Reducing the Risk of Supply Chain Disruptions

Most managers know that they should protect their supply chains from serious and costly disruptions — but comparatively few take action. The dilemma: Solutions to reduce risk mean little unless they are evaluated against their impact on cost efficiency.

For supply chain executives, the early years of the 21st century have been notable for major supply chain disruptions that have highlighted vulnerabilities for individual companies and for entire industries globally. In addition to taking many lives, the Japanese tsunami in 2011 left the world auto industry reeling for several months. Thailand’s 2011 floods affected the supply chains of computer manufacturers dependent on hard disks and of Japanese auto companies with plants in Thailand. The 2010 eruption of a volcano in Iceland disrupted millions of air travelers and affected time-sensitive air shipments.

Today’s managers know that they need to protect their supply chains from serious and costly disruptions, but the most obvious solutions — increasing inventory, adding capacity at different locations and having multiple suppliers — undermine efforts to improve supply chain cost efficiency. Surveys have shown that while managers appreciate the impact of supply chain disruptions, they have done very little to prevent such incidents or mitigate their impacts.1 This is because solutions to reduce risk mean little unless they are weighed against supply chain cost efficiency. After all, financial performance is what pays the bills.

Supply Chain Efficiency vs. Risk Reduction

Supply chain efficiency, which is directed at improving a company’s financial performance, is different from supply chain resilience, whose goal is risk reduction. Although both require dealing with risks, recurrent risks (such as demand fluctuations that managers must deal with in supply chains) require companies to focus on efficiency in improving the way they match supply and demand, while disruptive risks require companies to build resilience despite additional cost.

Disruptive risks tend to have a domino effect on the supply chain: An impact in one area — for example, a fire in a supply plant — ripples into other areas. Such a risk can’t be addressed by holding additional parts inventory without a substantial loss in cost efficiency. By contrast, recurrent risks such as demand fluctuations or supply delays tend to be independent. They can normally be covered by good supply chain management practices, such as having the right inventory in the right place.

Since the mid-1990s, managers have become much better at managing global supply chains and mitigating recurrent supply chain risks through improved planning and execution. As a result, the 1990s saw big jumps in supply chain cost efficiency. However, reliance on sole-source suppliers, common parts and centralized inventories has left supply chains more vulnerable to disruptive risks. Although sourcing from or outsourcing to distant low-cost locations and eliminating excess capacity and redundant suppliers may make supply chains more cost efficient in the short term, such actions also make these supply chains more vulnerable to disruptions — with potentially damaging financial implications when they occur. Low-cost offshore suppliers with long lead times leave companies vulnerable to long periods of shutdown when particular locations or transportation routes experience problems.

How should executives lower their supply chain’s exposure to disruptive risks without giving up hard-earned gains in financial performance from improved supply chain cost efficiency? Disruptions are usually well beyond a manager’s control, and dealing with them can affect a supply chain’s cost efficiency. To avoid increased costs, a manager might choose to do nothing to prepare for “acts of God” or force majeure. The alternative is to reconfigure supply chains to better handle disruptions, while accepting any effects on cost efficiency. In many instances, it is not an all-or-nothing proposition. Companies could elect to deploy different strategies in different settings or at different times. (See “About the Research.”)

Get Updates on Transformative Leadership

Evidence-based resources that can help you lead your team more effectively, delivered to your inbox monthly.

Please enter a valid email address

Thank you for signing up

In an earlier MIT Sloan Management Review article,2 we considered different supply chain configurations for risk and performance. We discussed different mitigation strategies that companies could tailor to the type and level of risk they faced. To implement those strategies we find, broadly speaking, that today’s managers have two choices for achieving lower risk in the supply chain: They can reduce risk while also improving supply chain efficiency — a “win-win” – or they can reduce risk while limiting the impact on supply chain cost efficiency.

