Generating Premium Returns on Your IT Investments

Although IT portfolio management has been a best practice for some time now, many companies are still getting returns from IT investments that are below their potential. New studies show that a measurable premium can be gained by implementing a set of interlocking business practices and processes, collectively called “IT savvy.”

When the weather is hot, 7-Eleven Japan’s stores in Tokyo have plenty of bento boxes —Japan’s cold boxed meals of rice, pickles and other foodstuffs — while on cold days there are lots of hot noodles for sale. The stores’ operators always seem to have plenty of what their customers want; in fact, they order and receive fresh food deliveries three times a day. It is no coincidence that the company is the nation’s most profitable retailer. Its 2004 gross margins topped 30% — six times its 1977 gross margins.

7-Eleven Japan Co. Ltd. is — to put it simply — very savvy about using IT. At least twice a week, every one of its 10,000-plus mostly franchised stores gets a visit from a 7- Eleven Japan “counselor.” The counselor works with the store manager or franchisee to improve the business, often by using data from the store’s information systems to manage and order more effectively.1

By matching local practices and preferences to IT investments, the store can continually introduce and succeed with new product lines. The typical store adds 70% new items for sale each year, a higher rate than that of any other retailer in Japan, which helped double its average stores’ daily sales from 1977 to 2004. The store managers regularly receive graphical data showing recent sales, weather conditions and product range information, so they always know just how many bento boxes to order.

7-Eleven Japan makes effective IT investments and manages an IT portfolio that constantly matches its business strategy. But the company’s well-managed IT investments are only part of the story behind its 20-year track record of industry-leading financial returns. The convenience-store giant blends its IT investments with a range of assertive IT practices and capabilities —everything from the counselors’ visits that increase the store operators’ IT skills to the “transparency” of an information infrastructure that links 70,000 computers in stores, at headquarters and at supplier sites.

A primary objective of this article is to show that IT investments alone, even using the much-heralded IT portfolio approach, cannot by themselves ensure that all key business goals are met. Our research shows that a measurable bottom line premium for every IT dollar invested is achieved by companies with a mutually reinforcing set of practices and capabilities that we call IT savvy.

7-Eleven Japan clearly has IT savvy in abundance; so, too, do quite a few other exemplary organizations. In our study of 147 companies over five years, we found that the impact of IT savvy is substantial.2 (See “About the Research.”) For example, for each dollar invested in IT infrastructure, companies with high IT savvy have higher net profits in the year after the investment than does the average company. Those with low IT savvy have, on the other hand, substantially lower net profits in the following year (controlling for many other factors).

In colloquial usage, the term IT savvy has been imprecise — a general descriptor at best. But in our work at MIT’s Center for Information Systems Research, we have developed a definition that describes the core attributes while preserving the “street smarts” sense of the term. To us — and in conversation with the business executives with whom we work regularly — IT savvy refers to the planned, ongoing use of a set of interlocking business practices and competencies that collectively derive superior value from IT investments. For companies like 7-Eleven Japan, IT savvy is ingrained, informing almost all of the company’s business decisions and sharply focusing its IT investments. The goal of this article is to introduce the concept of IT savvy in order to reframe the discussion about the business value of IT. We first review the different IT assets in which companies invest before discussing the gap in IT investment returns that separates those with IT savvy from those without.

Revisiting the Value of IT Assets

Just as investors address their objectives for risk and return using portfolios of financial investments, some companies use IT portfolio management to better enable their management teams to match IT investments to strategic objectives.3 Successful IT portfolio techniques change the conversation from technical to strategic considerations by applying a commercial lens to IT investments; the result is an allocation of IT assets that is appropriate for the company’s circumstances.

