Which Strategy When?

Just when you think you have settled on the right strategy, you may need to change. By understanding the particular circumstances and forces shaping your company’s competitive environment, you can choose the most appropriate strategic framework.

Topics

Markets are changing, competition is shifting and your business may be suffering or perhaps thriving, at least for now. Whatever the immediate circumstances, managers are forever asking the same questions: Where do we go from here, and which strategy will get us there? Should we fortify our strategic position, move into nearby markets or branch out into radically new territory? To help guide our decisions, most of us have a smorgasbord of strategic frameworks to draw on. But which one is the right one, and when? The strategic plans, market analyses and hefty binders that strategy consulting firms leave behind often jumble strategic lenses: Five-Forces analysis, portfolio review, assessment of core competencies; examination of profit pools, competitive landscape and so on. But which analyses are most helpful right now?

Most managers recognize that not all strategies work equally well in every setting. So to understand how to choose the right strategy at the right time, we analyzed the logic of the leading strategic frameworks used in business and engineering schools around the world. Then we matched those frameworks with the key strategic choices faced by dozens of industry leaders at different times, during periods of stability as well as change. (See “About the Research”) Two surprising insights emerged.

Pixar Animation Studios, whose worldwide megahits include the Toy Story movies and Finding Nemo, uses rules such as “great story first, then animation” to guide its strategy.

Image courtesy of Pixar Animation Studios

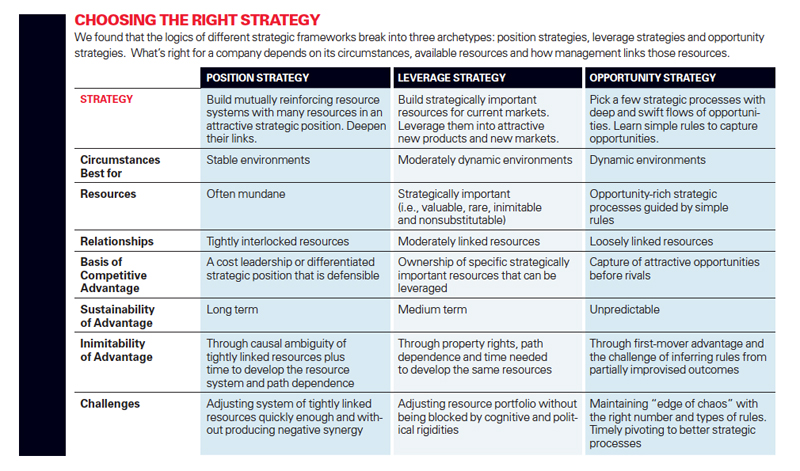

First, we discovered that the logics of the different strategic frameworks break into three archetypes: strategies of position, strategies of leverage and strategies of opportunity. What’s right for a company depends on its circumstances, its available resources and how management combines those resources together. (See “Choosing the Right Strategy.”)

Second, by observing market leaders employing archetypal strategies, we found that many assumptions about competitive advantage simply don’t hold. For example, although strategy gurus talk about strategically valuable resources, sometimes very ordinary resources assembled well are all that’s required for competitive advantage. Sometimes it makes good sense to bypass the largest markets and focus instead on where resources fit best. In other circumstances, it may be preferable to ignore existing resources and attack an emergent market. In some situations, basic rules of thumb work better than detailed plans. Surprisingly, these simple strategies can be harder to imitate than complex ones.

How to Choose the Right Strategy

To figure out when it makes sense to pursue strategies of position, leverage or opportunity, the key is to look first at the immediate circumstances, current resources and the relationships among the various resources. Understanding these factors will help you get started with the right strategic framework.

Get Updates on Transformative Leadership

Evidence-based resources that can help you lead your team more effectively, delivered to your inbox monthly.

Please enter a valid email address

Thank you for signing up

Understand Your Circumstances The first step for managers is a thoughtful review of their industry. Specifically, assess whether your industry is stable, dynamic or somewhere in between. How do you gauge this dynamism? Begin by asking yourself: Can I map the five industry structure forces in my industry? If you can identify buyers, suppliers, customers and substitutes by name and tick off barriers to entry, and if these five factors tend to stay largely the same, then you are probably operating within a stable industry. If the industry is too unsettled to map (think mobile Internet applications) or the basic rules are in flux (think clean or nano technology), then you most likely inhabit a dynamic industry.

