How Do You Win the Capital Allocation Game?

Which is better for your firm? Invest prodigious amounts of capital or scale back on capital investment? Reduce employment to raise the dollar amount of assets at work per employee or elevate employment to meet the demands created by new investments? Questions like these confront all senior managers as they formulate strategic plans and allocate capital. The questions become more compelling as investors demand that corporations consistently deliver shareholder value regardless of their long-term strategy for deploying human and financial capital.

An important factor that distinguishes the winners from the losers in creating shareholder value is the quality of investment decisions, which, in turn, depends on the soundness of a firm’s capital budgeting system. Unfortunately, the history of corporate America is littered with examples of poor investment decisions, ranging from investing too little in positive NPV (net present value) projects and too much in negative NPV projects to investment myopia.1 Such distortions can distract companies from what they do best, causing them to sink millions of dollars in the wrong products and ideas. For instance, Coca-Cola invested in pastas and wines, products for which its rates of return were not only well below those of its core soft-drinks business, but also below its cost of capital. Such errors deplete shareholder value and lead to corporate control contests that result in CEO replacements and hostile takeovers.

Despite the obvious consequences of misallocating capital and human resources, why do companies continue to blunder? We believe it is because they have flawed capital budgeting systems, which they apparently fail to recognize. Some firms sense the weaknesses in their capital budgeting analyses but view them as individual problems rather than systemic deficiencies. They misdirect efforts to redress mistakes and produce greater frustration. As a result, corporate strategy and capital allocation become misaligned and remain so despite disappointing financial performance. Senior management then gets the blame for failing to provide the appropriate leadership and strategic guidance.

Our goal is to present a framework that senior managers can use to allocate capital. The framework explicitly recognizes that capital budgeting cannot be the exclusive domain of financial analysts and accountants but is a multifunctional task that must be integrated with a firm’s overall strategy. Our capital budgeting framework has six key features, each indispensable (see Figure 1):

- It is dynamic, not static. It explicitly recognizes that the quality of information can be improved over time. Thus capital budgeting should be a sequential, multiple decision process that integrates the information needed to obtain cash flow estimates into the financial analysis of the cash flows.

- It is integral to the company’s strategy. Thus, while its conceptual underpinnings remain the same across companies (e.g., using NPV analysis), its details can vary greatly because it is tailored to the needs of a firm’s strategy.

- It recognizes the options inherent in value-enhancing capital budgeting. Most capital investments present a company with a sequence of options, which, when explicitly analyzed in capital budgeting, lead to a fundamentally different view of risk.2

- It takes a cross-functional approach. The quality of estimates of expected cash flows and the uncertainty in cash flows are critical. Since the underlying information for these estimates comes from many functions within the company, those providing information must see themselves as strategic partners in the process, i.e., they must fully understand the consequences of their input.

- It views the company’s compensation system as a centerpiece of capital budgeting. Unless the way in which managers and employees are rewarded is aligned with how capital is allocated, there will always be a possibility for poor decisions.

- It stresses the importance of performance-based training.3 The people using capital budgeting must understand it, buy into it, and implement it consistently across the entire company. Cross-functional training designed to enhance the performance of those involved is essential.

Common Drawbacks of Capital Budgeting Systems

Although there are countless ways in which capital budgeting systems can be flawed, in our experience, the most common drawbacks fall into one of nine categories.

Misalignment between Strategy and Capital Budgeting

Most companies have a well-articulated vision statement or corporate goal, followed by a description of the strategy for attaining that goal. The design of the capital budgeting system, however, is often not integrated into the strategy. For example, a company’s corporate strategy may be to grow aggressively through new product introductions, yet its capital budgeting practice may attach great importance to potential revenue losses when new products cannibalize old.

Lack of Dynamic Structure

A good capital budgeting system must involve not only an analysis of capital allocation requests when the project is executed, but also an analysis of all the capital needed to generate information (e.g., market research, prototype development, testing, and so on) prior to investing in the project. Moreover, the analyses of two capital requirements should be integrated within a dynamic system that takes into account the options inherent in most capital budgeting opportunities. Many firms lack such a well-developed system. We illustrate two (of the potentially many) kinds of problems this creates, using hypothetical companies, Sundial Electronics and Excellent Manufacturing (see the sidebars).

