Strategic Management of Intellectual Property

In recent years, the primary locus of value for many corporations has been found in their intellectual property rights. By one informed estimate from the late 1990s, some three-quarters of the Fortune 100’s total market capitalization was represented by intangible assets, such as patents, copyrights and trademarks.1 In this environment, IP management cannot be left to technology managers or corporate legal staff alone. Given that the generation of returns from IP rights is a capital-intensive, long-term activity and that decisions affecting intellectual property are usually irreversible at low cost, IP management must be a matter of concern for functional and business-unit leaders as well as a corporation’s most senior officers.

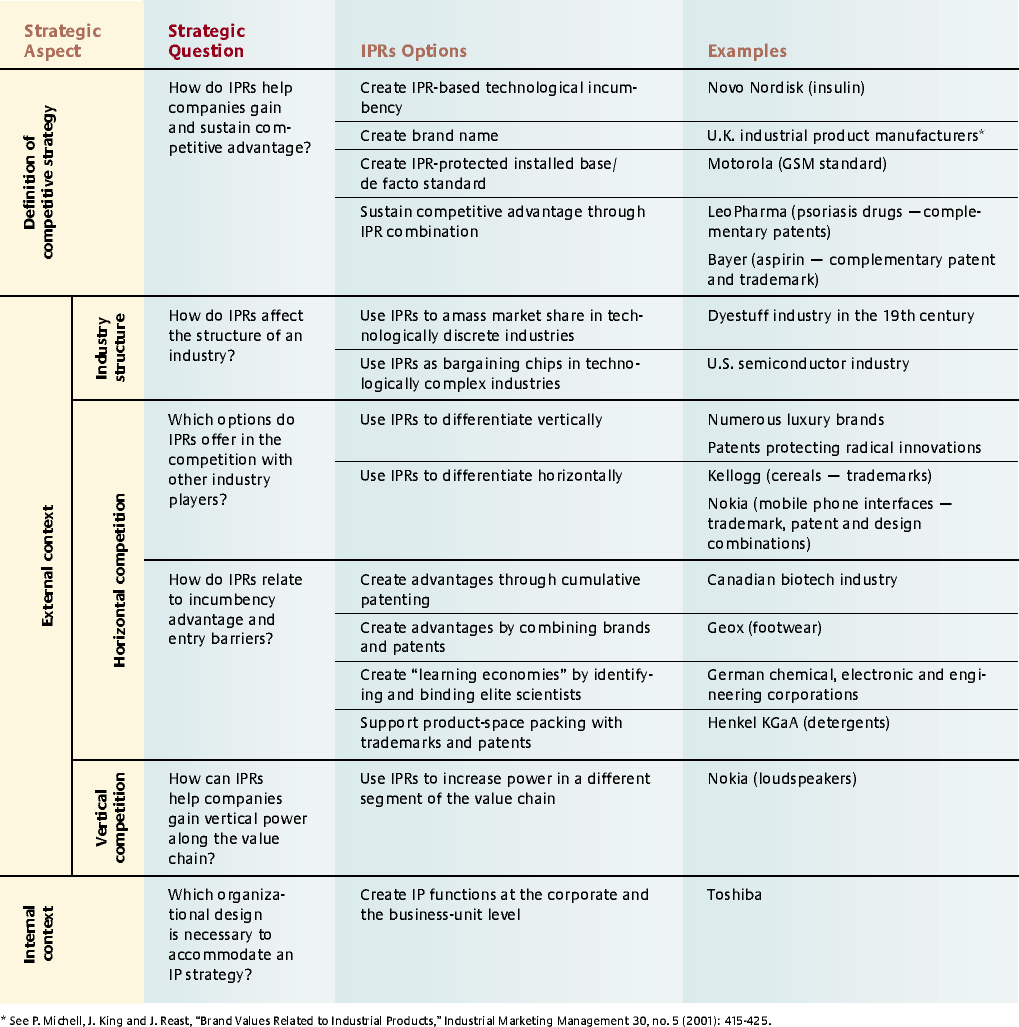

Little of the writing on the subject of intellectual property rights, however, has been directed at top-level executives; instead it has frequently been done by specialists, for specialists. And senior managers, in order to effectively govern and exploit their often huge IP assets, need help to answer these specific questions:2 How can the company use intellectual property rights to gain and sustain competitive advantage? How do IP rights affect the industry’s structure? What options do IP rights offer vis-à-vis competitors? How can IP rights grant incumbency advantage and establish barriers to entry? How can IP rights help the company gain vertical power along the value chain? What organizational design accommodates an intellectual property strategy most effectively?

Enormous knowledge is hidden in the economics literature and in the heads of corporate IP managers about the way companies have developed answers to these questions.3 Making such information available to top-level management will help lead intellectual property rights out of their shadowy existence in patent and legal departments and enable companies to tap into their strategic value. (See “About the Research.”)

Creating and Sustaining Competitive Advantage

Intellectual property rights can help a company gain competitive advantage in various ways, but three are paramount: They can provide a temporary technological lead (incumbency), protect brand names and help form an industry standard. Combinations of patents and trademarks can help to sustain IP-based competitive advantages.

The use of patents to enjoy a short-term technological lead is the best-known way to create competitive advantage with IP rights, but it is fading in importance in many industries. The pharmaceutical industry is an exception.

