Interactive Marketing: Exploiting the Age of Addressability

When AT&T entered the credit card business in March 1990, it had a powerful source of competitive advantage: it knew millions of its prospective customers by name and reputation because they were telephone customers.1 Many of those who called its toll free number in response to advertising were told, “You have been preapproved for the Universal Card with a credit limit of $….”

Even before a customer phoned, AT&T knew how badly it wanted that individual’s business and how large an incentive to offer to get it. The results were impressive: within three months there were over a million Universal Card holders, and they had made more than $100 million in purchases. AT&T was exploiting the freshest option available to marketing in the 1990s, the ability to address each customer personally, with information unique to his or her relationship with AT&T drawn from its on-line database.

The shift from broadcasting to directly addressing customers is a subtle change, but quite radical in its consequences for marketing practice. Broadcast media send communications; addressable media send and receive. Broadcasting targets its audience much as a battleship shells a distant island into submission; addressable media initiates conversations. The new marketing does not deal with consumers as a mass or as segments, but creates individual relationships, managing markets of one, addressing each in terms of its stage of development.

Addressability will change the marketing rules quite fundamentally. Among the changes we will discuss in this paper are the following:

- A database of transaction histories will be the primary marketing resource of many firms, determining what kinds of products they can deliver and what markets they can serve. Far more directly than they do today, customers will shape the firms that serve them.

- Marketing will be more accountable. The unit of measure will be the lifetime value of each customer to the firm. Marketing efficiency will be measured by changes in the asset value of the firm’s customer base over time.

- Distributors’ steady erosion of manufacturer power will slow and may even reverse, as manufacturers take back functions from other channel members and use electronic data systems to administer them.

- Niches too small to be served profitably today will become viable as marketing efficiency improves. Communications will reach small or diffuse targets with increasing precision, and feedback on marketing actions will become more accurate.

- The discipline of marketing will begin to feel more like engineering. Marketing managers will need to learn statistical modelling of dynamic systems if they are to interpret market responses to interactive marketing initiatives.

Addressable marketing is not new: the mail and the telephone have been important marketing tools for many years and the salesforce for even longer. What is new is low-cost electronic management of the dialogue. The cost of holding a consumer’s name, address, and purchase history on line has fallen by a factor of a thousand since 1970 and is continuing to fall at this rate. For firms like L.L. Bean, Fideliy Investments, and American Express, electronic customer transaction histories are among their most valuable assets.

To appreciate the power of a customer database, one must see it not merely as a mailing list, but as the memory of the customer relationship: a record of every message and response between the firm and each address. Add artificial intelligence and the system can design new messages, and even product offerings, at the individual level to reflect everything learned from past interactions. When a low-cost computer drives a two-way communication medium in this way, the result is an electronic marketer with as much flexibility as the average human salesperson, a better memory, and a talent for the most numbingly repetitive tasks.

What is an Address?