The example of Sundial Electronics highlights the problems associated with the common practice of “front loading” cash outlays for a new project. One problem, in particular, is the propensity to incur some engineering and tooling expenses early, when they should be incurred after project launch. When a company finally evaluates a project just before its execution, it considers these initial outlays “sunk costs” that are irrelevant to the decision to accept the project. In this way, more capital is committed to the project than is accounted for in the capital budgeting analysis. A dynamic capital budgeting system serves the purpose of justifying all capital outlays when they are, in fact, still relevant.

The case of Excellent Manufacturing demonstrates that the anticipation of future investment options can alter the value of present investment options. The option to acquire information about project costs increases the value of the option to acquire information about market demand. Thus these options are interrelated.4 In the example, if Excellent decides to launch production at full capacity at the outset, then it should spend only a moderate amount on market research. But a greater expenditure on market research is optimal if Excellent recognizes that it can better exploit the option to acquire information about production costs by sequentially committing to expanded production and thereby linking the decision to continue or abandon the project to what it learns about costs. Many companies don’t have dynamic capital budgeting systems that consider market research and product development outlays as investments in options and don’t integrate determining the amount to spend on these activities to their overall capital budgeting systems.

No Connection between Compensation and Financial Measures

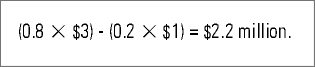

Many companies use the NPV criterion to select a project but compensate managers based on product earnings or rates of return.5 This misaligns their interests with those of shareholders (see the sidebar on Multiproduct Corp.).

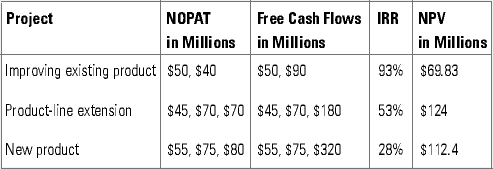

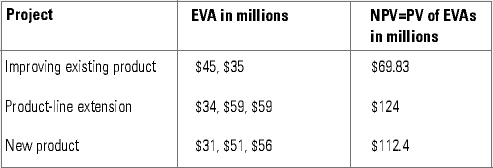

One reason for misalignment between compensation and capital allocation systems is that the NPV cannot be readily used to determine compensation because it is a stock measure. Moreover, NPV is a summary measure based on projected cash flows and not realized performance. What a company should use to determine compensation are flow measures that it can compute periodically, say, every quarter or every year, as they are realized. Some companies use flow measures such as earnings and cash flow; unfortunately, they can shift managers’ behavior away from shareholders’ interests. A flow measure such as EVA (economic value added) can be helpful, because it theoretically produces the same recommendations as the NPV.

Deficiencies in Analytical Techniques

Many companies use flawed analytical techniques in their capital budgeting. The most common deficiencies are:

Poor Base-Case Identification.

For any capital budgeting analysis, a company needs to know the base case that defines the status quo NPV, i.e., what happens if the company keeps things the way they currently are. The company then computes the NPV from the proposed alternative and asks which alternative dominates. The worse the base case looks, the better any alternative appears; this sometimes tempts financial analysts to make the base case look terrible so their “pet” project seems irresistible.

Competition and Cannibalization Issues.

A company should estimate the likelihood of competition using game theory and probabilistic scenarios and determine a probability distribution for the competitive entry, along with its impact on project cash flows.7 The company should then integrate this information into its capital budgeting. Cannibalization estimates do not involve game theory but do require probabilistic estimates that are woven into the capital budgeting. Moreover, the NPV-relevant impact of cannibalization is predicated on the assumptions about the competitive entry, an important interrelationship that companies often erroneously ignore. The example of Innovative Product Co. shows the importance of recognizing the interdependence between the competitive entry and cannibalization assumptions (see the sidebar).

Inadequate Treatment of Risk.

