How Global Is Your C-Suite?

Despite globalization, the vast majority of the world’s largest corporations are run by CEOs native to the country in which the company is headquartered. But more executive diversity at the top is sorely needed — and will require sweeping changes in how companies are organized.

The globalization of companies can be — and frequently has been — looked at in different ways: in terms of the internationalization of sales or assets, cross-border supply chains or shared services, organizational structures, functional policies (marketing standardization versus customization) and so on. In this article, we look at much less studied individual measures of globalization: the extent to which the managers who head the world’s largest corporations — at the CEO level and at the level of the managers listed as reporting directly to him or her (henceforth, the top management team) — are native or not to the country where the corporation is headquartered.

The Positive Consequences of National Diversity

Are the national origins of those who run the world’s largest corporations even worth considering? Despite all the research on “upper echelons theory,” at least some people think not. Some rely on author Thomas Friedman’s memorable characterization of the world as “flat” to aver that everybody, everywhere, is subject to the same forces of globalization, irrespective of nationality.1 However, the data suggest that most international interactions are, in fact, semiglobalized, and closer to the “zero-integration” extreme than to the “complete-integration” extreme — usually by a wide margin.2 And in terms of changes, a globalization index that one of us (Ghemawat) compiles annually indicates that current levels of globalization are still below those reached before the global financial crisis.3

A second, related argument about the irrelevance of nationality focuses on giant corporations that can seem to be “floating above a flat earth” (another phrase of Friedman’s),4 detached from all national contexts. To be more specific, consider one example Friedman cites: Lenovo Group, the Chinese company that bought IBM’s PC business in 2005. Lenovo does have roots in the United States — especially on the technology side — as well as in China, but having roots in two countries is very different from rootless cosmopolitanism. And the company’s Chinese roots arguably run deeper than its U.S. roots; as a result, the U.S. government publicly scrutinized Lenovo’s 2014 acquisition of IBM’s low-end server business. Even more important, Lenovo is exceptional among large companies rather than representative in regard to the seven nationalities represented on its top management team.

What are the consequences of having natives or nonnatives on the top management team of a company? It is useful to note a general proposition about diversity: Given the difficulties of working across divides, diverse groups can perform worse than homogenous groups.5 Probably for this reason, one recent study concludes that national diversity of top management teams becomes advantageous only in companies with a high degree of internationalization.6 Other studies, however, are less equivocal. A study published in Strategic Management Journal in 2013 concludes that nationality diversity on the top management team “is among the few diversity attributes that help increase firm performance” and “the effects of international experience and functional diversity diminish over time, whereas the impact of nationality diversity becomes stronger.”7 Another study of gender and national diversity on senior teams finds that “for companies ranking in the top quartile of executive-board diversity, ROEs were 53% higher, on average, than they were for those in the bottom quartile. At the same time, EBIT margins at the most diverse companies were 14% higher, on average, than those of the least diverse companies.”8

Given that many companies from advanced countries are looking for growth far from home, employing nationals from the target countries may help forestall some of the “liabilities of foreignness.” The consulting firms McKinsey and Bain, for example, have both counseled companies to “think global, hire local.”9 CEOs themselves routinely cite the lack of qualified managers as the key constraint on their ability to implement their emerging-market strategies. And visits by CEOs or other upper-echelon managers, even when feasible (for example, in a large market like China), are no panacea and can, if pushed past a certain point, turn into a problem.10

Another explanation of the positive effect of diversity on performance has to do with group creativity. In the words of Scott Page, a social scientist at the University of Michigan:

People from different backgrounds have varying ways of looking at problems, what I call “tools.” The sum of these tools is far more powerful in organizations with diversity than in ones where everyone has gone to the same schools, been trained in the same mold and thinks in almost identical ways.11

Other research on this topic reminds us that cognitive diversity, or multiplicity of perspectives, must be supported by appropriate structures and processes for it to have positive effects. Thus there are suggestions, particularly relevant to contexts that are dominated by one group, that a “lone ranger” — in the present context, a single nonnative on a company’s top management team — may have trouble influencing group deliberations.

C-Suite Diversity Sends a Signal

In addition to such direct effects of national diversity on performance, there is another indirect but presumably powerful effect due to signaling. If a large share of a global company’s assets, sales and employees are located outside its home country, yet it consistently chooses top leaders who are natives of its home country, that signals limited long-term career prospects for foreign middle managers already in the company as well as for potential hires. For example, according to a Corporate Executive Board survey, highly skilled Chinese professionals’ preference for working in multinational over domestic companies in 2010 was only half as strong as it was in 2007.12 Anecdotal evidence indicates that the expectation of greater upward mobility in local companies is an important contributor to their rising attraction.

