How to Find Answers Within Your Company

Internal knowledge markets can facilitate information sharing within large organizations. The trick for executives is figuring out how to make them work.

Los Angeles-based AECOM Technology had a problem. An AECOM plant in Argentina had made a successful move into biofuels processing and was producing sugar dust as a byproduct of its biofuels production. The problem: Airborne sugar dust can be explosive — and AECOM was concerned about the possibility of having fireballs near its fuel processing. A team of AECOM employees based in London had several ideas, but after weeks of back and forth, a solution finally emerged — via an internal company bulletin board — from an AECOM engineer in Australia.

The type of challenge AECOM faced — locating internal knowledge on a specialized topic — exists in any large organization. The larger and more segmented the company, the harder it is to match its people to its problems. As Lewis Platt, former CEO of Hewlett-Packard, once noted, “If only HP knew what HP knows, we would be three times more productive.” How can a large organization address the challenges of managing information flows internally?

One answer is an internal knowledge market. In broad terms, internal knowledge markets are protected environments where users trade their knowledge via price mechanisms. Although such markets have existed in different forms for years,1 their use to facilitate knowledge transfer inside organizations is relatively new. Early adopters such as Infosys, Siemens, McKinsey & Co. and Eli Lilly have demonstrated their value for managing information flows relative to traditional knowledge-management solutions. For example, the software company SAP has used a knowledge market to facilitate peer-to-peer response to questions among enterprise software developers both within and outside the company. This form of Q&A has improved response times substantially while saving SAP more than $6 million in technical support costs.

The Leading Question

How can companies use internal markets to help employees locate specialized knowledge?

Findings

- Seed the internal knowledge market with key content and then subsidize development of additional solutions.

- Let prices float in the knowledge market.

- Manage the knowledge market like a market maker or the Federal Reserve — not like a central planner.

In general, markets cause resources to speak up and self-identify. They facilitate reuse of existing information, cause new information to be created when needed and efficiently regulate use of resources, including people’s time. Markets provide the framework to arbitrage gaps between problem and opportunity. To get these benefits, executives can bring market forces to bear within their companies. However, the rules, rewards and management of internal markets differ from those used in traditional organizational hierarchies. Based on an analysis of more than 50 implementations of various types of internal markets, as well as underlying economic theory, this article provides guidance on how to design, launch and sustain internal knowledge markets.

Bringing Markets Inside the Company

A popular concept, the “wisdom of crowds” holds that businesses should not plan everything from the top.2 But planning from the bottom requires knowing when crowds are actually wise. Four valuable uses of information markets by companies include forecasting via prediction markets, idea genesis and evaluation via idea markets, problem solving via innovation markets that match R&D problems with researchers and peer-to-peer assistance via knowledge markets. All four types of information markets are in use at companies today. This article focuses on internal knowledge markets, although, where applicable, we draw lessons from companies’ experiences with the other three types of information markets as well.

An internal knowledge market is a forum within an organization that matches knowledge seekers with knowledge sources — for example, branch offices and headquarters, or novices and experts — and that includes material or social incentives to encourage information sharing. An internal knowledge market typically takes the form of an IT-supported platform whose value grows as more users join. In contrast to a social network — which connects users to people they already know — a knowledge market is a tool that helps connect users to experts and expertise they might not know. Companies can use internal knowledge markets to facilitate information sharing across a distributed organization, to capture best practices within a company and to generate faster responses to employees’ questions. Companies that have launched internal knowledge markets include Eli Lilly, McKinsey, Infosys, Siemens, Bank of America, IBM, the World Bank, Samsung Life Insurance, Fujitsu and NTT Software.

