Creating Value Through Business Model Innovation

Could your company benefit from a new business model? Consider these six questions.

Topics

The growing popularity of e-reading devices such as the Kindle is stimulating business model changes in book publishing.

Image courtesy of Amazon.

Companies often make substantial efforts to innovate their processes and products to achieve revenue growth and to maintain or improve profit margins. Innovations to improve processes and products, however, are often expensive and time-consuming, requiring a considerable upfront investment in everything from research and development to specialized resources, new plants and equipment, and even entire new business units. Yet future returns on these investments are always uncertain. Hesitant to make such big bets, more companies now are turning toward business model innovation as an alternative or complement to product or process innovation.

A recent global survey of more than 4,000 senior managers by the Economist Intelligence Unit found that the majority (54%) favored new business models over new products and services as a source of future competitive advantage. EIU analysts concluded that “the overall message is clear: how companies do business will often be as, or more, important than what they do.”1 And in a similar global study conducted by IBM, in which over 750 corporate and public sector leaders were interviewed on the subject of innovation, researchers found that “competitive pressures have pushed business model innovation much higher than expected on CEOs’ priority lists.”2 However, this level of interest may not have been too surprising given that the IBM study also found that companies whose operating margins had grown faster than their competitors’ over the previous five years were twice as likely to emphasize business model innovation, as opposed to product or process innovation.3 One CEO explained why his company’s focus on business model innovation had grown:

In the operations area, much of the innovations and cost savings that could be achieved have already been achieved. Our greatest focus is on business model innovation, which is where the greatest benefits lie. It’s not enough to make a difference on product quality or delivery readiness or production scale. It’s important to innovate in areas where our competition does not act.4

The Leading Question

What do executives need to know about business model innovation?

Findings

- Business model innovation can consist of adding new activities, linking activities in novel ways or changing which party performs an activity.

- Novelty, lock-in, complementarities and efficiency are four major business model value drivers.

- Within organizations, business model choices often go unchallenged for a long time.

Business model innovation can also help companies stay ahead in the product innovation game, where as one CEO from another study explained, “you’re always one innovation away from getting wiped out by a new competing innovation that eliminates the need for your product.”5 A good product that is embedded in an innovative business model, however, is less easily shunted aside. Someone might come up with a better MP3 player than Apple’s tomorrow, but few of the hundreds of millions of consumers with iPods and iTunes accounts will be open to switching brands.

Business model innovation matters to managers, entrepreneurs and academic researchers for several reasons. First, it represents an often underutilized source of future value. Second, competitors might find it more difficult to imitate or replicate an entire novel activity system than a single novel product or process. Since it is often relatively easier to undermine and erode the returns of product or process innovation, innovation at the level of the business model can sometimes translate into a sustainable performance advantage. Third, because business model innovation can be such a potentially powerful competitive tool, managers must be attuned to the possibility of competitors’ efforts in this area.6 Competitive threats often come from outside their traditional industry boundaries.

We define a company’s business model as a system of interconnected and interdependent activities that determines the way the company “does business” with its customers, partners and vendors. In other words, a business model is a bundle of specific activities — an activity system — conducted to satisfy the perceived needs of the market, along with the specification of which parties (a company or its partners) conduct which activities, and how these activities are linked to each other. We started our research into business models a decade ago by making in-depth inquiries into the business models of 59 e-business companies in Europe and the U.S. that had undertaken initial public offerings.7 (See “About the Research.”) Later, we developed a unique data set containing detailed information about the business models of 190 entrepreneurial companies listed on U.S. or European public exchanges between 1996 and 2000. We supplemented these data on companies’ business models with another manually collected data set on business strategy, establishing empirically that a company’s product market strategy and its business model are distinct constructs that affect corporate performance.8 More recently, we have developed cases on business model choice and evolution.9

Building on this work, we focus in this article on business model innovation in the context of established companies. However, these ideas are equally applicable to innovators of entirely new business models and to managers of companies who need to adapt their business model incrementally with the objective of achieving business model innovation new to their organization. Even under conditions of resource scarcity, organizations do not need to renounce innovation as a way of enhancing their performance prospects. Rather, managers should consider the opportunities offered by business model innovation to complement, if not substitute for, innovation in products or processes. Business model innovation can allow managers to resolve the apparent trade-off between innovation costs and benefits by addressing how they do business, for example, by involving partners in new value-creating activity systems.