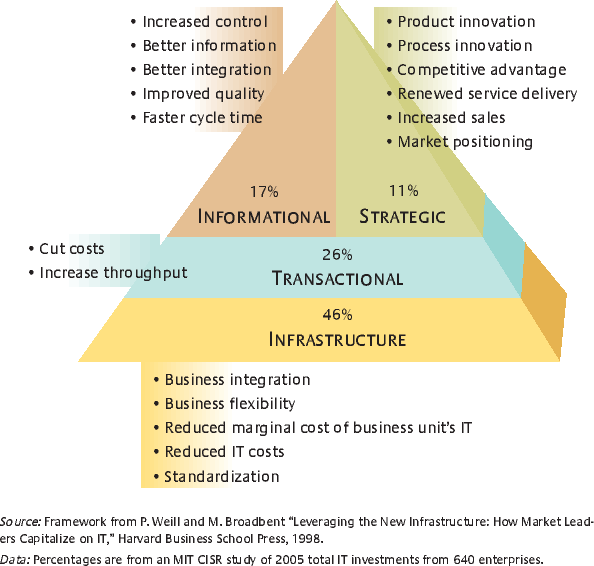

Our research identified four broad classifications of IT investments: transactional, informational, strategic and infrastructure. Transactional investments are used primarily to cut costs or increase throughput for the same cost (for example, think of a brokerage firm’s trade processing system). Informational investments provide information for purposes such as accounting, reporting, compliance, communication or analysis. Strategic investments are used to gain competitive advantage by supporting entry into new markets or by helping to develop new products, services or business processes (ATMs were a successful strategic IT initiative for the first banks that introduced them but they became transactional over time). And infrastructure investments are the shared IT services used by multiple applications (such as, servers, networks, laptops, customer databases). Depending on the service, infrastructure investments are typically aimed at providing a flexible base for future business initiatives or reducing long-term IT costs via consolidation.

Each type of investment represents a different IT asset class with its own unique risk-return profile. In the same way that any personal investment portfolio must weigh stocks, bonds, cash and other financial assets against personal goals, an IT portfolio must be balanced — and regularly rebalanced — so that it is constantly aligned with business strategy and provides the appropriate combination of short- and long-term payoff. It is senior management’s job to balance the IT portfolio, and to integrate these disciplines into the company’s IT governance processes.4

The average company studied in 2005 allocates 46% of its total IT investment to infrastructure. (See “Considering IT Investments as a Portfolio.”) Utilizing the infrastructure are the transactional systems, accounting for 26% of the average IT spend. Conceptually, informational and strategic systems sit on top of and use the transactional and infrastructure systems, absorbing 17% and 11% of average IT investment, respectively.

Considering IT Investments as a Portfolio

Investment for any single project can be spread over one or more asset classes. For example, the executives of a multibillion-dollar U.S. software and IT services company allocated a recent multimillion-dollar investment in a customer relationship management system this way: 60% informational, 5% strategic, 25% transactional and 10% infrastructure. As a relatively late adopter of CRM, the IT services company expected few strategic benefits from the investment. Also, it already had much of the infrastructure needed for the CRM implementation. By contrast, a competitor had successfully implemented CRM three years earlier with a higher total project cost and a different allocation of resources —more strategic and less informational.

Pharmaceuticals leader Eli Lilly and Company has used the portfolio approach since 1999 to categorize its IT investments. “We tend to want to have 5% [of our projects] in strategic areas, 15% to 20% in the informational category, and the remaining percentage split between the infrastructure and transactional,” explains Sheldon Ort, Lilly’s information officer for business operations.5

The technique is also engaging business leaders in IT investment decisions at Mohegan Sun, the Connecticut-based casino. CIO Dan Garrow reflects on the experience: “Comparing our strategy against our plans for expenditures in each of the four management objectives for investments, we realized there was a disconnect between our long-range plans and our resource allocations, both human and financial. Portfolio thinking helped us bring the day-to-day activities back into alignment with our long-range objectives. Portfolio thinking helps us determine what type of company we are and the level of risk we’re willing to take, particularly around our strategic business efforts.”

The Returns From the Four IT Asset Classes

The portfolio allocation approach works because it underscores the importance of how organizations use technology instead of focusing on the technology itself. Making a sensible asset allocation requires senior managers to be crystal clear about what they wish to achieve and about who will be held accountable — hardly the stuff of technical specifications.

