The Disruption Opportunity

Disruptive innovation has usually been considered by established businesses as an attack that must be met through defensive measures. And indeed, disruptive technologies and business models have toppled many established industry leaders and will likely continue to do so. But the real story behind disruptive innovation is not one of destruction, but of its opposite: In every industry changed by disruption, the net effect has been total market growth. Moreover, disruption can be a powerful avenue for growth through new market discovery for incumbents as well as for upstarts.

There are several keys to the successful navigation of this growth path. The first is recognizing that established players have more time than they think, provided they take off the blinders that keep them from seeing beyond their current customers. Disruption is not an immediate phenomenon — it can take years and even decades before the upstart business encroaches heavily on the established market. The second is finding the new customers who are eager to be served by the disruption. That can happen in a variety of ways, and there is no magic formula. Managerial intuition, knowledge of a variety of markets and serendipity can all play a part. The third key is building an organization that is capable of serving the new customers. It’s essential for companies to abandon their usual ways of dealing with the established market and to let the new customers dictate the business model by which they can be profitably served. The examples that follow suggest how companies can put these ideas into practice. (See “About the Research.”)

Missing Out on New Growth

One of the reasons it is so difficult for managers in established companies to recognize disruptions as opportunities is that the new markets lie outside their existing resource base.1 They may see a market developing but incorrectly conclude that it is outside their company’s scope for products or customers. In the early days of the minicomputer, for example, IBM Corp. hired a leading consulting firm to gauge the size of the emerging market. The firm’s report concluded that no opportunity existed for IBM — a predictable outcome, given that the firm had surveyed IBM’s leading customers, who were happy with the functionality provided by IBM’s mainframes. Five years later, minicomputers were a billion-dollar business.

Similarly, the CEO of a leading disk-drive manufacturer was once asked about the potential of an emerging product to disrupt his company’s established position. He responded, “I’ve read the reports, but I tell you the numbers are not there. We’ve surveyed our customers and nobody is buying those things. I’m telling you, someone is making those numbers up!” But the numbers were real, and the emerging market soon became a multimillion-dollar opportunity that this incumbent missed out on. At the root of these examples is the reality that the growth associated with disruption originates in a space in the market not traditionally served by the established players. The new customers are initially different, as is the way they use the product, making it difficult for established companies to recognize the opportunity with their existing systems.

Incumbents fail to see how they might take advantage of the new market and often mistakenly assume that the disruption will immediately displace their established business.2 Eastman Kodak Co., for example, has spent billions responding to digital photography. Fearing that digital newcomers would attack directly, Kodak’s first commercial effort in this market was to install more than 2,000 digital printing kiosks in its established retail distribution channel of pharmacies and grocery chains. Kodak was thus competing head-on with its own chemical film business. But the initial customer adoption of digital photography came through home and game applications — new customers seeking new applications. Digital photography will eventually attack the chemical film market, but it is growing initially in an area entirely outside the established market.

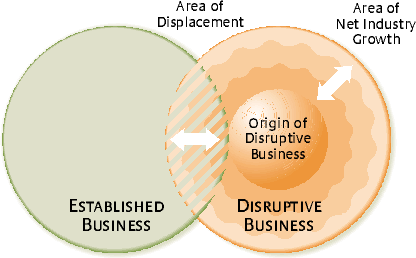

In other words, disruption creates net growth in the form of new markets and customers long before it directly encroaches on an established business. (For a graphic representation of this phenomenon, see “Disruption as an Opportunity for Growth.”) Examples from many industries, both recent and decades old, show how new entrants did not start out as competition to the established players; they were serving customers who could find nothing acceptable in the established market. Only as the newcomers moved upmarket did they create problems for the incumbent companies. Now-dominant players must learn to recognize the opportunities and do more than adopt a defensive posture in response.

