The Fundamental Dimensions of Strategy

Napoleon Bonaparte once wrote: “Always ask your generals about your strategy, but never assemble them in the same war room.” That statement sheds light on a paradox: Whereas most strategists are assertive people, corporate strategy is a fuzzy discipline. Almost half a century after seminal works in the field, corporate strategy literature boasts at least 10 separate schools of thought1 and more than a dozen definitions that focus on rather divergent perspectives: planning resource allocation or satisfying stakeholders, stretching unique competencies or adapting to the environment, programming sophisticated management systems or muddling through emerging ideas — even sticking to simple rules. Strategy is often confused with microeconomics (“Strategy is building rent”), with finance (“Strategy is creating shareholder value”), with marketing (“Strategy is finding optimal positioning on the marketplace”) or with organizational design “Strategy is enabling emergent processes”). There are even some bizarre hybrids, such as “strategic finance” or “strategic marketing,” as if strategy were only defined vis-à-vis other disciplines. Strategic innovation often consists of importing concepts and methods from other disciplines, sometimes as distant as physics (chaos theory) or biology (organizational ecology). Scholars, executives and consultants alike know that it is problematic to explain to their students, employees or clients which decisions are strategic choices and which are just operational options.

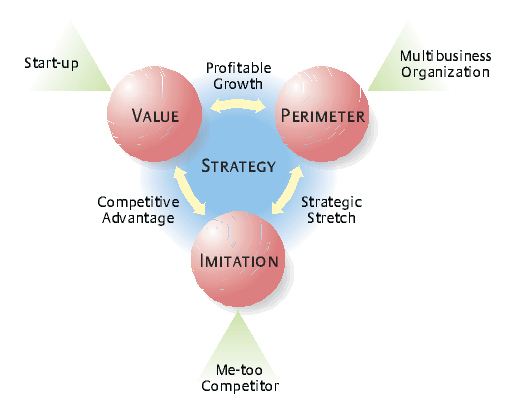

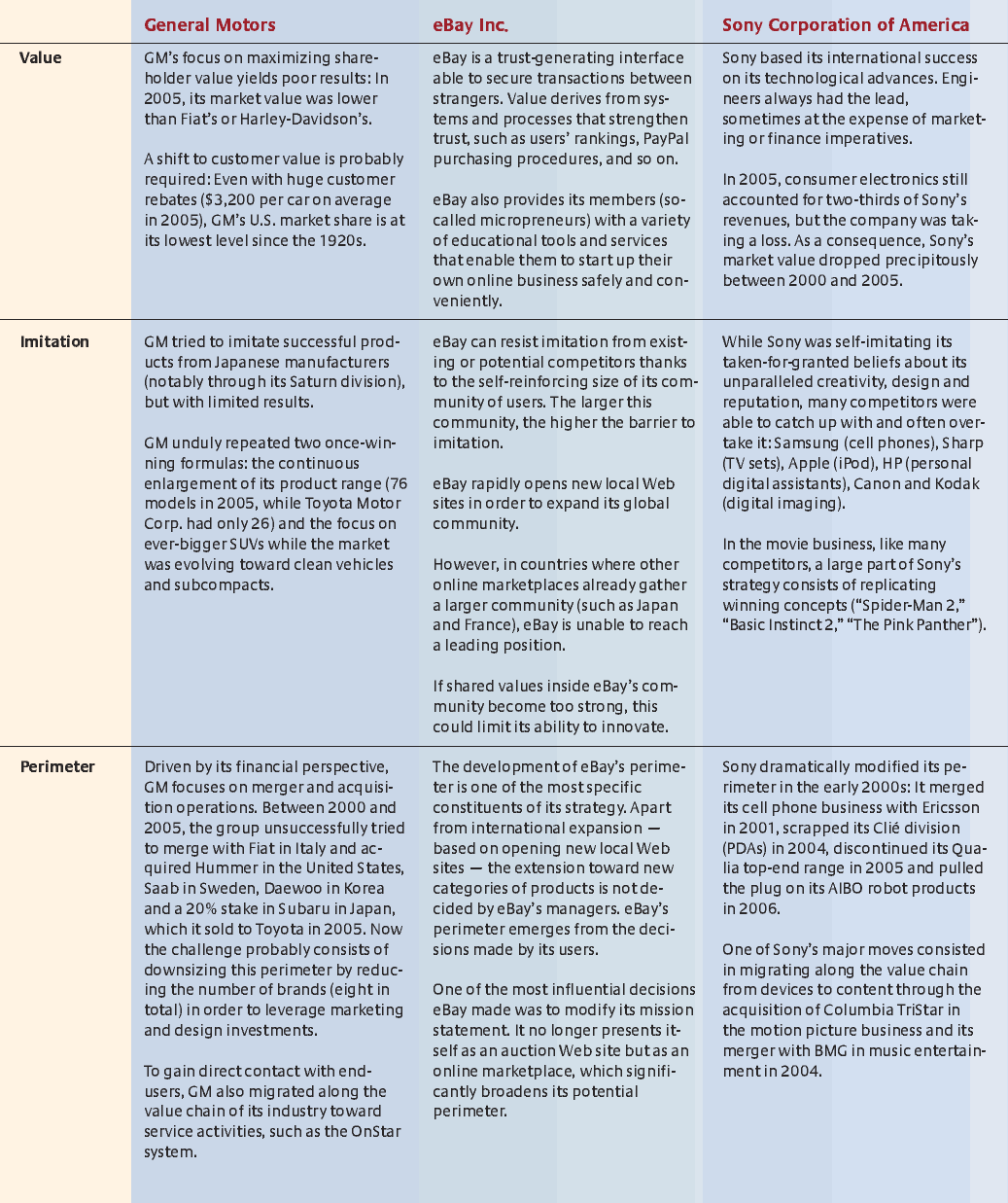

To clarify and deepen our understanding of corporate strategy, we need general guidelines that set the boundaries of the discipline, highlight its specifics and facilitate executive decisions. (See “About the Research.”) On a general level, strategy comprises three objectives: creating value, handling imitation and shaping a perimeter. (See “The Dynamics of Strategy.”)

The Why of Strategy: Value

The ability to sustain value creation, whether from the customer’s or the shareholder’s perspective, is the ultimate goal of any strategy. The essential challenge consists of defining the type of value we expect and the way we intend to share it.

Focusing corporate strategy on value creation relates to key debates on managerial ethics, agency theory and corporate social responsibility: How do you distinguish between pure financial maximization and long-term sustainability? How do you reconcile the conflicting demands of different stakeholders? What types of corporate governance structures can efficiently and fairly monitor value sharing? Must we include environmental or social externalities in our mission statement? Depending on how executives define and measure value, strategic options fall along a broad spectrum of ethical stances.

At one end of this spectrum, some organizations take the view that their only responsibility is the short-term interest of shareholders. However, high-profile corporate scandals, such as those at Enron and WorldCom in the United States, Parmalat and Royal Ahold in Europe or Livedoor in Japan, tend to prove that an exclusive focus on financial results does not necessarily align managerial and shareholder interests; on the contrary, it can give executives good reason to cheat.2