Conversely, selecting a nonnative can serve as a very powerful signal as well. Thus, when Satya Nadella, born in India, was appointed CEO of Microsoft, the move was significant partly because of the assurance it provided about the absence of glass ceilings at the company — presumably particularly valuable to the estimated one-third of Microsoft’s workforce that is Indian.13

Natives Rule the Roost

We have suggested that the level of national diversity of the top management teams of large companies might be of concern. This section uses new data to shed some light on the magnitude of the possible problem. It is subject to two main caveats. First, the analyses presented are simple — mostly descriptive. We justify this on the grounds that we are simply addressing the lack of well-researched and easily comprehensible facts that might help anchor discussions of this topic in reality. Second, we focus on just one measure of globalization at the personal level: being born “abroad,” that is, in a country other than the one in which the corporation one leads is headquartered (although we also examine whether nonnatives are from within the home region or not, and the number of nationalities represented on a company’s top management team). Obviously, one could look at many other measures of personal globalization: experience living, studying or working “abroad,” having foreign-born parents, speaking multiple languages and so on. Since classifying the members of the top management teams of the Fortune Global 500 by where they were born stretched available resources, we did not extend our analysis to these other dimensions.

The basic pattern emerging from our research, both at the CEO and the top management team level, is unmistakable: Even at the world’s largest companies, natives generally rule the roost. Let’s start at the CEO level, for which we have data on the Fortune Global 500 for the years 2013 and 2008.

In 2013, only 67 of the 500 companies had a foreign CEO; at about 13%, the share hasn’t changed much since 2008, when it stood at 14%.14 The small decline can be attributed to the growing proportion of Fortune Global 500 companies from emerging economies in general and from China in particular — the number of Chinese companies on the Fortune Global 500 tripled from 29 in 2008 to 89 in 2013 — where the prevalence of foreign CEOs tends to be well below the global average. So the percentage of CEOs that is nonnative has stagnated at less than one-half the foreign share of total sales, which averages 30% or more for the Fortune Global 500.

This stagnation occurred despite significant CEO turnover between 2008 and 2013. Of the companies in the Fortune Global 500 in 2008, 386 (77%) were still on it in 2013, and 207 (54%) of these changed CEOs. In other words, about one in two survivors had the opportunity to switch CEOs. But there were few switches from a native CEO to a nonnative. Of the 173 companies with a native CEO in 2008 that changed CEOs, 157 (91%) had another native CEO in 2013.

Also striking is the opposite effect at the 34 companies that had a nonnative CEO in 2008 and switched CEOs by 2013: More than half of them (18) had another nonnative CEO in 2013. In other words, there appears to be an acculturation effect — once a company gets used to having a nonnative CEO, it is much more likely to accept nonnatives in the future.

Broadening the 2013 analysis from the CEO level to the full top management team, we find that on average 15% of their members, excluding the CEO, are not natives of the country where the corporation is headquartered. Note that this percentage is only slightly higher than the percentage of nonnative CEOs (13%).

All the figures mentioned above are global averages that mask large variations. We find that four factors are correlated with the likelihood of nonnatives in the upper echelon of a company:

- the internationalization levels of a company’s sales, assets and employees;

- the country where the company is headquartered;

- the sector in which the company is active;

- the incidence of nonnatives in the company’s other upper echelons.

Company Internationalization Levels

The incidence of nonnatives at the top is significantly higher in companies with a significant amount of business outside their home countries. Since the data available on the Fortune Global 500 in this regard are limited, we consider — just for this subsection — the United Nations Conference on Trade and Development (UNCTAD) list of the world’s top 100 nonfinancial transnational companies; this list provides data on the share of assets, sales and employees located outside the company’s home country.15

