that they need. NIT (specifically, s ophisticated software for supply-chain management) enables Dell to sell such made-to-order computers at competitive prices. With other products like small home appliances (toasters or coffee makers) though, there is much less opportunity to profit from such customization.

Aggregation effects. 5

Products and services differ in the way they can be aggregated or combined. In the past, U.K. customers dealt with a bank for their savings and day-to-day transactions, a building society for their mortgages, an insurance agent for life and property policies, and an independent financial adviser for their investments. Thanks to NIT (and deregulation), institutions can offer customers bundled services (with attractive interest rates and better terms) to handle all those financial needs through one account. In addition to convenience, aggregation also affords customers greater confidence. For example, many consumers have begun to buy more than just books from Amazon.com, which now offers toys, clothing, tools and other items, because they are familiar with the Web site and trust the quality of its products and service.

Search costs.

Before the advent of companies like Amazon.com, finding an out-of-print book could require considerable time and effort.6 Now, the Web provides people with vast amounts of information, regardless of their location or time zone, lowering the search costs for finding exactly the product or service they want. NIT has also introduced more transparency in transactions: Customers and suppliers can now compare prices, product features and service attributes online. Nevertheless, although NIT has transformed markets that had high search requirements in the first place (for example, the travel industry), it has not achieved the same for other products, such as a pair of socks whose characteristics (color, size and thickness) are limited and generally remain constant. This explains why most consumers still buy their socks through traditional channels, by physically going to a store or by ordering from a mail catalog.

Real-time interface.

A real-time interface is necessary for companies and customers dealing with important information that changes suddenly and unpredictably. A good example is online trading, in which rapid fluctuations in the stock market can be devastating for those who lack instantaneous access to that information. But a real-time interface is also important for customers who do not want to be constrained to transacting business during normal office hours. At home at night, for instance, they might want to transfer money from their savings account, order a gift for someone or track a package they’ve sent. In contrast, customers who drop off clothes to a dry cleaner only need the information on the collection tag, telling them the pickup date. That is, real-time updates are of little value when the pertinent information rarely changes.

Contracting risk.

Buying new books online has little contracting risk for customers: Prices are relatively low; specifying the exact titles is straightforward; the physical quality of books varies little; and merchants are motivated to fulfill each order efficiently to encourage customers to return (and, anyway, if an order is mishandled, the cost to the consumer is minimal). Buying cars online is a completely different matter: Prices are substantially higher; specifying the exact product is difficult; the physical quality of the vehicles (for example, their color) can be different from the descriptions on a Web site; and sellers do not typically expect repeat purchases, so they might be less motivated to deliver premium service.

Network effects. 7

In many industries, the utility of a good or service increases with the number of people who are using it (or one that is compatible). A key benefit of using Microsoft Office, for instance, is that the suite of programs is ubiquitous in the business world, enabling people to share Word, PowerPoint and Excel documents easily. With other products and services though, the relationship is reversed. People who purchase status goods, for example, are drawn to such products because of their exclusivity. An example of network effects with respect to business partners is the Automotive Network eXchange Network (ANX), which General Motors Corp., Ford Motor Co. and Daimler-Chrysler created to support automated interactions with their parts suppliers. ANX defines a set of technology and service-quality standards for exchanging critical transaction and planning documents over the Web, thereby enabling a large network of partners to conduct business efficiently.8

Standardization benefits.

NIT has enabled companies to synchronize and standardize certain processes, resulting in greater efficiency in business-to-business transactions as well as increased convenience for customers. In the banking industry, the standardization of automated teller machines through shared networks has allowed people to withdraw cash from their accounts and check their balances even when they are traveling internationally. That is, they are not limited to the proprietary ATMs of their own bank. On the Web, the extensible markup language (XML) family of standards will significantly increase a company’s ability to broadcast a message to a wide audience in the most efficient and powerful way. But businesses that do not rely heavily on NIT (the restaurant industry, for instance) will see fewer direct benefits from standardization.

Missing competencies. 9

NIT can facilitate company alliances in which partners use each other to fill in missing competencies (defined as activities that an organization lacks internally but that are critical to an overall product or service offering). In 1994, for example, Air Canada decided to outsource all of its IT operations to IBM — an unusual move at the time. Seven years later, the company made IBM its partner in a bid to recoup some of its expenses in developing new airline-specific technology.10 Through the arrangement, IBM is helping Air Canada to improve a number of its products and services, such as providing passengers with in-flight Internet access. In contrast, NIT provides fewer opportunities for industries (usually low-tech ones) in which companies can be more self-sufficient.