Reduce the Risk and Improve the Performance

Supply chains often comprise a huge number of products or commodities that are sourced, manufactured or stored in multiple locations, thus resulting in complexity. Complexity can mean reduced efficiency as managers struggle with the day-to-day risks of delays and fluctuations, and it can lead to increased risk of disruption, in which dependencies between products can bring everything to a halt. Controlling the amount of complexity can therefore lead to higher cost efficiency and reduced risk, which is a win-win. Let’s begin by considering risk.

Managers can reduce risk by designing supply chains to contain risk rather than allow it to spread through the entire supply chain. The design of an oil tanker provides a fitting example of how good design choices can reduce fragility. Early oil tankers stored liquid cargo in two iron tanks linked together by pipes. But having two large storage tanks caused major stability problems; as the oil sloshed from one side of the vessel to the other, tanker ships were prone to capsizing. The solution was to design tankers with more compartments. Although such ships were more expensive to build, this approach eliminated the stability problem.

In a similar vein, executives need to ensure that the impact of supply chain disruptions can be contained within a portion of the supply chain.3 Having a single supply chain for the entire company is analogous to having an oil tanker with a single cargo hold: It may be cost effective in the short run, but one small problem can cause major damage.

In general, containment strategies are aimed at limiting the impact of a disruption to one part of the supply chain (in other words, like one hold in an oil tanker). For instance, a car company might have multiple supply sources for common parts or restrict the number of common parts across different car models as a way to reduce the impact of a possible recall or a parts shortage. We suggest two strategies for reducing supply chain fragility through containment while simultaneously improving financial performance: (1) segmenting the supply chain or (2) regionalizing the supply chain. In addition, we suggest how companies can design business continuity plans or respond to disruptive risk incidents using these strategies.

1. Segment the supply chain.

The story of Zara’s success using responsive sourcing from Europe is well known. Less known is the fact that as early as 2006, Zara, a clothing and accessories retailer based in Arteixo, Spain, was getting half its merchandise from low-cost suppliers in Turkey and Asia.4 What motivated this move to lower-cost countries? As Zara grew, it realized that producing everything in high-cost locations in Europe was not helping increase margins. Although it made sense to source the trendiest items from European factories that could produce them rapidly for European customers, basic items such as white T-shirts did not justify the same level of responsiveness. So Zara began to source some products from lower-cost locations. In doing so, it also reduced the impact of a potential disruption, since not all items would be affected by a disruption in one geographic area.

Large companies can segment their supply chains to improve profits and reduce supply chain fragility. For high-volume commodity items with low demand uncertainty, the supply chain should have specialized and decentralized capacity. For its fast-moving basic products (typically, low margin), it may be worthwhile to do what Zara does: Source from multiple low-cost suppliers. (See “Segmenting the Supply Chain.”) This reduces cost while also reducing the impact of a disruption at any single location, because other suppliers are producing the same item. For low-volume products with high demand uncertainty (typically, high margin), companies can take a different approach and keep supply chains flexible, with capacity that is centralized to aggregate demand.

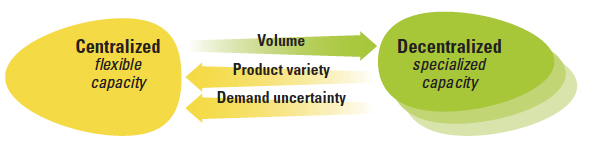

Segmenting the Supply Chain

The supply chain can be segmented using volume, product variety and demand uncertainty. Higher volume favors decentralizing (with more segments), as there is little loss in economies of scale. But significant product variety often goes hand-in-hand with low volumes of the individual products, so centralizing (with fewer segments) is needed. High demand uncertainty also requires centralizing to achieve reasonable levels of performance.

Even when production is centralized, the supply chain needs to be flexible to avoid concentrating risk in a single plant or production line. For example, to protect itself against supply disruption, Zara’s European operations are set up so that multiple facilities can produce even low-volume items. Practically speaking, this level of segmentation may not be feasible for small companies lacking sufficient scale.