Denmark-based healthcare company Novo Nordisk A/S, for example, built a dominant market position in Europe with diabetes drugs as the result of its license on a technology for manufacturing insulin from animal sources.4 “But cases like this are rare, even in pharmaceuticals,” says Lars Kellberg, Novo Nordisk’s vice president of business development and patents. “With modern high-throughput technology, screening methods and the wide availability of compound libraries, it’s usually just a matter of time until competitors find an alternative target molecule that offers a different route to the treatment of a disease from the patent-protected innovation of the first mover.” According to Kellberg, “Dominant market positions due to the patenting of one unique pharmacological solution are most likely to occur today in the field of naturally occurring hormones; for example, proteins derived from genome-based research.”

A second way to create competitive advantage with IP rights involves their relationship to standards. In the mid-1990s, Motorola Inc. had exclusive control of certain technologies that gave it a lead in the field of GSM (Groupe Spéciale Mobile) technology.5 Other players participating in the market at the time, including Nokia, Alcatel and Philips, held significant shares of the patents for such technologies as switching technology, speech coding, radio transmission and encryption. Motorola, however, built a superior position in Europe with a three-pronged IP-strategy approach.

First, the company supported the establishment of a common mobile-telephony standard in Europe from the initial meeting of the Groupe Spéciale Mobile in 1982, and it has continued to do so since 13 mobile-phone operators agreed to accept GSM as the international standard. Second, before and after the establishment of the GSM standard, Motorola pushed its IP activities and secured patent ownership of various essential technologies that GSM would depend on. Third, in 1988 Motorola refused to sacrifice its exclusive IP rights in phone-procurement negotiations with operators. This combination of patenting parts of the technology used in a standard, engaging in a hard-nosed licensing policy, and making farsighted investments allowed Motorola to create a competitive advantage in technologies that would usually be too complex for a single player to dominate.6

Sustaining the kind of advantage that Motorola created with its focus on GSM is difficult because, after all, technologies change and patents expire. (Patents usually expire 20 years after application; in certain specific cases in Europe, after 25 years.) In the pharmaceutical industry, it is not uncommon for a target molecule in the form of a commercialized drug to begin earning profits a decade after the patent was applied for. One way to mitigate this limitation is by developing an effective combination of intellectual property rights.

