The Dark Side of Close Relationships

The very factors that make partnerships with customers or suppliers beneficial can leave those relationships vulnerable to deterioration.

For decades, close relationships between firms and their suppliers and customers have been highly touted as a business strategy that can expand the pie of benefits for the parties involved. From 1996 to 2001, companies formed these relationships at a brisk pace: CEOs signed a partnership into existence every hour of every day, resulting in 57,000 alliances over this six-year period.1 And as the economy grows, firms are continuing to rely on close collaborations to grow their pie of benefits.

However, there is a persistent problem with this strategy that cannot be ignored: Close relationships are not always synonymous with good relationships. This is evidenced by the fact that many of these close relationships — whether they are joint ventures or loose alliances — fail. Indeed, a number of studies put the failure rate of joint ventures at anywhere from 30% to 50%.2

This reality of close relationships has been studied from a variety of perspectives, including psychology, marketing, management and economics. Each offers its own causal explanation. For example, psychologists have found that the closer and safer the parties of a relationship feel, the likelier they are to raise annoying issues and generate conflict.3 Marketing researchers speculate that partners grow increasingly dissatisfied as the relationship persists.4 Perhaps each side becomes less objective and its offerings stale, even as expectations grow unreasonably high. Strategic management research on joint ventures posits that partners initially depend highly on each other. Over time, as each party learns what the other knows, the relationship becomes unstable and vulnerable.5 Economists point to the growth of opportunism — self-interest seeking with guile — as the key factor that destabilizes close relationships between organizations.6

Several studies, involving thousands of ongoing business relationships, offer insights into how seemingly good relationships may go bad. The results suggest a striking phenomenon: Relationships that appear to be doing well are often the most vulnerable to the forces of destruction that are quietly building beneath the surface of the relationship. In other words, close relationships that seem the most stable can also be the most vulnerable to decline and destruction. We refer to this phenomenon as the dark side of close relationships.

Acknowledging the dark-side phenomenon of close relationships is not the same as saying that such relationships are dysfunctional and therefore prone to dissolution. Relationships marked by conflict, strife, competition and ongoing disagreements are clearly prone to breakup. Instead, the dark side subtly undermines relationships in which the parties are confident and optimistic about their collaboration, relationships in which both parties are satisfied and receive ongoing benefits. Since no trouble can be seen on the horizon, there is no apparent reason to change course, strategy or tactics.

In such cases, the onset of problems in the relationship is particularly painful, often because it is accompanied by initial denial. Reactions may range from “The relationship is such a good one; what could be going wrong?” to “Our partners are so trustworthy; how could they be exploiting us?” Moreover, if a breach in trust is suspected, it can sometimes be extremely difficult to prove. For example, it can be hard for a company to know if a partner is overcharging without access to that partner’s books, and it can be hard to be sure whether logistics problems are due to a partner’s lack of coordination or to a problem with the delivery middleman. It also can be difficult to calculate the scope of a partnership problem. The inability to pin down such details can add to the initial denial that there is anything wrong with the relationship.

In surveying 1,540 business relationships, we observed that relationships can linger in states of deterioration for surprisingly long periods with neither side terminating the relationship. Onset of the dark side can be very subtle, and partners may not be hostile. Instead, one simply neglects the other, a relatively passive reaction to disappointment. Specific investments (for example, capital equipment, dedicated human resources or specialized information systems) can make it difficult to walk away. Partners also remain surprisingly loyal within business relationships. For example, dealers who believe their trusted supplier has abused them often react with resignation, silence and even loyalty.7 Why? Perhaps one of the partners provides necessary resources that make it difficult to sever ties, such as significant brand equity or access to customers. In these cases, the less powerful partner will tend to shift resources to other areas or try to negotiate a better position in relation to its powerful partner, rather than terminate the relationship.8 Or perhaps the two parties keep transacting business in the belief that something is better than nothing. By the time this initial denial is overcome and the parties accept that the relationship has problems, the dark side may have overtaken the relationship in full force, resulting in destructive damage.

