Winning the Last Mile of E-Commerce

Topics

As the holiday season drew near, e-commerce retailers were either working anxiously to get their in-house processes ready or were double-checking with partners and service providers on order-fulfillment operations. Fears of revisiting the previous year’s fulfillment problems hounded them during their preparations for the projected high sales of Christmas 2000.1 “This is the season when the last mile will be the most crucial element of e-business,” one observer declared. “Sellers who come up with creative ways to deliver will secure enormous consumer loyalty.”2 What went wrong the preceding year? Online sales were at an all-time high in 1999, but many e-tailers found themselves unable to make timely, cost-effective deliveries. Late deliveries, broken promises and unmet expectations left both consumers and investors dissatisfied.3 In part because of that disappointment, stock prices plunged. E-tailers simply had not had operational processes capable of filling customers’ orders. By 2000, many still did not.4

It is true that e-commerce has improved the efficiency of placing orders. Trading partners communicate, coordinate, share information and manage inventory better as well. But in the future, e-businesses that can deliver the goods and services at a reasonable cost will have the edge. Order fulfillment can be the most expensive and critical operation for both the online and offline businesses of companies engaged in e-commerce. The ability to fulfill and deliver orders on time could determine an e-tailer’s success.

A few companies have come up with innovative ways to apply order-fulfillment strategies. The secret lies in making good use of information and leveraging existing resources to coordinate order-fulfillment activities. The principles are not new, but Internet technologies enable them to be applied in new and expanded ways.

E-Fulfillment Concepts

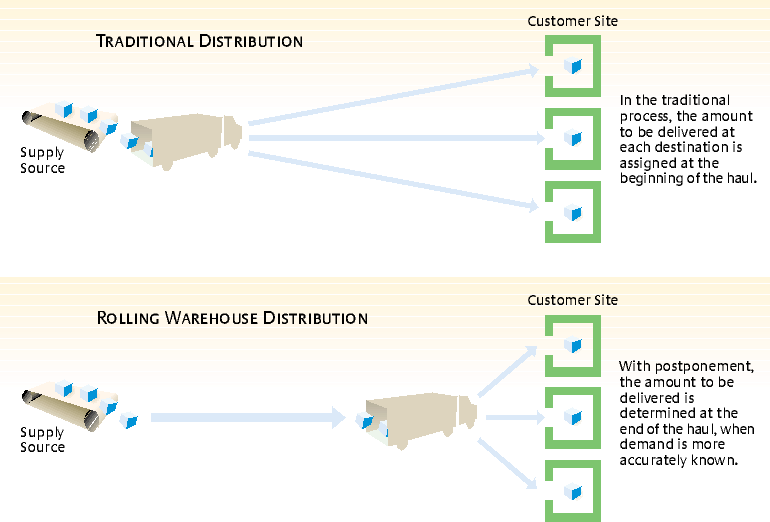

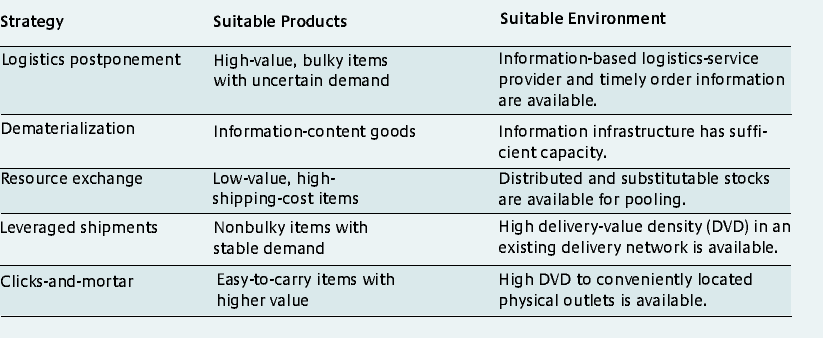

The two core concepts for making e-fulfillment efficient are: First, make more use of information flows than physical flows and, second, capitalize on current physical pipelines and infrastructures as much as possible for the last mile of delivery. The core concepts are tied to five strategies: logistics postponement, dematerialization, resource exchange, leveraged shipments and the clicks-and-mortar model. (See “From Concepts to Strategies.”)