Business Model Innovation in Practice

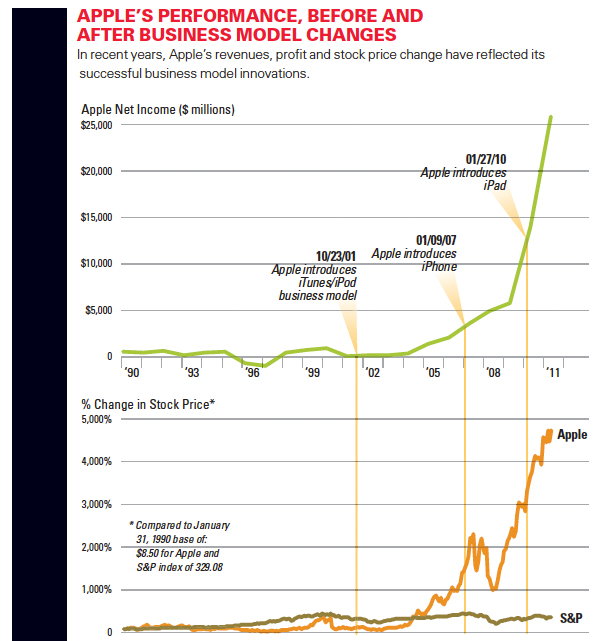

To illustrate the power of business model innovation, consider two cases: Apple and HTC, the Taiwan-based mobile device manufacturer. For most of its history, Apple was focused on the production of innovative hardware and software, mostly personal computers. By creating the iPod and the associated iTunes, a legal online music download service, Apple introduced a radical innovation of its business model. Apple was the first computer company to include music distribution as an activity, linking it to the development of the iPod hardware and software. By adding this new activity to its business model, which links the music label owners with end users, Apple transformed music distribution. Rather than growing by simply bringing innovative new hardware to the market, Apple transformed its business model to encompass an ongoing relationship with its customers, similar to the “razor and blade” model of companies such as Gillette. This enabled Apple, and its business model partners, to extract ongoing value from the use of the Apple hardware and software. In this way, Apple expanded the locus of its innovation from the product space to the business model — and its revenues, profit and stock price change have reflected that successful business model innovation. (See “Apple’s Performance, Before and After Business Model Changes.”)

Apple’s Performance, Before And After Business Model Changes

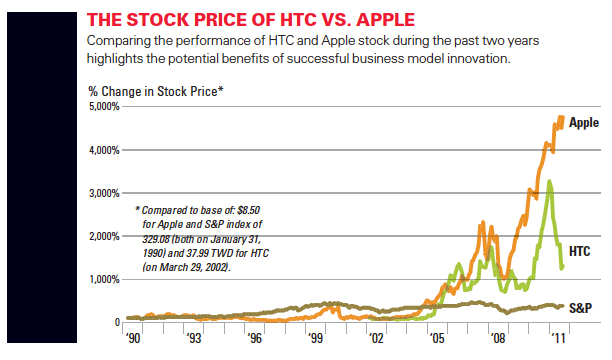

Such performance can be hard for even some otherwise high-performing companies to match if they rely solely on product innovation. HTC has been a very innovative, profitable and growing original equipment manufacturer since its founding in 1997. Initially, HTC manufactured handsets for Microsoft-powered mobile phones for companies such as Palm, HP and T-Mobile. In 2006, it changed its product-market strategy from being a contract OEM manufacturer to selling its own HTC-branded smart phones to wireless network operators and the general public through various distribution channels. HTC has excelled in many ways, recording many firsts in the smart phone product market space and winning numerous awards for its many technological innovations. Yet HTC’s business model has remained centered on hardware design and product innovation. In effect, HTC sells great razors, but no razor blades: Its business model allows it to benefit only from the sale of its innovative, state-of-the-art smart phones and tablets, but not from their use. Comparing the performance of HTC and Apple stock in the past two years highlights the fact that in the fast-moving technology market space, product innovation without business model innovation may not always provide enough competitive advantage. (See “The Stock Price of HTC vs. Apple.”)

