The Three Challenges of Corporate Consulting

Topics

Many managers in traditional product-oriented businesses are struggling to turn their companies into solutions-oriented ones, a strategy that is widely considered the route to success in the 21st century.1 An effective first step in this direction can be to establish corporate consultancies — consulting units whose main purpose is to provide solutions based on the traditional business’s products or expertise.2 That is why computer companies such as IBM are moving toward integrated information-technology solutions, telecom-equipment manufacturers such as Nokia are providing turnkey network solutions, and the train and signaling manufacturer Alstom is offering “train availability.”

To make the transition to a solutions business, companies must develop new capabilities in consulting, systems integration, operational services and financing.3 They need to change organizational structures, strategies for recruitment and skills development, and performance measures. For some (Xerox attempting to become a supplier of “document solutions”; Hewlett-Packard struggling to integrate its broad range of products into customer solutions), making the transition all at once is problematic.4

Corporate consultancies can be a better alternative. Under names such as Ericsson Consulting, Shell Global Solutions and AT&T Professional Services, traditional product businesses now offer value-adding professional services. Some have been so successful they have outgrown their product businesses, indicating that creating corporate consultancies may be a first step toward complete reorientation of the organization. The new IBM was built around IBM Global Services, in part a corporate consultancy, which during the 1990s built the world’s largest IT service operation. With the recent acquisition of PricewaterhouseCoopers Consulting, IBM is also one of the world’s largest business-consulting companies.

But even the intermediate step of corporate consulting presents daunting challenges. Three types stand out: the mission challenge, the identity challenge and the structure challenge. New research demonstrates that enterprises mastering those challenges not only strengthen their consultative component but also gain synergies with the product business. (See “About the Research.”)

The challenges relate to how companies handle the similarity vs. the distinctiveness of the product business and the corporate-consulting unit. On the one hand, the corporate consultancy is designed to have an identity, culture and processes all its own. On the other hand, its purpose is to generate synergies with the product business, which requires a certain degree of sameness. (See “Scandtel Consulting — Evolving in Ambiguity.”)

The Mission Challenge

Embarking on a journey toward a solutions business by adding a consultative component requires a clear understanding of the corporate consultancy’s mission in relation to the product business. The main rationale for the move is to exploit synergies between the traditional product business and the customer-driven consulting operation.5 That requires a balance between product-oriented and customer-oriented thinking.

However, even a successful balance is inherently unstable. The established product business seeks greater integration by imposing common procedures and policies on the consultancy; the consulting unit seeks growth through maximization of billable hours. The tug of war pushes the corporate consultancy either away from the product business or too far into it, making synergies difficult. A corporate consultancy that we call Scandtel Consulting typifies the instability caused by endlessly changing roles and internal debates about mission.

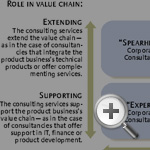

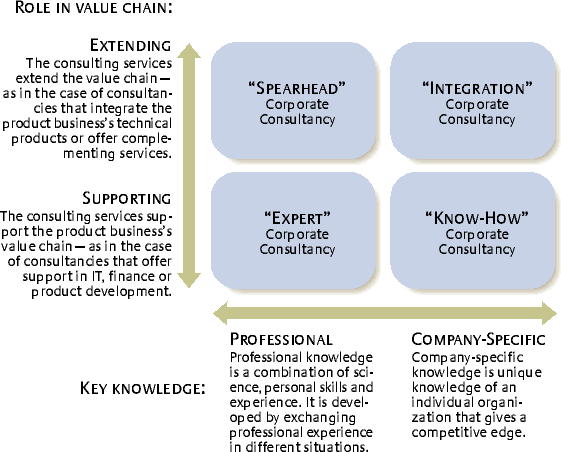

In defining a corporate consultancy’s mission, managers may choose from four generic types of operation differentiated by their relation to the product business’s value chain and key knowledge. These consultancies are: the expert CC, the know-how CC, the spearhead CC and the integration CC. (See “Four Types of Corporate Consultancy.”)

Expert Corporate Consultancies

Expert CCs exploit their professional knowledge by marketing it to external clients beyond the product business’s primary value chain. ABB Financial Consulting, for example, offers consulting services such as balance-sheet management, risk management, and treasury and finance operations to organizations not necessarily within ABB’s value chain. Other expert CCs include IT and technical-support units that provide external services, such as Porsche Engineering, which consults on automotive engineering. The Porsche services initially were launched to exploit free capacity, but today, external assignments are an important part of the company’s business, both in terms of profit and broader technical expertise.

