A Health Care Agenda for Business

Topics

The health care system in the United States is in crisis, and it has become a business crisis. Costs are spiraling upward, and the implications for businesses and their employees are profound. As employers struggle with unrelenting, double-digit health-insurance cost increases, some firms have decided to drop coverage entirely and many others have shifted costs to employees. And the quality of the health care being paid for by companies and their workers remains highly uneven despite the ever-increasing amounts of money devoted to improving it.1

Underlying such problems is a broken health care market. Unlike companies in other markets, health care providers and organizations lack sufficient incentives to innovate broadly or to improve quality. Similarly, consumers are unable to make health care decisions in the same way they make decisions about purchasing education or housing. And businesses that are rigorous and demanding purchasers of other goods and services are meek and ill-prepared when it comes to purchasing health care. In no other area of supply would they tolerate such cost increases and uneven quality.

The seriousness of the problem is underscored by a recent survey in which U.S. CEOs ranked health care benefit costs as their number one economic pressure.2 To put the issue into perspective, consider that Sprint Corp. would have to add $750 million in sales just to absorb next year’s projected increases in its current health plans. As the vice president of benefits for a large company told us: “Health care is a disaster. Every line in our income statement has an officer’s name attached to it. Our CEO points out that I have my name on the one item that is out of control.”

An even bigger profit drain for companies than health insurance may be “presenteeism” — in which employees are present for work but are less productive because they are ill or preoccupied with the health of a loved one. A study of nearly 29,000 U.S. employees estimated that absence and reduced performance caused by common pain conditions cost more than $60 billion a year. More than three-fourths of the lost productivity was explained not by absenteeism but by lower performance while at work.3 Through research at several U.S. locations, Dow Chemical Co. has projected that presenteeism is its largest health-related economic impact, ahead of absenteeism, health insurance and workers’ compensation.4

On its own, business cannot solve the health care crisis in America in all its aspects —exploding insurance costs, uneven quality, presenteeism on the job — but that doesn’t mean it can’t do a great deal to improve the system. Some companies, in fact, are taking more active control over the issue and getting better results on both cost and quality. To learn from such companies and from those who influence and deliver health care services, we conducted in-depth interviews with thought leaders in business, health care and related sectors. (See “About the Research.”) In this article, we share insights from the interviewees and the innovative companies we studied.

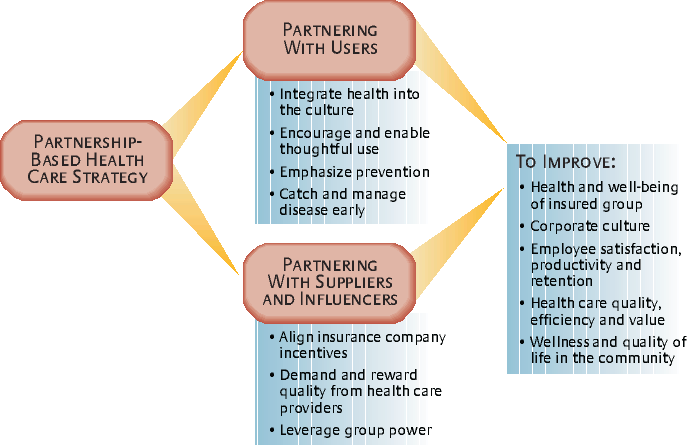

The overriding lesson from our research is the need for partnerships. Companies must build bridges to other players in the system to address the complex, systemic problems that transcend even the most powerful corporations. We propose a partnership-based health care agenda for business — a road map for taking direct action that will benefit not only companies and employees but also health care overall by strengthening the market mechanism and by encouraging the collaboration that health care desperately needs.

Partnering With Health Care Users

Companies cannot effectively manage their health care exposure without the active cooperation of employees. Collaboration on this issue requires a climate of trust and is more plausible in an organization already characterized by a spirit of partnership. Even so, because health care is such a personally important issue, any organization can make improvements in its approach to health care the cornerstone of increased trust. Below are four steps companies can take to partner with employees on health care.

Integrate Health Into the Culture

The phrase “healthy company” almost always denotes a firm’s financial health. Using the phrase more literally to denote employee health underscores the connection between it and a company’s financial performance. This connection becomes even more impressive when indirect costs such as presenteeism are calculated.5

What does it mean to integrate health into the corporate culture? It means that senior managers lead the charge through the personal examples they offer, the vision they establish for the organization, the goals they set and measures they use, and the resource allocation decisions they make — including the quality of people they put in charge of health programming. Indeed, many of the most innovative corporate health programs are being led by physicians or nurses.

