How Companies Can Avoid a Midlife Crisis

Executives can avert the seemingly inevitable decline of many mature corporations by viewing their organization as a portfolio of business opportunities at various life cycle stages.

Topics

The common perception is that companies, like people, pass through a series of life stages.1 Each firm begins with the experimentation and rapid-fire learning of a startup, passes through a frantic adolescence as it scales its business model, matures into a reliable albeit dull middle age and finally lapses into inevitable decline. Some companies progress through this sequence as cohorts — think of the Route 128 minicomputer makers or Lancashire’s cotton mills.2 Others pass through the life cycle alone, as Polaroid Corp. and fashion and home furnishing company Laura Ashley did.

For many people, maturity is a tough life stage, hence the midlife crisis. The thrills and excitement of youth have passed. Only the aches and decline of old age lie ahead. Maturity can be tough for businesses as well. The opportunities for product innovation seem few and far between, and the organization focuses on the relentless pursuit of process efficiencies, which at best stave off the inevitable decline. Daring acquisitions or groundbreaking research projects are dismissed as unseemly attempts to regain lost youth, the corporate equivalent of buying a red Corvette. (See “About the Research.”)

Although the metaphor of a corporation going through a life cycle is a compelling analogy, it is fundamentally misleading. In short, life cycle is not destiny.3 Our research into several supposedly “mature” sectors and companies reveals a wide gap between the winners that enjoy sustained profitable growth and the losers that stumble toward frailty and decline. Consider Lloyds TSB Group PLC, a major retail financial services company in the United Kingdom. From the early 1990s through 2003, Lloyds’ CEO won plaudits for the textbook management of a mature business as tough financial controls delivered an impressive return on equity. But those results were obtained at the expense of growth, because few investment proposals could clear Lloyds’ high return bar. In contrast, rivals like the Royal Bank of Scotland and Halifax Bank of Scotland have in recent years demonstrated all the signs of innovative vigor, delivering top-line growth as well as superior returns. This scenario, in which some companies turn back time while their competitors remain mired in middle age, is hardly unique. Think of General Electric and Westinghouse, Samsung and Daewoo, BP and Shell, Mittal Steel and U.S. Steel and Pepsi and Coke, to name just a few.

So, how can organizations find the corporate fountain of youth? Management gurus and consultants have peddled a wide range of formulas for rejuvenation, espousing the need for charismatic leadership, inspirational vision, constant revolution and breaking all the rules. All that sounds very exciting, but exactly what does it mean? In our view, the solution is to think about rejuvenation in a simpler and more straightforward way, and the key insight is this: Companies do not go through life cycles, but opportunities do.4 That is, most firms over-see a portfolio of opportunities at different stages in their life cycles: experimental startup, scaling, maturity and decline. There are, of course, single-product companies that at first glance resemble one-trick ponies. Even then, a deeper look often uncovers multiple opportunities. Eastman Kodak Co., for example, is mostly known for film and photography. But in the 1990s the company also had a vibrant medical imaging and clinical diagnostic business, even after divesting operations in photocopying, chemicals and pharmaceuticals.

Related to the insight about opportunity life cycles is the following crucial corollary: There are no mature companies, only mature portfolios. That is, executives should view their organization as an array of opportunities at various life cycle stages. They can then anticipate how that overall portfolio might evolve, paying particular attention to any imbalances or other trouble spots. And to avoid a corporate midlife crisis, they should recognize common portfolio pathologies, such as the use of the same metrics to assess opportunities at different life cycle stages or the systematic failure to exit unsuccessful initiatives. Only then can they manage their entire portfolio more effectively, seeding and nurturing the right opportunities while pruning those that drain valuable resources.

Mapping the Four Life Cycle Stages

The first step in managing a portfolio of opportunities is to map them. Executives can begin by disaggregating their businesses into components that correspond to opportunities, recognizing that these units will typically vary by life cycle stage. Startups in the experimental phase, for example, are often projects, either formal development initiatives or skunk-work efforts flying beneath the radar. Mature opportunities are typically independent business units with their own profit-and-loss responsibilities. They also vary by industry. In fast-moving consumer goods, for instance, opportunities typically cluster around brands within specific geographies. In professional services, firms often view opportunities in terms of specific client offerings.

