Outsourcing Innovation: The New Engine of Growth

Topics

Innovate or die. That’s a theme many senior executives support. How to keep ahead is the issue. With 2 billion new minds becoming innovation sources for our marketplaces between 1995 and 2010, no one company acting alone can hope to out-innovate every competitor, potential competitor, supplier or external knowledge source around the world.1

But there is hope. Strategically outsourcing innovation — using the most current technologies and management techniques — can put a company in a sustainable leadership position. Leading companies have lowered innovation costs and risks 60% to 90% while similarly decreasing cycle times and leveraging the impact of their internal investments by tens to hundreds of times.2 Strategic management of outsourcing is perhaps the most powerful tool in management, and outsourcing of innovation is its frontier.3

Thinking About Outsourcing

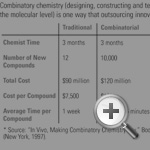

First, consider the pharmaceutical industry, where independent biotechnology research adds 100 gigabytes per day to the databases of the GenBank alone (the National Institutes of Health genetic sequence database, an annotated collection of all publicly available DNA sequences). No company can hope to keep ahead of such an outpouring by itself. Furthermore, at the applied research level, combinatory chemistry (designing, constructing and testing new compounds in vitro at the molecular level) has reduced experimental cycle times by more than 800 times and lowered costs and risks by more than 600 times. As a result, hundreds of small, sophisticated firms have entered the field as potential suppliers of innovation —radically changing the opportunities for outsourcing and restructuring the entire industry.

Next, consider both the large services industries, where most innovations are dependent on software, and the manufacturing world, which increasingly relies on embedded electronics. In both cases, a mere 15 sequences of software can be combined in more than 10 trillion ways, each creating a potential new product or process. No internal R&D group can possibly predict, evaluate or cover all possible designs or competitive positions. To prosper in this environment — even survive — companies need to systematically tap the capabilities of external knowledge leaders, not just for state-of-the-art products and services but also for the continuous innovation and evolution of ideas that will keep companies at the frontier of their industries.4 Carefully pursued, the strategic outsourcing of innovation has led to the restructuring of industries as diverse as automobiles, aerospace, computers, telecommunications, pharmaceuticals, chemicals, health care, financial services, energy systems and software.

A high-profile example of outsourcing for innovation is Cisco Systems, currently valued at $12.2 billion. In the early 1990s, the company found that it could not rely on internal manufacturing or hiring capabilities to keep up with its 100% growth rate. Instead, it established long-term relationships with a few selected manufacturers and opened its systems, processes and networks to them for joint equipment development. Today partners provide most of Cisco’s component, hardware and manufacturing innovation. About 30 vendors and service providers have recently joined the Cisco Hosting Applications Initiative (CHAI) to develop new technology for Cisco’s routers and to optimize performance in hosted applications.

Why the Time Is Right for Outsourcing Innovation

The time is right for outsourcing innovation. Four powerful forces are currently driving the innovation revolution. First, demand (as defined by real gross national product in the world’s largest and most rapidly growing economies) is doubling every 14 to 16 years, creating a host of new specialist markets sufficiently large to attract innovation.5 Second, the supply of scientists, technologists and knowledge workers has skyrocketed, as have knowledge bases and access to them. Software-based analytical, modeling, communications and market-feedback technologies have lowered costs and risks substantially, allowing many smaller enterprises to participate in emerging markets. Third, interaction capabilities have grown. Combined with the Internet and other information technology capabilities, interactions among technologies — including the biotech, computer, chemistry, environmental and food fields — are growing exponentially. Fourth, new incentives have emerged. Lower tax rates, privatization, the relaxation of many national and international trade barriers, and the lower capital investments needed in many fields have meant greater incentives for entrepreneurs worldwide to develop and exploit advances in knowledge. New management techniques, software, and communications systems have enabled much better coordination of highly dispersed innovation activities.

Outsourcing the Technology Chain

Depending on their capabilities and needs, many companies can profitably outsource almost any element in the innovation chain.6

Basic Research

For large pharmaceutical companies, outsourcing to universities, institutes and government laboratories has long provided fundamental research knowledge for new product streams. In the 1950s, Hoffman La Roche, through the La Roche Institute, was among the first to formalize such relationships, giving researchers support, independence and facilities that few universities or independent laboratories could equal. Continuous long-term support to outside researchers is now such an industry standard that some preeminent internal-research companies have been criticized for not outsourcing enough. New large-scale independent collaborative efforts, such as the Human Genome Project and the Cochrane Collaboration (which is assembling and analyzing all the literature on roughly 1 million controlled studies about the effectiveness of different medical treatments), have made it almost impossible to keep up through internal efforts alone.

