Innovating in Uncertain Markets: 10 Lessons for Green Technologies

History shows that the road to technological innovation is long and winding, but lessons from successes and failures with other emerging technologies offer managers a helpful guide.

Topics

Leading Sustainable Organizations

Innovations often follow the path of LED technology: beginning at the periphery before becoming more widely adopted.

Talking about “green technology” gets people excited. It’s thrilling to think that a new wave of inventions and discoveries will revolutionize the way we live, halt the degradation of our planet and conserve resources for future generations. And it’s more than just talk: Investors are committing real dollars. By one estimate, the global market for alternative energy sources (for example, wind, solar energy and biofuels) will reach $315 billion by 2018. In the past few years, the number of “significant investments” has grown by more than 30%.1

As the level of activity increases, however, discussions about green technology raise as many questions as they answer. Let’s say we start plugging our cars into a smart electric grid: Who will make the batteries, using which technologies, and what energy sources will we use to charge them? Similar debates arise over biofuels. Should we produce biofuels from algae? Will it become a more promising feedstock than corn or sugar cane? Can we produce a type of cement that releases considerably less carbon dioxide into the air — or should we begin developing alternative materials to replace it? Will energy management software spur U.S. households to regulate their peak load use — or is it simply too difficult to change people’s behavior?

The Leading Question

What can managers involved with green technologies learn from prior experiences in other technologies?

Findings

- Take the time to study the market opportunity, and don’t expect growth to be predictable or steady.

- Craft a flexible strategy that will help secure sustainable market leadership.

- Build an organization that can anticipate threats as well as opportunities, and adapt to them.

Addressing these questions is complicated by the fundamental uncertainties that are at the heart of the green technology market. The evolution of this market space depends on forces that are beyond the control of any individual entrepreneur or investor. (See “Defining Green Technologies.”) Governments must fashion coherent and durable energy policies. Risk capital must be available to fund massive infrastructure projects. And there are additional wild cards: oil price volatility, geopolitical conflicts, the rate of economic growth and public attitudes toward warnings of global climate change.

In light of these uncertainties, what’s the best approach for start-up ventures, large companies, government agencies and NGOs in the green technology space? How can organizations resist the hype and pursue the promise of emerging green technologies?

Learning from the Past

History shows that the road to technological innovation is a long and winding one. Between 2005 and 2007, runaway enthusiasm led to the proliferation of hundreds of new green technology ventures, many of which ran into trouble during the great recession. To move forward in the face of deep, long-term uncertainty and probable setbacks, green technology companies need to develop staying power. In addition to understanding the opportunities, they need to get ahead — and stay ahead — of competitors. To assist in this effort, we have identified 10 broad lessons for green technology players based on successes and failures across a broad array of emerging technologies, including the biosciences, nanomanufacturing, advanced materials, space science and numerous information technologies.2 Although our lessons are by no means immutable, managers should take them seriously given that they are drawn from comparable industry experiences. The lessons address three important areas of focus: understanding the nature and the dynamics of the market opportunity; crafting strategies for market leadership; and building an adaptable organization with enough “staying power” to handle the numerous uncertainties ahead.

Lesson 1: Timing is everything

Few people dispute the attractiveness of a green technology market. But where are the best opportunities? The late 1990s saw an enormous ramp-up in technology investment and market capitalizations. Most of the enthusiasm disappeared in 2000 and 2001 when the tech bubble burst. As extraordinary as it felt at the time, such reversals are common: Markets can defy the law of gravity for only so long. Usually some triggering event — such as a slow-down in sales, a technological discontinuity or a price drop — will cause a rapid exit of competitors and market consolidation. The result: a shakeout period, when as many as 80% of the players in that market vanish.

Bubbles and shakeouts are an unavoidable part of the natural selection process in free markets. The warning signs of bubbles include palpable enthusiasm over potential market size and growth, multitudes of new entrants (some of which are flying below the radar) and euphoria by the media, investment bankers and venture capitalists. The success or failure of any prospective business is a function of properly timing the market’s life cycle: Some companies are too early, and others miss the party. Although there is a myth that winners need to enter the market early, the reality is more complicated. Failure is frequently the result of not investing in capabilities needed to stave off competitors who imitate and improve on existing offerings.3 During the late 1990s there were over 2,000 biotech companies; today just a handful of major independent biotechs, such as Amgen, survive. Early movers either exit the market or are absorbed by other players, just as pharmaceutical companies gobbled up many new biotech ventures.

