Saturn’s Supply-Chain Innovation: High Value in After-Sales Service

Can you have your cake and eat it too? When it comes to combining a high level of customer service with a lean and efficient supply chain, few companies can match Saturn Corporation’s after-sales service business. Saturn’s success in that area is a wake-up call; its approach should serve as a model for any industry trying to forge the critical link between after-sales service and customer loyalty.

What Saturn has done is adopt and continuously refine the concept of jointly managed inventory, a variant of vendor-managed inventory that involves sharing inventory risks with “retailers” — the name Saturn gives its dealers. In doing so, it has uncovered a precept with broad implications: Companies that match their parts-supply strategy to the criticality of the customer’s need for the part can dramatically improve customer satisfaction in after-sales interactions.

Saturn’s success in after-sales service has been well documented by industry watch-dogs. Although its retailers’ service-parts inventory turns over more than seven times a year, far exceeding major competitors’ turnover, its retailers excel in off-the-shelf availability.

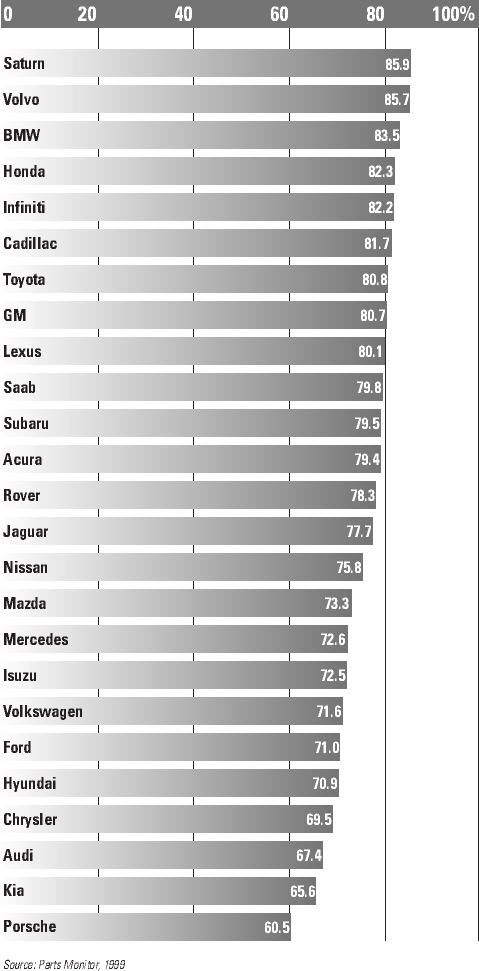

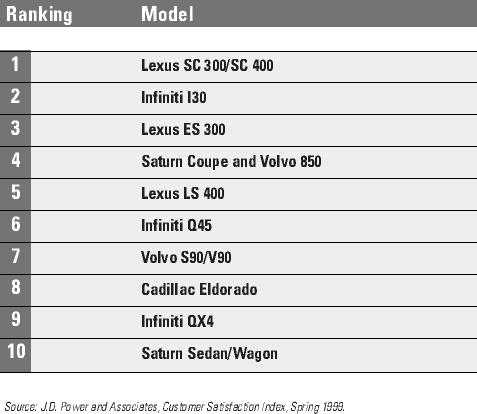

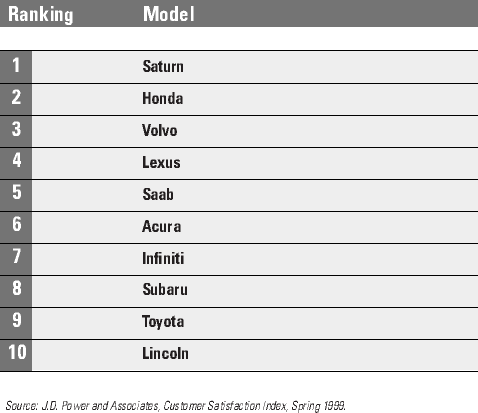

Such efficiency leads to both higher retailer profitability and satisfied, loyal customers. The spring 1999 survey from J.D. Power and Associates reported Saturn customers’ high satisfaction with the availability of parts to support after-sales service — and the low incidence of out-of-stock parts resulting in the car not being repaired right the first time. Indeed, Saturn consistently ranks among the top 10 brands of automobile manufacturers for supply-chain service, comparing favorably with luxury automobiles such as Lexus, Infiniti and Acura.

