The Opportunity Paradox

Experimentation, iteration and improvisational change are all the rage in today’s dynamic business environments. But when evaluating new business opportunities, there’s a paradoxical tension between strategic focus and flexibility that can define or break your business.

Capturing new growth opportunities is fundamental to strategy, innovation and entrepreneurship. But how can managers best meet this challenge? With flexibility or focus? The answer, as it turns out, can be more complex and more crucial to a company’s success than previously thought. Our research on mature corporations, growing businesses and new ventures suggests a paradoxical tension between focus and flexibility that can define or break your business. In this article, we explore when and where to be focused and disciplined versus when to be flexible and opportunistic.

Experimentation is a familiar innovation tool, but some industry pundits suggest that planning rarely succeeds in dynamic environments; instead, they argue for a rapid cycle of experimentation and pivoting.1 Such an approach holds both intuitive and rational appeal in a world characterized by uncertainty, where the flow of opportunities is swift yet unpredictable, where market boundaries are shifting and where competitors are constantly changing. Given the new competitive environment that promotes change and flexibility, is the old strategic emphasis on focus less relevant? We argue it is not. In fact, we discovered in our interviews with a wide variety of managers that focus may be just as important as flexibility, and, counterintuitively, a company’s focus may even influence its flexibility and vice versa. (See “About the Research.”)

Opportunities Are Complex

Opportunities are more complex than people recognize. Few managers recognize that there are two components to capturing a new business opportunity: opportunity selection and opportunity execution. Opportunity selection involves determining which customer problem to solve, whereas opportunity execution deals with solving the particular problem chosen.2 Most books, articles and thought leaders studying opportunities focus heavily on opportunity execution — how to create value by developing a solution for customers. But research suggests that most innovation efforts move so quickly to identify a solution that they have to cycle back to figure out what problem they are actually solving.3

We found that opportunity selection appears to matter as much as opportunity execution, the place where most companies spend their time. More importantly, how you approach opportunity selection (whether with flexibility or with focus) has a critical impact on how successful you are at opportunity execution.

Opportunists vs. Strategists

We observed that managers and entrepreneurs tend to fall into two groups that we label opportunists and strategists. The opportunists relied on a less scripted and more flexible approach to opportunity selection. Instead of mapping out ahead of time which opportunities they would pursue and then letting the map be their guide for subsequent action, opportunists let emergent customer inquiries shape opportunity selection. For example, one U.S.-based security software company made the choice to enter the German market because a German customer was interested in its security-monitoring services. Likewise, the software company’s decision to go to Switzerland was based on unforeseen customer demand in the country, not a deliberate plan to enter Switzerland. As one company executive stated about that decision, “It was more like we were drawn in rather than a conscious decision.”

On the surface, these managers and entrepreneurs felt they were cherry-picking low-hanging fruit and taking advantage of narrow windows of opportunity before those windows closed or before competitors captured the opportunity. Rather than wasting time developing and then executing detailed plans that might be flawed or outdated or both, they took advantage of what emerged. Overall, this flexible approach to opportunity selection is consistent with the broader strategy and entrepreneurship literature, which argues that the dynamic nature of the markets in which many companies operate lowers the benefit of pre-action deliberation, and that ambiguity is not necessarily a bad thing. Indeed, many business leaders make better decisions as they go along, rather than beforehand through focused planning.4

Strategists followed a different pattern. Since a central threat facing companies that capture emergent opportunities is the lack of focus associated with trying to address the needs of multiple markets, strategists constrained the selection of opportunities to particular markets in order to help their companies channel efforts toward opportunities that were more likely to result in success. As a result, rather than taking advantage of unforeseen emergent opportunities, strategists were more disciplined. They began by studying the nature of opportunity capture in their market. Once they had done this, they created a focused plan that riveted attention on what they believed was the best opportunity (not just the easiest) and that would allow them to capture several opportunities in a row versus one in isolation. For example, at a Finland-based company that helps organizations manage inventory through point-of-sale software solutions, leaders selected their first international market, Sweden, based on what they could learn — not just on their ability to get a sale. Although not a large market, Sweden was both culturally similar and geographically close. This reduced the risk that the company’s Finnish leaders would be overwhelmed with regional differences and increased the likelihood that they would be able to learn how to do business abroad. As the CEO explained, “We were quite conservative in this process because we didn’t know much about international business. So we started with Sweden.” After Sweden, the company chose Norway, then France, Germany, the United Kingdom and then the United States. It was able to gain experience in progressively bigger markets and exploit its growing knowledge. Overall, by being more focused in opportunity selection, companies can start with easier opportunities or opportunities that are advantageous to pursue earlier; those initial opportunities then provide the foundation for subsequent opportunities. Thus, just as the order of assembly is key when building a bridge or assembling a computer, the order of experience appears critical for effective opportunity capture.