Nevertheless, most industries continue to grow, even after a shakeout or dramatic consolidation. Excessive market exuberance can lead to high volatility and failures of individual companies, but sectors as a whole can still see growth. In the 1830s, when railroad fever swept through England, many landowners sold rights of way to railroad companies, leading to a bubble that soon collapsed. Nonetheless, more railroads were built in the subsequent decade than in the period before the boom. Even when a bubble bursts, it often sets the stage for subsequent growth. A recent example is the fiber optic cable industry. Between 1998 and 2001, based on wildly optimistic forecasts about growth in Internet usage, telecom companies laid a staggering amount of fiber optic cable. However, at the peak only 5% of this capacity was actually utilized. Most companies that invested in this frenzy either failed or sustained huge losses, but the huge network capacity they provided ultimately enabled cheap global communications — which in turn created new market opportunities as it helped “flatten” the world.

Lesson 2: Change occurs slowly

Understanding the market opportunity also means accepting the reality that change is usually slower than enthusiastic early investors expect. In a world where bubbles frequently accompany euphoria, it is hard to get the timing right. There are three main obstacles to rapid adoption of an emerging technology:

The chicken/egg problem. Without software, a great new hardware device has little value; but unless there is a strong prospect of robust sales, software developers won’t write the needed computer programs. A variant of this problem afflicted many B2B market exchanges that sprang up during the Internet bubble. Sellers wouldn’t join unless there was a critical mass of buyers, while buyers were waiting for more sellers.

Cost or performance barriers. Compact fluorescent light bulbs last five to six times longer than comparable incandescent bulbs and consume 75% less energy. The annual savings in energy and greenhouse gas emissions, assuming each U.S. household replaced one regular bulb with a CFL, would be the equivalent to taking 1.3 million cars off the road.4 Nevertheless, since their introduction in the late 1980s, CFL bulbs have penetrated only 11% of the U.S. residential lighting market. The reason: The price of CFLs averages three times that of a regular bulb, and they cast a somewhat harsher light.

Fuel-efficient and clean automobiles could face similar delays in widespread adoption. Considering past consumer or commercial repurchase cycles, it may take many years for a country to replace its fleet of cars and trucks. High fuel costs, subsidies and other incentives may expedite substitution, but overall, we suspect that it will take a long time for consumers to make the switch.

Diffusion models can help assess how quickly “green” technologies might spread through contagion and tipping point dynamics.5 But the rate of adoption of emerging technologies is often slowed by lock-in effects, inertia and market uncertainty.6 Additional impediments to quick adoption can occur if large upfront infrastructure investments are needed to achieve minimum efficient scale, such as charging stations for cars, or if there are high switching costs for consumers, as in moving from a standard light bulb to a CFL. Furthermore, many market segments initially may have to contend with multiple green technologies vying to become the standard, creating further uncertainty. Such factors can be barriers to change, leading to an overall pace of market evolution that is slower than expected or hoped for.7

Coevolution versus pure substitution. Technology substitution is rarely a zero-sum game. Even 40 years after the introduction of semiconductors, there is still a profitable market niche for vacuum tubes. Online retail has not replaced “bricks and mortar” — instead, in the most successful business models, retail and e-tail often complement one another. Likewise, in green technology, there will be a great deal of substitution, but we are apt to see different types of energy coexisting for quite some time. It is important to frame the problem as one of coexistence and coevolution, not just replacement.

Lesson 3: Collaboration is crucial

Considering the scale, scope and complexity of most green technology markets, experience shows that collaboration can be key to capturing the market opportunity. Strategic alliances with industry trade associations to develop common positions and with other companies via joint ventures as well as public/private partnerships have shown themselves to be extremely effective. Entrants need to understand the stakeholder positions that will influence policy makers and consumers. For example, some countries and cultures may be fairly open to understanding the complexity of climate change and be willing to move to a low-carbon economy. However, others may resist changes that alter their short-term economic or political interests. Diverse stakeholders will want to have a say in how green technologies unfold. The role of NGOs and venture capitalists will supplement the role of companies and government entities.

The global climate meeting in Copenhagen in December of 2009 illustrates both the importance and the difficulty of developing mutual understandings among international stakeholders.8 Prior to this meeting, hopes were high that it

would lead to major progress in combating global warming, specifically the adoption of clear carbon-reduction goals. Sadly, the leaders of Brazil, China, India, South Africa and the United States could only agree on a declaration of intent to adopt policies to limit global warming increases to less than 2 degrees Celsius (or 3.6 degrees Fahrenheit), so the final accord had few teeth.

