Finding Sustainable Profitability in Electronic Commerce

Warren Buffett, the president of Berkshire Hathaway Inc. and one of America’s most storied investment managers, remarked last year that if he were teaching an MBA class on finance, the final exam would have one question: “How do you value an Internet company?” He said anyone who turned in an answer would fail.

Clearly, it is extremely difficult to value e-commerce companies on their assets or profits, because most of these companies have little of either. Indeed, even multipliers of revenue are difficult to assimilate into any sensible financial valuation model. Yet, the price appreciation of e-commerce stocks in the past two years has been phenomenal, reaching a one-year gain of nearly 100% and a five-year gain of 1,100%, creating market capitalizations surpassing even some of the most widely held and admired growth and retail companies on the New York Stock Exchange.1

As of April 20, 2000, the market capitalization of Amazon.com Inc. was a stunning $18.3 billion — even though the company claims merely $1.6 billion in annual revenue and has never earned a profit. EBay Inc.’s market value was $19.6 billion, despite its unremarkable $11 million profit on merely $225 million in 1999 revenue. To put these dot-com valuations in perspective, consider the mere $14.2 billion market value of Sears, Roebuck and Co., which last year garnered more than $1.3 billion in net income on annual revenue exceeding $32 billion. Similarly, Federal Express Corp., a traditional “heavy asset” company, was valued at only $10.9 billion, even though it boasts almost $700 million in profits on nearly $18 billion in sales and will almost certainly earn more by delivering the goods ordered up during the dot-com revolution.

Indeed, these market data suggest that even after this spring’s market shakeout, investors would prefer to own a small and unprofitable e-commerce company such as Amazon rather than Sears — a profitable company 20 times the size of Amazon and one of the world’s most respected retail outlets.

It is easy for managers to ignore such stock valuations as whims of the market, venture capitalist hype and day-trader craziness. However, billions of dollars are riding on such whims, hype and craziness. Moreover, thousands of the nation’s brightest business and engineering minds have chosen to ride the dot-com wave. Given this investment of money and human capital, will e-commerce take over retailing and make traditional merchandising a thing of the past? Are current brands dying — soon to be displaced by new e-commerce brands? Or is this all just a passing fad?2 After all, new technologies have created bubbles in the market before. In the 1880s, companies built upon the harnessing of a new technology, electricity, saw their stock prices explode 1000%. But it soon became evident to investors that the promise of electricity would take years or decades to offer a return to these companies. Within two years of reaching their peak, electric company share prices fell to between 5% and 15% of their former values.

How can business strategists discriminate between types of e-commerce that will likely be attractive and profitable and those that will end up in a commodity market structure? Understanding the role of product quality, information transmission, reputation and risk in the context of industry structure and company capabilities can help us answer these nagging questions. A market segmentation analysis of the online retail trade can shed light on the industry and product characteristics that drive profitability. These findings lead to a set of segment-specific strategies that companies can employ to reach above-industry-average profits and, presumably, high and sustainable market valuations.

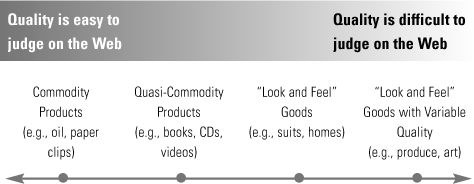

The E-Commerce Product Continuum

On the Web, all goods are not equal. Products possess different attributes and different levels of the same attributes. For example, one important dimension on which goods differ is in the ability of consumers to ascertain the quality of products in cyberspace. On one end of the spectrum are commodity products, where quality can be clearly and contractually articulated and conveyed. Products such as oil, paper clips and stock shares all fall under this category. On the other end of the continuum are products for which the perception of quality differs from consumer to consumer and product to product, such as produce, used cars and works of art. Understanding how difficult it is for retailers to convey quality, reliability or consistency for certain classes of products over the Web enables businesspeople to think strategically about the likely long-term success of different types of e-commerce ventures. Let us take four points on the continuum between barrels of oil and original oil paintings and examine each in turn.3 There are many product points between these four, but these serve as useful references for understanding the dynamics of e-commerce. (See “The Dot-Com Retail Continuum.”)