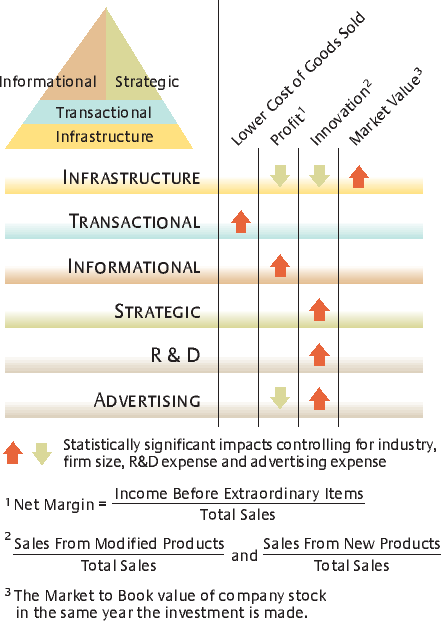

Different IT Assets Deliver Different Value

Each asset class is linked to different types of business value. (See “Different IT Assets Deliver Different Value.”) For example, companies that invest more heavily than their competitors in transactional IT have lower costs. Transactional investments pay off by using IT to support or automate repetitive business processes. Logistics leader United Parcel Services of America, Inc. offers a good example: The company uses IT effectively to cut business costs and increase productivity. For instance, it provides free package tracking information on its Web site or integrated into its customers’ enterprise resource planning systems. Before online tracking was offered, customer calls to the company’s call center cost UPS about $2 each; sometimes there were two follow-on calls to locate the package, for a total of $6 for one inquiry. Now each tracking request costs UPS only a few cents, even during the Christmas rush, when the company gets up to six million such requests a day.6 For any company that is eager to use IT to cut costs and improve productivity, it makes sense to tilt its IT portfolio toward transactional investments.

Similar evidence applies to the other IT asset classes. Companies such as 7-Eleven Japan that invest more heavily in informational IT have higher quality and larger margins (net profits per dollar of sales). Strategic IT investments help spur innovation and thus position an organization for growth. For example, Van-guard.com, the Web site of the mutual funds firm, has a customized, password-protected portfolio analysis tool that offers sophisticated calculations, including comparisons of investors’ current asset allocations versus long-term goals.

Investments in IT infrastructure serve multiple purposes. Some are designed to cut costs through standardization and consolidation — data center consolidation, for instance. Others reduce time to market for new business initiatives or provide a platform for delivering companywide initiatives such as a shared customer database for a single point of customer contact. (See “Building IT Infrastructure for Strategic Agility,” MIT Sloan Management Review, fall 2002.)

Carlson Companies Inc. offers a good example of the value created by a shared IT infrastructure. The $20 billion company is a leader in the marketing, hospitality and travel businesses; its most recognized brands include Radisson Hotels & Resorts, T.G.I. Friday’s restaurants, Carlson Marketing Group, Carlson Wagonlit Travel, Radisson Seven Seas Cruises and the Gold Points Reward Network.7 Although the businesses are run autonomously, Carlson has captured cost savings and synergies with a world-class shared services capability, which won the 2004 International Productivity and Quality Council’s award for the “best mature shared services organization.”

Carlson Shared Services is set up to operate as a business, offering IT and financial services (with plans to offer more); it is governed by a board comprising the CIOs and CFOs of the business units; and its IT organization provides 89 infrastructure services to Carlson’s businesses. The IT unit compares the prices of its services to those of external vendors, and outsources whenever a vendor can offer a better price or quality proposition than what internal IT resources can offer. As a result, Carlson’s business units use the shared IT services as much as possible, even though use is not mandatory.

Although the top performers (defined as the top third in terms of industry-adjusted return on assets, net margins and revenue growth) have IT portfolio allocations similar to the average company’s, collectively they spend 4% more on IT as a percentage of net sales.