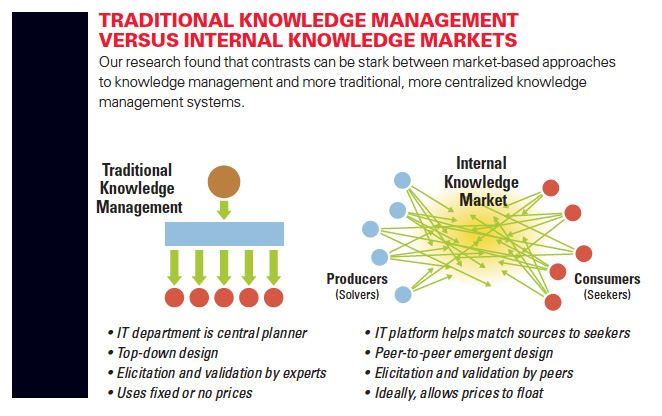

But there have been challenges and complications in implementing internal knowledge markets. To understand how to manage markets within companies, we first studied the costs and benefits of traditional versus market-based approaches to knowledge management. Our research found that contrasts can be stark. Traditional, first-generation attempts to manage knowledge relied mainly on centralized knowledge management systems. In that top-down approach, a central authority prioritizes development to address mainstream problems based on two assumptions: (1) knowledge needs are predictable, and (2) experts rather than peers elicit and validate knowledge. Both assumptions have limitations.

In traditional systems, relying on a company’s experts to provide answers works when they have capacity to serve all requests — in addition to doing their own work. But when the volume of questions exceeds capacity, experts become bottlenecks. Problems that could elicit an adequate solution from a peer may go unanswered while waiting for a perfect solution from an expert. Furthermore, because knowledge capture is costly, organizations selectively package only a fraction of their best practices. This leaves many workers with unacknowledged information needs. Finally, although unanticipated problems routinely affect business, traditional corporate knowledge management systems are unlikely to contain solutions to them.

Traditional Knowledge Management versus Internal Knowledge Markets

Not surprisingly, centralized knowledge management systems produce mixed results. One audit and consulting firm we studied spent more than two years codifying best practices to place on its knowledge management systems. Yet, after the system was given to more than 1,500 consultants, only 130 of them reported that they could find useful content on it. By contrast, an internal market is the information equivalent of just-in-time production. The platform helps people pull information and contacts when needed. Meeting unanticipated needs implies providing access to untapped knowledge, and it means providing access to diverse knowledge sources rather than just the central repository. (See “Traditional Knowledge Management Versus Internal Knowledge Markets.”)

An executive at Tokyo-based NTT Software beautifully captured the problem facing traditional knowledge management, stating that “attempts to promote knowledge management by requiring employees to contribute knowledge have failed.” Eighteen months after NTT Software introduced a knowledge market, questions posted to the Q&A forum received answers in as few as five minutes. Employees provided faster customer service, and best practices spread among software engineers and sales reps; redundant work fell by 9,000 hours.

Internal knowledge markets aren’t for everyone, especially organizations with insufficient scale. At one company we studied, Diamond Lease (which was later merged into Tokyo-based Mitsubishi UFJ Lease & Finance), executives noted that employees working side-by-side in an intimate setting naturally share information. In such settings, as employees interact they stay informed of work progress across the organization with no need for augmentation. As a business grows, however, working knowledge gets distributed across branch offices and divisions, and the flow of information stagnates.

Phase 1: Internal Knowledge Market Design and Launch

To implement internal markets, executives must consider fundamentally different design logic than that for traditional hierarchies. In this article, we provide executives with a framework for designing and maintaining effective internal knowledge markets. Because the implementation of internal knowledge markets is still evolving, we collected best practices from a variety of companies’ experiences to develop our framework, informed by underlying economic theory. We then built and tested internal knowledge market prototypes.

1. Use material and social incentives, but let prices float. David Ritter, CTO of InnoCentive, a supplier of knowledge markets based in Waltham, Massachusetts, offers some advice about creating effective internal markets: Incentives to collaborate are essential but they need to take three forms — spendable currency, recognition for expertise and the opportunity to have a positive impact. And, he observes, “We’ve found that participation in internal knowledge markets increases substantially when you can combine all three factors together.” Social rewards include recognition, peer rankings and professional identity.3 Intellectual rewards include learning, problem challenge and autonomy. Material rewards can include frequent flyer points, money or some type of virtual currency.