There are two main types of risk in capital budgeting: (1) the business and financial risk in cash flows that is reflected in the cost of capital (discount rate), and (2) the risk in estimating expected cash flows. We can think of the first risk as arising from the distribution of cash flows around a known statistical mean. For example, in the context of the capital asset pricing model (CAPM), such a distribution implies a particular relationship with the return on the market portfolio, which, in turn, helps determine the cost of capital. The second risk arises from the analyst’s lack of knowledge of the statistical mean of the cash flow distribution, or uncertain information. Failure to assess both risks in capital budgeting may produce a misleading picture of the project’s riskiness. Ignoring the second risk often leads firms to work with point estimates of financial measures like IRR (internal rate of return), NPV, and yearly EVAs. Occasionally, companies develop low-, medium-, and high-risk scenarios to characterize possible future project outcomes. These overly simplistic characterizations are often inadequate for well-informed decision making. Many companies are, however, increasing the sophistication of their risk assessment. For example, Merck has developed a sophisticated capital budgeting system that deals with both types of risk.8 Whirlpool has also recently moved away from discrete characterizations of risk to ranges of outcomes and probability distributions, something that we recommend.

Nonuniform Assumptions.

Many multidivisional companies contend with unwanted variety in the assumptions that their financial analysts use in capital budgeting. Assumptions about residual values, rates of growth in cash flows, inflation rates, cycle times, the amounts of capital required, and so on may not be uniform.10 With different assumptions in different capital allocation requests, senior managers are compelled to compare apples and oranges in ranking projects for capital allocation.

Finance Function Not a Strategic Partner

Financial analysts doing capital budgeting are sometimes seen more as traffic cops than strategic partners. They often enter the capital budgeting process near the end merely to rubber-stamp a conclusion that a marketing or manufacturing executive reached earlier. In other companies, financial analysts may be involved early on, but if the numbers they come up with are not “satisfactory,” they get the capital budgeting proposal back with the admonition, “Get the IRR up to 25 percent or else we can’t approve this request.” This invites massaging of the numbers. Capital budgeting then becomes an exercise in finding the values that produce the desired answer, and, consequently, the quality of the information for capital budgeting is seriously compromised.

Lack of Integration

In many firms, capital budgeting and expense budgeting are distinct processes. For example, the companies that do capital budgeting make assumptions about future cash flows that are dependent on certain advertising and sales promotion outlays. However, these outlays are typically covered by the expense budget. Even in companies in which the determination of the expense requests is tied at the outset to the capital requests, the people approving the two requests do not necessarily try to ensure consistency between the two budgets. And, even when consistency is achieved at the outset, a meltdown occurs later when pressure to produce short-term financial results causes cutbacks in expense budgets, resulting in two negative consequences. First, the cash flows promised in earlier-approved capital requests fail to materialize because of reductions in key expenses. Second, the poorer-than-promised financial results lead to skepticism about promises in future capital requests and threaten to choke off capital to future positive NPV projects.

Confusing Financial Measures

Many capital budgeting systems suffer from a multiplicity of financial measures, some of which produce conflicting recommendations in project ranking. For example, companies often calculate the NPVs, IRRs, and payback periods for the projects they analyze. In recognition of the obvious conflicts between the rankings produced by the different measures, companies sometimes develop a “point rating” system in which they assign each financial measure a relative weight and then rank projects based on their overall scores. The weighting scheme in such systems is arbitrary and often leads to decisions that do not maximize values.

Poorly Trained Financial Analysts

Even the most sophisticated capital budgeting system will fail if those executing it are not trained to use the available tools. Many companies have great enthusiasm for new ideas and techniques (e.g., EVA) but none for employee training. When resources are constrained, often the easiest expenditure to cut is training. This is an expense-budget problem, since training outlays are typically (incorrectly, in our opinion) treated as expenses rather than investments. However, without the necessary investment in upgrading those involved in capital budgeting, expecting good capital allocation is akin to expecting to win a battle by sending in people unfamiliar with guns.

