The Transforming Power of Complementary Assets

Reaping the elusive productivity rewards of information technology requires that an organization must change the way it does business. Schneider National took that dictum to heart and became a trucking and logistics powerhouse.

Successful companies recognize that information technology can fundamentally alter the very nature of work. Such a transformation, however, often requires that an organization rethink its corporate strategy and remake its basic structure and processes — a task that one Fortune 500 CEO compared to “changing the tires on a moving car.” Looked at in this way, the so-called productivity paradox articulated in 1987 by Robert Solow — “you can see the computer age everywhere but in the productivity statistics”1 — becomes less mysterious. In fact, though, computers do affect productivity — and they do so to the extent that organizations adapt their internal structures, processes and culture to extract the greatest value from the technology. The data show a clear divide between companies that effectively change their organizations and those that do not. Laggard firms can live off their momentum and existing customer base for a while, but eventually a competitor will offer customers a significantly better product or service.

In this sense, IT is like steam power in the 1800s and electricity in the 1900s — a general- purpose technology with long-term impacts on the nature of production and consumption throughout the economy.2 But IT has become affordable, and thus ubiquitous, much more quickly than those earlier advances. Since the late 1950s, the price of computing power has fallen more than 2,000-fold. Although IT has enabled the growth of new companies and even entire industries, these technologies have also transformed the opportunities and challenges facing established manufacturing and service firms.3

We will show that the degree to which a particular company gains from changes in IT depends on the ability of firms to exploit investments in complementary assets —not just physical capital but also human and organizational processes. To support this proposition, we focus on how one company in the transportation sector transformed itself as it put IT to work.

We take as our point of departure the seminal work of Alfred Chandler4 and Harold Leavitt,5 who established the interrelatedness of a few major elements common to all organizations — namely, their strategies, their organizational structures, their employees and their technology.6 Viewed through this lens, it becomes clear that companies who have exploited IT as part of remaking themselves have done so by changing each of these elements in a dynamic and balanced way that recognizes their essential complementarities.7 It is the ability of an organization to manage the dynamic interplay among these internal elements and the external socioeconomic and technical environment that lies behind the successful exploitation of IT.

The complementary fit of organizational assets among themselves, as well as with the customer’s needs, is a major driver of a successful and sustainable strategy for IT implementation.8 An effective strategy comes not only from positioning and combining activities but also from modifying the organization’s structure to match the economics of IT’s impact on production and coordination work. IT makes “activity systems” into dynamic reconfigurable elements in ways that only a few organizations have begun to take advantage of. As we will show, building such a network of complementary assets, woven together by information and process know-how, can substantially strengthen an organization’s competitive position. See sidebar.

Unfortunately, identifying statistically significant relationships between the various components of an organization’s technology and competitive environment and its internal organizational processes and strategy is not a straightforward task. The analysis requires data to be collated from disparate sources on performance (for example, market value and productivity); on proxy variables, such as computing power, that serve as measures of the value of IT investments; and on a range of other tangible and intangible assets. Moreover, the lag between IT investment and business outcome makes it difficult to disentangle causal impacts.

The hardware portion of the IT investment is small compared to these associated intangible and organizational components. For example, in the late 1990s less than 20% of the total $20 million installation cost of SAP R/3 software (an industry standard package for integrating and processing corporate data) consisted of capitalized hardware and software expense. The rest went toward customization design and organizational change and staff training9. Moreover, high investment in IT goes hand in hand with high investment in related organizational changes —and these tend to include a greater emphasis on decentralized structures, individual decision making, team-based incentive systems and training programs to raise skill levels. Finally, companies that combine high IT investment levels with investment in associated organizational transformations do better on a variety of measures than those that are high on one or the other but not both.

Large-scale statistical studies focusing at the business-unit level suggest important conclusions on interactions between complementary investments.10 MIT Sloan School of Management professor Eric Brynjolfsson and colleagues tested the hypothesis that intangible organizational assets complement IT capital just as new production processes and factory redesign complemented the adoption of electric motors more than 100 years ago.11 Their analysis indicates that organizations invest 10 times as much in the intangible assets associated with IT as in the IT itself. They also show that firms that invest heavily both in IT and in work organization have higher market valuations than those that invest heavily in only IT or only work organization.