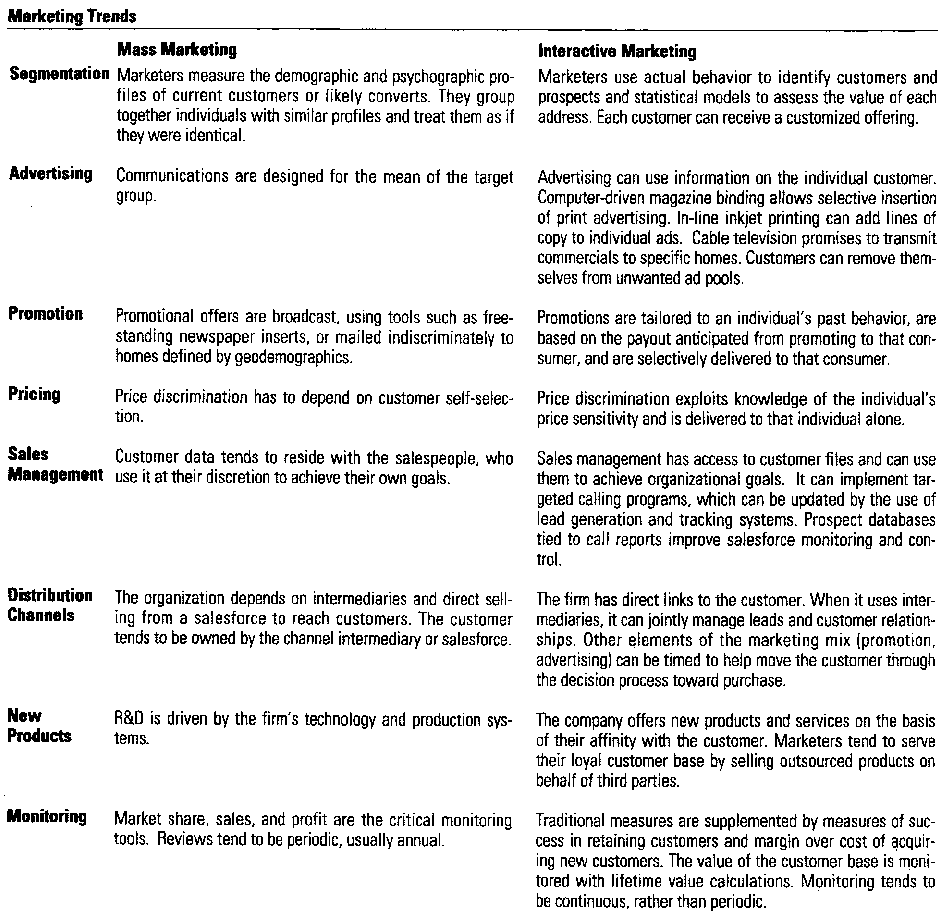

Anything that locates the customer uniquely in time and space in a database, so that responses, marketing actions, and respondents can be matched, is an address. Mailing addresses are the most common form of address. A number of commercial services are attempting to assemble comprehensive national databases built on mailing addresses, supplemented by descriptive data that can segment consumers and explain response rates (see Table 1).

Addresses are not restricted to mailing addresses. Telemarketing uses phone numbers, as do videotext systems such as Prodigy. A cable television hookup is a receiving address. With present technology it is not a transmitting address, but AT&T and American Express offer Call Interactive, a telephone system that can take responses from 10,000 television viewers in ninety seconds. Any vending machine accessed with a credit card is potentially an interactive marketing medium. Already some ATMs are dispensing postage stamps, rail passes, and grocery coupons, but the technology can do much more.2 Just as the machine dispenses cash and updates your bank balance, so it could dispense movie tickets and update its knowledge of your entertainment preferences, using the information to offer you other entertainment consistent with your tastes.

When addresses do not exist, some manufacturers create them. Quaker set out in September 1990 to find the addresses of 18 million of its customers by mailing cents-off coupons, each of which bore a unique household number.3 As customers redeemed coupons, the database began to assemble a picture of each household as defined by its pattern of Quaker product purchase. This information could be used to tailor and deliver future advertising and promotion to the unique needs of individual households.

Today’s most ubiquitous interactive marketer is the catalog retailer. Firms like Lands’ End, Spiegel, and L.L. Bean communicate with their customers with catalogs. The customer replies by buying or not buying. The retailer uses each customer’s purchase pattern to compute a probability of purchase for each of its merchandise lines, and it sends the customer only those catalogs for which the calculated purchase probability exceeds a threshold value.

Each catalog’s content evolves in response to demand because the marketer can use the computer to assemble a different catalog for every customer. Computer-driven catalog binding makes it possible for Lands’ End to construct, at least in principle, a unique catalog for every customer it serves. The model that predicts purchase probability and designs the personal catalog is updated continuously as it learns the outcome of its past predictions.

Computer-constructed catalogs are merely one of the two-way channels in the new marketing environment. Magazines are starting to adopt the same computer-driven binding technology as catalogs.4 American Baby uses selective binding to adapt the mix of editorial and advertising pages to the age of the baby in each subscriber’s household. Farm Journal recognizes 5,000 different subclassifications of farming practice and geographic region and produces a different edition for each. Time, People, Sports Illustrated, and Newsweek offer editions reaching households that have recently moved or that have recently purchased from a catalog. Newspapers make advertising and editorial changes on a suburb-by-suburb basis. When this technology is combined with in-line inkjet printing, magazines can be as addressable as direct mail. It is possible to imagine magazine ads talking to consumers about their catalog purchases: “Alan, that pair of loafers you bought three years ago might need replacing. Look at page forty-six of the Eddie Bauer catalog you’ll be receiving next week.”

What Interactive Marketing Can Do that Broadcast Can’t

A well-designed transactional database gives the interactive marketer a number of advantages over the traditional broadcast marketing corporation. These advantages shape the agenda of the new marketing.