We intend to turn a magnifying glass on the phenomenon of the dark side of close relationships. We begin with some compelling examples of seemingly successful relationships that have fallen victim to problems and illustrate the factors that gave the dark side a foothold in the first place. We then describe preventive strategies that can be used in close relationships with suppliers, customers or distributors, or in any other alliance. Finally, we conclude with some ideas about what to do if a business relationship has fallen victim to the dark side. (See “About the Research.”

The Dark Side Appears

Our premise is that generally relationships that have succumbed to the dark side have a single factor in common: Characteristics of the relationship that were put in place to enable and empower the relationship ultimately became the weakest link through which the problems began. One case study that outlines the relationship between an automaker and one of its parts suppliers, carefully documented by an ethnographic study, provides a telling example. In this case, both the automaker and its supplier invested in deepening the relationship.9 Over the years, the supplier, in particular, went to great lengths to forge strong relationships, learn the automaker’s business and win its trust. The supplier developed elaborate routines to ensure just-in-time delivery to the automaker’s assembly line from its own nearby facility. In a conscious program to build social relationships, the supplier encouraged its own personnel to build personal ties with the automaker’s employees, particularly those who worked on the factory floor. For example, both sides organized teams to play football during supplier-sponsored social events held for rank-and-file employees from both companies.

The relationship building worked very well, and the auto-maker profited in many ways. The supplier displayed extreme flexibility and customer orientation, even to the point of accepting unilateral price cuts decreed by the automaker from time to time. The automaker seemed to have it all — the gains from being vertically integrated without having to own and operate a supply division and without running the risk that a captive supply division would lose touch with market developments.

Unbeknown to the automaker, the supplier had its own ways of making money, while accommodating its customer’s many demands. The supplier systematically cut costs in violation of the contract and then exploited its employees’ relationships with the automaker’s employees to hide the resulting irregularities from the automaker’s purchasing department. A supplier executive explained opportunism in these terms: “If one decides to eliminate the first of three coats of paint put on the component, well, then one cuts costs on the price of the unit, and that profit will be shared with Purchasing, which will recuperate a piece of the pie. Now, if one doesn’t say anything, all the savings are ours [emphasis added]. But there’s a risk, which is that two coats of paint won’t hold up, and when the Office of Studies will make its analysis of the parts, it will figure out very fast that one was no longer putting on three coats but two, and then Purchasing is going to come down on us. … It’s necessary to know how to evaluate this risk, and one is also paid to do that.”

The elements of this story are surprisingly common. One side invested heavily to build a relationship that worked well and benefited the other side hugely. This resulted in a high level of trust, which was, in turn, used by the supplier to keep the “police officers” (principally, watchdogs in the purchasing department) ignorant. The supplier cut corners in a calculating manner, weighing the costs, benefits and risks as though it were pricing an insurance policy. In this manner, the trust, social relationships and investments that were developed to make the relationship successful became the doorway to the dark side.

Lest one be tempted to condemn the parts maker, recall the many stories in the business press of how some automakers have abused the trust and investments of their suppliers. Opportunism can run both ways. Anyone who has worked with a large key account can sympathize with the plight of the supplier. Perhaps the most surprising thing about this example is not that it happened but that it is so well documented.

Another example comes from the Italian construction industry.10 During the late 1980s and early 1990s, 49 large general contractors in Italy created a network designed to aid the control and distribution of resources and to diffuse risk among all members. Operating like a cartel, the group members protected each other from competitive pressures by restraining and controlling competition among themselves. This approach worked well for a number of years as the entire network benefited from higher and more efficient levels of business. Over time, however, this network of 49 contractors developed some destabilizing properties that produced negative returns for all involved. By insulating each other from the pressures of the market, the contractors unwittingly removed the external pressure that encourages companies to innovate and progress. As a result, the 49 companies gradually became inefficient. This slowed the pace of progress in the entire industry since ordinarily large firms set an example for other firms. That the top companies became uncompetitive meant that the construction industry in Italy suffered, as did customers that were getting poor value for their money. Again the close relationships that were carefully constructed to provide the network with a competitive advantage paradoxically became the weakest links.