Commodity Products

Electronic commerce in commodity goods has occurred for decades. Simply open up The Wall Street Journal or the Financial Times and you will see the vast array of goods in which transactions are consummated electronically or through e-commerce. From shares of stocks to pork bellies to ounces of gold, an active e-commerce auction market has existed for decades. Now we see many commodity products being exchanged daily on the Web. Paper clips, nails and even Internet bandwidth compose this new e-commerce market. Despite a shift in the products, many properties of the market are similar to the more traditional electronic exchange markets.

In these commodity markets, the quality of products can easily be determined by their description. When one specifies a one-inch, galvanized, #6 flathead wood screw, we need little other information to know precisely what the product is or does. Except in extremely high-performance construction situations, the actual maker of the nail is unimportant. The same is true when we specify a barrel of Texas intermediate crude oil, 100 common shares of MotherNature.com Inc. or 17 troy ounces of 18-karat gold. For commodity products like these, the mere title and its attendant specifications convey complete information about their characteristics and quality. Consumers in these markets care little about the identity of the seller; they only care about the correct characterization of the products, the price and the terms of delivery.

Quasi-Commodity Products

The biggest increase in e-commerce has occurred in quasi-commodity products. Books, videos, CDs, toys and new cars all fall into this class of products. Economists consider these differentiated products, as opposed to commodity products — and they are correct. In books, for example, there are classic English plays, romance novels and do-it-yourself guides. Differentiation exists here even within a product niche: Think of the difference between mystery writers such as Arthur Conan Doyle, Tony Hillerman and Agatha Christie. However, like commodity products, once a book is chosen by a consumer, it is identical across vendors. Any bookseller offering Hal Varian’s “Information Rules” carries the same book. There is no difference in the quality of the book, its content and, if properly shipped, the condition of the book upon arrival. Once a consumer has chosen a title, the competition looks very much like the commodity market competition for oil, gold and flathead screws.

Thus consumers engage in a two-stage decision-making process. First, the consumer must find a book he prefers among the many different books available. After selecting the title, the consumer cares primarily about its price and the reliability of the e-commerce vendor. That is, the consumer seeks the lowest price, assuming that his credit card transaction is secure, that the book is in stock and that it will be delivered undamaged and on time.

“Look and Feel” Goods

If a company without a well-known brand name advertised a wool suit on the Web, would the suit sell? Even if the size fit perfectly, the color met expectations and the style was acceptable, would it be bought with regularity if buyers had nothing but a picture to go by? When it comes to cosmetics, suits, upholstered furniture or model homes, unbranded products have difficulty competing with their branded counterparts on the Web. Consumers need to actually touch, feel, try on or see these products in person before they buy. Few would buy a house without actually stepping inside it, getting a “feel” for the neighborhood and assessing the condition of the house and its surroundings. The words “size 2, worsted wool suit” aren’t enough for a discerning clothes-shopper. Worsted wool has numerous consistencies and thicknesses, and a suit cut to fit some will not fit others. A size 2 made by one manufacturer may be classified as a size 4 or 6 by another.

“Look and feel” goods have a common characteristic — their quality is very difficult to assess from afar. Even something as mundane as bicycle pumps illustrates this concept. Professor Ely Dahan of MIT has conducted experiments with Web-savvy shoppers demonstrating that although the Web could capture many attributes of the product, critical aspects of some pumps were not conveyed. For example, the Web was not able to adequately simulate the quality of an innovative pump. Consumers who received and used the actual pump noted its quality was significantly lower than they had expected based on the Web presentation.

Consumers in this segment may be reluctant to buy a product of unknown or less than fully known quality. But once a consumer has selected a product, there are likely few substitutes. The characteristics of other competing products will probably differ on many dimensions, including quality, look, feel and reliability. Clearly, this is not a book market. Rather, the “look and feel” segment is truly a differentiated market in all respects.

