Financial Management & Risk

The Case Against Restricting Stock Buybacks

Research on stock buybacks does not find evidence that the practice results in the economic costs that critics allege.

Research on stock buybacks does not find evidence that the practice results in the economic costs that critics allege.

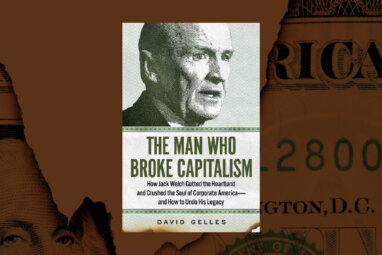

Corporate downfalls offer a warning about the risks of trading competitive advantages for short-term financial gains.

A new book about former GE CEO Jack Welch blames him for shareholder capitalism, but there were other factors at play.

Identify which stakeholders will create long-term value for shareholders.

Will the new Business Roundtable Statement have material impact for American workers?

There are many good reasons why companies should comply with TCFD disclosure recommendations.

Companies should be more forthcoming about long-term value-creation strategies when communicating with investors.

Boards need to take charge of share repurchases as part of the capital management strategy of their companies.

The authors of the 2016 Sustainability Report by MIT SMR and BCG share findings and insights from their research into sustainability practices.

Is board oversight — helpful as it can be — detrimental to innovation?

The expectations aren’t being met.

Checks and balances, competitive elections and term limits could improve corporate oversight.

For boards dealing with an embattled CEO, doing nothing may pay off in the long run.

A study reveals how rating agencies weigh governance factors.