How to Resolve Board Disputes More Effectively

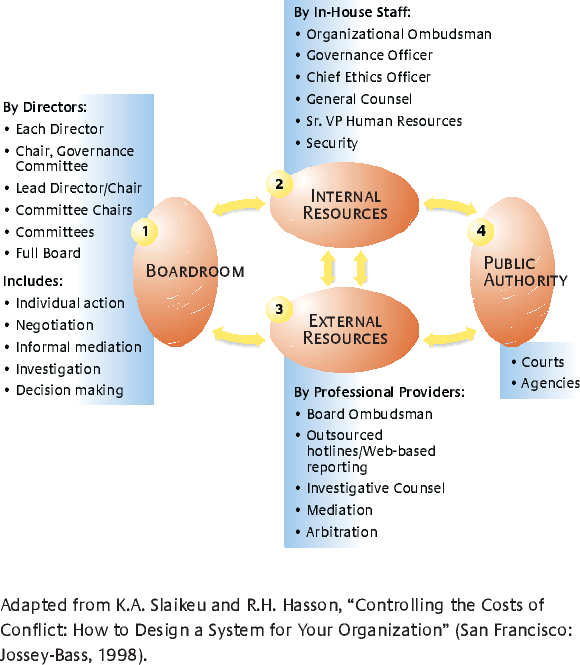

Companies have a number of internal and external conflict-resolution resources at their disposal. In addition, they should consider creating the new role of board ombudsman to mediate disagreements.

In 1999, Coca-Cola Co.’s CEO, Douglas Ivester, handpicked successor to popular Roberto Goizueta, was surprised in a Chicago airport by two members of the flagging company’s board of directors. According to the directors, Ivester’s hardhanded tactics with local bottlers and European regulators had alienated business partners and shareholders and left him with a reputation for not listening to the board. Mistakenly believing that the two directors spoke for the entire board, Ivester abruptly resigned. Shares of Coke fell 12% in two days as the board and investors struggled to make sense of what had happened. The incident would affect the company for years, and Coca-Cola would have three CEOs from 1997 to 2004.1 Certainly conflict is inevitable in any organization, but, with the right approach in place, boards can greatly increase the opportunity to resolve disagreements before they get a chance to get out of control.

Given the high stakes involved, it is important that boards use a comprehensive approach to specify roles, policies and procedures for resolving the routine disagreements that arise in the course of providing oversight. Boards using a systemic approach may find that not only will they resolve disputes more effectively, but they will also enhance their collaborative problem-solving and decision-making capabilities.2 Most of the time, boards do a pretty good job of talking things out. However, they can be far more effective if they establish a broad range of internal and external resources to assist them in uncovering and resolving problems. Additionally, organizations might want to consider adopting a new role: the board ombudsman. If the role were implemented, the board ombudsman could become a powerful resource for senior management and for the board as well, empowered with the capability to resolve disputes quickly, quietly and efficiently.

A Range of Skills Is Needed

Of course, any effective conflict-management plan must begin with the board itself. (See “A Comprehensive Board Approach.”) Ira Millstein has advised that when boards are selecting new directors they should consider the capacity of potential board members to respond constructively to trouble and to help the company prevent it.3 Best practices in conflict management and corporate governance alike call for directors and boards to take the lead in addressing their own problems and disagreements related to oversight responsibilities, using the most constructive approaches possible. To solve the thorny problems that come their way, directors need a range of skills and a clear understanding of when to use each: individual initiative, negotiation skills, informal mediation skills, investigative skills and decision-making ability. Specifically, the value of collaborative problem-solving skills such as negotiation and mediation should not be underestimated. Consider the struggles of the Walt Disney Co.’s board in March 2004. In the midst of a shareholder revolt, CEO Michael Eisner received a no-confidence vote of 43%. The board separated the CEO and chairman roles to quell the uprising. Although the board discussed other candidates, it named former U.S. Senator George Mitchell as nonexecutive chairman because of his experience and credibility as a mediator and negotiator. Mitchell reportedly considered shuttle diplomacy among investors, directors and Eisner as his chief responsibility.4

In addition to the range of problem-solving skills that directors need personally, boards need an established set of internal and external resources to assist them in uncovering and solving problems. In general, directors and boards needing assistance should first turn to the company’s internal specialists. For example, they might seek assistance from the general counsel, chief ethics officers or organizational ombudsmen. For explosive, sensitive or contentious problems, directors and the board should also have access to a number of external resources, including the board ombudsman, for highly confidential, informal problem-solving assistance. This assistance may take the form of independent investigation for matters requiring a formal inquiry, and external mediation or arbitration for full-blown disputes involving the board. Parties likely to come into conflict with individual directors or the board should also be encouraged to use the resources and roles available through the system. Finally, all parties retain access to the courts and to local, state and federal agencies. However, because the system helps the board to capture and resolve problems early, fewer problems end up in these forums.