Look-and-Feel Goods With Variable Quality

There is a final class of goods that can be characterized on this continuum as look-and-feel goods with variable quality. These are products where, even if the buyer has completed her search, knows the product, and recognizes the brand, she will need to see and perhaps touch and feel the individual product that will be delivered to her home or business. The distinguishing feature is that each and every individual product is different from every other. Original art, used cars and fresh produce all fall into this category. The mere names Sunkist orange, Golden Delicious apple or Chiquita banana convey some information. The phrase “Monet painting,” too, provides much information. However, consumers are often more discerning than this. They have preferences over the ripeness of the banana, the color of the orange, the hardness of the apple. They prefer to see, touch and feel the piece of fruit to be delivered. In order to assess the beauty of a painting, it must be viewed, not only over the Web, but also in its original form under different types of light. Indeed, particularly in the case of an expensive and original Monet, it is necessary to see the work of art in person.

Refinements to the Framework

Two important subtleties of this framework need to be recognized. First, it is important to notice that as you move from left to right on the continuum —from commodity to look-and-feel with variable quality — it is not only the intensity of the consumer “experience” that changes. (“Experience goods” are those that a customer must experience before buying.) In addition, a number of other aspects to the buying process change, such as how much more information the seller has about the product than the buyer, the need of the consumer to engage in a search for optimal goods, and the degree to which seller reputation is important. All of these (and other) aspects of economic and management theory come together in determining this market segmentation scheme.

Second, the purpose of the product and the need to engage in searching might determine the segment to which it belongs. Take books, for example. A textbook assigned to students by a professor takes on a commodity characteristic. The student has a specified title, author, even edition, and then searches for the book at the lowest price. However, if the consumer is searching for a tour guide to London, there exist a host of different book titles to choose from, making “tour books” a quasi-commodity. Rare books and one-of-a-kind used books most closely fit in the look-and-feel-with-variable-quality segment, since each book has been exposed to different wear, which greatly affects its value. A company’s choice of which book market to serve and the degree to which consumers must engage in searching will determine which e-commerce segment the firm participates in and, as the next section will show, which online strategies it should pursue.

Selecting Markets and Gaining Competitive Advantage

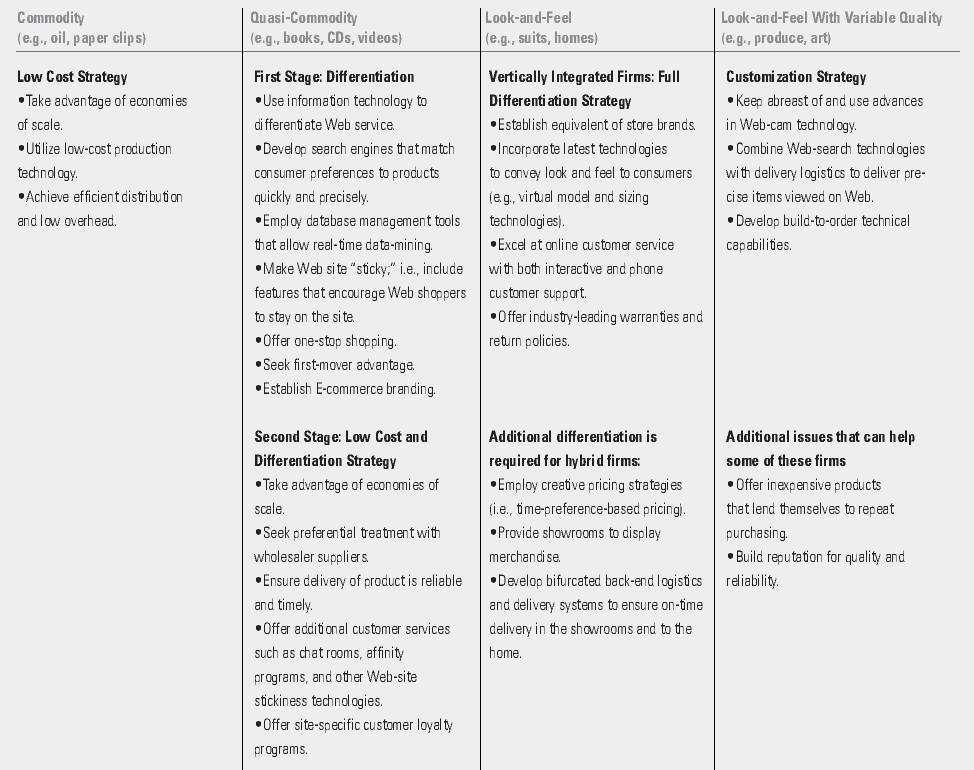

Given this understanding of e-commerce markets, what is the optimal strategy? This framework shows there is not a single optimal strategy, because the sources of competitive advantage differ across product segments. Entrepreneurs pursuing Web opportunities should use the four-segment approach to decide how to invest their time and money; incumbent producers need to carefully consider whether and how to enter the e-commerce fray. Indeed, the market the company serves determines the preferred strategy. (See “How To Manage E-Commerce for Competitive Advantage.”)