The opportunity life cycle consists of four stages. Opportunities begin life as experiments, when an entrepreneur or manager gives birth to a potential new opportunity by recognizing an unmet need in the marketplace and envisioning a new way of doing things that could meet this need. Like youth, the startup stage is marked by constant experimentation — to identify the best segment to target, for example, or to refine the business model. After the opportunity has been validated and the business model stabilized, the opportunity enters adolescence and scales up to seize market share. Then comes mature adulthood, in which the opportunity — now its own business unit — fights for market share against well-known rivals in a clearly delineated market. The final stage is decline, which can come about as a result of a number of factors, including the entry of low-cost competitors, shifting consumer preferences or the introduction of substitute products.

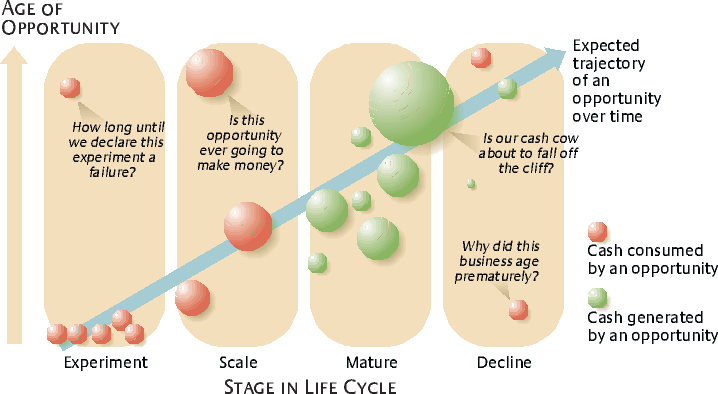

Opportunities consume different levels of resources depending on where they are in the life cycle. In the startup stage, entrepreneurs or middle managers can tinker with an idea for years without spending serious money. But the rapid growth of the adolescent period typically burns cash quickly. Mature opportunities can generate cash flow to support their own operations and also fund startups and adolescents. Declining businesses, if unchecked, can consume significant resources as well as management time and energy. Different opportunities can be denoted as balls that vary in size depending on the magnitude of net resources they consume (red balls) or generate (green balls). (See “Life Cycle Portfolio”) The balls are placed in the appropriate stage in the opportunity life cycle to present a snapshot of the portfolio at a point in time. They are plotted on the vertical axis based on their age, so opportunities will typically follow an upward-sloping line from young experiments (bottom left of figure) to old, declining businesses (top right). The opportunity life cycle framework can be used at various levels within a company to analyze business units, for example, or to drill down to look at customers and products within a specific division or group.

The easiest way to map an opportunity portfolio is to start with financial resources: Estimate the operating cash flows consumed or produced by an opportunity in a year and use that approximation to scale the red and green balls. This first-cut analysis provides the basis for plotting nonfinancial resources. One global engineering firm, for example, identified its 20 most promising managers and marked their initials on the opportunities they managed. All but two of these high-potential individuals were running mature businesses or staunching the bleeding in declining operations, thereby leaving promising scaling opportunities to second-string managers. Further refinements include the scoring of opportunities by risk, shadow circles to denote the potential magnitudes of opportunities and arrows to indicate the speed at which opportunities move from one stage to the next (in comparison with initial forecasts or industry averages). None of these refinements will help in every situation; they merely suggest possible ways to extend the core diagnostic tool to deepen executives’ understanding of portfolio dynamics and enhance their ability to anticipate how events might unfold.

Common Pathologies

The point of the mapping exercise is not precision. Most of the insight comes from plotting current opportunities to see where they fall with respect to the entire portfolio and playing around with how the portfolio might evolve over time. Mapping an organization’s portfolio of opportunities does not provide easy answers, but it does surface critical questions. Are resources currently in balance? Can the mature opportunities fund all the startup and scaling activities currently being undertaken? Are enough (or too many) experiments running? Is a core business about to enter a period of decline? When addressing these questions, executives should remain on the lookout for the following common pathologies.