Although such statistical evidence supports our thesis, it does not explain the underlying processes and organizational changes that produce the patterns of failure and success. A second approach, which uncovers more of the precise nature of the organizational transformation and interactions brought about by IT, is to examine sector changes. Here, the concrete nature of specific opportunities and changes linked to IT can be revealed. Retailing and wholesaling, which in both the U.S. and European economies account for about 10% of GDP and 15% of employment, provide good examples.12

In the United States, for example, Wal-Mart Stores Inc.’s tremendous productivity growth derives largely from the large-scale deployment of electronic data interchange and bar code scanning. Rivals struggling to compete with Wal-Mart have adopted some of these technologies. Because Wal-Mart competes across many retail categories, its technological impact is very widely felt — not only in big box retail but in clothing stores, drug stores, general merchandising and even groceries.13 In fact, labor productivity in retail firms grew 7.4% annually between 1995 and 2002, nearly triple the 2.6% per year pace between 1980 and 1995.14

The productivity growth in retailing came almost entirely from the opening and expansion of new establishments owned by the biggest retailers as they diffused their innovative organization across the United States.15 These changes were greatly facilitated by an urban-planning system that was conducive to the creation of big box superstores — a system that Wal-Mart fully exploited. Taken together, these changes in performance had a major impact on the productivity of the U.S. economy overall: Retailing and wholesaling were the top two of the six sectors that accounted for the whole of the U.S. productivity acceleration after 1995.16 (From this perspective, Arkansas made a greater contribution to productivity growth than did Silicon Valley.) As new, IT-driven possibilities develop in retailing, the ability to recognize and manage the opportunities they provide and to invest in the necessary complementary assets will continue to separate successful from unsuccessful competitors.

To more clearly illustrate the processes through which IT-related transformations interact with strategy, structure and people to produce successful corporate outcomes, we turn to a detailed case study of a single firm in a third sector: transportation.17

The Case of Schneider National Inc.

With the 1980 enactment by Congress of the Motor Carrier Act, everything changed in the trucking business. Trucking companies were given much greater leeway in what services they could offer, where they could operate and how they could set prices. It became much easier for any trucking company to operate in any state; anyone with the money to buy a truck could become a competitor. Between 1980 and 1995, the number of trucking companies tripled. The resulting competition was brutal — the decade of the 1980s saw 12,000 trucking companies go bankrupt.

The trucking business also felt a huge impact from the trends of the 1980s and 1990s toward lean production and just-in-time manufacturing techniques. Global pressure from low-cost producer nations drove manufacturers to improve operations. As a result, customers became extremely intolerant of poor service and began to insist on reliable, on-time deliveries. New companies like Federal Express Corp. conditioned people to expect deliveries overnight, while, as we have seen, companies like Wal-Mart showed the benefits of a well-run distribution system.

Lean manufacturing meant that companies needed fast, reliable deliveries of smaller loads. That’s an expensive headache for carriers — it meant delivering fewer pieces for the same fixed shipping cost (it costs almost as much to operate an empty truck as a full one). In this changed environment, trucking companies with a low cost-per-mile have an edge, as do those with a good on-time delivery rate. Another important competitive advantage goes to trucking companies that can figure out how to minimize the practice of having trucks return empty from delivery jobs. Such “deadhead” trips can as much as double the cost of a delivery. Manufacturers grudgingly pay the costs of deadhead trips and less-than-truckload service but constantly look for ways to trim such costs.

The company we examine — Schneider National Inc. — illustrates the power of investing in complementary organizational and process changes to wring the greatest productivity gains from IT in meeting this challenge and in so doing transform the nature of the transportation-related services it could deliver. Schneider is the second largest full truckload transportation company in the United States, with 20,000 employees and 2005 revenues of more than $3 billion.