Commodity Market Strategy

Industry structure in commodity markets is inherently unattractive. Companies are price takers held in check by customers willing and able to seek the lowest price on the same product from many competitors. Thus market power is difficult if not impossible to obtain; customer lock-in and customer loyalty are elusive. Rivalry between firms will make it unlikely for any firm to achieve “supernormal” profits far above the average player in the industry. Entry into commodity markets, although relatively easy, is not very attractive. Profits are whittled away by rivals, leaving little on the table for the entrepreneur. Entry is easy for the e-commerce start-up, but market power cannot be exercised by individual firms, leaving little net income for shareholders. The only strategy available to managers in this market segment is to drive down costs in order to obtain profits.

Quasi-Commodity Market Strategy

The purchase of quasi-commodity products is a two-stage process. In the first stage, consumers conduct a product search in a differentiated product market. In the second stage, consumers conduct a price search for the preferred product. Entry, in theory and in practice, is quite easy in this market. Any individual could list their home library on a Web site and become an online book vendor. In practice, despite the infancy of the Internet, 31 U.S.-based online book vendors last year each carried more than 100,000 titles.4 (Contrast this with 80,000 titles in the average Barnes & Noble Inc. superstore.) The strategic challenge for companies in these markets is to differentiate themselves on the first dimension (search) and to insulate themselves from price competition in the second dimension.

How is differentiation achieved in search? Amazon.com typifies a potentially successful strategy. A consumer may choose from a broad selection of more than 3 million book titles or 300,000 video titles. In addition, Amazon has developed sophisticated internal search engines to make product search very easy and precise. The online bookseller also offers additional search features, such as pointing the customer to related books of interest. Upon logging on to Amazon, a registered user will even find books recommended by the search engine, based on the consumer’s preferences and purchase history.

The problem for companies in these markets is that once a book — or any quasi-commodity product —is selected using their powerful search engines, the consumer may purchase it from another e-commerce vendor at a lower price. This is not a big problem in traditional retailing. Consumers have to drive to three or four other bookstores in order to find the same book at a lower price. Search costs, however, are far lower on the Web; consumers are therefore more likely to search for the lowest price. This, in turn, leads to greater price competition among vendors, lowering profits.

To make matters worse, Web-based intermediaries are making it even easier to search for the lowest price. Yahoo Inc., E-Compare and other search engines will now search 10 or more Web bookstores for your title and return to you a list of vendors who have the book and their prices. Even worse, the vendors themselves are entering the fray. At Books.com, after you choose a book, you can compare prices with other vendors. Books.com’s own search engine will ping Amazon.com and barnesandnoble.com Inc. and tell you their prices for the same book. If the competitors have lower prices, Books.com will lower its price to below those of its competitors.

Given what is potentially fierce price competition in the second stage of this quasi-commodity market, how can companies carve out their own niche positions and retain market power? First movers will have some advantage in this market. Early movers have historically had the highest Web-site “stickiness.” In addition, mechanisms that encourage consumers to stay on a site, such as creating virtual communities so consumers can talk to each other, or site-specific customer loyalty and reward programs, will be quite important for attracting repeat purchasers and engendering repeat visits.

Customer loyalty programs will find favor, too. However, since frequent-flier miles will soon become ubiquitous to Web sites, they will not be sufficient to foster consumer loyalty. If barnesandnoble.com and VarsityBooks.com Inc. both offer United Air Lines Inc. frequent-flier miles, frequent-flier programs are no longer a source of differentiation among vendors. Thus, only site-specific loyalty and reward programs will attract repeat purchasers and engender repeat visits. But even site-specific loyalty programs will work well only on those sites where there are repeat purchases to be made. Groceries and toiletries are goods with these characteristics, purchased on a weekly or twice weekly basis. In markets where purchases might be more occasional (such as books), online department stores will likely have an advantage. Although a single consumer might not purchase books, hardware or videos on a weekly or twice weekly basis, combined they may result in significant volume.