Improving the Use of Information

The first core concept, which emphasizes using information well, addresses the complexity of e-fulfillment. More-accurate, up-to-date information on customer demands can allow products to be delivered in the most direct way, thereby lowering cost and improving efficiency. Smart companies take the demand information that supply chains capture and use it to assemble or allocate final goods on demand, improving efficiency by shipping products to the final destination with fewer intervening stages. We call that strategy logistics postponement. The company postpones delivery decisions until it has the most complete information it can get about what the customer wants.5

Companies also should try to replace physical flows with information flows. If a physical good can be digitized (for example, as a music CD can be converted to the MP3 format), it can travel over the existing information and communications infrastructure. With information flows substituted for physical flows, companies can avoid stockouts without loading up on inventory, delivery can occur almost instantaneously, and the marginal cost of delivery is negligible. Information goods such as software and music are natural candidates for that strategy, which we call dematerialization.

Leveraging Existing Resources

The second core concept is to leverage existing resources to perform order fulfillment. One strategy that combines both concepts is resource exchange. The product a customer needs may be stocked at many locations. If the stock at all the locations can be pooled to form a virtual resource, then wherever customer demand shows up, companies can utilize the nearest location. Information flows around the network to locate the needed inventory, order requests are sent electronically to the appropriate stocking locations, and the original orders are filled. The flow of information displaces the flow of physical goods.

Another form of leveraging the infrastructure is to make use of the physical channels already in place for the delivery of other products. Because those channels already exist, the incremental cost of transporting the e-tailer’s product is often small. In order to consolidate the shipments of the e-tailer’s products with existing product flows, good information on required shipment flows is crucial. The strategy is called leveraged shipments.

If the existing physical-flow channels go from supply sources only to retail outlets or other designated locations, delivering products from there to final customer destinations can be costly — and the last mile inefficient. If, however, the locations or retail outlets are easy for customers to reach, then one solution is to have customers travel the last mile to pick up the product. That collaborative approach, in which suppliers ship the products to predetermined standard locations and customers do the rest, is the clicks-and-mortar (CAM) model of product fulfillment.

Some companies already are applying the information-flow and leveraged-infrastructure concepts, choosing among the five e-fulfillment strategies, implementing the necessary operational changes and capturing the resulting benefits. (See “Innovative Approaches to E-Fulfillment.”)

The Five E-Fulfillment Strategies

The five e-fulfillment strategies involve innovative approaches to logistics postponement, dematerialization, resource exchange, leveraged shipments and the clicks-and-mortar model.

Strategy 1: Logistics Postponement

Information can help run logistics efficiently, improving timeliness and reducing the cost of deliveries. The Internet can capture and move information among supply-chain partners, enabling logistics postponement. Without information sharing, it is common to have products shipped early or precommitted to key customer segments or locations. But if companies have to reship the products when demands change, expenses can mount. If companies can substitute information flows for some of those physical flows, wait to ship until they have more-accurate order information, they can make more-direct shipments. Third-party logistics providers who have invested heavily in information technologies often make that approach possible.

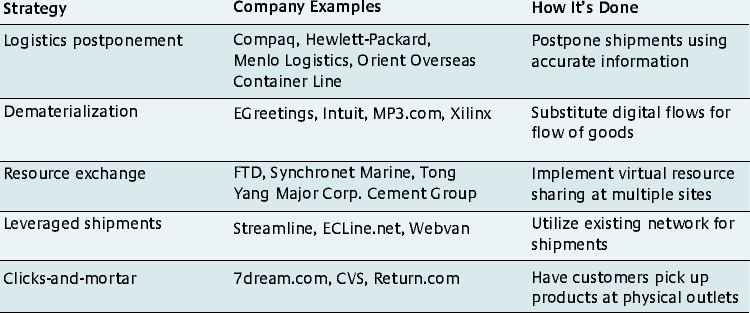

One example of logistics postponement is merge-in-transit. (See “Merge-in-Transit.”) Suppose an e-tailer sells a workstation system composed of two main parts: the central-processing-unit (CPU) box and the monitor. The monitor is purchased from a supplier in Taiwan and temporarily stored near a dock in California, by a logistics-service provider (LSP). The CPU box is built in New Hampshire. With the traditional approach, both monitor and CPU box first are shipped to — and stocked at — a warehouse in Texas. If a customer in California places an order, the two components get picked up from the warehouse and shipped to the customer. Thus the monitor travels from California to Texas — only to be shipped back to California. But under the merge-in-transit structure, the two components would be no longer stocked at the same site. Instead, when a customer places an order, an LSP uses a tightly controlled transportation schedule to pick up individual components directly from California and New Hampshire at appropriate times and brings the two components to whichever of the LSP’s merge centers or consolidation points is closest to the customer. Then the LSP delivers the components to the customer, perhaps even performing installation and system integration. Thus inventory is held only in California and New Hampshire (and not even in New Hampshire, if the CPU box is made to order), and unnecessary transportation is reduced.