A contrasting example is the Montreal Protocol, adopted in 1989 to phase out ozone-depleting substances. The international scientific community identified a clear and present danger (the ozone hole), its main causes (industrial uses of chlorofluorocarbons or CFCs) and how products and processes would need to be changed to reduce the problem. Thanks to effective international diplomatic efforts and market forces, the ozone hole is no longer growing dramatically. It took collective focus on a recognized global threat and the power of unassailable science to identify CFCs as the culprit. Another notable success is Energy Star, the energy conservation initiative launched in the United States by the Environmental Protection Agency in 1992. It was subsequently adopted by Australia, Canada, Japan, New Zealand, Taiwan and the European Union. Energy Star identified broad areas of waste, such as lighting, computers, appliances and buildings. It then used compelling examples to demonstrate how innovations in energy conservation would lead to cost savings, on both an institutional and an individual level. According to EPA estimates, the cumulative cost savings from the Energy Star program totaled $14 billion in 2006 alone.

Lesson 4: Innovation takes many forms

The final element of understanding the opportunity is recognizing the full meaning of the word “innovation.” People often think of innovation in terms of a new product or market, but it’s frequently broader than that, involving changes to business models, organizational designs, financial structures or production and supply chains.9 The technology space is accustomed to seeing battles between business model innovations, such as the one currently underway between Google and Netflix for movies on demand. Green technologies offer the potential for breakthrough innovations along the entire value chain. For example, India-based Suzlon Energy has become the third-largest wind turbine company in the world by solving customer problems with end-to-end solutions. The company started by offering wind mapping and land sourcing advice, but over time it expanded along the entire wind energy spectrum from generation to providing grid connections; previously customers had to assemble the various components themselves.

Creating new innovation models is essential for making green technologies work. Genuine innovation requires asking deep questions, and failure to do so can prevent managers from seeing new opportunities. IBM’s decision to turn down the opportunity to acquire the new Xerox reprographic process back in the 1960s provides a telling example.10 IBM hired Arthur D. Little, a respected consulting firm, to answer the question, “If we have a reliable, cheaper and faster process, how many more copies of documents will people make in a given year?” In those days, copies were made from originals, and both IBM and ADL framed the problem narrowly as “copies from originals,” overlooking a much larger market (i.e., copies of copies of copies, etc.). The new and broader market ended up being many times bigger, but it could only have been foreseen if people had reframed the original question as: “How will the new Xerox process alter when and how people make copies, and what are the potential implications?”

Lesson 5: Embrace uncertainty by maintaining options

Once a company has identified a genuine market opportunity, the next challenge is crafting a strategy that will help secure sustainable market leadership. It is easy to underestimate the risks of new ventures. Complex timing issues and other factors such as tail events, black swans and singularities can wreak havoc with the most airtight business plan.11 Traditional management tools pretend that managers can pierce the fog by calculating probability distributions and pursuing optimal decision paths. This approach may work when operating in familiar waters but not when venturing into the unknown. The challenge for emerging leaders in the green technology space is learning how to embrace uncertainty and benefit from it.12

Fortunately, tools exist to help organizations and individuals make the mental shift required to succeed in a deeply uncertain future. The shift requires moving away from trying to predict and control risk to embracing techniques that accept as a given that the best we can do is navigate the uncertainty, the way a ship captain does on the high seas. Scenario thinking, for example, helps managers envision a wide range of possibilities so that they can make mid-course corrections, even when confronted with unexpected events. Improved scanning capabilities can help companies spot the unexpected before it’s too late. (We will come back to this in lesson 9.)