No Exit

In most large, complex companies, resources are allocated through a bottom-up process.5 Front-line employees closest to the market identify and experiment with potential opportunities at little cost to the organization. But to secure the significant resources required for scaling, a well-regarded middle manager must sponsor the project, take responsibility for its execution and vouch for its ultimate success to senior management and the board of directors. Thus, the reputation of this middle manager will be on the line, providing a strong incentive for him or her to pick only winners and to deliver the goods.

Although this bottom-up process of resource allocation works well in promoting investment, it often stalls in reverse. That is, it frequently fails to trigger disinvestment from opportunities that are not panning out.6 Managers are reluctant to recommend killing a project that might jeopardize their own reputations or that of their colleagues. Moreover, they may escalate their commitment to a failing course of action to protect their reputations, doubling down when they should be cutting their losses.7

The cost of delaying exit from a declining business can be significant. With the introduction of radial tires in the 1970s, for example, incumbents such as Goodyear Tire & Rubber Co. and Firestone Tire & Rubber Co. were slow to close old factories rendered obsolete by the new technology.8 An estimate of annual plant-level cash flows revealed that over $1 billion in pretax value was destroyed by postponing exit from a declining business. Delays in exit also divert management attention, as senior executives spend so much time discussing “problem children” that they lose focus on ensuring the success of promising opportunities. To exacerbate matters, companies tend to allocate their best managers to fix the worst problems, often burning out those executives and depriving them of the opportunity to learn how to scale an attractive opportunity.

The “no exit” syndrome is a particularly thorny challenge in the scaling stage. Companies frequently let opportunities continue to consume resources in scaling even when they are not gaining traction in the market. These businesses are like airplanes that run out of runway without taking off — they keep taxiing at high speeds, knocking down trees and buildings along the way. Because opportunities in the scaling stage devour so many resources, they live in the corporate spotlight. And managers will typically stake their reputations on the success of a project to secure the resources required to scale, thereby creating enormous personal costs of exit. Consequently, executives cannot quietly kill scaling opportunities as they can startup projects.

One European financial services firm tackled the “no exit” problem head on. When the CEO appointed an executive to scale an exciting opportunity in Eastern Europe, he also built in checks to ensure it was possible to kill the initiative if necessary. Specifically, he made sure the team included senior members from the risk and finance functions and, before he would authorize the resources to scale, this group had to agree on a handful of “deal killers” — indicators that would constitute clear grounds for killing the business. He also structured the business as a separate legal entity, even though the firm owned all the shares. This legal structure allowed him to appoint a board of directors, which the CEO staffed with outsiders detached from the business, as well as directors who had successfully scaled a service business and could therefore distinguish between typical growing pains and real causes for concern. When the risks of the new opportunity proved to outweigh the rewards, the CEO took pains to orchestrate a face-saving exit for the executive, promoting him to a significant position in the core business and publicly praising his willingness to take on the scaling of a venture in an unfamiliar market.

Throwing Out the Baby with the Bath Water

When an opportunity fails to scale, the temptation is to forget it and move on. But that would be a big mistake. “Failed” opportunities that never gain traction can nevertheless be a source of valuable information, market insights or resources. Thus, successfully managing a portfolio of opportunities often requires salvaging useful bits of unsuccessful projects so that they can be later reused in bricolage (from the French word bricoler, which refers to how a handyman builds and fixes things by using the odds and ends he finds lying about). Instead of imposing preconceived notions on a situation, a bricolage approach encourages managers to create novel combinations from existing market insights and resources, including those spawned from failed experiments.

The origin of Java software illustrates bricolage in action. The story begins in 1990, when Sun Microsystems Inc. formed a team to build a breakthrough consumer product. The result was a hand-held appliance with a touch-sensitive screen that enabled consumers to control all the different electronic devices in their home. When the initial business model failed to pan out, the team morphed the model to create set-top boxes for interactive television and used the software, called Oak, to write applications for online services. But none of these initiatives caught on, and several business plans and millions of dollars later, Sun pulled the plug. At many companies the story would have ended there. But CEO Scott McNealy asked the team members what aspects of the project were worth salvaging. After hearing about Oak, which worked across various operating systems, McNealy placed the software team in another business unit while letting the hardware effort die. At that time, Sun’s technical guru Bill Joy was looking for a way to move Sun into the Internet era, and he seized on Oak as ideally suited to the Web because it was quick, secure and portable across platforms. Sun’s initial launch was a hit, and the company soon licensed the renamed Java software for a nominal fee to promote its widespread acceptance.