Calculate the Value of a Customer or Prospect

Financial statements value a firm’s tangible assets, but they neglect the value of its customer base. While some corporations have begun to compute the value of their brands’ equities, only direct marketers can compute the equity represented by their customers.5 By computing a discounted lifetime value of each customer, they can understand what is happening to the size and value of their customer base in response to their marketing actions.

Sales statistics do not directly measure the value of a customer base. Sales figures are a revenue measure; they tell how customers have responded over a fixed time interval. Lifetime customer value, in contrast, is an asset measure. Methods that measure the lifetime value of the firm’s customer base can help marketers judge their expenditures by measuring a plan’s efficiency in producing assets.

Customer lifetime value is computed by factoring in historical customer retention statistics, marginal costs of the products sold, promotional expenditures, and pricing to the customer. For example, suppose a customer has been buying from an office supplies catalog at a rate of $300 per month. Say that a customer with this pattern of demographics and buying habits has been estimated, by the use of statistical models, to have a buying life of two years. And say that, by computing marginal and promotional costs, the marginal profit per month from this customer is $60. At the end of the first year, the firm has an asset worth $720. Nowhere in the firm’s financial statement does this appear. Indirectly, it appears in financial analysts’ reports in cash flow and future profit projections. If the firm stops promoting prospects in the second year, sales and profits look very good. However, the firm’s value drops because the value of its customer base has declined. Thus firms that reduce investment in the maintenance of their customer base will have a lower asset value at year’s end.

Using lifetime value calculations, a firm can produce an accounting report that shows the value of its customer franchise. Accountants who understand how to develop statistical models of purchase behavior can audit this asset’s value. The firm can then report its customer value to the capital markets, which will react just as they do to an earnings statement and balance sheet.

The magazine subscription divisions of publishers adopted the lifetime value concept early. Time-Life offers significant price discounts to prospects, sometimes in the form of premiums, to become subscribers. The company may break even or lose money on the initial subscription, but, by tracking renewal rates and additional purchases, it can determine the profitability of the acquisition offer over the lifetime of the subscriber’s association with the firm. It can test different offers and determine which has the greatest long-run profitability.

Build and Manage Dialogues with Customers

Addressability gives commercial speech some of the character of conversation. When a firm can go back to a customer to respond to what the customer has just said, it is holding a dialogue, not delivering a monologue. Conversation can nurture relationships far richer and more idiosyncratic than one-way advertising can.

Imagine you shop regularly at Bob’s Food Emporium. As you check out, you present your “frequent buyer card.” The cashier uses an optical scanning wand to read the card’s bar code. The cash register’s memory immediately fills with a picture of your transactions over the past year. Your account is credited with the dollar amount of today’s purchases, and at the end of the year you receive a certificate for free products at Bob’s, valued at perhaps 1 percent of your cumulative spending. As a member of the program you also receive coupons from manufacturers who participate in Bob’s frequent buyer program.

On the surface the card appears innocuous: rather like S&H green stamps without the glue. In fact, frequent buyer programs are much more powerful relationship builders. They gather information that can be used by retailer and manufacturer to drive individually tailored marketing programs. The retailer captures and maintains a record of every purchase by each cardholder. This data is married to information from the customer on household characteristics such as address, income, education, family structure, competitive shopping behavior, frequency of shopping, and other pertinent information. The retailer uses the resulting matrix of demographic and behavioral data to seek out and communicate with precisely defined target audiences. Most important, the incentives and coupons that members receive are individually planned to expose them to products they have not yet tried, to reward loyalty to sponsors’ brands, and to encourage switching away from competitors’ brands.

If Diet Coke wants to locate new users, it may test a hunch that people who have been heavy drinkers of sugared sodas and who have recently begun to buy artificially sweetened foods and beverages are ripe for conversion. It could purge its target of regular Coke drinkers to avoid raiding its own franchise and direct its promotional offer to those who remain. Another target might be heavy users of Diet Pepsi, avoiding those who have also been sampling Diet Coke. While the number of possible target definitions is without limit, it is a simple matter to test one definition against another.

Catalina Marketing of Los Angeles recently attached a coupon printer to supermarket cash registers. It generates coupons, printed on the supermarket shopper’s receipt, offering discounts on future purchases. The coupons are based on the purchases the consumer has just made. For instance, the system can offer a customer who buys a product’s trial size an incentive to try the large size. It can encourage a user of one variant to sample the rest of the line. Each coupon is not haphazard but a precisely targeted tool in the process of forging a personal bond. The system is a medium for two-way conversation: the consumer speaks through purchases, and the manufacturer employs artificial intelligence to reply.

