Raising the Bar With Analytics

Most managers surveyed agree it’s time to step up analytics use. What’s more, a growing number of companies are viewing their data and analytics as assets with strategic value.

Topics

Competing With Data & Analytics

In the world of fashion, either you’re in or you’re out. And if you’re out, you can turn to StyleSeek to help unearth your inner sartorialist.

StyleSeek is a website that helps visitors and members discover their “StyleDNA” through a style game in which users choose their favorite lifestyle images from a series of pictures — from swanky front doors to magazine covers to sporty or elegant cars. The outcome of these selections is a user’s StyleDNA, which the site then uses to recommend apparel options culled from more than 200 retail partners, including Macy’s, Nordstrom, Anthropologie and J. Crew.

But Chicago-based StyleSeek is more than an online recommendation engine; it is a business that extracts a percentage of sales when users click out to a retailer’s site and buy a product within a 90-day window. StyleSeek visitors who click through to a retail partner’s site become buyers at the partner sites at a rate that is well above the industry average click-through conversion rate.1

Although it’s a startup, StyleSeek has already begun diversifying its business model. Some of the company’s retail partners want to lease a version of its analytics platform to improve their understanding of their own customers’ preferences and behavior. According to StyleSeek founder Tyler Spalding:

We can take our technology and put it on partner sites [to help them get] a deeper understanding of what’s happening with customers — what’s working and why. A lot of our big retail partners have already said, “Sign us up for this immediately; we’ll do whatever we need to do to get this working.”

StyleSeek is part of a cadre of companies that are feeding a growing demand for better data and, in some cases, changing their own business models as a result.

An Increasing Appetite for Data and Insights

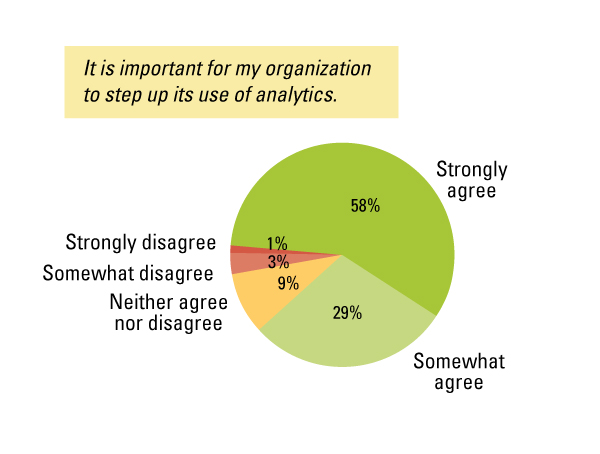

A Need to Increase Analytics Use

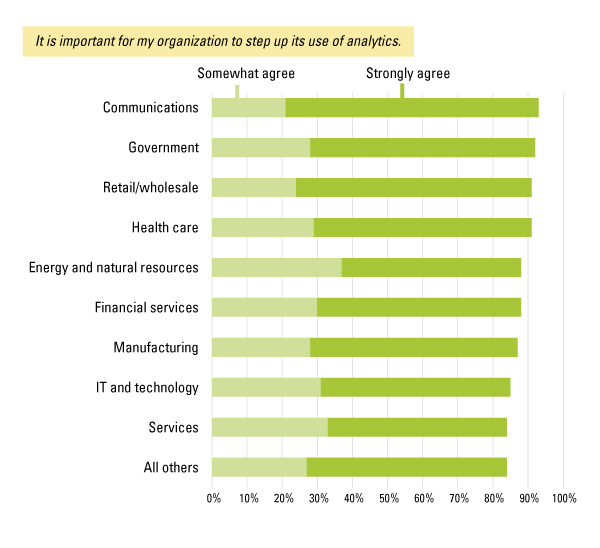

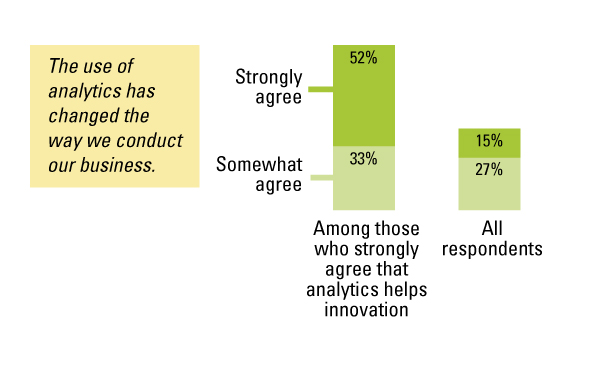

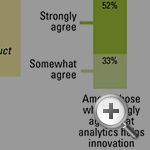

A surprisingly high percentage of managers see the importance of increasing the use of analytics in decision making, according to a recent survey of 2,037 managers conducted by MIT Sloan Management Review, in partnership with SAS Institute. (See “About the Research.”) More than half of the survey respondents strongly agree that their organization needs to step up the use of analytics to make better business decisions — and that percentage rises to 87% if respondents who agree “somewhat” are included. (See “A Need to Increase Analytics Use.”) This finding — that a majority of survey respondents agree strongly about the need to step up analytics use — holds true across a range of industries. (See “A Trend That Crosses Industries.”)

