Pathways to E-Business Leadership: Getting From Bricks to Clicks

As established business-to-consumer (B2C) companies set out to take advantage of the Internet, m any have found the task far more difficult and potentially destabilizing than they had anticipated. No mere business tool, the Internet goes to the heart of the corporation, challenging its existing business models and customer relationships.1

The challenges force traditional companies to address some fundamental questions, including: What do the Internet and its associated technologies mean for our business, our competitive strategy and our information-systems strategy? Which former imperatives need to be considered if we are to build a sustainable Internet business? How do we leverage the speed, access, connectivity and economy created by Web technologies to extend our business vision? And how do we organize in order to execute our business-Internet strategy?

The answers to those questions largely determine the success of a company’s Internet initiative. To investigate how organizations can effectively deal with the challenges, we examined 58 major B2C corporations from three continents and a wide range of industries. (See “Research Methodology.”) We found 15 “leaders,” 25“laggards” and 18 “medium-performing” organizations. Leaders shared generic characteristics that distinguished them from other companies. (See “Characteristics of B2C E-Business Leaders.”) However, they also followed distinctive routes. Although they may have started with strategy based upon the idea of technology leadership, they migrated through interim stages to a market strategy. Only then were they capable of yielding sustainable, consistent e-business profits. Leaders were the fastest and most focused at moving from an “e” that stands for electronic to an “e” that represents earnings.

Mapping the E-Business Evolution

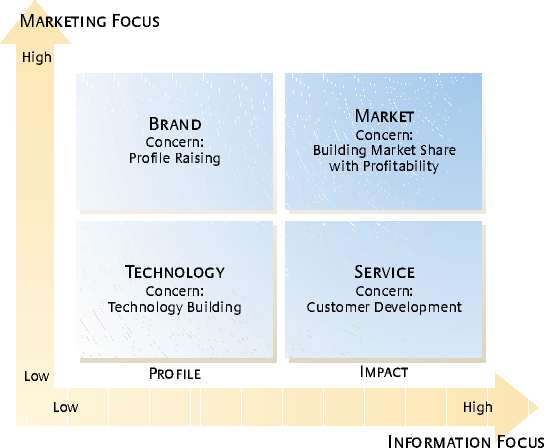

As we searched B2C e-business initiatives for common paths and practices, two things became clear. First, the move to the Internet was an evolutionary process for bricks-and-mortar companies; second, it involved planning and flexibility in the face of market and technology developments. To illustrate that evolution, we created a framework with four crucial strategic quadrants: technology, brand, service and market. (See “Business-to-Consumer E-Strategic Grid.”)

In practice, laggard companies never made it past the technology quadrant. Because they had no business model governing their use of Web technology, they became mired in debates about whether Web technology was a silver bullet or a passing fad. Thus, profits and market share remained elusive. Leading and medium-performing organizations, on the other hand, quickly moved beyond their starting points. They migrated toward a market strategy by concentrating either on a brand strategy or service strategy. Few migrated directly to a market strategy.

Interestingly, there emerged both more progressive and less progressive ways of operating within each quadrant. For example, by the end of last year, 24 of the study organizations had begun to operate on the edge of the market quadrant. But as market conditions became more competitive, their ability to own their market proved as elusive as profitability, let alone high margins. Many of our respondents talked of “being in the game for the long haul” and the need to “sort out channel conflicts,” “the complexity of integrating Web sites with legacy systems and business processes,” and the need “to include the whole management team and employees in the transformation process.”

Particularly interesting has been the variety of practices relating to brands. One of the early misconceptions about the Internet was that brands would cease to matter, that existing brands could be challenged easily by startups. On the contrary, we found that in an e-world characterized by information overload, multiple products and services, and by expanding search

The Transience of Technology Leadership

In all sectors we found e-initiatives that focused primarily on the technology. Some 18 companies, including Citicorp, BMW, Pratt & Whitney, W.R. Grace and Genentech, began in the technology quadrant in the mid-1990s. Others followed in the period from 1997 to 2000. But, as many discovered, being first technology mover is not always a successful strategy even when applied to a viable business model. Information-systems success carries its own risks.2 Moreover, in classic prime-mover examples such as the Sabre airline-reservation system, it’s the intelligent management of information that explains success.3 Sabre used technology to improve the process for making reservations, tracking customer preferences, accurately pricing products and services, and responding to patterns of behavior over time. In addition to using technology strategically, companies must deploy it in the appropriate organizational and managerial context. When technology is treated as an asset with a role in transforming the business, there is much greater likelihood of technology leadership and eventual business payoff.4

Lagging Practices

Technology laggards are companies that share the following characteristics:

- the IT department was made responsible for e-business developments;

- senior business managers underfunded and undervalued IT and e-business developments;

- IT and Web-based technologies were treated as a cost center rather than a profit center; and

- the CIO was positioned as a specialist functional manager.

