The Hidden Costs of IT Outsourcing

The popularity of outsourcing is somewhat enigmatic. Why would companies entrust activities that are its lifeblood — information technology, human resources, and marketing and sales — to a third party? Yet according to “The 1999 Outsourcing Trends Report,” they do, outsourcing roughly one-third of those activities and roughly one-fifth of their financial affairs.1 The outsourcing business is booming. The report says nearly all companies spent more on outsourcing in 1999 than in 1998 and anticipate continued increases.

The report shows IT outsourcing leading the increase, with companies giving 38% of their IT functions to vendors. One reason is reduced cost. IT is one of the most expensive parts of the organization to establish and maintain. But a vendor with many clients can operate at a scale a single enterprise cannot. Large vendors can use more powerful equipment, for example, than can individual clients. Moreover, their size helps them negotiate with hardware and software providers.

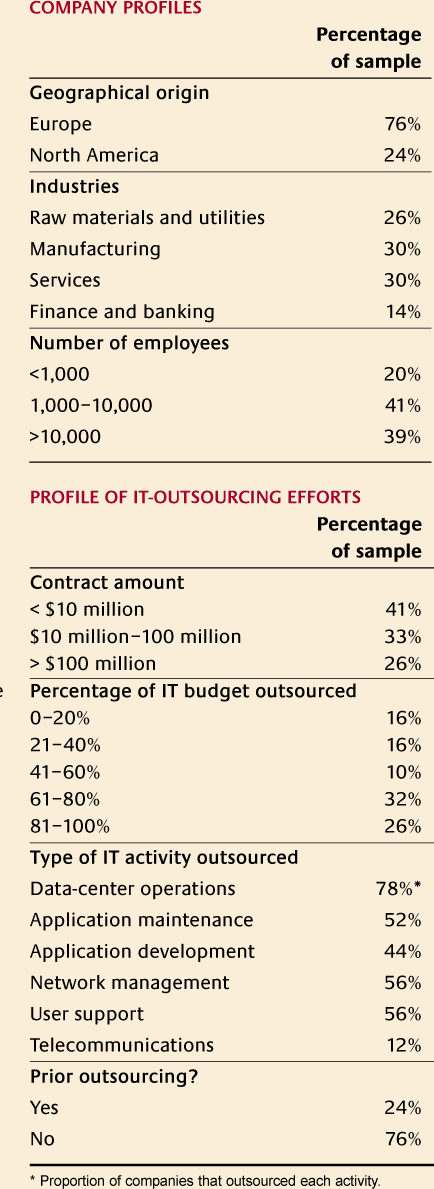

Another reason companies outsource IT is improved performance. The expertise of an in-house IT department often lags behind today’s technology. A vendor’s sole job is to follow the trends and provide leading-edge software and systems. Vendors have more expertise than their individual clients because they face more-varied issues. They also can have employees specialize in areas clients typically encounter only once, such as converting to a client-server architecture. (See “An IT-Outsourcing Survey.”)

Although the benefits of IT outsourcing are clear, they often get eaten away by costs that managers can’t pinpoint. In a survey of 50 companies, about 14% of out-sourcing operations were deemed failures. Companies say they entered an out-sourcing agreement believing that they understood all major costs. They agreed that some amount was needed for activities such as finding a vendor, drafting the contract and managing the effort, but they thought the amount would be negligible. Few businesses had thought at all about the cost of transitioning to the new vendor. The costs were not negligible — in some cases, they halved or even canceled out the company’s potential savings from outsourcing.

Most companies outsourcing IT for the first time aren’t aware of those costs. Only those who had a bad experience take preventive measures. As one manager put it, “My organization doesn’t have the kind of information that would help us evaluate these costs, and few of us have time to dig it up.”

Some companies just live with the costs, but others realize they cannot afford to be unprepared. They want to know — before the formal decision to outsource — where the money will be going and how much they can expect to spend. And after the outsourcing effort is over, they want to see the effect of those costs. Only then can they know if the effort was a success or failure.

