Analytics is Transforming Customer Service: Should We Worry?

As more sophisticated technologies are coming to bear on larger sets of data, individual privacy questions loom larger than ever.

Topics

Competing With Data & Analytics

Customer service and … cognitive computing? Really?

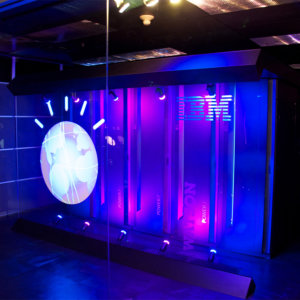

Yes, it’s happening. A recent Forbes article, IBM’s Watson Now a Customer Service Agent, Coming to Smartphones Soon, describes cognitive computing’s growing influence on customer service at a wide range of consumer-facing organizations — think financial services, telecoms, retail and insurance companies. ANZ Bank in South Africa offers a glimpse into a present that sounds more fictional than real. Joyce Phillips, CEO of ANZ’s global wealth and private banking group, says that:

ANZ Bank is going to start deploying Watson at its private wealth group, beginning with insurance offerings. “Imagine if you could sit down with an adviser and, in the time it takes to make a cappuccino, Watson will pull up all of your accounts, read all the fine print, and tell you what kinds of insurance protection you’re missing or where you’re overcovered.”

According to IBM’s press release, Watson Engagement Advisor allows companies to “crunch big data in record time to transform the way they engage clients in key functions such as customer service, marketing and sales.”

The IBM Watson Engagement Advisor will help companies make their interactions count by knowing, delivering and learning what each customer wants — in the context of their preferences and actions — sometimes before even the customer knows it themselves.

The IBM Watson Engagement Advisor “Ask Watson” feature greets, and offers help to, customers via any channel, be it through a website chat window or a mobile push alert, saving consumers the hassle of performing searches, combing through websites and forums, or waiting endlessly for a response about the information they need. Calling upon IBM’s Big Data Analytics technologies, IBM Watson retrieves data about customers to help ensure interactions are tailored to their needs, and search its corpus of stored information for the best solutions.

But it’s this very capability — the ability to determine consumer wants and desires, even (sometimes!) before customers themselves do so — that raises issues of individual privacy rights. The key question is this: Will Watson’s benefits (and those of other cognitive computational technologies) outweigh the likely public costs of lost privacy?

In Big Data for All: Privacy and User Control in the Age of Analytics, researchers