Progressive companies encourage healthier lifestyles and discourage wasteful health-related spending by freely sharing information with employees; they also use financial incentives to encourage desired behaviors. To executives who deem it inappropriate to intervene in their employees’ lifestyles, James Rippe, M.D., founder and director of Rippe Health Assessment, has an answer: “Like it or not, you are involved. You just don’t see it until your employee gets cancer.”

Seats Inc. is definitely involved. A privately held business of about 400 employees located in rural Wisconsin, the company manufactures seats for vehicles other than cars. It promotes better health in its employees by sponsoring health screenings, a walking club and a work site safety program; it has also converted to nonsmoking facilities. Its health care costs of $4,000 to $4,500 per employee are significantly lower than such costs at most companies its size.

Seats is self-insured and continually reminds employees, “This is our money. Spend it wisely.” Each year, management estimates the total health care cost for the company and specifies the percentage that employees will contribute. All nonmanagerial employees at Seats participate in a gain-sharing program that is affected by the firm’s health care costs. To encourage thoughtful spending, employees are taught the differences in cost for office, urgent-care, and emergency room visits, for example. The message to employees is quite clear: “My lifestyle and health care choices make a difference for the company’s bottom line — and for my own.”

At the other end of the spectrum in terms of company size is Johnson & Johnson, and no firm in our study has integrated employee health into its culture better than the health care giant. As far back as 1978, then-company chairman James Burke established two overarching goals for an initiative called Live for Life: Encourage Johnson & Johnson employees to become the healthiest in the world and lower the cost of health care for the company. Johnson & Johnson sponsored programs in nutrition education, weight management, exercise, smoking cessation, stress management, and blood pressure control and began documenting progress toward both goals. In 1995, the company integrated occupational medicine, disability management, employee assistance, wellness and health promotion, and employee work-life services (such as child care and elder care) into a single organization. This was pivotal in expanding the reach and coordination of programming and was culturally symbolic.

A cornerstone of the company’s efforts is employee completion of a biennial health-risk appraisal. When the results of an appraisal indicate that the employee is at risk because of high blood pressure, high cholesterol, smoking or other factors, he or she is given a referral for intervention services. The confidential appraisal is done online, and employees may use their own doctor or a company occupational-testing service for the laboratory tests that are part of the appraisal. Johnson & Johnson’s $500 medical benefit-plan credit to employees who complete the appraisal raised participation rates from 26% in 1985 to more than 90% in 1995.

Johnson & Johnson and its employees have clearly benefited from these efforts. In assessing changes in the risk profile of 4,586 employees who participated in two appraisals over several years, the company found improvement in eight of 13 risk categories, including tobacco use, aerobic exercise, blood pressure, cholesterol levels and dietary fiber consumption.6 One study found that annual savings averaged $225 per employee between 1995 and 1999, with savings in the form of reduced hospital, mental health and outpatient visits.

The Johnson & Johnson and Seats cases illustrate the no-nonsense approach to employee health that progressive companies embrace. These firms do not shrink from encouraging their employees to think more about personal health, and they use business tools — planning, goals, metrics, training, internal communications and financial incentives — to move forward. They have made employee health a mainstream issue guided by the belief that a healthy work force creates a stronger business.

Encourage and Enable Thoughtful Use

Health care is often used inefficiently in the United States, partly because employer health plans insulate consumers from information about cost, quality and effectiveness — information that consumers routinely seek when making other important purchases. Health care is the only service that consumers commonly buy without knowing its true cost beforehand, and the information is not always available even to those who seek it. Ben Cutler, chairman of Fortis Health, tells the story of trying to price a magnetic resonance imaging (MRI) exam that he needed for a rotator-cuff injury. Because of his high-deductible health plan, he would be paying the full cost, and so he phoned a dozen hospitals for prices. “Of all the places I called,” he recalls, “only two could or would tell me the cost. The response nearly across the board was, ‘Well, you have insurance, don’t you? What do you care about cost?’”7

The same problem exists for consumers who want to weigh the benefits and drawbacks of various diagnostic and treatment alternatives. The lack of medically sound information to guide people leads to serious misunderstanding about what constitutes effective care. A national survey of American adults, for example, documented a substantial public interest in total-body computer tomography screening even though no data show that such screening is beneficial or even safe, and it is not endorsed by any medical organization.8