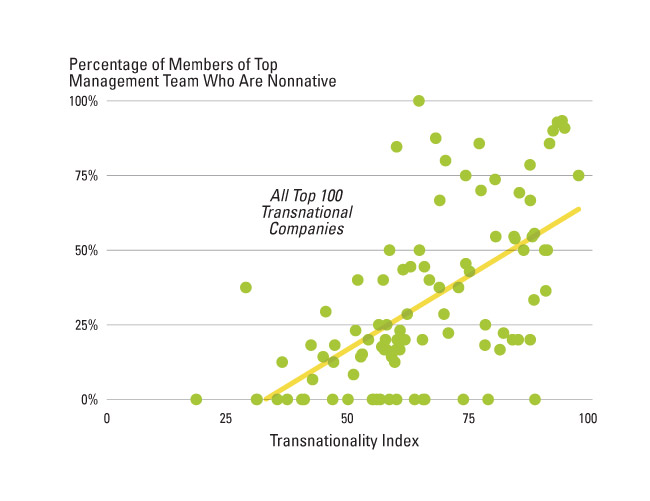

The UNCTAD 100 (with average revenues in 2013 of $93 billion) are larger companies, on average, than the Fortune Global 500 companies (which had average revenues of $62 billion in 2013) and — based on the data available for the latter as well — more internationalized. The UNCTAD 100 derive more than two-thirds of their sales from outside their home country, versus about one-third for the Fortune Global 500. Therefore, as one might expect, the UNCTAD 100 display a higher incidence of nonnative top executives: Based on our analysis, 29% of UNCTAD 100 CEOs were nonnative and 32% of the top management team were. Despite the higher percentage, however, the percentage as a fraction of foreign sales — roughly half — is similar to that of nonnative CEOs for Fortune 500 companies. There is a significant positive correlation (r = 0.60) between the incidence of nonnatives in the top management team and these companies’ Transnationality Index — the average of the shares of assets, sales and employees that are outside the home country. (See “Transnational Companies and Nonnative Top Executives.”)

Transnational Companies and Nonnative Top Executives

In analyzing UNCTAD data about the top 100 nonfinancial transnational companies,i we found a significant positive correlation (shown by the trendline in the graph below) between the incidence of nonnatives in the top management team and these companies’ Transnationality Index — the average of the shares of assets, sales and employees that are outside the home country.

Country Characteristics

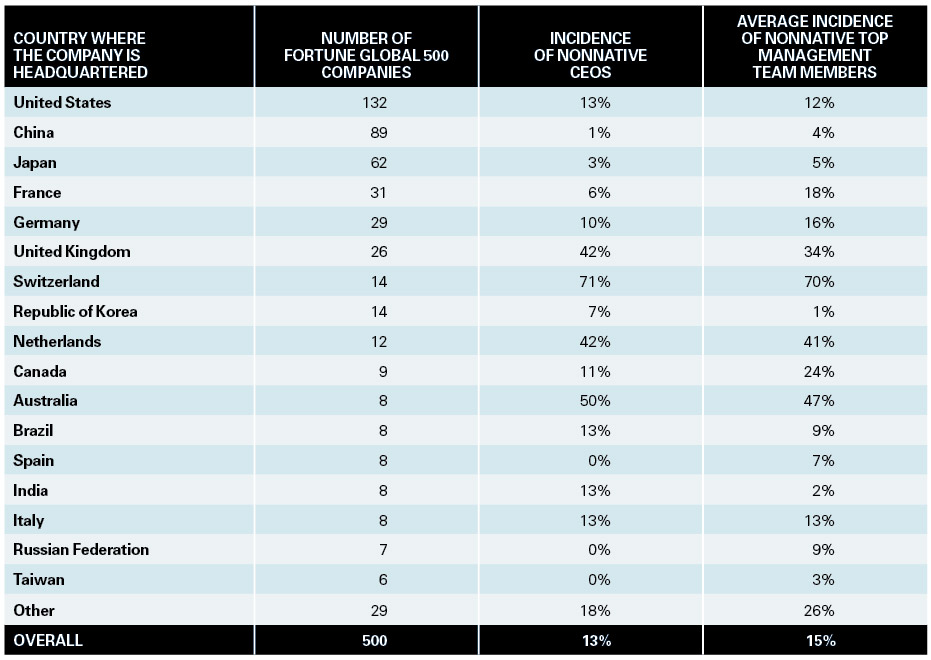

The average incidence of nonnatives in the upper echelons of the Fortune Global 500 masks very large variations across countries. (See “How Common Are Nonnative CEOs and Top Management Team Members?”) Companies in Switzerland, Australia, the Netherlands and the United Kingdom tend to have the most cosmopolitan top management teams. The figures for the United States fall close to the global averages, while Japan scores lower, with only two of the 62 Japanese companies having a foreign CEO in 2013 (the same absolute number as in 2008). And the percentages for some emerging economies are also lower than the global averages.

How Common Are Nonnative CEOs and Top Management Team Members?

Our analysis of the 2013 Fortune Global 500 companies found that there are large variations across countries in how frequently executives born outside the home country are represented in the top management team. Companies in Switzerland, Australia, the Netherlands and the United Kingdom tend to have the most cosmopolitan top management teams.