Reward America, a program of Citicorp, extended this idea to permit much more subtle dialogue over longer periods of time.6 When consumers subscribe, the system remembers all their purchases at member supermarkets. Firms can use frequent buyer programs to reward loyalty. They can construct sales promotions to attract own-loyal or competitor-loyal consumers, or to discourage deal-prone consumers. In categories where consumers are prone to seek variety, firms can help consumers to explore the category by offering incentives to try something new. Table 2 lists a variety of continuity or relationship-building programs.

Continuity programs are not a phenomenon of the supermarket only. Sears, Roebuck and Company returns to its credit card customers 1 percent of the value of their annual retail sales in excess of $200.7 WaldenBooks has formed a Preferred Reader Service to reward 1.5 million regular book buyers. It tracks their purchases and sends them newsletters tailored to their individual reading preferences.8 By raising the costs of disloyalty, these programs give the large retail chain a competitive tool against narrow specialty retailers.

Relationship management programs can bind consumers to manufacturers too. Directly addressed communications can replace advertising without any attempt to solicit orders. The Morris Report is a magazine mailed to cat owners, designed by Leo Burnett, the advertising agency responsible for the Nine Lives cat food brand, whose spokesperson is a cat named Morris. Leo Burnett has developed similar relationship-building programs for Huggies diapers and Virginia Slims cigarettes. Reader’s Digest magazine, which receives volumes of correspondence, employs an independent firm to reply to every letter, a sizeable investment in relationships at the individual level.

Leverage the Database for Economies of Scope

The costs of the technology required to run an addressable customer interface do not in general yield large scale economies. It is prudent, therefore, for firms to seek to offset these costs with economies of scope. They must broaden and deepen their product or service lines, mastering new technologies when necessary, to exploit the knowledge of their customers amassed in transaction databases. When information is the key corporate resource, corporations will define themselves by the customers they understand best. They become installed base marketers.

If a firm wants to exploit its customer database in this way, it must first define the source of customer affinity. Spiegel decided to redefine its business around the needs of busy, hardworking women in particular age and income ranges. It isolated the relevant segment of its installed base of customers, then promoted to them an appropriate range of products and services.

Marketing to an installed customer base affects the new product development process. Conventionally, firms develop new products to exploit a fit between their existing production technology and specific customer needs. The firm’s production technology constrains its choice of customer needs to pursue. Research and development is based on utilizing the firm’s current level of product and technical knowledge. Therefore, the firm’s current business and markets temper its ability to meet customer needs.

The interactive marketer is constrained less by its current production and technical expertise than by the affinity group it serves. Can USAA, whose affinity group is retired military officers, expand its product line beyond insurance? Yes, but the firm must make affinity the first consideration and treat its ability to produce the service or product as secondary.

This product development strategy requires the firm to be expert in outsourcing the services and products its affinity group wants. Sears entered the insurance business as Allstate because they could sell additional services to their customers. Today, Allstate is more profitable than Sears Merchandise Group’s retail stores. The same organization established the Discover Card to build an installed base of credit card customers to whom they could offer other services, as different as banking and travel agency services. The criterion for new product development in the Discover Card group is not whether the group possesses the relevant expertise, but whether the affinity group will be responsive.

Win Power Back from Distribution Channels

In the traditional marketing environment, the manufacturer’s broadcast channels are weak and separate from its distribution channels, which tend to be strong. The economic fruits of successful communication are notoriously easy to capture by strong channels, who then “bait and switch” the manufacturer’s customers. Addressability returns control to the manufacturer. It permits the manufacturer to usurp some of the distribution channel functions.

For instance, in the conventional brokerage or financial consulting firm, the brokers control customer information. The firm knows a customer’s transaction history, but it does not have the intimate grasp of the customer’s investment priorities and aspirations that the broker needs to manage the relationship. When a broker leaves the firm, the customer is likely to go, too. The broker, not the firm, owns the relationship with the customer. A firm that has abdicated relationship management to the broker is very vulnerable to a change in its sales-force.