Such companies typically remain stuck in the technology quadrant, where their projects are rationalized as “pilot” or “learning” vehicles. Laggard companies that try to move their initiatives to one of the other quadrants underachieve.

Leading Practices

What, then, characterized the technology leaders? Companies such as Lufthansa, Motorola, Citicorp and Royal Caribbean Cruises made judicious moves into Web technologies with a view to harnessing them for leadership in business terms. In other words, the companies focused on matching appropriate technology to business strategy and customer requirements. Most also ensured that appropriate technology capability and capacity were internally in place or available through partnering. All were building technology platforms to support Internet, intranet and extranet applications, with a view to reinforcing, improving or changing the value propositions of their core business. In theoretical terms, technology leadership amounted to early adoption of Web technologies to achieve a competitive advantage. In practical terms that meant learning the technology in the context of developing an information or marketing strategy — and thus being able to shift focus fairly rapidly from the technology quadrant to one of the other quadrants.

A Case in Point: The U.S. Power Industry

Technology leaders are able to see the business opportunity that Internet technology presents, shift focus and move into another quadrant. Consider the U.S. power industry. The Federal Energy Regulatory Commission (FERC) has ordered the industry to use OASIS (Open Access Same Time Information System), an advanced Internet technology that helps utilities buy and sell natural gas and pipeline capacity efficiently. Although FERC mandates that utilities work to reduce customers’ power consumption, the two utilities we studied saw an opportunity there: They could use OASIS to create additional value for customers and thus increase and lock in market share. With the low-cost Internet technology boosting their ability to monitor power usage (even of individual appliances) and to advise people on how to save money, they could gain customers. Their strategic focus moved from technology to market; they used technology to add value. Their plan to get closer to customers through the Internet and create wider market coverage was already bearing fruit by late 2000.

As the utilities discovered, to position a business in the technology quadrant is strategic in that it is an investment in the future, but the business value lies in moving company focus to brand or service — and then to market.

Brand as Strategy

Many organizations we studied exemplify IBM CEO Lou Gerstner’s assertion that “branding in a network world will dominate business thinking for a decade or more.” But although branding on the Web can indeed fuel market growth, it can generate problems for companies that fail to deliver on the promises their brands represent. As the organizations studied translated their brands to the e-business context, they generally concentrated on one of four approaches: brand reinforcement, brand repositioning, brand creation or brand followership, the first two proving more effective bridges to profitability than the latter.

Brand Reinforcement

One of the first routes out of the technology quadrant is to seek brand reinforcement via the Internet. Instead of treating the Internet as a new sales channel, established companies use it to reinforce customers’ awareness of, and regard for, the brand. In 1998 BMW astutely moved from a technology strategy to one that bridged both the technology and brand quadrants. Rather than sell autos over the Internet, BMW aimed to make its site “drive and feel like a BMW” — and use it to steer potential new-car owners to a traditional dealer. That way, it preserved its traditional face-to-face interaction with customers and avoided conflict with its dealers.

Levi Strauss tells a different story, revealing that the power of existing brands alone offers no guarantee of Internet market success. When the company launched its online stores levi.com and dockers.com, it prohibited key retail partners from selling Levi Strauss merchandise over the Web. Retailers reacted by turning their attention to private brand offerings. Meanwhile, Levi Strauss proved inexperienced at selling online. Sales floundered against increasing online costs — estimated at between $10 million and $100 million — and by summer 2000, Levi’s had closed its online operations.

Brand Repositioning

Several organizations surveyed used the Internet to effectively reposition their brands. Dow Jones, for example, responded to major online threats by extending its global vision and creating a new service bundle for the Internet. Meanwhile, the airline Lufthansa sought to reposition itself as a highly customer-focused travel agency and information provider through its online InfoFlyway service.