Eyeballing the data, it is clear that the proportions of nonnative CEOs and top management team members are closely related at the country level. In terms of explaining cross-country variation, the likelihood of having a nonnative member of the top management team increases with a country’s level of development and decreases with the size of its economy. Linguistic effects also appear to be important: English-speaking countries, in particular, can draw on a wider pool of talent. But the extent to which citizens of a country speak multiple languages also seems to matter. For example, Dutch citizens are more likely than Spanish citizens to speak a foreign language,16 and 42% of Dutch companies in the Fortune Global 500 have nonnative CEOs, compared to none of the Spanish companies.

This list of influences could be lengthened greatly by considering other country-specific factors. The upper echelons at the largest French companies, for example, are dominated by people who graduated with top grades from one of France’s grandes écoles and spent some time in a government cabinet — creating obvious barriers to entry for “outsiders.”17 Likewise, various explanations have been offered for the sparseness of foreign executives at Japanese companies: Language and communication barriers are formidable; Japanese top managers form an impenetrable web of personal relationships established at elite universities; human resources practices are not in sync with global standards; executive pay is uncompetitive; the practice of rewarding seniority and loyalty turns off ambitious outsiders; and a culture of avoiding uncertainty exasperates managers bent on rapid change.18

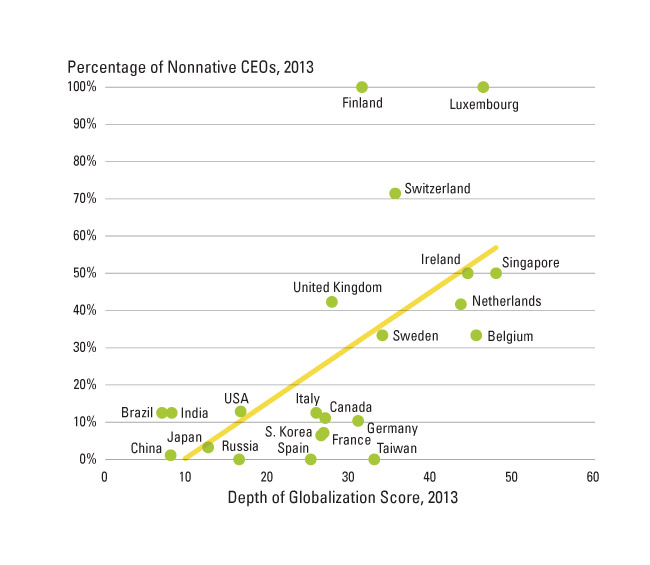

But instead of pursuing further country-by-country explanations, we prefer to report a striking cross-country correlation between a country’s globalization in terms of the nonnativity of the CEOs of its Fortune Global 500 companies and the depth of globalization of its economy in general, as measured by the DHL Global Connectedness Index.19 (The index relates the size of an economy’s international trade, capital, information and people flows to its domestic economy.) There is a significant correlation between the two factors (r = 0.46). (See “Nonnative CEOs and Country Depth of Globalization.”) It is interesting to speculate about the direction of causality, if any.

Nonnative CEOs and Country Depth of Globalization

We found a correlation (shown by the trendline in the graph below) between a country’s globalization in terms of the nonnativity of the CEOs of its Fortune Global 500 companies and the depth of globalization of its economy in general, as measured by the DHL Global Connectedness Index. Depth scores are drawn from the authors’ analysis of the DHL Global Connectedness Index 2014. Note: For readability purposes, we exclude countries that have both 0% of foreign CEOs and fewer than five Fortune Global 500 companies.

Sector Characteristics

The likelihood of having a nonnative CEO at a Fortune Global 500 company varies considerably, depending on the sector in which the company is active.20 Foreign CEOs are the most prevalent in health care/pharmaceuticals, business services and consumer/retail, with little change over time. Many of the leading companies in these sectors have exhibited relatively high internationalization levels for a long time. And the majority of them are headquartered in the United States or Europe, where, as noted above, there is more of a tradition of developing foreign executives. In addition, home-country networking (especially with public officials and regulators) appears to be less important in these sectors — with the possible exception of health care/pharmaceuticals — than in sectors such as construction, transport, banking or energy.

