Beyond Selfishness

On Wall Street, where shareholder “value” is vigorously pursued through ever leaner and meaner organizations, business as usual changed abruptly on September 11, 2001. Within hours after the tragedy, obsession with self gave way to serving others. At the very epicenter of self-interest, people became engaged in collective effort.

There is a message for management in this. The point is not that concern for others is suddenly going to replace self-interest, but that there has to be a balance between the two. The events of September 11 and the following days helped to make evident how out of balance our society has become. The role of management — responsible management — is to work toward restoration of that balance.

The House That Self-Interest Built

In the past 15 years, we in North America have experienced a glorification of self-interest perhaps unequalled since the 1930s. It is as if, in denying much of the social progress made since then, we have reverted to an earlier and darker age. Greed has been raised to some sort of high calling; corporations have been urged to ignore broader social responsibilities in favor of narrow shareholder value; chief executives have been regarded as if they alone create economic performance. Meanwhile, concern for the disadvantaged — simple, old-fashioned generosity —has somehow been lost.

A society devoid of selfishness is certainly difficult to imagine. But a society that glorifies selfishness can be imagined only as base. The intention here is to challenge such a society — not to deny human nature, but to confront a distorted view of it. In so doing, we wish to promote another characteristic no less human: engagement.

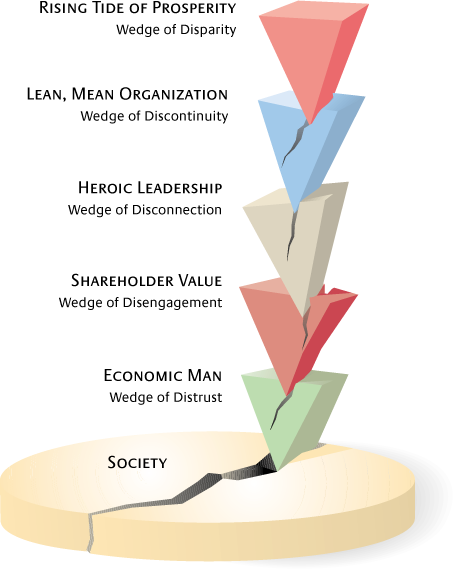

A syndrome of selfishness has taken hold of our corporations and our societies, as well as our minds. (See “A Syndrome of Selfishness.”) It is built on a series of half-truths, each of which drives a wedge into society: from a narrow view of ourselves as “economic man,” to a distorted view of our values — reduced to shareholder value, to a particular view of leadership as heroic and dramatic, to a nasty view of organizations as lean and increasingly mean, to an illusionary view of society as a rising tide of prosperity. All of this looks rather neat, as does a house of cards. Before it collapses outright, we would do well to balance it with a rather different set of beliefs.

It is important to note at the outset that Enron and the other companies now under investigation are not the problem. They are the tip of the iceberg — the exposed criminality. That can be dealt with in the courts of law. Far more massive and dangerous is the legal corruption taking place below the surface — behavior that, while technically allowable, corrupts our leadership, our organizations, our society and ourselves as human beings.

Below we take a look at each of these half-truths upon which the syndrome of selfishness is built. We refer to each as a “fabrication” to convey that they are assumptions we have constructed, not truths we have discovered.

First Fabrication: We Are All, in Essence, Economic Man

In this view of the world, we are all economic man, Homo economicus, obsessed with our own self-interest, intent on maximizing our personal gains. Homo economicus, in other words, is never satisfied, but always wants more — demonstrably, measurably more — and is continually calculating to achieve that end.

In “The Nature of Man,”1 an article that has profoundly influenced generations of M.B.A. students, finance professors Michael Jensen and William Meckling introduced five models of human behavior. The first three — sociological, psychological and political man — they quickly dismissed. The fourth, economic man, was not dismissed, but folded into their fifth and favored model, which goes by the rather convoluted label of Resourceful, Evaluative, Maximizing Model (REMM). The REMM postulates that everyone is an “evaluator,” constantly making “trade-offs and substitutions among” wants — specifically among the “amounts” of each. (That the amounts of some wants, such as money or diamond rings, can be evaluated and measured more easily than others, such as trust or integrity, is not discussed.) These wants are unlimited. REMMs cannot be satiated. And there are no absolutes.