In the United Kingdom, supermarket chain Tesco moved from brand reinforcement to brand repositioning over two years. First, in 1998 it reinforced its brand by creating Tesco.com, a wholly owned Internet subsidiary that allows customers to order groceries online for delivery and uses existing retail outlets for supply. In 1999, although the online business had lost £11.2 million on £125 million in sales, it also had attracted 500,000 users and was anticipating a profit in two years. By the end of 2000, Tesco had invested £56 million in its online retail business, dedicated 7,000 staff members to it, and had almost all 600 local stores online. At the same time, Tesco used the power of its existing brand and relationships with shoppers to reposition Tesco.com as a seller of services and goods other than food and to launch Tesco Personal Finance, an online joint banking venture with the Royal Bank of Scotland. Senior executives said they expected nonfood goods ultimately to comprise half of e-sales and both Internet businesses to move into the market quadrant and reach profitability in 2001.

Brand Creation

Brand creation has been most evident among Internet startups such as Pets.com and Buy.com. But Internet-only companies are not alone in launching expensive new Internet brands. Consider Prudential Assurance, a financial-services company that, in October 1998, launched Egg, an online bank that offers savings accounts, credit cards, loans and a shopping mall. By mid-2000, the subsidiary had acquired 940,000 customers, including 250,000 credit-card customers. Moreover, it had taken £7.6 billion in deposits and lent £679 million — and was being floated as a separate entity on the stock market.

But although Egg quickly achieved brand recognition in the United Kingdom, the cost was high. Egg spent £75 million on advertising in its first year and expected a loss of £377 million before breaking even sometime in 2001. Egg succeeded in attracting customers, but it did so by offering a savings account that paid a high interest rate — a strategy described by rivals as “handing out £20 notes in exchange for £10 ones.” A series of customer-service debacles further eroded its position: Web-site outages, long waits on the telephone, lack of integration between credit-card and savings-account systems, and delays in the launch of new cut-price unit trusts (managed portfolios of investments). Ultimately, the company expects to derive profits from cross-selling new products and services to its savings-account customers (thus moving to the market quadrant), but it is currently in the red.

Brand Followership

Brand followers copy early online movers in their approach to branding. For example, parts supplier RS Components looked to Dell Computer. Land Rover emulated other car manufacturers. Many online wine shops and bookstores modeled themselves after wine.com and Amazon.com (though Amazon has used its technology patents to slow brand followership through litigation). In rare instances, brand followers can succeed, but they need to reposition quickly. Otherwise, they merely reflect a reluctance to build on Internet opportunities.

What are the lessons? On the plus side, the Internet allows global branding and wider market reach. On the minus side, delivering on the brand (the “promise to the customer,” as it has been called) can be expensive and difficult. As Levi Strauss and Egg show, a high-profile brand means little if it is not connected to knowing customers well and delivering the services they require.

The Service Payoff

Service leaders in our study developed an almost obsessive focus on customers and information. That focus tended to be a more effective transitional strategy than a focus on brand. (In fact, brand leaders that migrated to the market quadrant adopted elements of the service strategy because the migration forced them to focus on information for customer reasons). Service leaders quickly learned to take advantage of the Internet to gather data about customers and provide them with information on their own terms. The companies variously used that information in adaptive profiling, mass customization and one-to-one marketing concepts.5 They applied customer-resource life-cycle analysis and focused on customer retention. Moreover, integration of technology led to seamless service. As an Office Depot executive commented, “The integration of systems is key; customer support and service through this is something we put a lot of emphasis on.” Companies that crossed into the market quadrant effectively turned such concepts into business practices.

Leading service-focused organizations developed service variations for specific contexts. Value-adding practices include:

Personalization.

Companies can offer online mass customization by tailoring a product’s attributes or presentation to individual customers. For example, Dow Jones, the publisher of The Wall Street Journal, introduced the Interactive Edition, which allows subscribers to organize the newspaper according to the information they deem most relevant.

Tiered service levels.

Dell allows customers to select their own level of service according to categories: “all,” “registered,” “contracted” or “platinum” service.

Collecting information and enhancing the customer experience.

Alamo Rent A Car, Office Depot, RS Components, Dell, Cisco, United Parcel Service (UPS) and Federal Express (FedEx) first collect data about the customer-resource life cycle and then use the data to support customers’ preferences and track purchases through to delivery and after-sales service.