At the other end of the spectrum, some organizations are mission driven: They exclusively concentrate on demonstrating best value for their customers or users, and they do not consider financial results as goals in and of themselves. However, this stance also can lead to strategic failure by threatening the long-term survival of the organization — when a business reaches effectiveness at the expense of efficiency, it contradicts its basic purpose.

As a consequence, a sound strategy must evolve between these extremes of shareholder value and customer satisfaction, profit maximization and corporate social responsibility.

Strategy must never be confused with operational efficiency.3 It implies more than cutting costs or optimizing day-to-day processes. In a global economy, cost-cutting techniques are widely employed among competitors and therefore cannot provide long-term competitive advantage. The uniqueness of a strategy resides in value creation; increasing customer value beyond cost is the seminal assumption of corporate strategy.

The How of Strategy: Imitation

The dynamics of strategy are tightly linked to the notion of imitation. Concepts such as benchmarking, differentiation, core competencies, unique resources, institutionalism and competitive rivalry, or even game theory, organizational ecology and dynamic capabilities are all connected with the ability to prevent, implement or leverage imitation.

Defining a new business model and implementing an innovative value offer is worthless if competitors can quickly catch up. Achieving and sustaining success depends on the ability to be unique. That is why imitation is a central theme in strategy, whether it consists of building and defending a sustainable competitive advantage (how to avoid imitation) or, on the contrary, matching an innovator’s positioning (how to imitate a winning business model). Because competitors can adopt the same management techniques, implement identical software or follow similar marketing approaches, tangible resources and explicit competences no longer offer robust protection against imitators. ISO standards, Six Sigma procedures and customer relation management solutions have become threshold requirements rather than distinctive best practices. Because the value of any strategic concept resides in its ability to create competitive advantage, the concept becomes irrelevant as soon as it is extensively adopted. In a hypercompetitive context, the better a strategic idea, the shorter its life.

Imitation also plays a key role in learning processes. Innovation can be defined either as the opposite of imitation or as the unexpected result of imperfect copying. Just like organisms, languages, the arts or fashion, business models primarily mutate and evolve because of imperfect copying of existing patterns. This imperfect copying generally leads to suboptimization or even to failure, of course: Imitators usually stay behind their models. However, it sometimes randomly creates a new model that outperforms the incumbent and becomes the new dominant standard.