Hidden Cost No. 1: Vendor Search and Contracting

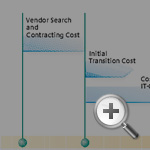

Many enterprises underestimate the expense to identify and evaluate suitable IT vendors, select a finalist, and negotiate and draft the contract. Companies incur such costs before spending the first dollar on the actual work. (See “Where Hidden Costs Occur.”) Thus it costs something just to think about IT out-sourcing. In the survey sample, that cost averaged $500,000, approximately 3% of the average total IT-outsourcing cost.

Determining Search and Contracting Cost

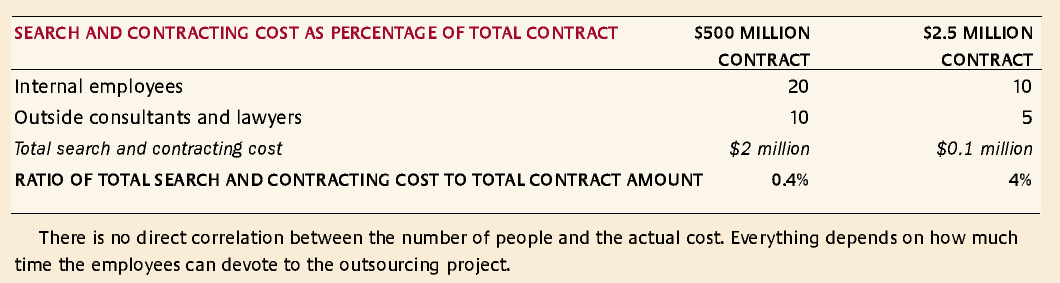

It is hard to judge the search and contracting cost from an average, because many such costs are fixed. Companies must collect similar information to determine the best vendor, whether the intended contract is $10 million or $500 million. Consequently, those costs tend to be a greater percentage of total cost for smaller contracts. (See “The Cost of Vendor Search and Contracting.”)

Reducing the Search and Contracting Cost

Companies may not want to reduce their spending for search and contracting, because it can significantly lower the other hidden costs. Additional time and expense early on helps avoid problems later, such as having to renegotiate the contract or constantly monitor the vendor to get the needed performance.

It is always cheaper to stay vague about your expectations and sign the vendor’s standard contract than to develop clear expectations and build them into the contract. It is cheaper to go with the convenient vendor, rather than research the vendor’s suitability. But it is not cheaper in the end.

Select a trustworthy vendor.

A vendor makes an outsourcing effort succeed or fail. An agreement with a trusted vendor has many advantages. A company can specify a looser contract, thereby spending less to draft it. The vendor wanting to protect its reputation is more likely to deal with any gaps fairly even if it is tempting in the short term to be opportunistic — say, by steering the client to a convenient technology rather than investing in a technology the client prefers.

The best way to know you have a trustworthy IT vendor is through firsthand information. If your vendor can handle a series of contracts involving commodity activities, such as providing programmers to give the business more flexibility in staffing-systems development, it is more likely to be able to handle sensitive IT activities, such as a company’s core applications development.2

One large European energy enterprise spent approximately two years with small deals and many vendors. The third year, it adopted a strategic approach, outsourcing to four key players. Thus it used small, low-risk contracts to spot the most proficient and the most trustworthy vendors. Only after careful selection, did it outsource a large chunk of its IT infrastructure. The strategy paid off. The company reported the vendors were “very cooperative,” a fact that made it affordable to manage four simultaneously.

Not every organization has the luxury of going through several low-risk contracts to build up trust, and some are recognizing the need to exchange vendor information. CIOs from 16 major companies with large IT-outsourcing contracts recently formed the International Information Technology Users Group to share information on emerging trends, quality issues, technology deployment and management practices.3 Members also share vendor experiences. Another source of vendor information is the trade press, although most articles are written during the vendor’s honeymoon period — and when things get worse, the details are rarely reported. Generally, the most reliable way to assess a vendor’s suitability is to interview its past and current clients.

Know what you want.

Many companies go into outsourcing with only a vague idea of what they want the vendor to do. Some amount of uncertainty is inevitable. In IT outsourcing, companies must deal with technological uncertainty. How can they write into the contract a technology that won’t become available for five years? They also must deal with volume uncertainty — the difficulty of predicting what IT needs will result from a growing or declining business or from mergers, acquisitions or sales of business units.