Even companies that recognize the need for markets to combine incentives can get them wrong. Consider the following examples from HP and Siemens. To stimulate knowledge supply and demand, HP established an incentive program based on frequent flyer miles. Posting a useful resource to the internal platform earned 2,000 miles, posting a question earned 1,000 miles, and posting an answer earned 500 miles. But 90 days after launch, only 20% of the target audience performed one of these activities. Siemens, similarly, relied on “shares” that participants could redeem for prizes. For contributing solutions and success stories, participating employees earned 20 shares, while they earned 10 shares for developing customer, technology or market bids. This program significantly increased contributions; however, information quality remained poor.

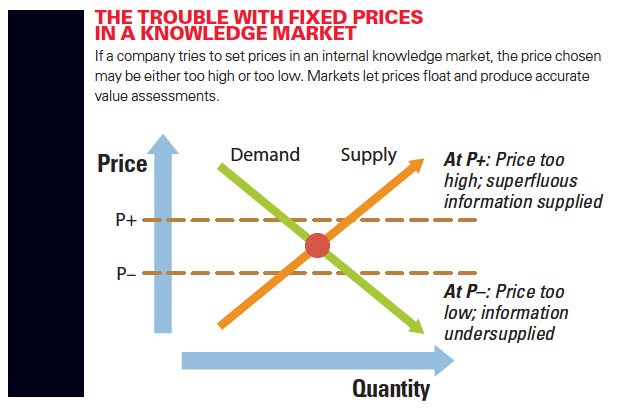

Both cases demonstrate a classic problem of knowledge management:4 Both HP and Siemens had used fixed rewards when creating their internal knowledge markets. When prices are fixed, information that is more valuable than the price is not created — experts won’t waste their time — while information that is less valuable than the price is created — in effect, less-expert workers volunteer just to get paid. (See “The Trouble with Fixed Prices in a Knowledge Market.”) As a result, such systems can either become burdened with irrelevant content or divert workers from more valuable activities with excessive rewards. To address these problems, managers should recognize fixed prices in internal knowledge markets as a form of central planning, in which some group within the company inadvertently plays the role of Politburo for a planned economy, directing activities across the organization. Price theory5 tells us that efficiency requires prices to float.

The Trouble With Fixed Prices In A Knowledge Market

Rather than rely solely on a fixed reward or rating system, companies can instead introduce virtual currencies to trigger quality content. Infosys, a 17,000-employee consulting and information technology company based in Bangalore, India, has implemented an internal knowledge market called K-Shop that uses such a virtual currency. Employees can submit research papers, project experiences and other knowledge goods to K-Shop. Both authors and reviewers are compensated via a company-issued virtual currency known as knowledge currency units (KCUs), which can be redeemed for cash and prizes.6 Within a year, people had contributed over 2,400 proposals, cases, software objects and reviews.

For internal markets, virtual currencies, such as point systems, cost less than real money, and evidence suggests they are also very good at promoting participation and information accuracy.7 Virtual currencies also promote the best use of everyone’s time. Because a person must work within a limited point budget, he or she must make choices about priorities. With a limited virtual currency budget, an employee will check the database of frequently asked questions before posting issues that have already been addressed. Meanwhile, important or critical issues immediately get flagged as important or critical through the pricing mechanism.

Of course, motives vary by individual, and incentives must be culturally appropriate. In life, when someone provides a service, an age-old question is whether to reciprocate a fee or a favor, a tip or a “thank you.” The closer the relationship, the more appropriate is reciprocal help or a thank-you. The more professional or distant the relationship, the more appropriate is a tip or a fee. Small organizations can obtain most of the information sharing they need through cultural norms and generalized reciprocity, but large organizations stand to benefit more from virtual currencies.