Stronger employer-employee partnerships can be built with health plans that promote the involvement of employees, align the interests of both parties, encourage efficiency and equitability, and offer informational tools that enable employees to make good choices. Consumer-driven health plans (CDHPs) have the potential to meet these criteria. One early supplier of a CDHP is Definity Health Corp., based in St. Louis Park, Minnesota. Companies working with Definity fund personal-care accounts (PCAs) for their employees on a pretax basis, say, $2,000 for a family. Employees tap their PCAs to buy health-related services. Preventive care is fully covered and is not deducted from the PCA. If the plan member uses all the account’s funds during the year, he or she is responsible for additional expenses (say, $1,500) before comprehensive coverage kicks in. (See “A Partnership-Based Health Care Agenda for Business.”)

PCA funds not used during the year are added to the member’s allotment the following year. The rollover feature is critical because it encourages employees to spend the funds wisely. Presently, 60% of Definity plan members roll over dollars each year. An array of online and phone-based resources is available to assist members in their purchasing decisions. Members can track their account activity online and get comparative pricing information for medical services and drugs. They also have telephone access to health coaches who can help them plan for a surgery, evaluate medical options, identify a home remedy or make other decisions.

Definity’s clients are seeing an average increase in health care spending of less than 4% for 2004 in comparison with the U.S. trend of more than 12%. The savings are driven by, among other things, higher use of generic drugs, lower use of emergency rooms and lower rates of inpatient hospital admissions. The use of health coaches to help employees weigh spending decisions also plays a role. Definity currently has a 95% member re-enrollment rate.

Most companies offering a CDHP also allow employees the option of selecting from traditional plans. In 2003, Textron Inc., a diversified manufacturing company, gave its 45,000 employees one option — a consumer-driven plan. Before launching the plan, the company invested heavily in an employee education campaign that included 400 meetings. Textron executives believed the CDHP would offer employees a better health insurance experience while increasing their personal involvement in health-spending decisions. First-year results showed increases in the use of preventive care and anti-hypertension drugs but lower usage of medical services and prescriptions overall. (See “Myths and Realities of Consumer-Driven Health Plans.”)

Emphasize Prevention

Persuading employees to lead healthier, safer lifestyles is no small task. Habits are hard to break. Moreover, the health care system is designed to treat illness and injury rather than to prevent them. Physicians are paid more generously for procedures than they are for counseling. Further, the payoffs from prevention are less obvious than the payoffs from treatment. As Scottsdale, Arizona, family physician Susan Wilder explains, “We may never see the gains from prevention because we may not attribute our lack of heart disease to our behaviors. If one doesn’t see immediate outcomes, the intervention is not perceived as effective.” Still another complication: Companies with high employee turnover may be reluctant to invest in prevention of disease under the assumption that another employer will reap the benefits.9

Despite these obstacles, much disease and many injuries are preventable. Diabetes is an instructive example. From 1990 through 2001, the percentage of U.S. adults with diabetes grew by 33%, and Type 2 diabetes, traditionally an adult disease, is becoming prevalent in overweight children.10 Employers have good reason to invest in the prevention and effective treatment of diabetes. If a company could reduce the onset of diabetes in its work force by 25% within five years, it would significantly improve employee productivity, overall health care spending in the firm and the quality of life for its employees.

Managers concerned about health care costs should try to answer this question: What are the biggest health risks in our company that can be lowered effectively? To answer that, Coors Brewing Co. couples a health-risk appraisal survey with an assessment of employees’ readiness to change their behavior. Coors has partnered with MayoClinic.com, which developed a customized Web site that Coors employees can use to complete the confidential appraisal and readiness-to-change survey and obtain a wide range of health-related information.

The appraisal includes an employee consent form allowing Coors Wellness Center staff to gain access to an employee’s specific results. Almost all employees give their consent, enabling staff to contact high-risk individuals to offer intervention programs. For example, employees who are at risk of heart disease are invited to participate during work hours in a risk modification program known as the Coors Health Intervention Program. Participants are supervised on site by a physician as they exercise and receive instruction on nutrition and stress management. Follow-up monitoring occurs at regular intervals.11

Coors has increased employee participation in wellness activities by tailoring programs to specific work groups and delivering programs at the work sites. Although the company has a well-equipped fitness center, more than 70% of its Golden, Colorado, employees don’t use it. To reach them and to accommodate intracompany variation in risk factors, Coors sponsors customized work-site programs in areas such as stretching, back care, use of pedometers, weight management and wellness education.