Flexible Selection and Inflexible Execution

So how do these different patterns for opportunity selection unfold? Although flexibility can be extremely useful, we found that the opportunists who had been the most flexible in the opportunity selection phase tended to be the least flexible in the execution phase. In other words, although these managers were adept at flexibly responding to emergent opportunities, once they started to execute the opportunities, many became surprisingly inflexible. For example, at a U.S.-based medical imaging software company, leaders were very flexible about the selection of opportunities. One cofounder noted, “We were trying to get something going in Europe, so we looked for opportunities and we cherry-picked.” The company decided to enter Sweden based on some interest from local doctors there. Yet, after the company entered Sweden, the doctors appeared reluctant to use what they viewed as a new technology for an established method of mammography. Importantly, instead of flexibly executing the opportunity and changing their solutions to meet local market needs, the software company attempted to sell Americanized products everywhere. Executives selected their second country, Norway, in the same flexible fashion. When sales there didn’t materialize, executives believed the targeted customers didn’t understand the product. Rather than adjusting their approach, they pushed existing solutions. The pattern of being more flexible in opportunity selection but less flexible in opportunity execution often led to poor results. For example, commenting on their entry into Sweden, executives at the medical imaging company remarked, “We could not sell into Sweden” and “They ran off a cliff. They went nowhere.” Performance in subsequent countries was much the same.

Focused Selection and Flexible Execution

Companies that were more focused in opportunity selection were generally more flexible in opportunity execution. This pattern surprised us because although these companies showed a consistent, focused pattern of disciplined search for opportunities, they were also remarkably flexible about how they pursued the selected opportunity. For example, the founders of a Singapore-based company that develops content for wireless providers thought long and hard about which markets to enter. Based on customer interviews and market observations, management outlined the best way to tackle multiple markets, concluding that they needed to start with the Japanese market, given that consumer trends appeared to diffuse from Japan to the rest of Asia. After entering Japan, leaders started selling digital content to Japanese wireless providers. But this required going head-to-head with Japanese content providers, who were technically competent and entrenched in the market. In light of these challenges, management decided to stop trying to sell their own company’s content in Japan and instead allied themselves with Japanese content companies to sell their partners’ content in Asia. As the chairman explained, “Instead of competing with them [Japanese content companies], we decided to partner with them and take their products and sell in Hong Kong, China and Japan. So we decided to change our strategy.” The outcome from flexibly executing the opportunity in Japan was greater success. As one leader remembered, “Once we decided to partner with [Japanese companies to start selling their content outside Japan], within three months we signed up quite a lot of very reputable content makers.” We observed a similar pattern with other companies in our study: Increased focus on opportunity selection meant increased flexibility in opportunity execution. (See “Focus and Flexibility in Opportunity Capture.”)

Lessons About Opportunity Capture

Our research revealed two lessons about opportunity capture that are fundamental for growth in new markets: (1) Although opportunists can be flexible in selecting opportunities, they are less flexible in executing them; and (2) longer-term success partly depends on sequencing opportunities for learning.

Cognitive Lock-In

We observed that once opportunists started to execute opportunities, they often became less flexible. Our research suggests that opportunistic managers fell into what is called a cognitive dissonance trap — a psychological pattern wherein individuals who make a decision contrary to a prior belief set experience discomfort that leads them to reshape their beliefs and perceptions to match the discordant decision.5 Not surprisingly, we observed that opportunists (like strategists) generally believed they were careful decision makers. When opportunity selection was flexible and emergent, opportunists subsequently rationalized their opportunity choices, often focusing only on the positive aspects of the opportunity and ignoring the negative. In a similar vein, they tended to blame bad events associated with the selected opportunity on external circumstances beyond their control rather than questioning the way they chose the opportunity in the first place.