W.W. Grainger Inc., which distributes industrial supplies to businesses, offers another example of reducing risk by segmenting the supply chain. The Lake Forest, Illinois-based company has about 400 stores in the United States. In an effort to reduce transportation costs, it keeps its fastest-moving products at the stores and at nine distribution centers. However, the slower-moving items are warehoused at a distribution center in Chicago. This segmentation reduces fragility by isolating the impact of disruptions and creating supply backups. Similarly, Amazon.com Inc. has expanded its number of U.S. distribution centers to be closer to consumers. Like Grainger, Amazon maintains inventory of its most popular items in the distribution centers and tends to hold slow-moving items more centrally.

Supply chains can and should evolve over time in response to product life cycles or experience with a new market.5 Early, when sales are low and demand uncertainty is high, managers can pool recurrent risk and minimize supply chain costs by centralizing capacity. But, as sales increase and uncertainty declines, capacity can be decentralized to become more responsive to local markets and reduce the risk of disruption.

In addition to separating products with different risk characteristics, managers should consider treating the more as well as the less predictable aspects of demand separately. They should view such an approach not only as a way to cut costs but, more importantly, as a way to lessen the risk of disruption. Some utility companies use this approach. They employ low-cost coal-fired power plants to handle predictable base demand, and they then shift to higher-cost gas- and oil-fired power plants to handle uncertain peak demand. Having two or more sources of supply reduces the impact of disruption risk from a single production facility.

2. Regionalize the supply chain.

Containing the impact of a disruption can also mean regionalizing supply chains so that the impact of losing supply from a plant is contained within the region. Japanese automakers didn’t follow this approach and paid a heavy price when the 2011 tsunami hit. Plants worldwide were affected by a shortage of parts that could be sourced only from facilities in the tsunami-affected regions of Japan.

Since rising fuel prices increase transportation costs, regionalizing supply chains provides an opportunity to lower distribution costs while also reducing risks in global supply chains. During periods of low transportation costs, global supply chains attempted to minimize costs by locating production where the costs were the lowest. However, as events like the Japanese earthquake showed, this approach can mean increased fragility, as the impact of any disruption can be felt across the entire supply chain.

As transportation costs rise, global supply chains may be replaced by regional supply chains. Like those of other companies, consumer goods producer Procter & Gamble Co.’s supply chains were designed in the 1980s and 1990s, when oil was about $10 a barrel. At the time, P&G designed a more centralized production network with the primary objective of keeping capital spending and inventories to a minimum. With oil prices much higher today, the most cost-effective network is more distributed, with multiple plants even within a single country like China.6

In addition, growing demand in emerging economies has caused some companies, such as London-based Diageo plc, the world’s largest distiller, to rethink their production and distribution networks from the ground up. In an effort to profitably increase its market share, Diageo is abandoning its global supply chain in favor of regional supply chains with local sourcing and distribution, often organized at a country level.7 Regionalizing often helps companies reduce costs while also containing the impact of disruptive events such as natural disasters or geopolitical flare-ups to a particular region. In the event that there is a problem, affected markets can be served temporarily by supply chains in neighboring regions.

In many product categories, companies are deciding to regionalize their supply chains to serve even developed markets. For example, Polaris Industries, a maker of all-terrain vehicles based in Medina, Minnesota, considered locating a plant in China to serve its market in the southern United States. But it ultimately decided to locate the plant in Mexico to save on transportation costs and allow for greater responsiveness. Similarly, some Chinese and Indian textile manufacturers are setting up plants in the United States despite the low labor costs at home. Although companies decide to regionalize supply chains to achieve lower costs, they also consequently “de-risk” their overall supply chain.

Managers need to respond to supply chain disruption incidents when these do occur, but how they respond will depend on how they have configured the supply chain. Researchers have identified three stages of response:8 (1) detecting the disruption, (2) designing a solution or selecting a predesigned solution and (3) deploying the solution.

