Managing Product Returns for Competitive Advantage

Effective product returns strategies and programs can result in increased revenues, lower costs, improved profitability and enhanced levels of customer service.

Topics

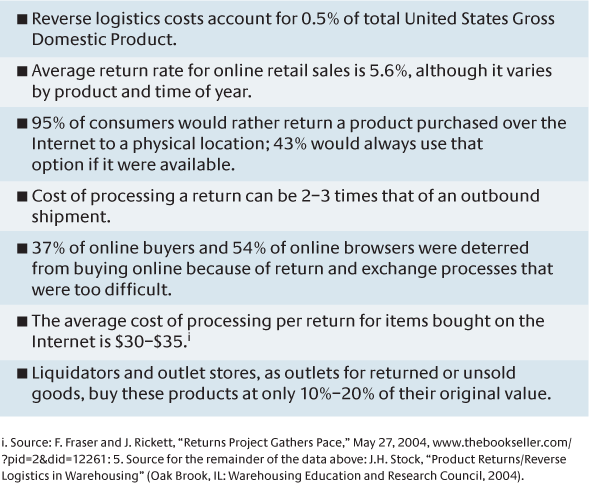

Product returns have often been viewed by customers as a necessary evil, a painful process and, usually, unavoidable. For retailers, manufacturers and distributors, returns have often been seen as a nuisance, a cost center and an area of potential customer dissatisfaction. As long as products are being sold, there will always be some returns. And, for many sellers, the process of handling product returns has been mostly on an ad hoc basis. However, many successful organizations have realized that the returns process incurs significant costs(See “Returns by the Numbers.”) and that an effective product returns strategy, which is a major aspect ofreverse logistics (the term that encompasses returns as well as a number of other activities related to items moving “backwards” in the supply chain) can provide a number of benefits.1,2 (See “About the Research”) Product returns can be categorized into two groups: (1)controllable returns, which can be avoided or eliminated by actions taken by the company, and (2)uncontrollable returns, which companies can do little or nothing about in the short term.

Controllable Returns.

References

1. J.H. Stock, “Product Returns/Reverse Logistics in Warehousing” (Oak Brook, IL: Warehousing Education and Research Council, 2004).

2. F. Fraser and J. Rickett, “Returns Project Gathers Pace,” May 27, 2004, www.thebookseller.com/?pid=2&did=12261: 5.

3. T. Sciarrotta, “How Philips Reduced Returns,” Supply Chain Management Review (November/December 2003): 34–39.

4. D. Dubbs, “Many (unhappy) Returns,” Operations & Fulfillment 8, no. 3 (March 2001): 14–23.

5. D. Blanchard, “Moving Forward in Reverse,” Logistics Today 46, no. 7 (July 2005): 1, 8.

6. L. Langnau, “Winning with Returns,” Material Handling Engineering 56, no. 3 (March 2001): 13–15.

7. Stock, “Product Returns/Reverse Logistics in Warehousing.”

8. Blanchard, “Moving Forward in Reverse.”

9. B. Caldwell, “Reverse Logistics,” InformationWeek, April 12, 1999, www.informationweek.com/729/logistics.htm

Comments (3)

Carl Tucker

Clement Masters

Carlos Aube