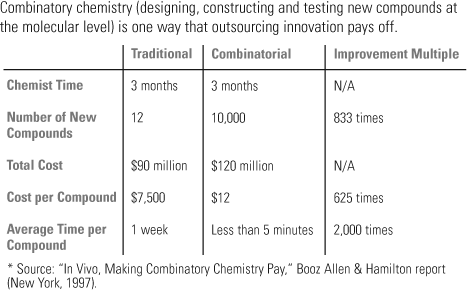

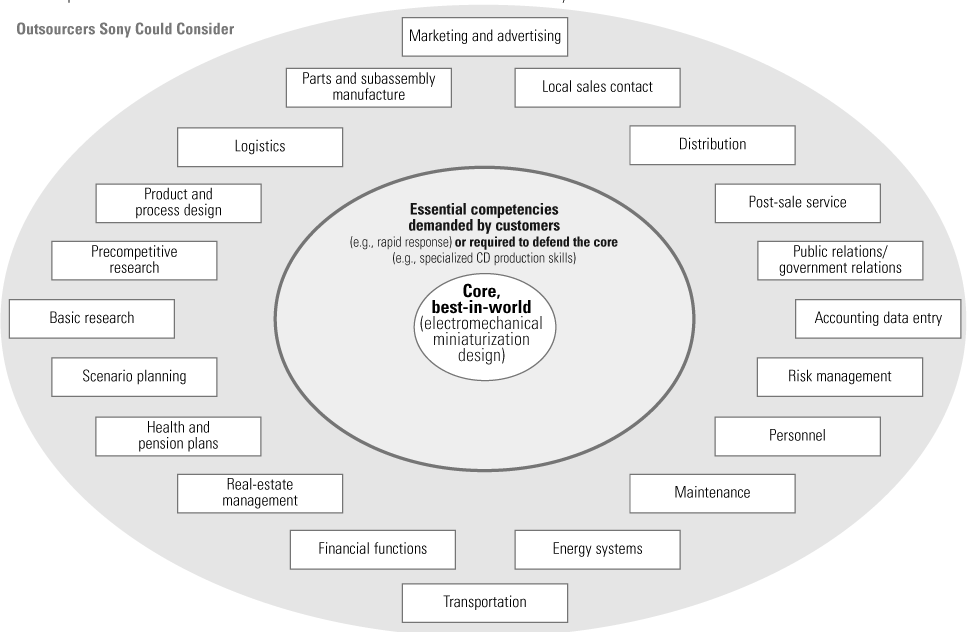

Ways in Which the Pharmaceuticals Industry Focuses on Core Competencies and Outsources Innovation

Early-Stage Research

Outsourcing early-stage applied and precompetitive research is critical in such industries as semiconductors (Sematech), aerospace (for systems modeling and new materials), computers (subatomic-particle phenomena and materials interactions) and foods (plant pathogens, nutrition and flavor enhancement, soils and weather research). Eaton, a major equipment manufacturer, has long outsourced basic and early applied analysis and design of its gear mechanisms to Illinois Institute of Technology, claiming a greater than 90% return over in-house sourcing.

Combinatory chemistry is now revolutionizing the pharmaceuticals and biochemistry industries. Millennium Pharmaceuticals, Inc. and 3D Pharmaceuticals, for example, have software models to build and analyze virtual chemicals that have demonstrated biological effects. They then can search for molecules with similar effects or combinatory possibilities, assisted by outsourcers who can rapidly build and test millions of possibilities using small-scale apparatuses and a few molecules of refined materials in vitro. Once a pathogen is identified, these companies can test thousands of compounds per day for activity that might destroy the pathogen or interrupt its path. After patenting the most promising compounds, they may present packages of attractive new products to their larger partners — to do testing on animals and humans, seek regulatory clearance or handle large-scale manufacturing and distribution. Alternatively, the small companies may themselves outsource those activities to independent testing labs for further verification, refinement of results or credibility before choosing between downstream alliances or proceeding in-house.

No single pharmaceuticals company can hope to match the sum of all the external enterprises innovating in its value chain. As knowledge bases from the Human Genome Project and from worldwide cellular and basic pathogen research explode, the interactive outsourced structure has become a model around which much of the industry is restructuring. Innovative companies focus on certain core activities and outsource not only product distribution but also basic research, combinatory chemistry, clinical trials and field monitoring.

Advanced Development

The outsourcing of advanced development and product innovation, especially for software and component innovation, has become de rigueur in industries where the most rapid and high-impact innovation occurs at the supplier level. For example, Boeing’s Defense Operations (including recently merged McDonnell Douglas and Rockwell) just introduced two prototypes of its Joint Strike Fighter (JSF), built using only 58 workers in its Palmdale, California, factory. With computerized modeling coordinating their activities, hundreds of suppliers developed and produced “snap-together” component modules — allowing Boeing to slash design and revision times and costs.7

By specializing, many suppliers have developed in-depth knowledge, skills, investment infrastructures and innovative capabilities for their segment of the value chain — advantages that are well beyond those that any integrated enterprise could obtain. Dell Computer and Intel exploit different ends of the innovation-outsourcing spectrum. As an integrator, the $18.2 billion Dell, growing at 47% compounded for the last decade, outsources virtually all design and innovation for components, software and nonassembly production. It invests heavily only in its core competencies (understanding customer needs, logistics and component integration) and wherever it sees a unique opportunity for adding value. By outsourcing, it avoids not just huge investments in facilities, inventory and human resources but also development risks and investments. Opening up technical needs and production schedules to suppliers, Dell obtains the most current products with the shortest innovation and cycle times, often with direct shipments from suppliers to customers. Dell has chosen to out-source component production and innovation, keeping component integration, logistics and customer understanding as in-house core competencies.

As a component supplier, Intel avoids end-product production and concentrates investments and formidable development capabilities on its specialized competencies. By doing so, the company has long been able to offer advanced microprocessors and complex integrated circuits to computer and system customers with a timing, quality, reliability and cost that has given it a preeminent position in microprocessors.

Ford and Johnson Controls offer a similar pairing between core competence and outsourcing in autos. When Ford moved from being 70% insourced and vertically integrated to 70% outsourced during the Taurus introduction in the early 1980s, it feared losing its detailed knowledge about subsystems and its capacity to remain innovative. Instead, it found that suppliers often had much greater knowledge depth, could innovate faster and better, and could save Ford the investments and risks of supporting a full range of development activities.8

Other automakers followed suit. Now there is a high correlation throughout the industry between a company’s degree of outsourcing, its innovativeness and its product margins and ROI.9 In conjunction with Oracle and Commerce One, the Big Three automakers just announced an Internet-based parts exchange (estimated at $490 billion) to support outsourcing.10

Johnson Controls, the world’s leading supplier of automotive interiors, concentrates only on certain subsystems and sells them to numerous customers. It can therefore support more depth than any integrated auto company in terms of technical knowledge, automated facilities and a wide supplier network for interiors innovation. As economies of scale in component knowledge and technologies become more important, disaggregation offers many companies greater flexibility, lower costs and higher rates of innovation — all at lower risk. Even Europe is beginning to exploit the opportunities, with the European Airbus integrators tapping into worldwide component-innovation sources to change the entire performance position of Airbus.