The challenge for these firms is to persuade the broker to share customer information with a centralized database in exchange for help in managing the day-to-day routine of the account. The computer’s fail-safe memory and appetite for detail have some appeal to the busy broker. A system that can remind him or her of a client’s birthday or option exercise deadline is worth cooperating with.

The Caribbean cruise business is typical of many in which independent agents jealously block the supplier’s access to the customer. Traditionally, therefore, advertising and PR have been the only direct communication channels between cruise lines and their customers. Recently cruise lines have begun to build database systems that offer such value to travel agents that they are willing to provide the names and addresses of frequent cruise takers in exchange for centrally managed direct promotion of their agencies.

Mary Kay Cosmetics built a multimillion dollar business by selling to women at home parties through a network of beauty consultants. Turnover of beauty consultants was disturbingly high, as high as 80 percent in some years, and when each consultant left, her customers went with her. In 1986 Mary Kay began to build a database of its customers to lessen its vulnerability to consultant-managed relationships.9 If the consultant supplied customer names and addresses, each of her clients received a Personalized Beauty Analysis. This consisted of a questionnaire with twelve questions about skin type and color, hair color, facial shape, and makeup preference that was completed by customers. The data was analyzed, and a diagram of the customer’s face was generated to illustrate the recommendations.

Today Mary Kay Cosmetics’ database has 9.5 million names, and since 1989 its party plan selling system has been complemented by five catalog mailings a year. The direct channel works in harmony with the consultant channel. It gives customers image-enhancing communication to position the firm’s products as competitive with those of Estee Lauder and Lancôme, it collects routine orders, and it preserves the relationship if the consultant should resign.

Integrate Marketing Campaigns

Marketers have long recognized that marketing tools are most potent when used in conjunction with one another. A sampling program, for example, might be most successful if consumers receive samples just as they see television advertising that helps them interpret the trial experience, and some time before they receive a promotional offer to induce them to make a second purchase. The search for truly integrated marketing programs has driven many advertising agencies to diversify, acquiring sales promotion firms, direct mail companies, and others. But integration has proved to be harder to accomplish than diversification. Database marketing may offer a solution.

A database of addressable customers can play the role of nerve center in an integrated marketing program. The response of a consumer to one element of the marketing program, detected by the database, becomes the trigger for delivering the next element.

A remarkably successful database-driven integrated marketing program was the launch of Acuvue disposable contact lenses by Johnson & Johnson. The marketing program was premised on the belief that no eye care patient would switch to disposable lenses without encouragement of an optometrist. Consequently, the program was driven by two linked databases: a list of registered eyecare professionals who stocked Acuvue and the names of contact lens wearers who had responded to disposable lens advertising. As indicated in Figure 1, a database tracked these prospective customers individually as they moved from expressions of initial interest through a first appointment with an optometrist to successive lens purchases. At each step of the way, the Johnson & Johnson computer coordinated appointment making, delivery of collateral sales material, and delivery of purchase incentive coupons. What appeared to the customer as a seamlessly integrated flow of communications was, in fact, the product of a number of quite distinct communication disciplines—print advertising, direct mail, telemarketing, and sales promotion.

Improve Marketing Productivity

Marketing is a notoriously inefficient activity, mainly because it is difficult to account for results.10 Addressability improves marketing’s productivity in three ways.

First, we can link expenditures to results. We can know whether an individual received a communication and whether he or she responded. Programs can be refined by a process of test, fail, retest at the individual level, until something approaching optimality emerges.

Second, we can identify and reach niches too small to be served by mass-marketing methods. Consumers who are allergic to the perfumes and dyes in laundry detergents make up a tiny fraction of the population, too small to have attracted a volume producer like Procter & Gamble a few years ago. Last year the company launched Cheer Free for just that niche, using advertising with response vehicles to invite those with the problem to identify themselves and following up with direct mail. The finely tuned marketing program paid out handsomely despite small total demand.

Finally, interactivity makes possible a shift in production strategy: from producing generic products and services to tailoring products for particular customers. The firm’s offerings need make fewer compromises among heterogeneous consumer tastes in pursuit of scale economies. The firm’s marketing program can begin to explore the ideal in which each customer receives an individualized offering. In principle, a credit card marketer could design a different product for each customer, each contact reflecting the way the customer trades off the interest rate against the annual fee against the credit ceiling. A manufacturer of specialized saw blades uses a portable computer to gather customer requirements and then transmits this information back to the plant to drive the production process and execute the customer’s order.