According to Jensen and Meckling, “there is no such thing as a need,” except, of course, the need for more itself. Everything is a trade-off. They illustrate this with a rather startling example:

George Bernard Shaw, the famous playwright and social thinker, reportedly once claimed that while on an ocean voyage he met a celebrated actress on deck and asked her whether she would be willing to sleep with him for a million dollars. She was agreeable. He followed with a counterproposal: “What about ten dollars?” “What do you think I am?” she responded indignantly. He replied, “We’ve already established that — now we’re just haggling over price.”

The story is not startling — it is, in fact, well known — but Jensen and Meckling’s use of it is startling. For, instead of qualifying this in any way, they follow it with this statement: “Like it or not, individuals are willing to sacrifice a little of almost anything we care to name, even reputation or morality, for a sufficiently large quantity of other desired things… .” In other words, pushed to the limit, every woman — and every man — is a willing prostitute. Everything, everyone, every value has its price.

Our quarrel is not just with the outrageousness of this claim, but also with its degree of truth. For while there are all too many such people in our midst, perhaps more than ever — too many athletes or financiers or university professors, willing to sell their integrity at some price — mercifully, that does not include everyone. For many people, integrity and self-respect are basic values. They are absolute needs open to no negotiation. Beyond material goods lies an inner sense of what is good. Beyond calculation lies judgment. Indeed, is this not the essence of responsible management? To judge the difference between short-term calculable gains and deeply rooted core values?

The fabrication of economic man drives a wedge of distrust into society, between our individual wants and our social needs. When everyone merely calculates, we end up with a scheming society. “In the end,” write Jensen and Meckling, “we can do things to and for individuals only.” There is no society, no social glue. This may be the perspective of economics, at least a narrow side of it, encouraged by the collapse of communism that stood so dogmatically for collectivism. But dogmatic individualism is hardly better. If capitalism stands only for individualism, it will collapse too. For we live as individuals in a social space: We certainly need individual initiative but embedded in social engagement.

Ernst Mayr, described by Scientific American magazine as a “towering figure” in evolutionary biology, wrote in that publication in 2000 that recent research “widespread among many social animals” has suggested that “a propensity for altruism and harmonious cooperation in social groups is favored by natural selection. The old thesis of social Darwinism — strict selfishness — was based on an incomplete understanding of animals, particularly social species.”2

In her influential writings, Ayn Rand considered selfishness a virtue. But she had a particular view of selfishness and of individualism: the courage of the individual to confront the faceless, mindless system, to pursue beliefs as a need, not a want, at the expense of measurable gain, if necessary. Rand was, of course, railing against the socialist tendencies she saw manifested in Eastern Europe. But one might wonder how she would react to the influence of the REMM on the corporate system of today.3

Second Fabrication: Corporations Exist To Maximize Shareholder Value

Corporations used to exist, or so we once believed, to serve society. Indeed, that was the reason they were originally granted charters — and why those charters could be revoked. Corporations are economic entities, to be sure, but they are also social institutions that must justify their existence by their overall contribution to society. Specifically, they must serve a balanced set of stakeholders. That, at least, was the prevalent view until perhaps ten years ago. Now one group of these stakeholders — the shareholders — has muscled out all the others.

For years a group of chief executives of America’s 200 largest corporations, calling themselves the Business Roundtable, promoted this balanced view of the corporation, including a sense of corporate social responsibility. In 1981, their “Statement on Corporate Responsibility” stated:

Balancing the shareholder’s expectations of maximum return against other priorities is one of the fundamental problems confronting corporate management. The shareholder must receive a good return but the legitimate concerns of other constituencies (customers, employees, communities, suppliers and society at large) also must have the appropriate attention… . [Leading managers] believe that by giving enlightened consideration to balancing the legitimate claims of all its constituents, a corporation will best serve the interest of its shareholders.4

