Jay Forrester’s Shock to the System

Forrester upended the conventional thinking in management, redefined what growth means, and invented system dynamics. In this excerpt from The Age of Heretics, Art Kleiner describes how the MIT Sloan School professor did it.

Leading Sustainable Organizations

In the 1960s, the values of the industrial era were questioned, loudly and publicly, through the computer modeling work of Jay W. Forrester, a professor at Massachusetts Institute of Technology. Forrester could not be ignored because he was one of the most accomplished engineers alive. He had invented the addressing system for digital computer memory.

Forrester grew up on a cattle ranch in the Sand Hills region of northwestern Nebraska. His aptitude for engineering appeared early; while a senior in high school in the 1930s, he built a wind-driven power generator for the ranch, using cast-off automobile parts. After getting a graduate degree in electrical engineering at MIT, he designed servomechanisms (mechanical control devices), radar controls, and flight-training computers for the U.S. Navy. That led him, during the early 1950s, to a job managing Project Whirlwind, a team at MIT that built one of the first digital computers. At Whirlwind, he figured out a way to organize into a grid the magnetic cores that stored information so that the contents of their memory could be retrieved. This became one of the foundational technologies of the modern computer. “It took us about seven years to convince the industry that random-access magnetic-core memory was the solution to a missing link in computer technology,” Forrester later said. “Then we spent the following seven years in the patent courts convincing them that they had not all thought of it first. ”

EDITOR’S NOTE:

I was delighted when I read MIT Sloan Management Review editor in chief Michael S. Hopkins’s interview with Jay Forrester, in part because it led me back to the section about Forrester in Art Kleiner’s magisterial The Age of Heretics: A History of Radical Thinkers Who Reinvented Corporate Management, which has recently been updated and reissued. In his book, which celebrates renegade management thinking and practice, Kleiner offers a taut summary of Forrester’s most important work and its ramifications. We are grateful to Kleiner, now editor of Booz and Company’s strategy + business, for his permission to reprint an excerpt here.

Also noted by Kleiner in this excerpt is his student the late Donella Meadows, cited by John Sterman, head of MIT Sloan’s System Dynamics Group, as his “mentor” in our most recent MIT Sustainability Interview. – Jimmy Guterman, MIT Sloan Management Review.

In 1956, still in his 30s, Forrester walked away from computer design, feeling that the exciting pioneering days were over. He joined the School of Management at MIT. At first Forrester planned to work in operations research, but he grew impatient with a methodology aimed, as he perceived it, at finding “little efficiencies in the corners.” He wanted to work on “issues that made the difference between corporate success and failure.” Soon after he arrived, a few managers from General Electric’s household appliance division found their way to his office with a problem endemic to any manufacturing business that no one had been able to solve. Some months the factories had so many orders they couldn’t keep up, even with massive amounts of overtime. Other months they wanted to lay off half their people. Why couldn’t they develop a steady production flow? Why did orders rise and fall?

Traditionally managers blamed these types of fluctuations on business cycles. Sometimes consumers bought more, sometimes bought less, and there was nothing anyone could do about it. But that explanation didn’t sit right with Forrester. The dynamics reminded him too much of servomechanism controllers, the automatic control devices that inspired the field of cybernetics in the mid-twentieth century, which he had spent years designing for the U.S. Navy. All machines can be used as analogues of deeper processes; Sigmund Freud had based his depth-plumbing psychology on an analogy to the hydraulic pump. Forrester built a modeling language on the servomechanisms he knew from his navy days. A servomechanism is a mechanical device hooked to a sensor, like a thermostat on a building’s automated heating unit. The first signals to come in from temperature sensors often report that the building is still too cold. Thus, the thermostat may continue dispensing heat, and the building becomes too hot. So then the thermostat signals for cooling, but once again, it takes time to change the temperature, and the building becomes too cold. The fluctuation has to do not with the actual outside temperatures but with the synchronization (or lack of it) between the heating and measuring devices.