Complementarities at the Top

Another striking pattern in the data relates to complementarities across different upper-level subechelons. The proportion of nonnatives in a company’s top management team is strongly correlated with the presence of a nonnative CEO. At the Fortune Global 500 companies with foreign CEOs, on average 45% of the top management team members are foreign as well, compared with only 11% at companies with native CEOs. Roughly half of foreign top management team members are from the same region of the world as company headquarters and roughly half from a different region.21

Of course, such correlations beg the question of causality. When companies tend to promote CEOs from within, the presence of nonnative executives on the top management team should raise the likelihood of nonnatives being appointed as CEOs. Alternatively, or in addition, a nonnative CEO may be more inclined to promote other nonnatives to the top management team. The importance of the first mechanism is signaled by the fact that 12 of the 16 companies in our sample that switched from a native to a nonnative CEO between 2008 and 2013 did so by promoting from within. Support for the second mechanism comes from our analysis of the boards of directors of UNCTAD’s 100 largest nonfinancial transnational companies. At the 21 companies with a chairman who is different from the CEO and not native to the country where the company is headquartered, 86% have a nonnative CEO as well, compared to 9% at the 43 companies with a chairman who is different from the CEO and native.22 Also note that if the chairman is nonnative, the percent of nonnatives on the board of directors rises to 59%, compared to 18% when the chairman is native.

It is worth adding that irrespective of which of the two mechanisms dominates in a particular case, the presence of a foreign CEO is relatively easy for outsiders to check and — given the correlations reported above — seems to serve as a simple and fairly reliable indicator that the company is open to foreign managers in general.

Levers for Change

We have provided some evidence that the degree of nativism in the upper echelons of the world’s largest companies may be a matter of concern to them, both because of its direct implications for performance and because of what it signals to nonnatives in the rest of the organization. In cases where excess nativism in the executive ranks is a concern, what can be done to address it? The most obvious way to relax some of the constraints that limited executive diversity can impose is to seek to change the composition of the top management team over time. But we can think of at least half a dozen other levers for enhancing a company’s ability to deal with international differences and distances. As a memory aid, we organize them in terms of the CHANGE acronym: Changing the mix of nationalities at the top; Hiring and promoting to broaden the pool of employees; Altering locations (and other structures); Networking across borders; Gestures and symbols; and Educating employees about globalization.

Changing the Mix of Nationalities at the Top

Especially in light of the correlations among nonnativity at the CEO, top management team and board director levels, how might a company that is native along all these dimensions but intent on changing that get started? Bekaert, the global steel wire company headquartered in Belgium, counts more than 70% of its sales in emerging markets. Yet its CEO and eight top management team members were all Belgians — until 2014. When the incumbent CEO moved to the chairman position that May, the brief to the executive search firm explicitly included the need to search for a nonnative CEO. The search led to the appointment of Matthew Taylor, who is British.

To cite another example in a slightly different vein, ABB Ltd., the engineering multinational headquartered in Zurich, Switzerland, had a nationally diverse board and top management team but nonetheless inducted Joe Hogan, an American, as CEO in 2008 because its board was looking for ways to bolster its historically weak position in the United States. (ABB’s previous big move there, the acquisition of Combustion Engineering, created major headaches for the company.23) During Hogan’s tenure as CEO, ABB spent more than $10 billion on acquisitions in the United States, with much better results. Even a highly diverse company benefited from inducting a top manager with local knowledge of a key target market.

Of course, both these dramatic changes were probably eased by country characteristics — Belgium and Switzerland both rank very high in terms of nonnativism in the executive ranks of their largest companies — as well as company-specific factors. Yanking a native CEO for a nonnative one may strike many companies as too risky a move, in which case they might begin by inducting nonnatives onto the top management team or the board — and ideally not just as tokens. Consider Accenture — now headquartered in Ireland and headed by a Frenchman, but formerly headquartered in Bermuda and headed by an American, William Green. Green, who became CEO in 2004, deliberately built up the non-U.S. component of his top management team and was succeeded by a Frenchman, Pierre Nanterme, as CEO and then chairman. The importance of promotion from within, in transitions from native to nonnative CEOs (discussed earlier), suggests that this less direct approach may in fact be more common.

Hiring and Promoting to Broaden the Pool

Companies can also enhance the likelihood of nonnatives — and more broadly, people with cross-border experience — eventually reaching the top by broadening the employee pool at all points in the pipeline, not just in the upper echelons. Attention in recruiting might be paid to people’s openness, curiosity about the world and ability to adapt; it is often easier to hire for such attributes than try to foster them later. Thus, when recruiting for its management trainee program, Nestlé S.A. favors applicants with dual nationality, international parentage or those who have lived in multiple countries. But that’s a very sophisticated example; many companies could improve if they simply discarded obviously dysfunctional policies. At the top U.S. business schools, for instance, some “global” companies still interview foreign citizens only for postings back home!