For example, executives at the Finland-based security software company flexibly selected opportunities. Entry into the first country, Sweden, was not planned out in advance. As the chief financial officer noted, “Sweden was very much ad hoc.” But this view was not consistent with the rationale managers gave later, when they suggested that Sweden was purposely selected as a location where employees could “cut their teeth.” When sales in Sweden fell short, leaders began placing the blame on external sources, such as their customers’ financial positions, rather than on internal ones, such as faulty strategy. Because the weak sales were attributed to external factors, leaders did not alter their method of executing opportunities. A senior leader described how the company worked with an outside lawyer to develop a standard template: “We just would not budge on that,” he said. These restrictive policies interfered with the company’s ability to work out agreements with several major customers when it was attempting to enter the United States. The experience underscores a paradox of opportunity capture: The more that leaders attempt to control opportunity execution, the less control they seem to have. The lack of control stems, in part, from trying to standardize solutions for opportunities that are inherently unique. Among opportunist companies, greater company maturity and increased executive experience seem to further decrease the chances of flexible opportunity execution. This may be because prior patterns for executing opportunities that have proved successful become increasingly rooted and institutionalized in company practices and executive actions.

A different pattern was evident among strategists. Particular opportunities within the broader set of possibilities were viewed ahead of time and found to be more attractive than others. As leaders selected the most attractive opportunities, this reduced the need to justify choices and therefore made leaders more likely to flexibly execute opportunities. As a result, they tended to improvise and experiment during the execution of opportunities, sometimes initiating radical changes to their product or business model. For example, one company we studied provided IT security software. After carefully studying its opportunity set, it decided to enter China. To management’s surprise, Chinese customers were suspicious about paying for software — they expected software to be free. So the team leading the effort switched gears and developed a hardware solution, which ended up selling very well. As the CEO recounted, “They [Chinese customers] only pay if they see hardware. It becomes an appliance … basically it’s a PC, and then they sell it to the customer.” In general, the strategists were more likely to pivot and change than opportunists when it came to opportunity execution. They were better able to abandon existing products and practices designed for opportunity execution and adopt new, more appropriate ones.

Sequencing Opportunities

On the surface, being more flexible would seem to help managers learn and adapt. However, we found that many of the managers and entrepreneurs who were the most flexible discovered an important lesson: It’s difficult to learn if you are always changing course. Sustained business success appears to depend not just on capturing one opportunity but also on stringing multiple opportunities together. Hence, longer-term success hinges in part on sequencing business opportunities: Understanding how to capture one discrete opportunity prepares managers and the organization to capture others.

Because opportunists often took advantage of the most immediate opportunities from the flow of possibilities, they found it very difficult to learn from and build off of their efforts. Managers of more established businesses often expressed confusion about the connection between the different opportunities they were chasing and uncertainty about the lessons learned. Managers of newer businesses complained that chasing multiple markets suggested a lack of vision. These executives had a morass of data — customer needs, feedback and product features — that pulled them in many directions. As a result, it was hard to know what was most important to do to succeed. For example, the CEO of the security software developer based in Finland described the difficulty his team had applying the lessons they learned, lamenting, “We should have had more focus and more country-by-country-specific plans rather than just trying to cover all the bases in a shotgun approach.” Similarly, a U.S. entrepreneur developing and testing tools for professionals recalled, “We were doing so many things — so many different tools and quiz formats — that it wasn’t clear what we were learning from any of it. Every time we made a change, we changed so many things [that] it wasn’t clear what caused what.”

By contrast, strategists who were more disciplined in opportunity selection also paid attention to how their opportunities were sequenced. They often selected smaller or more difficult markets, which allowed managers to learn from the opportunities. For example, an entrepreneur developing learning tools in the United States decided to eliminate nearly all of the solutions he had developed and focus instead on delivering quizzes to the education market. When asked why, he said, “By focusing on a single problem for a single market, we could actually really start to learn what solved customers problems … It was the best decision I ever made. We began to really understand what educators needed and what would lead to more revenue.” By narrowing his focus, the entrepreneur was able to increase revenue 400% in the next year before moving into the testing market for business enterprises, where he found even greater success.

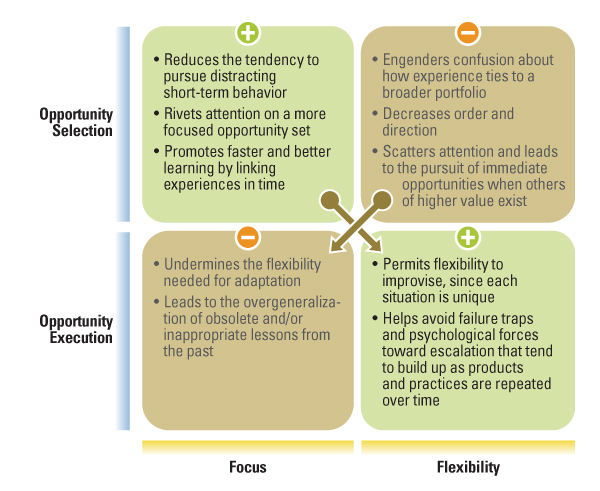

Focus and Flexibility in Opportunity Capture

More focused opportunity selection appears to lead to more flexible opportunity execution. However, more flexibility in opportunity selection often leads to less flexibility in opportunity execution.