Then, in September 1997, the roundtable’s report on corporate governance announced an about-face: The paramount duty of management and of boards of directors is to the corporation’s stockholders. Period. The customer may be “king,” and the employee may be the corporation’s “greatest asset” (at least in the rhetoric), but the shareholder is the bottom line. The report reads, “The notion that the board must somehow balance the interests of stockholders against the interests of other stakeholders fundamentally misconstrues the role of directors. It is, moreover, an unworkable notion because it would leave the board with no criteria for resolving conflicts between the interest of stockholders and of other stakeholders or among different groups of stakeholders.”5

This reflects a fallacious separation of the economic and social consequences of decisionmaking. As economists like Milton Friedman would have it, business attends to the economic, whereas government takes care of the social. Perfectly simple, except for one fatal flaw: Every economist readily recognizes that social decisions have economic consequences, in that they cost resources. So how can any economist or business executive fail to recognize that economic decisions have social consequences, in that they directly impact human beings? As Nobel Prize-winning author Aleksandr Solzhenitsyn, who suffered under Soviet communism and later lived in the United States, commented:

I have spent all my life under a communist regime, and I will tell you that a society without any objective legal scale is a terrible one indeed. But a society with no other scale but the legal one is not quite worthy of man either. A society which is based on the letter of the law and never reaches any higher is taking very scarce advantage of the high level of human possibilities. The letter of the law is too cold and formal to have a beneficial effect on society. Whenever the tissue of life is woven of legalistic relations, there is an atmosphere of moral mediocrity, paralyzing man’s noblest impulses.6

In “The Divine Right of Capital,”7 Marjorie Kelly, herself an entrepreneur, compares the privileges of today’s shareholders with those of feudal aristocrats. Why, she asks, should one group — particularly a group so distant from the operations —that may have added nothing for years, lay claim to such a large share of the benefits? Are today’s workers akin to the peasants who toiled the land yet could be removed at the whim of the owners? Kelly’s is a provocative argument imbued with more than a grain of truth.

The emphasis on shareholder value represents a curious turnabout, for shareholders have traditionally been the “residual claimants” on the corporation — those who took the surpluses, namely the profits, after the other claimants had been paid off. Now the corporation is managed for those profits, no matter how much pressure that places on employees. Under the calculations of EVA (economic value added), for example, a charge for the cost of capital provided by shareholders is subtracted from the profit of the business. In effect, the business earns no profit until the shareholders receive their due. Shareholder wants have thus been transformed into shareholder needs!

Let us take a good look at what these shareholders own and how they own it. In the modern economy, with instantaneous information, global access to capital and Internet-based stock trading, fewer and fewer shareholders are in any way committed to the businesses they “own.” Giant mutual funds buy and sell millions of shares each day to mirror impersonal market indices. Alongside these are the day traders who buy and sell within hours, looking for arbitrage or momentum opportunities. During the 2000 bull market, they accounted for 15% of NASDAQ trades.8 These new breeds of shareholder may not be interested in products or services or customers, let alone the companies themselves; nevertheless, company managers live in mortal fear of their volatile actions.

The pressure not to “miss a quarter” — not to upset the expectations of the market analysts — can promote some awfully dysfunctional behavior. Executives are forced to watch the scoreboard instead of the ball, as the saying goes, to cut costs wherever savings show up immediately (in jobs eliminated, for example), even if long-term benefits are forgone; to squeeze extra sales out of premature deliveries; at worst, to cut ethical corners and sometimes engage in downright illegal actions. Recently, we have seen case after case of this. All for more “value.” Shareholder value: What a curious term for something that refers to the price of the stock!

Shareholder value thus drives a wedge between those who create the economic performance and those who harvest its benefits. It is a wedge of disengagement, both between the two groups and within each. Those who create the benefits are disengaged from the ownership of their efforts and are treated as dispensable, while those who own the enterprise treat that ownership as dispensable and so disengage themselves from its activities. One manager in a large bank refers to “this shareholder value craze” as “Draconian.” Another says that shareholder value “neither guides nor inspires employees.” Who can get fired up about making money for strangers who don’t even care about the enterprise?