Three Mediation Strategies

The 10 drivers determine what type of mediation approach is most likely to succeed in a particular industry. (See “NIT Drivers and the Three Mediation Strategies.”) For each of the three strategies, a couple of drivers are dominant, several are ancillary, and others have little consequence.

Classic disintermediation is affected mainly by drivers that pertain to the inherent characteristics of a product or service. Specifically, electronic deliverability is a major factor. That is, why use a distributor when a product or service can be delivered electronically to the customer? Information intensity is another dominant driver. Before NIT, products or services with high information intensity often needed intermediaries, such as an insurance agent, to explain a complex policy. Now, a sophisticated Web site can perform much of that functionality. Less powerful drivers of disintermediation include customizability, search costs, real-time interface and low contracting risk. An industry that benefits from technology that provides a real-time interface, for instance, will favor disintermediation in order to eliminate the time lag caused by middlemen.

Remediation is affected mainly by two drivers: aggregation effects and high contracting risk. When there are benefits to combining products or services, companies can use NIT to work more closely with their middlemen partners, building strong, ongoing relationships. Some insurance companies, for example, now provide potential customers with online estimates of different policies through the Web site of the Automobile Association of America (www.aaa.com). High contracting risks also encourage companies to use NIT to establish closer — and more secure — relationships. Ford, for instance, relies on the Web-based applications of middleman Vastera Inc., a Virginia-based firm, to handle import and export processes, customs clearance, trade-regulation compliance and cost calculations for shipments to Mexico and Canada.11 Other drivers of remediation are customizability (if the middleman can contribute to the customization process rather than get in its way), real-time interface (if the interface is between the middleman and either the producer or customer — and not between the producer and customer, which would instead encourage disintermediation) and missing competencies. Note also that, as discussed earlier, high search costs tend to favor disintermediation instead of remediation.

Network-based mediation is affected mainly by drivers that pertain to a company’s interactions with its partners and competitors. Specifically, network effects and standardization benefits are clearly important reasons for industry players to work more closely together. Other drivers include high search costs (which favor the use of a network for locating products and information), the need for a real-time interface (which encourages partners to build an NIT system that enables them to deal with each other in real time) and missing competencies (which encourages companies, even competitors, to partner with one another to fill those gaps).

Classic Disintermediation

A good example of classic disintermediation is easyJet Airline Co., the British low-cost airline. Since its first flight in 1995, easyJet has spurred the transformation of the European travel industry by allowing customers to book flights online. That process bypasses travel agents, which enables the company to offer lower fares. Details of easyJet’s operations reveal the important role of different NIT drivers in the company’s success.

Electronic deliverability.

The first step was for easyJet to convert certain physical activities into digital processes. For starters, easy-Jet sold more than 90% of its tickets over the Internet, which meant there were no middlemen adding unnecessary costs. The company also pioneered ticketless travel in Europe: Passengers who book online receive just an e-mail containing their travel details and confirmation numbers. This innovation helped reduce the cost of issuing, distributing, processing and reconciling millions of tickets each year.

Information intensity.

Embracing the concept of the paperless office, easyJet implemented the motto If it’s possible, reasonable or feasible, we’ll do it over the Net. For example, easyJet scrapped its traditional hiring system in lieu of online methods, even recruiting pilots principally through its Web site. Candidates use the site to obtain job specs and fill out application forms. Subsequent correspondence between prospective pilots and easyJet is also conducted online, with physical contact taking place only for those candidates who successfully pass the early rounds. The system has had a side benefit: In anticipation of future growth, easy-Jet was easily able to build a database of potential recruits from the electronic information collected.

Search costs.

To facilitate price comparisons with competitors, the easyJet Web site remembers essential passenger information so that customers do not have to reenter details if they want to experiment with various travel dates and times. For registered users, the system also keeps track of details (for example, flight destinations, number of passengers, and so on) from one booking session to the next, thus personalizing the Web experience and simplifying future reservations.

Real-time interface.