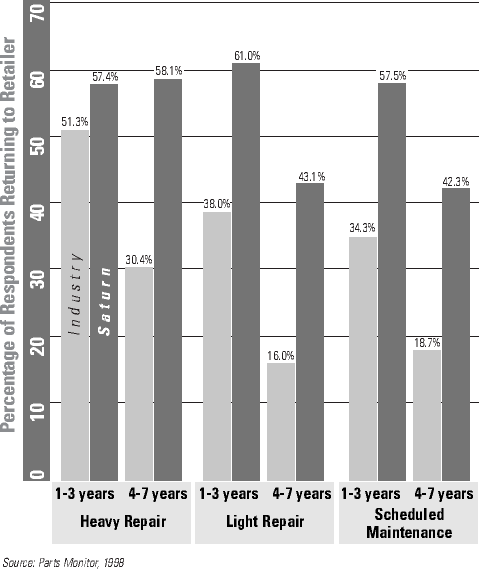

Unsurprisingly, customers of Saturn return for repairs and scheduled maintenance for many more years than purchasers of other automobiles. As managers know, high levels of brand loyalty result in high levels of repeat purchases.

How did Saturn manage to achieve its impressive performance in after-sales service? Its secret is twofold. It designed a service-supply-chain strategy that matches the urgency, or criticality, of its customers’ varying needs. And it effectively uses channel partners to execute the strategy.

All that didn’t happen overnight. From 1985 to 1987, while we were studying General Motors Corporation and offering recommendations on GM’s service support, the company coincidentally was forming Saturn. The ideas in our report greatly influenced the plans for Saturn. The GM team members working on our project also were involved in developing Saturn’s service-support function. One of the team members was author Carl Cull, who left GM to join Saturn. Author Don Willen, a senior manager at GM at the time, was another member of that team.

With managers at the new company sold on the basic concept of matching supply-chain strategy to the criti cality of the customers’ needs, Saturn went about the task of implementing and refining that strategy. Saturn worked closely with its channel partners to design a highly integrated distribution network that could meet the service requirements of the ultimate customers, the vehicle owners. The execution of the strategy requires tight coordination. In fact, the company uses an inventory-management process into which all retailers pour information, with Saturn making replenishment decisions for the channel. Proper incentives ensure that the risks and rewards of the collaboration are appropriately shared.

Saturn’s approach is unusual. In most industries, it is rare to find successful implementation of a supply chain in which all participants are that closely linked. It is even less common to find it in the after-sales business.

The Saturn Service Parts Operations Story

In the mid-1980s, General Motors created Saturn as a new company with a strong customer-focused competitive strategy. The company started with a clean sheet. It had new products, a new service-supply chain and, perhaps most important, a new concept for the “retailership.” Each retailer operates in a market region in which it is the only authorized Saturn retailer. Regions do not overlap, so retailers can put their energy into marketing the car against other brands, as opposed to competing with other Saturn retailers through “dealing.” Particular emphasis is on removing stress from the automobile-purchase transaction.

Saturn’s underlying competitive strategy is to give buyers life-cycle ownership value by providing a fair price (not necessarily the lowest price) and the highest level of after-sales service possible. It aims to create an intensely loyal group of customers, with a high level of repeat purchases and a high market share for after-sales service throughout the period of vehicle ownership.

Embracing the premise that the system must be oriented toward the welfare of the vehicle owner, Saturn managers designed the service operation from scratch. There were very few practices to emulate: Extensive benchmarking on after-sales service convinced Saturn that inventory management at the retailer level was at that time a “black art.”

To make the new approach work, Saturn had to overcome four management challenges within the service-logistics systems connecting the various stakeholders in the industry. First, parts consumption tends to be intermittent, and therefore demand is hard to predict. Inventories of service parts typically move slowly and often have very low turnovers. (We have benchmarked annual turnover values as low as 0.5 in high-technology industries.) Second, there is enormous disparity in the cost of the parts that must be provided (from pennies to hundreds or thousands of dollars in computer- and technology-driven industries). Third, there can be great variety in models or platforms. Product proliferation leads to part-number proliferation. Most automobile manufacturers have to maintain hundreds of thousands of separate stock-keeping units (SKUs). Fourth, the value of the delivered service to the customer can vary considerably, according to the severity of the failure incident. Such factors lead to a wide range of requirements for parts-delivery responsiveness and availability.