These cases are not isolated examples of an unusual phenomenon. Consider more recent findings indicating that long-term relationships with customers are not always profitable.11 Conventional wisdom has held that companies should strive for customer retention, which is thought to improve profits since the cost of servicing long-standing customers decreases over time. Countless companies have set up loyalty programs and rewards for faithful customers with the expectation of higher returns. And initially, this is what the businesses got. However, gradually many of these companies have discovered that long-standing customers, particularly those that do business in high volumes, know their value and tend to exploit it to get premium service and price discounts. As it turns out, long-standing customers in loyalty clubs are more price-sensitive than occasional customers because the former are generally more knowledgeable about products and quality. These customers also seem to resent firms that try to profit from their loyalty. Thus, it appears that loyalty programs put into place to reap the value of long-term relationships have often backfired and been undermined by the onset of the dark side of close relationships.

How the Dark Side Develops

In all of these examples, the relationships were purposefully shaped and developed to generate substantial returns for both parties. Yet for one reason or another, the mechanisms created to expand the pie of benefits for the parties also became the very poison that ruined their efforts. To understand why, we will examine three such mechanisms more closely: the creation of immediate benefits, the development of strong interpersonal relationships, and unique processes and adaptations.

Immediate Benefits

Close relationships are built with the expectation of benefits accruing to both parties. These benefits fuel the future of the relationship and give the parties an incentive to stick together. However, it is also the case that short-run benefits can outweigh long-run benefits. In the Italian construction example, the formation of the network improved coordination, control and resource distribution while minimizing risk. Multiple case studies have shown that such networks, particularly for small-to-midsize companies, can be invaluable for organizing the production of the members and sharing risk. So the creation of the Italian construction industry network was good for the short term but should not have persisted into the long run.

This trade-off between short-term and long-term gains is a natural point of tension for many business relationships.12 In general, if the partners in a relationship are too short-term oriented, both parties will have an incentive to exploit each other as quickly as possible and exit the relationship. On the other hand, if the partners are too long-term oriented and don’t periodically experience benefits, their motivation to stay in and support the relationship will wane.

Strong Interpersonal Relationships

Another common directive for forming successful relationships is to establish strong, trusting relationships among individuals in a partnership. After all, how can the organizations reap the benefits of the individual managers’ efforts if the individual managers in the two organizations cannot get along? Strong relationships create flexibility and a responsiveness that benefits the alliance. In the automotive industry example, management of both the automaker and its supplier encouraged personnel to forge close relationships and held social activities to accomplish this. This enabled the just-intime delivery system between the firms to work smoothly and efficiently. However, while cozy relationships sound good in theory, such relationships also provide an opportunity for covert activities designed to systematically cheat a partner (such as shirking on the painting process) to develop.

In this vein, strong interpersonal relationships between individuals can help explain the growing number of scandals emerging from the financial industry that involve individual fund managers and their exploitation of clients and resources. While trusting relationships were put in place to enable the fund managers to more efficiently manage financial returns for their clients, these relationships also provided opportunity for the fund managers to systematically cheat their clients on an ongoing basis. Strong interpersonal relationships can also cause problems in sales when sales reps form such close relationships with clients that they are able to take these clients with them when they leave the firm. For example, we found examples of stockbrokers who were able to change from one employer to another, collecting bonuses each time, on the strength of their ability to bring their customers with them; some brokers we studied had changed employers as many as six times in three years.13

Unique Processes and Adaptations

In close relationships, it is often impossible for the partners to expand the pie of benefits unless they make unique adaptations or investments to support the relationship.14 For example, manufacturers may adapt their products, processes and routines to suit a particular customer. A supplier of clothing may tag and package according to a retailer’s specifications and ship to stores following a protocol developed for the retailer. Such investments can improve the partners’ productivity and efficiency and enable both partners to receive greater returns than they could have obtained on their own. The good news about such privileged relationships is that both parties should be able to do more together. The bad news is that, over the long run, the parties may lose touch with alternatives that represent a better way to do things and thus may fail to innovate.

In the Italian construction example, the network of 49 contractors enabled better coordination of needs and resources and reduced the risk for any given member. While this was helpful in the short run, it also created a “network of indebtedness” that required contractors to reciprocate favors formally and informally with others in the network. Thus, each contractor had an “obligation” to everyone else in the network — either directly or through an intermediary. While this agreement reduced opportunism among the members, it also eliminated the simple “desire to win” element of competition because of the risk that any one member might be excluded as a result. Thus, the network was inwardly focused, and over time, innovations that developed outside the network failed to permeate the group.