The easyJet Web site provides instantaneous cost-per-seat comparisons with competitors, thereby guaranteeing customers the lowest prices for the flights they book. Moreover, customers have access to such information on a 24/7 basis.

For easyJet, eliminating middlemen has been an effective strategy. But classic disintermediation is tricky because a company must then become a one-man show, assuming the full responsibility of maintaining its relationships with customers.12 Consider Levi Strauss & Co., which tried to go it alone in e-commerce.13 Initially, the clothing giant thought it could keep the cyber market to itself by investing millions of dollars in its Web project and by preventing retailers from selling Levi’s jeans and other clothing online. But less than a year later, the company scrapped its efforts for selling direct on the Web and left such sales to retailers like J.C. Penney Co. Inc. and macys.com Inc.

An analysis of NIT drivers helps explain Levi’s failure. Of the five key drivers for classic disintermediation, only one (low contracting risk) applies to the mass market for jeans. The other four (electronic deliverability, information intensity, high search costs and a need for real-time interface) have little relevance. Levi’s experience brings home the important lesson that it’s not always feasible for companies to go it alone in dealing with their customers. Even NIT-enabled firms have learned that retailers, distributors and other middlemen are often better equipped to fill operational gaps, handling consumer interactions, promotions and service demands such as product returns.

Remediation

Companies like Toys “R” Us do not use NIT to cut out middlemen.14 Quite the contrary, they deploy NIT to work more closely with their value-chain partners. Details of the operations of such firms help illuminate the importance of certain NIT drivers.

Aggregation effects.

Grocery shopping can be a mundane and time-consuming task, so the idea of using the Web to perform the chore has inherent appeal. But, then, why did U.S. startups such as Webvan and Peapod Inc. initially fail? To answer that, consider the success of Tesco.com, an online shopping service provided by Tesco, the U.K. supermarket giant.15 Tesco.com has become the world’s largest online grocery retailer, and it is one of the most popular U.K. shopping destinations on the Web. In 2001, it had more than 1 million registered users and received more than 70,000 orders per week. One reason for that success is that Tesco aggregates by using its existing supermarkets as warehouses for its online business (in contrast to Webvan and Peapod, which started off as stand-alone operations that had to build vast new warehouse facilities, incurring huge capital costs).

High contracting risk.

One reason for the success of middleman eBay is that the auction service helps reduce the contracting risks between buyers and sellers. Items sold on eBay often have expensive prices, great complexity in product specification and wide variability in quality. Furthermore, many of those products also have a low potential for repeat business. To reduce the contracting risk, eBay has implemented a system through which buyers rate sellers. Also, eBay relies on other intermediaries — for example, SquareTrade, a company that licenses certain vendors and helps resolve disputes between buyers and sellers — to further reduce the contracting risk. Because of this, eBay, which started off handling mainly C2C sales, has increasingly been moving into B2C and even B2B transactions.

Missing competencies.

After it failed to deliver toys in time for Christmas 1999, Toys “R” Us quickly realized that it needed help with the logistics of electronic retailing. So the company partnered with middleman Amazon.com, which now provides the online platform for Toys “R” Us products. Through the arrangement, Toys “R” Us selects the merchandise and owns the inventory, and Amazon.com provides the Web site and fulfills the orders. The computer systems of both companies are linked to maximize operating efficiencies and provide customers with certain benefits. For instance, new products offered by the toy retailer are promoted on the Amazon.com Web site, and items bought there can be returned or exchanged through any of the Toys “R” Us physical retail outlets. Thanks to the partnership, Toys “R” Us gains not only a reliable online distribution channel for its products but also the positive association with a leading Internet pioneer. And the company is now free to concentrate on its strength: toy retailing.

Network-Based Mediation

In general, customers dislike being limited to a single provider.16 Instead they want the convenience and broad selection of multiple vendors. Similarly, suppliers do not want to be limited to a single customer, even if it is a large corporation. The strategy of network-based mediation addresses such issues. Because players are free to interact in the network, they can each carve out their own spaces, sometimes creating opportunities that did not exist before. Consider Eastman Chemical Co., which manufactures and markets chemicals, fibers and plastics.17

Network effects.