With automotive parts, the total service supply chain can contain billions of dollars in inventory, stocked at thousands of locations, with high transportation costs when shipments must be expedited. And yet the service provided to vehicle owners is often dismal. Many automobile dealers do not have the competence or interest to become state-of-the-art inventory managers, nor do they see a direct connection between inventory management and improving car sales. So in many cases, even if an automobile manufacturer could improve the operational performance of its parts-supply chain, the ultimate consumer would still face poor service.

How the Supply Chain Works

Saturn uses a demand-based approach for triggering movement of parts down the supply chain, an approach that recognizes the probabilistic nature of the part-consumption process in the field.

The process starts at the factory level. Parts are produced at Saturn’s factory in Spring Hill, Tennessee, or at vendor plants, which could be located anywhere in the world. The first actual decision to be made is where to stock the part and at what level — the “positioning” decision. Saturn stocks all parts at its central distribution center (DC) adjacent to its Tennessee factory. The retailers stock a subset of parts, and different retailers may stock different SKUs in different quantities.

Demands for parts might have their origin in a car crash or other repair incident, routine maintenance, a do-it-yourself project or the needs of a non-Saturn repair-service provider.

Repairs can occur at scheduled maintenance times or at random. Even if the repair time is scheduled in advance, the retailer will not know what parts are needed until the car is in the shop and the repair technician/mechanic can make a diagnosis.

The parts needed at the retailer’s repair shop or another party’s repair shop are ordered from the local retailer inventory. Job-completion standards usually are same day standards, except for major repairs and bodywork jobs. Customers do not want to wait more than one day to receive a car back in full operating condition.

In Stock and Out of Stock

If the part requested is in stock, the retailer will sell and, if necessary, ship the part to the location where it will be used. If the part is not in stock, the retailer will first ask members of its “pooling group” — a group of nearby Saturn retailers organized by Saturn for inventory pooling purposes — to see if it is avail able there. The search is facilitated by the information system Saturn maintains for all retailers. If the part is not available in the pooling group, then it can be ordered from the DC or from the supplier. It is possible to review all U.S. stocking locations in real time to determine the availability of a part. The retail er then orders the part and places the customer into a back-order position. The costs of such transfers are borne primarily by Saturn.

Retailers review Saturn’s target-level recommendations at the end of each day, and then Saturn automatically replenishes to the agreed-on target level. Thus, retailers can say yea or nay and can set the tar get level higher or lower or at nothing.

Replenishment orders are received at the central distribution center and are shipped out according to a delivery schedule — leading to a three-day or shorter response time if the ordered part is in stock at the DC. Otherwise, the part is either put on back order or sourced from the production-inventory stock.

Note that a pull system such as Saturn’s is based on target levels. Using one-for-one replenishment means that Saturn does not position inventory in advance based on forecast consumption. That is a key difference — one that is required by the highly unpredictable nature of the parts-demand process.

The financial arrangements include full reimbursement of costs to a retailer who supplies a part to another retailer as a result of a pooling-group request (rare because parts are usually in stock under the system). The shipped part also is replaced automatically within three days (assuming availability at the DC). Saturn essentially tells retailers what to stock. If a part does not sell after nine months, Saturn takes it back and repays the retailer for the cost of the part.

Each retailer’s inventory system is linked directly to Saturn’s management system. All transactions for all SKUs at the retailers are transmitted daily to Saturn via a satellite-based communication system. Upon receipt of the nightly updates, the central system at Saturn generates stocking decisions and replenishment quantities for each SKU for each retailer location. If an item is very high in cost and rarely demanded, Saturn sends fewer. Saturn initiates the process through which retailers buy parts, but it gives retailers the right to reject or modify the suggested replenishment decisions.

Overcoming Potential Obstacles

Saturn has innovated a variety of ways to leap over roadblocks.

People who keep things humming.

Saturn has material-flow coordinators — people positioned in the plant to facilitate coordination between manufacturing and service parts so that scheduling of parts production does not get overlooked. Material-flow coordinators represent a major innovation: They solve the classic problem that parts orders can be disrupted by the schedule established for assembling large numbers of new cars.

Performance measures.

Also important are appropriate performance measures that reinforce the right kind of behavior. Saturn realized that because it was managing inventory jointly with the retailers, it would not be sufficient to base its service-performance measures wholly on delivering parts to the retailers (as most supply chains still do). Instead, Saturn and the retailers together would have to be held accountable for the service performance the customers ultimately experienced. Hence, Saturn decided to use off-the-shelf parts availability (differentiated as crash-related, maintenance-related or consumable-related repair types) — at the retail level — as its performance metric for service delivery.