Using the merge-in-transit technique, companies such as Compaq and Hewlett-Packard were able to have monitors, modems and keyboards shipped directly by an LSP to customer locations. Not every LSP can perform merge-in-transit. It depends on the timing needed for the physical flows and on the LSP having tight control of the shipment schedules.

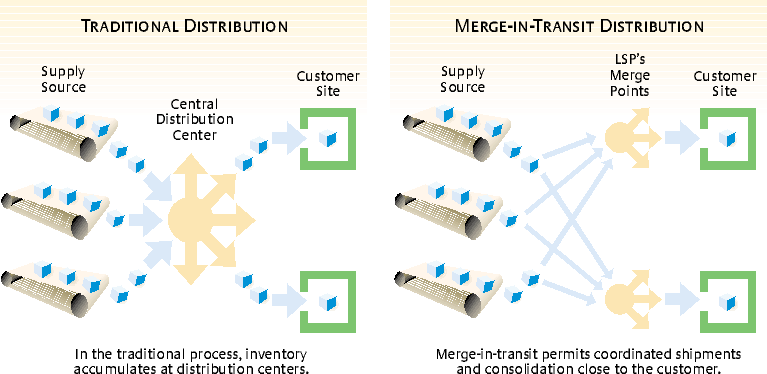

A third-party LSP, Menlo Logistics, has developed another logistics-postponement strategy, the rolling warehouse. (See “Rolling Warehouse.”) When a company ships products from the West Coast to the Northeast, for example, it often has to load the truck at the point of origin with well-defined shipment quantities for its various destinations (such as multiple warehouses) in the Northeast. After some days, the truck arrives and unloads all the products. Meanwhile, the demand at the destination warehouses may have changed from the original estimates. One warehouse may want more of the product; another may want less. So an alternative is to refrain from specifying quantities in advance. Instead, demand information can be monitored closely and sent, usually by satellite, to the truck driver, who can then make use of it to determine how much to unload at each destination. The products on the truck are not preassigned to a destination — that decision has been postponed from the time of loading to the time of unloading — and so the truck is like a rolling warehouse. In a similar fashion, shipping companies such as Orient Overseas Container Line have invested in information technology that allows their ships to postpone unloading decisions until arrival at destination ports. Their ships are floating warehouses.

Strategy 2: Dematerialization

Material flows are usually more expensive than information flows because of the costs of handling, loading and unloading, warehousing, shipping, returns, spoilage and damage. Hence, whenever possible, substituting information flows for material flows makes sense. An extreme form of such substitution is dematerialization, in which a physical product is completely replaced by information.

Consider e-tailer Egreetings, which offers customers electronic greeting cards for free. Its revenues come from banner advertisement, sponsorship and e-tailing commissions. The benefits derived from transforming paper cards to digital cards include no inventory, no stockouts, zero variable production cost, fast delivery, close-to-zero shipping cost, fast development-cycle time, and large selection of products. The multimedia format enriches the card with animation, music and voice. Mass customization of product and service is possible. In addition to letting senders customize their cards, the company can customize and dematerialize the service. It can record dates important to customers (birthdays of family and friends, wedding anniversaries and the like) in the Web site’s customer-profile database, then remind customers by e-mail days in advance — without labor cost.

Intuit develops and markets the world’s best-selling personal, small-business and tax-preparation software, as well as Web-based financial tools. The Tax Table Service (TTS) is part of the Intuit Payroll Services Group’s offerings associated with QuickBooks. Whenever federal and state tax codes change, federal and state withholding levels, Social Security rates and limits, and federal unemployment rates may change. TTS offers federal and state tax-table updates, which provide the underlying data for automated earnings and deductions calculations. In the past, such updates were distributed by disk to Intuit’s subscribers whenever tax-code changes were announced. Beginning in fall 1999, Intuit customers, upon notification of such changes, have been able to order updates via the Web; the tax tables also can be downloaded. The move to electronic ordering and distribution has decreased the cost of goods sold because disk and shipping costs are eliminated. And customers get the tax tables immediately, with updates taking less than one minute to download.