Given that many companies have invested in a variety of information technology systems for monitoring material flows (such as delivery and sales) and information flows (such as demand forecasts, production schedules, inventory level and information about quality) to ensure performance and manage recurrent risks, another win-win strategy is to leverage these systems to contain the impact of supply chain disruption incidents by ensuring the company can react quickly to such incidents. Such IT systems can be a win-win: They can reduce the impact of risk incidents by enabling a quicker response by screening for possible disruptions. To leverage the benefit further, the time required to design supply chains can be significantly shortened if a company and its partners can develop contingent recovery plans for different types of disruptions in advance. Li & Fung Ltd., a Hong Kong-based contract manufacturing company, has a variety of contingent supply plans that enable it to shift production from a supplier in one country to another supplier in a different country.

Building on the two containment strategies described above, detection, design and deployment become simpler and faster when the supply chain is segmented or regionalized. When supply chains are regionalized, the design time and necessary deployment time for backup supply can be reduced. Whereas a supply chain focused on improvements in cost efficiency may find itself without a backup in the event of a disruption, segmented or regionalized supply chains are more likely to have backup sources for critical parts or commodities. Thus, managers with segmented and regionalized supply chains can design and deploy solutions fairly quickly in the event of a disruption. For example, the International Federation of Red Cross and Red Crescent Societies holds inventories of vital goods in four geographically separate logistics centers to facilitate responses to earthquakes and other humanitarian disasters in any part of the world.9 While maintaining the same inventory in multiple locations may seem extravagant, a less-distributed model would not be able to respond as quickly or efficiently. What’s more, the supply chain itself is more robust — in case one of the logistics centers suffers a calamity.

Reduce Risk While Limiting the Impact on Cost Efficiency

In many instances, reducing disruption risk involves higher costs. In fact, the reason executives are reluctant to deal with supply chain risk comes from the perception that risk reduction will reduce cost efficiency significantly. However, managers can do much to ensure that loss of cost efficiency is minimal while the risk reduction is substantial by avoiding excessive concentration of resources like suppliers or capacity. And nudging trade-offs in favor of less concentration by overestimating the probability of disruptions can be much better in the long run compared to underestimating or ignoring the likelihood of disruptions.

1. Reduce the concentration of resources.

A direct consequence of making global supply chains more efficient and lean has been the increase in fragility. The billions of dollars of lost sales and costs that Toyota Motor Corp. incurred in the wake of its product recalls in 2010 were a direct consequence of a supply chain that relied on using a single part, sourced from one supplier, in many car models. Although using a common part helped Toyota reduce costs, it became the supply chain’s Achilles’ heel.

Companies often manage their day-to-day recurrent risks by “pooling” inventory and capacity by having fewer distribution centers or plants or by having common parts. More pooling reduces the supply chain cost incurred to mitigate recurrent (as opposed to disruptive) risks; the greater the total amount of pooling of parts and capacity, the greater the total benefit. It is important to realize, however, that pooling provides diminishing marginal benefits when dealing with recurrent risk.10 Simultaneously, increased pooling can make the overall supply chain more vulnerable to disruption risk. As the Toyota case illustrates, the use of common parts produced by a single supplier in many models can magnify the impact of a quality-related disruption.

Should managers seek to make their supply chains more lean and efficient by concentrating common parts and single suppliers, or should they seek to reduce disruptions and back off from trying to be more lean and efficient? To answer this question, it is important to recognize that pooling recurrent risks by, say, reducing the number of distribution centers, has diminishing marginal returns for supply chain performance while increasing the supply chain fragility and hence the additional risk of disruptions. When an auto manufacturer has no common parts whatsoever across different models of cars, building some degree of commonality offers significant benefits. But the marginal benefits grow smaller as more parts are made common. Conversely, going from one distribution center to two can dramatically reduce fragility without significantly losing too many of the benefits of pooling recurrent risks; this is especially true for large companies.11 (See “Decentralization and Costs.”) It is therefore possible to achieve an optimal point in pooling resources by way of parts commonality or fewer plants or distribution centers. This keeps recurrent risks low by pooling the resource and also keeps fragility of the supply chain low by not taking pooling to extremes.