Inadequate Post-Audits

Post-auditing the capital budgeting process is the examination of previous investments, comparing them to projections contained in the capital request, and documenting the causes of the observed deviations. When this process works well, it is an invaluable learning device, facilitating continuous improvement. It also prompts a review of the base-case assumptions, thereby stimulating a reassessment of the competition. However, many companies misunderstand the post-audit process and either don’t use it or misuse it. The process ends up being a policing device, creating suspicion and mistrust.

Framework for Dynamic Capital Budgeting

The framework for capital budgeting that we propose has the familiar objective of maximizing shareholder wealth. To meet this objective, we designed a system with three simultaneous steps:

- Map out the strategy of the firm. The capital budgeting system is a plan to execute the strategy.

- Develop an evaluation system for project proposals. The goal of evaluation is to separate winners from losers; the effectiveness with which a chosen project helps execute the strategy is the measure of success.

- Develop a culture within the firm that is consistent with the strategy and the evaluation system.

Strategy and Capital Budgeting

A company must first identify a status quo strategy and its performance to maximize shareholder value. It must ask what kinds of investments have enabled the strategy to be successful. The company can then understand the effective parts of the strategy and the amount of risk within which it must operate.

The strategy also helps define a fundamental trade-off in capital budgeting between cycle time and risk. The more time and resources that a firm is willing to commit to collecting information about project cash flows, the more it can learn about the cash flows and the lower the informational risk. But it achieves this risk reduction at the expense of a longer cycle time (see Figure 2, in which ABCD represents the cycle time–risk-efficiency frontier for a new and risky product initiative). It is impossible for a company to lie below the frontier, given existing human capital, organization structure, and technology. For any point off the frontier, say, point E, there is another point on the frontier that the firm would prefer. For example, point B represents a shorter cycle time with the same level of risk as point E, and point C represents a lower level of risk with the same cycle time as E. Depending on the cycle time–risk trade-off that the firm desires, it would prefer either point B or C to point E.

A company should view the frontier as a given, at least as a starting point. Where along the frontier it wants to be is a matter of strategic choice. A firm that is more tolerant of informational risk may prefer to be at point B, whereas one that is less tolerant of informational risk may prefer C. If these two firms have the same risk-efficiency frontier, then the firm that chooses B will be more error-prone in identifying customer tastes, estimating market demand, and so on, but when it is right, it will have a competitive first-mover advantage over the firm that prefers point C. This is an important aspect of time-based competition. A firm with shorter cycle times has a competitive edge, but it is also assuming more risk because the quality of the information on which its capital budgeting is based is not as good as that of a firm willing to tolerate longer cycle times. For example, some claim that Japanese companies prefer shorter cycle times (and greater risk) than U.S. companies when introducing new products.13 Of course, a firm need not consider the frontier as a given, but could try to push the frontier down to, say, A’D’. This usually requires a fundamental reengineering, which, if achieved, can be a powerful competitive advantage.

Firms that perceive different frontiers may also make different decisions about product introductions. Suppose two firms both view R as the acceptable level of risk. The firm on the risk-efficiency frontier ABCD would see its cycle time as T2, whereas the one on the frontier A’D’ would view it as T1. The firm with the shorter cycle time would spend less money before product launch and bring the product to market faster; thus it would assess a higher NPV from this product than its slower competitor. The NPV might be positive for the faster firm and negative for the slower firm, so that one firm would reject the product and the other would introduce it. An example of this is the flat screen that Westinghouse patented but never commercially produced. The Japanese powerhouse Sharp bought the early patents and successfully marketed the product not only for computer monitors but also for flat-screen, high-resolution TVs.

Whatever the risk-efficiency frontier, the company’s strategy determines the point along that frontier where the company wants to be. The company should communicate the implications of this strategic choice to the people responsible for capital budgeting. Just as importantly, those who screen capital requests and allocate capital should ensure that the criteria they use are consistent with the company’s strategic choice. Breakdowns occur when a company’s strategy is decoupled from its project-ranking criteria.

