Corporate Spheres of Influence

Topics

Johnson & Johnson, a company that is almost synonymous with baby care products, doesn’t have its own brand of diapers for babies. Procter &Gamble Co., known for its soaps and shampoos, doesn’t offer a major baby shampoo. These companies appear to be missing obvious ways to leverage their manufacturing, branding and other core competencies through extensions into synergistic areas. What could they be thinking?

These gaps suggest that there may be a deeper logic to building strong portfolios than simply leveraging competencies or assembling related businesses. It appears that Procter & Gamble (P&G) and Johnson & Johnson (J&J) may have established a standoff — similar to the nuclear age concept of “mutually assured destruction” — in which they implicitly agree to stay out of certain of each other’s markets to avoid direct confrontation and to devote their energies to battles on other fronts. P&G can devote more attention to confronting Unilever and Kimberly-Clark. J&J can concentrate on more profitable battles over medical equipment and hospital supplies rather than fight in consumer products.

While these moves may not make sense from the logic of leveraging the competencies of the organization, they may reveal a deeper strategic logic for designing portfolios and establishing a balance of power in an industry. For P&G and J&J, that strategic logic is, in short, that each has tacitly established its “sphere of influence” on different aisles of the supermarket, secured that sphere from attack from the other, and expanded its sphere in directions that do not conflict with the other’s ambitions, so they can divert their resources against other rivals.

The implicit division of the diaper and shampoo markets as well as the standoff between P&G and J&J highlight a central strategic concern of any organization: For a company’s portfolio of businesses and geographic market positions, what overall logic can be used to stake out and defend a favorable position within its industry or industries? Many companies have tried, with only partial success, to answer this by developing a financial logic for drawing together a portfolio of businesses in a conglomerate model in which every business is expected to contribute positively to the company’s overall financial performance, and by extending this logic into a strategic framework. Recognizing that these financial models do not capture the full opportunities for value creation, many other companies have also looked for technological, marketing and operational synergies by leveraging core competencies in R&D and customer knowledge, consolidating back-office operations or information systems, and building similar manufacturing facilities and processes.

Because these synergies are difficult to achieve and complex businesses can be confusing to investors and management, synergy approaches often fail. Companies such as America Online Inc. and Time Warner Inc. have sought to draw together related businesses, but what seemed related turned out to have few synergies due to conflicting management cultures, differing strategic interests of the business units and difficulties in managing the resulting behemoth. Because of such challenges, other companies have pursued a logic characterized by tight focus, leveraging a small set of competencies in a narrowly focused set of businesses to build economies of scale and market power. Anything that doesn’t reinforce this focus is jettisoned as excess baggage.

But all these approaches to portfolio planning either ignore competitors or, at best, treat them lightly. A stick-to-your-knitting approach or a synergy-seeking strategy provides little insight into how a company’s competitor selection and geographic and product positioning can allow it to defend against potential attacks, facilitate growth and influence a rival’s portfolio.

This article examines a systematic approach to developing and managing corporate portfolios that integrates and moves beyond these traditional models (see “About the Research”). While taking into consideration economies of scale, synergies and market power, this approach is based upon the strategic intent and competitive impact of selecting a set of market positions. How do the different parts of the business support one another in an effort to defend against entry by competitors? How does the portfolio build a platform for growth, while preventing rivals from capturing the high ground in an industry? How can a company’s portfolio be used to mold the portfolios of rivals to create a more favorable industry structure?

What Is a Sphere of Influence?

The sphere of influence is a concept borrowed from geopolitics1 and the subject of recent research in the management literature.2 It offers a framework for examining the strategic intent of the company’s portfolio and its implications for competitive strategy. A sphere is a product and geographic portfolio on steroids — a portfolio with influence over where and how competitors fight within their competitive space.

Spheres of influence in geopolitics have been used for centuries to manage relationships between countries. In business, a well-constructed sphere of influence can maneuver competitors into a corner, reduce price wars through the business equivalent of “mutually assured destruction,” and shape the industry to the players’ mutual advantage.