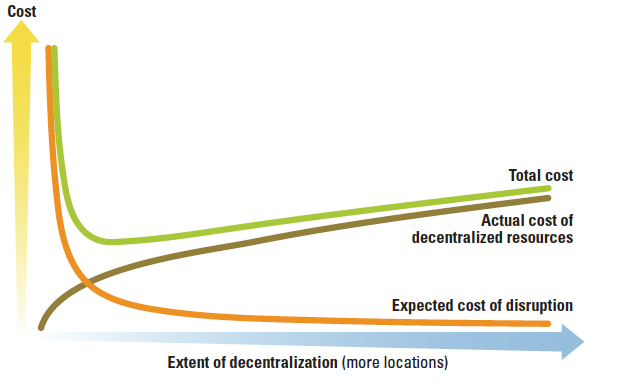

Decentralization and Costs

The actual cost of a resource goes up as a result of having multiple warehouses requiring more inventory, while the expected impact of a disruption goes down. Going from right to left, the total cost decreases as we centralize or pool the resource, but the cost jumps up as we centralize beyond a certain point. Thus, using a single supplier or a single warehouse adds cost.

Thus, executives need to keep in mind that dealing with recurrent risks in the supply chain shifts the balance toward more centralizing of resources, pooling and commonality of parts, whereas dealing with rare disruptive risks pushes the balance in the opposite direction. Finding the right balance for recurrent risks requires evaluating the costs of increasing or decreasing inventory, capacity, flexibility, responsiveness and capability, and centralizing or decentralizing inventory and/or capacity.12 However, managing disruptive risks will require designing supply chains where the resource in question (say, parts inventory or the number of suppliers) is never completely centralized. This is why companies such as Samsung Electronics Co. Ltd. always aim to have at least two suppliers, even if the second one provides only 20% of the volume.13

The implications of these principles are obvious. When the cost of building a plant or a distribution center is low, having multiple facilities in different locations reduces the supply chain’s risks without significantly increasing costs. In general, this is true when there are no significant economies of scale in having a large plant or when having inventory in the distribution center is relatively cheap. But even when economies of scale are significant enough to warrant having a single source to address recurrent risks or the cost of maintaining inventory is high, extreme concentration should still be avoided due to the potential impact of disruptive risks. Ignoring or underestimating the possibility of disruption can be very expensive in the long run, as it means having all of your eggs in one basket. Having even two baskets, while adding to the cost, greatly reduces fragility. Each additional basket typically has a larger marginal cost, while decreasing fragility by smaller marginal amounts. However, having many more than two baskets would be overkill is most cases: It would cost significantly more and wouldn’t reduce fragility much.

2. Nudge trade-offs in favor of reducing risk by overestimating the likelihood of a disruption.

In a well-documented example of supply chain disruption that took place in 2000, a fire in a Philips Electronics plant in New Mexico interrupted the supply of critical cellphone chips to two major customers: Ericsson and Nokia. While Nokia was able to find an alternate supply source in three days, Ericsson lost about a month of production. Due to component shortages, its mobile phone division suffered a $200 million loss during that period. Nokia’s ability to regroup came at an upfront cost, but it paid off in terms of less disruption.

Realistically, it is impossible to estimate the probability of a plant fire, the bankruptcy of a supplier or a faulty component. Compounding the problem is the human tendency to underestimate the probability of rare events the further removed we are from the time such events last occurred.14 Thus, supply chain designers and managers often underestimate disruptive risk when thinking about mitigation strategies. Traditional risk assessment comprises estimating the likelihood and the expected impact of an incident.15 In the context of disruptive risks, it is difficult to come up with good or even credible estimates. For example, there was no reasonable way for an automaker like Toyota to estimate the probability of a part failure or for airlines to anticipate that European airspace would be closed to air traffic.