Although bricolage is inherently messy, managers can structure the process to systematically capture insights from unsuccessful initiatives and recombine them into potentially promising opportunities. At one global professional services firm, an innovation steering committee analyzed the company’s opportunity portfolio and discovered that many of the most promising opportunities were built on core insights from experiments that had not quite worked the first time but had thrived in a slightly modified form elsewhere in the organization. Unfortunately, these recombined opportunities were the exception, not the rule, because tight boundaries between client sectors, practices and geographies had blocked the free passage of insights and specialized resources. Moreover, most failed experiments were killed and buried in secret, hampering the firm’s ability to learn from its failures.

To address these issues, the partners on the innovation committee worked with a creative consultancy to develop software they dubbed a “fruit machine.” The program is essentially a macro in Excel that generates all possible combinations of major practice groups (such as audit, tax and advisory), client types (financial services, government, industrial, energy, technology and so on) and 10 major products. Over a series of meetings, the committee used the resulting 150 combinations as fodder for discussions on what concrete projects the practice areas could launch to explore the crosscutting ideas. To ensure the reuse of existing insights and resources, the partners took the time be- tween meetings to study comparable past initiatives — whether they had succeeded or failed — for insights and resources that might be redeployed. Some of the combinations were impractical (for instance, acquisition advice for bankrupt government agencies), but a surprising number sparked genuine interest. More importantly, the process stimulated the partners’ creativity in thinking of ways to salvage parts of failed experiments for reuse across the organization.

Sticking to the Knitting

Finance theory instructs executives to invest only in projects that have a positive net present value and return surplus cash to investors. Value-based management puts a premium on credible forecasts of cash flow, and credibility results from investments in low-risk projects in known domains — sticking to one’s knitting, as the conventional wisdom goes. The recent emphasis on corporate unbundling has provided further impetus for corporate focus.9 But an investment process that values credibility and low risk above all else will penalize projects that have uncertain outcomes, even when they offer a substantial potential upside.10

Consider Blue Circle Industries PLC, at one time the global leader in the cement industry. From the early 1990s, the company was an exemplar of value-based management, adopting tough annual targets for return on capital employed that were given teeth through business-unit budget contracts backed by incentives. Blue Circle’s corporate office ranked potential investments according to prospective NPV and payback. Only those at the head of the curve were approved, while those at the tail were unequivocally rejected — a break from a past in which all capital projects received at least token funding. The approach worked: In the second half of the 1990s, Blue Circle’s ROCE doubled, producing cash used for share buybacks.

Then the competitive landscape shifted. The industry consolidated globally, and many of the most attractive opportunities were in emerging markets. Because Blue Circle’s capital budgeting process placed a premium on reliable cash-flow forecasts, the company turned down nearly all projects in emerging markets, instead favoring investments in stable countries with low growth prospects. This left Blue Circle a laggard in the race for globalization. Despite a desperate bid for expansion in Southeast Asia in 1997, the company was overtaken by more aggressive competitors, such as CEMEX S.A. de C.V., and was eventually acquired by Lafarge S.A. in 2001.

On the other hand, when executives oversee a pipeline without attractive opportunities, they often veer to the opposite extreme and attempt a crash course of renewal through large-scale initiatives, including unrelated acquisitions, transformational mergers or a major flurry of new product introductions. These desperate actions rarely pan out. A much better approach is to ensure that the organization has a set of promising new opportunities simmering on the back burner, waiting for the day when circumstances favor scaling.