Avoiding the risk of excess inventory.

The Saturn service operation is designed to relieve retailers of the burden of inventory management. As described above, Saturn manages retailers’ field inventory directly and shares the consequences of any over- or under-stock problems.

Implementation.

The heart of the matter is that the service-parts system is designed to support Saturn’s customer orientation and to exceed the expectations of customers for quality in support and service. All decisions and incentives are set to support that central strategy objective, and all extra costs are borne by Saturn.

Convincing the doubters.

The decision to accept the recommendations was made jointly by the senior managers designing Saturn from the ground up and by the relevant GM managers, who were anxious to see an experiment carried out. The major concern within Saturn initially was from the financial managers. The provisions to cover retailer costs and to take back unsold parts worried them, but once it was demonstrated that the system worked — higher service with less inventory — there was uniform acceptance.

Aligning Supply-Chain Strategy With Criticality

Saturn’s approach enabled it to meet customers’ needs effectively and efficiently through alignment of its service-network strategy with the urgency, or criticality, of a customer’s need. To assess that kind of alignment, managers can place their organizations on a matrix in which the vertical columns would indicate the structure of the service strategy and the associated level of coordination. At one extreme would be centralized supply chains (having essentially one central warehouse); at the other, distributed supply chains (with numerous, coordinated stocking points). The matrix’s horizontal rows would represent high and low levels of criticality — how crucial it is to the customer to get product performance. Any company that analyzes its place on the matrix can gain insights to improve after-sales service.

Criticality

First, a company must look at the criticality of its products and services, asking, “What is the value of our product’s performance (its uptime) to the end user? What is the cost to the customer if the product fails to function properly?”

A part in the computer system used by air traffic controllers would have high criticality. If it should fail, the cost could be catastrophic. Acceptable time to repair would be measured in seconds. Similarly, the manufacturing equipment used in a semiconductor fabrication plant could have high criticality. With a nonfunctioning piece of equipment, an entire manufacturing process line could grind to a halt. Lost profit: tens of thousands of dollars per hour. At the other extreme of the criticality spectrum might be a home hair dryer. If the dryer should cease to work, the cost perceived by most end users would probably be no more than a bad-hair day.

The definition of product failure for a car is more complex. If failure of an engine part renders the car undrivable, that would be perceived as serious, but for most drivers, failure of a radio part would have low criticality. Delivered value can vary, therefore, even for the same product.

Note that if product reliability could be increased to the point that downtime from product failure did not occur, then after-sales logistics support would be unnecessary. Product attributes, such as reliability, redundancy and the ability to self-diagnose a failure so that the product can “self-heal,” can be critical components of a firm’s service strategy. Upstream processes like product design and manufacturing can eliminate defects and make significant contributions to product service.

Centralized or Distributed?

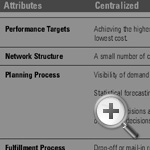

In addition to looking at the criticality of its products and services, a company should examine the supply-chain service strategy that it uses for matching supply with demand (and for satisfying the customer’s needs) to determine where it falls between a centralized strategy and a distributed or decentralized plan. Although there are many components of supply-chain strategy, it makes sense to focus on the critical elements in the Saturn case because of their relevance to after-sales service: performance targets, network structure, planning process and fulfillment process.

In weighing what kind of service strategy they have or want to have, managers may find it helpful to first assess their company’s supply-chain performance targets — the targets established to meet customer needs. Different targets can be used for different products or situations, depending on the customer’s attitude toward failure of a given product. Companies with a centralized supply-chain service strategy set their sights on cost reduction and efficiency. Their principal performance target is maximum inventory turnover. In a distributed strategy, companies emphasize such service metrics as availability and rapid response.

Next, managers should look at the structure of their distribution network — that is, the number of stocking and repair sites, the location of those sites and their interrelationship. The facility-network structure used in each supply-chain service strategy should be distinct. A centralized supply chain consists of a single stocking and repair point. In some cases, a small number of centralized stock and repair locations are organized into two distinct levels or echelons — central and retail. Distributed networks, however, are considerably more complex. Typically, the company will maintain multiple stock and repair sites organized into several echelons. Strategically positioning many facilities close to each customer location or “installed base” represents a considerable investment.