The Stock Price Of Htc Vs. Apple

In contrast to Apple, HTC has not been involved in the creation or delivery of mobile content or services, and its devices function on third-party operating systems such as Google’s, generating revenues for HTC only from the hardware sales. Apple, on the other hand, benefits from economies of scope due to the interoperability of its software base (iOS, iTunes, App Store, iCloud) for its various products including its computers (iMacs), tablets (iPads), phones (iPhones) and MP3 players (iPods). In addition, Apple benefits from direct ownership of its distribution channels (online App Store, brick-and-mortar Apple retail stores). Further, Apple’s business model enables it to derive revenue from App Store sales of third-party applications, from iTune songs, and from AT&T for the use of its iPhone for voice and data.

How to Innovate in Business Model Design

An innovative business model can either create a new market or allow a company to create and exploit new opportunities in existing markets. Dell, for example, implemented a customer-driven, build-to-order business model that replaced the traditional build-to-stock model of selling computers through retail stores.10

Changes to business model design, however, can be subtle; even when they might not have the potential to disrupt an industry, they can still yield important benefits to the innovator. Consider Taco Bell, the restaurant chain offering Mexican-style fast food, which in the late 1980s decided to turn the restaurant’s kitchens into heating and assembly units. Most chopping, cooking and clean-up activities were transferred to corporate headquarters. The food was sent precooked in plastic bags to restaurants, where it could be heated, assembled and served.11 This incremental business model innovation was not game-changing for the fast food industry, but it allowed Taco Bell to realize economies of scale and improvements in efficiency and quality control, as well as to increase space for customers within the restaurants.12 Other companies might wish to change their business models in similar incremental ways or follow a business model innovator in their industry in order to achieve competitive parity.

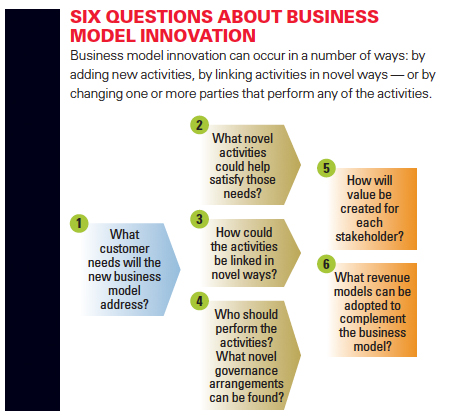

Business model innovation can occur in a number of ways:

1. By adding novel activities, for example, through forward or backward integration; we refer to this form of business model innovation as new activity system “content.”13

2. By linking activities in novel ways; we refer to this form of business model innovation as new activity system “structure.”

3. By changing one or more parties that perform any of the activities; we refer to this form of business model innovation as new activity system “governance.”

Content, structure and governance are the three design elements that characterize a company’s business model.14 (See “Six Questions About Business Model Innovation.”) Change one or more of these elements enough and you’ve changed the model. Consider the following.

Six Questions About Business Model Innovation

The content of an activity system refers to the selection of activities to be performed. For example, Colombia’s largest bank, Bancolombia, adopted activities beyond those of a typical retail bank. The perceived market need for these activities was the demand for microcredit among the more than 60% of Colombians who did not have access to banking services. To perform these new activities — an innovation in the content of its business model — the bank needed to train its top management, hire and train new staff and link the new activities to its existing system (platforms, applications and channels).15 Another example of business model innovation focused on content is IBM.16 After a severe financial crisis in the early 1990s, the company shifted its focus from being a supplier of hardware to becoming a service provider. Drawing on know-how built over decades, IBM launched a range of new activities in consulting, IT maintenance and other services. The transformation was substantial: By 2009, more than half of IBM’s $96 billion in revenues came from these activities, which had barely existed 15 years earlier.