Finally, branding will be an important part of any quasi-commodity strategy. Product brands will not be a point of differentiation for the e-commerce vendor, but e-commerce brands will be key. Strong e-commerce brands can signal quality in the reliability of delivery, security of personal information, dependability of the return policy and customer service in general. Indeed, firms that wish to make above-industry-average margins in this business will have to invest in building e-commerce brands.

Amazon.com is a case in point. As a first-mover to the industry, Amazon invested heavily in broad book choice, powerful search engines and strong branding. Amazon is now investing in other quasi-commodity businesses, such as over-the-counter drugs, toys and electronics, to encourage consumers to stay on its Web site. Moreover, Amazon’s additional planned investments in Web-site stickiness, such as affinity groups and chat rooms, foster an additional strategic advantage: The company learns an immense amount of information about customer preferences and Web search habits, which, in turn, allows Amazon to further tailor the Web site and its product offerings.

Conversely, it is not surprising that large, established companies such as Merrill Lynch & Co. and Toys “R” Us Inc. have had difficulty leveraging their traditional retail brands in the e-commerce markets. These companies have been second movers in a market where first movers have the advantage. Moreover, their corporate cultures and cost structures are built around traditional retailing, rather than faceless interaction. Finally, many incumbents have gone to great pains to avoid cannibalizing their traditional retailing business.

However, if traditional incumbents do not establish effective e-commerce ventures to compete with their own core businesses, others will. Fidelity Investments and Charles Schwab & Co. (incumbents unafraid to cannibalize their core businesses and early movers into the e-commerce market) and eToys Inc. (first mover, new entrant) will exploit their competencies in low-cost strategies and electronic know-how to force unbridled competition between e-commerce and traditional retailing in these segments.

The question remains, however, whether the profits that Amazon, eToys or any quasi-commodity e-commerce venture earns, will be dissipated by the fierce, commodity-like competition that occurs in the second stage of competition in these markets. The framework suggests that earnings will be low at best and frequently completely elusive.

Look-and-Feel Market Strategy

The third product point on the continuum, look and feel goods, poses a novel question for e-commerce vendors: How can e-commerce retailers provide consumers with look and feel over the Web? While pictures and animation can certainly help, alone they will be insufficient. Alternative technologies such as online customization tools will also assist, but unless the consumer feels the swatch of fabric for the suit, the decision to purchase is difficult. In the consumer’s quest for information about the quality and characteristics of the product, strong product brands (as opposed to e-commerce brands) will become the kingpins. Established brands like Hugo Boss, Evan Piccone and Victoria’s Secret all provide a substantial amount of information about the product to the consumer. Thanks to past experience, consumers understand the difference between L.L. Bean Inc. duck boots and other duck boots. Brands such as Ann Taylor convey information about the expected product quality, material and fit. Indeed, this concept suggests that well-branded incumbents, precisely because of their ability to differentiate their products, will be able to wield substantial market power and therefore obtain large profits in this segment of the market.

Given the power of product brands in the look-and-feel market, it is highly unlikely that we will see entrepreneurs successfully inundating this space in quest of profits. More likely, we will see the rise of two forms of distribution, led by traditional incumbents.

The first is a wholly owned vertical distribution system. One example is home furnishings retailer Pottery Barn, which sells its own Pottery Barn furniture exclusively. Such markets will be difficult for e-commerce vendors to penetrate without a strong brand or entry position. The e-commerce vendor must be vertically integrated and must excel at both product creation and product distribution. Building product brands from scratch is still time-consuming and costly, two unattractive features of a strategy when competing on Internet time. Once created, the product brand will then have to compete with products that already have established reputations and considerable brand equity, recognition and consumer admiration.

However, should an e-commerce company be able to overcome these high hurdles, the market has a number of attractive features, including oligopolistic competition, high entry barriers and customer loyalty, which are likely to promote profits in the long term. Successful companies in these product classes can retain substantial market power, as price competition is mitigated through substantial product differentiation.