Prevention strategies are not just for big companies. Highsmith Inc., in Fort Atkinson, Wisconsin, has approximately 200 employees. This distributor of supplies, furniture and equipment to schools and libraries takes an aggressive approach to disease prevention. At meetings, fruit is served instead of doughnuts or cookies. High-fat items in vending machines are subject to a “Twinkie tax,” which subsidizes low-fat items. An exercise instructor leads aerobics classes in the cafeteria. Employees are encouraged to walk the one-mile trail outside the company’s facility during shift breaks. Warehouse employees participate in mandatory stretching twice a day to prevent injuries and enhance fitness. Workstation ergonomic audits minimize strains and carpal tunnel syndrome. Highsmith’s approach is paying off: The company’s health care cost increases in 2002 and 2003 were only 2.9% and 3.1%, its workers’ compensation costs are declining, and employee turnover is in the single digits.

A prevention strategy should encompass injuries as well as illness. Union Pacific Railroad Co. and other industrial companies have discovered that employee health and safety are strongly correlated. At Union Pacific, the most significant predictors of injury besides age and tenure are overall health status, tobacco use, stress and body weight. The company has found that overweight employees are more likely to experience a safety incident than employees of normal weight. With most of its labor force working in the field, Union Pacific subsidizes employee access to more than 500 contracted fitness facilities along its system. Boxcars have been retrofitted as rolling gyms for maintenance crews that repair track in remote areas. The company sponsors smoking cessation, weight loss, stress and fatigue counseling programs and is developing a nutrition program. The railroad estimates savings of more than $3 for each dollar invested in its health programming.12

Catch and Manage Disease Early

As important as efforts at prevention are, they are not enough: People will still contract serious diseases. Early detection and effective treatment of disease should also be part of a firm’s health care agenda. For health and cost reasons, it is better to treat high cholesterol than heart disease, and better to detect cancers in their early stages.

Rosen Hotels & Resorts Inc. and SAS Institute Inc. provide free primary medical care for employees and dependents in company-owned clinics. In both cases, the rationale includes early detection and effective management of disease. Rosen has six hotels with a total of 5,000 rooms, all in Orlando, Florida. Employee benefits are exceptional and are clearly a factor in the company’s 15% employee turnover rate (in an industry in which even high-end hotels average turnover of between 50% and 60%). The Rosen Medical Center is located at one of the hotels, the Quality Inn International, and employees can visit the center while they are “on the clock.” Owner Harris Rosen considers the establishment of the health clinic his single best health care decision. “Our primary care facility reinforces among our employees that we really care about them. It also enables us to control our health care destiny. Our own doctors taking care of our own employees help us nip in the bud problems that could become far more significant.”

Software company SAS Institute also is known as a generous employer and has an employee turnover rate of only 3%. It is privately held, and its chief executive, Jim Goodnight, has a deep interest in health care. Presently staffed with three physicians and 13 nurse practitioners, the SAS Institute medical center saves the company money. Documented savings come from not having to pay the higher costs of external providers and from employees spending less time away from work for medical appointments. Hypothesized savings come from employees seeking health care earlier in an illness cycle and missing less work time later.

SAS Institute is one of approximately 40 large companies embarking on an ambitious collaborative cancer initiative called the Gold Standard. The companies are members of the CEO Roundtable on Cancer and cover more than 27 million employees and their dependents. Gold Standard companies have committed to a three-part cancer strategy. First is education aimed at prevention. CEOs are expected to play a personal leadership role in raising awareness. Second is early diagnosis. The companies are expected to use the best available screening tests and to encourage people to undergo screening. Third is facilitating access to clinical trials for individuals diagnosed with cancer. Medical specialists help newly diagnosed patients obtain credible information and then help them decide whether to enroll in a clinical trial. Whereas most children nationwide who get cancer enroll in clinical trials, only about 10% of adults do.

All these examples of companies working with employees show how costs can be reduced while quality of care and of life are improved. But partnering with health care users is only part of the agenda. Another crucial part involves partnering with suppliers and influencers — such as business coalitions —within the system.