Even in large organizations, however, “currency” can be any social benefit that people value. SAP, for example, has developed an innovative point system to reward its developer community for trouble-shooting, blogging and answering each other’s questions. Originally, developers earned points toward T-shirts and memorabilia. In 2008, the community expressed an interest in something more socially responsible. Based on that input, SAP offered charitable donations of €100,000 if the community could collectively generate 2.5 million points. The community rallied to a stretch goal of 3.5 million points, and SAP doubled its offer, sponsoring €200,000 worth of children’s education and health care through the United Nations. In addition to these group-based incentives, SAP continued to offer special recognition to its highest point-generating individual developers and business process experts. SAP also consults with those individuals on policies and product design — a clear win for everyone involved.

2. Capture knowledge at both ends of the “long tail.” Markets require critical mass. Internal knowledge markets also require specialized content, produced by autonomous distributed contributors and consumed by autonomous distributed users. But attracting and matching these two distinct groups remains tricky. In external markets, this problem has been recently formalized as the theory of two-sided networks.8 Two-sided networks are matching markets, where distinct networks of users provide each other with mutual benefits. Examples include buyers and sellers on eBay, job seekers and employers on Monster.com and listeners and musicians on iTunes.

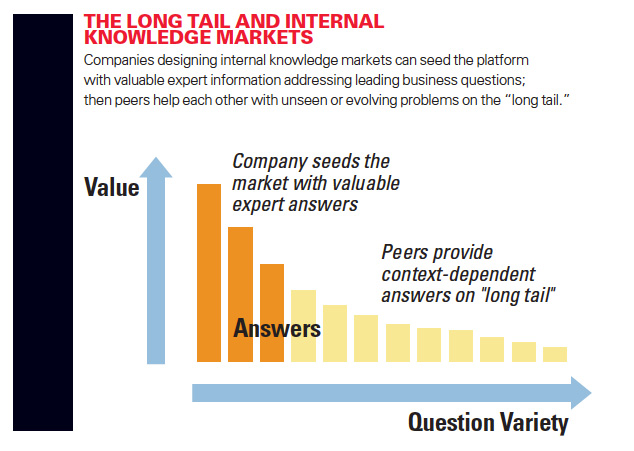

The Long Tail And Internal Knowledge Markets

Successful market launch of two-sided networks relies on two important strategies: seed and subsidize. These can easily be understood using the concept of the long tail.9 For any platform, if you sort the available content on the basis of popularity, the head of this distribution contains the handful of most popular items on the left, while the long tail contains the vast number of items trailing after it. (See “The Long Tail and Internal Knowledge Markets.”) The “seed” is the most important content provided by the platform sponsor. Apple, for example, seeds the iPhone with critical applications for e-mail, calendars, music and Web browsing. But Apple relies on its community to supply features it did not anticipate. Apple cannot afford to be the bottleneck provider of all the thousands of applications users desire. Instead, it subsidizes developers with platform tools and support services to help the community respond rapidly. Google, meanwhile, subsidized its long tail for the Android smartphone operating system with more than $1 million in cash prizes for the best apps. The analogy for a knowledge market is to seed critical solutions to leading business problems but to also support and subsidize community development of solutions to unanticipated problems. The seed serves as the essential value that stimulates user adoption. The subsidy takes the form of social or material rewards for providing novel content and peer-to-peer assistance.

Here’s how that process can work in practice. To seed its knowledge market, Bank of Tokyo employees distilled 90,000 Lotus Notes documents to 6,000 and placed them in the system to spark employee interest. Adoption soared following the introduction of the knowledge market, nonperforming loans went down and customer responsiveness went up. Even e-mail volume dropped as employees referred increasingly to the knowledge market. The next step required obtaining content for the long tail of the bank’s internal knowledge market. Platform sponsors typically lack resources and even the know-how to produce all the specialized content consumers need. The subsidy is achieved by providing points to employees who create valuable content for the internal knowledge market.