The Three Phases of Disruption

Disruption is sometimes mistakenly thought of as an all-at-once phenomenon, as if the new technology or business model came out of nowhere to upset the established market. But disruption actually develops in three distinct phases. In the first, the innovation creates a new, noncompetitive market independent of the established business. In the second, the new market expands and slows the growth of the established business. In the third phase, the disruptive innovation, having improved greatly over time, significantly reduces the size of the old market.

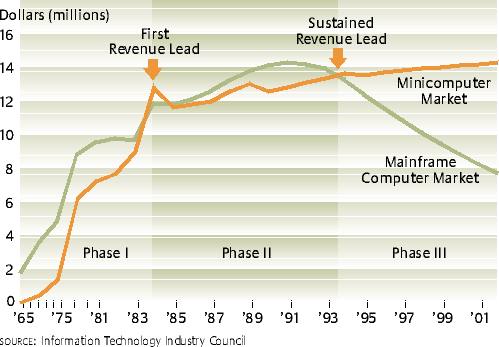

To see how these phases develop, consider again the minicomputer market. When the market got its start in 1965, minicomputers did not compete at all with mainframe computers. They created a new market, appealing to small and midsize businesses that did not require all the functionality that mainframes provided. For nearly two decades, constituting phase one, one set of customers continued to purchase mainframes at a rapid rate of growth, while another set did the same for minicomputers. In phase two, minicomputer companies improved their products’ performance enough to be able to meet the demands of most customers in the mainframe market at a significantly lower cost. Mainframe manufacturers responded by continuing to move upmarket toward more complex, higher-margin products. In phase three, they had nowhere left to go, and the mainframe market began to decline. Mainframe companies began to provide more than the mainstream market could absorb; their cost structures made it impossible for them to compete effectively with minicomputer makers for that market. At the beginning of this phase, the total market for minicomputers permanently surpassed that of mainframes. (See “Minicomputers Disrupt Mainframes.”)

Surprisingly, perhaps, there is good news in this scenario for incumbents. Although revenues from the minicomputer market first surpassed the mainframe computer market in 1984, they did not sustain that lead until the early 1990s — almost 35 years after the launch of the minicomputer market. The mainframe market grew rapidly for nearly 20 years and then more slowly for about seven more; even now, the mainframe market still generates more than $6 billion in revenue annually. But it has entered a long period of decline.3 Although a disruption may not completely destroy the established business, it usually takes away all the growth.

In an era of more rapid change, companies no longer have the luxury of spending 35 years in search of the opportunities made available by disruption. But they do have more time than they think, provided they start looking in the right place: where new customers are finding solutions to formerly unmet needs.

Finding New Customers

The first step in locating new customers is identifying a new market. Managers can use three criteria to do that: First, the disruptive innovation must be undervalued by current customers. Second, it must compete against nonconsumption; that is, it must allow people to do things they couldn’t do in the past for lack of money or skill. And third, it must help people accomplish things that they are already trying to do but can’t with the available products or services.4

By using these criteria, executives can develop the intuition they need to look outside their established markets for customers in a disruptive market. An example from the health care industry demonstrates how this can work.

Consider how treatment of heart disease has evolved. Before the 1960s, a person whose lifetime love of greasy food left him with coronary artery disease and extreme chest pain could do little more than take crude medications and hope for the best. Then coronary bypass surgery, which rerouted blood flow around a blocked heart vessel, literally gave the gift of life to thousands. That gift, however, came at a price. The operation, performed by a highly trained cardiac surgeon, was very invasive. It consisted of “cracking” the chest — literally sawing and separating the rib cage so the surgeon could have direct access to the heart. To permit the delicate sewing of the bypass graft (usually a vein from the leg), the heart had to be stopped completely. A complicated system of tubing, reservoirs, filters and other devices called a perfusion circuit played the role of the heart and lungs during the operation. Recovery time from the operation was fairly lengthy, and the pain was sometimes intense, often at the place in the leg where the vein had been harvested. For those patients with severe and sometimes multiple blockages, however, the procedure was a godsend.