Addressability and the Privacy Issue

New data sources that empower the marketer seem, for that very reason, intimidating and threatening to consumers. Already consumer groups have begun to lobby Congress and state legislatures to enact laws to protect their privacy, and fear of consumer backlash has discouraged several initiatives to gather or sell transaction data.

A plan by Lotus Development Corporation to sell compact disks containing personal information on 80 million U.S. households from the Equifax system was cancelled in response to widespread opposition from the American Civil Liberties Union and others. A proposal from within the Blockbuster videotape rental organization to market video rental records of its customers together with their addresses was also cancelled in response to widespread customer opposition.

The issues in the public debate are several. There is concern that much of the information is gathered without consent. Consumers are not given the right to prevent transaction information from being sold or used. There is hostility to the proliferation of direct mail marketing and telemarketing to households, and the assumption is often made that better databases will lead to more solicitation. There is fear that information may fall into the wrong hands: in 1989 a Business Week reporter gained access to a national database and uncovered the fact that Vice-President Dan Quayle charges more at Sears than at Brooks Brothers.11 There is a concern that personal information might be used in fraudulent schemes against naive or unsuspecting people. More generally, there is a fear of the unfamiliar; information that strangers are not “supposed” to know, used in ways that buyers never expected, gives an undue advantage to sellers in adversarial marketplace relationships.

Privacy, however, comes at a price. Better market data makes marketing more efficient, and in competitive markets some of the fruits of efficiency are passed on to consumers in the form of lower prices and more choice. If the availability of better data lowers the cost of reaching a niche market, for example, then products that might never have been brought to market can be launched, and products that would have been expensive become more affordable. It might also be argued that when a company can more precisely target its prime customers, it reduces rather than increases the number of unwanted commercial intrusions; it eliminates wasteful miscommunication.

The tradeoff between marketing efficiency and privacy is a matter of continuous negotiation in a market economy, whether the issue is the proper number of advertisements in an hour of television, the contest between an uncluttered landscape and outdoor advertising billboards, or freedom from interactive marketing during the dinner hour. In the near term, legislation and litigation must be expected as society debates where to draw this new line. In the longer term, however, we anticipate that the public’s fear of interactive marketing will prove largely groundless. More precisely targeted communications will seem less intrusive than broadcast advertising or indiscriminate junk mailing, and the cost will be borne as part of the burden of consumer sovereignty.

Transforming the Organization into an Interactive Marketer

Which organizations stand to gain most from a shift to one-on-one marketing? While some of the most vivid illustrations of interactivity involve consumer products, our research suggests that industrial and business-to-business firms often have more to gain. Industrial firms have fewer customers and so the size of their databases are much smaller and more manageable. The salesforce can gather relevant data from customers to develop profiles. And the payout of database marketing is often higher because the value of a single transaction is much larger.

The industrial firm faces one particular problem in implementing addressability—the difficulty of enlisting the salesforce to capture relevant data. Many industrial salesforces refuse to be an information source for the firm and to communicate the data to headquarters. With the threat of a salesforce rebellion, most firms are unwilling to require that information be gathered. The problem is that the firm fails to show the salesforce the benefit or economic return for gathering the information. If the information can increase sales in a given account, then the salesperson should be willing to provide it. Communicate the benefits, and cooperation should follow.

Designing a Marketing Database

The key to database design is premeditated investment. An interactive marketing program can seldom be built from past records collected for accounting, billing, or service delivery purposes.

Ten points should guide the construction of a marketing database.

- Avoid compromise. A good marketing database is designed for that purpose only. It is not an accounting or inventory management database adapted to support some marketing functions, though it may interface with other information systems.

- Use separate databases for prospects and loyal customers. You will need to maintain different data for the two groups and develop different communications and marketing activities to serve them.

- The prospect database should be able to track a prospect’s conversion process over time and give credit to the marketing initiatives that caused it.

- The loyal user database should be able to identify a potential defector and alert the marketing program to the need for defensive action.

- The database should be easily accessed by marketing and upper management; it should have “user friendly” data access tools.

- The database should contain a comprehensive history of all marketing activities directed to each customer so that marketers can analyze program effectiveness and discover the interactions among tactics.

- The system should routinely compute and maintain each customer’s lifetime value. It should produce management reports showing changes in the total value of the customer base over time.