Alternatively, e-commerce vendors like Bluefly Inc., a clothing “mall” on the Web, will arise that sell these branded look-and-feel products on a nonexclusive, widespread basis. Vendors of Broyhill chairs, Evan Piccone suits and Revlon cosmetics will not need to make investments in the product brands to signal quality. The product manufacturers will do this. Rather, they will have to make investments in merchandising, inventory management and distribution. Note, however, that these types of e-commerce ventures begin to look increasingly like the quasi-commodity product category. That is, once the search for a chair is complete, price competition can ensue among Web vendors. This suggests that profits will accrue to the branded product manufacturers and profits of e-commerce vendors will soon plummet.

Though the outlook is grim for most start-up or pure-play dot-com companies in this market segment, adopting certain policies can help them compete. For example, liberal warranties and return policies will help attract wavering consumers. Adoption of industry standards can help to allay fears of the wary customer — i.e., it’s easier to sell a personal computer that runs the Windows operating system than one that uses an obscure flavor of Unix. Unfortunately, such piecemeal approaches that involve warranties and standards are likely to be quickly copied by competitors.

Other solutions may also be available. Vendors can pursue a strategy of rapid or proprietary technological developments to support look-and-feel information over the Web. Alternatively, vendors can attempt to minimize price competition by seeking products that have limited distribution channels. The effective strategic alternatives for the pure e-commerce vendor in this segment of the market are not attractive: Either participate in the vertical structure of the market and make the investments in brands, where entry is difficult, or participate in the distribution of branded products, where the specter of price competition raises its head.

Unlike the commodity or quasi-commodity markets, many traditional, incumbent retailers in the look-and-feel segments are likely to survive the transition to an Internet-based economy in large numbers (though some will fail, too). Some will pursue the strong look-and-feel strategy and seek to differentiate their products as “must be worn” and their stores with “outstanding personal service.” These successful “pure play” traditional retailers, relying on brick and mortar, will stress the distinctiveness of the clothes and purchasing experience.

Other retailers will rely on showrooms. Rather than carry full inventories of all colors and sizes of clothing, retailers will be able to offer customers samples of clothing sizes and colors — a rack with one of each. Customers will be able to try on clothing, inspect quality and color and then turn to Web terminals right in the store to order clothes that will be delivered to their home the next day. These hybrid forms of retailing will offer a mechanism for new e-commerce ventures to move into the more traditional retailing channels.

Of course, some consumers may not be able to wait that long, and this opens up opportunities for vendors in these categories, and indeed all categories of products, to tailor pricing to time-based preferences. For customers who cannot wait for delivery of their products, a price premium will be paid. More concretely, a traditional retail vendor can allow the consumer to take it with her for $50, or permit ordering over the Web and delivery tomorrow for $40. Firms make huge margins on their catalog sales because they do not have to carry inventory, buy floor space or pay sales associates. Catalog margins are as much as 100% higher than in the retail stores. In offering this two-tiered pricing option, time preferences can be incorporated into the pricing system to the advantage of both consumers and vendors. A Web-based retailing system can co-exist with the traditional system of merchandising.

Eddie Bauer Inc. has implemented somewhat similar systems, integrating its stores and catalogs. An in-store customer who does not find the precise item she wants can order through the catalog using dedicated phones in the stores. Goods are delivered to her home address within a week without a shipping charge. While a start in the right direction, the Eddie Bauer model can be refined to incorporate the technology of the Web, the logistical prowess of a delivery system and the sophisticated scheme of preference-based pricing. Companies with successful catalogues will likely find the transition to the Web easier than those without.

Look-and-Feel With Variable Quality

In this category, quality is not only difficult to communicate, but it also varies by product, creating large obstacles for e-commerce. Each individual product needs to be inspected by the consumer. Surely, the ability to post product descriptions on the Web mitigates this problem, but it fails to provide a complete solution. One cannot easily sell a used car, 3000 different apples or original artwork on the Web. Indeed, many firms that have ventured into these segments have found the going difficult. Other firms have recognized this fundamental problem and have shifted to an intermediary function. Usedcars.com informs you of all the used cars available in your area and then tells you how to contact the person who owns the used car. They do not try to sell the used car, fully recognizing the problems of purchasing a used car directly over the Web. Note that the problems with participating in this segment of the market derive not from competition or other economic factors, but from external and technological factors outside managerial control.