Recruit Co. of Japan used to publish and distribute a seven-volume, one-foot-thick directory of job openings for graduating students. The directory was the main way graduating students in Japan learned about employment opportunities. Starting in the 1997–1998 season, Recruit’s human-resources division discontinued the publication of paper books (except for specialized market segments) and operated mainly on the Internet. The HR division was able to generate advertisement sales of ¥10 billion from 20,000 corporate clients in the fiscal year ending March 2000.

Xilinx, a semiconductor company, developed a dematerialization strategy to improve customer service. The innovation is called Internet Reconfigurable Logic (IRL). Xilinx’s high-end integrated circuits are field-programmable — that is, some of the chips’ capabilities can be specified by software in the field, even after they have been delivered to customers. Some of the products in which Xilinx chips reside go through constant product-generation changes that require updating of Xilinx chips. With IRL, end users can modify the field-programming logic at their premises by using networks and the Internet. The online field-upgradable systems are utilized in multifunction electronic devices, wireless-telephone cellular base stations, communications satellites and network-management systems. IRL makes it possible for product upgrades that used to require physically replacing an integrated circuit to be performed by information flow.

Other dematerializable products include software, publications, documents, music, videos, photos, stamps, bills, receipts, money and some services. Recently, dematerialization has been extended to such products as toys and mobile phones. Mindstorms products from the Lego Group (http:// mindstorms.lego.com) are designed with distinct hardware components (a robot made of Lego blocks) and software components (its control program). A user can build a robot using Lego blocks, download a control program over the Internet, write a program to give the robot a new move, and upload the new program to the Web site to share with others. Mobile phones achieve dematerialization by exploiting the wireless connection. Users can download a new ringing sound when they tire of the existing one. Similarly, games that run on mobile phones are distributed as information goods. In Japan, you can take a picture of your friend at a kiosk, upload it to a Web site (www.cybird.co.jp/english) and then download it to your mobile phone to be your screen page.

Strategy 3: Resource Exchange

Pooling resources is already common in the offline world. A Korean cement company with limestone mines and plants in the east has customer demands in the west; another cement company with limestone mines and plants in the west has customer demands in the east. With the cost of transporting cement high, the two cement companies swap their orders. Customers in the west are served by the western plant; customers in the east are served by the eastern plant. The bulk cement at both plants is pooled to satisfy the demands of customers, regardless of their location. Thus, only information has traveled, not the physical product. Such resource-exchange practices are used extensively in the oil and gas industries.

The idea can be extended to e-tailing. An example is Synchronet Marine (www.synchronetmarine.com), which operates an e-marketplace for exchanging shipping containers. Suppose Company A needs a container to ship widgets from Hong Kong to San Francisco this month but has none available. As it happens, Company B has a container sitting idle in Hong Kong. If Company B is likely to need the container to ship something from San Francisco next month, both companies will benefit from having B lend the container to A. Such exchanges are facilitated by Synchronet Marine’s marketplace.

Resource exchange may be facilitated and executed by logistics-service providers, such as FedEx and United Parcel Service, or e-commerce service providers (ESPs), such as Electron Economy (www.electroneconomy.com), Escalate (www.escalate.com) and Fingerhut (www.fingerhut.com). ESPs aggregate the logistical requirements of different e-tailers who, on their own, lack economies of scale. The pooled resources may be Web servers, information systems, communications capacity, warehouses, transportation equipment or logistical expertise.

Strategy 4: Leveraged Shipments

For most e-tailers, the order size from each customer is small. The cost of delivery is justified only if there is a high concentration of orders from customers located in close proximity — or if the value of the order is large enough. The cost of delivery is excessively high if customer orders are both small and distributed over a wide geographical region. A simple measure called delivery-value density (DVD) can help determine whether it is economical to deliver goods to a neighborhood area in one trip. DVD is computed by dividing average total dollar volume of the shipment per trip by the average travel distance per trip.