3. Consider offering points for improving information quality. What if employees post answers that are incorrect or of limited use? A properly designed knowledge market can address this problem. Naver, a popular South Korean community portal, includes a Q&A market where people earn points for commenting on the usefulness of answers, flagging obsolete content and organizing dispersed content. Contradictory answers can also be captured, critiqued, integrated and understood through community processing. The collective response can thus provide more than a questioner would get from a single source.

4. To overcome shyness, provide protected spaces. People who need information may avoid participating in an internal knowledge market if they are shy, self-conscious or reluctant to admit what they don’t know. Research shows that the psychology of interpersonal comparison, ego-threat and self-affirmation can affect how knowledge workers assess acts of taking or using advice from colleagues, and thus how information flows through an organization.10 Pfizer faced a shyness issue when launching its internal knowledge market in Asia. One solution: The internal knowledge market should include smaller, more private specialty markets where employees can voice questions and concerns with less widespread visibility. Protected spaces allow freestyle brainstorming where ideas can incubate. Second, market design should allow privacy and anonymity. Seekers should be able to ask anonymous questions, while solvers should be able to post anonymous answers or designate answers as private, visible only to the knowledge seeker. This encourages people to volunteer controversial information they would not otherwise share, or admit to ignorance they would not otherwise reveal.

5. To reduce hoarding, balance competition with collaboration. When colleagues are also competitors, individuals may hoard information for personal advantage. On first introducing its knowledge market, Diamond Lease’s sales staff disclosed little because, as one manager came to realize, their colleagues were also, in a sense, rivals. Correcting this competitive dynamic led the sales team to swap more than 250 proposals, significantly boosting productivity.

More generally, there is a solution to the problem of individuals hoarding information: using absolute rather than relative rewards.11 If a sales tournament rewards only top sellers, only relative position matters: One person winning means another person loses, so, in the company’s knowledge market, salespeople keep their best ideas to themselves. On the other hand, absolute rewards can foster information sharing: Anyone who passes a certain threshold earns a prize. Coworkers can help each other win, so collaborative knowledge trading helps teams cross the finish line together. The best incentives, therefore, balance competition and collaboration. Absolute incentives encourage sharing, but employees can coast on the work of teammates. Relative incentives discourage sharing, but employees work harder individually.

Use more relative rewards when problems require greater speed and diversity of approach, and solutions are substitutes. For example, InnoCentive runs a competitive external market where diverse solvers from around the world compete to find the best solutions to R&D challenges. Answers are strictly ranked, prizes are strictly limited and contestants cannot see each other’s work. Alternatively, use more absolute rewards when problems require complex coordination and solutions are complements. InnoCentive also runs collaborative internal markets inside client sites that offer online team rooms. Partial answers appear on discussion boards, and prizes go to whole groups of mixed expertise with little concern for individual rank.

6. Protect strategic information. Precisely because markets uncover ideas so well, they create risk of competitive disclosure. In some industries, it may be enough that a rival learns that its competitor posted a question, even if the answer stays private. For example, if a company uses an internal market to elaborate the advantages of a strategic acquisition and also predict its value, news leaking outside the company can raise the target’s price.12

As with the solution for employee shyness, executives can create more private specialty markets with exclusive membership. The U.S. government used this solution for its “terrorism futures” market, for example, where open prediction of likely terrorist targets had the potential to increase actual attacks. This prediction market was moved inside protected intelligence agencies where participants could be trusted. The trade-off is that openness and participation harness more diverse knowledge sources, while closure and exclusion reduce risk of strategic dissemination.

Phase 2: Market Development

1. Manage inflows for growth. In his seminal 1945 work arguing for the importance of market economies, economist Friedrich von Hayek emphasized that knowledge is unevenly distributed across society, and that centralized economic planning is prone to failure due to an inability to aggregate distributed knowledge and establish accurate resource prices. We believe this principle also applies to knowledge markets within companies. That’s why, when setting up internal knowledge markets, executive leadership should function less like a central planner and more like a Federal Reserve. This means setting policy for growth areas of the company’s internal knowledge economy and ensuring maximal use of company resources. It also means encouraging local initiative and relying less on top-down direction.13 Use experts, but also let peers help each other avoid bottlenecks. Rather than tell people what to do, ensure staff have what they need. In short, the executive sets policy, promotes flexibility and ensures liquidity.