Partnering With Suppliers and Influencers

Rising health care costs have created an adversarial relationship between businesses and the suppliers and influencers of health care services. Companies are frustrated with endless cost hikes from providers, lack of innovation by insurance companies, intransigence of unions, and weak leadership from public officials. The health care industry, logically the group to overhaul health care, is Balkanized by the conflicting goals of doctors, hospitals and health plans. Business, with so much at stake, and in its role as customer, needs to use its clout to create a dialogue with these groups through which reasonable expectations can be established and support for the missions of companies and their health care suppliers can be built.

Align Insurance Company Incentives

In an effort to control costs, businesses during the 1990s persuaded employees to enroll in managed-care plans. Such plans contributed to the relatively low growth in health care spending in the 1990s mainly by reducing payments to providers and shortening hospital stays.13 But providers and patients chafed under the tight cost controls. Employers responded to the backlash by loosening the controls, unleashing the double-digit cost spiral of the early 2000s.

Today’s innovative purchasers are building on the managed-care legacy to establish more effective relationships with insurance companies. Under managed care, employers adopted competitive bidding to drive down prices with insurance carriers, a method that until then had not been used to buy indemnity coverage.14 But bidding criteria generally have been limited to cost, claims service levels and network size. A few companies are now expanding negotiation criteria to include quality of care, using quality standards offered by the National Committee for Quality Assurance. And some insurance companies and businesses are partnering to fix systemic issues that drive up costs.

General Motors Corp., for example, uses financial incentives and education to encourage employees to enroll in higher-quality health insurance plans. The company scores insurance plans on the basis of a series of quality and performance measures that reflect national quality standards and GM’s priorities. The cost-effectiveness of each managed care plan is measured by comparing costs to those of indemnity plans in the same geographic region. Cost and quality are weighted equally to create an overall score. GM prices its offering to encourage employees to select better plans, so that families in top-tier plans contributed just $35 per month in 2001 compared with $173 for poorer-performing plans.15 Not only have employees migrated to higher-quality insurance plans, but also the plans themselves have improved since the process was initiated.

About 75% of total health care spending is dedicated to the treatment of chronic disease.16 Disease management programs (which help chronically ill patients follow a formally designed treatment plan) and health promotion programs are complex to implement. Insurance carriers have expertise but are reluctant to make the initial investment if a competitor is likely to enjoy the benefits in the next contract year. A few companies are structuring contracts to help align insurers’ interests with their own interests. Some pioneering contracts allow for premium adjustments based on the risk and illness severity of enrollees, and other contracts extend over multiple years. For example, the California Public Employees’ Retirement System’s three-year contract reduces Blue Shield of California’s risk of an unusually high claims year and encourages the insurance company to invest in disease management programs.17

One notable business and insurance partnership is between Ukrop’s Super Markets Inc. of Richmond, Virginia, and Anthem Blue Cross Blue Shield. Self-insured Ukrop’s was bludgeoned by a 32% medical cost hike in 2002, a flat sales year for the company. In the new three-year contract, Anthem is investing in disease management and prevention programs tailored to Ukrop’s employees’ medical needs. After evaluating Ukrop’s claims history, Anthem identified four areas in which Ukrop’s employees differ from peers. For example, they were frequent users of the emergency room. By requiring higher copayments for ER visits, the benefits program steers employees toward their regular doctor when conditions are not true emergencies.

To make the disease management programs cost-effective, Anthem uses statistical modeling to select patients who will benefit the most. Less-sophisticated programs often target the previous year’s sickest patients, many of whom would have rebounded without the intense intervention.

Insurance companies and businesses also are collaborating to identify which new medical technologies to adopt in their communities. This is important given that the health care industry defies the basic law of economics involving supply and demand. Whereas competition eliminates excess capacity in other markets, in health care, supply creates demand. The excess capacity remains available, increasing fixed costs and encouraging greater use of services. Many communities are characterized by a wasteful duplication of medical services. Costly new technology is frequently adopted even when it cannot be shown to improve health outcomes compared with older technology.

In Rochester, New York, an advisory board on technology assessment advises payers and other interested parties on the need for, and efficacy of, new technology or novel applications of existing technology, taking into account geographic location, access, cost-effectiveness and quality. The board is led by a local business leader and includes insurers, physicians, health system administrators and consumers. A physician committee of the board analyzes the issues on the basis of scientific, evidence-based studies. The process restrains unnecessary capital expenditures; for example, Rochester’s use of MRIs is 37% lower than that of nearby Syracuse, a demographically similar market.