The wedge of disengagement is also driven between a company and its customers, because the focus on ultimate financial performance tends to blind people to the means by which it is earned. Employees are encouraged to see dollar signs out in the marketplace and sources of shareholder value, not people in need of reliable products and services. So why not depreciate a respected brand for a quick boost in sales, or rush a questionable new product to market, or offer customer kickbacks to push up quarterly sales? Perhaps this is why the American Customer Satisfaction Index has declined steadily in almost every industry since the early 1990s.9 “Make the numbers and move on” seems to be the motto of the day. The problem is that you don’t really serve customers by serving yourself. You serve yourself by really serving customers.

Third Fabrication: Corporations Require Heroic Leaders

For decades, corporate shareholders remained passive. Indeed, famous books were written — from Berle and Means’ “The Modern Corporation and Private Property” in 1932 to John Kenneth Galbraith’s “The New Industrial State” in 1967 —about how managers had seized control of large corporations and manipulated shareholders for their own purposes. So pressures arose in the financial community to challenge this. The problem was fixed all right, but the pendulum swung the other way — with a vengeance.

How have these shareholders, so removed from the corporations, been able to appropriate so much of the benefits? The answer is rather simple: They have co-opted the chief executives by rewarding them disproportionately for the performance of the entire enterprise. Through options and bonuses, they have bought off the chiefs. According to a recent survey, “Executive Excess 2001,” conducted during the 1990s by the Institute of Policy Studies, CEO pay rose by 570%, while profits rose by 114%, and average worker pay rose by 37%, barely ahead of inflation (which was 32% over this period). Had workers’ pay kept pace, they “would have averaged $120,491 instead of $24,668” by the end of the decade.10 In 1999, while median shareholder returns fell by 3.9%, CEO direct compensation rose another 10.8%.11

Underpinning all of this is a massive set of assumptions: that the chief executive is the enterprise, that he or she alone is responsible for the entire performance, and that this performance can be measured and the chief executive rewarded to do the shareholders’ bidding. This kind of thinking has been reinforced by the all-too-willing media, hungry for personalities and simple explanations. Typical is this statement from the April 14, 1997, issue of Fortune: “In four years [Louis] Gerstner has added more than $40 billion to IBM’s share value.” Admittedly, Gerstner is a good CEO, but did he really do this all by himself?

But how could these chief executives, flesh-and-blood human beings like everyone else, deliver on such inflated expectations? By attempting to conform to the heroic images created and expected by the media and the shareholders. The obsession with shareholder value thus promoted the notion of heroic leaders, larger than life, riding in, not to save the day, but to raise the stock price. Heroic leaders announce magnificent strategies, do dramatic deals and promise grand results. Interestingly, as they gamble with other people’s money, these heroic “leaders” are protected no matter what happens: They cash in their options if the stock goes up and bail out with golden parachutes if it goes down — sometimes even both.

Could all the attention to shareholder value in the end prove to have actually depreciated shareholder value? Certainly there are success stories. But increasingly we find stories of failure, often dramatic, especially about executives who took their heroic personae seriously. Tales of heroic leadership gone awry can be told about John Sculley at Apple Computer, Michael Armstrong at AT&T, Rich McGinn at Lucent Technologies and Linda Wachner at Warnaco Group. Stay tuned to see what happens at DaimlerChrysler and Hewlett-Packard.

The problem with heroic leadership is that it is detached. It drives a wedge between the leaders sitting atop their pedestals and everyone else. This is a wedge of disconnection that sees leadership as something apart. Ironically, amidst all the talk of empowerment, partnership, knowledge work and the like, we are currently seeing a centralization of power along traditional hierarchical lines to a degree unmatched in decades.

Perhaps the reason we are so obsessed with leadership today is that we see so little of it. “Unhappy is the land that has no heroes,” comments a character in Bertolt Brecht’s “Life of Galileo.”12 “No,” replies another. “Unhappy is the land that needs heroes.”