A Trend That Crosses Industries

Several forces are helping spur managers’ interest in analytics, including increased market complexity (for example, omnichannel retailing that encompasses both digital and bricks-and-mortar channels) and the availability of better analytics tools and data. And, of course, if competitors are using data to gain an edge by making better or faster decisions, that alters the competitive landscape a company faces.

The demand for better analytics is shifting how some companies view their own and others’ data. Many companies aim to become better producers of goods or services by using their own data in more effective ways. But some companies, such as StyleSeek, are beginning to change that paradigm. They are aiming to become better producers of data and analytics in part so that other businesses can use analytics in more effective ways. Such companies are enhancing their business models by viewing their own analytics platforms — their own expertise or knowledge about customer segments or products — as assets with strategic and commercial value.

Consider Entravision Communications, a Spanish-language media company based in Santa Monica, California, that owns and/or operates more than 50 TV stations and 49 radio stations. It also has multimedia assets in 11 regional markets, with 106 local Web properties and other offerings that collectively reach most of the U.S. Hispanic consumer market, which had an estimated $1.2 trillion in purchasing power in 2013.2

Entravision’s senior management believed that the company could provide advertisers and marketers with better information about targeting media spots to the U.S. Latino community by integrating information from its own data stores with transactional data from about 300 external sources. The company set up a separate division, Luminar, to sell these insights, along with access to the company’s analytics platform, as a service to Entravision’s traditional media spot buyers. But executives soon discovered that their customers wanted (and were willing to pay for) Entravision’s information about U.S. Latinos independent of their interest in buying media spots. The company responded by shifting the focus of its new information services division.

Data Sharing and Innovation

Analytics and Innovation

Some companies are sharing their data and analytics with business partners in order to meet strategic business objectives. For example, WellPoint, a U.S. health insurer based in Indianapolis, Indiana, is using analytics to help forge a strategically important payment model with physicians — one that rewards providers when they reduce overall healthcare costs and enhance quality and health outcomes. Specifically, WellPoint is converting administrative claims and authorization data into useful information about populations of patients and sharing this information with physicians and their care teams to aid their decision making and care giving. This innovative and collaborative approach gives providers better visibility into the cost and quality of care their patients receive and reflects a major shift in the type of relationship WellPoint creates and maintains with its providers.

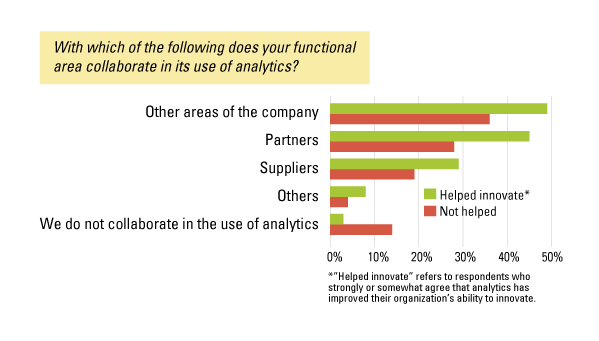

Collaboration and Innovation

In general, our survey data suggest that companies for which analytics has improved the ability to innovate are more likely to share data with partners and suppliers. Half of this year’s survey respondents agree, somewhat or strongly, that analytics is helping their organization innovate — and 16% believe that strongly. (See “Analytics and Innovation.”) Those survey respondents who agree that analytics is helping their organization innovate are much more likely to say they collaborate with partners and suppliers through the use of analytics than respondents who don’t think that analytics is helping their company innovate. (See “Collaboration and Innovation.”)