Managing like a market opens a new realm of control tools imported from macroeconomics.14 For example, executives can borrow from half a century’s application of the quantity theory of money, an economic theory that describes how to manage a supply of value — money, credit or points — to achieve economic value and growth by choosing expansionary or contractionary policies. In an internal knowledge market, an expansionary monetary policy, achieved by issuing additional points to market participants, grows the knowledge base. A guideline is to give people points in proportion to sources of value they add to the company, for example, to add them relative to a job class, salary or project workload. Total inflow volume should occur at a rate proportional to company benefits from creating new information. The goal is to keep “prices” stable while gradually expanding the point supply to stimulate transactions volume. In a well-designed internal knowledge economy, this should increase the number of questions answered, the number of information resources traded and the number of platform services provided.

Fiscal policy within the knowledge market can likewise be used for targeted stimulus spending. SAP in effect implemented a virtual fiscal policy when it temporarily offered developers double points, a budgeted subsidy, for knowledge market activity relating to SAP’s new customer relationship management (CRM) products. The subsidies boosted development of CRM content that SAP itself did not have to provide.

2. Manage outflows for stability. However, these powerful growth and policy tools can be easily misused. Executives might be tempted to flood the internal knowledge market with points in ever-expanding pursuit of productivity. That would be unwise, leading to internal market inflation and instability. Points devalue when question prices rise. The solution is straightforward. Just as the U.S. Federal Reserve implements a contractionary policy to curb inflation, the knowledge market maker can offer services or buy points to shrink the point supply if expansion of the point supply has gone too far. San Francisco-based Linden Research, creator of the virtual world Second Life, passes points to and from its Second Life virtual economy through a system of sources and sinks and even buys and sells its own virtual currency, Linden dollars.15 Sources increase the point supply and reward Second Life participants for desirable activities like joining, providing valuable content or upgrading to premium services. Sinks decrease the point supply through fees for activities like renting land, misbehavior or converting virtual money back into real dollars.

To complete a market, points should have outflow possibilities that are truly useful. Across the internal knowledge market, the preferred balance has inflows slightly exceeding outflows, so the internal economy expands gradually and points retain roughly constant value. Outflows occur as participants redeem points they have earned. Their acquired points become convertible into services, gift vouchers, new answers or other claims on company resources. Participants can decide to spend points immediately or accumulate them to either spend later or change their status.

3. Encourage cooperation. One social concern is that material incentives can perversely alter information sharing by converting volunteers within a company into vendors.16 Spontaneous social interaction can evolve into calculated exchange. At Infosys, for example, executives worried that their Knowledge Currency Units (KCUs) had encouraged employees to sell knowledge that they would otherwise have given freely.

To compensate for this effect, organizations can design the internal knowledge market to foster prosocial behavior. Design features can explicitly encourage norms such as helping, sharing and cooperation. Infosys, for example, reformulated its KCU score to increase social recognition and emphasize value created on behalf of others. Knowledge markets can also offer special recognition to generous information givers. If someone is unusually helpful, the system can allow questioners to give “thank you” points either directly to answerers or to their favorite charities.

Another prosocial design feature is to support formation of communities of practice or “identity-based” groups, that is, teams that self-organize around a common skill, desire or purpose. When such voluntary groups assemble, they are especially good at information sharing, managing turnover and achieving identity-based goals. Applying social psychology to group formation.17 has been shown to increase knowledge contributions in online communities.