Know-How Corporate Consultancies

Know-how CCs act primarily as internal support units and mostly within research and development. Here the driving force is the company-specific knowledge; consultants act as knowledge brokers between different corporate units. Shell Global Solutions, established in 1996 as a demand-driven global consulting unit, represents this type of knowledge broker.6 Former support functions, such as product research, and technical and business services, were merged to create a unit that could compete with external consultants. The business focus is on internal customers’ needs, but the group also serves Shell’s joint ventures and other external clients.

Spearhead Corporate Consultancies

Spearhead CCs complement the product business in the external market with services that are only loosely tied to the product business’s value chain. They might be professional services that build on professional knowledge, such as analyses and advice. Ericsson Consulting (part of which was formerly Edgecom), a global consulting unit with about 260 employees and wholly owned by the Ericsson group, is a spearhead CC. Its services are oriented toward the telecom industry and build on consulting capabilities in business strategy and customer-relationship management (CRM).

Integration Corporate Consultancies

Integration CCs also extend the product business, but unlike spearhead CCs’ services, theirs are more integrated with the product business, relying primarily on company-specific knowledge. PeopleSoft Consulting is typical. A supplier of enterprise-resource planning (ERP) and CRM, PeopleSoft charges the unit’s 2,500 consultants with handling software implementations, system optimizations, upgrades and other pre- and post-sales assignments. The services are closely tied to PeopleSoft’s product and are geared to turning customers into lifelong clients.7

The four types of corporate consultancy are ideal types, the dimensions that distinguish them being continuous rather than rigid. Some consultancies switch types as their mission changes. (See “Corporate Consultancy Overview.”) Scandtel Consulting, for example, started as a know-how CC, went through an integration-CC phase as the product business adopted a solutions strategy, and now operates as an independent spearhead CC.

The Identity Challenge

In order to offer customer-specific solutions with product-business capabilities and a strong consultative component, a corporate consultancy has to construct and nurture dual organizational identities — different ideas of both “who we are” and “what we do.” In their interactions with clients, consultants are typically expected to have a consultant identity. In their interactions with the product business, consultants are expected to have a staff identity.

A consultant identity implies an arm’s-length relationship with the product business, as corporate consultants are expected to cater primarily to client interests. In contrast, a staff identity involves catering to the product business. It also suggests compliance with internal policies and project models, charging like a staff unit rather than as an independent consultancy, supporting the product business’s image — and maintaining knowledge about and loyalty to company products and strategies.

Handling those parallel and conflicting identities is stressful for consultants and, when active management of the dual identity is lacking, a constant source of frustration. At Scandtel Consulting, for example, a survey elicited “indistinct” and “anonymous” as central characteristics of the organizational identity. It also revealed a widespread frustration among consultants over the consulting business’s lack of clear direction and external image.

Actively managing the dual identities (and corresponding external images) is thus a central challenge in setting up and running the consultative component of a solutions business.8 Although the coexistence of different identities may lead to creative ideas, it requires leaders capable of dealing with such complex issues as conflicting knowledge and interaction patterns.

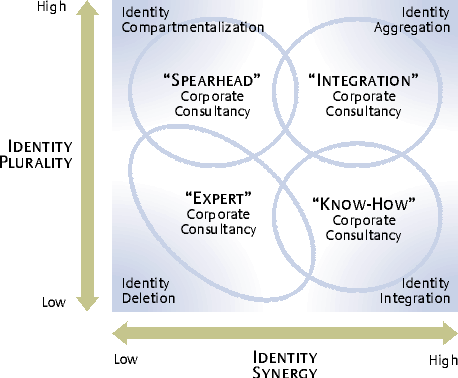

Successful companies manage multiple organizational identities through one of four strategies: compartmentalization (spatial or symbolic separation of identities), deletion (eliminating all but one identity), integration (fusing identities into a new whole) and aggregation (exploiting synergies among identities).9 The choice of strategy is dependent on two dimensions — identity plurality (how many different identities are best for an organization) and identity synergy (how much interaction among identities is desirable). The positions taken in relation to those dimensions differ according to the type of corporate consultancy. (See “Multiple-Identity Management According to Corporate-Consultancy Type.”) Different types apply different strategies for managing multiple identities and for handling the external image.