Like nations, companies build spheres of influence that protect their cores, project their power outward to weaken rivals and prepare the way for future moves. To be effective, the sphere must contain a secure power base — a core market — that can be used as a platform. And it must invest in other markets that are used for defense of the core and for migration or growth. Viewed in that way, elements of a portfolio exist not just to contribute financial return to the corporation. In fact, some parts of a portfolio may create minimal or even negative return, but they may preserve value elsewhere in the portfolio, just as Poland and Cuba, while a drain on the Soviet economy, served, respectively, as a buffer against Western Europe and as a forward position against the United States. Microsoft Corp., for example, has maintained its positions in less profitable businesses such as Internet services (MSN) and television network broadcasting (MSNBC), not as a major source of revenue but because of their strategic implications in helping to defend against attacks and offering outposts for moving in new strategic directions.

Thinking in terms of building a sphere of influence forces managers to draw together corporate- and business-level strategic analyses that are often treated separately. The corporate-level concern about “where to fight” and the business-level concern about “with whom and how to fight to win” are brought together into a coherent view in which where to fight is how and with whom you fight.

While portfolio planning is often done only at the corporate level in large companies, the sphere of influence concept can be applied at multiple levels of an organization by looking at single business units or at smaller geographic areas. Small companies can also build localized spheres against other small concerns or become allies or satellites in the spheres of larger companies. For example, open-source pioneers using Linux have made progress against Microsoft because of support from IBM, Intel and other companies that would like to see Microsoft’s influence over the industry reduced.

Not every company establishes a stable and secure sphere of influence, and not every company needs one. A few fast-moving companies can constantly migrate to new ground as their core products and customers are lost to more powerful rivals. Niche players can often survive without a sphere of influence in the short run, but often need to figure out an alliance structure that will counterbalance those players with strong spheres of influence. For any company that wants to lead its industry, however, a well-constructed sphere of influence is essential.

