The Benefits of Sustainability-Driven Innovation

The majority of managers who say that their company’s sustainability activities have added to profits also say that sustainability has led to business model change.

Topics

Leading Sustainable Organizations

At Greif, a leading manufacturer of industrial packaging, a sustainability agenda has become central to the company’s overall business operations and strategy.

Image courtesy of Greif.

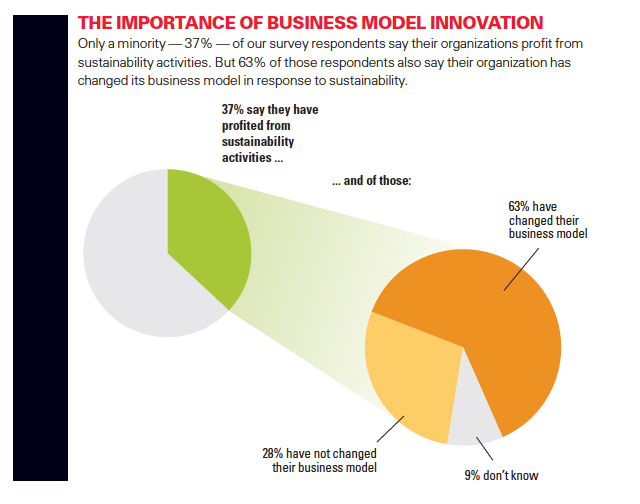

What connects corporate sustainability with business profits? According to our 2012 global executive survey on sustainability, an important factor is business model innovation. Managers who say that their company’s sustainability activities have added to the company’s profits are more than twice as likely to say that sustainability has caused their organization to change their business model than not. (See “The Importance of Business Model Innovation.”)

The sustainability story at Greif, a leading manufacturer of industrial packaging, illustrates the importance of business model innovation and several other key findings from our survey. Scott Griffin is chief sustainability officer at Greif, a 135-year-old global industrial packaging company headquartered in Columbus, Ohio that had net sales of $4.2 billion in 2011. Griffin says there are four keys to Greif’s sustainability agenda, which has become central to the company’s overall business operations and strategy. One is top management attention to sustainability. “One reason sustainability works here at Greif is high-level, strong executive commitment,” says Griffin. Unlike many chief sustainability officers, Griffin reports directly to the CEO and is a member of the company’s executive strategy team.

Another key to Greif’s approach to sustainability is collaboration. In the past three years, Greif has collaborated more with customers and nongovernmental organizations because of sustainability-related issues. These collaborations have helped the company not only establish sustainability-related goals, such as reductions in greenhouse gas emissions, but have also provided new opportunities for customer engagement and the development of new corporate capabilities.

The Leading Question

Do companies who change their business model profit from sustainability?

Findings

- Having a business case bolsters the success of business model change.

- Changing particular business model elements can have a significant effect.

- Collaboration with external stakeholders can be beneficial to sustainability efforts.

Collaboration with customers ties into the third element of Greif’s sustainability program: business model innovation. For instance, Greif worked with customers to analyze the life cycle of several of its products. The collaboration identified new business opportunities connected with reconditioning and extending the life of a major product line, steel and plastic drums. Greif now owns the largest global industrial packaging reconditioner, EarthMinded Life Cycle Services.

New internal organizational structures are the fourth key to Greif’s sustainability agenda. Greif created a global energy team composed of business unit representatives in charge of achieving multiyear sustainability goals connected with energy reduction goals. Team members have access to a pool of capital that they can allocate for sustainability projects that they believe will help meet their sustainability objectives. “Having the global energy team use the capital as they see fit is one of the most effective things we have done,” Griffin says. In 2011, the global energy team helped cut Greif’s greenhouse gas emissions per unit of production by 10% from 2008 levels. Greif now has similar teams for sustainability goals connected with energy, waste and water.

Greif’s story highlights several key findings from our fourth annual executive survey, to which 2,631 managers and executives in two dozen industries responded. (See “About the Research.”) Our survey suggests that business model change, top management support, collaboration with customers and having a business case are associated with creating economic value from sustainability activities and decisions. Ninety percent of all respondents who say their companies have all these characteristics also say their sustainability activities add to their profits.