Expert CCs support the product business by exploiting professional knowledge. Their choice of strategy depends on the nature of the ties between the product business and the consultancy. If the key knowledge is tightly linked to the product business’s core capabilities, as in the case of Porsche and automotive engineering, then identity integration is the best strategy. Expert CCs also should act under the product business’s brand to benefit from image spillover.

If, however, the key professional knowledge is only weakly related to the product business, as is the case with ABB Financial Consulting, identity compartmentalization is the appropriate strategy. Financial services are not part of ABB’s core business, and identity synergies are limited. The two identities are best kept apart and a subbrand used.

Know-how CCs exploit company-specific knowledge in supporting the product business. Doing so requires close interaction with the product business, implying an identity-integration strategy that highlights the product business’s identity in relation to the consulting one. Consultants in know-how CCs generally are recruited internally and continue working within already established networks. The muted consulting identity is therefore seldom perceived as a problem. Know-how CCs accumulate and exploit their expertise by carrying out assignments in different parts of the product business, making them important internal-knowledge brokers.

Philips Centre for Industrial Technology is an example of a know-how CC. Its knowledge-brokering role makes it a better carrier of the product business’s identity than Philips’ product units, which work in widely differing areas. If a know-how CC operates externally, the clients generally value consultants’ closeness to the product business more than their independence. Know-how CCs often become associated with the product company name.

Spearhead CCs exploit professional knowledge by providing services that extend the product business’s value chain. Such services often include giving advice or carrying out analyses. That requires maintaining a distance from the product business in order to remain trustworthy. Therefore the consultancy brand will typically be distinguished from the parent company’s brand, and an identity-compartmentalization strategy is best. That is especially true when a product business acquires a consulting unit accustomed to independence.

Even after the acquisition, acquirers may let consultancies operate under their old names. Ericsson, for example, only recently integrated Edgecom with Ericsson Business Consulting and renamed it Ericsson Consulting. And internally grown spearhead CCs may require active separation from the product business’s dominant identity.

Integration CCs that combine strong synergies with a strong need for plurality pose the greatest challenge in managing multiple identities. Although their services are directed mainly toward an external market to extend the organization’s value chain —which calls for independence — the key knowledge is company-specific, requiring some identification with the product business. The problem of simultaneous similarity and distinctiveness in relation to the product business is thus accentuated in integration CCs, which can neither pursue a separate consulting identity nor completely adopt the product business’s identity. An internal compartmentalization strategy separating the consultants who work with external customers from those who work mainly with internal customers is also difficult, as one consultant may work with both types of assignments. At Scandtel Consulting, a consultant’s engagement in both internal and external assignments was an important enabler of knowledge flows between the product business and its environment.

An identity-aggregation strategy allows for the coexistence of multiple identities — perhaps through mediating myths such as Scandtel Consulting’s slogan “Scandtel Consulting creates leverage,” which acknowledges both the independent consulting identity and the consultancy’s role of supporting the product business. Links among the identities may also be created through identity hierarchies. Scandtel Consulting’s CEO constructed a hierarchy by emphasizing the distinctive external-consultant identity and downplaying the staff identity.10

The Structure Challenge

Central to the corporate consultancy’s ability to manage multiple identities and to capture synergies with the product business is its structural position. The third managerial challenge involves deciding on the consultancy’s organizational position, its access to clients and the freedom it should have in relation to the strategies and processes of the product business. At Scandtel Consulting, the struggle for a distinct identity was intertwined with discussions concerning the unit’s right to access clients without going through the market units, to develop services based on product platforms other than Scandtel’s, and to develop organizational routines for product development and the like that were different from those of Scandtel product units. Scandtel Consulting’s various organizational positions — being a part of a product unit or a market unit, being independent — specified different prerequisites both for a distinct identity and for potential synergies.

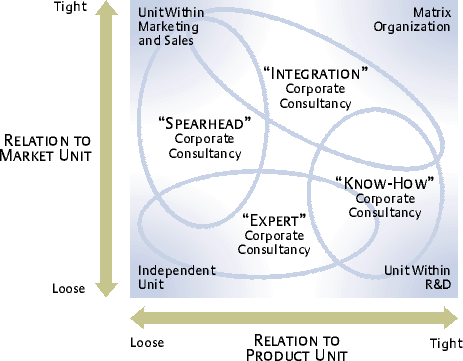

Management must decide how it wants the corporate consultancy to interface with product units and market units of the product business. Tight links imply a high degree of coordination of strategies and procedures; loose links imply less coordination and greater unit autonomy. Choosing the type of link is dependent on the synergies the corporate consultancy’s operations might share with the respective market and product units. The higher the potential synergies, the greater the need for tight links. (See “Ways To Link Corporate Consultancies to Product Businesses.”)