Parts of the Sphere

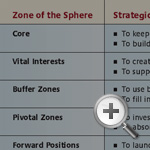

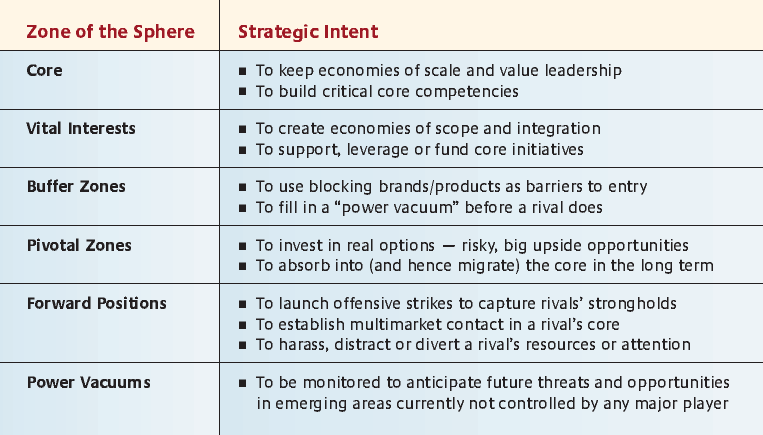

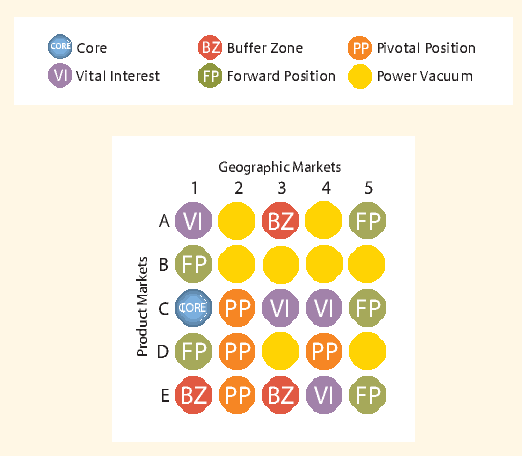

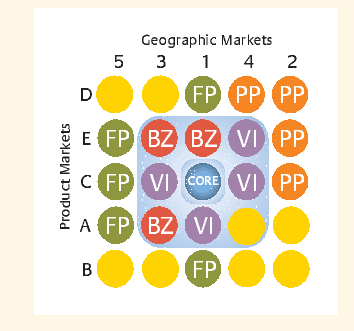

Designing a sphere requires assigning a role or strategic intent to each part of the portfolio. (See “Establish Strategic Intent for Parts of Your Sphere.”) In addition to core geographic and product markets, there are vital interests, buffer zones, pivotal zones and forward positions, each serving a specific strategic intent. There also are potentially important power vacuums that may lie just outside a sphere of influence. An examination of Microsoft’s sphere of influence illustrates each of these aspects. (See “Microsoft’s Evolving Sphere of Influence.”)

Core:

The core of a sphere is the product or geographic market that is the basis of the company’s power and generates the vast majority of its revenues and profits. It is, of course, where the company focuses on creating its critical core competencies, but having a core competence is not enough to create a sphere of influence. It requires dominance over and value leadership in a core market. Without that, a company’s sphere is weakened or ineffective. In the 1980s, Microsoft’s MS-DOS formed its core. The company gradually expanded its core to include the Windows operating system, the Office suite of applications and the Internet Explorer Web browser. To keep control over its sphere, a corporation must put down any assault on its core, just as Microsoft has tried aggressively to counter the Linux operating system.

Vital Interests:

These are geographic or product markets that provide the core with critical, often complementary, strengths that create economies of scope and integration, as well as support or leverage core initiatives and competencies. They might be complementary products or businesses that provide resources such as know-how, raw materials or skilled labor. For Microsoft, its network (NT) and portable device (CE) operating systems are vital interests that leverage, support or complement its core desk-top operating system and graphical user interface. They are vital to Microsoft’s continued dominance of operating systems for microcomputers and other such devices.

Buffer Zones:

These defensive positions provide insulation against attack by another player that might enter the core. They include blocking brands and products used to create barriers to entry. Buffer zones are expendable (unlike vital interests), because they make up a small percentage of a company’s revenues. If battles must be fought and territory lost, it’s better done in the buffer zone than in the core. Buffer zones protect against expansion by known and unforeseen rivals that could leverage their position in a nearby geographic market or related product markets in order to enter your core markets. In the 1980s and 1990s, Microsoft moved into PC applications such as the Office suite and created a buffer against incursions from companies with “killer applications” that could have bundled them into operating systems to challenge Microsoft’s core. These applications eventually became part of its core, and it is now building buffer zones in anti-virus, firewall and anti-spam solutions that are the killer applications du jour.

Buffer zones can also be “fighting brands” designed to minimize and localize the impact of a price-based entrant. For example, when the Japanese company Kao Corp. entered the diskette market, 3M launched Highland, a flanking brand of low-priced diskettes. Price-sensitive 3M customers, who likely would have switched to Kao’s product, switched to Highland instead, preserving a good deal of revenue for the parent company. Also, by not overreacting and cutting its core product prices across the board, 3M retained its sales to non-price-sensitive customers at the higher price point. With these moves, 3M made sure the battle would be joined at the low end of the market, effectively reducing Kao’s capability and motivation to enter the less price-sensitive part of the market.

Pivotal Zones:

These are market areas in which the future balance of power may reside. Taking a position in a pivotal zone is making a bet on the future, although not necessarily with a specific rival in mind. Microsoft’s code-named Longhorn operating system and graphical user interface represents such a position. It is based on a still-secret new concept that moves away from the “desktop” analogy that was originally created by Apple Computer Inc. for managing files. Longhorn aims to incorporate greater security features as well as powerful integrated search functions locally and across the Internet, creating a faster and more seamless user interface. The goal is to create the operating system that will replace DOS and extinguish the threat from Linux by superseding it. If it works, Longhorn will someday become Microsoft’s next core.