To expand its network of business partners, East-man created an Internet portal (PaintandCoatings.com) that provides value-added information to a community of users of coating products. The portal has allowed Eastman to extend its reach into this market segment, opening the door to new opportunities. In addition, Eastman has participated actively in specialchem.com, a comprehensive technology Web site for the chemical industry with a large membership of thousands of technical and R&D people around the world. The site enables those professionals to interact with Eastman’s technical experts, who might then recommend some of Eastman’s products as part of a proposed solution. Through specialchem.com, Eastman has developed numerous contacts and relationships, identified emerging technical trends, and found new projects with potential sales opportunities.

Standardization benefits.

Eastman collaborated with its peers to form a working group of the top 20 to 30 chemical companies. Their initiative, called the Chemical Industry Data Exchange (CIDX), created a standard format and language for transferring data electronically among different organizations. CIDX proved particularly effective in stopping the proliferation of incompatible systems across companies, users and industries.

Search costs.

The chemical and materials industry is characterized by high search costs: significant fragmentation of buyers and sellers, considerable regulatory oversight and complex information exchanges across the supply chain. CIDX enables data to be interchanged more easily, and NIT facilitates that process, making it simpler for buyers and suppliers to communicate their requirements, thereby decreasing search costs and making the supply chain more collaborative and efficient.

Real-time interface.

Eastman used NIT to differentiate itself by offering superior customer service. The process began with a fundamental shift from focusing on internal efficiency to changing the very nature of the customer-engagement process. Instead of managing a number of internal documents containing information that would then be relayed to the customer via fax, e-mail or phone, Eastman used NIT to provide a real-time, global interface to offer customer service on a 24/7 basis. To do so, Eastman had to decouple the customer interface from the company’s rigid internal process and then provide a flexible layer of integration between the two. In 1998, the company launched a Web site (www.eastman.com) that contains company and product information and provides customers with order-entry and tracking functions, as well as up-to-date account information enabling them to manage their purchasing levels better.

Missing competencies.

Early on, Eastman realized the potential of NIT to change the landscape of the chemicals industry, and it knew it had to build its competence in this area. So it formed an internal group dedicated to looking at how emerging digital technologies could affect business models in the chemical industry. The working group, dubbed Emerging Digital Technologies (EDT), applies rigorous tests on new technologies before recommending that Eastman either adopts them companywide or funds them through Eastman Ventures, its venture capital arm. Through the initiative, for example, Eastman has partnered with webMethods Inc., a leading provider of integration software, to adapt and refine that company’s products to the specific needs of the chemical industry. Today, webMethods solutions are present in the linkages among the enterprise-resource-planning (ERP) systems of many chemical companies, enabling efficient transactions.

Eastman was hardly the only company to use a strategy of network-based mediation. Indeed, “If you build it, they will come” became the mantra of hundreds of B2B exchanges that sprouted during the Internet boom.18 For various reasons, though, many of them flopped. Case in point: Chemdex Corp., the B2B e-commerce firm that specialized in enabling science professionals to buy hard-to-find chemicals and compounds.19 Chemdex thought it was positioned for success with a business model that seemed to fill a real market need. Yet even as the company managed to secure millions of dollars in venture capital to build a thriving network of suppliers and users, all connected through digitized transactions, success was still elusive. The problem was that Chemdex lacked an essential ingredient for network success: strong relationships with its trading partners.

In contrast, when Eastman formed a similar B2B venture, it relied heavily on its existing relationships with partners. That facilitated Eastman’s efforts to create a virtual network with them, enabling the secure exchange of highly specific and sometimes sensitive information, much like the transactions of online banking. This advanced level of connectivity not only empowered Eastman’s trading partners by providing them with greater and more varied access to the company, it also increased the trust and depth of the relationships between them.

An interesting development with network-based mediation is the establishment of large-scale systems in which an entire industry attempts to establish B2B connectivity. One example is Elemica, the global network for chemical buying, selling and supply-chain management. Elemica provides a tremendous number of connections (and thus myriad transaction opportunities), greater than any single company could have established with its own network. But although this type of network seems to have achieved a domino effect in terms of widespread adoption, its current focus on achieving transactional savings might be shortsighted. Eastman’s experience in private B2B connections with strategic partners suggests that greater value can be obtained by re-engineering relationships to solve the business-specific pain points found in the interactions between trading partners.