Based in Green Bay, Wisconsin, Schneider has always been a private, family-owned operation. Founder Al Schneider started grooming his son Don from age 16 to one day run the company; in 1973, Don Schneider rose to CEO. Soon after taking the helm of the company, he was visited by Irwin Jacobs, CEO of a new company, Qualcomm Inc., that had just developed a robust geographical positioning system called OmniTRACS. Jacobs offered this system to Schneider for a free trial period. Don Schneider sensed an opportunity: He could use OmniTRACS as a base on which to build information systems that would yield quicker deliveries at lower cost — in part by reducing the number of deadhead trips.

In 1974, Schneider began to hire a few IT professionals and to create systems and processes around the Qualcomm GPS technology to improve the firm’s performance.

Schneider took a strategic approach to these complementary investments in the sense that he looked at what technology the company would acquire over the long term and how to align its use with the company’s mission. This approach remains a Schneider hallmark. As Chief Information and Logistics Officer Christopher Lofgren explained, “We won’t go after an IT project unless there is a business leader within Schneider who will take it, fund it, and be accountable for the business outcome.” By 2004, Schneider employed 425 IT personnel.

Schneider saw technology investment as a means to an end: achieving the operational performance demanded by its customers. As Don Schneider tells it, “When we first put a satellite in, I was telling one of our major customers, an automotive company, how good this communication would be. They said ‘I don’t care if you use carrier pigeons to talk to your drivers. All I care about is that your price does not go up and that you deliver on time, any way that you know how.’ ”

Satellite Trucking

One pivotal technology that Schneider introduced was satellite communications. The company installed satellite communications and tracking systems in every truck at a cost of some $3,500 per vehicle. Beyond this initial investment, Schneider National spends an additional $7 million to $10 million per year (about 0.5 cents per mile) on satellite transmission fees.

The key point here is that it was not the technology acquisition alone that improved performance but rather the changed operational processes and the way that the technology became an integral part of the way the company operated. Although other trucking companies could (and would) copy the technology, they could not so easily copy Schneider’s unique blend of complementary assets — strategy, work processes and embedded know-how. For example, Schneider, in implementing its positioning-system data in trucks, recognized the value of the information on precise truck location and timing to meeting both drivers’ family needs and those of the customer for efficient service — data that Schneider embedded in its decision support systems.

Before acquiring this satellite communications system, Schneider barely knew where its trucks were. Drivers would report where they were when they called in. But such reports were sporadic and depended on the driver’s ability to determine and report location and the company’s ability to understand the report and translate it into a map location. With the new system, every communication between truck and center is automatically tagged with the truck’s true location, accurate to within less than 100 meters. Even in the absence of messages between the center and the truck, the system polls every truck every two hours to check their locations. Because these digital messages are formatted into a set of standard templates, they are easily compiled into detailed logs that enable Schneider to stay on top of every shipment and analyze the true travel time of deliveries.

With routine two-way communications, Schneider can confidently schedule drivers for pickups and deliveries. Tracking information helps the company reliably predict when a driver will be available for the next load and therefore to schedule another pickup in the immediate area. The result is less time spent parked and fewer empty miles driven. In 1978, Schneider became the first in the industry to deploy Qualcomm’s OmniTRACS system — a system now in use by 280,000 trucks operated by an array of carriers. In 2003, a decade and a half later, Schneider announced in a separate initiative that it had begun to install satellite tracking units in its 48,000 trailers, complementing the 14,000 tractors that currently have the units. The new communications and sensor technology embedded in each Schneider trailer detects when a trailer is connected or disconnected from a tractor, if it is loaded or empty and what its GPS position is. In addition to its earlier work with Qualcomm, Schneider worked for several years with Orbcomm — the company that supplied the satellite communications system — actively participating in the design and development of the system for its trailers.