With or without changes in recruiting, one could also imagine enormous benefits from career development and promotion policies that boost retention of the right kind of talent — and investments in one’s own development that also make sense from a company perspective. Local talent — particularly in emerging economies, where most of the increases in employment in many sectors are concentrated — needs to feel that the company offers a viable development path. So do expatriates. Unfortunately, research suggests that executives at European and U.S. multinationals who take on international assignments take longer to make their way up the corporate ladder to the top executive ranks.24 And more than 60% of respondents to a survey during a 2011 EIU Talent Management Summit agree that a posting in a major emerging or developed market should in principle help one’s career prospects, but only 27% believed this was reflected in their company’s talent-development strategy.25 Such patterns and perceptions will have to change if companies are serious about building up global bandwidth by reversing some of the large cutbacks in cross-border assignments since the late 1990s: According to one study, the percent of expatriates in senior management roles at multinationals in the biggest emerging markets declined from 56% to 12% between 1998 and 2008.26

Of course, progressive expatriation programs at large multinationals seek to move managers from different countries, not just natives of the headquarters country, across borders. The programs otherwise would further boost native shares of the top managerial ranks — and stoke resentments among managers from other countries. These days, there is also considerable interest in inpatriation — in other words, bringing managers from other countries to spend some time at headquarters. For example, Frank Appel, the CEO of Deutsche Post DHL Group, actively tracks the number of nationalities working at headquarters in Bonn, Germany. Media giant Bertelsmann regularly posts successful managers to its headquarters in Gütersloh, Germany, for several years. And the career development path at Nestlé typically includes two stays at corporate headquarters in Vevey, Switzerland — one in the early stages of an individual’s career and the other when reaching middle management. But such programs should be kept in perspective. According to one careful study of three large German multinationals, inpatriates accounted for 0.05% to 0.5% of the companies’ employment, versus a total of 1% to 2% of employment for all international assignees (including those on short-term assignments as well as longer-term expatriates).27

Altering Locations and Structures

Expatriation/inpatriation programs can be thought of as relocating individuals across borders. One can also imagine management teams and structures being relocated across borders, either permanently or temporarily. For example, Jean-Pascal Tricoire, the chairman and CEO of France’s Schneider Electric, has posted himself to Hong Kong to bring sharper focus to growth opportunities in Asia, particularly China. Fritz van Paasschen, CEO of Starwood Hotels, twice moved his headquarters team: to Shanghai for a month in 2011 and to Dubai in 2013.28 And while relocations of corporate headquarters are still rare, relocations of business/divisional headquarters are considerably more common. For example, P&G moved the headquarters of its global skin, cosmetics and personal-care unit from its Cincinnati headquarters to Singapore. And Royal Philips Electronics, Europe’s biggest maker of consumer electronics, moved the headquarters of its domestic appliances business to Shanghai.

Relocating businesses or functions is just one structural approach to increasing global bandwidth. Others include the appointment of chief globalization officers, many of them based in emerging economies; the creation of units specifically focused on emerging markets (as at IBM); and the implantation of regional structures/headquarters. And some of these changes are complements, not just alternatives. Thus, P&G’s relocation of the global headquarters of its detergent business to Geneva gained potential leverage from the fact that employees responsible for regional management of global business units for Europe, the Middle East and Africa were already based there.

Networking Across Borders

Companies can also work on fostering lateral linkages between diverse and/or remote teams and people. Cross-border projects and multinational task forces are fairly widely used in this respect. At the institutional level, a “corporate university” can be used to bring leaders together, with spots reserved for foreigners in particular. For example, Bekaert has instituted a one-week training program, bringing together 500 managers from across the company, to focus exclusively on the company’s values, thereby aiming to establish a shared vocabulary and understanding of key concepts (such as integrity) in spite of wide cultural differences. Such initiatives are meant to help natives to broaden their outlooks as well as help nonnatives to familiarize themselves with unwritten as well as written rules — and to help establish connections across the two groups.

Technology infrastructure and employees’ digital facility can also greatly enhance connections across the organization. Thus there is great interest in using internal social networks to connect employees who are already familiar with and accustomed to Facebook and Twitter. Although technology doesn’t entirely substitute for in-person interactions, it may, up to a point, be a complement. As Jean-Pierre Clamadieu, CEO of Solvay, a Belgian chemical company, has noted, high-quality video and other technology allow executives to spend longer periods in different regions of the world.29

Gestures and Symbols

In addition to concrete changes in policies, gestures and symbols matter a great deal. The objective, ultimately, is to transform the cultures of companies with a history of nativism in the top management team into cultures that allow and even promote national diversity. Given the interest in changing behavioral models (not just business models), symbolic actions may turn out to be indispensable.