Next ask: Where do my products fit in terms of product life cycle? In stable industries, standards are well-defined, product expectations are clear, product life cycles are known and often long and a limited number of competitors may slowly push the development envelope with anticipated innovations. However, in dynamic industries it’s different. Standards may not yet exist, product life cycles are short, products are diverse and no clear dominant technology or product has emerged. Some industries are in between. The auto industry is historically a stable industry. But new technologies (for example, hybrid and electric-powered engines), compressed product development times, volatile oil prices and regulatory pressure have increased dynamism. Also, don’t forget that your own company’s circumstances (for example, whether you’re a startup with a promising business model or an established player with global reach) will also affect where you fit.

Take Stock of Your Resources Once you understand your industry circumstances, take a look at your company. Assessing your resources and the links among them is essential. Why? Resources lie at the heart of strategy. They enable companies to set themselves apart from competitors. Tangible resources (such as Intel’s fabrication facilities or Starbucks’ locations) are relatively straightforward to assess. But intangible resources (for instance, Amazon’s patents or Procter & Gamble’s brands) are trickier. Beyond these, organizational processes (for example, the acquisition process of India’s Tata Group or General Dynamics’ divestment process) can provide a critical basis for advantage.

Once you know your resources, determine how advantageous they really are. The most strategically important resources are valuable (i.e., useful in your industry), rare (i.e., possessed by only a few), inimitable (i.e., difficult to copy) and nonsubstitutable (i.e., lacking in functional equivalents). These resources are a potential source of competitive advantage. Yet even if they can provide advantage, they aren’t absolutely necessary for competitive advantage. Indeed, even common resources can be a source of advantage depending on how they are linked with other resources.

Determine the Relationships Among Resources A secret to picking the right strategic framework is assessing how your resources relate to one another. Some resources are tightly linked. For example, Wal-Mart’s low-cost strategy in the United States depends heavily on its physical resources (often rural locations), sophisticated information technology (like maximizing selling space in stores and quickly replenishing inventories), efficient logistics (like cross-docking) and cost-conscious culture, all of which reinforce each other. By contrast, Google’s resources are more loosely linked. Executives can recombine human capital and technical resources as needed to tackle different markets and products. Of course, there are trade offs: Tightly linked resources create more defensible strategic positions, but they resist change; loosely linked resources are easier to change, but they can be inefficiently deployed and redundant.

Choosing a Strategy When does it make sense to choose one strategy over another? How do executives decide whether to build their strategies around position, leverage or opportunity? We will examine each framework separately.

The Position Strategy

When industries are stable, a strong case can often be made for a position strategy. Position strategies involve selecting a valuable and unoccupied industry position and then building up its defenses. This is the strategy that is commonly associated with Five Forces analysis,1 where competitive advantage comes from constructing a fortress around an attractive market. Industry stability ensures that the position of the fortress provides a long-term competitive advantage, thereby justifying repeated investments to reinforce and preserve the position. The strategy remains valuable until the terrain shifts and the strategic position is eroded.

With a position strategy, competitive advantage depends first on choosing a valuable and unoccupied strategic position in a given industry, and second on creating and linking company resources to defend that position. A valuable strategic position drives superior profitability through the ability to either boost prices (e.g., Porsche in the automotive industry) or reduce costs (e.g., Casio in the watch industry). Companies often defend their positions by assembling resource combinations that their competitors cannot easily imitate. In the U.S. mutual fund industry, for example, The Vanguard Group has built its strategy around conservative investment management and low costs. Vanguard, which claims that the average expense ratio of its mutual funds is a fraction of its main competitors, defends its position with mutually reinforcing resource choices, including low commissions, modest management perks and an absence of retail branches. Thus, the key to advantage with a position strategy is not just having a valuable strategic position, but also linking resources to defend successfully against challengers.