Outsourcing Business Processes

Even higher innovation returns can accrue from outsourcing entire business processes or process-design activities that are not core competencies. Functional services, such as advertising, maintenance and auditing, fall into that category. Increasingly, major systems — including logistics, worldwide accounting, energy supplies, real-estate operations and software systems development and operations —are also outsourced. Sophisticated specialist suppliers can arrive at solutions that fragmented internal sources could never even imagine — and they can implement those solutions rapidly without disruptive internal politics.11

For example, Enron Energy Systems has worldwide operations and multisourcing experience that enables it to handle a client’s full energy-management system efficiently (raw-material sourcing, conversion operations, equipment purchasing and maintenance, facility design and operations and specialized personnel training). Most clients have dispersed such functions into many different locations and organizations. Enron can often implement solutions for energy supply and usage across internal divisions that might not perceive or have incentives to create such solutions — for example, jointly purchasing larger equipment, sharing facilities with outsiders or optimizing plant-design, maintenance and energy-use trade-offs. One of Enron’s innovations involves first offering internal divisions stabilized energy costs through its sophisticated energy-industry knowledge, financial modeling and risk-sharing capabilities; and second, pricing energy on a per-unit basis (per room in hotels, per linear foot of production in manufacturing or per square foot in offices) to fit the specific strategic cost-control needs of each division. Enron can offer solutions using purchased raw materials and equipment at economies of scale its customers can’t touch. Another innovator, Trigen Energy Corporation, has invented processes that are more environmentally benign than most. For specific customers, Trigen has increased energy-conversion efficiencies from the national average of 35% to levels as high as 90%.

In corporate services (financial, logistics, maintenance, software, building design, auditing, real estate, human resources and Internet services), external sources are the dominant innovators. The success of such sources is a function of their depth of expertise, their software and investment support and the variety of their customer contacts (to enhance innovation opportunities). In comparison to internal counterparts in integrated companies, a PricewaterhouseCoopers or Arthur Andersen is more likely to come up with auditing innovations; Hay Management or Hewitt Associates with new performance-evaluation or incentive systems; and Vanguard, Merrill Lynch or Alex Brown BT with innovative investment or retirement-plan vehicles. Companies that use only internal sources, instead of outsourcing such activities, tend to cut themselves off from both a continuing stream of innovations and the opportunity to switch rapidly if a new value-added service appears. Proper outsourcing of entire business processes can speed and amplify major innovative changes.

Consider Royal Bank of Scotland (RBS). Under stress in a tight labor market, RBS wanted to shift its benefits package rapidly toward a new approach that would attract and retain highly qualified people. The bank worked with Hewitt Associates to design and implement the largest cafeteria-style flexible benefits plan in the United Kingdom. Through a “value account,” employees could select, for example, different in-house benefit options, supplemental health coverage or discounted vouchers for groceries, child care or life insurance. RBS and Hewitt created innovative tax-free pay and added special plans for maternity leave, new hires and termination. To speed implementation and enable continued innovation, RBS then outsourced much of the benefit management to Hewitt.12

Raytheon, based in Lexington, Massachusetts, provides outsourced technical support and rapid staffing throughout the United States and abroad. Using a robust and secure IT network, it electronically connects its Distance Solutions unit to customer sites to develop, transfer and coordinate internal and external solutions. Clients thus get faster solutions and avoid overloading local technical-labor markets.13

Outsourcing New-Product Introductions

Outsourcing key phases of new-product introduction speeds the process, lowers costs and amplifies impact. For example, few companies other than the dotcoms have a deep competence in developing and operating the interactive sites needed for successful product introduction on the Internet. Many independent software houses, however, offer sophisticated Web-site design capabilities. Recently, companies such as Verio and Exodus, large independent service providers (ISPs) that connect customers to the Internet, have been capitalizing on opportunities to support such activities by acting as application-services providers (ASPs). As a part of their services, ASPs provide specialized software applications and value-added services to their subscribers and other customers. In addition to providing Web access, they facilitate interfaces among innovators, Web-design houses, large individual customers and specialized market segments. The role of ASPs is evolving, not just as a hosting industry but also as an outsourcing industry that connects clients (especially small and midsize companies) to the most advanced software providers on a network basis.

A high percentage of all innovation occurs at the interface between innovative suppliers and customers — with customers making more than 50% of innovations on new products in many industries.14

Many companies have found that proper attention to outsourcing interfaces upstream and cooperative relationships with distribution partners downstream both lowers innovation costs and enormously expands the value of innovation to customers. Such relationships have benefits for both initial product introduction and subsequent product modification.

Nonalcoholic beverage brands, such as Snapple and rapidly growing SoBe, outsource the mixing and bottling of their new-product introductions; in so doing, they avoid huge investments, time lags and risks. Pharmaceuticals companies outsource their clinical studies for objectivity, higher quality and faster data collection from various sites. Quintiles Transnational Corporation at Research Park, North Carolina, offers outsourcing services and software to manage pharmaceuticals development, clearance and introduction more effectively across diverse locations. And auto companies, to make new-product introductions more responsive to customer demands and less subject to hunches, are modularizing their designs and accessories, reducing their response cycle times to four or five days and creating partnerships both with dealers and with Internet operators such as Autobytel and CarsDirect.com in order to collect and analyze consumer preferences rapidly so that they can modify prices and offerings responsively.15

In medical devices, codevelopment — outsourcing to obtain specialized customer expertise — is common. In developing real-time microsurgical magnetic-resonance-imaging (MRI) techniques, GE Medical Devices personnel worked directly with MIT’s artificial-intelligence laboratories and surgeon researchers at Boston’s Brigham and Women’s Hospital. Together, they created new devices, along with improved scanning and feedback systems, to help surgeons position and wield instruments in difficult-to-access locations — with minimum trauma for patients and improved outcomes.16 HP Medical Products has long had relationships with hospitals that allowed live-in Hewlett Packard observers to identify and solve problems that operating-room and medical-care personnel could not see while performing.17 Benefits are shared among the participating parties.

Many innovators have found that all they have to do is interest a single buyer at Home Depot, Wal-Mart or Circuit City, and they have immediate distribution and product support in the world’s most sophisticated marketplaces. Such distributors can provide instant feedback on models or features that are having problems or are selling best. Thus, downstream distribution outsourcing, coupled with the outsourcing of physical logistics to companies such as Federal Express or UPS, allows innovators to eliminate multiple phases of product introduction and focus on what they do best: creating. Furthermore, the Internet allows companies to deliver upgrades and service support directly to customers — or through intermediaries such as Synergys — without establishing dedicated service centers everywhere.

The classic examples are Dell, Cisco and the dotcoms, which connect a component or subsystem supplier to their product or service platform, shipping many elements directly from supplier to customer. Many suppliers have internal knowledge capabilities, access to multiple upstream technology specialists and contacts with downstream customer problems and innovations that the coordinating client cannot hope to duplicate.