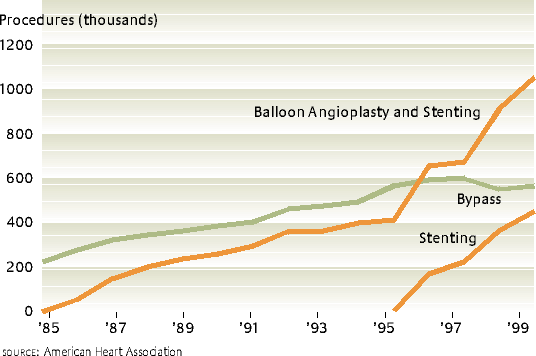

Few cardiac surgeons paid much attention when Andreas Gruentzig, a young German physician, performed the first balloon angioplasty procedure in 1974. In this procedure, the doctor guided a catheter through an artery into the blocked coronary artery and then briefly inflated a tiny balloon; the balloon compressed the plaque that was keeping the artery partially or completely closed and was then withdrawn with the catheter. This procedure was far less invasive and the recovery was far less painful than bypass surgery. Cardiac surgeons were understandably not interested when balloon angioplasty was introduced —it was a highly inferior solution for their core group of patients (whose heart disease was too far advanced to be treated in that way) and was reimbursed at a lower rate. But the procedure was embraced by another group, cardiologists, who valued the approach for its potential to expand their very different scope of practice. In addition, they were reimbursed for performing balloon angioplasties at a rate higher than they received for such customary procedures as angiograms. Thus balloon angioplasty created an entirely new market for patients unable to tolerate complex and invasive surgery and for those with less serious blockages. (See “Disruption in Cardiovascular Surgery.”)

Through the early 1990s, both balloon angioplasty and bypass procedures grew in tandem — phase one of the disruption. But angioplasty then became a much-improved option for patient care. One of its principal drawbacks until that time was its high level of restenosis, a renarrowing of the artery after the procedure. The introduction of stents — small cylindrical cages that remain in the vessel and keep it propped open — greatly reduced this problem. Because of that and other technical advances, demand for angioplasty began to soar, increasingly to the benefit of patients who in the past would have been candidates for bypass surgery — phase two of the disruption.

As in other instances of disruption, those who dominate the new market for heart treatments are not those who led the old one. Cardiac surgeons today are very good at treating patients with the most critical needs, but they’ve missed the opportunity to capitalize on balloon angioplasty. Cardiologists have seized this market and found a large group of new customers who can be treated with the new technology.

New Customers, New Business Models

Customers in a disruptive market can’t be served according to the established market’s business model. Cardiologists were able to serve new patients profitably and routinely with balloon angioplasty, thanks to an ability to do many more procedures per year with less staff in comparison to bypass surgery. Similarly, minicomputer companies could profitably serve their customers at gross margins lower than those of mainframe manufacturers because their selling costs were lower, their inventory turned quicker, and their fixed costs were a lower percentage of their total business.

But established players, which often have trouble seeing the new customer in the first place, also often find it difficult to conceptualize the new business model that would allow them to serve a new market profitably. The print newspaper industry illustrates how a focus on established customers can blind companies to business-model changes being led by new customers in a disruptive market.

As digital publishing took off in the mid-1990s, many newspaper companies spent millions of dollars designing and marketing their Web sites. Their stated motivation was almost exclusively to protect the newspapers’ print franchise. They were concerned that both readers and advertisers would move online, leaving them with lower revenues to cover their high fixed production and distribution costs. Most online newspapers simply replicated their print business model, trying to sell blocks of online advertising space to their usual customers — department stores, car dealers and other retailers that were not interested in exploring the benefits of interactive media at that time. In doing so, the newspapers initially missed the opportunity to reach advertisers that were trying to target individuals with customized messages.5