Position strategies seem straightforward, but it is often assumed their success requires strategically important resources. Although such resources can be helpful, they aren’t necessary. Competitive advantage can come from defending a strategic position through a system of tightly linked resources, not necessarily from the superiority of the resources per se. Consider JetBlue, the low-cost U.S. airline. On the surface, its strategy is based on common, even mundane, resources: Airbus A320 and Embraer 190 aircraft, comfortable passenger seats, DIRECTV access and SIRIUS XM satellite radio, e-mail and instant messaging services and fast turnaround capability at airport gates. None of these resources is particularly special. But as a package, they are mutually reinforcing and produce a differentiated offering that gives JetBlue a competitive advantage that other airlines would have difficulty imitating.

When resources are tightly linked, they are hard to copy. Interdependent resources create complexity, and so copying them and their linkages is challenging and time-consuming. Thus, even if imitators understand which resources are being used, they probably don’t understand exactly how they fit together because there are often many resources with unexpected combinatorial effects. Successful imitation, therefore, requires not only knowing which resources comprise another company’s strategy (i.e., ingredients), but also deciphering the proper sequence of their assembly (i.e., recipe).

Over time, since even fortresses need maintenance, managers with position strategies can’t just rest on their laurels. To maintain competitive advantage, they may need to refresh their resources and strengthen the links among them. For example, the Spanish clothing company Zara has updated several resources to bolster its strategic position, including more and better small-batch production that seamlessly links to air shipment logistics. Zara can now send new designs to any store in the world in less than two days.

Like any strategy, position strategy has an Achilles heel: change. When industries change, moving a fortress locked into a strategic position is tough. Changing a tightly linked system means dismantling the very synergies that management worked so hard to build and putting the organization at risk during the transition to a new strategy. For this reason, many managers either ignore change or make changes at the margin. But neither approach works. Once stable markets change, entrenched strategic positions tend to falter. Change forces managers to dismantle their existing resource systems and reassemble them in new strategic positions. This is difficult and time-consuming — a combination that can potentially be lethal because performance may not improve until the pieces are reassembled and linked. For example, Liz Claiborne, an apparel company, relied on a positioning strategy in which production, distribution, marketing, design, presentation and sales resources were all tightly linked. But when the industry changed, the company’s relationships with department stores were disrupted.2 In an effort to adapt, Claiborne executives changed resources such as their “no reordering” process that had antagonized department stores. But since this process was synergistically entwined with other resources like overseas logistics and distant manufacturing locations, the “no reordering” process could not be undone without damaging system coherence. Financial performance sank precipitously. Only after Claiborne executives dismantled their existing resources and started reconnecting new ones did positive performance begin to return.

The Leverage Strategy

In markets where change is moderate, leverage strategies often beat position strategies. Since change is incremental and predictable, it makes sense for managers to coevolve their strategically important resources with the industry. So while position strategies are based on the fortress analogy, leverage strategies are more like chess, where competitive advantage comes from both having valuable pieces and making smart moves with them. Take Pepsi. The company has several strategically important resources (including its brand, product formulas and distribution system). But what really matters is that the company has smartly leveraged them to support new products that fit with increasingly health-conscious consumers. Alongside its carbonated drinks, Pepsi now offers an array of alternative beverages, including waters (Aquafina, SoBe Lifewater), juices (Tropicana, Dole), teas (Lipton) and sports drinks (Gatorade), all of which take advantage of the company’s strategically important resources.

Companies that pursue leverage strategies achieve competitive advantage by using their strategically important resources in existing and new industries at a pace that is consistent with market change. This strategy, commonly associated with the resource-based view of the company,3 focuses on building or acquiring resources that are valuable, rare, difficult to imitate and nonsubstitutable, and leveraging them into new products and markets. But while resources in position strategies are often tightly interlocked, resources in leverage strategies are often only moderately interconnected.

Leverage strategies can focus on refreshing and consistently deploying core resources in current markets. For example, although Intel’s short-term success depends on extracting value from its current generation of microprocessors, its long-term growth depends on using its well-known design capabilities, branding and manufacturing resources in future generations of microprocessors. Similarly, Pizza Hut’s continued success depends on updating its highly important service resources in its existing markets. The company expanded into India in the late 1990s and soon distinguished itself from competitors based on its ability to provide customers with pizza and friendly table service in a relaxed atmosphere. Yet, by 2005, India’s casual dining sector was crowded. Pressured by rivals, including Domino’s, Pizza Hut refreshed its service resources and leveraged them to create a more upscale dining experience. As a result, Pizza Hut is still the most trusted food brand in India.