But the differences within specific industries are striking. For example, top performers in financial services spend 10% less on IT than the average financial firm but have portfolios more heavily weighted toward IT infrastructure. (In that sector, IT investment is so fundamental to business processes that IT systems are quite mature, with much of the advantage coming from higher efficiency in executing basic transactions and providing infrastructure to foster innovation.) By contrast, the top performers in wholesale, retail and transport sectors spend 11% more on IT than their average competitors and weight their portfolios more heavily toward informational assets, indicating that there’s still competitive advantage in the effective use of information.

The IT Savvy Premium

Clearly, companies that link their IT investments to their business strategies are well-placed to outrun their competitors along desired performance dimensions. But investing the right amount in the right IT asset classes is only the first step. Above-average management capabilities are also needed to achieve above-industry-average returns from those IT investments.

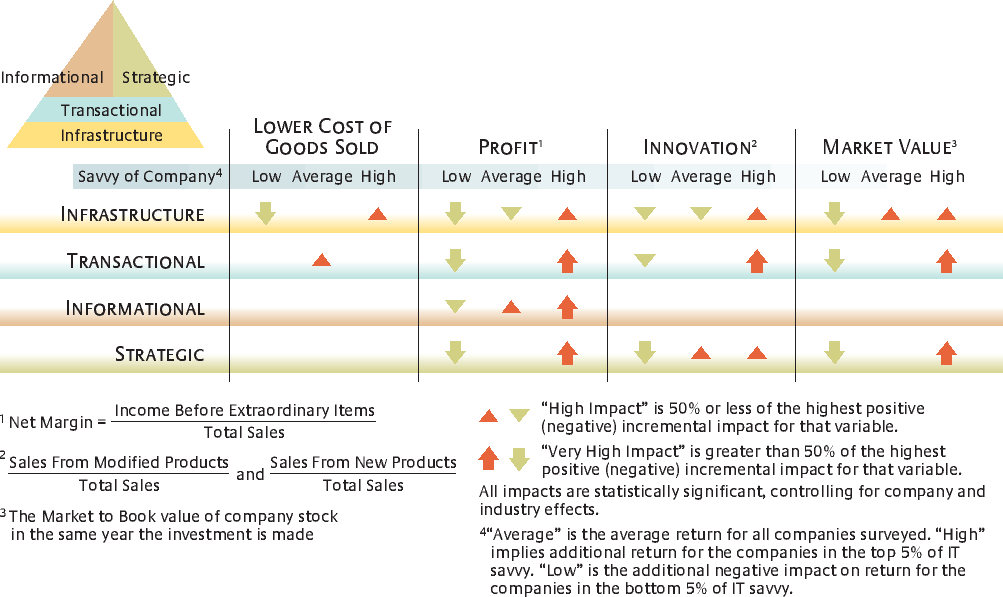

A subset of companies in our sample obtain performance gains that are far greater than those of their competitors. One year after an investment, companies with high IT savvy achieved higher performance from each IT dollar invested across all four IT asset classes. In effect, IT savvy yields a substantial financial premium. Our research assessed each company’s relative IT savvy by cataloging companies’ practices, processes and capabilities. (See “Companywide IT Savvy Affects Performance.”)8

Companywide IT Savvy Affects Performance

The returns from IT infrastructure — the largest IT asset class and often the most difficult to cost-justify in advance — strikingly illustrate the impact of IT savvy. For each dollar invested in IT infrastructure, companies with high IT savvy have $247 higher net profits in the year following the investment. Their infrastructure investments are also associated with superior returns for other key performance measures, including innovation and market capitalization. By contrast, companies with low IT savvy have, on average, $909 lower net profits the next year per dollar spent on infrastructure — controlling for industry, size and other investments such as research and development and advertising expenditures.

IT infrastructure is the foundation of all IT investments, including the communications network, shared customer data, laptops, data centers and servers; it accounts for close to half of the average company’s total IT spend. High-IT-savvy companies turn these enabling investments into value much faster than do low-IT-savvy companies — in one year compared with three years or longer. They achieve this premium by following particular practices more rigorously — for example, by ensuring that more of their business processes are digitized, and by more quickly designing and implementing changes to crucial business processes. Thus, instead of having their infrastructure investments hit the bottom line only as acquisition costs, IT-savvy companies put them to work faster, registering improvement on the bottom line in the next year.