We give the name Sustainability-Driven Innovators to those respondents who have changed their business model because of sustainability and also generate profits from their sustainability-related activities and decisions. They represent 23% of our survey pool.

Our research suggests several ways in which companies can become more effective at connecting business model change with sustainability-based profits. Based on the behavior of Sustainability-Driven Innovators, we discuss three recommendations for how managers can improve their odds of profiting from their sustainability activities.

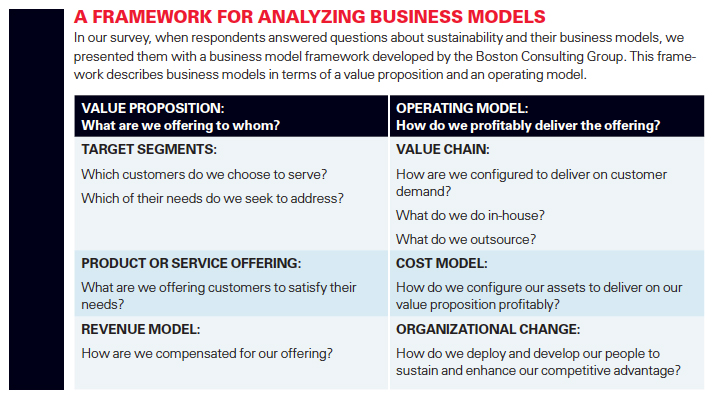

In our survey, we presented a business model framework developed by the Boston Consulting Group (BCG) to respondents when they answered questions about sustainability and their business models.1 This framework describes business models in terms of a value proposition and an operating model. The value proposition answers the question: What are we offering to whom? The operating model answers the question: How do we profitably deliver the offering? (See “A Framework for Analyzing Business Models.”)

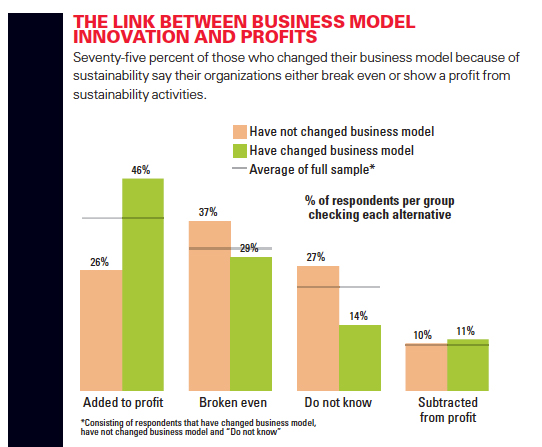

Using this framework, we asked respondents how (if at all) they have changed their business model in response to sustainability. Their answers are revealing: 48% changed their business model, up from 40% in 2011. Seventy-five percent of those who changed their business model because of sustainability say their organizations either break even or show a profit from their sustainability activities, and 46% say their sustainability activities added to profits. (See “The Link Between Business Model Innovation and Profits.”)

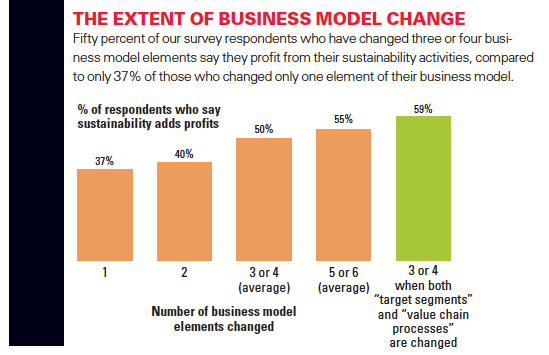

What’s more, 50% of our survey respondents who have changed three or four business model elements say they profit from their sustainability activities, compared to only 37% of those who changed only one element of their business model. (See “The Extent of Business Model Change.”) Respondents from organizations that have changed their business model because of sustainability are also more likely to be aware of sustainability’s influence on their profitability.

Certain combinations of sustainability-related business model changes appear to have a bigger link to profitability than others. Respondents whose companies changed both target segments and the value chain, for instance, are more likely to say their sustainability activities add to profit than respondents whose companies changed other combinations of business model elements.