Consider The Beta Group Inc., a business incubator in Menlo Park, California, that commercializes promising technologies. It evaluates many potential opportunities, quickly sorting them into one of three categories: Ideas with no real promise land in the dumpster; those that are ready for prime time get scaled; and promising ideas whose time has yet to come are stored in a “refrigerator.” Promising startups can be premature for any number of reasons — the current market is too small, the technology still has major kinks or the business model is unclear. Beta’s approach enables the firm to focus its limited resources on two or three opportunities that are ready to scale, all while keeping its eye on the progress of the 50 or so refrigerated projects. A company can keep tabs on such proposals by periodically reassessing their viability, perhaps through small-scale experiments or joint ventures to obtain current information on how those opportunities are evolving.

Maintaining a healthy stock of opportunities requires active leadership at the top. Even during periods of restructuring and ruthless cost cutting, senior management must nurture promising businesses by providing political cover, framing the opportunities as experiments or separating them from corporate antibodies. In other words, senior executives must do whatever is necessary to protect the seed corn during a hard winter. They must also be willing to plant and cultivate when the timing is right. In recent years, many companies have increased their profitability by maintaining a tight focus on margins, pruning money-losing businesses and implementing other hard actions in the context of favorable economic conditions. These organizations currently possess a war chest of cash on the balance sheet, healthy price-to-earnings ratios and credibility among investors. But this window of opportunity will not last forever, and CEOs and other senior managers now must be willing to invest some of their hard-won cash and credibility to scale the promising opportunities they have nurtured, or risk losing the moment.

Letting a Thousand Flowers Bloom

Sometimes the problem is not too few opportunities but too many. At one fast-moving consumer goods company, the top managers mapped their portfolio to understand why their significant investment in innovation had yielded such disappointing returns in terms of building mature businesses. What they found surprised them. The company excelled at identifying promising opportunities, and managers agreed it was reasonably easy to find the resources to scale projects. But of more than a dozen opportunities that the company was funding, most had been scaling for longer than projected, without gaining traction in the market.

The root problem was the ad hoc process the company used to select which opportunities received the resources required to scale. Managers implicitly aimed for fairness in allocating cash and talented people, but that egalitarian spirit meant the company gave the green light to numerous projects. Indeed, it was attempting to scale more than three times as many opportunities as its main competitor. As a result, none of the projects received the resources required to scale successfully, and they stalled in the market.

Letting a thousand flowers bloom is the bane of many highly innovative companies. Consider 3M Co., for decades an icon of innovation, with a third of the company’s sales coming from new products less than four years old. Famously, 3M allowed all employees to spend 15% of their time on “bootlegging”: exploring any new opportunity as they saw fit. And if innovators failed to receive local backing for emerging ideas, 3M’s decentralized norms encouraged them to seek support elsewhere, including from other groups. This process resulted in a fertile garden of more than a thousand projects.

By the late 1990s, however, 3M’s shareholder returns were lagging behind the market. So when James McNerney arrived as CEO in 2000, he took steps to prune 3M’s overgrown garden of opportunities by implementing 3M Acceleration,11 a disciplined approach that adhered to the Six Sigma discipline of fact-based analysis. Through the program, 3M collected data from more than 70 separate laboratories to create a centralized database of all the company’s initiatives, including their costs, projected sales, risks and time to market. Using that information, a team of technical directors made an initial rank ordering of the projects, followed by a second round of ranking by senior leaders from manufacturing, marketing and product development. This initial pruning reduced the number of projects to approximately 75.

McNerney followed that exercise with an initiative to instill ongoing discipline in selecting which opportunities to scale. To that end, 3M made an enterprise-level decision to favor opportunities in a few promising areas — including nanotechnology, fuel cells and optical displays — at the expense of incremental extensions in the core. Project proposals were required to discuss risks, cycle times and potential returns in order to secure funding, and no idea would be approved for scaling without a documented potential of at least $100 million in annual sales. To bring discipline and credibility to the analysis, marketing professionals participated in the process and could veto any project that lacked commercial potential. By adding objective rigor to the process of scaling, 3M Acceleration made it culturally acceptable to say no, because decisions were based on facts and a more transparent process.