Under Armour CEO Kevin Plank and his team realized that they could leverage their moisture-wicking synthetic fabrications into new markets.

Image courtesy of Under Armour

While leveraging resources in existing markets is important, leveraging resources into new markets is important, too. Under Armour, a Baltimore, Maryland, sports apparel company founded in 1995, offers a good example. CEO Kevin Plank originally planned to make breathable garments for football players. But he and his team soon realized that they could leverage their moisture-wicking synthetic fabrications into other markets. After screening markets to see where this resource could be introduced most effectively, Under Armour executives developed their first line of moisture-wicking running shoes. Similarly, Home Depot is currently attempting to leverage its core resources by selling automotive replacement parts. By exploiting both its extensive expertise in “do-it-yourself” and its 2,200 store locations, it hopes to propel growth.

A common mistake with leverage strategies is forgetting to reassess the strategic importance of resources (especially value, rarity and nonsubstitutability) in potential new markets. For example, when Amazon.com first tried to leverage its online ordering and inventory fulfillment capabilities beyond books and music to include other product categories such as toys, it hit a wall. As it turned out, the inventory systems that were tailored for books and music were not well suited for the extreme seasonality of toys, and the company’s warehouse logistics were not designed to handle toys, which come in all sorts of shapes and sizes.

Leverage strategy is not only about expansion. Sometimes, it makes sense to pull back and redeploy resources. For years, California-based Advanced Micro Devices used its superior engineering design resources to develop semiconductors. Recently, however, the company has redeployed some of its resources away from the hotly competitive semiconductor industry and into design services. Although products and services may rely on particular strategically important resources, these resources need not be wedded to specific products or services. Rather, they can be used to create competitive advantage in other contexts. In other words, a deep knowledge base of resources and capabilities is often fungible across multiple products and markets.

A primary challenge of creating competitive advantage with a leverage strategy is updating the resource portfolio as industries change. This can mean choosing whether to acquire, partner or develop key resources in-house. Toyota’s Prius is an example of leveraging some existing resources, including brand and electronics technology, even as the company developed and acquired new resources for hybrid technology, engine control software and regenerative braking. But, even when managers see the need for adding, upgrading or eliminating resources, entrenched beliefs and internal power struggles can interfere. Immediate performance from existing resources takes precedence over later performance from new resources that may be several years away. To support this point, one needs to look no further than Chrysler. In 1984, Chrysler introduced the first minivan. Over the next 20 years, it sold more than 10 million minivans, revitalized its popular Jeep line and introduced successful Ram and Dakota pickups and Dodge Durango SUVs. But the auto industry changed. While General Motors and Ford adapted their engine technologies to emphasize fuel efficiency and retooled their manufacturing plants for small cars, Chrysler failed to update its resource portfolio. As a result, the company, now controlled by Fiat, has yet to prove that it can gain the resources necessary to compete well in the new reality.

The Opportunity Strategy

In contrast to stable industries, dynamic industries are characterized by superabundant flows of fast-moving but often unpredictable opportunities. Industry structure is characteristically shifting as competitors come and go, customers modify their preferences and business models are in flux. How long will competitive advantage last? It’s impossible to know, but probably not very long. As the CEO of a security software company told us half-jokingly, “You need a degree in astrology to compete in our industry.” Even though managers seek a long-term competitive advantage, they do business as if it doesn’t exist. The famous Intel axiom that “only the paranoid survive” reflects senior management’s belief that at any point in time their competitive advantage will vanish. As a result, strategy focuses on capturing opportunities that create a series of temporary competitive advantages.

In contrast to the fortress and chess views of strategy, pursuing an opportunity strategy is like surfing: Performance comes from catching a great wave at the right time, even though the duration of that wave is likely to be short and the ride a precarious “edge of chaos” experience where falling off is always a possibility.4 Timing and capturing successive waves are what matters. The video game console industry provides a useful case in point. In the space of only a few years, different companies (including Sega, Nintendo, Sony and Microsoft) have “caught the wave” and for a time led the industry.