Sustainability-Driven Innovators often do more than just change their business model. They are also more likely than other survey respondents to have a business case for sustainability, to work closely with key stakeholder groups on sustainability issues and to have the attention of top management focused on their sustainability efforts. Our survey suggests that having a business case for a company’s sustainability efforts bolsters the influence of business model change on sustainability-based profitability.

Marks and Spencer’s sustainability strategy, Plan A, is a case in point. Since its introduction in 2007, Plan A, which aims to achieve 100 goals related to waste, supply chain, climate change, health and sustainable raw materials by 2015, has reportedly created about $296 million in net economic benefits for Marks and Spencer.2 As Mike Barry, head of sustainability business at Marks and Spencer, told BusinessGreen.com, Plan A “is about making hard cash by doing the right thing.”3

The Stakeholder Effect

While senior management, customers and legislation can enhance the effects of business model change on profits from sustainability, their effects are unequal. This year, as in the previous two years of our survey, respondents who identify legislative and political pressures as the top influencers of their sustainability behavior are more likely to report that sustainability does not add to profits. However, compared to respondents who don’t see sustainability adding to profits, Sustainability-Driven Innovators are more likely to report that their customers express a preference for sustainable products/services and are willing to pay a premium for their sustainability offerings.

In any company, customer demand for sustainable products can be a compelling force for organizational change. Just ask Lewis Fix. Fix is vice president of sustainable business and brand management for Montreal-based Domtar Corp., whose main product line, uncoated free sheet paper — things like copy paper, envelopes and check paper — is in a sector that has been contracting for the past several years.

Fix was an early proponent of making the company’s mills compliant with the Forest Stewardship Council (FSC) certification and pursuing more FSC-certified fiber, which was more stringent than the standard certification offered by the industry’s Sustainable Forestry Initiative. This approach was challenged when the company merged with Weyerhaeuser, according to Fix:

Right after 2007 when Domtar and Weyerhaeuser came together, there was a difference in the approach to certification, and some believed that we would never have our southern mills from Weyerhaeuser certified by FSC. They said, “the NGOs, the environmentalists are extreme. It can never work down here in the Southeast. We shouldn’t have to spend an extra dime or lift an extra finger to appease environmental groups and pursue FSC.”

Today, all of Domtar’s mills are FSC-certified. Fix didn’t change things himself. A new CEO came on board in 2009 who actively supported a range of aggressive environmental goals. But it also took a significant customer to say that it wanted a majority of its paper suppliers to be FSC-compliant. According to Fix:

It actually didn’t take long for our mills to ‘get it.’ If Staples says that’s what they want, we’re going to find a way to make sure we’re doing business with Staples.

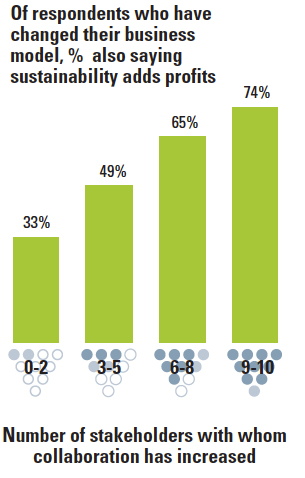

When both sustainability-oriented collaboration and business model change occur, the combination is strongly correlated with sustainability-based profits. For example, respondents who say that, as a result of sustainability activities, they have changed their business model and increased their collaboration with 6 to 10 types of stakeholders are also more than twice as likely to say sustainability added to their organization’s profits compared to those who say they changed their business model and increased collaboration with two or fewer types of stakeholders. (See “Collaborating With Stakeholders.”)

Timberland, for example, worked closely with its supply chain for leather, a key material in many of its products, to improve efficiencies and reduce costs. “We were very involved in developing this industry standard for assessing tanneries,” says Betsy Blaisdell, senior manager of environmental stewardship for Timberland. “Our supply chain leather team said that they want to have a target for only sourcing our leather from silver- or gold-rated tanneries, which, through the Leather Working Group assessment, demonstrate best practices related to energy, chemical and water management.”4