4. Beware of manipulation. Failures can occur when participants manipulate markets to their own ends. When the Schaumburg Flyers, a minor league baseball team based in Schaumburg, Illinois, opened their coaching decisions to popular vote, the resulting performance disappointed fans. One problem: Fans of opposing teams also got to vote.18 However, internal markets generally suffer less manipulation than external markets for three reasons. First, markets within companies have better goal alignment; gains from shilling ideas are usually far outweighed by the consequences of offering bad advice. Second, disputes can easily bump up to higher management rather than go through the courts. Finally, identities tend to be discernable, if truly necessary, which makes long-term reputation much more important than short-term gain. Regardless, the solution is to identify and discourage voting and advice giving in cases of conflict of interest.

Phase 3: Evolution

1. Design for self-design. Even if a knowledge market responds to current user needs, those needs can change. As users grow more competent, they see new opportunities and dream up new ways to use their systems. One solution: Let users use their points to request new features. Then the system can adapt to provide features not supported in the original design.19

Consider the proper balance between competition and collaboration. InnoCentive’s initial market included only competition without supporting collaboration. Operating within its own market, however, executives at InnoCentive issued a challenge to users to design ways to support complementary solutions. The result was InnoCentive@Work, which now supports discussion forums, expert locator tools, group collaboration and social networking tools. Management effectively bought new features. The new system makes partial solutions visible and increases public recognition.

Markets also solve the problem of inflexible taxonomies, like the mismatch between information as represented in a person’s head and as represented in a database. If a novice searches the database using the wrong words and no answers appear, the market can either connect the seeker to an old answer or provide a new one. Either way, the next time the problem arises, the answer will be ready to hand.

2. Use market data to help measure knowledge value. Internal knowledge markets have the potential to provide executives and academic researchers with two instruments to help solve the problem of measuring knowledge value. First, prices in the knowledge market give managers a sense of the relative value of certain types of information to employees. These prices, however, will necessarily underestimate the value of the information to the organization because information in a knowledge market can be reused by other people — and reusing valuable information can have significant productivity benefits. Estimates from the MIT Center for Information Systems Research show that companies with above-average information reuse experienced 4% higher margins and 12% higher revenue growth in 2009 than companies with below-average reuse.20