Leo Pharma A/S, a Denmark-based drug company, follows this approach with certain skin medications. The patents protecting the company’s blockbuster drug, Daivonex, will expire in three to four years. Whereas the application of Daivonex is recommended for the steady treatment of psoriasis, Leo Pharma has developed a second drug, Daivobet, for the treatment of acute attacks of the disease. The two drugs are therapeutic complements, but the patents for Daivobet will last another 17 years. Leo Pharma is bundling the two products into one therapeutic approach; joint branding of the products to physicians and patients assures that sales of Daivonex will benefit from the remaining patent lifetime of its acute-treatment complement.

The Daivonex-Daivobet example illustrates the complementary use of identical types of IP rights: two patents. A patent and a trademark can also be used complementarily, as Bayer AG has done with aspirin. Bayer’s first patent on aspirin expired at the beginning of the last century, but the company still earns enormous revenues as a result of the strong brand value. As trademarks can, in principle, be renewed indefinitely, managers should be prepared to shift their focus from patents to trademarks as the former expire. Recent studies show that the postexpiration patent value of a drug is enormously affected by the product’s marketing during the patent’s life. The returns from originally branded drugs can be significantly higher than expected after patent expiration, despite competition from generic products.7

Finally, substitute patents can be used to sustain a competitive advantage in certain industries, such as basic chemicals. Companies can build a “patent fence”; that is, they protect not only a product’s core invention but also easy-to-build substitutes.8

Patents That Shape Industry Structure

Going back to the 19th century, when international dyestuff manufacturers used patent rights to form cartels in certain market segments (such as alkali), IP rights have been used to shape the structure of various industries. In 1933, DuPont licensed its cellophane to Sylvania (a U.S. subsidiary of a Belgian company). The contract specified that DuPont would earn a 2% royalty on Sylvania’s sales of cellophane when Sylvania had 20% or less of the market’s share. But DuPont would earn royalties of 30% on any sales over that market-share figure, rendering it unprofitable for Sylvania to exceed its quota.9

In the semiconductor industry today, patents are also licensed but not primarily for reasons of market sharing. Patent-protected technology is exchanged mutually between a larger number of players in the market. The exchanged technology is highly complementary and enters the products of many players. Since daily production costs in the industry are enormous, however, one of the most dangerous threats for a firm arising from this mutual dependence is to have its production facility closed — if only for a few days — as the result of an injunction in the case of pending patent litigation. The losses can be so severe as to drive a company out of business. To pose a credible counterthreat, companies seek to hold patents that are also used by their competitors. Thus the main purposes of patenting in this industry are not necessarily to deter entry but to create a market for know-how exchange and to obviate the threat of being shut down by established competitors.10

Vertical and Horizontal Differentiation

In cases of head-to-head competition with core products, senior managers must consider such issues as product design, information and timing as they relate to IP rights. Competition along the dimension of technical IP rights has long been thought of as a matter of protecting major technological breakthroughs that would lead to radical innovations in the market (that is, competition with vertically differentiated products). This perspective is still legitimate in some industries (pharmaceuticals, for example) but not all. According to a top IP manager at Nokia, one of the company’s most precious assets is a multiple patent, design and trademark combination covering Nokia’s unique user interfaces for cellular phones. A cellphone interface is rarely a radical innovation driving down the opportunity costs of production. (Competition on this feature comes much closer to horizontal than to vertical differentiation, well known from the field of branding but almost unknown in the patent sector.) User surveys confirm, however, that Nokia’s interface is valued highly by a large share of customers.

Companies can also outwit competitors by conveying IP information strategically. They may, for example, disclose information in legal bulletins about IP rights that confuses competitors about potential technology trajectories they are pursuing. German companies in the 19th and 20th centuries issued misleading “evasion” patents to render it difficult for competitors to establish a clear link between dyestuff patents and the dyestuff products actually sold in the market.11

The timing of IP rights decisions is also important. The key trade-off lies between the disclosure of technical knowledge and the assurance of early protection through patents.12 Products with short life cycles may generate most of their returns before a patent is granted. If such products are illegitimately imitated during this period, patent holders face difficulties in claiming their real economic losses in courts as opposed to patent infringement occurring after a patent’s grant.13 For that reason, secrecy may be more effective than the patent process for technology products with short life cycles.