Forward Positions:

These are offensive, front-line positions typically located near the vital interests or core of a specific identifiable competitor. They can be used to weaken the core of a rival, but they can also be used to create stability when each rival maintains a forward position in the other’s core to build mutually assured deterrence. The forward position can also be used to harass, distract or divert a rival’s resources or attention. Microsoft holds a wide range of forward positions to counter large rivals such as AOL, Sony and Palm, or Hewlett-Packard/Compaq in personal digital assistants (PDAs). All are building their own operating systems or graphical user interfaces to challenge Microsoft’s core, so Microsoft is attacking their core markets using MSN, gaming systems (Xbox) and handheld devices. It is even investing in “smart” consumer products such as watches. Microsoft is not likely to displace these players as leaders in their industries, but it can deter or weaken these companies by undermining the profitability of their cores.

Power Vacuums:

Finally, while they are not actually part of a company’s portfolio, there are parts of the competitive space that might not be controlled by any major player. These power vacuums are not yet pivotal zones, but it is important to be aware of and monitor them. For example, China’s software market is not yet pivotal for Microsoft, because little revenue can be generated from a market where piracy is so prevalent and Chinese written characters present costly programming problems. Depending upon how Chinese government policy evolves on issues of piracy, intellectual property rights, and software and technology standards, however, the competitive landscape could change rapidly. China does have a number of small software development companies and if one were allowed, for example, to become a national monopolist based on building and selling a rival operating system using modified Microsoft code without paying royalties, it could have tremendous global impact, given the potential size of the emerging Chinese market. Power vacuums are often places where small upstarts arise and become stronger (the Japanese automakers and consumer electronics companies are examples), so attention needs to be paid to them, even if the established company deems them too unimportant to take action.

Different parts of the portfolio can serve more than one function. For example, a forward position into another competitor’s core can also serve as a defensive buffer zone against attack from that same competitor. MSN serves as both a vital interest (helping to make Microsoft’s core browser better connected to Internet content) and as a buffer zone against AOL. The distinctions between different parts of the sphere are often a matter of degree, so there is naturally some blurriness, just as boundaries in geography are often much less clear than the lines on a map.

Defining the role for each part of a company’s portfolio can force it to clarify its strategy, assess the logic of its mergers and acquisitions, and help defend against competitive threats. (See “Mapping and Assessing Your Sphere of Influence.”) Assessing the parts of the sphere can also focus the attention of a company that has leveraged a competency into a number of businesses, and, in the process, accumulated many new competitors that expose the business to numerous threats.