Most new entrants into online media such as Yahoo!, Monster.com and CNET built business models that captured the interactive opportunity. But more important, they sold to advertisers that had not traditionally advertised in the established newspaper market, especially companies that run direct-to-consumer campaigns. Newspapers, despite their investments of time and money, failed to tap the largest advertising growth categories associated with digital-content business models.6 A comparison of a selected group of online entrants with a group of online newspapers in 2002 showed that many newspapers were completely missing these new categories of revenue, which made up some 40% of the total for online entrants. (See “Online Newspapers vs. New Competitors.”) Print newspapers continued to sell advertising through their established sales channels to established customers, who were not demanding the new direct-advertising products.

Today, newspapers companies like the New York Times, the Washington Post and Knight Ridder have started to change their business models to take advantage of the new categories. They have learned to sell to new advertisers that value the consumer-direct attribute of online media. The more successful companies have looked outside the newspaper industry, hiring managers who have sold direct-marketing products in other markets.

Sticking With the New Customers

Companies that wish to succeed in new markets need to be disciplined. They have to learn how to stick with the identified new customers so that the business models and product design rules fit the new market. A comparison of two companies reveals why this is so important.

In the early 1990s, both Hewlett-Packard Co. and Teradyne Inc., a manufacturer of semiconductor test equipment, recognized the potential implications of disruptive technology. At the time, Hewlett-Packard’s Disk Memory Division manufactured high-end 2.5-inch disk drives.7 Managers decided to create a 1.3-inch drive, which they named Kittyhawk. But team members recognized that this drive would not have the memory capacity or access speed of the 2.5-inch drives, and they required everyone who wished to join the team to sign this statement: “I am going to build a small, dumb, cheap disk drive.” HP then explored potential customers for the new product. The company looked in the established notebook and PDA markets, whose customers wanted high-end functionality from the smaller drive. Then HP found that Nintendo was looking for a $50 disk drive to slot into its game consoles to allow its platform to support faster, more complex games. The company was not then using disk drives at all, and the cheapest 2.5-inch drives cost $130 each. HP would have to make a significant design breakthrough to produce one profitably at $50.

The team was initially committed to creating a product for an emerging customer, but the expectations of established markets soon got in the way. HP’s senior management had focused its attention on Kittyhawk — the CEO actually carried around the prototype 1.3-inch drive in his pocket — and that pressured the team to raise its growth forecasts considerably and target a much larger market. It was difficult for the team to feel confident that a nonconsuming market for game consoles could be large enough or grow quickly enough to satisfy senior management expectations. Thus the team also tried to serve the established markets for notebooks and PDAs with the new drive, and once it built in product specifications for those markets, it could no longer successfully serve Nintendo at $50 per drive. Kittyhawk was ultimately stuck in the middle, not good enough for the established markets, but too expensive for the emerging disruptive market. The venture cost the company millions in losses and was eventually shut down.

At Teradyne, managers recognized that CMOS (complementary metal-oxide semiconductors) and Windows NT could be used to lower the cost of semiconductor testing significantly, though the initial product would likely be less reliable than the technologies then on the market.8 At first, they were unsure which customers to target. They identified applications for their established market, microprocessor companies, and also for a new market, microcontroller manufacturers. The latter did not use test equipment at the time, largely because the existing solutions were too expensive in comparison with the price of microcontrollers.

CEO Alex d’Arbeloff was committed to the CMOS business, but he kept expectations and resources low until the team locked in on the new customer and could start to build a business model and product architecture around the needs of microcontrollers. Because the team was not required to meet the needs of Teradyne’s established customers, it had the flexibility to build a product with a significantly lower cost structure. For example, the test analytics software for microprocessors was complex and expensive. For the microcontrollers, Teradyne’s engineers learned to use simpler and less costly tools such as commercial spreadsheet and analysis software. It could not perform all the analytics that were used in the established market, but it met the needs of microcontroller customers at a price they could afford. Teradyne built an entirely new division around the new microcontroller customers — a market now exceeding $200 million in sales.