Keeping it simple.

FedEx, Alamo, Direct Line and Dell excel at making it easy for customers to do business with them and to do their jobs. For example, Dell developed customized firewall-protected intranet sites for more than 200 of its largest global customers, permitting clients’ purchasing staff to view and select all products that meet the configurations authorized by the client.

Responding to what customers do not like doing or do badly.

In the United Kingdom, Direct Line recognized that getting auto insurance is a chore for car owners, and so it offered one-stop insurance by telephone, saving customers time and money. The service netted Direct Line more than 8 million customers. Direct Line now operates through a Web site integrated into its core insurance business, and it has expanded into other insurance areas, such as household and travel insurance. A Scandinavian company, MeritaNordbanken, discovered that customers hate paying bills and do it inefficiently, often incurring late fees. Therefore, in early 2000 it developed a now widely used Internet bill-payment application.

Providing a one-stop shop for service.

Pratt & Whitney and Nortel Networks have developed virtual call centers, allowing customers to make purchases and resolve questions and problems from a single Internet site. Lufthansa also moved its ticketing services online, saving customers the potential time and expense of using a travel agent or the phone.

Balancing customer self-service with support.

Offloading some of the service tasks to customers may save money, but it may not enhance the customers’ experience. Hard-goods supplier W.W. Grainger achieves a successful balance by delivering online catalogs customers can easily customize, scan and order from. And as credit-card company American Express offers an ever greater array of online financial services, it engages in ongoing efforts to balance self-service with customer support.

Knowing the customer best.

Lufthansa identifies “superior knowledge of customers” as a competitive goal. Its InfoFlyway service demonstrates that focus by tracking customer tastes closely and offering home pages in more than 35 languages. The award-winning site also delivers individual e-mail and offers account access, monthly auctions, hotel links, travel guides, baggage tracing and an online booking system for 700 airlines. The payoff: In 1998 the service had developed 400,000 registered users who had made 41,000 electronic bookings, producing £17.6 million in revenues.

In Search of (Profitable) Market Growth

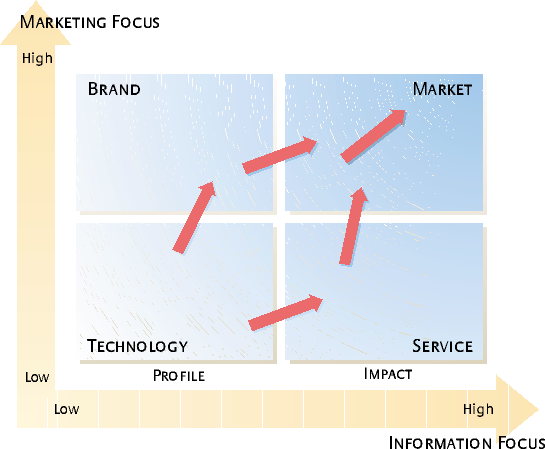

Let us now bring together a mapping of the optimal paths leaders have been pursuing through the e-strategic grid. (See “Leadership Paths on the E-Strategic Grid.”) What distinguishes the most successful companies is their ability to integrate marketing, customer service and use of information and technology to deliver a profitable long-term market share or niche strategy. Behind that integration has been a “re-engineering on steroids” stage — reorganizing and re-educating people, reconfiguring processes and remodeling technology infrastructure. The integration of processes, technology and skills gave the leading organizations the platform to convert their strategic intents into business value. In bricks-and-mortar companies we found integration capability a scarce and not easily replicable resource.

Businesses operating in the upper right of the market quadrant stood out in their ability to combine marketing, service and information capabilities in order to achieve disproportionate Web-based B2C market growth and profitability. The most notable among them were Fidelity Investments, Cisco Systems, Charles Schwab, Office Depot and Dell. By 2000, other companies had moved in varying degrees into the market quadrant, but generally their integration was less effective, as was the intensity and focus with which they deployed the relevant capabilities. Companies such as W.W. Grainger, MeritaNordbanken, Direct Line, Lufthansa, Alamo, Royal Caribbean Cruises, UPS and FedEx were driving hard to gain market share, but only some were generating profits.