The goal is to change the flow of events when a problem or dispute arises, shifting the focus away from full-blown battles and after-the-fact damage control toward prevention and early intervention. Encouraging collaborative methods increases the opportunity to solve problems quickly among those directly involved. By making independent and confidential resources for informal assistance available to every employee and every director, the board enhances its capacity for ethics oversight. Formal procedures that can be considerably more expensive, time-consuming or divisive, such as investigations or litigation, are needed less often, and are more efficient when they are used. The most expensive and destructive approaches of all, political maneuverings and sabotage, are reduced to an absolute minimum.

The Board Ombudsman

A comprehensive approach may not be enough without the inclusion of the board ombudsman. When it comes to solving problems and resolving disagreements, directors and boards have at least two related needs not commonly met through existing resources. One need is for a highly competent, independent and confidential resource that can help directors and boards to solve problems through effective, informal methods, such as assisted negotiation or shuttle diplomacy. Second, the board needs assistance from resources that reflect the unique nature of its relationship to the company and its shareholders. As trustees of the company, members of the board may have bosses (shareholders) and subordinates (the CEO and the senior management team) but they have no peers.5 Therefore, particularly in highly sensitive or potentially explosive matters, it may be extremely difficult, and in some cases even inappropriate, for a director or full board to seek advice or assistance from an internal resource regarding problems with a fellow director or a senior manager. The board ombudsman could step into this breach and become a confidential resource for informal assistance and an independent and neutral problem solver and go-between.

The model for a board ombudsman role as described here is the organizational ombudsman, as defined in the standards and codes of the International Ombudsman Association.6 However, the board ombudsman and the organizational ombudsman remain separate and distinct. The power of the board ombudsman role stems from the individual’s credibility as an independent and neutral resource as well as an objective peer. While the board ombudsman role does not currently exist, others have informally taken on this role in the past. In tough situations, boards and CEOs have often benefited from the assistance of outside advisers. When eight former Morgan Stanley & Co. Inc. executives launched an effort to unseat CEO Philip Purcell in 2005, the board turned to lawyer Martin Lipton for assistance.7 In 2001, the Rain-forest Action Network, an environmental advocacy group headquartered in San Francisco, announced plans to target wood and paper products manufacturer Boise Cascade Corp., now Boise, over the use of wood from old-growth forests. RAN went after Boise’s customers, persuading a number of them, such as Kinko’s, L.L. Bean and Patagonia, to reduce or eliminate their contracts with Boise. In early 2003, Lowe’s Companies Inc. CEO Robert Tillman, a recent adopter of RAN’s wood-purchasing policies, stepped in to provide shuttle diplomacy, encouraging Boise’s CEO, George Harad, to engage in direct talks with RAN. In September 2003, the parties announced an agreement stating that Boise would agree to give incentives to suppliers who bought wood from forests that were certified as well managed.8

Despite the value of the assistance in each of these examples, neither Tillman nor Lipton could offer truly neutral assistance to either party, nor could they provide independent and confidential assistance to all the disputing factions. Lipton was fulfilling multiple roles on behalf of Morgan Stanley, and Tillman’s company, Lowe’s, had already reached an agreement with RAN. The board ombudsman fills a need by acting as a confidential resource for informal, independent assistance and as a source for shuttle diplomacy. This resource must be made available and attractive to any director or committee, to the full board and to the CEO or other parties with whom the board is likely to come into conflict. The board ombudsman would be available on an as-needed basis. The parties would decide if and when to seek assistance from the board ombudsman, rather than being forced to rely on outside intervention.

Additionally, the board ombudsman could have broader, ongoing responsibilities to the board as a whole — to identify troubling patterns or trends developing within the board, or between the board and management, and to advise the full board of the need for changes in its polices and procedures. Finally, the board ombudsman could be an even more valuable resource if made available to other parties likely to come into conflict with directors, such as large, institutional shareholders, key customers and business partners. A major benefit could be a significant increase in the board’s ability to expose and address a wide variety of problems early. The board ombudsman would become part of the comprehensive system for providing many opportunities to catch problems at different stages and through a variety of channels.

Aligning Resources

Many of these best practices for resolving board conflicts are not yet in common use, and interested boards must take a number of steps to ensure that all the necessary resources are in place. First, the board working with the CEO should commission a team to develop its plan. One or more members of the governance committee should be included, as developing and implementing the sort of system described here certainly fits within that committee’s responsibilities. The team should also include a member of the audit committee, since one key benefit of such a system is an increased ability to uncover and address allegations of financial wrongdoing. The lead director, if the board has one, is likely to play an important role in the system, and should be included as well. Because internal specialists are critical to the system, the committee should include the organizational ombudsman and the leadership of compliance functions, as well as a senior line officer or two. The corporate governance officer, if the organization has one, should be included, since he or she may play a principal role in implementing, administering and monitoring the system. With a team in place, the board can set goals for the system. The team can then compare existing procedures against the board’s goals, and consider what changes or additions to existing roles, policies and procedures might be needed to encourage more productive, low-cost resolutions. Based on its review and comparison, the team can develop a plan for implementing the new system.