The structure of an activity system describes how the activities are linked and in what sequence. Consider Priceline.com. This online travel agency has established links with airline companies, credit card companies and Travelport’s Worldspan central reservation system, among others. By introducing a reverse market in which customers post desired prices for sellers’ acceptance, Priceline developed a fundamentally novel exchange mechanism through which these parties interact and by which items such as airline tickets are sold. Priceline was granted a business method patent on its innovative activity system — a novel structure that continues to distinguish the company from other travel agencies.

When he first began franchising 7-Eleven stores in Japan, Toshifumi Suzuki was introducing a business model innovation in the Japanese market.

Image courtesy of Flickr user marko8904.

The governance of an activity system refers to who performs the activities. Franchising, for example, represents one possible approach to innovative activity system governance. It can be the key to unlocking value, as when Japanese entrepreneur Toshifumi Suzuki realized in the early 1970s that the franchise system that had developed in the U.S. was an ideal response to the strict regulations imposed by the Japanese government on retailing outlets, which limited their size and restricted opening times. By franchising 7-Eleven stores in Japan, Suzuki adopted a novel type of activity system governance (new to Japan, but not to the rest of the world) and managed to create value through professional management and local adaptation.17 Another example of an innovative governance structure is the recent formation of a consortium of magazine publishers, including Time, Hearst, Meredith and Condé Nast, to develop an online magazine newsstand using multiple digital formats. The resulting company, Next Issue Media, is jointly owned by industry rivals and is a response by the rival publishers to declining print circulation (and hence print advertising revenue) and the growth of digital media. Fighting for survival, the publishers are looking beyond their otherwise fierce competition to their common interest in inventing a new context for magazines in the digital era. As Ann Moore, the former CEO of Time, stated, “It’s increasingly clear that finding the right digital business model is crucial for the future of our business.”18

A consortium of magazine publishers is working to invent a new context for magazines in the digital era.

Image courtesy of Next Issue Media.

But how does a company increase the odds of developing the right business model for its situation? In our earlier work,19 we identified four major interlinked value drivers of business models: novelty, lock-in, complementarities and efficiency.

1. Novelty captures the degree of business model innovation that is embodied by the activity system.

2. Lock-in refers to those business model activities that create switching costs or enhanced incentives for business model participants to stay and transact within the activity system. Consider for example Nespresso, a division of Nestlé Corporation. It introduced a new, low-cost espresso maker that uses Nespresso-produced coffee capsules. Once a customer buys a Nespresso machine, he or she needs to use Nespresso coffee capsules — creating a lock-in that enables Nestle to profit from both the sale of the machine and the use of the machine by selling consumables that machine owners must buy from Nespresso. Launching these products involved a radical redesign of the activity system, for example, by branching out into retailing activities.

3. Complementarities refer to the value-enhancing effect of the interdependencies among business model activities. Consider, for example, eBay, which offers a platform to conduct sales over the Internet among individual buyers and sellers of used and new products. A key requirement for the platform to function properly is a payment mechanism that allows buyers to make credit card payments even when the seller does not have access to credit card services. PayPal, the online payment company that eBay acquired, offers such a function, facilitating trades that could not otherwise be completed. In other words, PayPal has a value-enhancing effect on the eBay activity system.

4. Efficiency refers to cost savings through the interconnections of the activity system. Consider Wal-Mart, which not only championed the concept of discount retailing but also designed an activity system that supports its low-cost strategy. An important activity within this system is logistics. Over time, Wal-Mart developed highly sophisticated processes, such as cross-docking, unrivalled in the industry. These processes help the company to keep its costs lower than its competitors, giving Wal-Mart an important competitive advantage.

Our research suggests that the presence of each of these value drivers enhances the value-creation potential of a business model. Moreover, we find important synergies among the value drivers. Complementarities, for example, can be more valuable when supported by novel business model design.