Expert CCs often start as internal support units. Then, if there is outside demand and excess capacity, they may offer their services externally, often to customers who differ from the product business’s customers. Thus Porsche Engineering can offer automotive-engineering services to other car manufacturers. Expert CCs nurture their own customer networks and need a fairly independent position in relation to the market units of the product business.

An expert CC’s relation to product units depends on the character of its expertise. If it is related to the central capabilities of the product units, as in the case of Porsche, the connection is tight, with the consulting unit pursuing the strategies and operations of the product units. Porsche Engineering also is tightly linked structurally to the product units. If the expert knowledge is not directly linked to the product units (ABB Financial Consulting), the links to the units are looser, enabling greater independence.

Know-how CCs’ role supporting the product business’s operations calls for close alignment with product units’ strategies and processes. Shell Global Solutions, for example, emerged as a unit within R&D and only later became an independent Shell Group business. It continues to maintain tight links to R&D by exchanging product-unit and Shell Global Solutions personnel. The consultancy has developed important knowledge networks and acts as a hub for sharing technical experience and knowledge within Shell. It thus creates synergies for (and with) Shell’s product units.

As in the case of expert CCs, the services of know-how CCs do not represent a natural extension of the product business’s value chain and are partly aimed at customers other than the product business’s customers. That reduces the need for tight relations to the market units.

Spearhead CCs extend the offerings of their product business by providing services such as vendor assessment and business-development support. That brings them into contact with management representatives of key customers of the product business. Spearhead CCs are thus capable of developing market knowledge and valuable market relations. But although they can be valuable for the market units, they tend to be on the customer’s side, rather than on the product business’s side and may be perceived as a threat.

Market units often strive for a tight coupling with the consulting business in order to exert control. Spearhead CCs, however, must project an aura of independence to gain credibility —for example, in vendor-assessment assignments — and therefore require looser coupling to both market and product units. Spearhead CCs typically need their own market channels, the freedom to go beyond product units’ products, and flexibility in organizational routines. Consequently, as Scandtel Consulting developed from an integration CC into a spearhead CC, it changed its structural position from that of a market unit to a more independent role within Scandtel Holding, a division of autonomous businesses not directly linked to the core business of Scandtel.

Integration CCs, which offer services that leverage the product business’s products and capabilities, thrive on close ties to both market and product units. Constant coordination of the corporate consultancy’s strategies and operations with the overall strategies of the product business is critical, but when a product logic, rather than a solutions logic, is dominant, problems may arise. Unless there is a companywide understanding of the corporate consultancy’s business, the tightly coupled integration CC will have trouble maintaining its distinctive ability to provide customer-centric solutions.

Leveraging the potential of an integration CC therefore requires tweaking the product business’s dominant logic. It’s the job of senior managers to establish mechanisms to help the corporate consultancy adapt to both the market and product units — and vice versa.11 IBM successfully increased coordination by introducing a matrix organization — considerably increasing the power of IBM Global Services and its ability to influence the strategic agenda of the product business. For Louis Gerstner, the former CEO who transformed IBM, services were the key to a company capable of delivering integrated customer solutions. As Gerstner put it, “Had the effort to build IBM Global Services failed, IBM — or at least my vision of IBM — would have failed with it.”12

Transitioning

For many organizations, especially in the business-to-business segment, the ability to offer customer solutions rather than products will be essential for long-term survival. Profits and growth potential increasingly originate in an ability to solve customers’ problems, at the same time as margins on standardized stand-alone products are shrinking. This is most obvious in industries providing complex product systems, such as telecom or IT. However, other industries will most probably follow this trend as their level of complexity increases because of such factors as industry migration and deregulation.

Although the establishment of a corporate consulting operation may be a smoother way of becoming a solutions provider than a complete reorientation of a company, companies must guard against isolating customer orientation to a specific part of the organization — the corporate consultancy — in order to enable the traditional product business to go on with “business as usual.” Leveraging the potential of a corporate consulting operation for customer solutions requires the management of simultaneous distinctiveness and mutual adaptation. Awareness of the corporate consultancy’s mission has to be created throughout the product business, and traditional power structures in favor of the established product business have to be broken up in order to increase the influence of customer-oriented elements.