How can an e-tailer improve its products’ DVD? By leveraging shipments. Even though Streamline’s slow customer acquisition ultimately caused it to fail in the marketplace, the Boston-based online grocery store had an e-fulfillment approach worth imitating. First, Streamline instituted an efficient process for picking groceries off shelves, enabling lower variable costs. Second, the company chose a warehouse facility in a low-rent area and thus traded off lower fixed real estate cost against the slightly higher cost of driving longer distances to make deliveries. Streamline improved its DVD by offering customers delivery on a company-specified day of the week. Customers located in the same neighborhood got deliveries on the same day. The aggregation of orders resulting from a weekly cycle and from pooling a neighborhood enabled a high volume of products per trip.

Streamline also lowered the cost of home deliveries by eliminating the time cost of the driver having to wait or revisit a customer when the customer is not at home at the time of delivery. The e-tailer installed a delivery receptacle in the customer’s garage and allowed the driver access through a numeric password-based security system installed at the garage door. A second innovation improved the utilization of Streamline’s trucks on the return journey by offering additional service to customers — video rental returns, dry-cleaning and film drop-off, recycling of bottles and shipping of parcels.

ECLine (www.ecline.net) of Korea, a third-party LSP for e-tailers, offers another example of the leveraged-shipment strategy. Lacking high volume and a good DVD, ECLine developed a new business model. It recruited a network of highly localized home-delivery service providers — “dealers.” Each dealer oversees a zone, with dealers selected for their familiarity with the zone through past or current business interest. In ECLine’s model, the company handles the backbone deliveries to the dealers, and the dealers take care of local deliveries. Using a fleet of trucks, ECLine picks up packages from the e-tail client (for example, an e-tailer selling books or a home-shopping retailer selling small electronic devices) and drops off the packages at dealer depots. The dealers deliver the packages in their respective neighborhoods multiple times a day, traveling by motorcycle. The model benefits everyone. The client gets a good service at a lower delivery price. E-tail shoppers in and around Seoul receive the order within 24 hours (often in six hours). Customers outside the metropolitan area receive the order within 48 hours — all at less than $3 per package. Dealers get additional business and increase their DVD — and their bottom line. ECLine makes money through high-density logistics operations, picking up and dropping off only in bulk. ECLine has filed for a Korean patent for its business model. It now has more than 70 e-tail clients (including yes24.com, the largest book e-tailer in Korea). And it’s profitable.

Leveraging existing logistics networks was behind the alliance that Toys “R” Us formed with Amazon.com. The online toy store uses Amazon’s distribution system for order fulfillment. Similarly, DHL has formed alliances with post offices in Asia to do its final deliveries.

Strategy 5: The Clicks-and-Mortar Model

The basic idea of the clicks-and-mortar (CAM) model is to elicit consumer cooperation for the final mile of the delivery journey. When an e-company’s physical assets are located near customers and when deliveries from the supply source to those locations are economical (which is the case if the locations are retail outlets with pre-established resupply networks), then the company may be able to get customers themselves to handle the last mile. If e-tailers have their own retail outlets, as does furniture-maker Ethan Allen, for example, they can use their bricks-and-mortar outlets to perform the final delivery to the customer.6 Alternatively, e-tailers may partner with retailer channels for delivery of goods.

Customers also can use online Web sites to search for product information and then go to a local shop or dealer to pick up what they need. To succeed, e-tailers have to form tight links between suppliers and the outlets. Customers should not have to do extra work to place orders, track orders or receive products. Automobile manufacturers have seen the importance of that. Ford Motor Co., for example, created its own site, but it routes any orders to dealerships where customers can take possession of products. Bicycle companies such as VooDoo of Sunnyvale, California, and Cannondale of Bethel, Connecticut, use their Web sites to allow customers to create personalized, customized bicycles. Then they link customers directly to a local dealer for placing the final order and receiving the product. Linking sellers and outlets is what makes CAM successful.

The CAM model also can be applied to the return process. Returns are an essential part of e-tailing because customers can’t check the item out before making a purchase decision. If customers use a designated carrier, most e-tailers allow them to return the order for free. Given that e-tailers pick up the charge, how can they improve cost-effectiveness in the return process? Return.com allows e-commerce shoppers to return their purchases at a nearby Mail Boxes Etc. store. E-tailers partnering with return.com usually deliver products to customers in return-ready packages. If a return is necessary, the customer repacks the product in the convenient package and visits the Web site (www.return.com) to file for the return transaction. The customer then leaves the product at the nearest Mail Boxes Etc., and Return.com picks it up there when it picks up other returned items. Multiple disposal alternatives are available: eventual shipment back to the e-tailer, shipment to an LSP, storage for future customer demands, or scrapping the product. Thus the last mile of the return process is covered by shoppers themselves. Return.com’s process relieves e-tailers of some of the cost and complexity of dealing with returns. The CAM model is promising as a last-mile solution, but it is not clear how widely customers will accept it.