Interdependencies in Business Models

Interdependencies in business models are created by entrepreneurs or managers in several ways: when they choose the set of organizational activities they consider relevant to satisfying a perceived market need, when they design the links that weave activities together into a system and when they shape the governance mechanisms that hold the system together.

Interdependence among business model design elements. Content, structure and governance can be highly interdependent. Take the San Francisco, California-based peer-to-peer lending company Prosper, for example. The venture aims at enabling direct, small, unsecured loans between individual lenders and borrowers. Early on, the founders made the conscious decision to let lenders choose the borrowers to whom they wanted to lend their money. This was a structural choice that settled the question of how lending and borrowing activities were linked, but it also constituted a decision about governance because it shifted the evaluation and selection activities to the customers and away from the company.

Interdependencies between business and revenue models. Managers also need to consider the interdependency between a company’s business model and its revenue model. The revenue model refers to the specific ways a business model enables revenue generation for the business and its partners.20 It is the way in which the organization appropriates some of the value that is created by the business model for all its stakeholders. A revenue model complements a business model design, just as a pricing strategy complements a product design. Consider Better Place, whose business model aims to provide electric vehicle charging services. Like a mobile phone operator whose business model centers on enabling the use of the mobile phone device through its network rather than on the handset device itself, Better Place’s business model centers on providing charging networks and services rather than on the electric vehicle itself. It involves an innovative business model structure with partners ranging from governments, vehicle manufacturers, clean energy producers and others. Just as mobile phone operators charge customers variable or flat rates for telecommunication services, Better Place intends to implement a revenue model as a function of customers’ car usage (miles driven), thus taking into account the interdependency between its business and revenue models.21

The concepts of business and revenue model, although conceptually distinct, may be quite closely related and even inextricably intertwined. For example, in the product world, Gillette uses its pricing strategy of selling inexpensive razors to make customers buy its more expensive blades. A business model lays the foundations for a company’s value capture by codefining (along with the company’s products and services) the overall “size of the value pie” (that is, the total value that is created), which can be considered an upper limit to the company’s value capture.22 The greater the total value created through the innovative business model, and the greater a company’s bargaining power, the greater the amount of value that the company can appropriate.23

Caveats. As the Better Place example suggests, business model innovators need to bear in mind that identifying technologically or strategically distinct activities can be conceptually challenging, because the number of potential activities is often quite large.24 Many seemingly inseparable activities can now be broken down even further, especially given ongoing advances in information and communications technologies.25 (This, of course, represents not only a conceptual challenge but also an opportunity for innovative managers to redesign the activity systems of their organizations in novel ways.)

What’s more, making changes to a company’s whole activity system rather than optimizing individual activities (such as production) requires systemic and holistic thinking, which can be demanding. When responding to a crisis, operating in tough economic times or taking advantage of a new opportunity, rethinking an entire business model may not always be the first thing on a manager’s mind. This is particularly true when the level of resistance to change is predicted to be high. As a result, choices on business model design often go unchallenged for a long time.

Six Questions to Ask Before Launching a New Model

Our research shows that in a highly interconnected world, especially one in which financial resources are scarce, entrepreneurs and managers must look beyond the product and process and focus on ways to innovate their business model. A fresh business model can create and exploit opportunities for new revenue and profit streams in ways that counteract an aging model that has tied a company into a cycle of declining revenues and pressures on profit margins.26 We suggest that managers ask themselves the following six key questions as they consider business model innovation:

1. What perceived needs can be satisfied through the new model design?

2. What novel activities are needed to satisfy these perceived needs? (business model content innovation)

3. How could the required activities be linked to each other in novel ways? (business model structure innovation)

4. Who should perform each of the activities that are part of the business model? Should it be the company? A partner? The customer? What novel governance arrangements could enable this structure? (business model governance innovation)