In the near future, survival and profitability in this segment will be difficult. However, this situation may not last forever. Research and innovation under way at top universities may enable this segment of the market to grow. Indeed, technology is being developed to allow Web browsers to more finely examine texture and minute details. In addition, software and hardware advancements will soon allow consumers to view the actual products they are selecting in real time and then take quick delivery. Developments like these will help make this product segment accessible to e-commerce vendors, but some product markets, like used cars and homes, will always be difficult to penetrate. In these segments, technological barriers will prevail for years, and intermediaries will need to arise before such problems can be solved.

Until this day arrives, what can managers do? In this segment, and indeed, in the look-and-feel segment more generally, managers must exploit two instruments under their control: price and reputation.

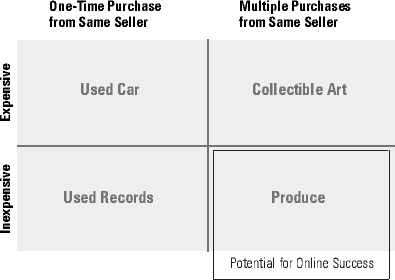

Companies like Peapod Inc., Streamline.com Inc. and HomeRuns.com Inc. have shown that consumers are willing to purchase items such as produce and vegetables over the Web. These companies demonstrate that some look-and-feel products with variable quality might succeed on the Web if they offer inexpensive repeat purchases. Repeat purchases allow the e-commerce vendor to build a reputation for quality by repeated provision of the product to a given consumer. Inexpensive products allow the consumer to mitigate risk. If the consumer does not perceive the products to be of high quality, the loss is relatively low and he can take his future business elsewhere. Thus, inexpensive prices give consumers the incentive to experiment and give the e-commerce vendor the opportunity to build a reputation. A good reputation coupled with low prices will allow some firms to survive in this segment. (See “Used Cars, No; Fresh Fruit, Yes.”)

Incumbents vs. New Entrants: Which Has the Advantage?

Given this framework and the strategies that companies pursue, can we explain the success and failure of the traditional brick-and-mortar incumbents in various market segments? Here examples may be instructive. Victoria’s Secret and Saturn Corp. have found significant sales on the Web. Borders Books and Toys “R” Us, both late-movers, have so far failed to succeed. These companies help to illustrate a more general pattern and application of market segmentation on the continuum: Traditional incumbents have substantial advantage in products that tend toward the look-and-feel end of the spectrum and encounter difficulty in products that tend toward the commodity end of the continuum. That is not to say that traditional incumbents will not succeed in the commodity end of the spectrum, but that they will likely find the playing field more even in those markets, as their brands and brick-and-mortar stores provide little advantage.

Consider again the example of individual online trading. Charles Schwab and Fidelity Investments have found significant success with their online trading services. Merrill Lynch has been slow to launch, and its success is uncertain. Here is a glaring exception to the pattern suggested above. Why might this be? First, Schwab was a very early mover to the online trading arena. In addition to the first-mover advantage, the firm built in switching costs. Schwab charges customers substantial financial and transaction fees to close an account before it can be moved to another broker. Second, Schwab has long-held competencies in serving a customer base from a distance. Its telephone trading system was in place long before the Internet existed, and its information and data systems made it relatively easy to make the transition to the Web. Schwab’s corporate culture has supported its “serving a customer at a distance” strategy. These in-place competencies and assets transferred efficiently and effectively to the Web, and gave Schwab an advantage over its counterparts.

As the discount brokerage example illustrates, incumbents in the commodity and quasi-commodity segments with first-mover advantage and strong histories in information technology and serving a customer at a distance can become exceptions to this general rule. Such incumbents can reap rewards in these fiercely competitive segments.