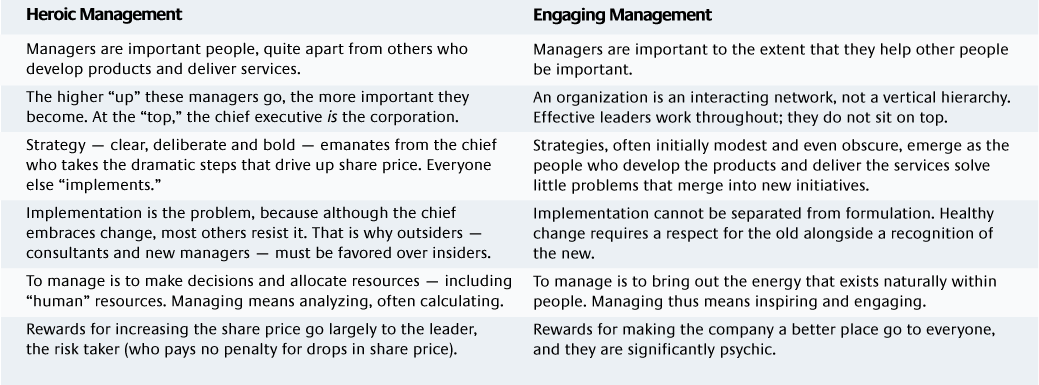

Real leadership is often more quiet than heroic. It is connected, involved and engaged. It is about teamwork and taking the long-term perspective, building an organization slowly, carefully and collectively. (See “Two Ways To Manage.”)

Fourth Fabrication: The Effective Organization Is Lean and Mean

“Lean and mean” is a fashionable term these days, a kind of mantra for economic man. “Lean” certainly sounds good —better than fat. But the fact that “mean” has been made into a virtue is a sad sign of the times.

There is nothing wonderful about firing people. Slash-and-burn tactics are merely the quickest way to “performance” in the absence of imagination. “Chainsaw” Al Dunlap, the master slash-and-burn artist, who eventually got slashed and burned himself, was not an aberration, but only the extreme example of a popular trend. In the year 2000, before the current downturn, U.S. employers discharged approximately 1.2 million workers in mass layoff actions — ending the year with the highest number of layoffs since the U.S. Bureau of Labor Statistics resumed calculating these statistics in 1995.13

Like the other easy assumptions of this syndrome of selfishness, lean and mean is supposed to offer it all: lower costs, higher productivity, flatter and more flexible structures, more empowered workers (with their bosses gone) and happier customers. It is often packaged in glib phrases like “doing more with less”and “win-win.”

Sure, all this can happen, but once again it is half the truth. The other half comprises burned-out managers, angry workers, quality losses in the guise of productivity gains and disgruntled customers. Lose-lose. Thus, the chief economist for Morgan Stanley Dean Witter, writing about “the dirty little secret” of the productivity miracle of the last decade, suggests that there may be more “perspiration than inspiration” here — “… in other words, pushing people and machines to their limits rather than discovering smarter ways to run economies.”14

Perhaps the worst consequence of all this restructuring has been the breaking of a basic covenant between employer and employee: the implicit pledge of security in return for loyalty. People feel betrayed these days. “Is share-owner value a threat to your job? Or will it sustain your career?” asked a Coca-Cola brochure published for employees in 1996. Four years later, employees received an answer as 6,000 of them — about 20% of the workforce — were laid off.15 Hewlett-Packard, long famous for its commitment to its employees, has now followed suit. No wonder one recent study reported that only 34% of employees worldwide felt a strong sense of loyalty to their employers; in the United States, only 47% saw the leaders of their companies as people of high personal integrity.16

These feelings of betrayal in the workforce cannot help productivity in the long run, but productivity does not seem to be measured in the long run these days. Quarterly earnings per share are easier to measure. So the lean and mean organization drives a wedge of discontinuity between the present and the future.

It has been said that the greatest advance in health care was not penicillin or insulin but simply cleaning up the water supply. Maybe it is time to develop healthier organizations by cleaning up our attitudes. We need economic sustainability too, in addition to social and environmental sustainability.