THE NUMBER OF technologies and software capabilities that exist today far exceeds that which any company could ever possibly adopt. And even newer information technologies are currently being developed for future use. Indeed, the availability of NIT is not the problem. Instead, the issue is choosing which technologies to deploy — and to what purpose. To be sure, different industries offer companies differing potential for using NIT to transform their businesses through three types of mediation strategies. By looking at the 10 drivers of NIT, companies can determine the mediation approach that will work best for their particular businesses.

The examples of companies like easyJet and Eastman have shown the power of NIT to transform an industry. For Eastman, networks enabled instant connectivity to customers as well as to fellow members of the value chain. But that’s just part of the story. Both new and established companies participating in the network still faced significant hurdles in using NIT to optimize their business operations. For new players, the challenge was to develop a profitable and scalable business model, with NIT as a tool. For established players, the obstacles were often more daunting, because the entire organization needed to adopt the right attitude to adapt to new business methods. In other words, determining the best mediation approach is merely the first step of a long journey. Companies must then execute that strategy, implementing substantial changes in their organizations, along with all the necessary business restructuring that they entail.

References

1. We define NIT as information technologies commercialized in the 1990s as well as the more intensive and extensive applications of earlier information and communication technologies, or ICT.

2. See, for example, the “critical success factors,” which are quite different from our drivers, in J.F. Rockart, “The Changing Role of the Information Systems Executive: A Critical Success Factors Perspective,” MIT Sloan Management Review 24 (fall 1982): 3–13.

3. For some arguments for this driver, see Y. Bakos, “The Emerging Role of Electronic Marketplaces on the Internet,” Communications of the Association for Computing Machinery 41 (August 1998): 35–42.

4. See A. Slywotzky, “The Age of the Choiceboard,” Harvard Business Review 78 (January–February 2000): 40–41.

5. See S. Madnick and M. Siegel, “Seizing the Opportunity: Exploiting Web Aggregation,” MIS Quarterly Executive 1 (March 2002): 1–15; and Y. Bakos and E. Brynjolfsson, “Bundling and Competition on the Internet,” Marketing Science 19 (winter 2000): 63–82.

6. For similar examples, see S. Konicki, “A Page From Amazon’s Book,” Informationweek.com, Sept. 17, 2001, 105–107.

7. See P. Cartwright, “Only Converge: Networks and Connectivity in the Information Economy,” Business Strategy Review 13 (summer 2002): 59–64; and O. Shy, “The Economics of Network Industries” (Cambridge, U.K.: Cambridge University Press, 2001).

8. J.E. Frook, “Automotive Extranet Lights Fire Globally,” Internetweek, Apr. 20, 1998, special volume, 1.

9. See W. Ebeling and A. Snyder, “Targeting a Company’s Real Core Competencies,” Journal of Business Strategy 13 (November–December 1992): 26–32.

10. J. DiSabatino, “IBM and Air Canada Expand Relationship,” Computerworld, July 30, 2001, 61.

11. M. Songini, “Ford Gets Help With Global Supply Chain,” Computerworld, July 30, 2001, 12.

12. A similar argument is put forward by D. Rogers, “Who’s Afraid of Disintermediation?” Catalog Age 17 (August 2000): 12–13.

13. J. King, “Disintermediation/Reintermediation,” Computerworld, Dec. 13, 1999, 54–55.

14. For discussions related to remediation, see S. Vandermerwe, “The Electronic Go-Between Service Provider: A New Middle Role Taking Centre Stage,” European Management Journal 17, no. 6 (December 1999): 598–608; and P. Anderson and E. Anderson, “The New E-Commerce Intermediaries,” MIT Sloan Management Review 43 (summer 2002): 53–62.

15. See www.tesco.com.

16. For a discussion of network-based mediation, see N. Carr, “Hypermediation: Commerce as Clickstream,” Harvard Business Review 78 (January–February 2000): 46–47.

17. See also L. Downes, “The Strategy Machine” (New York: Harper Collins Publishers, 2002): 76–80, 93–96 and 127–128.

18. See “Business: Time To Rebuild,” The Economist, May 19, 2001, 55–56.

19. See “Wharton: The Chemdex Approach to B2B E-Commerce,” May 2000, http://www.ebizchronicle.com/wharton/07_chem.htm; and P. Samec, “Thinking Ahead on E-Marketplaces,” Computerworld, July 2, 2001, 24.

Comment (1)

JEAN-FRANCOIS GORE