Incumbency Advantages

Incumbency advantages can result from economies of scale, cumulative investment in a technology, consumer loyalty and switching costs. Companies can often use intellectual property rights to obtain incumbency advantages.

Incumbent biotechnology companies in Canada have successfully employed cumulative investment. Increases in the level and concentration of incumbents’ patenting appear to discourage the founding of new businesses and to enhance incumbency advantages, particularly in human application sectors (such as diagnostics, therapeutics and vaccines) of the industry where development and approval processes are more costly and time-consuming.14

Companies can also use IP rights to increase switching costs. One effect of established standards is that subsequently developed complementary technology is often designed to be standard-compatible. Switching costs for users changing from Microsoft desktops to Linux do not solely depend on the features of the Microsoft and the Linux operating system but also on complementary software.

And standards are not the only way to create switching costs. Novo Nordisk has a trademark-protected insulin-delivery device called NovoPen. As Lars Kellberg notes, “The most profitable part of the business in this sector is the refill business — selling insulin cartridges that fit the base delivery device.” To make sure that competitors cannot enter this market at low cost, the corporation has taken sophisticated IP countermeasures. “We patent-protected the cartridge-pen interface,” says Kellberg, rendering it difficult for rivals to offer cartridges that go with NovoPen. Consumers face full switching costs — including the purchase of a new base delivery device — if they want to choose cheaper cartridges from another supplier.

IP rights are not solely a matter of technical advantages. Promotional advantages are created through the existence of strong, trademark-protected brands. And some companies recognize the value of patents for branding. At least three large shoe manufacturers, Teva, New Balance, and Geox, incorporate (pending) patents directly or indirectly into their marketing by making the information visible to the customers. Geox even has a top-level Web site category called “Patents.”

Binding human resources to a corporation is also important for companies seeking to maintain incumbency advantages with IP rights. Recent studies show that a small elite of inventors accounts for the major part of a firm’s patented output.15 Identifying and binding such people to the corporation is essential for building up “learning economics” in high-tech corporations. Attracting top scientists from competitors can accelerate the learning process. And IP rights information services, found in many large companies today, can help to complete these tasks.

Raising Entry Barriers

Optimally, an incumbency advantage can be turned into an entry barrier for followers. Companies have long used trademarks as one of several legitimate ways to “pack” a product space to reduce the number of profitable niches for competitors.

Henkel KGaA Germany, a laundry and home-care company, has protected a wide variety of laundry detergents with trademarks, capturing many preferences consumers may have.16 By doing so, the company makes further horizontal product differentiation more difficult for its competitors. While the practice of differentiating products horizontally and protecting them with trademarks is well-known (Kellogg’s approach with breakfast cereal is another example), Henkel’s laundry-product portfolio is differentiated vertically as well. Several of the detergents exist both in traditional and advanced patent-protected fast-solubility forms (which are also protected by trademarks). The goal is “to support every delivery form and any reasonable concentration range of innovative active ingredients,” notes Thomas Mueller-Kirschbaum, CTO of Henkel KGaA’s Laundry and Home Care. “Aside from patents, a lot of our products and packagings are protected by utility models, design patents, and trademarks,” he says. The strategy has paid off: Henkel has been ranked among the European market leaders for detergents for many decades now.

The same rationale explains why Novo Nordisk brings out patent-protected one-way insulin-delivery devices and partly cannibalizes its own business of NovoPen. The one-way devices (not refillable) “patent block” another niche in the product space for insulin-delivery devices.

Creating Power With Suppliers

Even among sophisticated IP managers today, it is commonly assumed that the use of IP rights is restricted to horizontal competition. But there is little theoretical reason to stick with this premise, and the real world provides some contradictory evidence.