For managers, engaging in a solutions strategy by establishing corporate consultancies means building a conflict into their organization, a conflict between a product-oriented logic and a customer-oriented one. This is a conflict that may not be resolved but needs to be managed on an ongoing basis. Conflict resolution as well as teamwork skills will thus be essential skills of the manager aiming at a solutions strategy by corporate consultancies.

References

1. For a description of the customer-centric logic of solutions providers, see A.C. Hax and D.L. Wilde, “The Delta Model: Adaptive Management for a Changing World,” Sloan Management Review 40 (winter 1999): 11–28; and S. Vandermerwe, “How Increasing Value to Customers Improves Business Results,” Sloan Management Review 42 (fall 2000): 27–37. How product manufacturers are moving downstream in the value chain is described in R. Wise and P. Baumgartner, “Go Downstream: The New Profit Imperative in Manufacturing,” Harvard Business Review 77 (September–October 1999): 133–141.

2. The term corporate consulting is based on R.F. Good, “Pros and Cons of Corporate Consulting,” Journal of Management Consulting 2, no. 3 (1985): 29–34.

3. The SPRU research program at University of Sussex, United Kingdom, recently started a project on integrated solutions. For their outline of a capability framework, see A. Davies, P. Tang, T. Brady, M. Hobday, H. Rush and D. Gann, “Integrated Solutions: The New Economy Between Manufacturing and Services” (Brighton, U.K.: Science and Technology Policy Research [SPRU], 2001).

4. See N. Foote, J. Galbraith, Q. Hope and D. Miller, “Making Solutions the Answer,” The McKinsey Quarterly, no. 3 (2001): 84–97; and E. Cornet, R. Katz, R. Molloy, J. Schädler, D. Sharma and A. Tipping, “Customer Solutions: From Pilots to Profits” (New York: Booz Allen & Hamilton, 2000).

5. Establishing a product business based on a traditional service business involves a similar challenge of finding synergies. See S. Nambisan, “Why Service Businesses Are Not Product Businesses,” MIT Sloan Management Review 42 (summer 2001): 72–80.

6. Similar know-how CCs at Boeing and Hewlett-Packard are described as internal knowledge brokers in A.B. Hargadon, “Firms as Knowledge Brokers: Lessons in Pursuing Continuous Innovation,” California Management Review 40 (spring 1998): 209–227.

7. For a case description of the establishment of PeopleSoft Consulting, see M. Gregoire, “How PeopleSoft Created a Successful In-House Consulting Division,” Consulting to Management 12 (June 2001): 6–11.

8. For a description of how image is mirrored in organizational identity, see J.E. Dutton and J.M. Dukerich, “Keeping an Eye on the Mirror: Image and Identity in Organizational Adaptation,” Academy of Management Journal 34 (September 1991): 517–554.

9. Multiple identities are becoming more common as organizations face increasingly complex environments. In addition to corporate consultancies, there are joint ventures, co-ops, churches running banks and so on. For four recommended managerial responses to multiple organizational identities, see M.G. Pratt and P.O. Foreman, “Classifying Managerial Responses to Multiple Organizational Identities,” Academy of Management Review 25 (January 2000): 18–42. The authors consider various combinations of two dimensions: identity plurality and identity synergy. See also H. Bouchikhi and J.R. Kimberly, “Escaping the Identity Trap,” MIT Sloan Management Review 44 (spring 2003): 20–26.

10. See also R. Sandberg, “Managing the Dual Identities of Corporate Consulting: A Study of a CEO’s Rhetoric,” Leadership & Organization Development Journal 24, in press.

11. An ideal organizational design for this has recently been described as the “hybrid organization” and consists of customer-centric front-end units and product-centric back-end units, coordinated by a number of linking processes. See J.R. Galbraith, “Organizing To Deliver Solutions,” Organizational Dynamics 31 (fall 2002): 194–207.

12. For Gerstner’s own thoughts about IBM’s transformation, see L.V. Gerstner, Jr., “Who Says Elephants Can’t Dance? Inside IBM’s Historic Turnaround” (New York: HarperBusiness, 2002).

Comment (1)

Ryan Burglehaus