Utilizing outsourcing fully can bring the costs and risks of innovation to new lows. It also mitigates a new reverse-risk — that of a company becoming obsolete if it doesn’t participate properly in outsourcing innovation both upstream and downstream.

Managing Outsourced Innovation

How does a company manage in the new world? The best analogy is surfing. With many waves of change occurring at once, innovation surfers cannot be sure of riding the right one. So they position themselves where experience or intuition tells them many waves will be forming. They prepare themselves with the best equipment and training, including hundreds of hours of studying waves and other surfers. They learn to discern a likely surfing opportunity from the sea’s random motion, seeking waves that build on the energy of previous waves until they can tell that a really big one is forming. They may test a few. When a truly attractive wave starts to form, they speed into the curl and try to adapt quickly to each shift for a long, fast (profitable) ride. Finally — and just as importantly — they recognize when the wave is fading and get off before it hits the beach. Using the same equipment and skills, they reposition and look for the new wave.18

In today’s world, attempting to build permanent marketing or production dominance is futile. But building up skill sets, platforms and sensing capabilities can produce successive fast rides.19 Companies must drop outmoded core competencies, learn from each ride and develop a genuine scanning capability for future opportunities. Like Cisco riding the Internet-router wave, they must keep in mind that the interacting power and shape of the waves are more important than an individual company’s swimming abilities. In today’s stormy markets, high-level technical, market-scanning, sensing and responsiveness skills — and a well-designed platform for continual innovation —are key.

Commitment to Exciting Goals

At the core of successfully managing outsourced innovation is an exciting vision that inspires internal and external people to work together with energy. Such visions are essential in outsourcing because daily line contact is impossible and technical people feel free to jump to wherever the action and rewards look most exciting.20

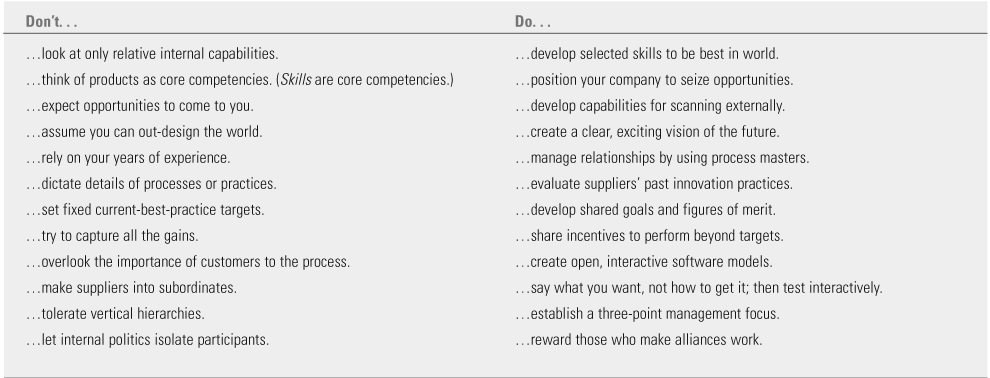

Jointly developed visions and figures of merit help create identity and make goals exciting and explicit. As one CEO said, “They can’t just be my goals or ‘the buyer’s’ goals. Unless the outsource and its people enthusiastically support and benefit directly from innovation, it is unlikely to happen.” Before finalizing contracts, carefully investigating potential partners’ records on innovation, attitudes toward innovation, treatment of innovative champions and reward structures for innovation offers high payoffs. Some enterprises literally vibrate with a palpable sense of energy, vision and delight in change. Others don’t. If either the buyer or seller doesn’t expect, drive, welcome and reward change, innovation is unlikely.

Hay Management Group, a leading human resources outsourcing firm, notes that “the key to success is both sides getting the relationship right at the outset. There must be mutuality of interest, common objectives and an agreed-on scorecard.” Hay works with its clients in workshops to understand as clearly as possible each party’s needs, desires and worst fears. It then jointly establishes a “mirror-image” scorecard and a two-way accountability system defining exactly which specific Hay and client employees are responsible for each major program goal. Hay notes that the effort “vastly decreases risks of outsourcing failure, increases client satisfaction and lowers coordination costs.”

Effectiveness requires both parties to embrace a shared platform, first, of goals or purposes and, second, of ethical principles or culture. It also requires that each party has a strong sense that the other is entitled to operate independently despite the interdependence of the relationship.21 Although different from one another, Dell, Nintendo, MCI, Eli Lilly, Sony, Microsoft, Home Depot, 3M, Hewlett Packard and Wal-Mart are among the companies that have effectively established such relationships. As a result, outside inventors seek them out directly.

MCI’s innovation-management team seeks and implements associations with small groups and individuals developing services that could attach to the MCI network. Recently, MCI’s chief technology officer noted that the company had about 20 times as many professional technical people working full time at vendors’ or partners’ premises as it did in its own offices. Internally, MCI designed the overall operating system and did all specifications, process rating, operational procedures and system testing. MCI controlled the system itself but recognized it could neither attract nor afford (on a full-time basis) all the required talent.22 However, by offering adequate interface information, a reputation for fairness, a well-known brand name, nationwide distribution and attractive profit prospects, MCI stimulated outside software and service innovators to design many new products for the company. (It is too early to appraise the future effect of the WorldCom merger.)

Making Sure Your Partners Benefit

To attract innovative cooperation, a company must have some capabilities to access desired markets that supplier-inventors cannot duplicate. That means developing best-in-world performance in a grouping of services, skills or systems important to customers. It also means focusing on those genuine core competencies — and a few other essential competencies — that protect the core or are demanded by customers.23 Those central activities define the way the company creates value for customers. They also provide essential bargaining leverage with suppliers and serve as a strategic block against suppliers or competitors wishing to bypass the company and move into its markets.

Consider the following example. Exploiting its powerful marketing, mass production, brand and distribution capabilities, Nintendo offers outside game designers a low-investment opportunity to roll out their innovations worldwide. The company’s complex presentation technologies and patents (as well as its massive marketing capabilities) prevent independents from attacking its markets directly. Although it creates some games itself, Nintendo focuses its resources on those core activities — and lets many outsiders create the games that have made more Japanese game designers into millionaires than any other company.24

Any company can similarly benefit from outsourcing the activities that it cannot become best-in-world at performing — or that are peripheral to its strategic posture — to a best-in-world supplier.