Fifth Fabrication: A Rising Tide of Prosperity Lifts All Boats

The notion of win-win has gone beyond the lean, mean corporation into the entire society. As this homily would have it, a rising tide of prosperity lifts all boats: Everyone prospers in the selfish economy. This amounts to either a wonderfully convenient truth or a cynical justification for greed: The winners needn’t worry about the losers, because there are no losers. All consciences can rest assured.

Let us take a look at this metaphor and then at some facts. First, tides are regular. If anything, this syndrome of selfishness has created a tidal wave. A tidal wave lifts only those boats that are moored to nothing. The rest, which are connected to real things, get swamped, as do the lowlands, where the people drown if they have nowhere else to go. Are we to be concerned only with people in high places? Moreover, tides and tidal waves are not sustainable. They eventually fall back as far as they have risen, only to reveal the devastation that has been hidden by the waters.

Our point is not to stem the tide, so to speak, but rather to challenge the simplistic and blinding use of a metaphor —indicative of so much of the rhetoric of this syndrome of selfishness. Metaphors can be used creatively to open vistas or mindlessly to hide evidence. What evidence does this one hide?

In 1989, the United States had 66 billionaires and 31.5 million people living below the official poverty line. A decade later, the number of billionaires had increased to 268, whereas the number of people below the poverty line had increased to 34.5 million.17 A recent survey of the world’s 18 wealthiest countries by the United Nations ranked the United States highest both in gross domestic product and poverty rates.18 Given these figures, it should come as no surprise that the stock market gains between 1989 and 1998 went disproportionately to the rich. The wealthiest 10% of American households saw their stock market holdings increase by more than 72%, while those in the bottom 60% of the income ranking saw their holdings increase by less than 4%.19 In 1999, at the height of the economic boom, one in six American children was officially poor, and “poverty was more acute than in prior years, while income inequitably remained at record levels.”20

Despite increases in income among some groups during the 1990s, the inflation-adjusted minimum wage is 21% lower today than in 1979. In 1999, 26% of all workers were in jobs paying poverty-level wages, a larger share than in the past.21 Overall, the top 1% of households saw their after-tax income rise by $414,000 from 1979 to 1997 (exclusive of their capital gains), while the middle fifth gained $3,400 and the bottom fifth actually lost $100.22

Much has been made of the diffusion of stock ownership in the United States and of companies pushing stock options beyond the executive suite. Here, too, some figures are revealing. Stock ownership is clearly up — about 16% in the past 10 years. But more than half the population owns no stocks or mutual funds, and only one-third of all households hold stock worth $5,000 or more.23 And the plunges in high-tech stocks, bankrupting some employees who had cashed in their options and then had to pay taxes, have hardly encouraged more stock ownership. Should a society feel comfortable when more than 30% of its households have a net worth, including homes and investments, of less than $10,000?24

Is this, then, a rising of the tide or a shifting of the waters? Has a wedge of disparity been driven between the prime beneficiaries of stock price increases and the large numbers of people disadvantaged by the corresponding actions? Moreover, many of those who have done best in this economy — REMMs, in constant quest for “more” — have led a relentless and successful attack on taxes, further undermining protections for the most disadvantaged people in society. In the U.S., the wealthy today “pay a lesser share of vastly increased incomes” — and yet continue to win advantage in the form of tax cuts. 25

Internationally, in some significant pockets at least, the disparity of wealth has become alarming. In certain countries in South America (e.g., Bolivia, Paraguay) and Africa (e.g., Central African Republic, Guinea-Bissau, Lesotho, Sierra Leone), the top 20% of the population receives more than 60% of the country’s income, while the bottom 10% of the population receives less than 1%.26

As a part of the “rising tide” metaphor, people around the world are promised that free trade will solve every social problem. Win-win once again. The economic will magically take care of the social. Certainly economic development helps to foster social improvement. But no less certainly, social development (such as free elections) helps to foster economic improvement. It appears that the two have to work in tandem, which means that economic development with social regression may be destructive. That seems to be the experience of a number of “developing” countries.