Raytheon Company illustrates how IT infrastructure investments can deliver cost savings and provide a platform for business agility, and it shows how business processes and decision-making practices must change accordingly. Rebecca Rhoads is vice president and CIO at the $21 billion aerospace and defense corporation, which has grown significantly through mergers with the defense operations of Texas Instruments, Hughes, General Dynamics and E-Systems. She explains that the practices guiding Raytheon to a standardized technology infrastructure after the mergers were just a first step in generating value from IT:

“You will outgrow the governance model that makes you successful. It took me a while to figure that out because we had developed a governance model that was so effective — everybody was so supportive of it. We had buy-in, we had alignment, we were moving forward on it. It was a governance model that helped us consolidate and shape up the company. So once we reduced a couple of thousand legacy applications, once we went from 150 payroll systems to one, 28 e-mail systems to one, we reduced IT spend by over 40%. That’s what we needed to do over the first three to four years of being the new company, because if you don’t get the synergy of the merger, you’re not going to come up for air ever.”9

However, Rhoads found that, following Raytheon’s cost-cutting successes, the focus needed to shift to agility, to questions of how the company would grow and how IT enables that growth.

High-IT-savvy companies also see higher performance associated with transactional IT investments used to automate repetitive transactions, cut costs and increase throughput. Not only does Wall Street value such investments in high-IT-savvy companies, but also these companies have higher profits. Interestingly, companies with more transactional IT investment also have more sales from new and modified products. Paradoxically, in high-IT-savvy companies, process digitization enables innovative new products and services by freeing up managers to innovate on the platform of these digitized processes. For example, Amazon.com, Inc., the quintessential IT-savvy company, can relatively easily try a new service such as tailored recommendations based on the consumer’s purchase history and on other customers’ reviews. The new service requires only marginal investment on top of Amazon’s current digitized processes. Better yet, the product can be offered to only a few target customers and the impact can be measured immediately. By contrast, low-IT-savvy companies do not convert transactional investments into innovation.

Strategic IT, with its objectives to create new business value or growth, is historically a high-risk, high-return asset class. But companies with high IT savvy mitigate the risks inherent in strategic IT investments and have higher than average profits, innovation and market capitalization for each dollar invested. In such companies, business management involvement and a culture of IT use in business processes are necessary for more successful strategic (and in other companies, risky) IT investment.

Again, IT savvy makes a big difference with informational IT investments. Companies with strong IT savvy demonstrate particularly strong profitability because of the disciplines required to use common sets of information effectively. There is no impact from informational IT on innovation, cost or market capitalization in the average company.

So what’s the outlook for companies with low IT savvy? Overall, their IT investments are associated with lower returns from all four asset classes in their IT portfolios. The situation for these companies is bleak, with value leaking from most of their IT spending. These companies would do well to reduce their IT investments to essential areas only and to re-weight their portfolios toward lower-risk transactional IT assets until they have improved their overall IT savvy. Otherwise, they will continue to leak value, particularly from the longer-term and higher-risk asset classes such as strategic IT.

Characteristics That Create IT Savvy

What are the hallmarks of the IT-savvy company? Companies with high IT savvy have developed the five mutually reinforcing characteristics described below. The first three characteristics are practices related to IT use, and the last two are competencies needed for high IT savvy. The mutual reinforcement of both practices and competencies is necessary for high IT savvy, and these five characteristics are representative but not exhaustive of companies with stronger overall IT savvy. (See “The Five Characteristics of IT Savvy.”)

The Five Characteristics of IT Savvy

IT for communication — extensive use of electronic channels such as e-mail, intranets and wireless devices for internal and external communications and work practices. For example, 7-Eleven Japan’s system connects 70,000 computers in stores, at headquarters and at supplier sites, providing transparency across the entire value chain. A salesman for one of the company’s food suppliers put it this way: “[Their] information system is so good that we can instantly find out which goods of ours are selling to what types of customers and how much.” The collaboration between 7-Eleven Japan and its partners includes shared information, information systems and know-how about operations management as well as quality control throughout the value chain.