Consider the effects of Nokia’s patents on loudspeakers. Even though the company does not engage in the production of cell-phone components, it keeps a handle on its suppliers by maintaining control of key IP rights in different segments of the value chain. Nokia has such patents not in order to squeeze suppliers but “to forearm against price increases in an upstream segment where competition is not too high as there is only a handful of suppliers,” according to senior IP manager Peter Halkjær. In more competitive areas involving, for example, antenna technology, where Nokia can choose from dozens of suppliers, it is not as important to buttress its supply chain management by leveraging IP rights. Still, the company plays it safe, taking out patents in other technologies, and because of its strong position on the value chain, it can influence disputes between suppliers and operators of Nokia equipment.

Organizational Design

Since the tasks associated with the execution of a proper IP strategy are many, labor has to be divided and hierarchy and control have to be established. In addition to filing for and enforcing IP rights, companies must attend to licensing, technology forecasting, information provision and consultancy regarding the choice of research trajectories. Reports coming out of IP departments should help to identify potential strategic allies, select lucrative market segments, and recruit new personnel.

Researchers agree that Western companies have lagged behind in the organizational implementation of IP strategy. The vanguards are found in Japan, and Hitachi Ltd. and Toshiba Corp. are two of the leaders.17 At Toshiba, intellectual property departments exist at both the business-unit and corporate level. Toshiba’s IP units provide the planning and coordination of activities related to IP rights; draft and stipulate technology contracts; protect software; file and license designs, trademarks and patents; and host an information center. The organizational structure reflects both the importance assigned to IP rights by top-level management and the company’s comprehensive approach to the issue. Toshiba’s IP strategy yielded roughly 340 European patent applications per year between 1978 and 2003 over hundreds of technological subgroups.18

The increasing corporate value of intellectual property has a consequence for senior leaders: They must not leave IP-related questions to functional management levels alone. Instead, they must take a strategic approach to the issue. The key lies in treating intellectual property as they would any other strategic issue facing their organizations. By thinking through the questions systematically — about competitive advantage, industry structure, entry barriers, competitors, suppliers and organization — they can make IP a strategic weapon in the corporate arsenal. See sidebar

References

1. Peter J. King, managing partner of Arthur Andersen’s Intellectual Property Asset Management Practice, quoted in the introduction to K. Rivette and D. Kline, “Rembrandts in the Attic: Unlocking the Hidden Value of Patents” (Boston: Harvard Business School Press, 1999).

2.The particular order of the questions is inspired by G. Saloner, A. Shepard and J. Podolny, “Strategic Management” (New York: John Wiley, 2000), 160, 165.

3. Next to the specifically mentioned references in the following end-notes, this article builds on the following major contributions: G. Rahn, “Patenstrategien japanischer Unternehmen,” Gewerblicher Rechtsschutz und Urheberrecht (international) 5, (1994): 377–382; E. Kaufer, “The Economics of the Patent System” (New York: Harwood Academic Publishers, 1989); S. Scotchmer, “Standing on the Shoulders of Giants: Cumulative Research and the Patent Law,” The Journal of Economic Perspectives 5 (winter 1991): 29–42; N.T. Gallini, “Patent Policy and Costly Imitation,” RAND Journal of Economics 23 (spring 1992): 52–63; J.R. Green and S. Scotchmer, “On the Division of Profit in Sequential Innovation,” RAND Journal of Economics 26 (spring 1995): 20–33; P.C. Grindley and D.J. Teece, “Managing Intellectual Capital: Licensing and Cross-Licensing in Semiconductors and Electronics,” California Management Review 39 (winter 1997): 8–41; D.J. Teece, “Capturing Value From Knowledge Assets: The New Economy, Markets for Know-How and Intangible Assets,” California Management Review 40 (spring 1998): 55–79; R.C. Levin, A.K. Klevorick, R.R. Nelson and S.G. Winter, “Appropriating the Returns From Industrial Research and Development,” Brookings Papers on Economic Activity 3 (1987): 783–820; and C. Shapiro, “Navigating the Patent Thicket: Cross Licenses, Patent Pools and Standard-Setting,” Innovation Policy and the Economy 1 (2001): 119–150.