Sustaining a Competitive Advantage

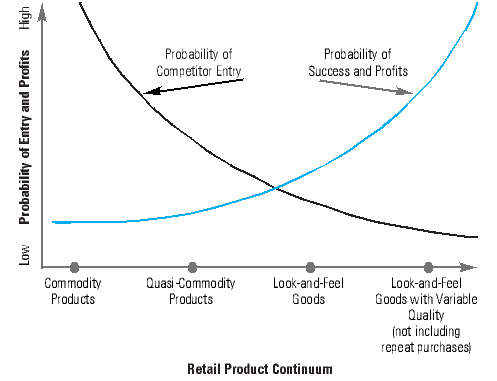

So what about e-commerce? What about these Internet valuations? What about entrepreneurial opportunities for the legions of engineers, MBAs and venture capitalists entering the e-commerce market? The first thing to recognize is that the barriers to entry grow higher as we move across the continuum from commodity to look-and-feel with variable quality. However, precisely because entry will be easy and competition fierce, those companies that enter the commodity and quasi-commodity types of businesses will find small, if any, profits. Nevertheless, companies that are able to “crack the code” and enter successfully into the look-and-feel and look-and-feel-with-variable-quality segments will find substantial profits. It is precisely in these latter segments that bricks will combine with clicks to generate profits.

Companies should not, however, be content with industry average profits, in whichever segment they choose to compete. They must strive for higher-than-industry profits and recognize that the sources of competitive advantage will differ across segments. Commodity product sellers must strive for low-cost positions. Quasi-commodity sellers must develop strategies to insulate their products from price competition, through customer loyalty programs and

Web-site stickiness. Look-and-feel sellers must meld their traditional assets with the electronic marketplace to distinguish their products and exploit their current product brands. Look-and-feel-with-variable-quality sellers must either think small and inexpensive to develop a reputation that allows them to grow or invest in both front-end and back-end technologies to facilitate customer purchases.

Finally, branding strategy will be important. In the commodity and quasi-commodity product segments, the actual e-commerce vendor brand is important to the extent that it signals reliability and customer service. In the look-and-feel markets, product brands will dominate as a source of competitive advantage. And both e-commerce brands and product brands are important sources of competitive advantage in the look-and-feel-with-variable-quality segments. An e-commerce startup’s brand strategy will be substantially determined by the markets it serves. Moreover, although even branded retailers in commodity and quasi-commodity products face difficult times ahead, all incumbent brands are not dead. Indeed, product brands will persist, and some retail outlet brands, especially those that cover the look-and-feel segment, will continue to profit. The opportunity for new e-commerce brands has arisen, however, in the commodity and quasi-commodity segments. Hence, we see the rise of Amazon, Buy.com Inc. and Travelocity.com Inc.

This brings us back to the first question: Are these Internet company market valuations justified? If one believes in efficient capital markets, then one must assume that the price of each Internet venture incorporates all information, both past and in expectation, and thus these companies are fairly priced. If capital markets are not perfectly efficient, and we incorporate the framework proposed, many of these valuations will be called into question. The majority of entries into the e-commerce market have been in commodity and quasi-commodity markets. The framework suggests that only a small fraction of these companies will be very successful and generate the supernormal profits their valuations suggest. But those companies that have invested in capabilities that exploit the sources of competitive advantage in their particular product segment will have a much higher probability of justifying their valuations in the long term.

References

1. Hambrecht & Quist, Internet Index, January 2000. H&Q (www.hamquist.com) tracks a number of Internet stocks, which are placed in its Internet Index. The Chase Manhattan Bank completed a purchase of the San Francisco-based H&Q in December 1999.

2. “Doing Business in the Internet Age,” Business Week (June 22, 1998): 121-172.

3. Note that these categories are analogous to the production processes outlined 15 years ago in: R. Hayes and S. Wheelwright, “Restoring Our Competitive Edge: Competing through Manufacturing” (New York: John Wiley, 1984).

Continuous flow, assembly line, job shop and project. Another way of thinking about these categories is in a cumulative manner: commodities are differentiated in one attribute (price); quasi-commodities are differentiated in multiple attributes, one of which is price; look-and-feel products are differentiated in multiple attributes, including quality; look-and-feel with variable quality products are differentiated in multiple attributes, including quality, where there are differences within category. Each successive category requires more and more experience with the product.

4. Gomez.com survey from Spring 1999.Gomez.com rates Web sites.

Comments (2)

Randy@whats-hot-weekly.com

Randy@Guitar Slides