It seemed to Forrester that the General Electric managers were faced with a similar problem — and, if so, they could fix it. He computed manually how production, employment, inventories, and backlogs would behave when controlled by the management policies then in use at General Electric. He showed that even with constant demand from consumers, those policies were themselves able to produce the instability of production that had been observed. He tested his diagnosis by tracing back a series of horrible fluctuations at the factory to the original orders that came in from retail stores, plotting the inventory levels and the number of goods on order, week by week, at every point in the distribution chain. Then he entered all the numbers into a computer model he had developed, translating the manufacturer’s policies into algorithms that demonstrated their effects over time. Unlike most other computer models of its time, Forrester’s incorporated the principle of feedback: the way that a circuit, an ecological niche, a human body, an organization, a culture, or any other system will regulate itself, growing or seeking stability. In any system involving feedback (which includes all of nature and human activity), influence is cyclical. There is no single cause-and-effect; the effect always influences the cause. You turn a faucet to produce a stream of water and fill a glass, but the volume of water in the glass is also controlling your hand by influencing it to stop when the glass gets full. Feedback relationships could interact for years, with various management policies pushing each other in intricate patterns, producing complex results that would seem thoroughly mysterious unless you understood the dynamics of their interrelationships over time.

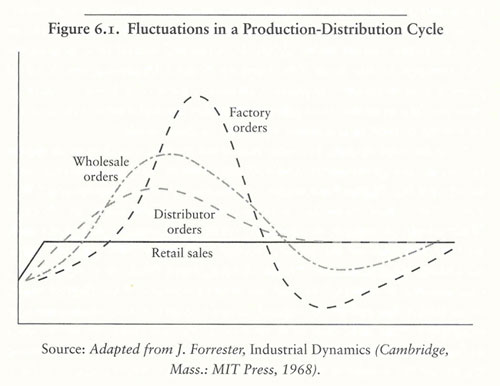

In the first quarter of GE’s data that Forrester studied, for instance, retail appliance sales increased by 10 percent. Retailers then ordered more appliances to refill their inventories. But it took weeks for orders to work their way through the wholesaling channels and for the GE factories to ship their products. While they waited, retailers tended to panic — and to pile on more orders than they needed. This in turn caused distributors and wholesalers to pile on their orders, and that added pressure at the factory, where orders jumped by 51 percent. After six months, when all the orders had finally arrived, there was a glut at appliance stores, so they cut orders and returned their extra stock to the warehouses. Distributors sent them back to GE. Factory production eventually dropped to 3 percent below where it had started — a disaster.

The result was a series of curves that rose and crashed in succession. That tiny 10 percent jump in sales had been amplified again and again as it worked its way back and forth along the distribution chain, until it resulted in hundreds of thousands of dollars’ worth of excess toasters on warehouse skids. It was all exacerbated by the managers’ reactions to what they perceived as outside problems, like seasonal demand or competitors’ actions, because they had no understanding, Forrester said, of how the system worked. If they really wanted to smooth out the fluctuation, he suggested, they could eliminate a level of distributors or react more slowly to surges in orders. That’s where the leverage existed.

Fluctuations In A Production-distribution Cycle

Soon Forrester developed a computer model of GE’s supply chain, which some of his MIT students turned into a board game for team play in the early 1960s. As college students, they found beer more appealing than toasters, and they called it the “MIT Beer Game.” It is still played frequently in corporate training programs. But there was a lot more to Forrester’s method than streamlining the production-distribution cycle. Concepts from engineering, such as noise (irrelevant signals) and the use of nonlinear equations, all had implications for organizational leaders. And at least one of those implications was very hard to accept: most problems that corporate leaders (or leaders of any other system) face aren’t caused by outside forces: competitors, market trends, or regulation. Problems tend to derive from the unintended consequences of the leaders’ own ideas and efforts.

During the next few years, Forrester refined his appliance model into a more general-purpose computer modeling language called DYNAMO. It represented managers’ decisions in terms of the vessels and pipeline valves ( “stocks” and “flows” ) of fluid dynamics. The resulting simulations were particularly good at explaining the gradual accumulations and accelerations of the kinds of forces that creep up slowly and unnoticed, until one day the entire system shifts. (Malcolm Gladwell would later popularize this concept in The Tipping Point.) Modeling this kind of growth and resistance requires nonlinear calculus, a form of math so intricate that even the most gifted and highly trained mathematicians are incapable of solving nonlinear equations in their heads.

Over the next decade, Forrester consulted in arenas as diverse as manufacturing, city government, and medical research. In one celebrated case, he advised the Digital Equipment Corporation (whose founder and CEO, Ken Olsen, had been his student and a collaborator on Project Whirlwind), to expand production, while the company was still small, into the full floor of the former woolen mill where DEC had started in Maynard, Massachusetts. “A lot of companies think they expand as a consequence of orders,” he told the other members of the Digital board of directors. But orders, he argued, actually come in as a consequence of expansion. They held their next meeting in the new space, an empty floor as big as two football fields. Standing in the middle of the room, they could barely see the windows at the opposite end. Nine months later, the floor was completely full of machines and people, returning a net profit of 15 percent of after-tax revenues. Digital continued to buy buildings and land in the area anticipating when they would be needed. Forrester’s suggestion contributed to the development of the Route 128 industrial corridor outside Boston.