One Size Fits All

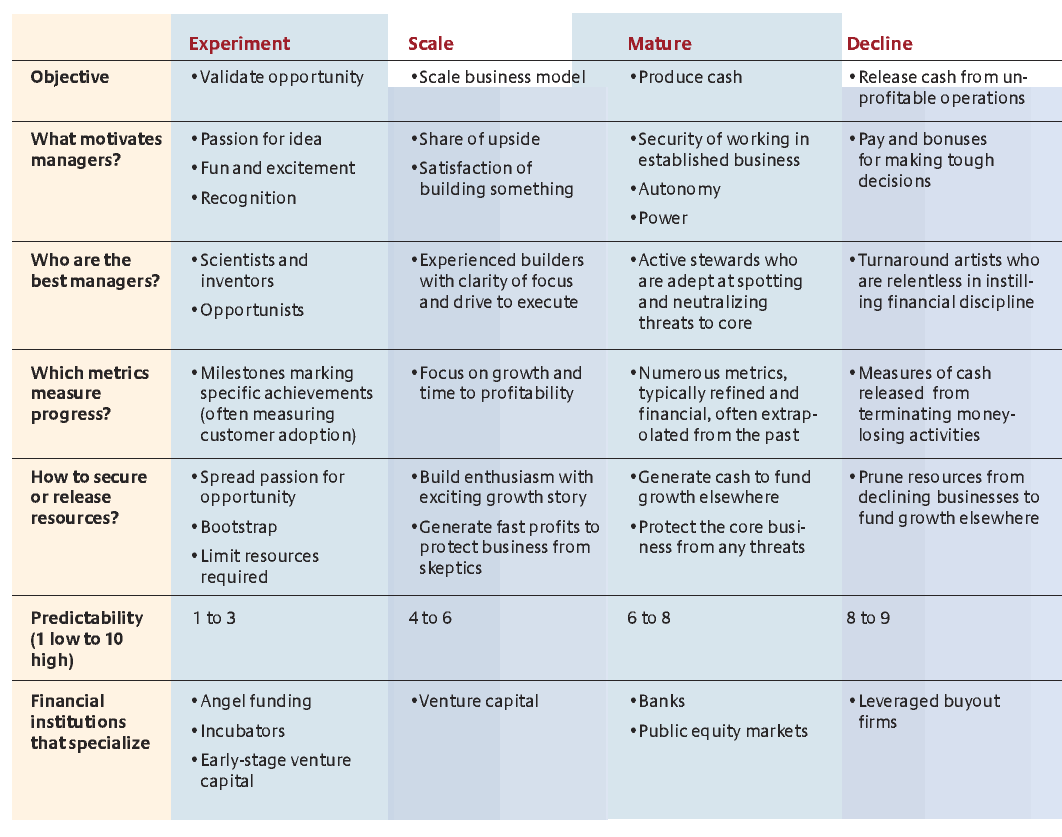

Another pathology occurs when managers fail to translate common sense into widespread practice. The common sense is that projects at various stages in their life cycles require very different management styles: promoting variation at the startup stage, making tough calls to select projects for scaling, integrating businesses at the point of maturity and fixing the problems of decline. (See “Managing Across the Life Cycle.”) Thus, leaders responsible for an entire opportunity portfolio must select managers whose styles, competencies and enthusiasms match each life stage. And the leaders themselves face the difficulty of engaging with, supporting and disciplining these very different managers with distinct missions.

To tackle this challenge, IBM Corp. created the Emerging Business Opportunity management system in 1999. The goal was to spur IBM’s organic growth and to protect new opportunities until they became mature enough to be transferred to the company’s group operating structure. Sponsorship came from the very top through the vice chairman of the board. EBO drew on a “horizons of growth” model that distinguished between opportunities in the startup phase, those that were scaling through rapid growth and mature businesses.12 IBM recognized that each growth horizon required very different approaches to people, strategy, resource allocation and measurement. Part of EBO’s role was to protect nascent opportunities from the rest of IBM, but just as critical was the need to identify opportunities that were at the point of transition from one horizon to the next.