- Firms should add “profile” information indicating the sales potential for the customer, relevant demographic characteristics, and life-style and psychographic information. Sometimes this information can be gathered unobtrusively, from secondary sources such as the national household databases identified in Table 1, but it will sometimes be necessary to directly survey customers. This is a sensitive process, and care should be taken to convince the customer that the information sought will benefit both parties to the relationship.

- The database should maintain all records and names for the relevant entity together. For consumers this is usually the household; for industrial firms it may be a plant location or a department.

- The system should periodically compute, maintain, and update scores predicting the likely responses to different types of marketing so that marketing management and sales can quickly target likely responders for specific promotional or marketing programs.

Prescriptions for Staffing an Interactive Marketing Unit

The concept of interactive marketing is easy to understand but difficult to execute. It is an unfamiliar approach for the traditional marketer, and management often does not understand the kinds of skills it takes to do it well. Below are listed some of the critical competencies the firm must possess.

- Database Management. The firm must be adept at designing and managing large databases. This requires the ability to acquire and modify relational database software. Most firms work with transactional databases, not customer files. The systems and software to work with transactional files are not the same as those required to work with customer files.

- Statistical Modelling. Database marketing is very analytical. It can be much more precise than broadcast marketing and consequently can allow much better control of marketing costs. To become an accomplished database marketer, the firm must develop, or initially acquire, the expertise to compute the lifetime value of its customers and to develop statistical scoring systems that compute the likelihood that a customer will respond to a specific promotion, advertisement, or sales call. These tools are not usually found in marketing research departments, and, therefore, the firm may have to recruit new skills.

- Marketing to an Installed Base. One of the advantages of database marketing is that the firm can market more intensively to its customer base. However, a new attitude to R&D and procurement may be needed to guide the acquisition of products and processes its existing customers want.

- Production. The firm’s production expertise will need to shift as the firm learns to manufacture small quantities to match the new precision of its marketing programs. Skill is needed to tailor products to specific customers.

- Accounting. The firm must learn to compute cash flows and profit estimates for newly acquired customers based on their lifetime of purchasing. Otherwise most initial marketing programs will not pay out, and the firm will reject customer acquisition programs that are highly profitable but that do not generate first-year profits or positive first-year cash flows.

Finally, however, the challenge of the new marketing is strategic. A market of individuals, individually addressable and open to interactive communication, threatens the very existence of many firms. The economics of large scale production favors large firms with strong brand identities. The economics of customer information will breed a generation of smaller, flexible firms with healthy firm-to-customer relationships. Investment in big brands with broad appeal is yesterday’s solution, useful in the shallow communications environment of broadcasting. In an era of addressable media, corporate reputations will count for more than brand reputations. Corporate reputations will span a range of customized product offerings. The future lies with firms who can use the new two-way channels of communication to create richer, more securely based relationships, reaching across a whole range of products and resting on honest and intelligent dialogue with their customers.

References

1. “AT&T Signs Up a Million Accounts for Credit Card,” Wall Street Journal, 13 June 1990, p. B6.

2. “Banks Start Spicing Up Their ATM Menus,” Wall Street Journal, 5 October 1989, p. B1.

3. “Quaker Direct,” Direct, September 1990, p. 1.

4. “Magazines: Glimpsing a Day When No Two Copies Will Be Alike,” New York Times, 24 April 1989, p. D9.

5. See, for example, F.R. Dwyer, “Customer Lifetime Valuation to Support Marketing Decision Making,” Journal of Direct Marketing 3 (1989): 8–15; and R.C. Blattberg, “Research Opportunities in Direct Marketing,” Journal of Direct Marketing 1 (1987): 7–14.

6. “Citicorp POS Forges On,” Adweek’s Marketing Week, 30 July 1990, p. 26.

7. “Sears Rewards Shoppers in Bid to Boost Sales,” Chicago Tribune, 12 September 1990, sec. 3, p. 1.

8. “Walden Gets to Know Millions of Customers through Reader Clubs,” Direct, March 1990, p. 6; and “Database Masters Become King of the Marketplace,” Marketing News, 18 February 1991, p. 13.

9. “Mary Kay, Avon Augment Salesforces with Databases,” Direct, September 1990, p. 24.

10. F.E. Webster, “Top Management’s Concerns about Marketing: Issues for the 1980s,” Journal of Marketing, Summer 1981, p. 9–16.

11. “Is Nothing Private? Computers Hold Lots of Data on You—And There Are Few Limits on Its Use,” Business Week, 4 September 1989, p. 74.