Schneider was the industry pioneer in extending the satellite-based technology to trailers. The Orbcomm system tracks the “passive” chips in the trailers that provide the data, but its full exploitation by the company depends on Schneider’s own proprietary system. This system, called Vantage, is a complementary investment; it lets Schneider manage the productivity and efficiency of its trailer assets by linking trailer location and status directly into the company’s fleet management and logistics systems.

Schneider was able to exploit these IT-based technologies only because it worked hard at maintaining deep communication with its drivers and thus had their good will and acceptance of changes in work practices. Moreover, the effective linking of the data itself to effective decision making required the introduction of supporting internal systems and the open sharing of information and decisions among all categories and levels of the organization.

Technology on the Job

The technological advances and transformations Schneider made affected all employees and were particularly important for drivers, customer service representatives, service team leaders and dispatchers.

Drivers: Technology has helped Schneider improve working conditions for drivers. At the most obvious level, drivers no longer waste time stopping to call for instructions. But the same technology also helps relieve drivers’ stress and enables them to spend more time with their families. For example, the system maintains a record of driver preferences and “blackout dates,” such as children’s birthdays, and adjusts drivers’ schedules accordingly.

Customer service representatives: Customer service employees at Schneider sit together in a large open space that takes the entire first floor of the building; this physical proximity allows them to easily share information and experience. Satellite communications enable the reps to pinpoint the location and status of shipments. If the customer is requesting a change in pickup or delivery, the rep can be confident that the driver will get the message and respond promptly. This confidence in the timely execution of customer requests makes the customers happier as well as the reps.

The tools available to customer service reps for taking orders efficiently typify how Schneider has captured operational processes in software. The people grow and the software evolves with daily use. The Capacity and Demand Tool, for example, displays a map of the United States, color-coded by the number of trucks available in that region. Green means that drivers are available for that region; red indicates that there are fewer drivers than loads, which may mean that a load will have to be declined. “If a key customer calls and needs a load in a red region we wouldn’t say no, but we’d try to postpone one of the other deliveries for the next day,” explains customer service rep Janice Steffes. “The CSR can ask a [supervisor] or make the decision on her or his own.” To further ensure smooth planning, teams meet every morning to set the strategy for the day.

Service team leaders: Whereas customer service is designed to look out for the best interests of the customers, the service team leaders look out for the interests of the drivers. They help make sure that drivers get the loads they need and can get home in a reasonable amount of time. These team leaders also keep track of drivers’ performance and give them advice on how to do a better job.

The biggest technologically induced change for the service team leaders is that each one now manages more drivers — 40 instead of 25. Contrary to what one might think, however, team leaders are now able to spend more time with each driver, not less. With technology handling the essential and routine communications, team leaders have time to talk to each driver daily, getting a sense of his or her health and satisfaction. Ensuring that drivers are getting the miles they need to earn a good living, while getting home on days they want to be home, helps ensure driver loyalty and retention.

Dispatchers: Schneider has developed an interactive decision support system that enables its dispatchers to make complex tradeoffs in the intricate process of matching drivers with loads. The system relies on optimization algorithms but leaves room for human judgment; it thus enables dispatchers to balance economic data with their knowledge of qualitative factors. Dispatch decisions include optimizing a number of short-term and long-term objectives, such as minimizing the time a driver has to wait for a load and the distance he or she must go to collect the next load. These factors affect the company’s financial performance and its quality of service as well as the attitudes of drivers — an important consideration because it has an impact on pay requirements and driver turnover rates.

The main tool that Schneider’s dispatchers use is the Global Scheduling System, which takes into account how far each driver is permitted to drive per day, as well as what loads need to be moved, and the drivers’ locations and availabilities. The software chooses the most efficient routing while also ensuring that drivers get the maximum distance allowed per day. Despite its powerful heuristics, the software does not replace human dispatchers. Experienced dispatchers can override the software’s matchup of drivers and loads to cover complex exceptions related to the special needs of customers, drivers and the situation. All in all, Schneider’s dispatchers override the system less than 20% of the time — generally for cases involving “special” loads that are critical to a customer and require creative and innovative solutions that draw on the shared know-how of Schneider employees.The way IT was introduced into Schneider is typical of the procedure used by effective companies. Importantly, Schneider understands that it’s not the technology per se that makes the real difference. Rather, the key is to apply the technology in a focused way to enhance the organization’s strategy combined with investments in human capital and other complementary organizational assets. This holistic, systemwide thinking was led by a CEO with a long-term vision and a focus on customers as the source of the firm’s well-being. As straightforward as this story might seem, it is not often replicated in the business world; many, perhaps most, companies seem to treat the technology as an end in itself18 and do not make adequate management or operational process changes.