Internet use — more use of Internet architectures for key processes such as sales force management, employee performance measurement, training and post-sales customer support.

Digital transactions — a high degree of digitization of the company’s repetitive transactions, particularly sales, customer interaction and purchasing. The underpinning for 7-Eleven Japan’s digital capability is the network of 70,000 computers that collect data at the point of sale on every customer and every item sold. Each day’s data is analyzed for use the next morning. Other digitized processes allow each store to place orders and receive deliveries three times daily, with deliveries organized by temperature — frozen, refrigerated, ambient, etc.

Companywide IT skills — the ability of almost all employees to use IT effectively. There are strong technical and business skills among the IT staff, strong IT skills among the business staff and an adequate market supply of highly skilled IT staff. 7-Eleven Japan trains its 200,000 employees to use available point-of-sale data along with information on product, local weather forecasts and regional demographic and purchasing patterns so they can propose and quickly test hypotheses about the appeal of different types of products in each store.

Constant management involvement — strong commitment of senior managers to effective IT use. Business-unit managers are heavily involved in IT decisions, strengthening partnerships between IT staff and business units to help generate value from IT investments.

The mutually reinforcing aspect of IT savvy is critical. Our findings show that in the companies that exhibit high IT savvy, IT practices are interlocking and tightly clustered. Putting it another way, the companies that focus on strengthening IT capabilities have developed the IT practices and companywide IT skills that complement investments in the four IT asset classes. The strong commitment of senior management encourages more business-unit managers to become involved in IT decisions. This in turn leads to more companywide IT skills via formal and informal education programs, along with more use of IT for communication, work practices and transaction digitization.

The results of IT savvy are clearly observed when measuring process digitization. On average, the 147 organizations we studied completed 19% of their sales and 23% of their purchases electronically; there was little variation across industries. However, the third of companies with the most digitized processes completed 50% of their sales and 55% of their purchases electronically.

Seven Ways to Extract More Business Value From Your IT Portfolio

Our research identifies the returns on different types of IT investments for the average company, and demonstrates that even higher returns are available by matching IT-savvy practices and competencies with the IT portfolio. But how can managers work to match IT savvy with the IT asset mix? Here are seven suggestions based on the experiences of the top performers:

Identify the current and previous year’s IT portfolios.

Using our portfolio categorization, estimate your company’s IT portfolios for the last three years and the proposed IT portfolio for next year.10 At an IT investment committee or governance meeting, discuss whether these investments are appropriate for the company’s business strategy. A recent discussion with an insurance company, looking back over the last four years of IT portfolios, raised these important questions:

- Why did the company’s percentage of strategic IT investments fluctuate so dramatically?

- Will the low infrastructure investments planned for next year adversely affect strategic agility?

- Does the decentralized and departmentalized decision making about IT investments fritter away IT resources and undercut support of the company’s overall strategic direction?

- Why do some business units with different strategies have the same IT portfolios?

By answering these questions, the insurer reconsidered its IT investment process and began increasing the IT savvy of the whole organization — starting at the top. The CFO put it succinctly: “This is the first IT discussion I have really understood —investments, asset classes, risk profile, savvy and accountability for performance.”

Understand IT asset class performance and benchmarks for your business.

Using the results reported in this article and other benchmarks, assess whether your current IT portfolios are appropriate for your company’s or business unit’s strategic goals, IT savvy and appetite for risk. An attractive alternative to using benchmarks is to compare multiple business units in your company. Since each business unit has a different strategy and IT savvy, comparisons of the alignment of their objectives, practices, capabilities and IT portfolios will help highlight where IT investments are applied thoughtfully and what changes should be considered.

Understand and track your organization’s IT savvy.