Demand and Reward Quality From Providers

While it’s important to have smart relationships with insurers, individual doctors and hospitals have even more influence over health care outcomes and costs than health plans do. A major problem is the wide variation in efficiency and quality among doctors and hospitals. Tens of thousands of Americans die each year because the care they get strays from medical standards. These people include heart attack patients who didn’t get beta blockers and chronically ill patients whose blood pressure, diabetes or cholesterol were not brought under control.18

Some doctors and hospitals are more likely than others to adhere to the strongest scientific findings, a practice known as evidence-based medicine. Proponents argue that the use of evidence-based medicine yields better health outcomes with lower total cost to payers. But providers have no financial incentive to adopt best practices because purchasers typically pay health care providers the same, regardless of efficiency and quality. That’s beginning to change. Several large employers are starting to steer patients to better performing providers and to reward clinicians and hospitals for meeting quality or efficiency goals.

General Electric Co. rewards physicians treating diabetic patients for following evidence-based care guidelines such as controlling blood-sugar levels and providing regular foot exams. Ten percent of GE’s total health plan costs go for diabetic care and related hospitalizations. GE estimates an annual $350 savings for each diabetic employee who is treated according to standards set by the American Diabetes Association, the National Committee on Quality Assurance and other quality organizations. The company is sharing half the savings with doctors and patients to motivate best-practice behavior. Qualified doctors earn a $100 annual bonus for each diabetic patient for whom they provide care that meets national best-practice standards. Patients pocket $75 for following their doctor’s advice about medications and exercise.

Employers can help physicians apply the strongest medical guidelines. Sears, Roebuck contracts with an external company to review patient-specific data to identify gaps in care. The external company, ActiveHealth Management Inc., continuously applies thousands of clinical rules through its database to identify specific cases in which a patient’s care differs from evidence-based standards. Registered nurses confidentially alert both the patient and the physician to potential problems.

The ultimate way to demand quality? “Stop paying for bad care,” suggests Helen Darling, president of the National Business Group on Health, an alliance of large employers. “We expect GE to fix the refrigerator or take it back. If employers refused to pay for care when there is a preventable medical incident, quality would improve.”

Leverage Group Power

A single business, no matter how large, lacks the muscle to overhaul the health care market on its own. “Health care is such a monster that, even with 75,000 insured employees, I’m a speck in the ocean,” comments Bob Ihrie, compensation and benefits vice president for Lowe’s Companies Inc., the home improvement chain. Accordingly, businesses are banding together to tackle the health care crisis. As a first stage, they are forming alliances to leverage their buying power. General Mills Inc., for example, has achieved deep pharmaceutical discounts by joining with several other large employers to purchase drugs.

The employers sponsoring the Leapfrog Group go further, using their buying power to promote safety improvements that will ultimately enhance overall health care value. Leapfrog is challenging hospitals to implement computerized physician order entry to reduce medication errors, to refer patients requiring selected complex treatments to hospitals with the best outcomes or the most experience, and to use physicians trained in critical-care medicine to monitor patients in the intensive care unit. Leapfrog’s initiatives have attracted controversy; for example, software systems to support computerized order entry are costly. The group counters that, though blunt tools, these three initiatives will save up to 58,000 lives and prevent up to 522,000 medication errors each year.

Several business coalitions help their members reward strong performance by hospitals and physicians. Wisconsin’s Employer Healthcare Alliance Cooperative, for example, prodded the state’s medical groups to publish performance reports. Now employers in the alliance are experimenting with an approach that ties health care rate increases not to inflation, but rather to improved performance; providers are rewarded, for example, for having lower rates of hospital readmissions, complications from treatment and Caesarean sections. As quality-of-care metrics about individual physicians become available, the organization will help design incentives to encourage employees to use the best combination of cost and quality.

The Truly Healthy Company

What is your company’s philosophy about employee health care benefits? Is health care an aggravating and potentially ruinous cost of doing business or an investment in overall business success?

Innovative companies seek to control their company’s health care destiny. Just as they do not outsource critical financial or strategic planning decisions, they do not outsource major decisions to their health insurance administrator. They acknowledge the influence of illness and injury on the company’s prosperity. They believe healthy people deliver healthy profits. They avoid a silo approach in favor of a holistic approach, and they measure outcomes from their investment. They seek quality information about performance and fair cost.