For companies pursuing opportunity strategies, competitive advantage comes from capturing attractive but fleeting opportunities sooner, faster and better than competitors. This strategy, which is commonly associated with “simple rules” heuristics,5 requires combining two elements: choosing a focal strategic process and developing simple rules to guide that process. Together, they enable companies to be flexible enough to capture unanticipated opportunities while still being broadly coherent and efficient. In choosing a focal strategic process, the key is to choose one where the flow of attractive opportunities is steady and deep. Tata Group, whose diversified operations range from steel and autos to communications and beverages, provides a good example. Because of its high market capitalization and ready access to corporate debt, Tata has relied heavily on acquisitions as its focal strategic process. Its managers have pursued a series of acquisition opportunities quickly and effectively. For example, in 2007, the company paid $12 billion for Corus, a European steel company. Several months later, it paid $2.3 billion to buy Jaguar and Land Rover from Ford. In contrast, Apple focuses on a different strategic process — product development — to churn out coveted new designs. Yet in contrast to position strategy, which depends on tightly connected processes, opportunity strategy is built on processes that are only loosely connected to one another.

Once managers have identified their focal strategic process, they need to learn some simple rules. The easiest to learn are rules of thumb for picking and processing opportunities; rules for pacing and priority rules are more difficult to learn. The idea is to provide enough structure for action while also allowing flexibility to capture unanticipated opportunities. At Pixar Animation Studio, whose animated films (including the Toy Story movies, A Bug’s Life, and Finding Nemo) have become worldwide megahits, the rules are clear. One rule is “no studio executives.” Pixar is run by creative artists, or as Andrew Stanton (director of WALL-E and Pixar’s ninth employee) called it, “film school without the teachers.” This gives company artists maximum leeway to create without having to fight their way through middle management. A second rule is “great story first, then animation.” That not only ensures a steady stream of prestigious awards (Ratatouille holds the record for the most Oscar nominations for a feature-length animated film), but also makes it easier to attract talent. Another rule stipulates “in-house original ideas only.” And while ideas must come from within, they don’t come just from creative types: Everyone from janitors to auditors is encouraged to submit ideas, and all ideas are considered. Finally, as the surfing analogy would suggest, the rules affecting pacing are particularly important. A key one at Pixar is “one new movie per year.” But while there are rules, there is plenty of space at Pixar to create unique movies.

On the surface, opportunity strategies relying on simple rules seem easy to copy. But since the opportunities and outcomes are so varied, it is actually difficult to decode the rules from the outside. Of course, competitors can try to mimic processes (say, for acquisitions or product development), but rules are often the results of idiosyncratic trial and error, making them difficult for rivals to duplicate. Moreover, even if competitors understand the underlying logic and copy a company’s rules, it’s often too late: The most attractive opportunities will have already been captured. For example, although Cisco System’s networking rivals eventually copied the rules of its acquisition process, they could not replicate the opportunities that Cisco had already acquired.

Managers often tinker with their rules by making them better or more suited to their changing industries. In doing so, managers not only alter the number and content of rules, but also their abstraction. For example, CRF Health, an international company that expedites drug discovery in the pharmaceutical industry, frequently adjusted the rules that guided its internationalization process. When the company entered the United States, it relied on a rule that had been highly effective in Sweden: “Hire strong locals using online resources.” But this rule proved ill-suited to the new market because there were few individuals with both clinical development and technical skills willing to work in a startup. Indeed, the rule led to several early hires who were not well-qualified. Based on this experience, CRF’s team decided that the existing rule needed to change to one emphasizing local hiring without regard to source. Thus, leaders raised the abstraction from “Hire strong locals using online resources” to the more general “Hire strong locals.” This new rule focused attention on the overarching aim of hiring, but did not prescribe whether to rely on online resources, headhunters or other sources. Although intuition suggests that rules begin as abstract and become detailed, opportunity strategy stresses the opposite. Rather than becoming routine to ensure efficiency, rules often become more abstract and remain few in number to ensure flexibility to address unanticipated opportunities.