Prosperity is not just economic and cannot be measured by averages alone. It has to be societal too, and that depends on distribution. Real prosperity combines economic development with social generosity. Have we made progress in recent years? Economically, it is not clear. Societally, it is all too clear.

A series of damaging wedges has been driven into our social fabric. They will harm us more severely — all of us — if they are not soon removed. Which is not to say that material wants, benefits for stockholders, leadership, productive efficiency, economic prosperity and even selfishness should be challenged per se. But they must be rejected as ends in themselves. The calculus of glorified self-interest and the fabrications upon which it is based must be challenged.

Toward Engagement

Logical argument supported by factual evidence may be an appropriate way to confront the syndrome of selfishness, but not the most effective way to promote engagement, for that is a different phenomenon. Engagement is rooted in experience — in the stories of those whose actions have promoted the values of trust, judgment and commitment. There are many such stories.

A woman at State Farm Mutual Insurance Co. was converting a paper database into an electronic one. “Why are you working so energetically?” someone asked her. “Don’t you know that you are working yourself out of a job?” “Sure,” she answered, “but I’ve been here long enough to know that I can trust them. They’ll find something else for me. If I didn’t believe that, I might be tempted to sabotage the process.” How much sabotage has been taking place in our lean and mean organizations? Imagine, in contrast, the value — including shareholder value — of this kind of engagement.

Consider Alistair Pilkington, an engineer in Pilkington Glass (a family-owned company, although he was not a relative). One evening, while doing the dishes at home, he got an idea for a new way to make plate glass by floating it on a bath of tin. The board encouraged him, and the experiments began. The board maintained its support through seven years of problems and negative cash flow, not to mention 100,000 tons of glass thrown away. When board members asked, “Can you make saleable glass?” Pilkington answered: “I don’t know, but nothing has proved it’s impossible.” Eventually the process was perfected, the patents were granted, and the company licensed the process worldwide — soon every new factory in the industry used it.27

Read the strategy books and you will not get the impression that remaking a production process is strategy, especially when championed by a lowly engineer who thought of it while doing the dishes. Read the finance press and ask yourself which analysts today would tolerate seven years of failure. “It isn’t just what you do this year that matters,” said one Pilkington director later, “but what you are working on that is going to bear fruit in ten years’ time. It is important that the company is not only profitable, but also has a ‘heart.’ ” This company had a heart, and it made a great deal of money too. The man who championed the new process eventually became chief executive.

IBM’s entry into e-business was driven by two people far removed from the formal leadership, a “self-absorbed programmer” who had the initial idea and beat all sorts of people over the head to get them to understand it, and a staff manager who picked up the ball and somehow, with hardly any resources, stitched together the loose team of people that made it happen.28 Of the latter, one manager said: “[He] was hard to refuse [in his initiatives] partly because it was clear that he was operating in IBM’s interest as a whole and not just fighting for his own little group.”When first presented with the idea, CEO Louis Gerstner recognized the initiative’s potential and encouraged it. Gerstner, who according to the Fortune report cited earlier, added $40 billion to the company’s share value all by himself, played a background role. Of course, he may have set the tone that enabled such things to happen in the first place. But that is often what real leaders do. It may be that the truly effective CEO is more quietly supportive than dramatically heroic.

Sixty years ago, after a decade of depression, there was an enormous surge in the U.S. economy. American men and, in unprecedented numbers, women engaged in the efforts of World War II, pulling together after one of the most divisive decades in the nation’s history. Thousands of people laid down their lives; many others toiled in factories and bought government bonds in huge numbers — not to make their fortunes but to further the cause. This surge of collective effort, according to Charles Handy, “violated many of the precepts of allocative efficiency but pushed GDP up by 50% in four years and laid the basis for subsequent growth.”29

That surge of cooperative human engagement carried the United States through the war and then began to recede. It has been receding ever since. It was arguably at its lowest point since 1945 when a catastrophe occurred in New York City and shades of that earlier engagement reappeared. Perhaps it represents an opportunity for fundamental change. Jensen and Meckling were right in one limited respect. We do have a trade-off to make, one crucial choice facing each of us as individuals. We can live our lives and manage our enterprises obsessed with getting ever more, with keeping score, with constantly calculating and scheming. Or we can open ourselves to another way, by engaging ourselves to engage others so as to restore our sense of balance.