These three factors — immediate benefits, strong interpersonal relationships and unique processes — often figure prominently in close relationships. With all of these features, the tension between being flexible and rigid is what renders close business relationships unstable.15 If the relationship is too rigid, as in the Italian-contractor network example, the members are stifled; if the relationship is too flexible, the members may not achieve all the potential benefit that exists among them. Alliances that are too rigid or too flexible cannot achieve success. The key is to develop a relationship in which the partners are able to respond to market or environmental changes yet have enough rigidity or structure to create stakes for both parties and motivate them to act in the best interest of their relationship.

Suppressing the Dark Side

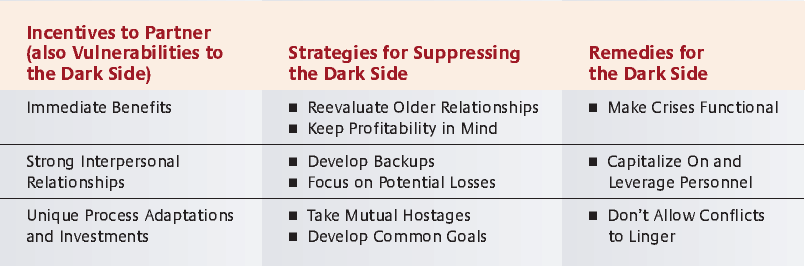

Given that we recognize and understand the dark side of close relationships, how can it be suppressed? As always, prevention is the best medicine. Bolstering relationships — through regular evaluation, backup plans and crisis management — helps create efficient, motivated and productive relationships that allow partners to take risks, try out new ideas and determine creative ways to expand their joint pie of benefits. (See “Keeping the Dark Side at Bay.”)

Evaluate Older Relationships

One of the best approaches for maintaining the initial benefits of a close business relationship is constantly to evaluate the relationship. Be wary of developing a take-it-for-granted mind-set and putting the relationship on cruise control. Rotating personnel through the front lines is one way to invigorate business relationships; a fresh set of eyes is always invaluable. The Lincoln Mercury division of Ford Motor Co. takes that approach with its territory managers who work with its dealer network. Every two years, the managers are moved to a different region of the country, and they must work with those dealers to better promote and sell Lincoln and Mercury cars. This rotation system prevents relationships with dealers from becoming complacent, and the relationships benefit from the experience of managers who have been exposed to the methods, strategies and approaches used in other regions.

Focus on Profitability

Long-term relationships with customers can become costly, as customers may expect and demand lower prices in exchange for loyalty. Keeping an eye on profitability, not revenue, can help prevent such problems from developing. Companies should be aware that the cost of providing service to customers who frequently buy low-margin products may outweigh the revenue they bring in. Instead, companies should calculate the average profitability of each customer or customer segment in any typical purchase period; in this information-rich age, many companies can easily calculate the profitability of their customers from historical sales data.

Develop Backups

Every important relationship or situation needs a backup act. Montreal-based Cirque du Soleil, which produces innovative entertainment performances, maintains a bank of musicians, clowns, acrobats and various artists who are available to take the place of any performer in any of its shows. Much as a hospital may maintain backup generators so that its surgeons can continue to perform critical surgery if there is an electricity outage, key relationships also need good backups. Consider the example of the automaker and the supplier that cut corners. In that situation, the managers who were the relationship custodians ultimately became the conduit for the dark side. Generally, a key relationship should not rest on the interpersonal relationship between two individual managers. Other individuals should be involved on both sides of the partnership on an ongoing basis. While this may appear inefficient and redundant, it can serve as a worthwhile safeguard.

We studied 321 relationships between agricultural-product distributors and their suppliers and found that, when things are going well, the interpersonal relationships of individual managers help the intercompany relationship to perform well.16 Companies evaluate each other’s performance positively, competitive advantages are achievable, joint profits are higher, and the partners plan and expect a long, successful relationship. However, the value of interpersonal relationships evaporates when trouble begins to develop. Many companies make the mistake of waiting until this point to begin sending in the troops to tackle the meltdown: Upper management, lawyers, mediators and the like arrive on the scene to investigate and repair the relationship.