When an opportunity flow becomes less attractive (e.g., greater competition for the opportunities or lower payoff from the opportunities) or when more attractive opportunity flows emerge, it’s time to pivot to the superior flow and its related strategic process. The key point is that shifts in where to compete are driven more by the attractiveness of opportunity flows than by fit with the company’s strategically important resources. For example, as product development opportunities slowed down at Google, management placed more emphasis on internationalization opportunities. The company ramped up to enter more than 55 countries with more than 35 languages by supporting localized search, and it now generates more than half its revenue from outside the United States. Similarly, once its user network had grown to a sufficient scale, LinkedIn switched from emphasizing its strategic process for user acquisition to one for developing new revenue-producing services.

Just as positioning and leverage strategies have their pitfalls, so does opportunity strategy. For entrepreneurial startups, it is often critical to add more strategic processes and rules than is comfortable. Too little structure is riskier than too much. But for large companies, the greater risk is having too much structure. Most managers intuitively worry about bureaucracy and red tape. But what they don’t know is that pursuing an opportunity strategy requires holding the line on the number of rules, not just their content. In other words, the number of rules matters. Managers should also be alert to signs of consolidation, standardization, longer product life cycles and other such indications that the industry is maturing and becoming less dynamic.

So which strategy should you use? The reality is that no single strategy works in every industry always. Although the essence of strategy is being different, establishing that “difference” — whether it’s through different positions, different resources or different rules — depends on the circumstances. Each approach works best in particular settings and has its own implications for strategic actions, pitfalls, competitive advantage and performance. And just when you think you have it right, you may well need to change again. But by understanding the archetypal strategic frameworks and the factors underlying each choice, you’ll be better prepared to craft your next strategy.

References

1. M.E. Porter, “Competitive Strategy” (New York: Free Press, 1980); M.E. Porter, “What Is Strategy?,” Harvard Business Review 74, no. 6 (1996); J.W. Rivkin, “Imitation of Complex Strategies,” Management Science 46, no. 6 (2000): 824-844; N. Siggelkow, “Evolution Toward Fit,” Administrative Science Quarterly 47, no. 1 (2002): 125-159 C.B. Bingham and K.M. Eisenhardt, “Position, Leverage and Opportunity: A Typology of Strategic Logics Linking Resources with Competitive Advantage,” Managerial and Decision Economics 29, no. 2-3 (2008): 241-256.

2. N. Siggelkow, “Change in the Presence of Fit: The Rise, the Fall, and the Renaissance of Liz Claiborne,” Academy of Management Journal 44, no. 4 (2001): 838-857.

3. C.K. Pralahad and G. Hamel, “The Core Competence of the Corporation,” Harvard Business Review 68, no. 3 (1990); D.J. Collis and C.A. Montgomery, “Competing on Resources,” Harvard Business Review 73, no. 4 (1995): 118-128 J. Barney, “Firm Resources and Sustained Competitive Advantage,” Journal of Management 17, no. 1 (1991): 99-120; M.A. Peteraf, “The Cornerstones of Competitive Advantage: A Resource-Based View,” Strategic Management Journal 14, no. 3 (1993): 179-191.

4. J.P. Davis, K.M. Eisenhardt and C. B. Bingham, “Optimal Structure, Market Dynamism and the Strategy of Simple Rules,” Administrative Science Quarterly 54 (2009): 413-452.

5. S.L. Brown and K.M. Eisenhardt, “Competing on the Edge: Strategy as Structured Chaos” (Boston: Harvard Business School Press, 1998); K.M. Eisenhardt and D.N. Sull, “Strategy as Simple Rules,” Harvard Business Review 79, no. 1 (2001): 107-116; C.B. Bingham, K.M. Eisenhardt and N.R. Furr, “What Makes a Process a Capability? Heuristics, Strategy and Effective Capture of Opportunities,” Strategic Entrepreneurship Journal 1, no. 1-2 (2007): 27-47; C.B. Bingham and K.M. Eisenhardt, “Rational Heuristics: The ‘Simple Rules’ That Strategists Learn from Their Process Experiences,” Strategic Management Journal (in press); C.B. Bingham and J. Haleblian, “How Entrepreneurial Firms Learn Heuristics: Similarities and Differences Between Individual and Organizational Learning,” Strategic Entrepreneurship Journal (in press).

Comments (5)

SYUKRI LKMAN

Mni Nomnga

Jimbo Holloway

Michelle Grey

Kaythi Aung