Schneider’s technology-intensive strategy to support customers and operations has yielded clear benefits. Between 1980 and 1998, delivery costs dropped from $1 per mile to $0.60 per mile (in constant dollars). Internal costs have dropped by 24% through more efficient administration. Satellite-based tracking of trucks’ locations yielded a 25% decrease in deadhead miles. Decision support systems software help Schneider know how much to charge and whether it can profitably accept a particular shipment.

Schneider’s quality of service has also improved. The fraction of late deliveries has dropped more than tenfold, even as delivery deadlines have tightened. Automated information systems have reduced errors and improved responsiveness to customers. Schneider’s confidence in its systems and its people led the company to offer guarantees to its customers. If a Chrysler production line goes down because of a delivery lapse by Schneider, for example, Schneider will pick up the cost, which can run $100,000 to $200,000 per hour. The overall drop in costs caused by improved information flow have more than paid for these investments as employees closest to the action can make informed decisions on the spot.

Expansion and Service Transformation

Schneider began by offering well-delineated, undifferentiated services. Now, the company is a diversified company focused not on trucking per se but also on designing, managing and delivering complex logistics systems — the very systems that enabled the company to become so successful have led to a transformation in the range of transportation-related services it can offer. Schneider’s transformation has blurred the traditional boundary separating a service provider from its customers and from its competitors. In the past, most transactions were arm’s length — one company (the supplier) handed a load to a second company (the carrier), which in turn brought the load to a third company (the buyer).

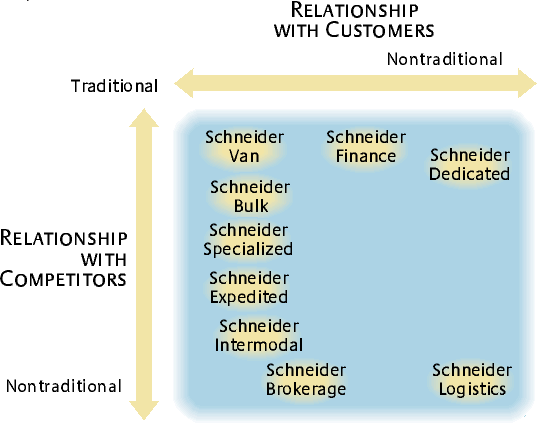

Schneider has changed considerably — it is now much more than just a trucking company. It offers complex combinations of services that depart from the arm’s-length arrangement of simple contract shipping. Many of these services would seem to divert revenues from Schneider, giving them either to competitors or forgoing them with customers. Only four of the business units that make up Schneider today look like those of traditional trucking companies. The other five represent knowledge-based services that Schneider has created since 1980. (See “The Nine Pieces of Schneider National.”)

Schneider has taken the improvements it made to its traditional trucking operations and repackaged them with embedded know-how to create new services in an evolving organizational structure. To provide a flavor of the mix of complementary physical and intellectual assets that have enabled such growth, we will elaborate on two of these new services: Schneider Dedicated and Schneider Logistics.

Schneider Dedicated

Schneider Dedicated is an outsourcing service that takes over a customer company’s private fleet, typically with three-year contracts. The services offered by Schneider Dedicated include logistics engineering and analysis, truck purchasing and maintenance, hiring and training drivers and warehousing. These arrangements tend to blur the line between Schneider and the customer. The trucks, for example, are owned by Schneider but are painted in the customer’s colors and are used only for the customer’s loads. The drivers use Schneider’s satellite communications system but drive routes designed by the customer. As John Lanigan, the former general manager of Schneider Dedicated, describes it, “We really create a new trucking company for each new customer.”