Every outsourcing opportunity offers possibilities to improve innovation. Leading professional outsourcers — real estate, human relations, software systems or financial firms — are just as likely to come up with major innovations as specialized technical-research or product-design houses are. That’s how they maintain their own margins, satisfy customers’ needs and leverage their own intellectual resources.

Creating Internal Masters of the Process

To help find and develop the most talented outsourcing partners, some companies — for example, Chevron — use “process masters.” Individual process masters (who are usually inquisitive and gregarious people with excellent specialist skills) and small groups of them become knowledge centers for all divisions in a company. Process masters identify and transfer to other parts of the company best-in-class internal innovations. They also find, benchmark and track best-in-world external capabilities for the company’s processes. Constantly prospecting, process masters are often sources of a high percentage of the innovative concepts entering organizations.25 Chevron’s process masters, through constant travel and networking, develop knowledge maps to guide other Chevron employees toward both internal and external expertise and help stimulate and facilitate the adoption of new solutions.

The biggest obstacle to adopting innovative ideas internally is to adjust traditional performance measures to reward implementation. By improving information about outsourcing possibilities, process masters help buttress senior managers with more objective checks against internal pressures to continue outmoded practices.

Developing Open, Interactive Software Models

Well-developed, open, interactive software models are at the core of most rapid innovation today.26 Such models provide a constantly updated, accessible, visual and dimensional view both of the system to which any innovation must adhere and of the performance that the innovation must surpass. The models also provide software hooks and defined interfaces that enable external designers to innovate independently.

Almost all new services — for example, in human resources or financial services, in product design or electronic commerce — are developed and tested collaboratively with customers through shared screens. Everyone shares enough interface, goal and performance criteria for a variety of independents to operate individually and to propose totally new solutions that fit system needs and that can be tested quickly by the software model. Many others —including Boeing, Ford and Millennium — do the same thing in the product world.

An example is NASA’s Web-based, collaborative aeronautical-design system, called Darwin. Darwin lets its Ames Research Center, other NASA facilities and industry partners come together in a virtual work space that is interconnected by NASA’s secure nationwide Aeronet. Through broadband video links, the parties compare their projections to actual test data while the test is going on. Experts estimate the system lowers design-stage costs for advanced aircraft by 80% to 90%.27

Structural Research Dynamics Corporation (SRDC) is one of many specialized software companies helping aerospace, auto and mechanical-equipment companies link their CAD-CAM or Catia (mechanical design) software to outside suppliers and customers worldwide. Built on Oracle databases, the software allows parties to interact (instantaneously or asynchronously) in either a visual or a formulaic mode to design parts, component subsystems or styling features. Worldwide inputs offer many more opportunities for totally new insights, yet the software enforces the snap-fit dimensional discipline needed for manufacturing. Both quality and customer-accommodating inputs increase. The approach helps automakers assess thousands of possible engines, body configurations and interiors in customer and performance tests that would otherwise be prohibitively expensive.

With such software models, participants in different time zones or work cycles can perform precisely and asynchronously. Three-shift, around-the-clock research and development have become common, decreasing cycle times by two-thirds, lowering development capital costs and risks by at least that much and allowing the coordinating company to tap into the world’s best minds for better results. Software —not new team concepts or personnel-management models — is responsible for most of the increased speed and precision of today’s innovation processes.

Establishing Audacious Goals: Figures of Merit

With the far-flung participation that software allows, companies need to ensure that they focus on innovation efforts. To do so, many adopt figures of merit, which define what winning performance really demands and specify technical-economic performance levels that are feasible but sufficiently high to shift customers from one provider to another.28 In several studies on innovation, virtually all the top innovative companies (including Sony, Hewlett Packard, Intel, Motorola, DuPont and Vanguard Securities) utilized figures of merit.29 Company leaders would project known trend performance in the industry and set 30% to 500% higher performance targets — sufficiently high for customers to take risks, make changes and invest in new solutions.

Figures of merit are exciting performance targets that induce innovators to rethink existing approaches and come up with something genuinely new. They can provide the focus, cohesion and energizing goals needed for delegating to small, flexible, decentralized, self-coordinating internal or external innovation groups. In contrast, benchmark targets may merely stimulate copying best-in-class providers. Consider the case of Donna Dubinsky and Jeff Hawkins, who left 3Com to form Handspring and build the Visor hand-held computer. To lure customers away from Palm Pilot, they set a target of superior performance and features — at “less than half” Palm Pilot’s price and with appropriately rigorous goals for outsourced features.30

Concentrating on What Needs To Be Accomplished, Not on How To Get There

Once companies identify the most talented people and once those individuals have internalized figure-of-merit targets, the innovation process can be decentralized and outsourced to any desired level. Too often, however, buying parties insist on specifying what processes will be used (the how) rather than focusing on the desired result (the what). Some also install detailed process approvals and checkpoints. Such checks comfort the buyer but constrain innovators. True innovation is complex and tumultuous —full of spurts, frustrations and sudden insights.31 By insisting on overly detailed schedules, the buyer may prevent the very innovations it seeks. Because the supplier has greater knowledge in the area under development, attempting to manage suppliers rigorously is futile.

The norm for success in outsourcing innovation is continuous interactive tests and feedback about subsystem and system performance. A properly constructed governing software model offers the most objective possible program checks and feedback, from competing ideas and customers, about gaps the innovating supplier and the potential buyer should address. Software systems based on customer inputs (such as Kao’s Echo) or interactive design software (Aavid’s Fluent for flow-process design or CAVE for large-scale equipment demonstrations) help innovative suppliers understand customer issues in detail, lower the risk of creating a new product or process that will fail, assist clients in understanding and preparing for innovation, transfer knowledge smoothly to them and provide the necessary comfort level to ensure use of the product.