In other cases, we found that strategist managers sequenced opportunities to improve their legitimacy and credibility in the marketplace. Sometimes, managers of unproven businesses attempted to establish themselves with third-tier customers and then tried to move to second-tier customers and eventually to first-tier customers. For example, a provider of semiconductor solutions for wireless devices had aspirations to sell in the U.S. market but recognized that it first needed to establish a track record. To do so, it began selling to customers in Taiwan, then leveraged those sales to win customers in Korea, and eventually lined up customers in the United States, Germany and Japan. Depending on the circumstances, the pattern can also operate in reverse and involve starting at the high end and then expanding to the broader market. For example, Tesla Motors Inc. of Palo Alto, California, which designs and manufactures electric cars, decided that selling high-end electric vehicles would promote the sale of electric vehicles in other parts of the market.

Overall, creating a sequence for opportunity capture permits leaders to bring the present and future together in a way that facilitates team alignment and channels the energy and attention of geographically dispersed employees and managers. This helps organizations get into a rhythm and move forward in a synchronized fashion. Sequencing therefore provides an order for opportunity selection (that is, where organizations are now, where they want to go and the path to get there) that serves as a counterpoint to the more freewheeling manner of selecting opportunities based on emergent customer demand. More broadly, the use of sequencing reflects increased cognitive sophistication, as it takes time for individuals to gain insight about how opportunities can and should be ordered. This is perhaps one reason why the use of sequencing seems to occur more in older companies or in companies where founders have greater experience.

Managing the Opportunity Paradox

Leaders who acted more flexibly during opportunity selection (Which problem should we tackle?) tended to be less flexible during opportunity execution (How do we solve the problem?). Conversely, leaders who were more focused during opportunity selection tended to be more flexible in executing those opportunities. Focused selection and flexible execution lead to better outcomes than the reverse. The pattern of flexible opportunity selection leading to lower-performing, less flexible opportunity execution suggests another paradox for companies pursuing new avenues for growth and profitability. While being open to selecting new opportunities based on emergent customer demand appears attractive because it offers the promise of an immediate reward, that very openness may prevent the reward from being realized.6 A key implication for entrepreneurs and managers is that they should be disciplined in seeking to understand the nature of opportunities and linkages among them and then focus their resources on the opportunities that will help them move in a sequenced fashion from their current state to a desired end state.

How to Select Opportunities

At the start of the process, there are a few rules of thumb to guide you in choosing an opportunity. To begin with, resist jumping at the first potential opportunity or customer. Showing restraint may not be easy when cash is limited and the opportunity appears to be reasonable. Nevertheless, it’s important to focus on the longer term rather than the shorter term. What does the right opportunity look like, and how will it set you up for future opportunities? Remember the lessons on sequencing: Try to see if there is an internal sequence to a series of opportunities. Will one opportunity position you for another one? Will this opportunity help you learn about another one? Will it give you the legitimacy to capture future customers? The founders of a digital gaming company applied these criteria when they assessed their opportunities for building their consumer business in Asia. In their case, it meant starting in Japan and then progressively moving to Taiwan and Hong Kong before going after other markets. One founder remarked: “The digital content business is really a consumer business, and looking at Asia’s development for consumer business — whether it’s fashion or electronics or whatever, the trend always starts in Japan and progressively moves to Taiwan and then to Hong Kong and then to the rest of the market. I mean, this trend has been like that for the last 50 years. So when we pushed consumer-based, consumer-oriented digital products, that’s the same thing we did. We started by securing deals in Japan and pushed to the next most obvious market, which is Taiwan. Once [the] consumer products were accepted in Taiwan, then we progressed even more to other markets.”

Second, think about the full portfolio of choices before you, taking into account such criteria as the opportunity size (Is it large enough to be worth your time?); reachability (Does the company have or can it develop capabilities to capture the market?); and competition (How crowded is the field of competitors?). Many managers make the mistake of chasing small opportunities that are not worth the time, big opportunities that are out of reach or moderate opportunities that are too competitive.