A large European chemical company ensured that its IT function would be up-to-date by including two clauses in the contract. The first required the vendor to spend a certain amount each year on technology improvement, with the exact improvement left open. The second stated that the vendor must use emerging and state-of-the-art technologies. However, the clauses could not provide shelter from the cost of bargaining with the vendor about specific implementations.

The approach will work in some cases, but it is typically better to have a solid idea of what you want so that the contract does not have gaps. Complete contracts specify most future contingencies and how to deal with them. They are generally easy to enforce and do not need renegotiating. The less certain a company is, the more details must be worked out later, and the higher the cost of bargaining and renegotiating.

Spend some time on the contract.

Next to the vendor itself, the contract is probably the most important part of an outsourcing effort. A vague contract with lots of open issues invites disaster. The CIO of a U.S. energy company learned that the hard way. Two years after the contract had been signed, the IT costs had increased by nearly one-half, yet the vendor had failed to meet the client’s performance objectives. The relationship had soured. When asked why, the CIO said the contract was too open to interpretation, did not precisely define the expected performance — and yet was not flexible.

Flexibility means using flexibility clauses, not omitting clauses or having vague ones. The U.S. energy company’s contract did not have a clause to address service-level reports, an omission that caused problems in managing the effort. Nor did it specify much about technology evolution or how to adjust charges when the energy company’s business requirements changed. The company was constantly bargaining for improved performance and reduced costs. The CIO had one word for the contract: “trouble.”

A U.S. tire manufacturer that outsourced its applications maintenance also learned the consequences of a rushed vendor search and poorly drafted contract. The manufacturer spent only three months and about $50,000 on finding a vendor and drafting the contract — for a $10 million agreement. Although it had never drafted an IT-outsourcing contract, it relied solely on its employees to finish the process. Predictably, the standard contract was insufficient, and constant bargaining was necessary to get performance. Two years after the operation began, the costs of managing the IT-outsourcing operation were as high as 35% of the yearly contract amount. Worse, the tire manufacturer could not walk out. Because there were no reversibility clauses, the company would have had to wait one year to replace the vendor.

The CIO of a European car-rental company said it best: “A contract is an investment whose value becomes clear only if the relationship with the supplier becomes sour.”

To help prevent trouble, companies should include two types of clauses in the IT-outsourcing contract:

- Evolution clauses apply both to technology and to the price and the scope of the outsourcing contract. The most common technology- and price-flexibility clauses are benchmarking clauses. The less standard the outsourced IT activity, however, the harder it is to find relevant benchmarks.

- Reversibility clauses are about either material reversibility or human reversibility. One gives the company the option to rebuy premises and equipment from the vendor; the other allows the company to hire employees from the vendor. Without such clauses, the company or a new vendor may have to rebuild the entire IT department.

Hidden Cost No. 2: Transitioning to the Vendor

Switching in-house IT activities to a vendor presents probably the most elusive hidden cost. Most companies don’t realize how much they’ve spent until the transition is complete. It can take months before the vendor knows as much as the internal IT department, and it is hard to say exactly when the vendor has taken over.

Most managers in the survey couldn’t analyze the transition cost. The best they could do was report transition time, a mea-sure offering only limited insight into what drives transition cost. The average transition period — when the organization actually incurred a cost — was about a year. For 70% of the companies, the period was longer than 10 months. The surveyed companies that had completed their transition reported approximately the same time for transitioning as those still in the process — indicating that actual duration is close to expected duration.

Determining Transition Cost

Transition costs are elusive: A company incurs them as long as the vendor has not completely taken over from the internal IT department. The time that internal employees spend helping the vendor are transition costs. Costs that stem from disruption — and from the vendor’s inability to react as quickly and appropriately as the internal department did at the beginning of the contract —are transition costs.

The characteristics of the outsourced activity greatly influence transition cost. The more idiosyncratic the activity (the more tailored for the specific company), the higher the cost to pass it to a vendor that must take time to learn the activity. Outsourcing commodities such as PC procurement and maintenance entails lower transition costs.

Also, the more complex the outsourced activity, the harder the transition. A European bank outsourced a telecommunications network that covered 50 countries. The bank did not realize how complex the transition would be. The vendor could not manage it alone, and the bank had to hire extra specialists.