Multiple Scenarios For Q-cells

Multiple Scenarios for Q-Cells

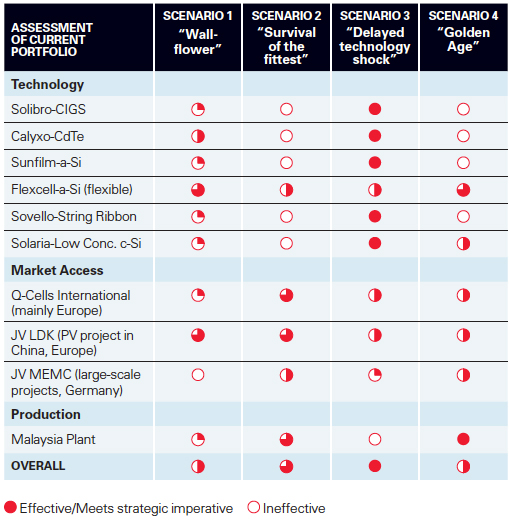

Q-Cells is a German company whose core business involves producing and marketing photovoltaic cells based on crystalline silicon. Founded in 1999, the company grew to be the largest producer of solar cells, with a global market share of 8% in 2008.i The company is active in three main business segments: producing solar cells (the bulk of its business), developing large-scale solar PV projects and investing in other related new technologies. In addition to technological uncertainty, the company faced other unknowns involving subsidies for solar technology development, new regulations, competitive market dynamics, economic growth and consumer preferences. Michael Dreimann and Raphael Speck, two of our Wharton MBA students, developed four different scenarios for Q-Cells looking out to 2020, structured around two key uncertainties: (1) the extent of new PV incentive programs and (2) the relative technological advancement of c-Si technology vs. alternative PV technologies. By dichotomizing and crossing these two uncertainties, and considering additional uncertainties listed above, they developed four scenarios.ii

When juxtaposing Q-Cells’ strategic options against different business scenarios, some options turned out to be more robust than others. One investment option was for Q-Cells to buy into Calyxo, a company owning an exclusive global license for the commercialization of a thin-film technology based on cadmium telluride. To enhance market access, the company considered the development of solar PV projects in China and Europe. It also explored a joint venture to develop large-scale solar parks that would be sold to financial investors after completion. Lastly, some of the options considered entailed low-cost production opportunities in emerging countries, such as c-Si cell manufacturing in Malaysia (an option since exercised). Once various options are generated, they can be scored in terms of attractiveness under different scenarios. The analysis suggested that Q-Cells was generally well positioned for scenario 3 but less so for the other three scenarios. This meant that the company should either generate additional options that score well across all four scenarios or approach the less robust options with greater caution, investing in stages and with clearly formulated exit criteria in place.

A natural adjunct to scenario planning is “real options thinking.” When the level of uncertainty is high, it may be wise to make multiple small bets, as opposed to one large bet. The risk of a single large bet failing is big. Motorola learned this the hard way back with Iridium LLC, a global network

designed to support worldwide voice and data communication from handheld satellite phones and devices. The company began offering services in 1998 and filed for Chapter 11 bankruptcy only nine months later after burning through billions of dollars. In many settings, a multistep investment approach works better; it preserves flexibility by

allowing managers to play multiple options, akin to purchasing call options on several stocks rather than betting all on one stock. With smaller investments, the company buys the right to observe the emerging technologies close up, allowing managers to decide at different points whether to make bigger investments or to pull out.13 (See “Multiple Scenarios for Q-Cells.”) Such real options can help companies scout for opportunities, establish a foothold in early stage markets or obtain various types of licensing and other participation rights, which can be triggered when a technology breaks through.14 Once emerging technologies develop further, such that their trajectories and market opportunities become clearer, traditional measures such as net present value can be used.

Lesson 6: Anticipate where the money will be

Success in an emerging industry is like success in ice hockey: It relies on anticipation, keeping an eye not just on the market but on the competitive moves and countermoves that will shape its trajectory. In order to create a strategy, leaders need to envision the future — as the great hockey player Wayne Gretzky put it, you need to “skate to where the puck will be.” In other words, the market is not linear but highly dynamic.

Consider the renewable energy market. In recent years, we have seen tremendous gains in solar, wind and geothermal energy. Between 1998 and 2008, the total global installed capacity for these sources grew from 20 to 145 gigawatts. Today, in Denmark, wind power accounts for 20% of electricity generation. Despite these gains, however, fundamental uncertainties remain. It’s still not clear which of the competing technology platforms will prevail — or whether a brand-new technology will emerge.

This conundrum is particularly evident in the solar power market. Because of the high grid-price of solar photovoltaic electricity relative to traditional sources,15 solar PV projects are subsidized in many parts of the world. These subsidies have taken the form of investment incentives (via tax breaks or low-interest-rate loans), guaranteed resale prices for solar-derived power (through so-called feed-in tariffs) and/or mandates to include solar power in the overall energy mix. In Japan, for example, government incentives have helped to feed a robust solar PV market since 1994. Germany has used incentives for solar energy projects since 2000, which in turn promoted impressive growth rates in solar PV.