References

1. Originally published in M.C. Jensen and W.H. Meckling, “The Nature of Man,” Journal of Applied Finance, 7, no. 2 (1994): 4–19 (revised July 1997).

2. E. Mayr, “Darwin’s Influence on Modern Thought,” Scientific American, July 2000, 83.

3. See, for example, A. Rand, “The Virtue of Selfishness” (New York: New American Library, 1965).

4. “Statement on Corporate Responsibility” (New York: Business Roundtable, October 1981), 9.

5. “Statement of Corporate Governance” (Washington, D.C.: Business Roundtable, September 1997), 3.

6. A. Solzhenitsyn, “How the West Has Succumbed to Cowardice,” Montreal Star, News and Reviews, June 10, 1978, p. B1.

7. M. Kelly, “The Divine Right of Capital: Dethroning the Corporate Aristocracy” (San Francisco: Berrett-Koehler, 2001).

8.T. O’Brien, “The Day Trader Blues,” Upside, January 2000, 182–192.

9. American Customer Satisfaction Index, Q1, 2001, National Quality Research Center, University of Michigan Business School, Ann Arbor; www.bus.umich.edu/research/nqrc.

10. S. Anderson, J. Cavanagh, C. Hartman and B. Leondar-Wright, “Executive Excess 2001” (Washington, D.C.: Institute for Policy Studies, 2001), 1.

11. J.S. Lublin, “Executive Pay (A Special Report). Net Envy,” Wall Street Journal, Apr. 6, 2000, p. R1.

12. B. Brecht, “Life of Galileo,” trans. J. Willett, ed. R. Manheim (New York: Arcade Publishing, 1995)

13. “Extended Mass Layoffs in 2000,” Report 951, U.S. Department of Labor, Bureau of Labor Statistics, July 2001, p. 1.

14. International Herald Tribune, Feb. 15, 2000.

15. P. Barta, “In Current Expansion, As Business Booms, So, Too, Do Layoffs,” Wall Street Journal, March 13, 2000, p. A1.

16. A. Keeton, “Only 34 Percent of Employees Feel Loyal,” Montreal Gazette, Oct. 9, 2000.

17. C. Collins, C. Hartman and H. Sklar, “Divided Decade: Economic Disparity at the Century’s Turn” (Boston: United for a Fair Economy, 1999), 2.

18. E. Olson, “Rights and Strong Economies Go Hand-In-Hand, UN Finds,” International Herald Tribune, June 30, 2000.

19. L. Mishel, J. Bernstein and J. Schmitt, “The State of Working America: 2000-2001” (Ithaca, New York: Economic Policy Institute, Cornell University Press, 2001), 270.

20. “Poverty in the U.S.,” International Herald Tribune, Sept. 29, 2000.

21. Mishel et al., “The State of Working America: 2000–2001,” 353.

22. “Richer and Richer,” International Herald Tribune, June 7, 2001, p. 8.

23. Mishal et al., “The State of Working America: 2000–2001,” 266–267.

24. Mishal et al., “The State of Working America: 2000–2001,” 264.

25. “The Gulf Widens,” Washington Post, June 5, 2001, A20.

26. World Bank, “World Bank Section 28, Distribution of Income or Consumption,” in “World Development Indicators 2001,” 70–72.

27. J.B. Quinn, “Pilkington Brothers P.L.C., Case 3–1,” in “The Strategy Process (Concepts, Contexts, Cases),” eds. H. Mintzberg and J.B. Quinn (Englewood Cliffs, New Jersey: Prentice Hall, 1991), 826–844.

28. G. Hamel, “Waking Up IBM: How a Gang of Unlikely Rebels Transformed Big Blue,” Harvard Business Review 78 (July/August 2000): 137–146.

29. “The Invisible Fist,” The Economist, Feb. 15, 1997.