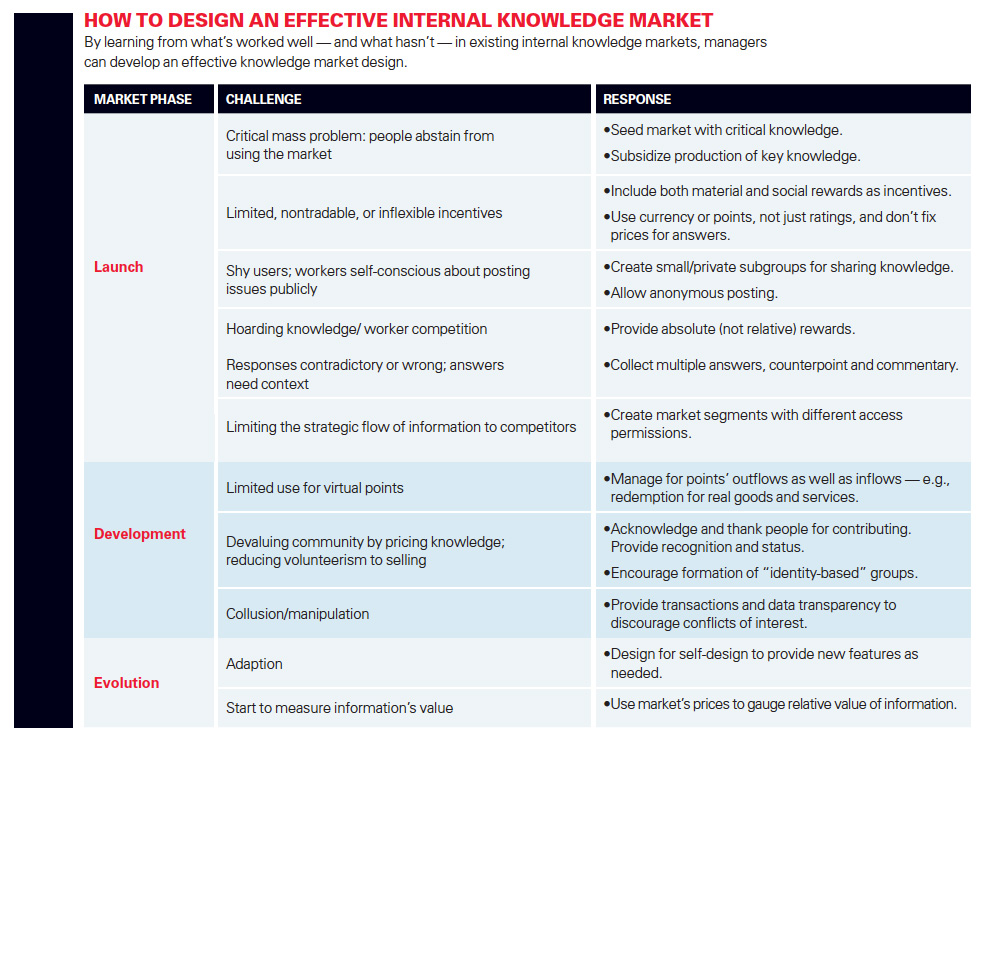

How To Design An Effective Internal Knowledge Market

Second, an internal knowledge market provides instruments to observe the effects of having access to new information. The operating hypothesis of most IT systems is that access to newer and more accurate information boosts productivity. For knowledge workers whose output can be quantified, as is the case for sales, coding, law, consulting and others forms of billable and project work, researchers can measure the indirect effects of information access on productivity. Among executive recruiters, for example, one study measured white collar output at $2,150 per day. What’s more, the recruiters’ productivity was significantly affected by use of information systems.21

For researchers, observing knowledge-worker productivity based on access to new information has the potential to provide new insights. How much does access to news, lessons learned, contract templates and a more diverse array of knowledge objects boost output? Data gleaned from knowledge market transactions should provide new ways to put a price on knowledge.

Governance Implications of Internal Knowledge Markets

Well-designed internal knowledge markets can provide a powerful set of tools to help large companies address the problems they face in accessing the wealth of dispersed information and talent. (See “How to Design an Effective Internal Knowledge Market.”) However, introducing an internal market opens a company to new forms of governance and creates completely new roles for those who would manage expertise. The IT department can no longer behave like a central planner but must instead behave like a market maker or the Federal Reserve. As market maker, the IT department steps in to provide liquidity when market participants have failed to match up, when they lack information or when they are too busy to provide assistance. As a Federal Reserve, the IT department manages the internal economy for optimal growth. Although most executives have not been trained to perform them, these roles are crucial to bringing markets inside the company.

This implies that executives must not only change their tools and how their people interact, but also change themselves. The true test of internal market adoption is whether companies begin to use them for critical issues, not just fringe areas. When the internal knowledge market contains questions and answers from employees that prove better than the conventional wisdom at headquarters, is that employee knowledge allowed to influence company choices?

Executives should support the change in power that follows from a change in the sources of expertise. In one Pacific Rim bank we studied, over 90% of questions in the company’s traditional knowledge management system traveled up from field offices to headquarters while answers traveled down in the opposite direction. Tapping expertise only vertically misses the full benefits of openness. Truly democratizing knowledge requires an open organization where employees can deliberate, argue, compete and collaborate horizontally across fields of expertise.

References (21)

1. The first known use of the term “knowledge market” is found in F.A. Hayek, “The Use of Knowledge in Society,” American Economic Review 35 (1945): 519-530.

2. The idea that groups tend to make better decisions than individuals was popularized by J. Surowiecki in “The Wisdom of Crowds: Why the Many Are Smarter than the Few and How Collective Wisdom Shapes Business, Economies, Societies, and Nations” (New York: Random House, 2004).

Comments (3)

hari

Euwyn Poon

Katherine Radeka