In mid-1999, the largest and most successful convenience-store chain in Japan, 7-Eleven Japan, formed a joint venture with six other Japanese giants using a CAM model of e-commerce. 7-Eleven Japan, Nomura Research Institute, Mitsu & Co., Sony Corp., JTB Corp. (Japan Travel Bureau), NEC Corp. and Kinotrope put together a Web site called 7dream.com that lets the partners offer a large pool of products without having to stock a store with inventory. Customers can pick up products at one of Japan’s ubiquitous 7-Elevens two or three days after ordering.

An important component of 7dream.com is a multimedia kiosk at 7-Eleven stores. The special-purpose computer is a gateway to 7-Eleven’s distribution centers and suppliers. Customers without an Internet connection can stop by and order items not available at the store. In addition, customers can develop their digital film using a thermo-activated printer inside the kiosk. The film-developing function is the result of a 7dream.com alliance with Fuji Photo Film Co. People also can make their own minidisc at the kiosk, using a direct link to a Sony entertainment system song list and writing with the kiosk’s MiniDisc writer.

Although 7-Eleven’s CAM model has numerous merits, it is unclear whether it would work outside Japan. Most Japanese commute to work by rail, not car. Convenience stores are everywhere, particularly near railway stations. If you live in Tokyo, you may see three or four convenience stores during a 10-minute walk from the station to your apartment. Hence, customers do not view picking up an order at 7-Eleven as an inconvenience. Moreover, Japan, like most Asian countries, is still a primarily cash-based society, and the use of personal checks and credit cards is not widespread. Thus the store can play the additional role of collecting payments for e-commerce.

In the United States, some CAM models are emerging. The pharmaceutical chain CVS has adopted a CAM strategy for online sales. Today, with more than 5,000 CVS items available for purchase online, 65% of online purchases are picked up by the customers at CVS stores, solving the last-mile problem. Circuit City, a major electronics retailer, also uses the CAM model for online customers.

Matching the Strategy to the Company

What is the right e-fulfillment strategy for a particular company? That depends on the company’s business environment and on the characteristics of its products. (See “Using the Right Strategy.”)

If products are of high value and bulky and if customer demands are highly unpredictable, the first e-fulfillment strategy, logistics postponement, is preferred. Without logistics postponement, the high value of the products and the uncertain nature of customer demands would require considerable inventory, stocked in numerous locations — an uneconomical approach. Also, if the product is bulky, minimizing the distance it has to be shipped from the source becomes important. A case in point is that of the CPU and monitor mentioned in the discussion of the merge-in-transit approach. In order for logistics postponement to be effective, companies need an extensive information system that captures timely demand information for a competent LSP to act upon. An LSP with the right information technology is crucial.

For the second e-fulfillment strategy, dematerialization, to work, the products naturally must be able to be dematerialized. Goods that are mainly information can be dematerialized readily into digital form. Then, the flow of the dematerialized product must be efficient and timely if it is to replace physical flow. Companies need the right information and communication infrastructures and sufficient capacity — for example, server capacity, bandwidth or other storage capacity in telecommunication networks.

The third strategy, resource exchange, works only when the company already has access to stock and resources widely distributed across a geographical region. For a high-value product, a widely distributed network of stock would not have been economical to begin with. If the cost of shipping the product is low, then it also may be simpler to ship it from one source to all customers directly. Flowers are a good fit for resource exchange because the ratio of transportation cost to product value is high. In order for resource exchange to work, incentives are needed that encourage the sites with stock to pool and share products. Moreover, products at the different sites must be standardized and substitutable. It is also important to have an integrative information system that can track the available inventory at every site participating in the exchange.

The fourth innovation, leveraged shipment, is ideal for products with stable demands that are less likely to distort the delivery-value density of the existing delivery network. If demands are highly erratic, with a route sometimes having a high DVD and at other times a low one, the delivery cost would not be as economical. Very bulky products, too, limit the usefulness of an existing delivery network. The products that Return.com and ECLine handle are usually consumer products that are not bulky and are in steady demand. If the existing delivery network has a high DVD, economical delivery pipelines can be leveraged. Sometimes a delivery network with a low DVD can move to a high DVD after the e-tailer’s products are added to the network.