Schneider’s relationship with PPG Industries Inc. of Pitts-burgh, Pennsylvania — the largest North American glass maker — provides a good example of the complexity of such arrangements. Technically, Schneider Dedicated took over PPG’s private fleet. Although the drivers and tractors of this venture belong to Schneider, however, the trailers remain the property of PPG. To sweeten the deal, Schneider offered PPG its core freight management software. PPG’s IT personnel modified this software, and it now runs PPG’s entire enterprise wide logistics system.

In a further twist, only 30% of PPG’s loads go to the Schneider-run private fleet. Schneider’s software is good at managing a portfolio of third-party carriers, picking appropriate carriers for each load and electronically letting them accept or reject the load. This software enables PPG to give loads to some 40 other carriers (competitors to Schneider). In short, Schneider gave PPG software that serves the best interests of PPG, not those of Schneider. Of course, this could be seen as enlightened self interest, as the “gift” brought with it further contacts between the two companies’ employees, requiring Schneider employees to keep delivering value to PPG. These contacts permit further learning and improvements in the software available to both PPG and Schneider. This arrangement, in turn, can lead to packaging of such know-how to yield better delivery or service times.

Schneider leverages its people, processes and technology from throughout the whole company to provide input to Schneider Dedicated. Employees with PhDs in operations research and experienced IT personnel work with the customer to determine its logistics needs and to meld customer and Schneider IT systems together. A well-honed, well-managed project team implements the transition to dedicated service. Tried-and-true processes for fleet management help Schneider create and maintain each new dedicated fleet. The company’s experienced team can readily copy sophisticated software for use with each new customer. Logistical models and experience help Schneider price the offered service competitively and profitably. By the late 1990s, Schneider Dedicated had surpassed all other Schneider divisions in revenue. In 1990, the division accounted for 7% of all Schneider’s revenue; by 2004, that share had risen to over 38%.

Schneider Logistics

Like all the new divisions of Schneider, Schneider Logistics illustrates the power of building complementary assets to match IT capabilities. This division provides analysis, design and management services for such activities as warehousing, distribution and inventory management. Schneider Logistics builds onto the mother company’s core technological base with its own customized software for decision support software and logistics optimization.

A customer company can outsource its entire logistics function to Schneider Logistics. As a result, Schneider Logistics personnel may well find themselves managing carriers that are competitors to Schneider’s traditional shipping lines. This division of the company thus blurs both the lines between Schneider and its customers as well as the line between Schneider and its competitors. As a testament to the importance of this service and its success, Schneider Logistics has grown rapidly and now has greater revenue than Schneider Dedicated.

DaimlerChrysler AG hires Schneider Logistics to coordinate critical freight movement between its Alabama Mercedes-Benz plant and its suppliers. Schneider manages daily truckload collection routes from 35 suppliers, delivering 160 loads per day. The task is especially challenging because the Mercedes plant uses a process called In-Time and Sequence (ITAS) to get entire assembly systems completed and delivered in production-run order to its factory floor. With ITAS, suppliers perform subassembly work so that instead of Mercedes’ receiving headrests and seat cushions and assembling them, for example, it receives fully assembled seats. There is no margin for delay on deliveries, as each subsystem is supposed to be used in the assembly line within hours of the truck’s arrival at the loading dock. Schneider must set pickup and delivery windows and monitor transit times to ensure it is moving freight into the plant in a manner that supports Mercedes’ stringent inventory levels.

Saying Yes to Customers

At the core of Schneider’s ability to transform itself is its willingness to accept and then leverage the challenges that customers present. When 3M wanted to totally outsource logistics in 1983 (a decade ahead of everyone else), Schneider proved to be a willing partner. The results of this collaboration were then offered to other customers and became the foundation for Schneider Logistics. When Case Corp. wanted logistics help in Europe in early 1998, Schneider said “yes” and formed its first international division, Schneider Logistics Europe.