Outsourcing activities that require transferring many people to the vendor also increase transition costs. The transferred employees often feel betrayed. They can resist outsourcing initiatives either directly (a European retailing company’s IT employees went on strike for three weeks) or indirectly (by lowering their productivity).

Reducing Transition Cost

The first step in decreasing transition cost is to be aware of it. Companies would be well advised to avoid outsourcing activities that are idiosyncratic and to keep key IT employees in-house. If transfers are inevitable, the company should work hard to keep the goodwill of both the transferred employees and the retained employees because of their in-depth knowledge of the outsourced activity. Businesses also should specify a waiting period to ensure that transferred employees will not move too quickly to the vendor’s other clients.

Transition costs are also lower when a company knows what it wants from the outsourced activity. Then it can communicate its needs effectively to the vendor, smoothing the transition. And as might be expected, lower costs can follow simply from having experience with IT outsourcing.

Hidden Cost No. 3: Managing the Effort

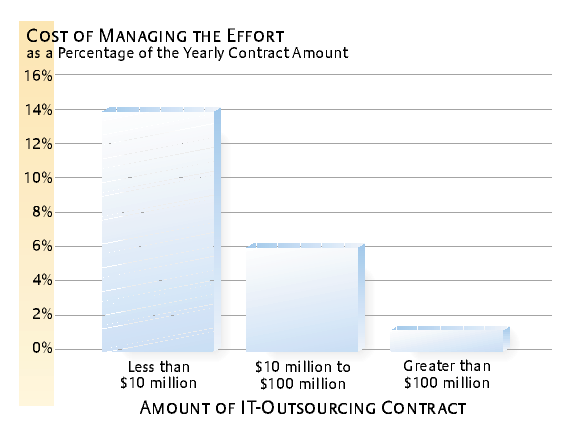

Managing the effort probably represents the largest category of hidden costs because it covers three areas: monitoring to see that IT vendors fulfill their contractual obligations, bargaining with IT vendors (and sanctioning them if necessary), and negotiating any needed contract changes. (See “Cost To Manage the Outsourcing Effort.”) The costs average $300,000 per year, approximately 8% of the yearly contract amount.

Determining the Cost of Managing Vendors

Unlike outsourcing fees, vendor-management costs for IT outsourcing are not readily apparent. A company knows what it pays to the vendor. Indeed, many businesses outsource to find out how much they pay for IT. Management costs, in contrast, are purely internal. Because of the costs’ relative obscurity, many companies don’t take them into account until they become visible — usually when the overall outsourcing cost has noticeably escalated.

A U.S. oil company outsourced a large part of its IT infrastructure (including PC procurement, help desk, end-user support, asset management, selected server support, micro-data-center operations and PC software configuration). The outsourcing fees were 7% to 8% lower than internal IT costs before out-sourcing. The vendor also instituted improvements such as better control of expenses and had offered access to competencies not available internally.

Nevertheless, the company viewed the outsourcing effort as barely satisfactory. The five-year contract was $12 million per year. The management cost was estimated at almost 17% of that — $2 million per year. For a comparable contract, the average is closer to 6%. Instead of saving money on IT, the company ended up paying more. The high costs stemmed from the company’s attempt to manage four IT vendors simultaneously without anticipating any additional management cost.

Reducing the Cost of Managing Vendors

IT-outsourcing experience obviously reduces the cost of managing the relationship. The more a company has dealt with IT vendors, the faster it can assess a vendor’s performance. British Petroleum Exploration (BPX) substantially decreased its time to negotiate vendor-performance goals. Its initial negotiations with the vendors took two months in 1993; subsequent negotiations in 1994 took one week, and in 1995 they took a single afternoon. BPX had learned a lot in setting performance targets, and the vendors had gained a greater understanding of BPX’s expectations.4

Another way to reduce costs is to cultivate trust in the vendor relationship. Trust is the antidote to opportunism. When the relationship between the client and its vendor is adversarial, the vendor will take advantage of gaps in the agreement. When there is mutual trust, vendors often work hard to deal fairly with the gaps.

A company can promote trust by: making sure that both sides’ objectives are clearly understood; fostering good communication through discussion of potential problems as soon as they arise and through collaboration on problem solving; and striving for frequent face-to-face meetings. If personal contact is frequent enough, companies can have a relationship like an in-house IT relationship. The CIO of a Canadian grain-collection and grain-transportation company meets at least once daily with the vendor. “I see the contract as only a protection tool in case a conflict arises.”