EBO’s approach to measurement therefore went beyond financial metrics to include horizon-specific milestones. Startup opportunities, for example, needed to win share of mind, as evidenced in press and analyst reports. Scaling businesses needed to demonstrate progress in trials and early customer adoption, while mature businesses were managed with respect to profitability and sales-volume objectives. The milestones helped executives spot when an opportunity was ready to move into the next horizon, perhaps requiring a change of management as well as different forms of support and incentives from EBO. A set of requirements were used to test whether an opportunity had become a viable business, depending on the clarity of its strategy, readiness for execution and market success. Once all the requirements were met, the fully fledged business was ready to stand on its own alongside the other mature members of IBM’s portfolio.

Generation Gap

The final pathology has little to do with process and everything to do with people. Just as opportunities pass through life stages, so do the people behind them. Across a wide range of organizations, portfolios have decayed when older executives maintained a tight grip on the reins of power for too long, locking up-and-comers out of positions of authority. In these situations, the veteran executives often lack immediate personal incentives to renew the opportunity portfolio — it is much easier for them to rest on their laurels and bide their time until retirement. When a cohort of seasoned executives have control over which opportunities to scale, they often err on the side of loss aversion, that is, protecting the mature businesses (which they often scaled and ran) while avoiding risky bets on the future. “There are no mature businesses,” Warren Buffett once observed, “only mature managers.” But mature executives can make a series of portfolio choices that spark a midlife crisis.

To avoid this fate, companies must empower younger managers who have a large stake in the future. When 47-year-old John Browne became BP PLC’s group CEO in 1995, he explicitly set out to place operating power in the hands of the next generation. He and his team broke BP’s bureaucratic organization into approximately 150 business units, each overseeing an oil field, chemical plant, regional marketing area or other operation. Browne then handed the keys to these businesses to a new generation of managers, most of whom were in their 30s or early 40s. This was a massive transfer of power because these operations collectively generated over $120 billion in revenues by 2001 and employed more than 100,000 people.

But what to do with the heroes from the last war? In many organizations, the biggest obstacle to a generational shift comes from seasoned executives who want to maintain an active role. At BP, many of these leaders became group vice presidents, positioned between the 150 business units and Browne’s team. It should be noted, however, that the role of group vice president was not designed to direct or second-guess the operating managers. Rather, these senior executives were charged with coaching the next generation, overseeing talent development and succession planning and negotiating aggressive but achievable performance contracts with the business-unit leaders. This structure left Browne and his team free to focus on larger, longer-term issues.

ACCORDING TO CONVENTIONAL WISDOM, companies resemble organisms destined to pass ineluctably through the predetermined stages of startup, scaling, maturity and decline. In reality, things are not so simple. Business opportunities — and not firms — pass through these stages, and most organizations consist of multiple opportunities arrayed across the different stages of the life cycle. Executives who understand this crucial distinction can view their company or business unit as a portfolio of opportunities that requires constant rejiggering to maintain vibrancy and to balance the demands of the present with the promise of the future. They can map their portfolio to anticipate how it might evolve and drill down to understand the root causes of any imbalances. But make no mistake: Managing a portfolio of opportunities is hardly a simple task. Neglecting it, though, could easily lead to the corporate midlife crisis and organizational decline that so many executives mistakenly take for inevitable.

References

1. Larry E. Greiner published the seminal piece on organizational life cycles. See L.E. Greiner, “Evolution and Revolution as Organizations Grow,” Harvard Business Review 50 (July–August 1972): 37–46. Subsequent scholars explored the life cycle model in greater detail. See J.R. Kimberly and R.H. Miles, “The Organizational Life Cycle” (San Francisco: Jossey-Bass, 1980). For a more recent review of life cycle theories, see A.H. Van de Ven and M.S. Poole, “Explaining Development and Change in Organizations,” Academy of Management Review 20, no. 3 (1995): 510–540.

2. The evolution of firms in a cohort often follows the life cycle of the underlying product technology. See S. Klepper and K.L. Simons, “The Making of an Oligopoly: Firm Survival and Technological Change in the Evolution of the U.S. Tire Industry,” Journal of Political Economy 108, no. 4 (2000): 728–760; S. Klepper and E. Graddy, “The Evolution of New Industries and the Determinants of Market Structure,” RAND Journal of Economics 21 (spring 1990): 27–44; and S. Klepper and K.L. Simons, “Technological Extinctions of Industrial Firms: An Inquiry Into Their Nature and Causes,” Industrial and Corporate Change 6, no. 2 (1997): 379–460.