Self-imitation also is a major cause of strategic success or failure. Some companies, such as McDonald’s, Starbucks and Wal-Mart, based their global expansion on replicating the same elementary value creation units (shops, points of sale, etc.) in order to conquer new territories.4 Even when development does not involve this kind of direct replication, organizations exhibit a tendency to imitate themselves by sticking to accepted beliefs or experience-based wisdom. Self-imitation certainly is a critical success factor for any organization, but when a company indefinitely repeats the same successful patterns, it becomes prone to strategic drift. Because it replicates what has been successful, it limits the scope of its portfolio of resources and capabilities and truncates its ability to adapt to new circumstances. For instance, when confronted to the shift from analog to digital imaging, Polaroid Corp. was unable to question its conventional — but successful — wisdom and routines about managing innovation. Repeated success thus can lead to failure.5

Imitation can also shape entire industries. Because it makes sense for competitors to mimic successful strategies, there is a great deal of similarity between organizations in many industries. This accumulation of imitation creates an “orthodoxy” of strategy that legitimizes some competitive moves and rejects others. While this leads to a great degree of conformity, it can open up new business opportunities to competitors who dare to challenge any taken-for-granted assumptions.6 This is one of the reasons why low-cost airlines like Southwest in the United States or Ryanair and easyJet in Europe became so successful: They adopted a new perspective on their business and defined fresh strategic spaces while many established airlines were on the verge of collapsing from their conventional business models. Only when management practice encourages variety and tolerates divergent ideas does building and sustaining successful strategies become possible.

The What of Strategy: Perimeter

Beyond designing a valuable business model and managing imitation, the overarching mission of the strategist is shaping the perimeter of the organization, defining — or setting the limits of — its scope. Decisions about diversification, outsourcing, vertical integration, internationalization and positioning, as well as defining new markets untainted by competition, are all linked with the search for a profitable perimeter. Of course, strategy is not limited to choices related to the organizational scope, but conversely any alteration of the perimeter can be considered as a strategic move. When Dell Inc. decided to enter the consumer electronics business in 2003, its CEO presented this enlargement of perimeter as a major strategic change. Similarly, by divesting its Hertz Corp. subsidiary in 2005, Ford Motor Co. signaled a strategic evolution of its perimeter. Defining the perimeter addresses the never-ending debate about diversification versus refocusing.

Even if researchers disagree about the actual process — does the perimeter result from deliberate resource allocations, or does it emerge from day-to-day activities? — it is undoubtedly a central strategic issue. Indeed, the notion of perimeter addresses two fundamental questions in strategy: What business are we in, and where do we position ourselves along the value network of our industry?

The first question implies a clear definition of the overall mission statement or purpose of the organization. Depending on the answer, it can reduce marketing myopia.7 Rather than defining a business by the products the business sells, perimeter thinking defines the organization in terms of the benefits customers seek. Because Google did not consider that its perimeter was limited to Web searching, it sought to become the leader in “organizing and making accessible all of the world’s information,” just as Apple did not tie its perimeter to computers and successfully extended it to the iPod/iTunes business.

The second question addresses a company’s positioning inside the overall value chain of its industry. Defining the perimeter also relates to make-or-buy and vertical integration decisions, and therefore to choosing one’s partners, suppliers, customers and even competitors. The concept of value migration8 reminds us that because of evolving regulations, technological innovations or increasing competitive pressures, profitability can be a moving target within a value chain. Consequently, the organizational perimeter must migrate along with the locus of value.

For instance, the most valuable positioning in the computer industry during the 1970s and 1980s was to be a manufacturer. Starting in the 1990s, value began to move to both ends of the chain: upstream to components and operating systems and downstream to services and consulting. Compaq was taken over by Hewlett-Packard Co.; IBM personal computers were sold to Lenovo Group Ltd., Intel, Microsoft, Accenture and IBM Consulting Services became the new winners.

In the digital imaging industry, the global conglomerate Thomson Electronics Co., once a powerful business-to-consumer player in consumer electronics — in 1997, 85% of its revenues derived from TV sets and VCRs, notably through its RCA subsidiary — redesigned its entire business by refocusing on business-to-business activities (professional video equipment, cable decoders, modems, visual effects for the movie industry and so on). In 2004, Thomson’s television set business was sold to Chinese giant TCL to create TCL-Thomson Electronics. Thomson’s cathode-ray tube activity was sold to Videocon Industries, the Indian multinational. In only five years, the entire perimeter of Thomson evolved dramatically. Although half of its employees and one-third of its revenues vanished during this value migration, its profit margin almost doubled.

A Tool for Executives

Considering value, imitation and perimeter can be a useful tool for vetting strategic decisions. (See “How to Clarify Strategies.”) Executives can judge whether an issue can be considered strategic by deciding if it consists of designing or modifying a value system, preventing or ensuring imitation and redefining a perimeter. Decisions that have no impact on any of these dimensions or just on one dimension are not strategic. For example, if a managerial decision concerns only customer value, it is probably more related to marketing; if it is only linked with imitation, it is probably organizational design; and if it is a pure perimeter issue, it is probably related to finance. Whether applied to existing businesses or to new entries into the competitive environment, one thing is constant: True corporate strategy resides only at the crossroads of all three dimensions.

References

1. H. Mintzberg and J. Lampel, “Reflecting on the Strategy Process,”