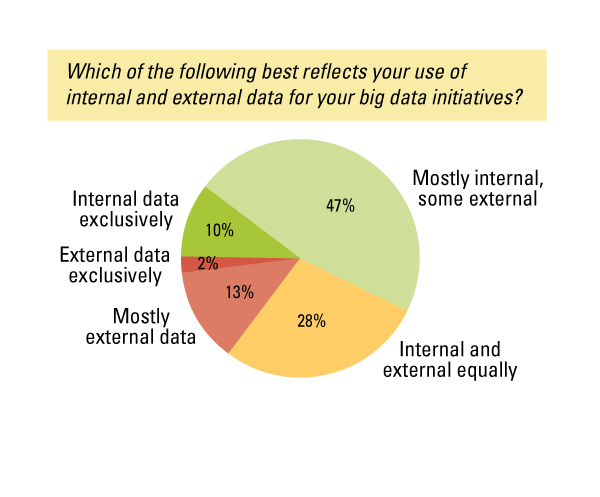

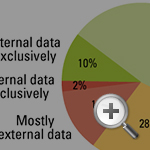

Blending Internal and External Data

A number of the companies we interviewed that are improving their ability to innovate with analytics are reaching beyond their own data to feed their analytics processes. They combine their own hefty data sets with external data. This approach to data, as it turns out, is typical of most big data projects. Our survey results indicate that the vast majority — 88% — of respondents from companies with big data initiatives say their organization uses a mix of external and internal data in those projects. Just 10% of respondents say their organization’s big data projects use only internal data, and just 2% say only external data sets are used. (See “Blending Internal and External Data.”)

Analytics and Business Transformation

Analytics and Organizational Change

Interestingly, among the 16% of respondents who strongly agree that analytics is helping their organization innovate, 85% also strongly or somewhat agree that the use of analytics is changing the way their company does business. (See “Analytics and Organizational Change.”) For example, at MillerCoors, the joint venture merging the U.S. and Puerto Rican operations of SABMiller and Molson Coors Brewing Company, analytics is a central part of a corporate program to change the way the organization conducts business. According to Rob Saker, business intelligence and analytics transformation leader at MillerCoors:

There were benefits and efficiencies with the joint venture — for example, going from two breweries to eight and being able to produce beer closer to where people are drinking it. The challenge is, we never brought our organizations together from a process or system perspective. So our leadership and board decided that they wanted to undertake a transformational effort to bring together and improve the efficiency of the organization. But they wanted to do it in a way where it propelled us forward.

Analytics is the key component in this transformation. We are leveraging analytics to make better decisions and to invest our resources more effectively: the right information to the right person at the right location.

The connection (or lack thereof) between improving innovative capabilities with analytics and analytics-based organizational change is equally striking among those survey respondents who said that analytics isn’t helping their company innovate. None of those survey respondents strongly agreed that analytics is changing the way their company conducts business. Just 4% somewhat agreed that analytics has changed the way their company does business.

The growing appetite for analytics reflects optimism that traditional modes of decision making — those relying to a greater extent on experience and intuition — can be effectively enhanced with analytics.

Enhancing Decision Making — and More

Analytics is not, of course, an end in itself; the value of any analytics effort lies largely in whether it can help decision making. The growing appetite for analytics indicated by our survey reflects optimism that traditional modes of decision making — those relying to a greater extent on experience and intuition — can be effectively enhanced with analytics.

But the finding that some respondents see analytics as both helping their organization innovate and changing the way the company conducts its business suggests that analytics can have an effect on organizational behavior even beyond its influence on decision making.

Organizations that innovate and change their business conduct in part because of analytics adopt what are known as emergent or deliberate strategies,3 and in some cases both. Emergent and deliberate strategies have different characteristics to which managers need to pay attention. Emergent strategies typically require openness to new ideas, as well as a willingness to pursue opportunities even when they do not fit neatly with pre-existing plans. Deliberate strategies demand a clear vision about goals and the means of achieving them.

Entravision, for example, deployed both kinds of strategies over time. It initially responded to shifts in the media industry by intentionally developing a big data infrastructure. It then reacted to market demand, as did StyleSeek. WellPoint and MillerCoors have also deliberately developed strategies to achieve important business objectives with analytics. All of these efforts are, however, in the early stages.

Whether or not managers are intending to use analytics to improve decision making, innovate or achieve important strategic objectives, there are clear takeaways from the survey findings. One is that the pressure to develop more effective decisions through analytics is growing across industries. Another is that as companies use analytics to improve their ability to innovate, they also tend to collaborate more through their use of analytics: Analytics becomes an important medium through which organizations interact with both internal and external stakeholders. Thus, organizations that innovate with analytics don’t merely increase their use of analytics in decision making; they also change the way they behave as organizations.

References

1. R.B. Ferguson, interview with Tyler Spalding (StyleSeek), “How Analytics Is Giving Fashion a Makeover,” September 24, 2013, https://sloanreview.mit.edu.

2. The $1.2 trillion purchasing power estimate comes from the Selig Center for Economic Growth at the Terry College of Business at the University of Georgia. See “Minority Buying Power Grows in 2013, According to Selig Center Report,” September 4, 2013, www.terry.uga.edu.

3. H. Mintzberg and J.A. Waters, “Of Strategies, Deliberate and Emergent,” Strategic Management Journal 6, no. 3 (July-September 1985): 257-272.

View Exhibit

View Exhibit View Exhibit

View Exhibit View Exhibit

View Exhibit View Exhibit

View Exhibit View Exhibit

View Exhibit View Exhibit

View Exhibit

Comment (1)

Michaela Kennedy