Four Spheres of Influence

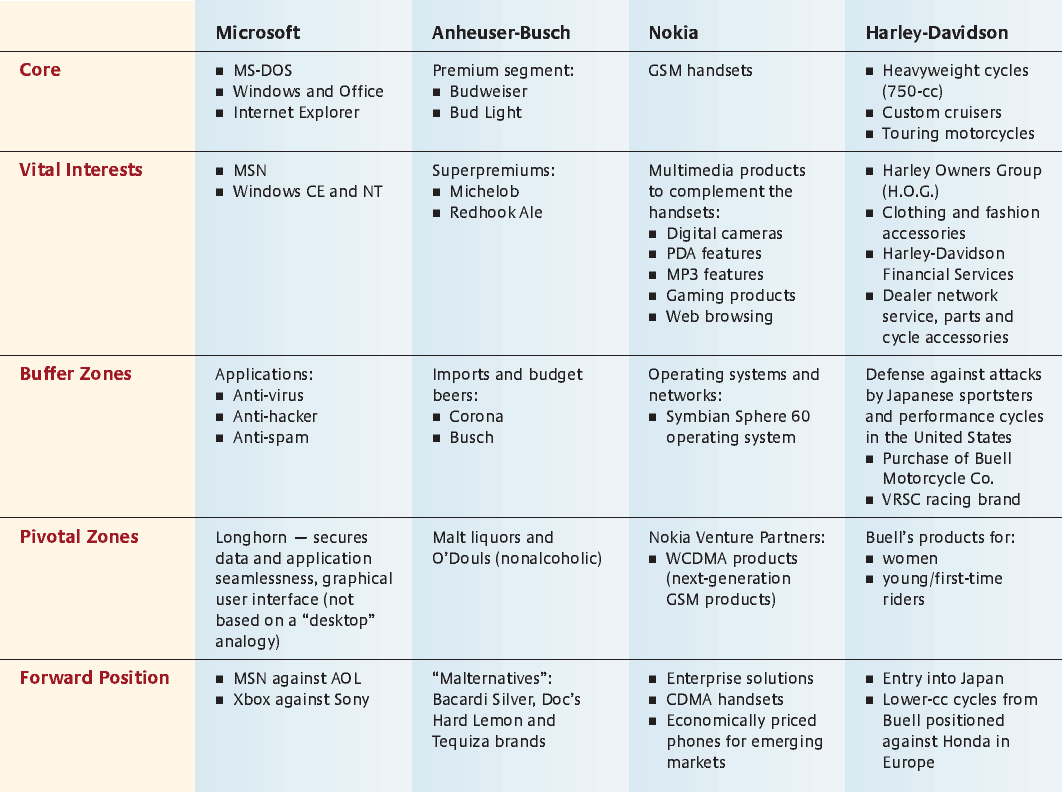

The parts of the sphere come together to provide a coherent strategic positioning of the company and competitive maneuvering against rivals. Among the threats to Microsoft are a revolution by Linux in operating systems and the rise of “smart” consumer electronics and handheld devices. Microsoft’s strong sphere of influence can help it respond to these attacks by buffering the moves of rivals, creating its own incursions into competitors’ markets, and by helping to strengthen, evolve or even migrate its core. Similarly, Anheuser-Busch, Nokia and Harley-Davidson each have created spheres of influence in very different industries against very different domestic or global competitors. Each has staked out and defended the high ground —the best place to be — in the market and used its sphere in competitive maneuvering to dominate its rivals. (See “Four Spheres of Influence.”)

Anheuser-Busch Cos. Inc.

The core of Anheuser-Busch initially was established in the premium beer segment, where its Budweiser brand is the best-selling beer. As the premium beer segment lost share to light beers, imports and other new entrants, Anheuser-Busch continued to expand its core and extend its sphere of influence. In the 1980s and 1990s, it moved Bud Light and other brands into its core. By 1997, Anheuser-Busch became the leading maker of light beer, and light beer constituted a 45% share of all its brands.

Anheuser-Busch established vital interests with its Michelob and Redhook Ale superpremium brands to complement its core products with higher-end, higher-margin products. As import rivals such as Heineken, Labatt and others gained ground, Anheuser-Busch created buffer zones by purchasing an equity stake in Mexico’s Grupo Modelo, maker of Corona, the best-selling imported beer in the United States. It also countered attacks at the low end, with budget beers such as Busch. Imports and budget beers are too small or too unprofitable to be vital interests, but they are necessary to prevent brewers positioned in those markets from getting large enough to move into the premium and superpremium markets.

Anheuser-Busch also moved into pivotal zones that could be potentially important to its future with its line of malt liquors and O’Doul’s nonalcoholic beer. Finally, the company countered the threat of nonbeer “malternatives” such as Smirnoff Ice through forward positions using its Bacardi Silver, Doc’s Hard Lemon and Tequiza brands. These moves have helped to sustain, and even increase, its share of its core U.S. market, which reached 49% in 2002.

Nokia

Finland’s Nokia has built the core of its sphere of influence around wireless telephone handsets on the basis of global system for mobile communication (GSM) technology, allowing it to lead in a very competitive industry of over 100 handset manufacturers. Nokia has supported its core through vital interests in multi-media products such as imaging (Nokia is now the world volume leader in digital cameras), PDA features, MP3 players, messaging and Web browsing. These businesses support and strengthen its position in the core by providing the handset features and functionality that users desire. Nokia has established buffer zones in wireless telecom infrastructure as well as in its investment in the Symbian Sphere 60 operating system and network, which helps defend against attacks from competing hardware and software systems that could be bundled or used by rivals such as Microsoft and Palm or companies employing Linux-based systems.

