How Hadco Became a Problem-Solving Supplier

Topics

Every action has an equal and opposite reaction. We can apply this Newtonian principle to the vertical supply chain: for every part outsourced by an original equipment manufacturer (OEM), there is an equal and opposite opportunity for a parts supplier to furnish that part. While many parts or products have been outsourced to non-U.S. suppliers during the past twenty years in an intensely competitive environment, some U.S. parts suppliers have successfully expanded their share of the business by developing more effective methods to compete against the low labor-cost advantage many offshore suppliers enjoy.

Although no two success stories are exactly alike, there are some general patterns emerging in global competitive markets. We chronicle one company’s efforts to develop successfully a new set of core competencies that give OEM customers what they want, when they want it. The transformation of a manufacturing company from underachiever to a thriving world-class competitor illustrates the more general results we obtained in surveys of small and medium-size manufacturers (SMMs).1 We use a case study of one company, Hadco Corporation, to illustrate specific practices.

First, we discuss the strategic supplier typology we developed using survey data. In the following section, we introduce Hadco and discuss the business and competitive reasons for Hadco’s choice to compete in the printed circuit board (PCB) industry during the 1980s. Next we detail how Hadco changed to take advantage of opportunities in strategic outsourcing. Finally, we synthesize the coarse detail of the survey data with the fine detail of the case data to build a more complete picture of the role of SMMs in the U.S. economy. The lessons we learned from the typology and the Hadco case give clear prescriptions to companies that compete in global markets.

Classifying SMMs

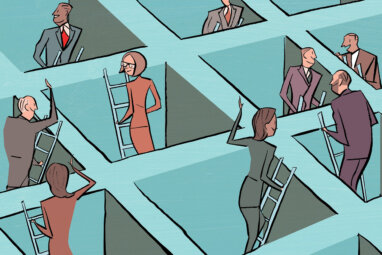

We began our study of SMMs by dividing suppliers into two types: problem solvers and commodity suppliers. We define problem solvers as suppliers that compete primarily on their ability to solve process and product problems for their OEM customers. These suppliers compete in dense vertical and horizontal learning networks, which enhance their ability to absorb and transfer knowledge.2 In contrast to spot-market or commodity suppliers, problem solvers share these characteristics:

- They earn many different certifications from their customers, which usually involve documentation of quality processes and practices (including delivery and service), long-term contracts, and target pricing.

- They engage in early design work with customers, requiring close communications.

References (40)

1. M. Merenda, A. Kaufman, and C. Wood, “Collaboration and Technology Linkages: A Strategic Typology” and “Empirical Evidence on Problem-Solving Suppliers” (Durham, New Hampshire: University of New Hampshire, Whittemore School of Business and Economics, New Hampshire Industry Group Working Papers, 1994).

2. N. Rosenberg, “Technological Change in the Machine Tool Industry, 1840–1910,” Journal of Economic History 23 (1963): 413–443;