A more effective approach is to focus on the potential loss, as opposed to a loss that already exists. The company that focuses on potential losses is one that understands the importance of having multiple people or teams involved in a relationship on an ongoing basis. A relationship-savvy company doesn’t rely on one individual alone to maintain and steer the partnership into the future, but instead relies on a team of individuals to navigate the relationship’s course.

Take Mutual Hostages

Interestingly, we have found that the best antidote to relationship deterioration is the swapping of “mutual hostages.” The mutual hostages are dedicated investments such as assets, human resources, specialized strategies and capital equipment that are difficult to move and redeploy in other relationships.17 These investments are also the only way to achieve a supernormal return on investment from the relationship and accomplish the synergistic performance that motivated the partnership in the first place. By developing mutual hostages, the partners create what economists call “self-enforcing contracts” because each party loses an incentive to cheat the other and instead gains a powerful motive to stay in the relationship and make the most of it.18

Creating mutual high stakes causes partners to act with restraint. However, the key to developing mutual hostages is the term “mutual.” A company that doesn’t ensure that its partner is also investing may find itself saddled with investments that are completely unrecoverable if the partner should suddenly decide to end the relationship.

Establish Common Goals

Having common goals is another critical safeguard against relationship difficulties.19 At the start of the relationship, these goals are critical for establishing expectations, clarifying roles and communicating intentions. When all is well, these goals seem to fade into the background as business is carried out. However, our research suggests that when the relationship develops problems, the partners will review their goals and reevaluate why their relationship was formed in the first place. This reconsideration is often helpful for restabilizing the relationship and recharting its course. Highlighting these goals and reevaluating them can make a substantial difference to the relationship’s future and can help safeguard both parties’ share of the expanded pie of benefits.

Avoid the Spiral of Suspicion

Although it is important to be vigilant, one can also be too zealous in efforts to mitigate the dark side. An overwhelming feeling of distrust can be as dangerous as blind trust and can lead partners to fall into a spiral of suspicion. This slow slide may initially occur with a seemingly minor suspicion, such as “Why is my partner meeting with my competitor?” or “Why are they sending market scouts into my overseas markets?” This may then cause the suspicious firm to, knowingly or inadvertently, act differently toward its partner. It may send messages such as “We reiterate the need to withhold confidential information from our competitors” or “We will no longer share information about our overseas markets.” In this way, the suspicious company begins to protect itself from possible exploitation by the partner. Its partner begins to notice this change in behavior, and it, too, becomes suspicious. So this partner also begins to withdraw and modify its behavior, which only further fuels the initial misapprehensions of the uneasy partner. In a study involving confidential interviews and data on approximately 220 industrial partnerships, we observed that, in a significant portion of the sample, this dysfunctional spiral of suspicion formed and gave momentum to relationship deterioration.

This is not a new phenomenon. A classic example of the spiral of suspicion occurred in the 1920s, when General Motors Corp. came to suspect that its sole supplier of car bodies, Fisher Body Co., was taking advantage of its single-source status and the assets it had dedicated to GM in order to inflate prices. Fisher Body assured GM that its prices were fair reflections of its cost, as per contract. General Motors believed otherwise. Suspicion created an acrimonious relationship; the partners swapped allegations and denials. Ultimately, GM acquired Fisher Body in 1926 so that it could examine operations and records — only to learn that opportunism had never existed.20

When Problems Occur

When problems arise, a long-term relationship can hit a crisis. Such problems should be treated as an opportunity for a spectacular save, for a turnaround that will help the relationship reach a new level. Good relationships have often survived “functional crises” — potential conflicts that were ultimately constructive because the partners came together and worked out their issues.21 The goal is to turn problematic incidents into opportunities for improvement that bolster the relationship and remind the parties of what is good between them.

Capitalize on Your Personnel

However, problems can leave a business relationship battle-scarred by difficulties. During the time it takes for these scars to heal, the relationship remains vulnerable to further decline. New personnel can help reduce this vulnerability and reinvigorate the relationship: Relationship managers without battle scars may bring in a fresh perspective that is more optimistic.