Both Teradyne and HP recognized the potential for disruptive innovation with their new technologies. They created independent teams to target the innovation, gave the projects senior-level attention, and identified potentially new nonconsuming customers. While Teradyne was able to stick with those customers and build the necessary new business model around them, the aggressive growth expectations and pull of the established market kept HP from sticking with Nintendo.

Realizing New Growth

Much attention has been paid to the negative implications of disruptive innovation for established industry leaders. The irony is that even the companies most at risk in the past were poised on the brink of a tremendous growth opportunity if they had only been able to recognize the implications of finding a new market with new customers. Below are a few of the lessons managers must take to heart if they are to capture the new growth associated with disruptive innovation.

First, disruption creates new net growth. Minicomputers eventually overtook the mainframe market, and personal computers eventually did the same to minicomputers, but the effect of each disruption on the industry as a whole was always positive. The key is to focus on the combined net effect of growth rather than the potential losses in one market.

Second, new customers must be found outside the established market. Disruptive innovations serve those who are currently nonconsuming but want to move upmarket and accomplish things they can’t with available products or services. By definition, existing customers don’t match that description.

Third, disruptive technology is never disruptive to the customers who buy it. Balloon angioplasty was viewed as a poor solution to heart disease by cardiac surgeons but as a breakthrough by cardiologists. Part of the key to successful disruptive innovation is finding customers who will more than welcome it, even if it delivers less than the standard in the established market.

Fourth, the new customer will make the disruptive path clear. In other words, the needs of the new customer should dictate the new business model. Products should be built according to the outcomes demanded by the new market, and the legacy costs and undervalued features associated with the established products should be abandoned.

Finally, a disruptive new business should start small and not be forced to grow quickly. Starting small enables managers to figure out what the new customers require and don’t require, adjusting business models and product architectures early before huge resources are poured into the new business. It also eases pressures to make the disruption conform to the established market.

Disruption has been and will continue to be a tremendous source of growth in the economy. It will also continue to attack established markets and destroy entrenched businesses. Managers who understand that the net effect of disruptive innovation is positive will be in a much better position to seek out new opportunities. They will build organizations that can identify promising new customers and stick with them as they pursue the innovation that leads to major new growth.

References

1. This correlates with Howard Stevenson’s definition of entrepreneurship as “the pursuit of opportunity without regard for the tangible resources currently controlled.” H.H. Stevenson and J.C. Jarillo, “A Paradigm of Entrepreneurship: Entrepreneurial Management,” Strategic Management Review 11 (summer 1990): 17–27.

2. C. Gilbert and J.L. Bower, “Disruptive Change: When Trying Harder Is Part of the Problem,” Harvard Business Review 80 (May 2002): 94–101.

3. Note that a similar fate likely awaits minicomputer makers that did not learn from their experience in taking on mainframes when desktop machines came on the scene.

4. See C.M. Christensen, M.W. Johnson and D.K. Rigby, “Foundations for Growth: How To Identify and Build Disruptive New Businesses,” MIT Sloan Management Review 43 (spring 2002): 22–31.

5. For example, the Internet allows an advertiser to target men in the 30-to-35 age range who primarily read the sports section with a different ad than it would use for women between 50 and 55 who spend most of their time on the arts section. The advertiser could later follow up the display ad with an e-mail targeted to that specific profile.

6. T.R. Eisenmann, “Internet Business Models: Text and Cases” (New York: McGraw Hill, 2002).

7. C.M. Christensen and G.C. Rogers, “Hewlett-Packard: The Flight of the Kittyhawk,” Harvard Business School case no. 9-697-060 (Boston: Harvard Business School Publishing, 1997).

8. J.L. Bower, “Teradyne: Managing Disruptive Change,” Harvard Business School case no. 9-397-112 (Boston: Harvard Business School Publishing, 1997).