Can Sensors Fuel Productivity Growth?

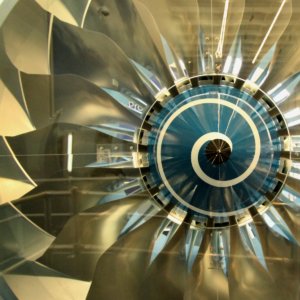

A new report, “Industrial Internet: Pushing the Boundaries of Minds and Machines,” predicts that the internet of industrial machines like jet engines, turbines and MRIs will lead to large-scale improvements in efficiency.

Topics

Competing With Data & Analytics

For all the hype and dollars spent, the Internet Revolution has so far failed to deliver the kind of long-term productivity punch we got from the Industrial Revolution. Meanwhile, embedded devices like sensors stubbornly refuse to achieve their potential. Sensor-driven smart devices thus have no chance of kickstarting Internet-driven productivity, right?

Wrong, say two General Electric executives, strategist Peter C. Evans and chief economist Marco Annunziata. They recently released a report, “Industrial Internet: Pushing the Boundaries of Minds and Machines” [pdf]. It predicts that the Internet of things — or really, of industrial machines like jet engines, turbines and MRIs, as well as dozens of others — will lead to large-scale improvements in efficiency. In fact, they’re predicting it will add 1 to 1.5 percent of productivity growth a year to the U.S. economy between now and 2030.

What would be the impact of that kind of productivity growth? According to the report,

- As much as $15 trillion in GDP growth around the globe by 2030 (the equivalent of adding the entire U.S. GDP to the global economy).

- The elimination of $150 billion in wasted spending.

- A 25 percent to 40 percent rise in U.S. incomes.

Here’s a taste of how, from their report:

The Industrial Internet starts with embedding sensors and other advanced instrumentation in an array of machines from the simple to the highly complex. This allows the collection and analysis of an enormous amount of data, which can be used to improve machine performance, and inevitably the efficiency of the systems and networks that link them. Even the data itself can become “intelligent,” instantly knowing which users it needs to reach.

In the aviation industry alone, the potential is tremendous. There are approximately 20,000 commercial aircraft operating with 43,000 commercial jet engines in service. Each jet engine, in turn, contains three major pieces of rotating equipment which could be instrumented and monitored separately. Imagine the efficiencies in engine maintenance, fuel consumption,crew allocation, and scheduling when “intelligent aircraft” can communicate with operators. That is just today.