Our research has also shown that individual salespeople can play a key role in mitigating the dark side of close relationships, managing to create relationship satisfaction despite deteriora-tion.22 The sales rep’s efforts to manage an orderly termination or to repair customer perceptions or past mistakes can preserve the customer’s sense of overall satisfaction with the relationship. However, once difficulties have developed, the sales rep can also produce a surprisingly negative effect on the customer’s satisfaction with financial margins from the relationship. A customer with excessive trust in a sales rep (that is, trust without wariness) may believe that the sales rep can influence the customer’s financial outcomes in the relationship when the sales rep really cannot.

When problems develop, the sales rep may involve other individuals (inside or outside the company) who have the power to significantly alter the customer relationship, restore equity or find alternative solutions. Events may grow rapidly beyond the sales rep’s control as the relationship undergoes greater scrutiny. Questions will be asked, and additional organization members (such as supervisors, executive managers and division leaders) will be called in to investigate, to offer opinions and, ultimately, to intervene. Relational processes, developed via trust in the sales rep, may be altered or terminated, thus diminishing customer satisfaction. Hence, there are limits to what an individual sales rep can accomplish alone in mitigating the dark side.

Recovering From Wounds

One option for a deteriorating business relationship is reconfiguration. That could mean restarting the partnership, redefining the scope and responsibilities, investing or changing personnel. It also could mean deciding that a strategic relationship is not necessary and that ordinary contracting at arm’s length will do, or that it’s time to do business with someone else.

In studying more than 1,200 business-to-business relationships from the buyer and supplier side of the relationship, we observed that relationships that are built together — where goals are articulated, a common path is charted, and both firms are committed to collaboration and successfully creating returns for both parties — tended to outperform those that have reconfigured themselves to a growing or stable state after a decline. That means that recovering relationships do not enjoy a fresh start. Rather than “wiping the slate clean” and starting over, organizations in once heavily damaged relationships carry over some of the negativity when they attempt to start again. The upshot? A negative history exacts its price. Psychological scars hamper a company’s performance. Hence, companies do well to avoid relationship problems altogether. It may be better to dissolve a relationship than to allow the partners to “marinate” in a declining phase for an extended period of time. By recognizing quickly that the relationship is incompatible or inoperable, companies should cut their ties and move on to new relationships.

Unlike personal relationships, business relationships cannot be expected to endure indefinitely. Perhaps a better perspective is the notion of moving in and out of networks of companies over time. For example, a manufacturer might work within a set of five suppliers. Within this network, it continually balances its business, winding down some supply arrangements while altering existing ones and starting new ones — all within the same set. This is normal and desirable for organizations.23

CLEARLY, COMPANIES SHOULD under no circumstances take close relationships for granted. The mechanisms that build a relationship — immediate benefits, interpersonal relationships, unique processes and the like — can, at the same time, be the very door that exposes the relationship to the onset of the dark side. A close business relationship demands maintenance, investment and attention. The best of intentions, without accompanying safeguards, expose even the strongest alliance to the threat of internal decay.

References

1. J.H. Dyer, P. Kale and H. Singh, “When to Ally and When to Acquire,” Harvard Business Review 82 (July–August 2004): 109–115.

2. P.W. Beamish, “The Characteristics of Joint Ventures in Developed and Developing Countries,” Columbia Journal of World Business 20, no. 3 (1985): 13–19; J.P. Killing, “Understanding Alliances: The Role of Task and Organizational Complexity,” in “Cooperative Strategies in International Business,” eds., F.J. Contractor and P. Lorange (Lexington, Massachusetts: Lexington Books, 1988), 55–68; B. Kogut, “Joint Ventures: Theoretical and Empirical Perspectives,” Strategic Management Journal 9 (1988): 319–332; S.H. Park and G.R. Ungson, “The Effect of National Culture, Organizational Complementarity, and Economic Motivation on Joint Venture Dissolution,” Academy of Management Journal 40 (1997): 270–307; and A. Stuckey, “Vertical Integration and Joint Ventures in the Aluminum Industry” (Cambridge: Harvard University Press, 1983).