Based on this activity, the solar market might appear to be an area ripe for investment. But which technology platform is most likely to prevail? At present, the crystalline silicon cell is the dominant technology for producing power from solar sources. But there are several competing technologies such as concentrated solar, thin film designs using nanoparticle inks or “solar trough” designs that could leapfrog c-Si. Vigilant companies will watch these contenders and buy real options as appropriate to protect their position.

Lesson 7: Think beyond industry boundaries

Experience in other technology-based industries shows how common it is for technology innovations to cross industry boundaries. The biosciences, for example, have wide-ranging implications for national security, climate change and green technologies.16 Other examples of cross-industry innovation can be found in telemedicine, health informatics and tissue engineering. Alternative energy offers rich opportunities for cross-fertilization as well. During the 1970s, when gasoline shortages posed a threat to U.S. energy supply, corn-based ethanol helped provide energy security. In the past decade, ethanol has once again moved into the spotlight — this time as a means of stretching gasoline resources. “Green” biofuels, produced not from corn but from sugarcane, sugar beets and nonfood crop cellulosic plants such as switch grass, are currently in various stages of commercial application.

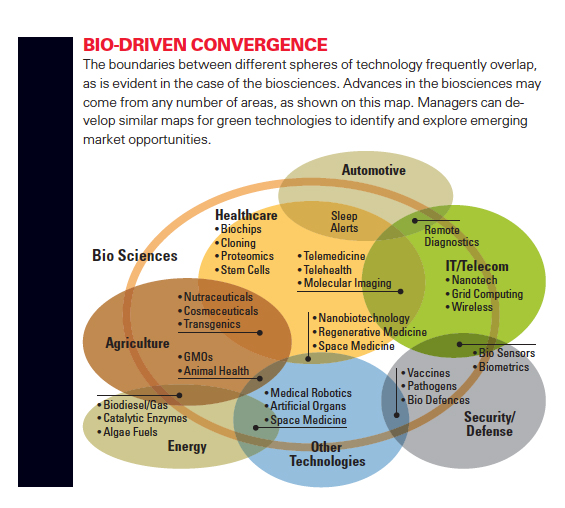

Bio-driven Convergence

The development of new enzymes — specifically, ethanol-fermenting organisms — by Novozymes, Danisco and others could be a significant step. It could transform the transportation energy market and open the door to affordable, homegrown sources of energy. Especially promising are crossover technologies that involve genetically engineered plants and microorganisms, where DNA molecules from different sources are fused using recombinant DNA. Fermentation has been used for millennia to convert barley into alcohol. Recently, bacteria have been used to ferment switchgrass to make jet fuel.17 Additional flexing of market boundaries will continue to occur in green technologies, given their diversity and innovation potential. Mapping out adjacent technology domains can help point managers to where boundary spanning might occur. (See “Bio-Driven Convergence.”) A dynamic space such as green technologies is unlikely to evolve with fixed market segments, and thus it is crucial to envision why and how industry maps may morph over time.

Lesson 8: Share for joint gain

Technological innovation rarely happens within a single company. Over the past decade, building an adaptable organization has increasingly become a collaborative effort with an array of players: knowledge brokers, suppliers, specialized contractors and design firms. A diverse web of participants magnifies the value of individual perspectives, while distributing the risks and rewards of investment more broadly.

This diffusion of risk is especially attractive in the green technology space, where uncertainty is high and the scale of irreversible capital investments and extended payback periods are more than most venture investors can handle alone. Networks with superior skills, experience and market insights can absorb or reduce some of the risk. In addition, the network is often wiser than any of the individual participants. Wisdom involves not just what the network knows but also who it knows. The extended network has an exponentially greater number of points of contact with the outside world — thought leaders, connectors and experts. This network can help players keep an eye on the periphery of the market, detecting early signs of potential problems or opportunities before their competitors recognize them.18

Companies that master the complex competencies of network orchestration have an opportunity to reap the benefits of network synergies. To partner effectively, companies must protect their intellectual property and avoid losing control of their green initiatives. Successful companies will line up good partners — those with track records of proven success. Ultimately, those that protect themselves and cultivate open cultures will be able to work with different groups to achieve common objectives. The successful joint public/private initiative to stop acid rain provides a good example. The EPA identified sulfur dioxide emissions from power plants as the main culprit of acid rain, and instituted a cap and trade policy to limit emissions. The result: various market and plant innovations that radically reduced SO2 in the environment. Since its inception in 1990, the cap and trade component of the Acid Rain Program has reduced SO2 emissions from power plants by 10 million tons, which is more than 60%. The program is now fully implemented, with a permanent cap on SO2 emissions that is about 50% below 1980 levels. This success story illustrates how a responsible government agency, using sound public policy, relied on market mechanisms to share the risks and gains of technological innovations.