But Forrester was also disillusioned with the response he got from many corporate leaders: they often lost interest when his models suggested fundamental change was needed. Clients would thank him politely and then ignore his suggestions. Like Pierre Wack, he felt that mental models were so deeply embedded in managers’ images of themselves that they could not appreciate alternatives.

When Forrester’s first book on corporate systemic patterns, Industrial Dynamics, came out in 1961, it was compared with the work of Galileo, Malthus, Rousseau, and John Stuart Mill. And like all other efforts to delineate the behavior of systems, the same techniques could be applied to a wide variety of endeavors. In 1968, for instance, Forrester began working with John Collins, a former mayor of Boston, on a theory about urban growth and poverty. Using his dynamics modeling language, he was one of the first analysts to recognize how postwar measures such as urban renewal created more of the poverty that they were designed to eliminate. That led to a second book, Urban Dynamics, as dense and provocative as the first.

In 1970, a small but influential group of business leaders, government ministers, and academics invited Forrester to use his system dynamics approach on an unprecedented scale. The invitation came from the Club of Rome, an informal society deliberately designed to be international, entered through invitation only, and limited in its by-laws to 100 people. They had organized themselves in 1968 to investigate what they called the world’s problematique humaine : their feeling that world population, pollution, poverty levels, natural resource depletion, crime, international terrorism, and youth rebellion were all bound inexorably for crisis and were also somehow interrelated. Could any of these problems be addressed in the long run without addressing the others?

Aurelio Peccei, the founder, didn’t think so. The prime mover behind the club, he was a former Fiat executive, a long-time member of the Olivetti board, a former World War II anti-Fascist resistance leader, and the founder of ItalConsult, Italy’s most prominent economic consulting firm. Peccei had intended the club to be a carefully selected group of people who could investigate the problematique and present the public with an approach to solving it. There was always a long waiting list to get into the club, for the members included a variety of eminences and thinkers: Hassan Ozbekan, a Wharton professor who had prodded Peccei to start the club; Eduard Pestel, president of the University of Hanover in Germany; Saburo Okita, head of the Economic Research Center, a private institute in Tokyo; and Carroll Wilson, one of the first people appointed to the U.S. Atomic Energy Commission — a MIT physicist who had spent the past few years researching the longtime effects of pollution.

Wilson introduced Jay Forrester as a new member at a club meeting in Bern, Switzerland, in June 1970. The club had been promised a $ 400,000 grant from the Volkswagen Foundation if they could propose a viable research project. Hassan Ozbekan, the Wharton professor, had written a preliminary proposal, but the foundation had rejected it. Now the 60-odd members of the club couldn’t agree on how to proceed. Forrester sat through the first day without saying anything, feeling self-conscious about being an “ugly American” in this international gathering. Then, at 6:00 p.m. , someone mentioned that Volkswagen would cancel the grant unless the club could show they had a satisfactory methodology.

“Excuse me,” Forrester said, “I think I have the methodology you are looking for.” He explained briefly and invited them to visit MIT and see for themselves. “This isn’t something I can cover briefly,” Forrester said. Members should come either for two full weeks, he added, or not at all, because it would take that long to understand.

They agreed. Suddenly Forrester had only days to organize a massive conference. On the flight home, he began to muse about what he would show them. He began scribbling out a design for a model of the problem; before long, his diagrams occupied nine empty coach seats. On the following Saturday, the Fourth of July, Forrester worked until 11 p.m., converting his equations into a computer model (which he named “World” ). By the time the Club of Rome members arrived in mid-July, his model was virtually complete. Forrester’s graduate students quickly painted it onto a white bedsheet, which covered one wall of the MIT classroom where the group met.

Like all of Forrester’s other models, World was a computerized network of interrelated policies, all affecting each other over time, as the model evolved. When “population” rose, for example, that caused “demand for goods and services” (such as schools and medical care) to rise, which increased “employment” and “capital investment,” which allowed “population” to rise still further. A cycle was in place, pushing “population” continually higher unless other forces intervened. There were many such interrelated cycles in the model, and they all came alive when researchers ran the simulation. A researcher could enter a scenario of zero population growth, or of rapid population growth, along with various policies for economic development and agricultural production. Then the model would churn out its calculations and simulate the fate of the world over the course of two hundred years. The Club of Rome wanted Forrester to drop all his other work and devote the next year to refining, testing, and reporting on the model, but he refused: instead, he delegated the job to a team of MIT-based researchers.