IT savvy should be assessed and actively managed. The five practices and competencies discussed above provide a good starting point. Again, it’s informative to compare IT savvy across multiple business units. Companies or business units with low overall IT savvy should consider re-weighting their IT portfolios toward the less risky transactional and informational investments.

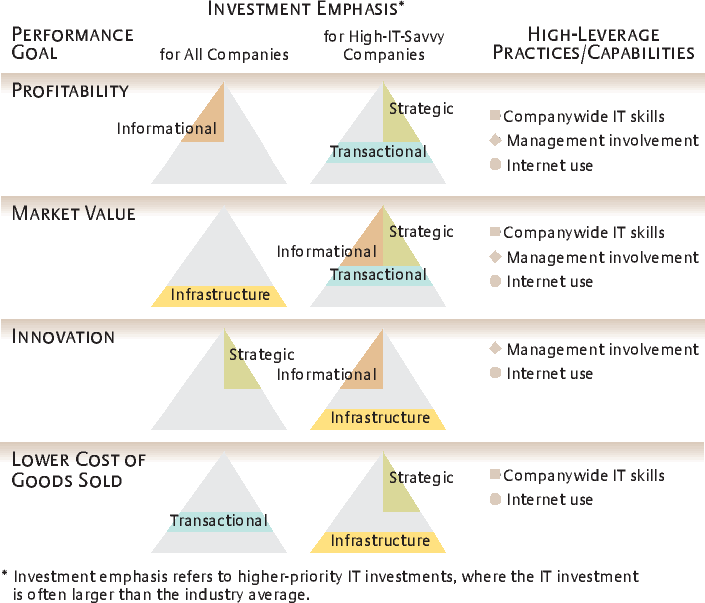

At the same time, low-IT-savvy companies can focus on improving the IT practices and competencies that are most important for the asset classes in which they invest the most. (See “Different Performance Goals Call for Different IT Investment/Savvy Profiles.”) To improve IT savvy, start with characteristics that provide leverage for the most important asset classes in the company’s or business unit’s IT portfolio. Practices from strong IT-savvy business units can be codified and transferred to those with less IT savvy.

Different Performance Goals Call for Different IT Investment/Savvy Profiles

Balance the portfolio for alignment and risk-return profile — and ensure that the process is transparent.

Using the results from the previous three steps, senior management must make judgments about the company’s IT portfolio. The judgments are based on management’s intuition concerning strategy, appetite for risk, the company’s IT savvy, the economy, available capital, etc. Having an IT portfolio process makes this judgment explicit and trackable over time instead of hidden within the budgets of each project or department.

Re-weight portfolios annually and whenever major changes occur.

Like personal investments, IT portfolios need to be re-weighted as business and economic circumstances change. For example, as companies achieve high overall IT-savvy ratings, they can invest more in IT and assume more risk (such as increase strategic or infrastructure investments) in their portfolios relative to competitors or to previous investments.

Incorporate the IT portfolio approach into the IT governance framework.

Effective IT governance specifies the decision rights and accountability framework to ensure that IT is applied in the right ways. IT investment is one of the key IT decisions that needs to be governed. Effective governance institutionalizes the disciplines of IT investment (often incorporating IT portfolio management) in a repeatable process that is understood and followed by all managers and linked to the company’s incentive and reward systems. Organizational learning is predicted, in part, by the time between action and feedback. The shorter the time lag, the greater the number of opportunities to learn. Tracking the impact of IT investment decisions and using these results to inform the next cycle of IT investment promotes enterprise learning — the faster the better.11 (See “Monday Morning Mandate for the Senior Management Team.”)

Learn from post-implementation reviews and formal training.

Most companies woefully underinvest in IT education and training. Various sources estimate that around 2% of the average IT budget is allocated to education and training. What’s worse, training is one of the first areas to be cut when times get tough. Many companies also miss out on the important opportunity for learning offered by a post-implementation project review. Growing numbers of companies now include in their project budgets an allocation for development of people that includes education, training and post-implementation reviews (or even in-process implementation reviews). Professional development helps companies generate the expected benefits of IT investment, and helps motivate and energize staff.