With determination, companies can build trust even if the relationship has problems. A European carrental company and its vendor had an adversarial relationship. A newly appointed CIO pointed out to the vendor that animosity was detrimental to both sides and that communication was better. The company now has informal contacts with the vendor every other day and formal meetings every two weeks; the relationship has become more collaborative. Although the contract did not demand it, the vendor agreed to pay a penalty for each system breakdown.

Hidden Cost No. 4: Transitioning After Outsourcing

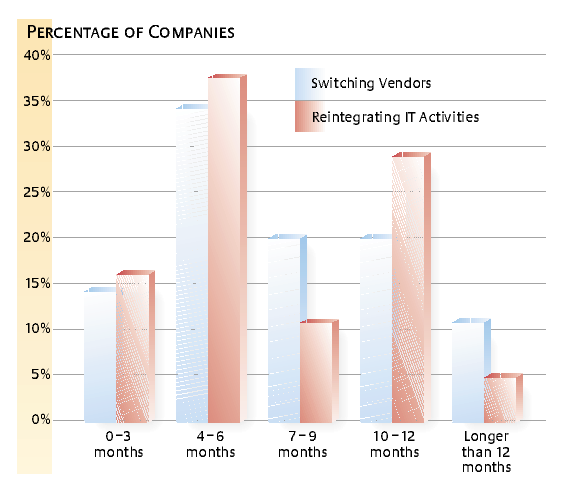

The fourth hidden cost comes from switching vendors or reintegrating IT activities internally — an expense managers find hard to quantify. Most managers are reluctant to think about the end of the contract. Outsourcing IT to focus on a company’s core business or to cut costs is generally meant to be permanent. Companies do not plan to reintegrate IT. Even switching vendors is a move they prefer to avoid.

Thus, regardless of how the contract ends, the end signifies a failed outsourcing effort. Most managers find it hard to consider that possibility. (See “How Transition Time Compares.”)

Determining the Cost of Transitioning After Outsourcing

When activities must be redirected to a new vendor, the cost involves finding that vendor, drafting a new contract and transitioning resources. When activities must be reintegrated, the cost involves building a new internal IT activity from scratch. The time needed is roughly the same regardless of the kind of transition.

Reducing the Cost of Transitioning After Outsourcing

The best defense against the post-outsourcing transition cost is awareness of it. Companies seldom realize how difficult and costly it is to end an IT-outsourcing contract. That knowledge may make some companies less eager to outsource in the first place. Another defense is to insert reversibility clauses in the contract so that a transition doesn’t drag on.

Calling back employees transferred to the vendor when the activity was first outsourced can ease the transition. Hardware and software also must be brought back in-house or transferred to another vendor.

Keeping a sufficient level of IT expertise inside the company is another way to reduce costs at the end of the contract. A European department store outsourced half its IT budget (data-center operations and applications maintenance), transferring 85 of its 100 employees to the vendor. The CIO then quickly replaced with more-proficient personnel seven of the 15 who remained. The strategy was to have a top internal team with enough IT expertise to both manage the vendor and handle any change of outsourcing scope or a vendor switch.

What Influences Hidden Costs?

Much current literature says that the cost of outsourcing varies with the kind of activity outsourced. Generally, applications development is considered the most expensive to out-source, whereas data-center operations and mainframes are considered the least costly. In the companies surveyed, however, the type of outsourced activity had less effect on hidden costs than the value of the IT activity to the company, how well the company understood it and the company’s level of outsourcing experience.

Outsourcing Idiosyncratic IT Activities

Physical resources and human resources can be idiosyncratic. Specialized equipment, operating procedures and systems tailored to a single company’s requirements are examples of idiosyncratic physical resources. Expertise that internal IT personnel have acquired through years of training and knowledge — expertise that is useful only in the context of a single organization — is an example of idiosyncratic human resources. Despite the emergence of industry-standard platforms and shared services, the need for both kinds of resources remains strong.