Through interactive software, customers are “sold” on the innovation in advance on their own premises. The customer is closely involved in the innovation’s development and becomes familiar with it. As a result, before money actually changes hands, the customer is anticipating the innovation and will resist other competing innovations. Because of the uncertainties always present, a company working with a number of innovating outsource partners should keep them all participating and competing as long as possible. With more innovators involved and critiquing ideas through interactive software, the company can decrease its performance and market risks, increase the probability of successful innovation and obtain valuable product-performance insights that otherwise might not surface.32

Using Software To Coordinate the Players

By forcing a common language, measurement system and set of rules, software improves human communications, capturing and preserving knowledge with a precision, detail and transferability that person-to-person communications and hard-copy reports cannot. Sophisticated electronic modeling and visual presentations offer an opportunity for companies to perform joint reviews with their outsourcers and to develop subtleties (microscopic views, extreme-environment scenarios or simultaneous internal/external views) that would be too expensive or impossible to create with physical models.

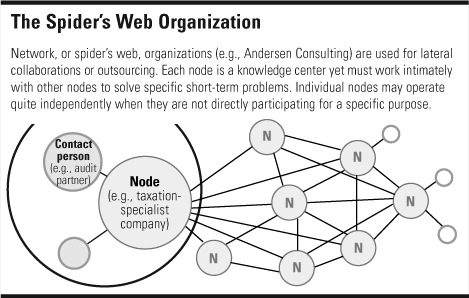

Such capabilities allow joint design to move beyond traditional, physically interactive, culture-sharing teams to collaboration among diverse and independent entities that are physically dispersed and serve no single authority. That new model, which might be called “independent collaboration,” is already common at the frontiers of biotechnology, software development, oceanographic and environmental research, nanotechnology, microbiology, new-materials development and sensor technologies, and it is used in the creation of financial tools or entertainment products.

Even for systems like the one Boeing used for its joint-strike fighter, which simultaneously involved thousands of participants worldwide, individuals remained in their own units working for their own goals, while benefiting from interactions with other units. Software can coordinate progress and results with exceptional precision and speed — despite the fact that most interactions are occurring at a distance. It allows specific, instantaneous, disciplined interactions, undiluted by personal, linguistic or interpretive biases.

Sharing Gains from Surpassing Targets

Figures of merit, properly set, are based on the exponential gains in knowledge that are expected to flow from multiple suppliers and their outsource partners working together to improve performance. The amplified knowledge gains that come from network interactions and feedback are usually sufficiently large that returns from improved performance can be shared among all contributors — without hurting cost targets. But fixed targets are not sufficient. If a company offers to share with outsource partners any gains from exceeding the targets, it may realize entirely unexpected boosts in performance levels. That is what environmental regulators found when they moved from current best-technology standards to market-like incentives that shared gains that went beyond initial targets. Because so much innovation is now in software and potential software is constantly evolving, companies that outsource have found that targets based on today’s techniques are unproductively binding — and that bonuses for performance gains beyond initial targets offer much higher payoffs. Today “hedonic measures” (anticipating currently unspecifiable but expected total performance gains) augment directly forseeable cost and gain measures so that managers can make the most of the learning that results from networks.

For example, Chrysler Corporation has standard contract clauses that specify continuous, measurable performance-improvement levels beyond current targets in each year of a contract’s life. In industries such as biotechnology, performance trends are hard to predict. But even there, cost improvements and future yields are often estimated based on an experience curve. Then they can be embedded in targets. Although neither buyer nor supplier knows how they can achieve the result, their experience indicates they can achieve it. In some companies — such as Dell and the dotcoms — performance levels are improving and costs are decreasing so fast for their outsourced segments that specifications and prices have to be changed almost daily and shipments made from suppliers directly to customers. These companies have had to create entirely new organizational structures and information systems to deal with the constantly accelerating pace.

It is important that both parties agree on specific performance targets that are fair, few in number, easy to understand and readily usable by the people doing the work. Although clients generally want an out-source provider to innovate and keep its operations at state-of-the-art levels, they may insist unrealistically that suppliers pass all gains from innovations to the buyer in their pricing, use the buyer’s own practices to ensure consistency and quality and bill professional inputs on an hourly basis instead of using value pricing or jointly shared innovation incentives. That approach is deadly. In a short time, the buyer will lose the very things it is seeking from outsourcing —greater knowledge and innovative depth, access to the most up-to-date systems, highest quality at lowest cost, maximum flexibility and no front-end investment. The highly successful CEO of a $4 billion out-sourcing company has suggested a wiser approach, saying, “To encourage innovation, I won’t worry about how much the provider makes from the transaction…[but] I will constantly want to know how our relationship with the provider is making us more money than we would otherwise.”

A Three-Point System of Information Exchange and Project Execution

To help monitor and implement the innovation-creating relationships they seek, many of the most successful companies we studied utilized three points of contact to form a system of information exchange and project execution. The first contact point is one in which a few top-level managers review developing opportunities, create exciting goals and challenging figures of merit, constantly realign existing strategic priorities as external environments change and break bottlenecks that may occur at lower levels. The second contact point is where champions on both sides meet — people whose careers depend on the relationship’s success. The third comprises numerous interactions among those who actually develop, produce and operate the invention — the people who are often the first to spot new operating needs or technical opportunities and creatively solve problems. Interactions at that contact point help ensure that the valuable nuances of tacit knowledge about problems and processes get transferred when needed — and that the best vendor talent and sufficient urgency are applied to the project.

Communications and innovation are substantially enhanced if client and outsourcer share the same electronic model of products or processes and can work together asynchronously, yet within the discipline the software imposes. That is especially important if multiple outsourcers must cooperate. For example, Xerox PARC has found its Colabra software helpful in supporting multiple-knowledge-source interactions that rely on the concept of WYSIWIS (What You See Is What I See). Everyone who works on a product utilizes the same software model and sees what everyone else sees. If one person makes a change, the other people see the change appear on their screens. Supplemented by PARC’s Agnoter and Cognoter software, the system augments remote or same-room verbal communications, allowing different groups to create together and evaluate concepts instantaneously and with precision. By allowing others to observe and critique ideas, such software also prevents the contact people from becoming overly impressed by their partners’ particularly articulate technical people or newest technical solution.33

Incentive Systems and Open, Compatible Information

Many innovative companies operate with highly decentralized organizations that feature only three organizational levels — the people at the top, the people doing the project and, using open information systems, everyone else — and strong incentives adapted to the specific type of innovation sought. At the heart of successful innovation is a common, open-information capability that places all participants on the same footing in discussions. To develop their knowledge in depth, specialists normally work closely in units with others from their specialty. Like high-school students returning to homeroom, they return to those units between project activities. But to solve particularly complex problems, they work in small project teams with specialists from other disciplines, sharing a common information base that is open to everyone. (Fire walls exist for highly secret or personal information.) With an open system, people cannot argue that their ideas should prevail because they have proprietary information. Many consultants, software houses, financial services and emerging high-tech companies use such open structures. By contrast, multilayered, divisional organizations — because they keep people and information in one silo away from the others — are an anathema to innovation. Generally, companies that are successful at innovating have porous organizations developed around three such contact centers, permitting maximum information exchange and avoiding endless approvals and communications delays. Flat organizations further amplify individual responsibility and flexibility — both of which are critical to fast-response, highly motivated innovation.