Schneider’s acquiescence to customer requests is not automatic. Information systems, extensive models and reams of data on past shipments help Schneider objectively determine what it can and cannot do profitably. If a customer wants an overly aggressive shipping schedule on some route (one that might force drivers to drive too fast), Schneider will negotiate a more feasible schedule or decline it. Indeed, Schneider Logistics turns away more RFPs (requests for proposal) than it accepts. But the company has cultivated the ability to understand what it can do profitably for its customers without creating stultifying rules that limit flexibility.

Schneider’s strategy of doing more for its customers is not just a matter of selfless devotion, nor is it a simple reactive strategy. The company could not effectively respond to novel customer requests without its investments in people, processes and technology. Indeed, Schneider’s most important (and most well-hidden) asset is its ability to learn the customer’s situation and create a customized solution in record time. This is especially valuable with Schneider Dedicated and Schneider Logistics, where solutions must meld the company’s technology and processes with those of the client. It is Schneider’s seemingly extensive and expensive base of complementary assets that lets it take on new challenges that create new businesses within the company, sustaining growth in an otherwise uncertain environment.

We draw from this research two central lessons. First is that successful deployment of IT in an organization requires heavy investment in a wide range of complementary assets to support the technology — along with the patience to wait for these investments to pay off. Second, the research shows that a combination of the IT assets and the relevant set of complementary assets (in people skills, new organizational structures and new work processes) can transform “services” into “products” that will evolve into yet more new services and new products, creating a virtual spiral with enormous competitive advantages.

References

1. R.M. Solow, ‘’We’d Better Watch Out,’’ New York Review of Books, July 12 1987, 36.

2. E. Helpman, ed., “General Purpose Technologies and Economic Growth” (Cambridge, Massachusetts: MIT Press, 1998).

3. J.E. Triplett, “The Solow Productivity Paradox: What Do Computers Do to Productivity?,” Canadian Journal of Economics 32, no. 2 (April 1999): 309–334.

4. A.D. Chandler, “Strategy and Structure” (Cambridge, Massachusetts: MIT Press, 1962).

5. H.J. Leavitt, “Managerial Psychology” (Chicago: University of Chicago Press, 1967).

6. M.S. Scott Morton, “Management of Tomorrow’s Corporation,” in “Amdahl Corporation: Review of Research Findings,” 1988; and M.S. Scott Morton, “The Corporation of the 1990s: Information Technology and Organizational Transformation” (Oxford: Oxford University Press, 1991).

7. M.S. Scott Morton, “The Corporation of the 1990s: Information Technology and Organizational Transformation” (Oxford: Oxford University Press, 1991); M.S. Scott Morton, “Emerging Organizational Forms,” European Management Journal 13, no. 4 (December 1995): 339–345; and T. Malone and J. Rockart, “Computers, Networks and the Corporation,” Scientific American 26, no. 3 (March 1991): 128–136; and A. D. Chandler Jr. and J.W. Cortada, eds., “A Nation Transformed by Information: How Information Has Shaped the United States from Colonial Times to the Present” (New York: Oxford University Press, 2000).

8. M.E. Porter, ‘’What Is Strategy?,’’ Harvard Business Review (November–December 1996): 61–78.; D.J. Teece, G. Pisano and A. Shuen, “Dynamic Capabilities and Strategic Management,” Strategic Management Journal 18, no. 7 (1997): 509–533; and D.J. Teece, “Profiting from Technological Innovation: Implications for Integration, Collaboration, Licensing and Public Policy,” Research Policy 15, no. 6 (1986): 285–305.

9. Gormley and others (1998) cited in E. Brynjolfsson, L.M. Hitt and S. Yang, “Intangible Assets: How the Interaction of Computers and Organizational Structure Affects Stock Market Valuations,” Brookings Papers on Economic Activity: Macroeconomics 1 (2002): 137–199.