For example, the strategy may be to grow aggressively through global expansion in developing markets, yet a key capital budgeting criterion may be to discriminate against projects with payback periods longer than three years. Alternatively, the strategy may be to introduce a new product every year, yet the demands on the quality of market research data used to support assumptions about sales volume may be so great that it is impossible to achieve the cycle time–risk trade-off consistent with the strategy. It’s no wonder that some innovative customer-focused companies like Compaq, Motorola, and Steelcase are shortening cycle times for new product introductions by reducing their dependence on market research data.

Evaluation System

The system for evaluating projects and preparing capital allocation requests must be consistent with the strategy and reflect the role of financial analysts as strategic partners. It must be a dynamic system with well-defined checkpoints for examining the consistency of projects with strategy (see Figure 3). Many companies have adopted (or are adopting) such multiphase evaluation processes for major capital investments, for example, Merck, Shell, United Technologies, Boeing, and Whirlpool.

The system has four phases and three tollgates. For approval, a project must pass through all three tollgates, with a review at each gate. In the first phase, the company generates new ideas. This is a multi-functional process; many firms have formally charged advanced product-concept groups with this task. The company screens ideas at the strategic tollgate for consistency with its strategy. Thus the company should present ideas as proposals that outline consistency with the strategy and enhancement of shareholder value. Moreover, the company must determine a budget for expenses that it will incur during preliminary evaluation and set a date for the next review. This ensures consistency of the cycle time between the strategic and preliminary tollgates and the strategy.

During preliminary evaluation, the company should shape the idea into practical reality and obtain preliminary estimates of costs and capital requirements. It should formulate explicit assumptions regarding product demand. Also, it should clearly identify the base case and crystallize assumptions about the competition and cannibalization. This should lead to preliminary estimates of cash flows and NPV and the need for additional information. This, in turn, will help determine the expense budget and the duration of the next phase, business evaluation.

The expense budget for the business evaluation phase includes the amounts allocated for information acquisition and product development. The company should see the amount allocated for acquiring information as the cost of purchasing an option. Thus the analysis of how much to invest in information acquisition during this phase could exploit the insights of option pricing theory. In particular, the greater the informational risk in the project, the more the company should be willing to invest in information acquisition, since options on riskier securities are more valuable.

If the company decides against committing further resources to the project at the preliminary tollgate, it should terminate the project. If the company decides to go through business evaluation, then the expense budget committed to this phase and its duration should be consistent with the cycle time–risk tradeoff implied by the firm’s strategy.

The company should do the bulk of its information gathering during business evaluation. It should complete product specifications, develop and test prototypes, conduct market research, and refine all the earlier assumptions regarding costs and capital requirements. The purpose of this phase is to implement the information-acquisition strategy developed during the preliminary phase and approved at the preliminary tollgate. Information gathering during business evaluation is a multifunctional task. The financial analyst, working as a strategic partner with others from manufacturing, technology, and marketing, should elicit information to accurately estimate future cash flows but also assess risk. If the information from manufacturing, technology, and marketing managers is in the form of point estimates, for example, how can the financial analyst obtain ranges and probabilities of possible future outcomes? Thus the method for eliciting information is critically important. Moreover, the analyst must be trained to judge the quality of the information, so he or she can quantify informational uncertainty in assessing project risk.

During business evaluation, the financial analyst should also revisit the assumptions made earlier about the base case, since base-case cash flow estimates may change over time. The analysts should refine probabilistic estimates of competitive entry and its impact on cash flows and evaluate the overall joint impact of cannibalization and competition. The analyst should determine the variables to review in the first post-audit and its scheduled date.

The capital allocation request should stipulate the expense levels in each year of the project’s life that will support the cash flow assumptions. There should be a link between the capital invested in a given year and the expense budget for that year to ensure that the two remain temporally and strategically aligned.

The analyst should prepare a brief summary of the key value drivers and financial performance measures for the project. The performance measures could include the project’s NPV and the EVA for each year of the project’s life. Moreover, the risk analysis could include probability distributions of the NPV and each year’s EVA.

Ranking Projects.