Transferring such resources to an outside vendor and then trying to switch vendors or reintegrate the outsourced activity invites problems. The Montreal Urban Community, known as MUC, discovered that when it outsourced its entire IT department. The organization failed to retain the most idiosyncratic human resource of all — anyone with general architecture expertise who could manage the connections between IT and the rest of the organization.

At the time of contract renewal, a new vendor made such an attractive offer that MUC decided to switch vendors. But it quickly discovered that many IT activities required specialized knowledge about the organization. Because the new vendor did not have that knowledge, MUC’s IT was paralyzed for two months.5

Problems also arise when a company that has out-sourced idiosyncratic IT activities wants to reintegrate those activities at the end of a contract. Then companies find they have no one left with the expertise to manage an internal IT department.

In contrast, a U.S. automotive supplier that out-sourced highly standardized systems felt confident it could reintegrate the activity in less than six months, had it chosen to do so. Moreover, because it knew ahead of time that it would not incur much transition cost, it spent only 1% of its $1.5 million contract on vendor search and contracting — and slightly less than 4.5% of the yearly contract amount on managing the effort. Both those percentages are low for a contract of that size, the average being 6% and 14%, respectively.

Outsourcing Critical IT Activities

An IT activity is “critical” when it helps distinguish a company from its competitors in products and services as well as performance. For example, a critical IT activity for a bank would be its communications network.

It is best not to outsource critical activities, because doing so can threaten a company’s future. The demise of the U.S. consumer-electronics industry has been attributed to extensive outsourcing of the production activity to Japanese vendors.6 A company that decides to outsource critical activities, perhaps to access outside expertise, can expect high hidden costs. Some can be managed, but the search and contracting costs will be high.

A U.S. company in the managed-care industry outsourced activities that the vice president of computer and operations services deemed critical. The activities contributed to the company’s overall profitability, enabled it to differentiate itself from its competitors, and had numerous operational links with the company’s other activities.

Recognizing that the operation could entail tremendous vendor-management costs, the company involved 40 people in the vendor search and prepared an airtight contract. However, although the company was able to keep management costs at a reasonable level, the activities’ critical nature meant that switching vendors or reintegrating the activities could take two years. The company was locked into its vendor relationship.

Level of Outsourcing Experience

Experience with IT outsourcing is a sure way to reduce hidden costs. A European car-leasing company put what it had learned from its disastrous first outsourcing effort to good use by drafting a much clearer contract the next time. The new contract was easier and less costly to enforce. In fact, the vendor-search and contracting cost represented only 1% of the total contract — a full 5% lower than the average for a comparably sized contract.

But not many companies want to accumulate IT-outsourcing experience through trial and error. So it is worth the additional cost to contract with outside experts who can maneuver the organization through common outsourcing pitfalls. Legal experts can help write the outsourcing contract and negotiate with the vendor. Technical experts can help develop precise measures, such as service-performance level. Many companies balk at taking those steps, because they increase vendor-search and contracting costs. But if a business lowers its vendor-management costs and the cost to transition the IT activities to a new vendor or back in-house, the extra expense is worth it.

Another way to gain experience is to hire people who have managed an outsourcing effort. According to a recent study, most companies would be willing to pay a premium of 6% or more to such managers.7 The study goes on to state that managers seldom explicitly mention such expertise in résumés. Hence companies should watch for managers with experience in outsourcing, joint-venture management, or leading multiskilled or cross-functional teams.

Shared Outsourcing Knowledge

Even a little experience is worth sharing, but companies seldom have the time or budget to spread expertise companywide, so it remains largely isolated in the activity that was outsourced. That is unfortunate because what drives hidden outsourcing costs is nearly independent of activity type. For example, the same contractual expertise is required for drafting an internal auditing contract or an applications-maintenance contract. However, in most companies, the finance and IT departments would not share out-sourcing experiences.

Companies that use outsourcing a lot could set up a department devoted to capitalizing on outsourcing-management expertise. When the company considers outsourcing an activity, the project team could draw on that expertise instead of having to pay consultants. In-house talent would be more valuable than outside experts because it would understand the company’s specific needs better.

As companies become increasingly virtual, knowledge about outsourcing and vendor management will be increasingly crucial. Capitalizing on the expertise accumulated throughout the organization will be an important strategic challenge.