Lesson 9: Watch the periphery

In the emerging technology world, two capabilities are essential to long-term survival: organizational vigilance and senior management’s ability to adapt to change. Before innovations are recognized broadly, they often appear at the periphery of a business or market. This is why companies need to cultivate the capability to sense, interpret and act on weak signals of threats and opportunities. The history of LED technology is instructive. After years of research, most people weren’t aware of LEDs until they began appearing in applications like illuminated exit signs and cell phone displays. LEDs have since found their way into traffic lights, automotive brake lights and turn signals, but they still have not made significant dents in the core soft illumination market in homes and offices. Future innovations in green technologies are likely to follow a similar path — beginning at the periphery before moving to the center. By seeing the possibilities sooner, companies have more control over their own future. Rather than reacting to events, they can actively shape them to their advantage.

One key finding from research on peripheral vision is that managers often see too late that one emerging technology is being overtaken by another peripheral technology.19 For example, consider the competition between Silicon Valley and China in the PV market. Given Silicon Valley’s highly

advanced and low-cost methods of printing thin layers of materials on silicon, investors didn’t anticipate that China would set its sights on attacking this market so quickly. But China surprised them, employing vast scale and hefty government subsidies to drive volume down the experience curve and gain market share. Weak signals can be difficult to interpret — that’s what makes them dangerous.

Lesson 10: Become ambidextrous

Boards and investors in green technology companies put a premium on organizational vigilance. Although they don’t expect prescience, they do rely on leadership teams to read early warning signals of trouble or opportunity and to act on them. Vigilant leaders who prosper in turbulence and uncertainty possess a distinct advantage over operational managers who are skilled at execution and achieving short-run efficiency but who get stymied when chaos strikes.20 Vigilant leaders are more ambidextrous. They know how to balance a learning and a performance culture, attend to the short-term while also taking the long view and orient toward both people and tasks, as the situation demands.

Ambidexterity can be an organizational as well as an individual skill — and greatly enhance a company’s ability to innovate.21 Leaders can foster this skill by allowing independent units to maintain their own processes, structures and cultures, with the purpose of driving rapid implementation of agreed-upon strategies. Some even go so far as to support startups and experimental ventures, sometimes providing them with special resources. Conventional organizations prefer to have one way of operating. Because operating managers in these organizations are resistant to allocating funding and staff to projects that seem risky and/or lack alignment to existing performance metrics, good ideas can die on the vine.

To manage the various uncertainties underlying green technologies well, it is crucial to learn from successes and failures. Successful leadership is rewarded by attracting both investors and talented people. However, in the end it is not just about strategy and leadership. It is also about building organizational capacity to improve how leaders navigate the complexity and uncertainty of green technologies.

When management teams are immersed in the immediate demands of starting new ventures and responding to uncertainty, they can easily lose sight of the big picture. Our purpose is to help them learn from the experience of winners and losers from other emerging technologies so they are able to ask better questions, consider a richer array of strategies and probe deeply the staying power of their organizations. Our extensive research on emerging technologies compels us to advance a few predictions for the green technology domain. We envision a multidecade process of moving from the old “brown” technologies to green technologies, with countless twists and turns along the way. At present, green technologies span a broad range of industries and applications, and many more promising segments will emerge. Successful players in the green technology space will formulate strategies that are calibrated against uncertainties at many levels. They will also develop and foster leaders who can manage high levels of complexity and uncertainty. As managers prepare their organizations for the daunting task of evolving embryonic green technologies toward a stable, prosperous future, we hope that they can benefit from some of the insights provided here.

References (23)

1. J. Bennett, “Are We Headed Toward a Green Bubble?” Entrepreneur (April 2010): 51-54.

2. The research supporting this study was funded by the Mack Center for Technological Innovation at the Wharton School of the University of Pennsylvania. See G.S. Day and P.J.H. Schoemaker, “Wharton on Managing Emerging Technologies” (New York: Wiley, 2000).

Comments (2)

Horia Liviu POPA

Siswanto Gatot