Somewhat Orderly Chaos

“Managed chaos” once described successful innovation processes within companies.34 But with today’s speed and numerous outside suppliers, the chaos is not so much “managed” as it is “somewhat orderly.” No one manager or team controls the hurricane of worldwide supplier, customer and competitor innovations; and yet the hurricane has some broadly predictable characteristics — for example, greater bandwidth, speeds, wireless capabilities and interconnectivity. To keep up with the pace, leading organizations are reforming into circular, independent modes with knowledge centers that broadly match anticipated changes but little visible authority or ownership structure. The new structures are built on two premises. First, those who have the necessary knowledge will work with but not for those who lack it; second, change is so constant that almost any structure is an impediment.

Using the somewhat-orderly-chaos model, companies such as MCI, Dell, Nintendo and Amgen — as well as television networks and financial-services houses —let it be known that they are interested in new product or service concepts with certain defined characteristics, that they will use their infrastructures to introduce new products or services for inventors and that they will share rewards fairly. Independent innovators, scientists or service providers develop and test their concepts on a small scale until their probabilities of success, performance characteristics and potentials are clear enough to permit them to approach the firm as a partner.

The independents may receive some early information or support from the potential partner in return for a right of first refusal. As the project passes some way points — points changing constantly with scientific, industry and marketplace conditions — the independents may receive further guidance and support. If they then prove they can exceed established figure-of-merit targets, their innovations may become serious candidates for internal and beta-site testing against other finalists’ proposals. From that group, a final marketplace test will indicate which concepts should be commercialized, and profit- and risk-sharing incentives then take over. Most innovations do not progress along a predictable, linear path but one that is tumultuous and interactive. The process should be managed as such — with a focus on winning goals, incentives and “whats,” not “hows” — lest genuine innovation be stifled.

Adapting and Exploiting the Innovation

One of the more difficult problems of outsourcing innovation is adapting and exploiting innovation in internal operations. When the innovation is embodied in products, it may simply appear as a purchased component in the final assembly. Although CAE/ CAD/CAM systems have reduced problems of physical fit, components often have software features that must be carefully integrated. Hence, successful outsourcers insist on constant interactive development, disciplined by frequent software tests both before and after physical models are available. Software testing helps create an explanation of why things happen, and rapid repeated testing in both physical and software simulations decreases the likelihood of unexpected problems.

In cases other than buying or developing innovative components for established product lines, many companies migrate toward more circular (and therefore simultaneous) organizational models, with units that act independently. They avoid hierarchical models that require ideas to pass in a sequence up and down an organizational ladder or across departmental barriers. Two circular, independent organizations are the starburst structure and the network enterprise.

Why Outsource Innovation?

Different structures, specifically matched to the strategic needs of each outsourcing project, can help enormously in stimulating, monitoring and transitioning innovation in individual situations.35 But there are some common reasons companies of any size are increasingly benefiting from outsourcing particular aspects of innovation.

Resource limits.

No single company can innovate better than the combination of all its potential direct, functional, component and service competitors. Each potential supplier can tap into many more upstream technological sources and downstream customer problems and solutions. The combination of their capabilities can be overwhelming.

Specialist talents.

Companies may not have the motivation or depth of knowledge in all necessary technical fields. They may be short on managers who know how to stimulate innovation and who can tolerate its uncertainties, challenges and risks.

Multiple risks.

The company that outsources knows it cannot afford development risks for every desired innovation, whereas outsource suppliers can spread risks across multiple present and future customers.

The company that outsources upstream and partners downstream significantly lowers its innovation-adoption risk.

Attracting talent.

For a noncore activity, a company may be unable to attract the most talented people to work in-house. Such workers tend to seek out the best specialist and innovation houses where their talents will be most recognized and rewarded.

Speed.

Companies can get to market faster through outsourcing and avoid time delays in hiring, infrastructure development and internal resistance to new ideas. Small companies that take in outsourced work can often be more flexible, nimble and objective about new ideas than large companies, and they have fewer historical barriers to solutions. They must innovate to succeed — or die.

As innovative solutions become more complex —requiring more specialist knowledge and more specialized software support (while other economies of scale drop) — more deeply skilled, competing specialist outsourcers have appeared. Outsourcing offers increased opportunities for much faster and lower-cost innovation to companies that develop their core competencies and outsourcing-management practices properly. In fact, the supplier side of the process has become the major source of new high-technology jobs, new companies and economic growth worldwide.36

Managers will need new strategies for surfing the opportunity waves around them. They will need to leverage their own resources to improve internal innovation practices and develop sophisticated outsourcing partnerships with those billions of new minds who can provide innovative support. And they will need to overcome the not-invented-here forces inside their own and their customers’ companies. Developing the necessary management practices is not easy. But using only traditional internal innovation practices can be fatal.

More by the Author

J.B. Quinn, J. Baruch and K.A. Zien, “Innovation Explosion: Using Intellect and Software to Revolutionize Growth Strategies” (New York: Free Press, 1997), 448 pp.

J.B. Quinn, “Intelligent Enterprise : A Knowledge and Service Based Paradigm for Industry” (New York: Free Press, 1992), 473 pp.

References

1. Forester Research and Access Media International estimate 140 million Internet users doubling at least annually through 2005.

2. Figures derived from interviews conducted between 1997 and 2000 with leading practitioners cited in this article.

3. The definition of “outsourcing” includes the relatively permanent purchase of goods or services in a particular category from a single source or mul tiple sources. “Innovation” is widely defined as the first reduction of a concept to useful practice in a culture.