The fifth strategy, the CAM model, works only if the products are easy to carry and customers can participate in the last mile with ease. Customers are more likely to make the effort for products with a relatively high value — for example, a custom CD or Sony Walkman from 7dream.com. The CAM model requires a high-DVD delivery network to the physical outlets to make e-fulfillment economical and efficient. The outlets, in turn, have to be conveniently located for the customers.

Winning the Last Mile

Winning the last mile requires hard work, but the taste of victory can be sweet. Remembering a few key steps in the midst of battle can be helpful. (See “Keys to Winning the Last Mile.”)

By making use of information and leveraging existing physical resources, companies have devised strategies to keep e-fulfillment from preventing e-commerce success. The companies cited here, moreover, also use the strategies to create new business opportunities. Intuit uses its digital channel both to deliver products and to provide extra services. The company files taxes for customers, manages payrolls and provides automatic payment processing and other services. Indeed, service now accounts for more than 20% of the company’s revenue. When Amazon.com used its fulfillment infrastructure to form the alliance with Toys “R” Us, it instantly boosted its partner’s Christmas toy sales. Korea’s second-largest corporation, SK Global Co., enables Korean customers to purchase goods from foreign shopping malls. 7-Eleven Japan’s 7dream.com is more than a convenience store e-tailer, because its kiosks act like remote manufacturing sites for Sony music CDs and electronic games. Besides offering an expanded product selection, 7-Eleven stores now offer services such as concert- and train-ticket sales. The value created from using fulfillment strategies in innovative ways for e-commerce goes beyond cost containment. The secondary opportunities can take companies beyond the last mile.

References

1. Online shopping for the 2000 holiday season was expected to jump by 80%, but according to the Web site BizRate.com, it rose by only about 60%.

2. E. Neuborne, “E-Tailers, Deliver or Die,” Business Week, Oct. 23, 2000, 16.

3. Sears found out after the Christmas season that many of its online orders were never registered within the company’s databases and hence never were filled. Toys “R” Us realized it could not deliver all its online orders before Christmas. It closed down its Web site, and three days before Christmas it issued $100 gift certificates to customers whose deliveries would be late. The same year, in a study that Andersen Consulting (now Accenture) dubbed the “e-Santa Study,” the firm’s consultants experimented with placing orders online and found that for most e-tailers, about 50% or more of the orders were shipped late.

4. An Accenture study of U.S. e-fulfillment in December 2000 found that 67% of deliveries were not received as ordered; 12% were not received in time for Christmas.

5. For an introduction to the concept of postponement, see E. Feitzinger and H.L. Lee, “Mass Customization at Hewlett-Packard: The Power of Postponement,” Harvard Business Review 75 (January–February 1997): 116–121; and H.L. Lee, C. Billington and B. Carter, “Hewlett-Packard Gains Control of Inventory and Service Through Design for Localization,” Interface 23 (July–August 1993): 1–11.

6. Details can be found in D.F. Pyke, M.E. Johnson and P. Desmond, “eFulfillment — It’s Harder Than It Looks,” Supply Chain Management Review 5 (January–February 2001): 26–32. Using the furniture industry as an example, the article also does a good job of describing the challenges of e-fulfillment.

ADDITIONAL RESOURCES

A thorough discussion of e-fulfillment issues can be found in David Anderson and Hau Lee’s “The Internet-Enabled Supply Chain: From the First Click to the Last Mile,” in the second volume of a 2000 Montgomery Research publication called “Achieving Supply Chain Excellence Through Technology.” The same volume contains many examples of how companies from different industries wrestle with fulfillment. Readers also may find useful David F. Pyke, M. Eric Johnson and P. Desmond’s “eFulfillment: It’s Harder Than It Looks” and Laura R. Kopczak’s “Designing Supply Chains for the Clicks-and-Mortar Economy” — both in the January–February 2001 Supply Chain Management Review. The Web site www.scmr.com carries interesting stories about how different companies deal with similar challenges. The Stanford Global Supply Chain Management Forum’s Web site, www.stanford.edu/group/scforum/, gives periodic updates on new developments in the field. Accenture’s study of Christmas e-fulfillment may be found at www.accenture.com, and the magazine Inbound Logistics is recommended for the latest news on logistics innovations.

Comment (1)

James Hendley