Don’t Underestimate the Costs

All too often, companies neglect the hidden costs of IT outsourcing. Consider this statement by the manager of a company that considers its outsourcing a success: “We never anticipated the management resources and time, and thus cost, that we have had to put in. Perhaps it is fortunate that companies rarely record the costs of management.”8

But overlooking the hidden costs is unwise. Although the outsourcing efforts the survey covered differed in degree of success and failure, operations that were plagued with large hidden costs were never successful.

A better approach is to manage the four costs proactively and holistically and to spend extra time and resources in the early stages of the outsourcing effort. (See “Reducing the Hidden Costs.”) Knowing what you want and spending time on the contract can help curb the cost of managing the initiative and of transitioning outsourced activities when the contract ends. Contracts with well-articulated expectations and clear performance measures decrease the costs of bargaining with the IT vendor. Taking time to select a trustworthy vendor also can reduce the transition cost.

Companies that invest time and resources in the early stage are more likely to have successful outsourcing experiences. Those that aren’t getting as much as they had hoped for from outsourcing should take a hard look at the time they spent in that critical early period.

References

1. “The 1999 Outsourcing Trends Report” (New York: Michael F. Corbett & Associates Ltd., 1999) reflects the opinions of a wide variety of U.S. private- and public-sector executives and industry experts.

2. P. Ring and A. Van de Ven, “Structuring Cooperative Relationships Between Organizations,” Strategic Management Journal 13 (1992): 483–498.

3. B. Caldwell, “CIO Group With Clout — Exclusive Group Holds $60 Billion in Outsourcing Deals,” InformationWeek, June 23, 1996, www.techweb.com.

4. J. Cross, “IT Outsourcing: British Petroleum’s Competitive Approach,” Harvard Business Review 74, no. 3 (May–June 1995): 94–102.

5. B. Aubert, S. Rivard and M. Patry, “A Transaction Cost Approach to Outsourcing Behavior: Some Empirical Evidence,” Information and Management 30 (1996): 51–64.

6. R. Bettis, S. Bradley and G. Hamel, “Outsourcing and Industrial Decline,” Academy of Management Executive 6, no. 1 (February 1992): 7–22.

7.M. Useem and J. Harder, “Leading Laterally in Company Outsourcing,” Sloan Management Review 41, no. 2 (winter 2000): 25–36.

8. M. Earl, “The Risks of Outsourcing IT,” Sloan Management Review 37, no. 3 (spring 1996): 26–32.

ADDITIONAL RESOURCES

The importance of good contracts is addressed in C. Saunders, M. Gebelt and Q. Hu’s 1997 California Management Review article “Achieving Success in Information Systems Outsourcing.” The article shows that — if companies write tight contracts — IT outsourcing can be successful even when information systems are considered core functions. “The Information Systems Outsourcing Bandwagon,” by M. Lacity and R. Hirshheim in the fall 1993 Sloan Management Review, provides practical advice for negotiating contracts and suggests that IT outsourcing does not always lead to cost reductions.

Several additional MIT Sloan Management Review articles offer helpful guidance on strategic outsourcing — deciding what to outsource and what to keep in-house. M. Lacity, L. Willcocks and D. Feeny’s spring 1996 “The Value of Selective IT Outsourcing” explains that outsourcing only some IT activities generally yields better results than outsourcing an entire IT department. A. DiRomualdo and V. Gurbaxani’s “Strategic Intent for IT Outsourcing,” in the summer 1998 issue, distinguishes among three kinds of strategic intent: improve IT, improve IT’s contribution to company performance and commercially exploit IT to generate new revenues. J. Quinn and F. Hilmer’s summer 1994 “Strategic Outsourcing” defines strategic outsourcing as outsourcing noncore activities and focusing on core activities. The authors present tools that help managers determine which activities fall into which categories.

Two sources offer foundational reading on transaction-cost economics (TCE), which holds that economic activity depends on balancing production economics against transaction costs. In TCE terminology, IT-outsourcing fees are production costs; the hidden costs of IT outsourcing are transaction costs. R. Coase’s seminal article “The Nature of the Firm,” published in Economica in 1937, introduces TCE, and O.E. Williamson’s 1985 Free Press book, “The Economic Institutions of Capitalism,” develops Coase’s ideas.

Comments (2)

rusell william

P. Weiss