These suggestions are just a start. They are not meant to be a step-by-step “how-to” for overhauling the IT strategies of large, complex organizations, nor are they meant to provide a new organization blueprint for the IT-savvy company. But they are intended to provoke the kind of thinking that can quickly point out performance gaps and inspire robust initiatives to close those gaps and keep them closed.

Clearly, there are myriad pressing issues clamoring for the attention of the top management team. Many of those issues call for sizable resource commitments in terms of funding and dedicated staff. But IT savvy in and of itself is not a major resource drain. In our experience, companies with average or low IT savvy can significantly increase their returns and reduce their IT risk without investing another cent in technology. That should be reason enough for many business leaders to elevate the issue.

More fundamentally, though, the story of IT savvy is a story of untapped potential — of money left on the table, and of competitors who can grab a lasting advantage. In a time of unrelenting competition from all corners of the globe, managers must understand the consequences of not acting to enrich their organizations’ IT savvy. They must find answers to questions about the best utilization of technology in their organizations and give serious consideration to an increasingly important question: Are we IT savvy enough for 2010 and beyond?

References

1. For more information, see K. Nagayama and P. Weill, “7-Eleven Japan Co. Ltd.: Reinventing the Retail Business Model,” working paper 4485-04, MIT Sloan School of Management, CISR, Cam-bridge, Massachusetts, January 2004.

2. S. Aral and P. Weill, “IT Assets, Organizational Capabilities and Firm Performance: Do Resource Allocations and Organizational Differences Explain Performance Variation?” working paper, MIT Sloan School of Management, CISR, Cambridge, Massachusetts, 2005.

3. See M. Jeffery and I. Leliveld, “Best Practices in IT Portfolio Management,” MIT Sloan Management Review 45, no. 3 (spring 2004): 41–49, who report 24% of companies had effectively implemented IT portfolios and 78% expected implementation by the end of 2004; P. Weill and M. Broadbent, “Leveraging the New Infrastructure: How Market Leaders Capitalize on Information Technology” (Boston: Harvard Business School Press, 1998); P. Weill and S. Aral, “Managing the IT Portfolio,” (update circa 2003), MIT Sloan School of Management CISR Research Briefing, vol. III, no. 1C, March 2003, available in “CISR Research Briefings 2003,” CISR working paper 340; and P. Weill and S. Aral, “Managing the IT Portfolio: Returns From the Different IT Asset Classes,” MIT Sloan School of Management CISR Research Briefing, vol. IV, no. 1A, March 2004, available in “CISR Research Briefings 2004,” CISR working paper 351.

4. See P. Weill and J. Ross, chap. 3 in “IT Governance: How Top Performers Manage IT Decision Rights for Superior Results” (Boston: Harvard Business School Press, 2004).

5. Adapted from T. Datz, “Portfolio Management: How to Do It Right,” CIO Magazine, May 1, 2003.

6. See J. Ross, “United Parcel Service: Delivering Packages and E-Commerce Solutions,” working paper, MIT Sloan School of Management, CISR, Cambridge, Massachusetts, August 2001.

7. Drawn from N. Fonstad and J. Ross, “Case Vignette of Carlson,” MIT Sloan School of Management, CISR, Cambridge, Massachu-setts, January 2003.

8. For example, the practice — digital transactions — was measured as the percentage of orders and total sales conducted electronically, which averaged 22%. Each company’s IT savvy was calculated by a linear combination of the five characteristics shown. (See “The Five Characteristics of IT Savvy,” p. 44.)

9. R. Rhoads, “RTN on Governance” (presented at the MIT CISR summer session, Cambridge, Massachusetts, June 2005).

10. To estimate your portfolio using the MIT CISR IT portfolio framework, go to http://web.mit.edu/cisr/MITCISR-ITPortfolio.doc to obtain a brief questionnaire.

11. See P. Weill and J. Ross, “A Matrixed Approach to Designing IT Governance,” MIT Sloan Management Review 46, no. 2 (winter 2005): 26–34.