Nokia also has staked out forward positions to attack Motorola and Korean rivals such as LG Electronics and Samsung by making low-priced, entry-level phones. Also, the company is now moving into forward positions to attack rivals in business enterprise solutions that have built strongholds in the commercial wireless telecom market. Through Nokia Venture Partners, Nokia has established positions in pivotal zones in areas such as WCDMA phones (the wideband standard that is seen as the successor to GSM), an area that might become important or offer opportunities for Nokia to migrate its core in the future. Nokia’s sphere allowed it to build a 35% global market share in handsets by 2002, with sales more than double those of industry founder Motorola.

Harley-Davidson Motor Co.

While Harley-Davidson’s core has long relied on heavyweight (750-cubic centimeter, or cc) motorcycles and a rebel image, it has evolved considerably in the century since its founding. Although Harley’s core products have remained similar, it has used and extended its sphere of influence to encompass a more mainstream customer. Harley now serves a core customer base of middle-age males with average incomes of approximately $80,000. By 2004, it had achieved 56% market share in the 750-cc motorcycle segment.

To support its core of enthusiastic riders, the company established a set of vital interests, including the Harley Owners Group (H.O.G.), genuine Harley-Davidson clothing and other accessories, a financing arm that added $211 million in revenues in 2002 and a dealer network that offers service/parts and extends the Harley experience. These vital interests not only provide revenue to the core but also reinforce the brand image and help draw in new customers. Harley also created the Rider’s Edge training program to help first-time customers develop the riding skills to move up to its large cycles.

To thwart attacks from companies such as American Honda Motor Co., which sell smaller and performance cycles, Harley created a buffer zone by introducing the VRSC engine for competitive racing and by purchasing a European company, Buell Motorcycle Co. The Buell purchase also gave Harley access to key pivotal zones for the future, with smaller-cc products targeted toward female, younger or first-time riders, none of whom are in Harley’s primary market — but all of whom could become key emerging segments. Finally, Harley established forward geographic positions by entering into the heart of the domestic markets of Japanese rivals such as Honda, Yamaha and Suzuki. By early 1995, Harley had captured 20% market share in Japan. The acquisition of Buell also served as a forward position that helped Harley attack Honda’s market leadership in Europe and in smaller motorcycles.

This sphere of influence has helped sustain Harley’s dominance in the U.S. market, particularly in the large motorcycle/thrill-seeker segment, with commanding margins of 27%–30% as compared with 2%–8% for its rivals.

Geographic Spheres

Although the above examples have focused on spheres that are primarily related to products and market segments, spheres of influence can also be examined through a geographic lens. While Anheuser-Busch, Harley-Davidson and Nokia all have created geographic spheres of influence on the basis of U.S. or European markets, the development of a geographic sphere of influence can perhaps best be illustrated by the global success of Monterrey, Mexico, cement company CEMEX S.A. de C.V. (See “CEMEX’s Globalization Moves.”)

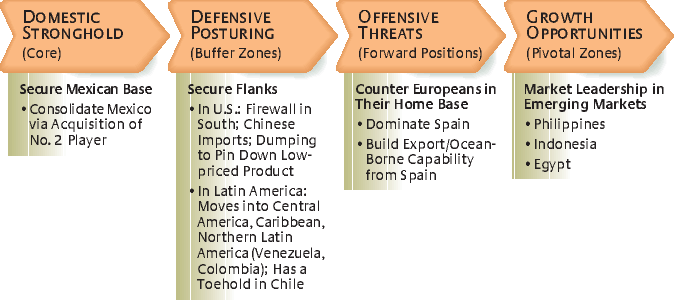

CEMEX built a global sphere of influence in four logical phases: consolidation of a core market, protection of its core’s north and south flanks, establishment of a forward position near the core of its major rivals to create mutually assured deterrence, and movement into pivotal zones to ensure the necessary growth for continued leadership in the marketplace of the future. In 1989, CEMEX completed the consolidation of a stronghold in its domestic market in Mexico through the acquisition of the No. 2 player based in central and southern Mexico. To protect its Mexican base, it created buffer zones in the Southwestern United States and Southern California, and as well as in Central and Northern Latin America. In the U.S. buffers, CEMEX created what it called a “firewall” with foothold entries, including the acquisition of a one-million-ton plant in Texas to reinforce its presence in the U.S. ready-mix business. To pin down two rivals that held small positions in the Mexican market, Holderbank and Lafarge, CEMEX also used cheap Mexican and Chinese imported cement distributed through its West Coast terminals. This kept them distracted in the United States and diverted their resources to fighting CEMEX outside of Mexico. And with similar moves in Latin America, CEMEX became the No. 1 player in Panama, Costa Rica, Venezuela and Colombia, conceding Argentina and Brazil to local competitors and Holderbank and Lafarge, as well as containing CEMEX’s rivals in southern South America.