In such settings, managers have an incentive to underestimate the likelihood of disruptive risks by simply ignoring them — thus avoiding the need to deconcentrate resources or make any trade-offs at all. After all, preparing for a possible disruptive risk incident requires upfront investment in risk mitigation. That makes it attractive for managers with fixed budgets to underestimate or even completely ignore the likelihood of a disruption.

But underestimating disruptive risks, for instance, by completely ignoring them, is a dangerous bet. Our research using analytical models and simulation found that underestimating the likelihood of a disruptive event is far more expensive in the long run than overestimating the likelihood.16 In the event of a disruption, the loss incurred generally overwhelms any savings from not investing in risk mitigation strategies. This was clearly the case for Ericsson: Any savings it might have generated from having a single supplier were overwhelmed by the losses from the plant shutdown. In contrast, strategies designed to deal with disruption risk (such as having multiple suppliers) compensate for the upfront cost to some extent by providing some benefits even in the context of recurrent risk (for example, supply can be shifted from one supplier to another as regional demand or exchange rates shift). To be sure, investment in additional facilities to mitigate the effect of rare disruptions is a real cost, while the savings from avoided costs of disruptions are hypothetical until a disruption occurs. Nonetheless, given that even rare events will actually occur, the average costs from disruptions are typically much larger than any savings from avoiding upfront investments. Overinvesting in protection against disruptions may be more economic in the long run than not doing enough. (See “Overestimating Risk Results in Better Decisions.”)

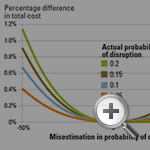

Overestimating Risk Results in Better Decisions

Moreover, one doesn’t need to estimate the chance of disruption with great precision. For a typical supply chain, we found that the total expected cost of a robust supply chain is not very sensitive to small errors in estimating the likelihood of disruption. In our simulations, an error of up to 50% in estimating disruption probability in either direction resulted in less than a 2% increase in total costs stemming from disruptive risk incidents over the long run. Large costs from future disruptions can be avoided as long as the risk of disruption is not completely ignored. So rough estimates of disruption risk are sufficient, and overestimating is better than underestimating. This knowledge should help managers make better trade-offs between reducing the risk of disruption and accepting reduced cost efficiency.

Senior managers cannot ignore disruption risk management because effective solutions are unlikely to be identified and implemented at the local level. Executives should carefully stress test their supply chains to understand where there are risks of disruption.17 The goal of this thought exercise is to identify not the probability of disruption but the potential sources of disruption. If no risk mitigation strategies are in place for a particular source of disruption, a disruption probability of zero has effectively been assumed. This significant underestimation can be very expensive in the long run and should be avoided if at all possible. It is often cheaper in the long run to assume some arbitrary but positive probability of disruption rather than to ignore it.

For large companies in particular, building resilience is often relatively inexpensive, and in many cases it can be done without increasing costs. Segmenting the supply chain based on product volume, variety and demand uncertainty not only increases profits; it also improves the ability of the supply chain to contain the impact of a disruption. Similarly, for many products, especially those with high transportation costs, regionalizing the supply chain both reduces cost and improves supply chain resilience. But even when implementing a risk mitigation strategy seems expensive, it is important to remember that in the long run, doing nothing can be much more costly.

To be sure, overestimating the probability of disruption requires senior managers to overcome two challenges. First, they must be willing to invest in additional supply chain resilience even though the benefits may not follow for a long time. Since ignoring disruption is always cheaper in the short term, companies must be willing to absorb the additional costs and maintain their commitment to the additional investment (such as a backup supplier) even when no disruption occurs for a few years.