Finally, we note that being strategic about which opportunities make the most sense may be particularly important for younger businesses. By considering the unique characteristics of each opportunity and its link to other opportunities, entrepreneurial companies can more easily and rapidly overcome inherent liabilities of newness (such as lack of resources and track record)7 by accumulating experience in a manner that builds on the past, while simultaneously increasing credibility.

How to Execute Opportunities

Once you have selected an opportunity, remember that opportunity execution requires having a flexible, rapid and iterative learning cycle. Therefore, while emphasizing common products and practices is important for capturing efficiencies, too much emphasis on routine actions can make it hard for companies to adapt or to walk away from losing situations in the future. Leaders should begin by designing a series of experiments to test what customers want and then rapidly adjust the offerings to meet their needs. Many of the companies we studied made radical changes to their products and business models (sometimes as significant as changing from selling software to selling hardware or from being content providers to being content resellers) upon entering a new market. Some of the most successful companies walked away from what seemed like an attractive opportunity after their initial experiments. In most cases, successful execution depended on regular interaction with customers and an openness to seeing negative results and adapting, rather than blaming negative results on someone else or firing salespeople.

The Opportunity Audit

How should you proceed if you suspect you have been too opportunistic in selecting new projects and too rigid in executing those opportunities? What should you do in that situation? In our view, you should conduct an opportunity audit built around the following questions:

- How did you choose the opportunities you are currently pursuing?

- If you could start over, which opportunities would you choose? Which opportunities make the most sense in terms of building a powerful sequence?

- What are the results of your current efforts? What excuses have you made for negative results that place the blame externally? What could you be missing by doing this?

- If the company were threatened with bankruptcy today, what one opportunity would you keep and which opportunities would you give up?

After answering these questions, don’t be afraid to make substantial changes to what you are doing. Throwing good money after bad is a common trap: People tend to increase their commitment to a failure they feel responsible for when, in fact, the most rational choice may be to simply let it go and adopt a more disciplined process for opportunity selection in the future. Although this may seem counterintuitive, it will help foster the flexibility you will need for opportunity execution.

Although flexibility in opportunity capture is extremely popular these days, few recognize that opportunity capture is a two-phase process involving opportunity selection and opportunity execution. Greater focus and discipline during opportunity selection through sequencing can increase effective flexibility during opportunity execution. By contrast, a lack of discipline in selecting opportunities can result in reduced ability to learn and adapt, which in turn can hurt chances for success. Overall, what appears to be at the core of successful opportunity capture is the intended capture of the expected along with the emergent capture of the unexpected. While the former is more controlled, future-oriented and top-down, the latter is more spontaneous, action-oriented and bottom-up. Moving back and forth between focus and flexibility during opportunity capture allows companies to glean the benefits of efficiency while still allowing room for change.

References

1. E. Ries, “The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses” (New York: Crown Business, 2011).

2. C.B. Bingham, “Oscillating Improvisation: How Entrepreneurial Firms Create Success in Foreign Market Entries Over Time,” Strategic Entrepreneurship Journal 3, no. 4 (December 2009): 321-345.

3. C.B. Bingham, K.M. Eisenhardt and N.R. Furr, “What Makes a Process a Capability? Heuristics, Strategy, and Effective Capture of Opportunities,” Strategic Entrepreneurship Journal 1, no. 1-2 (November 2007): 27-47; and C.B. Bingham and K.M. Eisenhardt, “Rational Heuristics: The ‘Simple Rules’ That Strategists Learn From Process Experiences,” Strategic Management Journal 32, no.13 (December 2011): 1437-1464.

4. K.M. Eisenhardt, “Making Fast Strategic Decisions in High-Velocity Environments,” Academy of Management Journal 32, no. 3 (September 1989): 543-576; and A.V. Bhidé, “The Origin and Evolution of New Businesses” (New York: Oxford University Press, 2000).

5. E. Aronson, “The Theory of Cognitive Dissonance: A Current Perspective,” in “Advances in Experimental Social Psychology,” vol. 4, ed. L. Berkowitz (New York: Academic Press, 1969), 1-34; L. Ross and R.E. Nisbett, “The Person and the Situation: Perspectives of Social Psychology” (Philadelphia: Temple University Press, 1991); and K. Weick, “Sensemaking in Organizations” (London: Sage Publications, 1995).

6. Bingham, “Oscillating Improvisation.”

7. C.B. Bingham and J.P. Davis, “Learning Sequences: Their Existence, Effect, and Evolution,” Academy of Management Journal 55, no. 3 (June 2012): 611-641.

View Exhibit

View Exhibit