10. S.E. Black and L.M. Lynch, “How to Compete: The Impact of Work-place Practices and Information Technology on Productivity,” Review of Economics and Statistics 83, no. 3 (August 2001): 434–445; S.E. Black and L.M. Lynch, “What’s Driving the New Economy? The Benefits of Workplace Innovation,” Economic Journal 114, no. 493 (February 2004): 97–116; A.D. Cosh, X. Fu and A. Hughes, “Management Characteristics, Collaboration and Innovative Efficiency: Evidence from U.K. Survey Data,” working paper 311, Centre for Business Research, University of Cambridge, Cambridge, United Kingdom, September 2005; E. Brynjolfsson and L.M. Hitt, “Computing Productivity: Firm-level Evidence,” Review of Economics and Statistics 85, no. 4 (2003): 793–808; E. Brynjolfsson and L.M. Hitt, “Information Technology as a Factor of Production: The Role of Differences among Firms,” Economics of Innovation and New Technology 3, no. 4 (1995): 183–200; E. Brynjolfsson and L.M. Hitt, “Beyond Computation: Information Technology, Organizational Transformation and Business Performance,” Journal of Economic Perspectives 14, no. 4 (fall 2000): 23–48; M.A. Huselid, “The Impact of Human Resource Management Practices on Turnover, Productivity and Corporate Financial Performance,” Academy of Management Journal 38, no. 3 (1995): 635–872; and C. Ichniowski, K. Shaw and G. Prennushi, “The Effects of Human Resource Management Practices on Productivity: A Study of Steel Finishing Lines,” American Economic Review 87, no. 3 (June 1997): 291–313.

11. E. Brynjolfsson, L.M. Hitt and S. Yang, “Intangible Assets: How the Interaction of Computers and Organizational Structure Affects Stock Market Valuations,’’ Brookings Papers on Economic Activity: Macroeconomics 1 (2002): 137–199.

12. R.H. McGuckin, M. Spiegelman and B. van Ark, “The U.S. Advantage in Retail and Wholesale Trade Performance: How Can Europe Catch Up?,’’ working paper 1358, The Conference Board, New York, March 2005.

13. McKinsey Global Institute, “U.S. Productivity Growth 1995–2000. Understanding the Contribution of Information Technology Relative to Other Factors,” (Washington, D.C.: McKinsey Global Institute, October 2001); L. Foster, J. Haltiwanger and C.J. Krizan “The Link Between Aggregate and Micro Productivity Growth: Evidence from the Retail Trade,” working paper 9120, National Bureau of Economic Research, Cambridge, Massachusetts, August 2002.

14. R.H. McGuckin, M. Spiegelman and B. van Ark, “The U.S. Advantage in Retail and Wholesale Trade Performance: How Can Europe Catch Up?,’’ March 2005.

15. L. Foster, J. Haltiwanger and C.J. Krizan, “The Link Between Aggregate and Micro Productivity Growth: Evidence From the Retail Trade,’’ 2002.

16. S. Basu, J.G. Fernald, N. Oulton and S. Srinivasan, “The Case of the Missing Productivity Growth: Or Does Information Technology Explain Why Productivity Accelerated in the United States but not in the United Kingdom?,” working paper 8, Federal Reserve Bank of Chicago, June 2003; and B. van Ark, R. Inklaar and R.H. McGuckin, “‘Changing Gear’ Productivity, ICT and Service Industries: Europe and the United States,” research memorandum GD-60, Gröningen Growth and Development Centre, University of Gröningen, The Netherlands, 2002.

17. M.S. Scott Morton and A. Meyer, “Schneider Corporation A-E,” (Cambridge, Massachusetts: MIT Sloan School of Management, 2004).

18. E. Brynjolfsson and L.M. Hitt, “Beyond Computation: Information Technology, Organizational Transformation and Business Performance,” Journal of Economic Perspectives 14, no. 4 (2000): 24–48; and N.G. Carr, “The End of Corporate Computing,” MIT Sloan Management Review 46, no. 3 (spring 2005): 67–73.