The second challenge relates to how supply chain resilience gets measured and implemented. A company’s leadership must convince the global supply chain of the benefits of overestimating the probability of disruption and must be able to implement global (as opposed to local) mechanisms to deal with disruption. Building a reliable backup source at a high-cost location may make sense globally, even when each location may prefer to source from the lowest-cost location. To the extent that the deconcentrated resources can be deployed in segmented or regionalized supply chains, the executive’s task of explaining any increase in local costs is rendered easier through a decrease in global costs.

References

1. C.S. Tang, “Robust Strategies for Mitigating Supply Chain Disruptions,” International Journal of Logistics Research and Applications 9, no. 1 (2006): 33-45.

2. S. Chopra and M.S. Sodhi, “Managing Risk to Avoid Supply-Chain Breakdown,” MIT Sloan Management Review 46, no. 1(fall 2004): 53-61.

3. M. Lim, A. Bassamboo, S. Chopra and M.S. Daskin. “Flexibility and Fragility: Use of Chaining Strategies in the Presence of Disruption Risks,” Northwestern University research report, 2010.

4. See K. Capell, “Fashion Conquistador,” BusinessWeek, Sept. 4, 2006.

5. R.H. Hayes and S.C. Wheelwright, “Link Manufacturing Process and Product Life Cycles,” Harvard Business Review 57, no. 1 (January-February 1979): 133-40.

6. J. Birchall and E. Rigby, “Oil Costs Force P&G to Rethink Supply Network,” Financial Times, June 26, 2008.

7. L. Lucas, “Diageo Overhauls Its Supply Chain,” Financial Times, March 11, 2013. In the past, Diageo largely sold a few premium brands globally (such as premium Scotch whiskey). These were sourced from a central location and distributed globally. As Diageo has grown in emerging markets, it has started selling many other products locally. While the sourcing for Scotch whiskey cannot be decentralized for obvious reasons, Diageo has worked hard to locally source as many products as possible, creating a more regional supply chain.

8. M.S. Sodhi and C.S.Tang, “Managing Supply Chain Risk” (New York: Springer, 2012), chap. 5.

9. See, for instance, L.N. Van Wassenhove, “Humanitarian Aid Logistics: Supply Chain Management in High Gear,” Journal of the Operational Research Society 57, no. 5 (May 2006): 475-489.

10. Chopra and Sodhi, “Managing Risk to Avoid Supply-Chain Breakdown.”

11. Actual costs go up with the square root of the number of pools of resources, while expected costs of disruption go down as the inverse of the number of pools.

12. Chopra and Sodhi, “Managing Risk to Avoid Supply-Chain Breakdown.”

13. M. Sodhi and S. Lee, “An Analysis of Sources of Risk in the Consumer Electronics Industry,” Journal of the Operational Research Society 58, no. 11 (November 2007): 1430-1439.

14. N.N. Taleb, “The Black Swan: The Impact of the Highly Improbable” (New York: Random House, 2007).

15. Sodhi and Tang, “Managing Supply Chain Risk,” chap. 3.

16. M.K. Lim, A. Bassamboo, S. Chopra and M.S. Daskin, “Facility Location Decisions With Random Disruptions and Imperfect Estimation,” Manufacturing & Service Operations Management 15, no. 2 (spring 2013): 239-249; and B. Tomlin, “On the Value of Mitigation and Contingency Strategies for Managing Supply Chain Disruption Risk,” Management Science 52, issue 5 (May 2006): 639-657. In a different setting, Tomlin (2006) observed results similar to Lim et al. (2013) from misestimating the duration of a disruption. He found that underestimating the duration of a disruption typically led to significantly larger increases in cost than overestimating the duration of a disruption.

17. Chopra and Sodhi, “Managing Risk to Avoid Supply-Chain Breakdown.”

View Exhibit

View Exhibit View Exhibit

View Exhibit View Exhibit

View Exhibit

Comments (4)

Sameer Mehta

Rabindranath Bhattacharya

M Sodhi

Sameer Mehta