3. Some empirical analysis supports the hypothesis that firms can be described as passing sequentially through a series of predictable stages. See D. Miller and P.H. Friesen, “Momentum and Revolution in Organizational Adaptation,” Academy of Management Journal 23 (1980): 591–614; and R. Drazin and R.K. Kazanjian, “A Reanalysis of Miller and Friesen’s Life Cycle Data,” Strategic Management Journal 11 (1990): 319–325. This research, however, is primarily descriptive and fails to articulate a theory of the underlying microprocesses to explain why firms pass through these stages. As a result, the models cannot predict which firms will pass through these life cycles, or explain exceptions.

4. More precisely, an opportunity is a novel combination of resources that create value (in excess of their value in alternative deployments) by meeting an unfulfilled need in the marketplace. The value created can come from either increasing customers’ willingness to pay or decreasing the cost of providing the goods or service.

5. The seminal work on the intrafirm resource allocation process was written by J.L. Bower, “Managing the Resource Allocation Process” (Boston: Harvard Business School Press, 1970). For a review of recent research, see J.L. Bower and C.G. Gilbert, eds., “From Resource Allocation to Strategy” (New York: Oxford University Press, 2006).

6. See D.N. Sull, “The Dynamics of Standing Still: Firestone Tire & Rubber and the Radial Revolution,” Business History Review 73 (fall 1999): 430–464.

7. J. Ross and B.M. Staw, “Organizational Escalation and Exit: Lessons From the Shoreham Nuclear Power Plant,” Academy of Management Journal 36 (1993): 701–732; and I. Brockner, “The Escalation of Commitment to a Failing Course of Action: Toward Theoretical Progress,” Academy of Management Review 17, no. 1 (1992): 39–61.

8. D.N. Sull, “No Exit: Overcapacity and Plant Closure in the U.S. Tire Industry,” Academy of Management Best Paper Proceedings (1997): 45–49.

9. J. Hagel III and M. Singer, “Unbundling the Corporation,” Harvard Business Review 77 (March–April 1999): 133–141; and C. Zook with J. Allen, “Profit From the Core: Growth Strategy in an Era of Turbulence” (Boston: Harvard Business School Press, 2001). Recently, strategy scholars have argued that this logic applies not only to routine tasks such as customer service but also to innovation — the core activity in renewing a company for the future. See C. Markides and P. Geroski, “Fast Second: How Smart Companies Bypass Radical Innovation to Enter and Dominate New Markets” (San Francisco: Jossey-Bass, 2004); and H.W. Chesbrough, “Open Innovation: The New Imperative for Creating and Profiting From Technology” (Boston: Harvard Business School Press, 2003). The argument again boils down to focus. Established firms excel at commercializing innovations by reducing their cost and bringing them to a wider market. They rarely do well in developing nonincremental innovations to rejuvenate their product or service offerings.

10. K.B. Clark and C.Y. Baldwin, “Capital Budgeting Systems and Capabilities Investments in U.S. Companies After World War II,” Business History Review 68, no. 1 (1994): 73–109.

11. M. Arndt, “3M’s Rising Star: Jim McNerney Is Racking Up Quite a Record at 3M. Now, Can He Rev Up Its Innovation Machine?” Business Week, Apr. 12, 2004, 62; and D. Del Re, “Pushing Past Post-its: By Allowing His Top Scientists to Peek Over the Horizon, 3M’s Larry Wendling Helped Turn a Century-Old Giant Into a Nanotech Pioneer,” Business 2.0, Nov. 2005, 54.

12. M. Baghai, S. Coley and D. White, “The Alchemy of Growth: Practical Insights for Building the Enduring Enterprise” (New York: Perseus, 2000). For an excellent description of IBM’s changes, see D. Garvin and L. Levesque, “Emerging Business Opportunities at IBM,” Harvard Business School case no. 304–075 (Boston: Harvard Business School Publishing, 2004).