There are many specific ways in which this objective might be pursued — from celebrating the success of nonnative managers when they are promoted to holding top management team meetings in new locations. For instance, when IBM’s then-CEO Sam Palmisano decided in 2006 to hold a meeting of his board in Bangalore as well as a series of events around it involving an entourage of employees, investors, analysts and journalists and approached one of us for help with this, the first question that came to mind was “Why?” Palmisano thought that there would be substantive benefits in terms of forcing some attention to India — where IBM would soon have more than 100,000 employees — for an entourage with generally limited knowledge of that country. But he placed even more emphasis on the benefits of signaling IBM’s commitment to India to its increasingly Indian workforce. IBM had, along with the Coca-Cola Co., left India in the 1970s as Indian Prime Minister Indira Gandhi applied pressure on multinationals; the meeting in Bangalore, right up to the president of India addressing the event, was meant to signal that IBM was back big and for the long haul.

Educating Employees About Globalization

While direct personal experience of other nations and nationalities is essential to broadening individuals’ mindsets, education about globalization that goes well beyond diversity training is helpful. Individuals, including top managers, have a robust tendency to overestimate how global the world is and to overlook the differences between countries.30 Such “globaloney” (a term coined by Clare Booth Luce in 1943) seems a poor basis for cross-cultural sensitivity, not to mention developing and aligning around a sensible global strategy. Familiarization with the basics of globalization is a better bet and requires an awareness of “semiglobalization” — the incomplete cross-border integration that is common today.31 Leaders need to take a broad but rooted view of international differences and distances instead of treating them as insurmountable (as in a purely local/national world) or negligible (as in a fully globalized world).

Implications for Companies

We have presented some exploratory analysis of the extent to which the senior leaders of the world’s largest corporations were born in the country where the corporation is headquartered, as well as possible consequences and corrective measures. As noted above, this is just one measure of national diversity that could usefully be broadened, as well as extended to smaller companies. In addition, national diversity itself is just one dimension of diversity and so it would also be useful to undertake such analysis of diversity along other dimensions and links across them. (The recent furor over Microsoft CEO Satya Nadella’s comments on whether women should ask for pay raises reminds us that sensitivity along one dimension does not guarantee sensitivity along others.)

But even with those caveats, our findings do seem to have some implications that stretch from the top to the bottom of corporate hierarchies. At the top, national diversity should be a topic of conversation for boards of directors. Board involvement seems particularly essential when the CEO is native to the country in which the company is headquartered — which turns out to be the case for 87% of the Fortune Global 500 and presumably higher percentages of broader samples of companies. And, of course, CEOs (and other top managers) can and should themselves pull on the change levers we have discussed.

Looking far lower down in the hierarchy, not all companies are equally congenial to nonnative talent. A nonnative considering a particular company as an employer might do well to look at the percentage of assets/sales/employees outside the home country, whether the home country is one that is relatively open to nonnatives or not (which turns out to be correlated with general globalization levels) and the number of nonnatives in the top management team and on the board. And if more people do so at the lower echelons, there will be more pressure on the upper echelons for real reforms along this dimension.

References

1. T.L. Friedman, “The World Is Flat: A Brief History of the Twenty-First Century” (New York: Farrar, Straus and Giroux, 2005).

2. P. Ghemawat, “World 3.0: Global Prosperity and How to Achieve It” (Boston, Massachusetts: Harvard Business Review Press, 2011).

3. P. Ghemawat and S.A. Altman, “DHL Global Connectedness Index 2014: Analyzing Global Flows and Their Power to Increase Prosperity,” October 2014, www.dhl.com.

4. Friedman, “The World Is Flat,” 210.

5. See, for instance, K.Y. Williams and C.A. O’Reilly III, “Demography and Diversity in Organizations: A Review of 40 Years of Research,” in “Research in Organizational Behavior,” ed. B.M. Staw and L.L. Cummings (Greenwich, Connecticut: JAI Press, 1998), 77-140.

6. S. Kaczmarek and W. Ruigrok, “In at the Deep End of Firm Internationalization” [in English], Management International Review 53, no. 4 (August 2013): 513-534.

7. B.B. Nielsen and S. Nielsen, “Top Management Team Nationality Diversity and Firm Performance: A Multilevel Study,” Strategic Management Journal 34, no. 3 (March 2013): 373-382.

8. T. Barta, M. Kleiner and T. Neumann, “Is There a Payoff From Top-Team Diversity?,” McKinsey Quarterly (April 2012).

9. T.-Y. Hsieh, J. Lavoie and R.A.P. Samek, “Think Global, Hire Local,” McKinsey Quarterly 4 (1999): 92-101; and S. Shankar and V. Vishwanath, “Winning in Emerging Markets,” June 17, 2008, www.bain.com.