The team was led by two young postgraduates, around 30 years old, who were married to each other and had just finished a year-long trip around Asia together. Their names were Dennis and Donella (Dana) Meadows. Dennis was lanky, long-faced, long-sideburned, slow-speaking, and cerebral; his previous system dynamics work had focused on the fluctuations of pork bellies in commodities markets. Dana was talkative, a bit elfin in her features, and an avid writer. Her background was in biophysics and ecology: “I saw the world through the second law of thermodynamics,” she later said.

They had stepped forward as volunteers to claim the project, and Forrester did not object. He completed his model and produced his third book, World Dynamics. “It had everything necessary to guarantee there would be no public notice,” he later said. It had 40 pages of equations and dealt with issues decades in the future. He doubted it would get reviewed, but notices were generally receptive. They focused on the message that the model seemed to substantiate, based primarily on the interrelationships of economic growth, pollution, and the consumption of resources. If unchecked and unmodified, industrial civilization would overshoot its ecological and population limits — and painfully collapse. That was the nature of exponential growth — growth that builds on itself, faster and faster. It can lead to deep trouble that isn’t seen as deep trouble until it’s too late. In their model, the MIT researchers tracked five key variables: population, food production, industrial production, pollution, and the consumption of natural resources. If you looked at each of these growth patterns separately, they all seemed relatively easy to cope with, and some seemed like cause for celebration: the changes in industrial output suggested that the world’s overall living standard would double by 1984. But growth in each of the five key variables seemed to accelerate the growth of the others, and to a dangerous degree. The modelers entered various proposed “fixes, such as technological investment, higher-yield agriculture, and higher prices,” into the program. In every case, unless industrial growth in its current form leveled off somehow, the model led to calamitous decreases in population, and finally in pollution, as industrial civilization faltered. Even without a decline in natural resources (for instance, if low-cost nuclear energy replaced oil), industrial growth would still be stopped by the accelerated rise of toxic pollution.

Dana Meadows didn’t fully see the implications until a meeting at a resort outside Ottawa early in 1971 where the MIT team made a presentation to the Club of Rome. The Meadowses struggled for a while as they tried to explain the notion of exponential growth and the finite limits of the world, without getting through to the club members. Then Forrester stood up. “This growth and these limits are structural,” he said. “It’s built into the system.” He had seen growth overshoot itself before, at Digital and Cummins Engine. When they introduced a new product, they often expected sales to continue growing indefinitely and were unprepared for the time when sales leveled off. It wasn’t much of a leap to observe the same pending dynamic in the statistics on global population and resources.

Listening to Forrester, Dana had a vision of the Asian countries she’d visited the year before. She’d seen places where local economies collapsed after the villagers burned up their forests for fuel. The same thing could happen to the world as a whole, she thought. With half an ear, she heard the Club of Rome members argue back. Poverty was the key problem, one member said, so we needed to focus on economic growth in developing countries. No, another member said; pollution was fundamental, and we need economic growth to develop technological solutions. No, said yet another; the problem was energy. “We have to find more oil and build nuclear power plants.” They were trying to solve every problem with economic growth. As she listened, it seemed to her that this fixation on growth — this “mental model,” as Forrester called it — was a boastful, bullying living thing, with its own malignant needs. It seemed to believe that although the world’s resources and pollution capacities were infinite, the wherewithal for a decent life was scarce. The only effective way to live well was to grasp and hoard. What civilization really needed, she thought, was the reverse: an attitude where the Earth was seen as finite and sharing was appropriate. If people managed their own endeavors more efficiently, there would be enough for everybody’s physical and emotional needs. Businesses would have to find ways to be innovative without the emphasis on growing — by providing better services and better goods. We’d need to start asking ourselves, she decided, What we are growing for? For whom? For how long? And at what cost?

This article is an excerpt of The Age of Heretics: A History of Radical Thinkers Who Reinvented Corporate Management, and is copyright © 2008 by Art Kleiner. All Rights Reserved. MIT Sloan Management Review thanks the author for permission to publish this excerpt.

Comments (3)

RALF LIPPOLD

RALF LIPPOLD

It’s dangerous for you to be here « The Monkey Represents Sharing