Innovative CEOs use their positions to create a burning commitment to change. They align health benefit incentives and give employees the tools and encouragement to stay healthy and make smart health care decisions. They reward insurance companies and providers for improving outcomes and efficiency. They strive to improve health care system performance not just in their own companies but throughout their communities.

As the pioneering companies in our study demonstrate, the business community can set the agenda for a better future. A partnership-based agenda offers a dynamic strategy that involves all stakeholders. Everyone shares the rewards when the whole system improves. The corporate culture thrives because employee satisfaction, productivity and retention rates increase. Employees benefit because health care quality, efficiency and value get better. The community prospers because wellness promotes a higher quality of life for all. The truly healthy company is sound not only financially but also in the physical and mental well-being of those who make up the organization.

References

1. Problems with the system are well documented in the health policy and medical literatures. For several comprehensive sources of information, see Institute of Medicine, “Crossing the Quality Chasm: A New Health System for the 21st Century” (Washington, D.C.: National Academy Press, 2001); D.M. Berwick, “Escape Fire: Designs for the Future of Health Care” (San Francisco: Jossey-Bass, 2003); and M.R. Chassin, E.L. Hannan and B.A. DeBuono, “The Dartmouth Atlas of Health Care 1999” (Lebanon, New Hampshire: Dartmouth Medical School, 1999).

2. Business Roundtable, “Business Roundtable December 2003 Economic Outlook Survey” (Washington, D.C.: Business Roundtable, 2003).

3. W.F. Stewart, J.A. Ricci, E. Chee, D. Morganstein and R. Lipton, “Lost Productive Time and Cost Due to Common Pain Conditions in the US Workforce,” Journal of the American Medical Association 290 (Nov. 12, 2003): 2443–2454.

4. This statement and many others that appear in this article come from interviews conducted by the authors. The research process is described in “About the Research.”

5. P.E. Greenberg, S.N. Finkelstein and E.R. Berndt, “Economic Consequences of Illness in the Workplace,” Sloan Management Review 36 (summer 1995): 26–38.

6. R.Z. Goetzel, R.J. Ozminkowski, J.A. Bruno, K.R. Rutter, F. Isaac and S. Wang, “The Long-Term Impact of Johnson & Johnson’s Health & Wellness Program on Employee Health Risks,” Journal of Occupational and Environmental Medicine 44 (May 2002): 417–424.

7. B. Cutler, “Putting Pricing in the Picture: Shielding Consumers From True Costs of Healthcare Diminishes Their Responsibility,” Modern Healthcare 33 (Nov. 10, 2003): 22.

8. L.M. Schwartz, S. Woloshin and F.J. Fowler, Jr., “Enthusiasm for Cancer Screening in the United States,” Journal of the American Medical Association 291 (Jan. 7, 2004): 71–78.

9. S. Leatherman, D. Berwick, D. Iles, L.S. Lewin, F. Davidoff, T. Nolan and M. Bisognano, “The Business Case for Quality: Case Studies and an Analysis,” Health Affairs 22 (March/April 2003): 17–30.

10. J.F. Bailey, D.V. Gibson and N.A. Tate, “The Diabetes Epidemic in Tennessee,” University of Tennessee Health Science Center, 2003.

11. Mayo Clinic Health Management Resources, “E-Health Management Case Study: Adolph Coors Co.” (Rochester, Minnesota, 2002).

12. B. Abresch and E.A. Deas, “Fighting Obesity at the Nation’s Largest Railroad,” Absolute Advantage 1 (April 2002): 16–17.

13. A.C. Enthoven, “Employment-Based Health Insurance Is Failing: Now What?” Health Affairs Web Exclusive (May 28, 2003): W3-237–249.

14. J. Maxwell, P. Temin and C. Watts, “Corporate Health Care Purchasing Among Fortune 500 Firms,” Health Affairs 20 (May/June 2001): 181–188.

15. P.R. Salber and B.E. Bradley, “Perspective: Adding Quality to the Health Care Purchasing Equation,” Health Affairs Web Exclusive (Nov. 28, 2001): W1-93–95.

16. National Center for Chronic Disease Prevention and Health Promotion, “Chronic Disease Overview,” www.cdc.gov/nccdphp/overview.htm.

17. R. Ceniceros, “CalPERS Health Plan Decides To Go Steady,” Business Insurance (May 19, 2003): 1–2.

18. National Committee for Quality Assurance, “The State of Health Care Quality 2003: Industry Trends and Analysis” (Washington, D.C.: National Committee for Quality Assurance, 2003).