A company can use probability distributions of project financials to rank projects if it is rationing capital. Some companies use an NPV distribution–strategy grid analysis to rank projects (see Figure 4). The grid shows the range of NPVs for each of a company’s proposed projects within each major strategy grid. Each vertical line represents the range of NPVs for that project. The company can choose projects based on each project’s contribution to the overall risk of the project portfolio (the range of possible NPVs for the project is useful) and allocate the amount of capital to each strategy based on the company’s overall strategy. Thus, in the grid, if all four strategies are equally important, senior managers should ask why there are only two projects proposed in strategy III. Perhaps the people proposing projects under this strategy are playing it too safe. Moreover, since each strategy, other than III, contains projects with NPVs that could be negative, how many the company funds depends on the overall portfolio risk that it wants to take. This kind of analysis is integral to capital budgeting.

A benefit of a dynamic capital budgeting system is the opportunity for learning. The financial analysis of future projects is aided by feedback from previous projects. As one project proceeds through the capital budgeting process, a firm can ask:

- How reliable was the information generated by earlier market research?

- Did the quality of this information justify its cost?

- What fraction of the total cycle time was consumed by market research and what fraction by product development?

One way to assess the value of risk reduction ex post is to calculate the project’s NPV, say, at the business tollgate, including the previous expenditures or the costs that the company now considers sunk. Although a company should never use a project’s NPV, including sunk costs, to accept or reject a project at the business tollgate, it can use it for accountability and learning. In particular, the company can monitor and curb analysts’ propensity to front-load project outlays so as to treat them as sunk costs at the business tollgate (as in the Sundial Electronics example). Moreover, if the NPV with sunk costs is negative and the NPV without sunk costs is positive, the company would accept the project but conclude that the risk-reduction and product development outlays were excessive. Such information would be valuable for future projects.

Culture

Although companies often ignore these three cultural aspects, they are crucial to the success of capital budgeting in implementing the chosen strategy:

Commitment.

A company’s culture should be consistent with both the chosen strategy and the proposed evaluation system. In some companies, employees perceive no long-term commitment to strategy. Various aspects of the strategy are viewed as “programs of the month,” which impedes implementation.

Training.

Essential to effective capital budgeting is employee training. Financial analysts and people from other functional areas should learn the system’s conceptual underpinnings and details, so that they understand its pivotal role in implementing strategy. The company should design the training to improve the performance of those involved in capital budgeting. Moreover, training should be a strategic instrument for eliciting information from financial analysts and line managers that could help refine the evaluation process. In particular, it should provide an opportunity to find the organizational impediments to executing strategy. In this regard, training can be a direct instrument for organizational change. The company should capitalize and amortize training outlays rather than view them as expenses.

Compensation.

Compensation is central to aligning the incentives of people involved in capital budgeting with shareholders’ incentives. Thus it is imperative to develop a compensation system in which bonuses are tied to performance measures that correlate highly with shareholder wealth. Many companies, such as Coca-Cola, AT&T, CSX, and Briggs & Stratton, have recently adopted compensation systems based on EVA. In a capital budgeting context, this system is equivalent to basing them on NPV, because EVA is the flow equivalent of the stock measure NPV. Thus, by tying compensation to EVA, management provides wage incentives that are aligned with maximizing NPV.

However, not all companies that tie compensation to EVA recognize that the desired behavioral change requires more than just asking financial analysts to calculate EVA in addition to other financial measures. Quite often, a fundamental overhaul of the entire capital budgeting system is required, as Whirlpool, Eli Lilly, and R.R. Donnelley have recognized.

Putting It All to Work

Capital allocation, as one key to developing competitive advantage, should be carefully aligned with a company’s strategy. Companies can no longer compete only along product dimensions. Rather, they compete with all firms in the global community. A company with an effective capital budgeting system invests capital more effectively, finds it easier to raise additional capital, invests in R&D and product innovation, and grows. Developing such a system requires careful integration of corporate strategy, a dynamic project evaluation system, and corporate culture.

