Global Strategy

A Reshoring Renaissance Is Underway

Geopolitics and supply chain resiliency are just two of the factors spurring some manufacturers to move back to the U.S.

Geopolitics and supply chain resiliency are just two of the factors spurring some manufacturers to move back to the U.S.

Meaningful economic climate action requires not only regulation but commercial demand for sustainable finance.

When e-commerce sites make buying quick and easy, they could be missing out on deepening customer relationships.

A panel of artificial intelligence experts weighs in on whether organizations are adequately investing in responsible AI.

Robust appraisal systems make pay transparency an opportunity to improve performance rather than a compliance burden.

Executives must confront a strategic planning blind spot: their assumptions about the future business context.

Modifying culture can help drive organizational change but requires clarity about the type of change leaders are seeking.

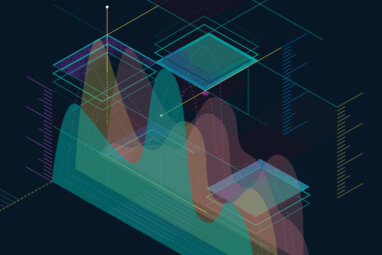

A data monetization matrix can help leaders assess opportunities and approaches for converting data into revenue.

A new Deloitte study says most companies surveyed report falling short of their margin goals.

The fall 2023 issue of MIT Sloan Management Review examines innovation systems and strategies for business leaders.

Operators of platforms must balance market health and power dynamics in determining who sets prices.

Organizations need to take a new approach to governance of digital innovation initiatives.

Executing strategy requires understanding your critical roles and putting your best people in them.

CEOs can maintain full engagement with and control of an organization redesign by addressing their own vulnerabilities.

Businesses must take a multilayered approach to effectively combat counterfeit and unauthorized sales of their products.

Research on stock buybacks does not find evidence that the practice results in the economic costs that critics allege.

Researchers are seeing stronger business benefits when KPIs are adjusted with or created by AI tools.

Experts weigh how a proposed ban on noncompete agreements might affect innovation and entrepreneurship beyond tech hubs.

The 2023 MIT SMR-BCG responsible AI report finds that third-party AI tools pose increasing risks for organizations.

The summer 2023 issue of MIT Sloan Management Review examines risk, disruption, AI, finance strategy, and equity.