3. R.H. Ephross and T.V. Vassil, “The Rediscovery of Real World Groups,” in “Social Work With Groups: Expanding Horizons” (Binghamton, New York: Haworth Press, 1993).

4. K. Grayson and T. Ambler, “The Dark Side of Long-Term Relationships in Marketing Services,” Journal of Marketing Research 36 (February 1999): 132–141; and C. Moorman, G. Zaltman and R. Deshpandé, “Relationships Between Providers and Users of Market Research: The Dynamics of Trust Within and Between Organizations,” Journal of Marketing Research 29 (August 1992): 314–329.

5. A.C. Inkpen and W.B. Paul, “Knowledge, Bargaining Power, and the Instability of International Joint Ventures,” Academy of Management Review 22, no. 1 (1997): 177–202.

6. O.E. Williamson, “The Mechanisms of Governance” (New York: Oxford University Press, 1996); and B. Klein, “Why Hold-Ups Occur: The Self-Enforcing Range of Contractual Relationships,” Economic Inquiry 34 (July 1996): 444–463.

7. J.D. Hibbard, N.Kumar and L.W. Stern, “Examining the Impact of Destructive Acts in Marketing Channel Relationships,” Journal of Marketing Research 38, no. 1 (2001): 45–61.

8. J.B. Heide and G. John, “The Role of Dependence Balancing in Safeguarding Transaction-Specific Assets in Conventional Channels,” Journal of Marketing 52 (January 1988): 20–35.

9. J. Neuville, “La Stratégie de la Confiance: Le Partenariat Industriel Observé Depuis le Fournisseur,” Sociologie du Travail 20, no. 3 (1997): 297–319.

10. G. Soda and A.Usai, “The Dark Side of Dense Networks: From Embeddedness to Indebtedness,” in “Interfirm Networks: Organization and Industrial Competitiveness,” ed. A. Grandori (London: Routledge, 1999), 276–302.

11. W. Reinartz and V. Kumar, “On the Profitability of Long-Life Customers in a Noncontractual Setting: An Empirical Investigation and Implications for Marketing,” Journal of Marketing 64, no. 4 (October 2000): 17–35.

12. T.K. Das and B.S. Teng, “Instabilities of Strategic Alliances: An Internal Tensions Perspective,” Organization Science 11, no. 1 (2000): 77–101.

13. E. Anderson and T.S. Robertson, “Inducing Multi-Line Salespeople to Adopt House Brands,” Journal of Marketing 59 (April 1995): 16–31.

14. S.D. Jap, “‘Pie-Expansion’ Efforts: Collaboration Processes in Buyer-Supplier Relationships,” Journal of Marketing Research 36, no. 4 (1999): 461–475.

15. Ibid.

16. S.D. Jap and E. Anderson, “Safeguarding Interorganizational Performance and Continuity Under Ex Post Opportunism,” Management Science 49, no. 12 (2003): 1684–1701.

17. Ibid.

18. B. Klein, “The Economics of Franchise Contracts,” Journal of Corporate Finance 2, no. 1 (1995): 9–37.

19. Jap and Anderson, “Safeguarding Interorganizational Performance.”

20. B. Klein, “Vertical Integration as Organizational Ownership: The Fisher Body-General Motors Relationship Revisited,” Journal of Law, Economics, and Organization 4, no.1 (1988): 199–213; and B. Klein, R.G. Crawford and A.A. Alchian, “Vertical Integration, Appropriable Rents, and the Competitive Contracting Process,” Journal of Law and Economics 21 (October 1978): 297–326.

21. J.C. Anderson, “Relationships in Business Markets: Exchange Episodes, Value Creation, and Their Empirical Assessment,” Journal of the Academy of Marketing Science, 23, no. 4 (1995): 346–50.

22. S.D. Jap, “The Strategic Role of the Salesforce in Developing Customer Satisfaction Across the Relationship Lifecycle,” Journal of Personal Selling and Sales Management 21, no. 2 (2001): 95–108 (special issue on strategic issues in salesforce management).

23. R. Gulati and M. Gargiulo, “Where Do Interorganizational Networks Come From?” American Journal of Sociology 104, no. 5 (1999): 177–231.