Looking Outside

Given the broad range of resources included in this process, boards will need help from other organizations to implement these new practices. Private and nonprofit organizations that support executives, directors and boards, or that interact with them on a routine basis, can play a key role in the development of the new systems. One or more of the professional associations concerned with governance, perhaps in tandem with one or more leading academic institutions, could develop a board ombudsman program as a pooled or shared resource, available on a contract basis to any board. In addition to their own internal resources, the organizations developing the program could draw on the expertise of private service providers, insurers and experts in conflict management, corporate governance and related disciplines. Including institutional shareholder groups in the design of such services could make them even more attractive and effective. The same sort of organization could also provide skills training geared to the needs of individual directors, committee chairs, lead directors/board chairs and the full board and senior management, to help directors fulfill their new responsibilities for problem solving and conflict management. There is also a need for incentives to encourage development of these new approaches. One such incentive could come from the carriers who insure boards and directors. Boards, and the network of organizations that support them, should be working with insurers to develop criteria for board conflict-management systems and to integrate such criteria into the consideration of governance practices in the underwriting process. The resulting benefits for insurers could include reduced losses and enhanced compliance with legal and regulatory standards; for directors and boards, reduced premiums and/or more favorable terms of coverage; and for all, including shareholders, less costly, more productive problem solving and conflict management as integral components of good governance.

ONCE THE BOARD HAS ASSEMBLED ITS TEAM and external resources and implemented the system, it can begin cutting the costs of conflict — in dollars, time and risk to reputation. With individual directors fulfilling their roles and using the internal and external resources available to take individual and collaborative action, the board’s ability to provide oversight improves dramatically.

The goal is for every organization to be able to avoid costly errors and disagreements, as Medtronic’s CEO William George was able to do. Several years ago, George won an overwhelming 11–1 approval for a major acquisition. The dissenter engaged with George constructively and persuasively about potential dangers of the deal. George listened and reconvened the board, and this time they voted not to go through with the acquisition.9 Direct talk, however, won’t always be enough to solve the problems facing boards quickly and constructively. Not all boards will have a CEO willing to listen or a board member skilled enough to win over 11 fellow directors. The board also needs a comprehensive array of supporting resources, with clear policies and procedures for each that reflect best practices in conflict management. Implementing these new systems can not only significantly improve corporate governance, but it has the potential to greatly increase insight into operating effectiveness as well.

References

1. B. Morris with P. Sellers et. al., “The Real Story: How Did Coca-Cola’s Management Go From First-Rate to Farcical in Six Short Years? Tommy the Barber Knows,” Fortune, May 31, 2004, 84–98. See also C.H. Deutsch, “Coca-Cola Reaches Into Past for New Chief,” The New York Times, May 5, 2004, sec. C, p. 1.

2. K.A. Slaikeu and R.H. Hasson, “Controlling the Costs of Conflict: How to Design a System for Your Organization” (San Francisco: Jossey-Bass, 1998).

3. I.M. Millstein, “‘Trouble’— A Factor in Selecting Directors,” Directors Monthly (June 2000): 1–4.

4. L.M. Holson and C. Hulse, “For a Diplomat, Task Is Quelling Disney’s Unrest,” The New York Times, March 5, 2004.

5. C. Elson, interview with author, Sept. 28, 2004.

6. The Code of Ethics and the Standards of Practice of the International Ombudsman Association are available at www.ombuds-toa.org.

7. T. Landon Jr., “Counselor for All Reasons,” The New York Times, July 28, 2005, sec. C, p. 1.

8. M. Gunther, “The Mosquito in the Tent: A Pesky Environmental Group Called the Rainforest Action Network Is Getting Under the Skin of Corporate America,” Fortune, May 31, 2004, 158–165; Y. Trofimov and H. Cooper, “Globalization Protestors Plan to Target Companies,” The Wall Street Journal Online, July 23, 2001; G. Winter, “Timber Company Reduces Cutting of Old-Growth Trees,” The New York Times, March 27, 2002; J. Carlton, “Boise Cascade Turns Green,” The Wall Street Journal Online, Sept. 3, 2003.

9. C. Hymowitz, “Changing the Rules,” The Wall Street Journal Online, Feb. 23, 2003; P. Pryzant and V. Caracio, “Overcoming Warren Buffett’s ‘Boardroom Atmosphere,’” Directors Monthly (December 2003): 9.