5. How is value created through the novel business model for each of the participants?

6. What revenue model fits with the company’s business model to appropriate part of the total value it helps create?

To illustrate how managers might productively and proactively use these questions, consider the business model of McGraw-Hill’s book publishing business.27 In the U.S., general and trade books (including consumer titles and celebrity author books) represent about 55% of industry revenues, while academic and professional books generate the remainder. Until recently, only in business-to-business and academic text segments have websites been a true marketing platform for digital content. While e-readers such as the Kindle and the iPad are now rapidly gaining popularity, the time-consuming and expensive book publishing process had not changed in a material manner in many decades. However, Google, Amazon and other competing information and content providers have stimulated a growing customer interest in electronic formats. Publishers in the U.S. and Europe are searching for solutions to meet the emergent demand for creating and delivering digital content on portable devices while preserving and enhancing value.

Meeting the demand for digital content may require publishers to perform new activities (new business model content). Although it is unlikely that the traditional hardback/paperback book will disappear, it is expected that the demand for printed publications will fall sharply. If printing and physical distribution become less relevant in the process, the time it now takes to add a new title to a catalogue and to bookstore shelves will be reduced. Accordingly, designing, uploading and maintaining the most complete online catalogue may become a central new activity in publishers’ business models. In addition, to the extent that publishers decide to bypass traditional retail bookstores in their new business models, they will have to develop a new marketing activity targeting retail buyers. Production will need to change as well. Creating content with a digitally enabled streamlined process is another activity 21st-century publishers will probably need to incorporate into their new business models.

Linking the various activities to each other, sequencing these linkages and deciding how stakeholders will interact with one another in the new business models requires careful consideration (new business model structure). For example, the ways in which McGraw-Hill decides to interact with multiple digital distribution partners such as Apple and Amazon, through which McGraw-Hill distributes digital content to retail consumers, will affect the breadth of the company’s access to the retail digital book market. The linkages among content creators, including authors, editors, other publishing professionals and distributors, will constitute the heart of the new business model. These linkages must reflect alternatives available to authors — such as bypassing publishers altogether — as well as approaches adopted by competing publishers.

Determining whether McGraw-Hill or another partner will carry out each of the activities of the new business model requires a careful consideration of trade-offs (new business model governance). For example, should the publisher’s content be delivered through a new McGraw-Hill branded device, or by proprietary devices offered by such partners as Amazon (with its Kindle) or Apple (with its iPad), thereby leveraging their existing position in the market? Or should its content be delivered through Internet-based platforms compatible with a broad range of devices, enabling global distribution? These are crucial governance decisions that a new publishing model will answer.

Publishers’ new business models will create value through the complementarities and interdependence among activities and through the enormous efficiencies in the publishing process that the new business models could generate. A number of alternative revenue models associated with these new business models could be considered, such as single subscription pricing independent of the number of downloaded manuscripts, piecemeal pricing and/or value-based pricing for time-sensitive publications.

Taking a Systemic View

Addressing the six questions outlined above can help managers see their companies’ identities more clearly in the context of the networks and ecosystems in which their organizations operate. Without a business model perspective, a company is a mere participant in a dizzying array of networks and passive entanglements. Adopting the business model perspective can help executives purposefully structure the activity systems of their companies; the purposeful design and structuring of business models is a key task for general managers and entrepreneurs and can be an important source of innovation, helping the company look beyond its traditional sets of partners, competitors and customers. Most importantly, perhaps, this approach encourages systemic and holistic thinking when considering innovation, instead of isolated, individual choices. The message to executives is clear: When you innovate, look at the forest, not the trees — and get the overall design of your activity system right before optimizing the details.

References (28)

1. “Business 2010: Embracing the Challenge of Change,” white paper, Economist Intelligence Unit, New York, February 2005, p. 9.

2. G. Pohle and M. Chapman, “IBM’s Global CEO Report 2006: Business Model Innovation Matters,” Strategy & Leadership 34, no. 5 (2006): 34-40.

Comments (6)

Patricia Parker

David Chapman

Business Model Innovation | Barry Young's Blog

Why Business Model Innovation Rocks BMN!

javvadih.rao

globalroundhouse