10. C. Bouquet, J.-L. Barsoux and O. Levy, “The Perils of Attention From Headquarters,” MIT Sloan Management Review 56, no. 2 (winter 2015): 16-18.

11. C. Dreifus, “In Professor’s Model, Diversity = Productivity: A Conversation With Scott E. Page,” New York Times, Jan. 8, 2008, sec. F, p. 2.

12. C. Schmidt, “The Battle for China’s Talent,” Harvard Business Review 89, no. 3 (March 2011): 25-27.

13. See, for instance, P. Ghosh, “Microsoft’s (MSFT) New CEO Satya Nadella Underscores Rise of Indians in U.S. High Tech,” International Business Times, Feb. 1, 2014.

14. H. Vantrappen and P. Kilefors, “Grooming CEO Talent at the Truly Global Firm of the Future,” Prism 2 (2009): 90-105.

15. United Nations Conference on Trade and Development, “Annex Table 28: The World’s Top 100 Non-Financial TNCs, Ranked by Foreign Assets, 2013,” June 25, 2014, http://unctad.org.

16. “Europeans and Their Languages,” Special Eurobarometer 386, June 2012, http://ec.europa.eu.

17. F.-X. Dudouet and H. Joly, “Les dirigeants français du CAC 40: entre élitisme scolaire et passage par l’État,” Sociologies Pratiques 2, no. 21 (2010): 35-47.

18. P. Ghemawat and H. Vantrappen, “Japan Slow to Attract Foreign Executive Talent,” Nikkei Asian Review, April 24, 2014; N. Oishi, “The Limits of Immigration Policies: The Challenges of Highly Skilled Migration in Japan,” American Behavioral Scientist 56, no. 8 (August 2012): 1080-1100; and the Hofstede Centre, http://geert-hofstede.com.

19. Ghemawat and Altman, “DHL Global Connectedness Index 2014.”

20. Note that the likelihood of having a nonnative top management team member does also vary across different sectors. In our analysis, we found that the correlation coefficient between sectors’ ranks on CEO and top management team nonnativity is 0.72.

21. For this analysis, we compared the following regions of the globe: East Asia and the Pacific; Europe; the Middle East and Africa; North America; South and Central America; and South and Central Asia.

22. In 36 companies, the same person is chairman and CEO.

23. For a description of some of the turmoil at ABB before Hogan’s arrival in 2008, see P. Ghemawat, “Aggregation,” chap. 5 in “Redefining Global Strategy: Crossing Borders in a World Where Differences Still Matter” (Boston, Massachusetts: Harvard Business School Press, 2007); and “How Asbestos Burned ABB,” March 3, 2001, www.bloomberg.com.

24. M. Hamori and B. Koyuncu, “Career Advancement in Large Organizations in Europe and the United States: Do International Assignments Add Value?” International Journal of Human Resource Management 22, no. 4 (February 2011): 843-862.

25. Talent Management Summit 2011, “Leading with Purpose” (Economist Conferences, London, June 9, 2011).

26. W.J. Holstein, “The Decline of the Expat Executive,” July 2008, www.strategy-business.com.

27. B.S. Reiche, “The Inpatriate Experience in Multinational Corporations: An Exploratory Case Study in Germany,” International Journal of Human Resource Management 17, no. 9 (2006): 1572-1590.

28. For evidence on the benefits of having senior leaders located in key emerging markets, see A. Mall, D.C. Michael, L. Spivey, A. Tratz, B. Waltermann and J. Walters, “Playing to Win in Emerging Markets,” September 13, 2013, www.bcgperspectives.com.

29. H. de Barbeyrac and R. Verhoeven, “Tilting the Global Balance: An Interview with the CEO of Solvay,” McKinsey Quarterly 4 (2013): 69-75.

30. P. Ghemawat, “Developing Global Leaders,” McKinsey Quarterly 3 (2012): 100-109.

31. P. Ghemawat, “The ABCDs of Leadership 3.0,” in “Leadership Development in a Global World: The Role of Companies and Business Schools,” ed. J. Canals (Basingstoke, U.K.: Palgrave Macmillan, 2012), 62-89.

i. Transnationality Index data are from the authors’ analysis of United Nations Conference on Trade and Development, “Annex Table 28: The World’s Top 100 Non-Financial TNCs, Ranked by Foreign Assets, 2013,” in “World Investment Report 2013: Global Value Chains — Investment and Trade for Development” (Geneva: United Nations, 2013).

View Exhibit

View Exhibit

View Exhibit

View Exhibit

View Exhibit

View Exhibit

Comments (2)

Samiran Ghosh

Ganeshshermon@gmail.com