The Role of Top Management

Perhaps not surprisingly, respondents who say that their company has changed its business model because of sustainability and that sustainability is permanently part of top management’s agenda are more likely to say that sustainability has added to profits than respondents whose companies have made sustainability-related business model changes without that degree of support from top management. Former Campbell Soup CEO Doug Conant explained why he led that company’s corporate social responsibility efforts. “You can talk about making it a priority, but if you don’t organize to do it in a priority way, it doesn’t get done. It has to have a line that gets all the way up to the CEO in a compelling way,” Conant says.5

Recommendations

Mustering an appetite for organizational change can be difficult. However, the three to four types of business model changes that are most strongly correlated with a sustainability-related increase in profitability in our survey do not represent mere tweaks to business operations. Such changes are associated with a deeper understanding of customers, increased collaboration with outside groups and, in some cases, a new perspective on how to compete through an organization’s sustainability activities. Below are three recommendations for how companies can increase their odds of profiting from their sustainability efforts.

1. Be prepared to change your business model. Respondents to our surveys over the past four years believe — by a wide margin — that sustainability is necessary to be competitive. This year we have established that business model innovation is a key indicator of whether a company will profit from its sustainability activities. Since the business model innovations most strongly associated with increases in sustainability-based profits can involve significant corporate change, expectations that sustainability will add to profits should take into account both the need for and the speed of corporate change. Setting multiyear sustainability goals that matter may require consistent top management attention, especially if achieving them requires adding new capabilities and changing elements of your business model.

2. Understand how your customers think about sustainability — and what they are willing to pay for in connection with sustainable products or services. Find out whether your customers are willing to pay a premium for sustainability, and explore whether you need to charge a premium for a more sustainable product or service. Use this information to determine whether targeting current or new customers with a more sustainability-oriented brand is a viable option.

3. Collaborate more with individuals, customers, businesses and groups beyond the boundaries of your organization. Many companies are forming outside advisory groups to help frame their sustainability agenda. This process can be an opportunity to get closer to customers, who in turn can be a useful resource for identifying other appropriate members. NGOs have become much more constructive in their corporate engagements and can help your company identify credible and meaningful sustainability objectives that lack the appearance of ‘greenwashing.’ Participate in or help create an industry group; either approach can be an effective benchmarking tactic, as well as an opportunity to shape perceptions about your brand’s connection with sustainability. In addition, participating in such groups gives your business an opportunity to shape what ‘doing good’ means in your market.

References

1. Z. Lindgardt, M. Reeves, G. Stalk and M.S. Deimler, “Business Model Innovation: When the Game Gets Tough, Change the Game,” white paper, Boston Consulting Group, New York, December 2009. There are many business model frameworks to choose from. See also, for example, H. Chesbrough, “Open Business Models: How to Thrive in the New Innovation Landscape” (Boston: Harvard Business Press, 2006); M.W. Johnson, C.M. Christensen and H. Kagermann, “Reinventing Your Business Model,” Harvard Business Review 86, no. 12 (December 2008): 50-59; A. Osterwalder and Y. Pigneur, “Business Model Generation: A Handbook for Visionaries, Game Changers and Challengers” (Hoboken, New Jersey: John Wiley & Sons, 2010); P. Lindgren, R. Jørgensen, Y. Taran and K.F. Saghaug, “Deliverable D 4.1: Baseline for Networked Innovation Models,” NEFFICS Consortium, 2011; and R. Amit and C. Zott, “Creating Value Through Business Model Innovation,” MIT Sloan Management Review 53, no. 3 (spring 2012): 41-49.

2. L. Brokaw, “Marks and Spencer’s Emerging Business Case for Sustainability,” July 13, 2012, https://sloanreview.mit.edu.

3. W. Nichols, “Mike Barry: M&S Is Cashing in With Plan A,” November 9, 2010, BusinessGreen.com.

4. Betsy Blaisdell, interviewed by N. Kruschwitz, “New Ways to Engage Employees, Suppliers and Competitors in CSR,” November 14, 2012, https://sloanreview.mit.edu.

5. Douglas R. Conant, interviewed by N. Kruschwitz, “How an ‘Abundance Mentality’ and a CEO’s Fierce Resolve Kickstarted CSR at Campbell Soup,” August 14, 2012, https://sloanreview.mit.edu.

Comment (1)

SEVERO LOPEZ MESTRE ARANA