References

1. See W. Fruhan, “Pyrrhic Victories in Fights for Market Share,” Havard Business Review, volume 50, September–October 1972, pp. 100–107; and

A.V. Thakor, “Investment ‘Myopia’ and the Internal Organization of Capital Allocation Decisions,” Journal of Law, Economics and Organization, volume 6, Spring 1990, pp. 129–154.

2. See L. Trigeorgis, Real Options (Cambridge, Massachusetts: MIT Press, 1996); and

A.K. Dixit and R.S. Pindyck, “The Options Approach to Capital Investment,” Harvard Business Review, volume 73, May–June 1995, pp. 105–118.

3.See, for example:

R.F. Mager, What Every Manager Should Know about Training (Belmont, California: Lake Publishing, 1992).

4. For interesting research on this issue, see:

L. Trigeorgis, “The Nature of Option Interactions and the Valuation of Investment with Multiple Real Options,” Journal of Financial and Quantitative Analysis, volume 28, number 1, 1993, pp. 1–20.

5. In firms with large amounts of debt following leveraged buyouts, it is typical to tie compensation to cash flows because a key objective is to generate cash flows to pay off the debt.

6. EVA is defined as [return on net assets - weighted average cost of capital] × net assets. Thus the present value of all future EVAs for a project equals its NPV.

7. See A.M. Brandenburg and B.J. Nalebuff, “The Right Game: Use Game Theory to Shape Strategy,” Harvard Business Review, volume 73, July–August 1995, pp. 57–73; and

F.W. Barnett, “Making Game Theory Work in Practice,” Wall Street Journal, 13 February 1995.

8. N.A. Nichols, “Scientific Management at Merck: An Interview with CFO Judy Lewent,” Harvard Business Review, volume 72, January–February 1994, pp. 88–99.

9. One way to evaluate both types of risks is with Monte Carlo simulation. Analysts can forecast input ranges (or probability distributions) for a project’s key value drivers (e.g., units sold, price, costs, and so on) instead of assigning a single expected value. These values determine the project’s yearly free cash flows (FCFs), which are then discounted at the cost of capital to arrive at the project’s NPV. A simulation then draws from these input distributions, resulting in a distribution of yearly FCFs and NPVs. The analyst now has the expected NPV and the likelihood that the NPV is positive, given the underlying assumptions. All else equal, the firm should accept all projects with positive expected NPVs. However, in light of capital constraints, corporate strategy, and project interactions, the distribution of NPVs may be very important in making key decisions.

Simulation analysis is also useful for calculating the expected yearly FCFs when there are interdependencies across different variables or options latent in the project. For example, price and unit demand may be negatively correlated or there may be an abandonment option. Often, the analytical solution to these relationships is difficult to obtain, thereby making the simulation analysis useful in calculating the numerical solution to these problems.

10. In one company, we observed analysts in one region who consistently assumed that the assets invested in new products had no residual value after ten years, whereas analysts in another region would assume that the residual value was the present value of a perpetual stream of the net operating profits after tax in the tenth year. Both regions competed for the same capital pool. Guess which region received larger capital allocations?

11. This issue was raised by:

P. Barwise, P.R. Marsh, and R. Wensley, “Must Finance and Strategy Clash?,” Harvard Business Review, volume 67, September–October 1989, pp. 85–90.

12. For a discussion of other consequences of draconian expense cutting, see:

B. Wysocki, Jr., “Some Companies Cut Cost Too Far, Suffer ‘Corporate Anorexia,’” Wall Street Journal, 5 July 1995.

13. Another benefit of consistently having short cycle times is that the firm becomes quite adept at responding quickly to change, which may result in a lowered operating risk for the project, thereby offsetting some of the information risk. There may also be learning benefits (learning by doing) associated with short cycle times.

14. It is important to note that while a firm’s strategy will dictate where the firm should be in terms of cycle time and risk for different types of projects, the option valuation method for risk reduction will enable the firm to focus its capital allocation on projects that are consistent with that strategy.

15. See, for example:

J. Martin, “Ignore Your Customer,” Fortune, 1 May 1995, pp. 121–126.