4. In 1926 Novo Nordisk started exporting insulin to the rest of Scandinavia and Germany. In 1936 Novo was supplying insulin to not fewer than 40 countries.

5.For a comprehensive empirical study of this industry, see R. Bekkers, G.M. Duysters and B. Verspagen, “Intellectual Property Rights, Strategic Technology Agreements and Market Structure: The Case of the GSM,” Research Policy 31 (2002): 1,141–1,161.

6. Ibid. According to the literature, however, it seems legitimate to say that Motorola did not fully sustain this advantage to the present.

7. J. Hudson, “Generic Take-Up in the Pharmaceutical Market Following Patent Expiry: A Multi-Country Study,” International Review of Law and Economics 20, no. 2 (2000): 205–221.

8. For discussions of patent fences, see O. Granstrand, “The Economics and Management of Intellectual Property: Towards Intellectual Capitalism” (Cheltenham, England: Edward Elgar Publishing, 1999): 6–8, W.M. Cohen, R.R. Nelson and J.P. Walsh, “Protecting Their Intellectual Assets: Appropriability Conditions and Why U.S. Manufacturing Firms Patent (or Not),” working paper w7552, National Bureau of Economic Research, Cambridge, Massachsuetts, 2000; and M. Reitzig, “The Private Value of ‘Thickets’ and ‘Fences’ — Towards an Updated Picture of the Use of Patents Across Industries,” Economics of Innovation and New Technology, in press.

9. A. Arora, “Patents Licensing and Market Structure in the Chemical Industry,” Research Policy 26, no. 4–5 (1997): 391–403.

10. B.H. Hall and R.H. Ziedonis, “The Patent Paradox Revisited: An Empirical Study of Patenting in the U.S. Semiconductor Industry, 1979–1995,” RAND Journal of Economics 32, no. 1 (2001): 101–128.

11. Arora, “Patents Licensing and Market Structure in the Chemical Industry,” 393.

12. See I. Horstmann, G. MacDonald and A. Slivinski, “Patents as Information Transfer Mechanisms: To Patent or (Maybe) Not To Patent,” Journal of Political Economy 93 (October 1985): 837–858, for a more fundamental discussion of the trade-off between patenting and secrecy.

13. C. Heath, J. Henkel and M. Reitzig, “Who Really Profits From Patent Infringements? Innovative Incentives and Disincentives From Patent Indemnification,” working paper 2002-18, Center for Law, Economics and Financial Institutions at Copenhagen Business School, Copenhagen, Denmark, 2002.

14. T.J. Calabrese, A.C. Baum and B.S. Silverman, “Canadian Biotechnology Start-Ups, 1991–1997: The Role of Incumbents’ Patents and Strategic Alliances in Controlling Competition,” Social Science Research 29, no. 4 (2000): 503–534.

15. H. Ernst, C. Leptien and J. Vitt, “Inventors Are Not Alike: The Distribution of Patenting Output Among Industrial R&D Personnel,” IEEE Transactions on Engineering Management 47, no. 2 (2000): 184–199.

16. According to the database of the German Patent Office, Henkel’s national trademark protection in Germany for detergents comprises 64 trademarks in connection with Persil, 19 in connection with Weisser Riese, 11 with Spee, 13 with Fewa and 9 with Perwoll — to mention five of its nine brands.

17. Granstrand, “The Economics and Management of Intellectual Property”; see also R.H. Pitkethly, “Intellectual Property Strategy in Japanese and U.K. Companies: Patent Licensing Decisions and Learning Opportunities,” Research Policy 30, no. 3 (2001): 425–442.

18. According to the European Patent Register, Toshiba (which includes Kabushiki Kaisha Toshiba as well as those corporations bearing the fragment Toshiba in their corporate name) had filed for 8,427 European patents between 1978 and October 2003. Patents were distributed over 2,430 subgroups.