Lessons From Leading Practices

After experiencing an early but indifferent technology start, car-rental company Alamo quickly moved into the service quadrant. There it redeveloped its Internet offering to reflect customer preferences and its recognition that the Internet plugged straight into the heart of its mission. Alamo managed the problem of channel conflict with travel agents by developing a special Web site tailored to their needs. And it realized that customers prefer to pay for their cars at the counter rather than online and therefore chose not to develop an online payment system.

UPS integrated Web technologies into its business model and greatly extended the power of the model and the number and speed of services offered. (See “E-Leader Case Study: UPS in Distribution.”) So did Office Depot. Like UPS, it had the advantage of prior robust, integrated technology infrastructure. It could easily have used the Internet merely as an information catalog, but instead Office Depot treated it as a means of transacting business. Similarly, Charles Schwab, another company founded on a strategy of technological innovation, spent five years transforming itself from a traditional broker to an online financial-services company that today is conducting more than 70% of its customer transactions online.

The companies making it deep into our market quadrant share certain characteristics: They integrate Web technologies into their core, use information gathered online to gain insight into the customer and to augment service, and focus intensively on customers and marketing. Moreover, they have identified ways of using Web technologies strategically and seek ways to sustain their advantage — through brand, size and customer relationships as well as differentiation. They also made key decisions at the right time about how and when to structure their moves to e-business. (See “Choosing a Bricks-and-Clicks Organizational Structure.”)

The Importance of Differentiation

The practice of differentiation is key to B2C e-business success. In most sectors, commodity-based, price-sensitive competition on the Web will not be a sustainable business model. A business must enter the competitive arena with a customer offering (the inseparable bundle of product, service, information and relationship) that is an alternative to or a close substitute for what rivals offer. The challenge over time is to continually differentiate the offering — and to make it less price-sensitive — in ways that remain attractive to the targeted market segment.

The support dimension of an offering represents those differentiating features that help customers choose, obtain and then use the offering. All other differentiating features belong to what is called the merchandise dimension.6 The support features of a car sold over the Web include availability of information, ease of purchase, the test-drive, promptness of delivery, and service arrangements. Companies can augment the support dimension through personalization (the personal attention paid to each customer’s needs) and through expertise (the seller’s superiority of brainpower, skill or experience in delivering and implementing the offering). FedEx facilitates Internet tracking of parcels; Wine.com offers online access to wine information and the expertise of a sommelier.

Merchandise features include color, shape, size, performance characteristics and in-car entertainment. Companies can further differentiate the merchandise component by augmenting content (what the offering does for the customer) or aura (what the offering says about the customer). Amazon.com makes available a wider range of books and products than do competitors; MeritaNordbanken provides wireless-application-protocol (WAP) phone access to a customer’s account. Both companies’ brands augment the aura of the offering. Leading organizations in our study strove to tap both sources of differentiation (particularly through leveraging information bases) to get closer to customers and lock them in.

What matters is achieving differentiation in a changing competitive context so that customers see the dynamic value proposition as superior to alternatives. Achieving such differentiation requires a knowledge of and relationship with customers and a speed and flexibility of anticipation and response that many organizations have found difficult to develop, let alone sustain. Moreover, differentiation has to be achieved in specific Internet environments where power often has moved decisively in favor of the customer.7

Context, Timing, Focus and Flexibility

Statistical analysis of business-unit data elsewhere delivers strong evidence that information technology can have a significant, often positive, multifaceted effect on business productivity.8 That effect comes not in isolation but as a result of interaction with other factors, such as organizational structure, percentage of knowledge workers, and relative competitive position. The context, timing and focus of IT investment is emerging as all-important — a finding that our study and other studies on Web-technology investments demonstrate.9

But if a company is to exploit the Internet to achieve business goals, its journey through the e-business strategic grid has to be guided by both new management thinking and certain perennial principles and practices. If it all gels, real bricks-and-clicks strategy develops. However the journey does not guarantee success. Strategy has to stay flexible because even leading companies find they cannot assume that their market position on the Internet will remain constant. It changes 24 hours a day, seven days a week, time zone to time zone, and market segment to market segment. Even more fundamental for the future — and disguised by the focus on competitive positioning issues — is putting in place the key human-resource, IT and organizational infrastructure to support the processes and behaviors designed to deliver on strategic intent. Increasingly, companies trying to crack B2C e-business will discover what the leading organizations already know — that e-infrastructure is a boardroom investment and ownership issue because it goes to the core of executing sustainable, anticipatory business performance.