In response to rising competition from European corporations on its northern and southern flanks, CEMEX established a forward position in Spain. Although CEMEX has not yet begun to market products to France, Italy and Germany — the homes of its major European competitors — its base in Spain gives it the capability to do so if the Europeans become too aggressive in Mexico or in CEMEX’s buffer zones. Finally, CEMEX created leading positions in emerging, high-growth pivotal zones such as the Philippines, Indonesia and Egypt in order to grow at a rate that would help it stay a global industry leader.

By building a coherent global sphere of influence, CEMEX went from being a minor player in 1985 to the No. 3 player in the industry on the basis of capacity by 1999, as well as the world’s largest international cement trader with the highest margins in the industry. Its rivals have weaker spheres than CEMEX, suffering from numerous problems that impede their profitability, including having cores in less favorable locations, being spread too thin, lacking dominance in their cores, unwisely selecting pivotal zones in emerging economies and failing to establish buffers against entry from rivals in adjacent countries.

In the future, CEMEX faces many choices for strengthening its sphere of influence. Power vacuums such as China and India, where no one company holds more than a 1% market share, might offer opportunities to create additional pivotal zones if those governments allow entry and the distribution infrastructure improves. CEMEX must also decide whether to press further into Europe using its low-cost methods, state-of-the-art information and communication systems, and its superefficient logistics systems to capture market share outside Spain. This would turn a forward position intended to create a standoff with European competitors into an invasion that could weaken the cores of selected rivals, perhaps softening one of them for acquisition as the industry’s global consolidation continues. CEMEX’s sphere of influence demonstrates how the creation and extension of the sphere can be used to structure an industry by dividing it geographically. Industry dominance is then maintained by establishing equilibrium on some fronts, while focusing competitive resources on others.

The Balance of Power

As the CEMEX example illustrates, the sphere of influence is not just a platform for a company’s offensive or defensive maneuvers. It determines how much power a company holds in relation to rivals. A well-designed sphere orchestrates a company’s grand strategy, balancing its market power in relationship to its rivals so it can continue to maneuver freely without fear of retaliation and indeed mold the evolution of its industry structure in ways most advantageous to itself.3

References

1. H.J. Morgenthau, “Politics Among Nations: The Struggle for Power and Peace” (New York: McGraw-Hill, 1985); Z. Brzezinski, “The Grand Chessboard: American Primacy and Its Geostrategic Imperatives” (Basic Books, 1997).

2. H. Ma and D.B. Jemison, “Effects of Spheres of Influence and Firm Resources and Capabilities on the Intensity of Rivalry in Multiple Market Competition,” unpublished working paper, Bryant College, Smith-field, Rhode Island, 1994; R.A. D’Aveni, “Strategic Supremacy: How Industry Leaders Create Growth, Wealth and Power Through Spheres of Influence” (New York: Free Press, 2001); R.G. McGrath, M.J. Chen and I.C. MacMillan, “Multimarket Maneuvering in Uncertain Spheres of Influence: Resource Diversion Strategies,” Academy of Management Review 23, no. 4 (1998): 724–740; R.A. D’Aveni, “Mapping and Managing Competitive Pressure Systems,” MIT Sloan Management Review 44, no. 1 (fall 2002): 39–49; and I.C. MacMillan, A.B. Van Putten and R.G. McGrath, “Global Gamesmanship,” Harvard Business Review 81 (May 2003): 63–71.

3. R.A. D’Aveni, “The Balance of Power,” MIT Sloan Management Review 45, no. 4 (summer 2004).