Managers also should weigh the supply-chain strategy’s planning process — that is, the process the company uses to position inventory and manage the material that flows throughout the network. In a centralized strategy, planning is based primarily on visibility of point-of-sale (POS) transactions (at the retail part-consumption level) and utilizes statistically-based forecasting methods. Although central inventory resources can be shared, companies often make planning decisions for retail locations independently, looking at forecasts of local demand and lead times from the central depot or suppliers. In centralized environments, planning systems tend to be derivatives of the classic distribution-resource-planning systems that were developed to push finished goods through distribution channels.

Planning under a distributed strategy involves pull rather than push. The strategy is based on complete visibility of inventory and transactions at all locations. Forecasting is based on information such as the installed base of customer machines in each region and the underlying reliability aspects and other engineering characteristics of the products in the field. The stocking decisions are not based solely on projections of historical consumption patterns but also depend on the drivers of demand (installed base, national failure rates, market forecasts, and so on). The principal difference from a centralized strategy, however, lies in the provisioning process, where stock-level decisions for all SKUs and locations are linked and are interdependent.

Another aspect of a company’s supply-chain service strategy, the “order-fulfillment process,” is concerned with the physical processes of completing a service repair or delivering goods for a customer. In the centralized strategy, fulfillment requires little coordination among different stocking locations within the firm’s supply-chain network. Centralized strategy fulfillment focuses on the central distribution facility, its linkage to suppliers, and its role as the sole source for emergency stock backup. Centralized systems are amenable to outsourcing to third-party logistics providers.

The fulfillment process in the distributed strategy, however, is characterized by a much higher level of coordination, both within the company and across company boundaries. All locations in the network act as emergency backup sources, and pooling of stock is promoted. In distributed environments, there also is more potential to link upstream processes like product design and manufacturing to after-sales service support. The linkages can be based on programs like “design for serviceability” and total quality management, which have the goal of increasing product reliability and/or decreasing the cost (and time) for defect diagnosis and repair.

Plotting one’s own company on a strategy/criticality matrix is helpful for finding an appropriate match between a company’s service strategy and the criticality of product uptime to customers. The supply-chain strategy Saturn adopted represented a significant move from GM’s model to the distributed model. The strategy was accompanied by a market positioning of the product that promoted the quality of after-sales support to the vehicle owner. As a result, Saturn was able to obtain a match on the matrix that continues to provide the company with a clear competitive advantage. Saturn’s more-coordinated and -integrated supply-chain strategy increases the value of product ownership to customers and lowers costs for all players in the supply chain. Saturn has fine-tuned a distributed service strategy that has let it go beyond automobile-industry standard practices to exceed its competitors in multiple performance measures. The result is that Saturn has gained a significant edge in the service dimension of the industry.

Much has been said about the potential for major change in supply-chain design and management as a consequence of the Internet. Automobile manufacturers are now involved in efforts to use the Web to sell directly to customers without using dealers as middlemen. Currently, such disintermediation efforts are proving difficult to pull off for a variety of legal and strategic reasons. Our case study of Saturn indicates that dealers remain important. A partnership between an automobile manufacturer and its dealers/retailers to provide maximum service quality to vehicle owners has significant value for all members of the supply chain. Such value-creating relationships make movement away from current industry-channel structures to an e-commerce basis even less likely in the near future.

Happy Customers

For most industries, matching the right supply-chain service strategy with the criticality of the product is a survival step. In the North American computer industry, for example, many companies face multiple market segments with very different perceptions of service criticality. At one extreme are corporate customers for whom computers are mission critical and who therefore demand same-day, on-site service and will pay for it. At the other extreme are consumers who are satisfied with three-day (or longer) service-response times and are not willing to pay a premium for same-day service.

Companies struggling with a single approach for all customers are following a route that leads to inefficiency and inappropriate levels of service. A better route to follow is a targeted service-supply-chain strategy. A competitively priced product, serviced in a way that meets or exceeds expectations, will lead to customer satisfaction.

References

1. J. Ball, “Cutting In,” Wall Street Journal, May 10, 2000, p. 1.

2. M.A. Cohen and V. Agrawal, “After Sales Service Supply Chains: A Benchmark Update of the North American Computer Industry,” project report (Philadelphia: Fishman-Davidson Center for Service and Operations Management, the Wharton School, University of Pennsylvania, August 1999).

Comment (1)

Lorraine