References

1. N. Venkatraman, “Five Steps to a Dot-Com Strategy: How To Find Your Footing on the Web,” Sloan Management Review 41 (spring 2000): 15–28; and D. Feeny, “Making Business Sense of the E-Opportunity,” Sloan Management Review 42 (winter 2001): 41–50.

2. M. Vitale, “The Growing Risks of Information Systems Success,” Management Information Systems Quarterly 10 (December 1986): 327–336. The article points to systems that change the basis of competition to a company’s disadvantage, lower entry barriers, bring litigation or regulation, increase customers’ or suppliers’ power to the detriment of the innovator, turn out to be indefensible and may even induce disadvantage, are badly timed, transfer power and are resisted by other market players, and may work in one market niche but not in another. That implies an overreliance on the technology and inadequate analysis of the competitive context to which it is applied.

3. T. Davenport, “Putting the I in IT,” in “Mastering Information Management,” eds. T. Davenport and D. Marchand (London: Financial Times Prentice Hall, 1999), 1–6.

4. L. Willcocks, D. Feeny and G. Islei, eds., “Managing IT as a Strategic Resource” (Maidenhead, England: McGraw-Hill, 1997).

5. B.J. Pine, “Mass Customization: The New Frontier in Business Competition” (Boston: Harvard Business School Press, 1993). Though written before the Internet took off as a business tool, the book is highly relevant to Internet applications.

6. S. Mathur and A. Kenyon, “Creating Value: Shaping Tomorrow’s Business” (London: Butterworth-Heinemann, 1997); and A.M. Van Nievelt, “Benchmarking Organizational and IT Performance,” in “Beyond the IT Productivity Paradox,” eds. L. Willcocks and S. Lester (Chichester, England: Wiley, 1999), 99–119.

7. See, for example, P. Seybold with R. Marshak, “Customer.com: How To Create a Profitable Business Strategy for the Internet and Beyond” (New York: Random House, 1998); and S. Vandermerwe, “Customer Capitalism” (London: Nicholas Brealey Publishing, 1998); and F. Newell, “Loyalty.com: Customer Relationship Management in the New Era of Marketing” (New York: McGraw-Hill, 2000).

8. See, for example, A.M. van Nievelt and L. Willcocks, “Benchmarking Organizational and IT Performance” (Oxford: Templeton College, 1998); and E. Brynjolffson and L. Hitt, “Paradox Lost? Firm-Level Evidence on the Returns to Information Systems Spending,” in “Beyond the IT Productivity Paradox,” eds. L. Willcocks and S. Lester (Chichester, England: Wiley, 1999), 39–68.

9. R. Plant, “E-Commerce: Formulation of Strategy” (New York: Prentice Hall, 2000); and C. Sauer and L. Willcocks, “Building the E-Business Infrastructure” (London: Business Intelligence, 2001).

ADDITIONAL RESOURCES

Two recent Sloan Management Review articles on developing e-strategy for bricks-and-mortar companies will be helpful to readers: David Feeny’s “Making Business Sense of the E-Opportunity” in winter 2001 and N. Venkatraman’s “Five Steps to a Dot-Com Strategy: How To Find Your Footing on the Web” in spring 2000. Recommended books are the 1999 “Information Rules: Strategic Guide to the Network Economy,” by Carl Shapiro and Hal Varian, and the 2000 “How Digital Is Your Business?” by Adrian Slywotzky and David Morrison, which presents case studies of Cemex, IBM, Schwab, General Electric, Cisco Systems and Dell. Michael Rappa runs a good Internet site on business models (http://ecommerce.csc.ncsu.edu/business_models.html). Peter Weill and Mike Vitale’s “E-Commerce Business Models,” published this year, is a well-researched analysis of eight foundational models. For information on branding, see Michael Moon and Doug Millison’s 2000 “Firebrands: Building Loyalty in the Internet Age.” Readers also may find useful Chris Sauer and Leslie Willcocks’ 2001 “Building the E-Business Infrastructure,” which provides a comprehensively researched review of infrastructure. One of the best monthly magazines tracing developments is still Business 2.0 (Web site: www.Business2.com).