4. J.B. Quinn, “Strategic Outsourcing: Leveraging Knowledge Capabilities,” Sloan Management Review 40 (Summer 1999): 9–21. The article provides a complete framework and key practices for outsourcing state-of-the-art products and services.

5. United Nations, “Statistical Yearbook,” New York, 1998.

6. The basic framework for strategic outsourcing was delineated in the following publications: J.B. Quinn, “Intelligent Enterprise” (New York: Free Press, 1992); and

J.B. Quinn and F. Hilmer, “Strategic Outsourcing,” Sloan Management Review 35 (Summer 1994): 43–55.

The classic economist’s statement of the rationale for outsourcing is:

R. Coase, “The Nature of the Firm,” Economica [number?] (November 1937): 386–405.

7. “A New Kind of Boeing,” The Economist, January 22, 2000: 62–63.

8. H. Mintzberg and J.B. Quinn, “Ford Team Taurus,” in “The Strategy Process,” (New York: Prentice Hall, 1996).

9. R. DaVeni and P. Ravenscraft, “Economies of Integration vs. Bureaucracy: Does Vertical Integration Improve Performance,” Academy of Management Journal 37 (October 1994): 1167–1206.

10. R.L. Simison, F. Warner and G.L. White, “Big Three Car Makers Plan Net Exchange,” The Wall Street Journal (February 28, 2000): A3.

11. Quinn’s “Strategic Outsourcing: Leveraging Knowledge Capabilities,” cited above, develops this concept, numerous examples and management practices in depth.

12. T. Blackman, “Trading in Options,” People Management, May 6, 1999: 42–46.

13. Company documents.

14. E. Von Hipple, “Sources of Invention” (New York: Oxford Press, 1988).

15. “Business: Wheels and Wires,” The Economist, January 8, 2000: 58–62.

16. W. Grimson, R. Kikinis and F. Jolesz, “Image Guided Surgery,” Scientific American 280 (June 1999): 62–69.

17. For an excellent review of this and other techniques, see:

E. Wilson, “Product Definition: Assorted Techniques and Their Marketplace Impact,” Institute of Electrical Engineers: Engineering Management Conference Report, 1990: 64–69.

18. This analogy was first suggested by S. Halsted, managing partner, The Centennial Group, 1998.

19. For a full analytical approach for operating in this mode, see:

R. DaVeni, “Hypercompetition” (New York: Free Press, 1997).

20. “The Future of Work,” The Economist, January 29, 2000: 89–92 (Special Section); and

J.B. Quinn, P. Anderson and S. Finkelstein, “Managing Professional Intellect: Making the Most of the Best,” Harvard Business Review 76 (May–June 1998): 71–80.

21. K. Zien and S. Buckler, “From Experience: Dreams To Market: Creating a Culture of Innovation,” Journal of Product Innovation Management 14 (July 1997): 274–287.

22. Interviews in support of “Information Technology in the Service Society,” Report of Committee on the Impact of IT on Performance of Service Activities, Computer Science & Telecommunications Board, U.S. National Research Council, U.S. National Academy Press, Washington D.C., 1994.

23. These concepts were first published in J.B. Quinn, T. Doorley and P. Paquette, “Technology in Services: Rethinking Strategic Focus,” Sloan Management Review (Winter 1990): 79–87; and

J.B. Quinn, T.L. Doorley and P.C. Paquette, “Beyond Products: Services Based Strategy,” Harvard Business Review 68 (March–April 1990): 58–68; and

J.B. Quinn, J. Baruch and K. Zien, “Innovation Explosion” (New York: Free Press, 1997) extends this concept to innovation outsourcing in detail.

24. H. Mintzberg and J.B. Quinn, “Nintendo of America,” in “The Strategy Process” (New York: Prentice Hall, 1996).

25. R. Katz and T. Allen, “Project Performance and the Locus of Influence in the R&D Matrix,” Academy of Management Journal 28 (March 1985): 67–87 ; and

M. Tushman and P. Anderson, eds., “Managing Strategic Innovation and Change” (New York: Oxford University Press, 1996).

26. J.B. Quinn, J. Baruch and K. Zein, “Software Based Innovation,” Sloan Management Review 37 (Summer 1996): 11–24; and

Quinn et al., “Innovation Explosion,” 1997.

27. G. Arnaut, “Partners in Virtual Workspace,” Information Week, Dec. 16, 1996: 70–77.

28. For a detailed development of the design and use of figures of merit, see:

Quinn et al., “Innovation Explosion,” 1997.

29. J.B. Quinn, “Logical Incrementalism” (Homewood, Illinois: Irwin, 1980);

Quinn, “Intelligent Enterprise,” 1992;

U.S. National Research Council, “Information Technology in the Service Society,” 1994; and

Quinn et al., “Innovation Explosion,” 1997.

30. W. Mossberg, “A Pilot Rival Organizes Your Life, Then Morphs Into Something Else,” The Wall Street Journal, September 16, 1999: p. B1.

31. The following major studies of innovation support this thesis: J. Jewkes, D. Sawers and S. Stillerman, “Sources of Invention” (London: St. Martin’s Press, l958);

T. Kuhn, “The Structure of Scientific Revolutions” (Chicago: University of Chicago Press, 1962);

D. deSolla Price, “Of Sealing Wax and String,” Natural History (January 1984): 48–57;

J. Diebold, “The Innovators: The Discoveries, Inventions, and Breakthroughs of Our Times” (New York: Dutton, 1990);

R. Root-Bernstein, “Discovering” (Cambridge, Massachusetts: Harvard University Press, 1991); and see the monthly series “Scientific Pathways,” Science.

32. The full logic for this is developed in: Quinn, “Logical Incrementalism,” 1980.

33. Government R&D procurement offers an example of the need for both human and software interactions. Contract officers’ personal knowledge was often necessary to overcome the slow bureaucratic review committees that are remote from the actual work. Yet they often unintentionally became “captured” by certain groups with exciting ideas. Software testing with independent observers helped ensure balance.

34. J.B. Quinn, “Managing Innovation: Controlled Chaos,” Harvard Business Review 63 (May–June 1985): 73–84.

35. Quinn et al., “Innovation Explosion,” 1997.

Chapter 8 illustrates many of the most common and useful forms and their associated incentive and performance measurement systems.

36. “The Future of Work,” The Economist, Jan. 29, 2000.